Kakao Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kakao Bundle

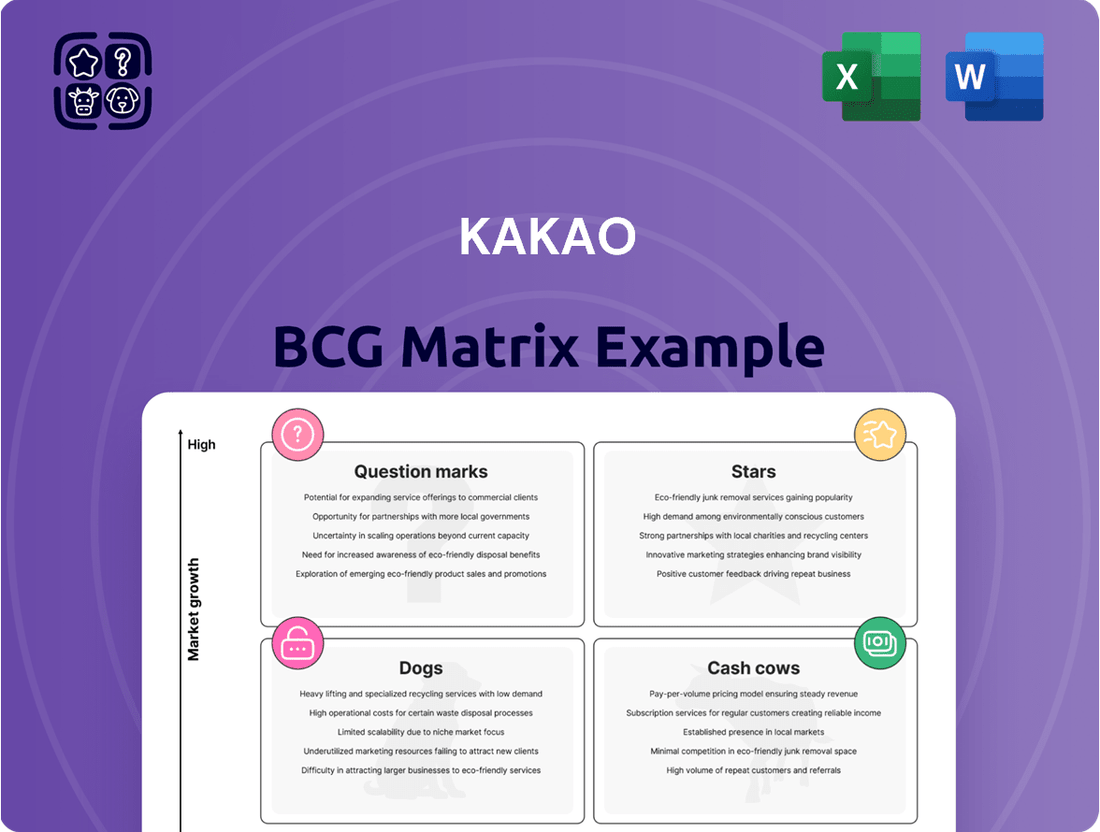

Curious about Kakao's strategic product portfolio? This glimpse into their BCG Matrix reveals the potential for growth and stability across their diverse offerings. Understanding where Kakao's services fall as Stars, Cash Cows, Dogs, or Question Marks is crucial for informed decision-making.

This preview offers a foundational understanding, but to truly unlock Kakao's market potential, you need the full picture. Dive deeper into their BCG Matrix to gain actionable insights and a clear roadmap for future investments.

Purchase the complete BCG Matrix report for a detailed quadrant-by-quadrant analysis, complete with data-backed recommendations tailored to Kakao's specific market positioning. Equip yourself with the strategic clarity needed to navigate the competitive landscape.

Don't miss out on the opportunity to understand Kakao's product performance at a granular level. Get instant access to the full BCG Matrix and discover where to allocate your capital for maximum impact.

Stars

Kakao Pay is a clear star in the Kakao BCG Matrix, showcasing impressive momentum. In 2024, its revenue surged by 25% to $1.2 billion, and it achieved its inaugural quarterly operating profit in Q1 2025. This strong performance is underpinned by consistent double-digit growth across all its business segments, with projections indicating a 13% compound annual growth rate from 2024 through 2027.

Kakao Mobility, a key player in South Korea's mobility sector, is leveraging its Kakao T platform to solidify its dominant position. In Q1 2025, the company reported robust growth in its parking and quick delivery services, demonstrating strong domestic traction.

The company is actively pursuing international expansion with its k.ride taxi service, extending its reach to 12 new countries. This strategic move aims to bolster its global footprint and compete more effectively against international ride-sharing giants like Uber.

While its primary focus remains on strengthening its domestic market share, Kakao Mobility's ambitious international expansion signals a clear intent for high growth in emerging markets. This positions the company as a potential star in the broader mobility services industry.

Piccoma, Kakao's leading digital comics platform in Japan, has cemented its position as a powerhouse, consistently ranking at the top for consumer spending for five straight years, from 2020 through 2024. This sustained success highlights its global dominance in the rapidly expanding webtoon sector.

As of January 2025, Piccoma's estimated consumer spending reached an impressive $497 million, underscoring its substantial market share within Japan's burgeoning digital comics landscape. Despite LINE Manga overtaking it in overall app revenue during the first half of 2025, Piccoma's strength in the specific comics and novels segment remains undeniable.

Kakao Bank

Kakao Bank is a standout performer, firmly positioned as a Star in the Kakao BCG Matrix. By early 2025, its user base surged past 20 million, growing to over 25.45 million across all demographics by the first quarter of 2025. This rapid user acquisition translates directly into financial success, with a notable 23% year-over-year increase in operating profit for Q1 2025, hitting $131.09 million. As a leading digital bank in South Korea, Kakao Bank's expanding market share signals robust potential for sustained growth and profitability.

Key metrics highlighting Kakao Bank's Star status include:

- User Base Growth: Exceeded 20 million by early 2025, reaching over 25.45 million by Q1 2025.

- Profitability Surge: Operating profit increased 23% year-over-year in Q1 2025, amounting to $131.09 million.

- Market Dominance: Rapidly capturing market share as a prominent digital bank in South Korea.

- Future Outlook: Strong indicators of continued expansion and profitability in the financial sector.

KakaoTalk's Talk Biz (Commerce and Advertising)

KakaoTalk's Talk Biz, combining advertising and commerce, demonstrates robust expansion by capitalizing on the platform's massive user base and deep engagement. This segment is a clear star in Kakao's portfolio, benefiting from high market share and significant growth potential.

In the first quarter of 2025, Talk Biz saw a healthy 7% year-over-year revenue increase. Within this, the commerce sub-segment, including KakaoTalk Gift and Talk Deal, experienced even stronger growth, rising by 12%.

Future growth is anticipated from strategic initiatives. The rollout of innovative advertising solutions and the upcoming launch of the 'Brand Message' product are poised to further bolster revenue streams and reinforce Talk Biz's dominant position within Kakao's core offerings.

- Talk Biz Revenue Growth: 7% year-over-year in Q1 2025.

- Commerce Revenue Growth: 12% year-over-year in Q1 2025, driven by KakaoTalk Gift and Talk Deal.

- Key Growth Drivers: New advertising products and the planned 'Brand Message' feature.

- BCG Matrix Classification: Star, indicating high market share and high growth.

Kakao Pay, Kakao Mobility, Piccoma, Kakao Bank, and KakaoTalk's Talk Biz all represent Star businesses within Kakao's portfolio. These entities demonstrate strong market share and are operating in high-growth sectors, indicating significant future potential.

Kakao Pay's revenue grew 25% to $1.2 billion in 2024, achieving its first quarterly operating profit in Q1 2025. Kakao Mobility, dominant in South Korea, is expanding internationally with its k.ride taxi service to 12 new countries. Piccoma, Japan's leading digital comics platform, maintained its top consumer spending ranking for five consecutive years (2020-2024), with estimated spending of $497 million by January 2025. Kakao Bank surpassed 25.45 million users by Q1 2025, with a 23% year-over-year operating profit increase to $131.09 million. Talk Biz, Kakao's advertising and commerce segment, saw a 7% revenue increase in Q1 2025, with its commerce sub-segment growing 12%.

| Business Unit | 2024/Q1 2025 Performance Highlight | Growth Indicators | BCG Classification |

|---|---|---|---|

| Kakao Pay | Revenue up 25% to $1.2B (2024); First quarterly operating profit (Q1 2025) | 13% CAGR projected (2024-2027) | Star |

| Kakao Mobility | Dominant in South Korea; Expanding k.ride taxi to 12 new countries | Strong domestic traction; International expansion | Star |

| Piccoma | Top consumer spending in Japan (2020-2024); $497M spending (Jan 2025) | Sustained market leadership in digital comics | Star |

| Kakao Bank | 25.45M users (Q1 2025); Operating profit up 23% to $131.09M (Q1 2025) | Rapid user acquisition; Growing market share | Star |

| KakaoTalk Talk Biz | Revenue up 7% (Q1 2025); Commerce up 12% (Q1 2025) | New ad products and 'Brand Message' feature | Star |

What is included in the product

The Kakao BCG Matrix analyzes its diverse business units by market share and growth, guiding investment decisions.

The Kakao BCG Matrix offers a pain point reliever by providing a clear, one-page overview of each business unit's position.

Cash Cows

KakaoTalk stands as the dominant force in South Korea's messaging landscape, commanding an impressive 97% market share with 48.2 million users in 2025. This core messaging service, despite slower user growth, functions as a stable super app and the primary access point to Kakao's expansive digital ecosystem.

The platform's consistent user engagement indirectly drives revenue for numerous other Kakao services, leveraging its vast user base with minimal incremental marketing expenditure. Its essential role in daily communication solidifies its position as a reliable revenue generator, fitting the profile of a cash cow.

Kakao's advertising business, particularly on its flagship KakaoTalk platform, leverages immense user traffic to generate consistent revenue. This segment is a cornerstone of Kakao's platform strategy, capitalizing on high user engagement.

The advertising business is a mature offering, demanding minimal new investment for sustained operations. It enjoys robust profit margins thanks to its established market position and the inherent value of its user base.

In 2023, Kakao reported total advertising revenue of approximately 1.8 trillion KRW (roughly $1.3 billion USD), with platform-based advertising forming a significant portion of this. This demonstrates the steady and substantial income this segment provides, fueling overall platform growth.

Melon, Kakao's dominant music streaming platform in South Korea, continues to be a significant cash cow. As of the fourth quarter of 2024, it boasted 9.8 million subscribers, solidifying its substantial market share.

While music revenue saw a 6% decline year-over-year in the first quarter of 2025, a common trend in mature markets, Melon's extensive subscriber base means it requires minimal promotional spending to maintain its operations.

This operational efficiency allows Melon to consistently generate robust cash flow, acting as a stable financial pillar for Kakao's broader content business segment.

Kakao Gift and Talk Deal

Kakao Gift and Talk Deal represent Kakao's prime cash cows within its BCG Matrix framework. These features are intrinsically linked to the daily routines of South Korean users through KakaoTalk, ensuring robust transaction volumes and sustained revenue generation.

In the first quarter of 2025, commerce revenue, which includes KakaoTalk Gift and Talk Deal, saw a significant 12% increase year-over-year. This growth was primarily fueled by a surge in direct purchases, highlighting the platform's effectiveness in driving consumer spending.

The profitability of these services is largely attributed to KakaoTalk's dominant market share, which provides a captive audience. This allows Kakao to capitalize on its existing user base with minimal additional investment needed for market expansion, solidifying their status as reliable profit generators.

- Dominant Market Share: KakaoTalk's extensive user base underpins the success of its commerce features.

- Consistent Revenue: Kakao Gift and Talk Deal generate steady income through high transaction volumes.

- Q1 2025 Growth: Commerce revenue, including these features, grew 12% year-over-year, driven by direct purchases.

- Low Investment Needs: Existing platform penetration minimizes the need for new capital investment to maintain profitability.

Daum Portal

The Daum web portal, a foundational element of Kakao's offerings, likely continues to hold a substantial presence in South Korea's digital landscape, particularly for search and news consumption. While its exact market share isn't explicitly detailed, its role as a primary portal suggests a significant user base.

However, the portal's financial performance reflects a mature market. Daum's revenue experienced a 6% decrease in the fourth quarter of 2024, signaling a period of low growth or even stagnation for this segment. This decline is a key indicator of its position within the BCG Matrix.

- Market Position: Daum operates in a mature search and news portal market in South Korea, likely with a established, though potentially declining, user base.

- Revenue Trend: Experienced a 6% revenue decline in Q4 2024, indicating a low-growth environment.

- Cash Flow Generation: Despite the revenue dip, it continues to generate stable income for Kakao.

- Investment Needs: Requires minimal new investment for growth, fitting the characteristics of a cash cow.

Kakao Gift and Talk Deal are prime examples of Kakao's cash cows, deeply integrated into daily user activities via KakaoTalk. These services consistently drive high transaction volumes and revenue, with commerce revenue, including these features, showing a 12% year-over-year increase in Q1 2025 due to a surge in direct purchases.

Their profitability stems from KakaoTalk's dominant market share, offering a captive audience that allows monetization with minimal new investment. This established user base ensures reliable profit generation, solidifying their status as key revenue drivers for Kakao.

| Service | Category | Key Metric | Q1 2025 Performance | BCG Status |

| Kakao Gift | Commerce | Transaction Volume | 12% YoY Growth (Commerce Segment) | Cash Cow |

| Talk Deal | Commerce | Direct Purchases | 12% YoY Growth (Commerce Segment) | Cash Cow |

What You See Is What You Get

Kakao BCG Matrix

The Kakao BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic insight, will be delivered directly to you without any watermarks or demo content, ready for immediate use in your business planning.

Dogs

Kakao Games experienced a significant downturn in 2024, marked by a 13.6% revenue decline and a staggering 74.6% decrease in operating profit, resulting in a KRW 128.1 billion net loss. This performance places Kakao Games firmly in the "Dogs" category of the BCG Matrix, indicating low market share and low growth potential for its current offerings.

The gaming division's struggles continued into Q1 2025, with revenue dropping by an additional 40%. This sharp decline is attributed to a combination of underperforming new releases and a lack of sustained success from existing titles in the competitive gaming market.

While the company has plans for new game launches, the current situation highlights a portfolio that is not generating substantial returns. The capital invested in these underperforming titles is not yielding the expected growth, further solidifying their position as "Dogs" that require careful management or divestment.

Kakao Entertainment's media business is currently positioned as a Dog in the BCG matrix. In the first quarter of 2025, its revenue saw a substantial 21% year-over-year decrease. This downturn is largely attributed to a weak advertising market and a noticeable reduction in content spending by clients.

This segment is characterized by a low market share and faces significant challenges in achieving growth. Consequently, it consumes resources without generating proportional profits, acting as a financial drain on the larger Kakao Entertainment entity.

Kakao VX, focusing on golf-related ventures, experienced a significant downturn in 2024, with reports indicating a decline of at least 20% year-over-year. This contraction is attributed to a broader slowdown within the golf simulator market, impacting the company's core operations in this sector.

In response to these market pressures, Kakao VX undertook strategic divestments, suspending several non-core businesses. This move signals a clear intent to streamline operations and exit underperforming segments, thereby focusing resources on more promising areas of the business.

This golf-related segment is best characterized as a low-growth, low-market-share area within Kakao's broader portfolio. The company's active efforts to optimize and potentially divest from these underperforming assets align with a strategy to improve overall business efficiency and profitability.

Specific Underperforming Gaming Titles

Within Kakao Games' diverse portfolio, several specific gaming titles have unfortunately landed in the 'Dog' category. These are games that, despite initial investment or existing presence, are not generating substantial revenue or capturing significant market share. This underperformance means they are consuming resources without providing a strong return, a common characteristic of 'Dogs' in the BCG Matrix.

The overall decline in gaming revenue for Kakao Games, as indicated by financial reports from late 2023 and early 2024, points to a broader issue of underperforming titles. For instance, while specific numbers for individual underperforming games are often not disclosed publicly, the company's consolidated financial results show a struggle to achieve consistent growth in its gaming segment. This suggests that a number of these titles are failing to resonate with players or are facing intense competition.

- Underperforming Titles: Games failing to meet revenue projections or user engagement targets.

- Resource Drain: These titles consume development, marketing, and operational resources without significant returns.

- Market Traction: Lack of strong market position or player base growth signifies their 'Dog' status.

- Strategic Review: Kakao Games likely needs to evaluate these titles for potential divestment, restructuring, or discontinuation.

Niche E-document Services

Kakao's niche e-document services are currently positioned as 'Dogs' in the BCG matrix. These services have seen a significant decline, with a 47% user decrease in 2024, highlighting their struggle for market traction and profitability.

This strategic streamlining suggests that these low-growth, low-market-share offerings are being phased out or heavily scaled back. The inability to achieve widespread adoption or generate substantial revenue has led to this re-evaluation.

- User Decline: A 47% drop in users during 2024.

- Market Position: Characterized as low-growth and low-market-share.

- Strategic Action: Undergoing 'strategic streamlining' or phasing out.

- Profitability Concerns: Inability to gain widespread adoption or profitability.

Kakao's portfolio contains several segments operating as 'Dogs' within the BCG Matrix, indicating low market share and low growth prospects. These units consume resources without generating significant returns, necessitating careful management or divestment strategies to optimize overall company performance.

The gaming division, specifically Kakao Games, faced a substantial revenue decline of 13.6% in 2024, with operating profit plummeting by 74.6%, resulting in a KRW 128.1 billion net loss. This performance, further impacted by a 40% revenue drop in Q1 2025, firmly places many of its titles in the 'Dog' category.

Kakao Entertainment's media business also exhibits 'Dog' characteristics, experiencing a 21% revenue decrease in Q1 2025 due to a weak advertising market. Similarly, Kakao VX, in the golf simulator market, saw a 20% decline in 2024, leading to strategic divestments of non-core businesses.

Furthermore, Kakao's niche e-document services experienced a 47% user decrease in 2024, underscoring their low market traction and profitability, leading to strategic streamlining.

| Business Unit | BCG Category | 2024/Q1 2025 Performance Highlights | Key Challenges |

|---|---|---|---|

| Kakao Games | Dogs | 13.6% revenue decline (2024), 74.6% operating profit decrease (2024), KRW 128.1B net loss (2024), 40% revenue drop (Q1 2025) | Underperforming titles, intense market competition, lack of sustained success |

| Kakao Entertainment (Media) | Dogs | 21% revenue decrease (Q1 2025) | Weak advertising market, reduced client content spending |

| Kakao VX (Golf Simulators) | Dogs | 20% revenue decline (2024) | Slowdown in golf simulator market, non-core business divestments |

| Niche E-document Services | Dogs | 47% user decrease (2024) | Struggling market traction, low profitability, strategic streamlining |

Question Marks

Kakao's ambitious push to become an 'AI Native' company by 2025 is highlighted by significant investments in new AI initiatives. The development of 'Kanana,' an AI-integrated messenger app, and the incorporation of generative AI features into KakaoTalk demonstrate this commitment. These ventures are positioned within the burgeoning AI market, a sector experiencing rapid expansion and innovation.

While operating in a high-growth industry, Kakao's AI initiatives, like Kanana, currently face the challenge of establishing a significant market share. Initial user reception for Kanana was reportedly lukewarm, with some critics deeming it underwhelming, suggesting a low or uncertain market position at this early stage. This places them in the 'Question Mark' quadrant of the BCG matrix, requiring substantial investment to prove their viability.

The success of these AI endeavors hinges on future user adoption and effective monetization strategies. Kakao is channeling considerable resources into these projects, acknowledging the high stakes involved. The ability to overcome initial criticisms and demonstrate clear value propositions will be crucial for Kanana and the generative AI features in KakaoTalk to gain traction and achieve sustainable growth in the competitive AI landscape.

Kakao Entertainment is actively pursuing global expansion of its digital content, notably its webtoon services, beyond its robust presence in Japan with Piccoma. This strategic move targets emerging, high-potential international markets across Europe and other regions.

While Kakao Entertainment achieved significant success with Piccoma, its market share in these newer, developing territories is currently modest when measured against established local competitors. This indicates a competitive landscape where Kakao is still building its brand and user base.

These global ventures necessitate considerable investment. Funds are being allocated to crucial areas such as content localization, tailored marketing campaigns, and the acquisition of new intellectual property to resonate with diverse international audiences.

The objective is to cultivate these nascent markets, aiming for them to evolve into future 'Stars' within Kakao's portfolio. By 2024, Kakao Entertainment's global webtoon market penetration is still in its early stages, requiring sustained effort to challenge existing players and secure significant market share.

New, unproven gaming titles like Kakao Games' 'Chrono Odyssey' and 'ArcheAge Chronicles,' slated for 2025 releases, fit squarely into the question marks quadrant of the BCG Matrix. These games are targeting global markets with AAA aspirations, indicating high potential for future growth and market share.

However, their current market share is effectively zero as they are either unreleased or in very early stages of development and access. This lack of established presence means they are speculative investments, requiring substantial development resources but offering no guaranteed return.

The success of these titles hinges on their ability to capture significant market share in competitive PC and console gaming landscapes. In 2023, the global games market was valued at over $184 billion, highlighting the immense opportunity but also the intense competition these new titles will face.

Exploration of Third Revenue Streams

Kakao is proactively seeking a third revenue stream, signaling a strategic shift towards entirely new business ventures beyond its established services. These nascent initiatives are positioned in sectors with significant growth potential, but as expected, they currently command a minimal market share and necessitate considerable strategic investment and nurturing. The trajectory of these ventures remains uncertain; they could evolve into future Stars within Kakao's portfolio or falter in gaining market traction.

For instance, Kakao's investment in Webtoon, a digital comic platform, exemplifies this pursuit. By July 2024, Webtoon had achieved over 170 million monthly active users globally, demonstrating substantial user engagement. This aligns with the 'question mark' category, as the platform, while growing rapidly, still requires significant capital to expand its content library, global reach, and monetization strategies to solidify its market position against competitors.

- New Ventures: Kakao is investing in unannounced or developing businesses in high-growth sectors.

- Low Market Share: These new areas currently represent a small portion of Kakao's overall market presence.

- Strategic Investment: Significant capital and strategic focus are required for these ventures to mature.

- Uncertain Outcome: They possess the potential to become future market leaders or to fail to gain traction.

International Expansion of Kakao's Broader Platform Services

Kakao's strategy for expanding its broader platform services internationally is positioned as a "Question Mark" within the BCG matrix due to its high-growth potential and uncertain market share. The company targets increasing its international revenue contribution from around 15% to 30% by 2025, signaling a bold move into new territories for its diverse platform offerings. This ambitious global push requires substantial investment and a keen focus on adapting to local market nuances and consumer preferences to gain traction.

This expansion into diverse markets where Kakao's brand recognition is currently low presents both significant opportunities and considerable risks. The success hinges on effectively navigating varying regulatory environments and cultural landscapes. For instance, Kakao's venture into Southeast Asia with services like KakaoTalk and its fintech offerings demonstrates this high-risk, high-reward approach.

- Target: Increase international revenue to 30% of total revenue by 2025, up from approximately 15%.

- Strategy: Broad expansion of platform services into new geographies.

- Market Position: Low brand recognition and market share in target international markets.

- Resource Allocation: Significant investment required for market penetration and localization.

Kakao's new ventures, like AI initiatives and international content expansion, are categorized as 'Question Marks' due to their high-growth potential but currently low market share. These areas demand significant investment to establish a foothold and prove their viability. The success of these speculative bets will determine their future as market leaders or their potential to falter.

| Venture Area | Current Market Position | Investment Focus | Potential Outcome |

| AI Initiatives (e.g., Kanana) | Low/Uncertain Market Share | User adoption, monetization | Star or Dog |

| Global Content Expansion (Webtoons) | Modest in new territories | Localization, marketing, IP acquisition | Star or Dog |

| New Gaming Titles (e.g., Chrono Odyssey) | Zero (unreleased) | Development resources | Star or Dog |

| Broader Platform Services (International) | Low brand recognition | Market penetration, localization | Star or Dog |

BCG Matrix Data Sources

Our Kakao BCG Matrix is built on a foundation of comprehensive market data, integrating Kakao's financial disclosures, user engagement metrics, and competitive landscape analysis.