Jungheinrich SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jungheinrich Bundle

Jungheinrich, a leader in intralogistics, boasts strong brand recognition and an extensive product portfolio. However, the competitive landscape and evolving technological demands present significant challenges. Our comprehensive SWOT analysis delves into these crucial factors, revealing the opportunities for innovation and the potential threats to market share.

Want the full story behind Jungheinrich's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Jungheinrich stands as a global frontrunner in intralogistics, boasting a comprehensive portfolio that spans a wide range of material handling equipment. This includes everything from robust forklift trucks to versatile pallet trucks and cutting-edge automated guided vehicles, serving a broad spectrum of customer requirements. Their extensive global presence, with operations in over 40 countries, underpins their strong market position.

What truly sets Jungheinrich apart is their capacity to deliver end-to-end intralogistics solutions from a single provider. This integrated approach, encompassing not just the hardware like equipment and racking systems but also sophisticated warehouse management software, creates significant value for clients. For instance, in 2023, the company reported an order intake of €5.7 billion, highlighting the strong demand for their comprehensive offerings.

Jungheinrich’s strategic emphasis on automation and digitalization is a significant strength, aligning perfectly with the evolving demands of the intralogistics sector. This focus translates into a robust portfolio of solutions, including automated storage and retrieval systems, autonomous mobile robots, and sophisticated warehouse management software, all designed to enhance efficiency and productivity.

The company's commitment to this area is further evidenced by key acquisitions. For instance, the integration of robotics specialists like Magazino and arculus in recent years has substantially expanded Jungheinrich's technological prowess and market reach in the rapidly growing field of automated intralogistics.

By investing heavily in these cutting-edge technologies, Jungheinrich is well-positioned to capture market share as businesses worldwide increasingly seek to optimize their supply chains through automation. This forward-thinking approach is crucial for maintaining a competitive edge in a dynamic industry.

Jungheinrich's unwavering dedication to sustainability and eco-efficiency is a significant strength. The company has earned EcoVadis Platinum certification for four consecutive years, a remarkable achievement placing them in the top 1% of sustainable businesses worldwide. This consistent recognition highlights their deep integration of environmental responsibility into their operations.

Their strategic focus on reducing greenhouse gas emissions and increasing renewable energy usage is a key driver of this success. Furthermore, Jungheinrich is actively pioneering circular economy strategies, notably through the development and implementation of energy-efficient lithium-ion technology in their product portfolio.

This commitment not only solidifies their environmental credentials but also significantly bolsters their brand reputation. It strongly resonates with an increasingly large segment of customers who prioritize environmentally responsible partners and solutions, translating into a competitive advantage in the market.

Robust Financial Performance and Strategic Growth Targets

Jungheinrich demonstrated strong financial resilience in 2024, navigating economic headwinds with stable Earnings Before Interest and Taxes (EBIT) and a healthy free cash flow. This performance underpins their strategic direction.

The company's ambitious Strategy 2030+ is a key strength, setting clear targets for significant growth. They aim to achieve €10 billion in revenue and a 10% EBIT return on sales by 2030, driven by focused global expansion and advancements in automation solutions.

- Strategic Revenue Target: €10 billion by 2030.

- Profitability Goal: 10% EBIT return on sales by 2030.

- Growth Drivers: Global expansion and automation.

- Financial Health: Stable EBIT and strong free cash flow in 2024.

Extensive Service and After-Sales Network

Jungheinrich’s extensive service and after-sales network is a significant strength, offering customers a complete suite of solutions beyond just equipment sales. This includes vital services like maintenance, financing, and rental options, all designed to enhance and optimize intralogistics operations worldwide.

In 2024, this robust after-sales segment proved its value by effectively counterbalancing dips in new equipment business during a more challenging economic period. This demonstrates the resilience and critical importance of their service offerings in maintaining business stability even when market conditions fluctuate.

The company’s commitment to a comprehensive service approach fosters enduring customer loyalty and secures predictable, recurring revenue streams. This focus on long-term partnerships is a key differentiator in the competitive intralogistics market, ensuring consistent performance and customer satisfaction.

- Global Service Network: Jungheinrich operates a vast network of service technicians and support centers across more than 100 countries.

- After-Sales Revenue Contribution: In the first nine months of 2024, Jungheinrich reported that its services business unit contributed significantly to overall revenue, showing resilience.

- Customer Retention: The integrated service model is credited with high customer retention rates, with many clients engaging Jungheinrich for the entire lifecycle of their intralogistics equipment.

- Digital Service Solutions: Jungheinrich is increasingly investing in digital tools to enhance service efficiency and customer support, including predictive maintenance capabilities.

Jungheinrich's comprehensive, single-source intralogistics solutions are a major strength, covering everything from equipment to software. This integrated approach, bolstered by €5.7 billion in order intake in 2023, provides significant customer value. Their strategic focus on automation and digitalization, including acquisitions like Magazino, positions them well for future growth in an evolving market.

What is included in the product

Delivers a strategic overview of Jungheinrich’s internal and external business factors, highlighting its market strengths, operational gaps, and potential growth drivers.

Offers a clear, organized framework to identify and address potential threats and weaknesses, enabling proactive problem-solving.

Weaknesses

Jungheinrich's financial performance in 2024 showed a clear sensitivity to economic conditions, with a notable impact from weaker markets like Germany and North America. This led to a slight dip in the company's total revenue for the year, underscoring its exposure to regional economic health.

Looking ahead to 2025, forecasts indicate a continued challenging economic climate in Europe. This persistent weakness in crucial markets suggests that Jungheinrich will likely remain vulnerable to broader macroeconomic shifts and downturns.

The company's reliance on the economic stability of specific regions, particularly Germany, creates a risk of revenue volatility. Any significant slowdown in these key markets can directly translate into reduced sales and profitability for Jungheinrich.

The intralogistics sector is fiercely competitive, featuring well-established giants like KION Group, Toyota Industries, and Daifuku Co. Ltd. This crowded landscape puts pressure on Jungheinrich's pricing strategies and can erode market share if the company doesn't consistently invest in cutting-edge technology. For instance, KION Group reported revenues of €11.4 billion in 2023, highlighting the scale of its operations and competitive capacity.

Furthermore, the rise of strong local competitors, particularly within the dynamic Asian markets, adds another layer of complexity. These regional players often possess deep understanding of local customer needs and can offer tailored solutions, challenging Jungheinrich's market penetration in these crucial growth areas. This necessitates agility and localized strategies to effectively compete.

Jungheinrich's strategic outlook, particularly its 2025 forecasts, hinges on the assumption of stable global supply chains and a steady geopolitical landscape. Any adverse shifts, such as heightened trade tensions or regional conflicts, pose a significant risk to the company's operations. These disruptions can directly impede the flow of essential components and finished goods, potentially increasing lead times and manufacturing costs. For instance, the ongoing global semiconductor shortage, which persisted through early 2024, demonstrated the fragility of intricate supply networks and their immediate impact on production capacity across the automotive and industrial equipment sectors, a vulnerability Jungheinrich is not immune to.

High Investment in Research and Development (R&D)

Jungheinrich's commitment to innovation, while a strategic advantage, necessitates significant and ongoing investment in research and development. This continuous pursuit of new material handling equipment, advanced energy storage solutions, sophisticated mobile robots, and comprehensive automated systems demands substantial financial resources. For instance, the company’s focus on developing cutting-edge digital products further escalates these R&D outlays.

This considerable R&D expenditure can place a strain on the company's financial health, especially if revenue growth slows or during periods of economic downturn. The need to stay at the forefront of technological advancements in a competitive market means that R&D spending is not a discretionary item but a fundamental requirement for future competitiveness.

- Substantial R&D Outlays: Continuous investment is required for new material handling equipment, energy storage, mobile robots, and automation.

- Financial Strain Risk: High R&D spending can pressure financial resources, particularly during economic uncertainty or slower revenue periods.

- Digital Product Investment: The push towards digital solutions adds another layer of financial commitment to R&D efforts.

Personnel Costs and Workforce Management Challenges

Jungheinrich faces potential headwinds from rising personnel costs, with higher wages expected in 2025 due to existing collective bargaining agreements. This could put pressure on the company's profit margins.

The company's strategic personnel adjustments in 2024, which involved a workforce reduction primarily in Germany, highlight the delicate balance required. Effectively managing headcount while simultaneously nurturing existing talent and drawing in new expertise for crucial areas like automation and digitalization presents an ongoing operational hurdle.

- Anticipated 2025 Personnel Cost Increase: Higher costs linked to collective wage agreements are a key concern.

- 2024 Workforce Reduction: A cautious personnel policy led to employee reductions, mainly in Germany.

- Talent Management for Future Growth: Efficiently managing workforce levels while attracting and retaining talent in automation and digitalization is a significant challenge.

Jungheinrich's reliance on specific regional markets, particularly Germany, exposes it to revenue volatility if these economies falter. The competitive landscape, with giants like KION Group (which reported €11.4 billion in revenue in 2023), demands constant innovation and can pressure pricing.

The company's strategic forecast for 2025 is vulnerable to global supply chain disruptions and geopolitical instability, which could impact component availability and manufacturing costs. High research and development outlays for new technologies, including digital products, also pose a financial strain, especially during economic downturns.

Anticipated increases in personnel costs in 2025 due to wage agreements could squeeze profit margins. Furthermore, balancing workforce reductions with the need to attract specialized talent in automation and digitalization presents an ongoing operational challenge.

| Weakness | Description | Impact | Example/Data Point |

|---|---|---|---|

| Regional Economic Sensitivity | Dependence on stable economic conditions in key markets like Germany. | Revenue volatility and potential profit decline during economic slowdowns. | Weaker markets in Germany and North America impacted 2024 revenue. |

| Intense Competition | Presence of large, well-established competitors and agile local players. | Pressure on pricing, potential market share erosion, and need for continuous technological investment. | KION Group's €11.4 billion revenue in 2023 highlights competitive scale. |

| High R&D Investment Needs | Continuous significant expenditure on innovation in material handling, energy, automation, and digital products. | Potential financial strain on resources, particularly if revenue growth slows or during economic downturns. | Focus on developing cutting-edge digital products increases R&D outlays. |

| Rising Personnel Costs | Anticipated increases due to collective bargaining agreements in 2025. | Pressure on profit margins. | Existing collective bargaining agreements necessitate higher wage outlays. |

What You See Is What You Get

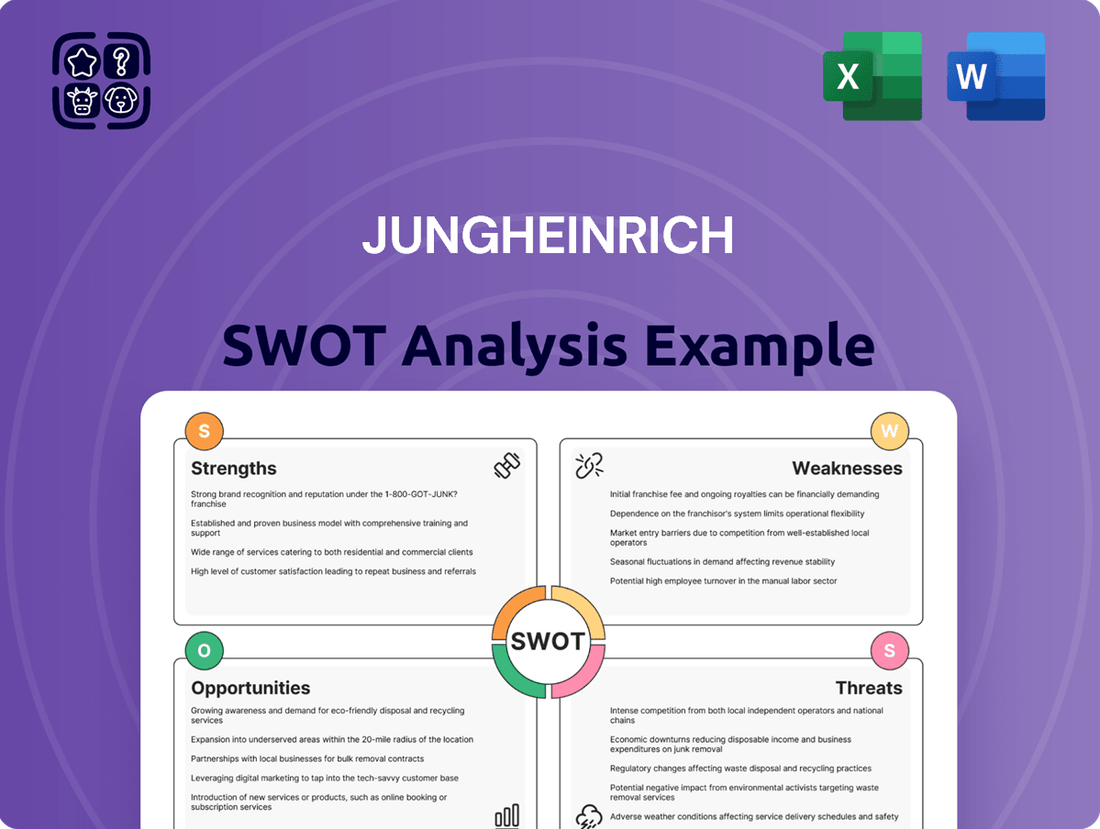

Jungheinrich SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment. You'll see Jungheinrich's internal Strengths and Weaknesses, alongside external Opportunities and Threats. This detailed breakdown provides actionable insights for strategic planning.

Opportunities

The global market for material handling solutions, particularly in warehouse automation, is experiencing robust growth. Projections indicate an average annual increase of 8% over the next five years, reflecting a strong upward trend.

This surge is largely fueled by the continued expansion of e-commerce and the increasing pressure on businesses to optimize their order fulfillment processes for speed and accuracy.

Jungheinrich is strategically positioned to benefit from this trend, given its significant investment and expertise in automated guided vehicles (AGVs) and comprehensive automated warehouse systems.

By offering advanced solutions that enhance efficiency and reduce operational costs, Jungheinrich can effectively capitalize on the heightened demand for sophisticated logistics technology.

Jungheinrich's Strategy 2030+ clearly outlines a commitment to global expansion, with a sharp focus on boosting its presence in North America and the Asia-Pacific (APAC) region. This isn't just talk; the company has actively pursued this, evidenced by strategic acquisitions. For instance, the acquisition of Storage Solutions in the United States has provided a robust foundation for growth in these economically significant territories.

By expanding its direct sales network and strategically establishing regional hubs, Jungheinrich aims to significantly broaden its global reach and diversify its revenue streams away from its traditional European stronghold. This move is crucial for capturing growth opportunities in emerging and established markets alike.

The APAC region, in particular, represents a substantial growth frontier. In 2023, Jungheinrich reported a notable increase in sales in the APAC region, exceeding expectations and underscoring the potential of this market. This expansion strategy is designed to capitalize on the growing demand for automated intralogistics solutions in these dynamic economies.

Jungheinrich's established leadership in sustainability, particularly its early adoption and advancement of electric mobility and energy-efficient lithium-ion technology, is a powerful opportunity. This forward-thinking approach allows the company to stand out in a market where environmental consciousness is rapidly growing, attracting customers who value eco-friendly solutions and solidifying relationships with like-minded businesses. Indeed, in 2023, Jungheinrich reported a significant increase in orders for its electric forklifts, reflecting this growing market demand for sustainable intralogistics.

The company's commitment to a circular economy model also unlocks avenues for innovative business development. By focusing on resource efficiency and product lifecycle management, Jungheinrich can explore new service offerings and revenue streams. This strategy is particularly relevant as regulations and customer expectations push for greater product longevity and reduced waste, a trend that is expected to accelerate through 2025.

Strategic Partnerships and Acquisitions for Portfolio Extension

Jungheinrich is actively seeking strategic partnerships and acquisitions to bolster its portfolio, especially in the burgeoning automation sector and in key growth markets like North America and the Asia-Pacific region. This strategy is designed to accelerate revenue generation and expand market reach. For instance, their collaboration with EP Equipment to launch the 'AntOn by Jungheinrich' brand, a Mid-Tech offering, demonstrates a clear move to capture a wider customer segment and quickly integrate new technologies.

These strategic moves are critical for Jungheinrich to maintain its competitive edge. By acquiring companies or forming alliances, Jungheinrich can gain access to innovative technologies and established market presences more efficiently than through organic development alone. This approach is particularly valuable in rapidly evolving fields like warehouse automation, where staying ahead requires constant technological advancement and broad market penetration.

The expansion into North America and APAC through these channels is a significant opportunity. These regions represent substantial growth potential for intralogistics solutions. Jungheinrich's proactive pursuit of these avenues signals a commitment to diversifying its revenue streams and solidifying its global footprint. The company aims to leverage these partnerships to achieve significant additional revenue in the coming years.

- Targeted Growth Areas: Focus on automation and expansion in North America and APAC.

- Portfolio Extension: Strategic partnership with EP Equipment for the 'AntOn by Jungheinrich' brand to reach new customer segments.

- Market Entry Strategy: Utilizing M&A and partnerships for rapid market entry and technology acquisition.

- Revenue Enhancement: Aiming for additional revenue generation through these strategic initiatives.

Digital Transformation and Service Innovation

Jungheinrich has a significant opportunity to expand its digital warehouse offerings, leveraging AI and Big Data to enhance warehouse operations. This includes optimizing internal workflows and customer-facing processes, which can lead to substantial efficiency improvements and the creation of novel service packages. For instance, by mid-2024, the company was focusing on integrating AI-driven predictive maintenance into its automated systems, aiming to reduce unplanned downtime by up to 15% for its clients.

Further development of digital fleet management systems presents another avenue for growth. By providing enhanced connectivity and data analytics, Jungheinrich can offer more proactive support and personalized solutions. This digital evolution is crucial for improving the overall customer experience and fostering stronger client relationships. The company's commitment to digital services was underscored by its 2023 investments, which saw a notable increase in R&D spending dedicated to software and digital solutions.

Exploring innovative business models, such as those nurtured through initiatives like Uplift Ventures, allows Jungheinrich to tap into new revenue streams. These ventures can focus on areas like flexible equipment leasing, data-driven logistics consulting, or subscription-based service models. Such diversification not only broadens the company's market reach but also strengthens its competitive position in an increasingly digitalized logistics landscape. By the end of 2024, Uplift Ventures had successfully piloted several new service concepts, with early indicators suggesting a potential for a 10% uplift in recurring revenue for participating business units.

- AI and Big Data Integration: Enhancing the digital warehouse with advanced analytics to drive operational efficiency and new service offerings.

- Process Optimization: Streamlining both internal and customer-centric processes through digitalization for improved performance.

- Digital Fleet Management: Advancing fleet management systems for better customer experience and proactive support.

- Innovative Business Models: Leveraging initiatives like Uplift Ventures to create new revenue streams and diversify services.

Jungheinrich is well-positioned to capitalize on the expanding global market for material handling solutions, driven by e-commerce growth and the need for optimized logistics. The company's strategic focus on automation, particularly with AGVs and automated warehouse systems, directly addresses this demand. In 2023, Jungheinrich saw a significant rise in orders for its automated systems, reflecting the market's strong embrace of these technologies.

The company's proactive global expansion, especially into North America and APAC, presents a significant growth opportunity, further bolstered by strategic acquisitions like Storage Solutions in the US. Jungheinrich also stands to gain from its established leadership in sustainability, with a strong offering in electric forklifts and lithium-ion technology, a segment that saw a notable increase in demand in 2023.

Further opportunities lie in expanding digital warehouse offerings, integrating AI and Big Data for enhanced efficiency, and developing innovative business models like flexible leasing and data-driven consulting. Jungheinrich's investment in digital solutions, with a notable R&D increase in 2023, signals a commitment to leveraging technology for future growth and customer value.

Threats

Jungheinrich faces a significant threat from a persistently weak European economy and challenging market conditions, amplified by geopolitical instability and escalating trade conflicts. These factors contribute to recessionary pressures that can dampen industrial capital expenditure. For instance, if major economies experience a contraction, businesses are likely to delay or reduce investments in new equipment, directly impacting Jungheinrich's sales pipeline.

An economic slowdown directly translates to reduced demand for material handling equipment and sophisticated intralogistics systems. Companies under financial strain often postpone upgrades or new purchases, opting to extend the lifespan of existing assets. This contraction in capital spending can lead to a noticeable decline in incoming orders and, consequently, affect Jungheinrich's revenue streams and overall profitability.

The current economic climate, with inflation still a concern and interest rates remaining elevated in many regions as of early 2024, further squeezes corporate budgets. This environment makes it harder for customers to finance large capital investments like new warehouse automation or fleets of forklifts, a core part of Jungheinrich's business.

Jungheinrich's reliance on stable supply chains, as factored into its forecasting, presents a significant threat. Geopolitical tensions, natural disasters, or even widespread health crises can severely disrupt the flow of necessary components, leading to shortages and increased manufacturing expenses. For instance, the semiconductor shortage experienced globally in 2021-2022, which affected many manufacturing sectors including automotive and industrial equipment, highlights this vulnerability.

Furthermore, the price of essential raw materials, such as lithium crucial for battery production, exhibits considerable volatility. Fluctuations in these commodity markets directly impact Jungheinrich's cost of goods sold. In 2024, lithium prices saw significant swings, with benchmark prices for battery-grade lithium carbonate in China experiencing a sharp decline from early year highs, only to stabilize and show some recovery later in the year, illustrating the unpredictable nature of these inputs and its potential to squeeze profit margins.

Jungheinrich faces a significant threat from intensifying competition within the dynamic intralogistics market. Established players and agile new entrants are relentlessly innovating, particularly in areas like automation and robotics, forcing Jungheinrich to constantly evaluate its product development and market positioning.

Rapid technological advancements by competitors, such as breakthroughs in AI-driven warehouse management or more efficient autonomous mobile robots, could quickly erode Jungheinrich's market share if the company cannot adapt its own offerings at a comparable pace. For instance, the increasing sophistication of competitor AGV and AMR solutions demands continuous product upgrades.

The necessity to invest heavily and consistently in research and development (R&D) presents a substantial financial burden. In 2023, for example, companies in this sector saw R&D spending as a percentage of revenue rise, a trend likely to continue, making it a critical but costly competitive necessity for Jungheinrich to maintain its technological edge.

Geopolitical Tensions and Trade Conflicts

Escalating geopolitical tensions and trade conflicts pose a significant threat to Jungheinrich's global operations. These disputes can result in increased tariffs and trade barriers, directly impacting market access in crucial growth areas such as North America and the Asia-Pacific region. For instance, ongoing trade friction between major economic blocs could lead to higher import duties on components or finished goods, squeezing profit margins.

Such disruptions can severely impede Jungheinrich's strategic expansion initiatives and destabilize established international supply chains. The company's ambitious revenue targets for 2024 and beyond are particularly vulnerable if key markets experience protectionist measures or outright market closures. This uncertainty makes long-term planning and investment in new facilities or markets considerably more challenging.

- Tariff Increases: Potential for higher import duties on machinery and spare parts, impacting cost of goods sold.

- Market Access Restrictions: Limited ability to operate or sell in specific countries due to trade disputes or sanctions.

- Supply Chain Volatility: Disruption of international logistics and component sourcing, leading to production delays and increased costs.

- Reduced Demand: Economic slowdowns triggered by trade conflicts can dampen demand for material handling equipment.

Increased Personnel Costs and Labor Shortages

Jungheinrich faces significant headwinds from rising personnel costs, particularly as collective wage agreements in Germany, where a substantial portion of its workforce is located, continue to drive up labor expenses. In 2024, German industrial sector wage increases have averaged around 4-5%, directly impacting operational budgets.

Furthermore, the company is susceptible to labor shortages, especially for skilled professionals essential in cutting-edge fields like automation engineering and software development. The demand for these specialized roles has intensified, creating a highly competitive talent market. This competition can force Jungheinrich to offer higher compensation and benefits to attract and retain key personnel, potentially squeezing profit margins.

- Rising Wage Pressures: Collective bargaining agreements in Germany are a primary driver of increased personnel costs.

- Skilled Worker Deficit: Shortages in automation and software development talent create recruitment challenges.

- Talent Acquisition Costs: Attracting and retaining top employees in a competitive market inflates labor expenses.

- Operational Efficiency Impact: Labor shortages can hinder scaling efforts and affect overall operational output.

Intensifying competition, particularly in automated solutions, presents a significant threat, as rivals are rapidly advancing their technologies. Jungheinrich must continually invest in R&D to keep pace, a costly necessity. For example, the global intralogistics market is projected to reach USD 33.5 billion by 2028, with automation being a key driver, highlighting the competitive pressure.

Geopolitical instability and trade disputes are also major concerns, potentially leading to higher tariffs and restricted market access, impacting Jungheinrich's global sales and supply chains. As of early 2024, ongoing trade friction between major economic blocs continues to create uncertainty. This environment makes it challenging to forecast demand and manage international operations effectively.

Economic downturns and persistent inflation, coupled with elevated interest rates, squeeze customer budgets, delaying essential capital expenditures on material handling equipment. In 2024, many European economies faced slower growth, directly affecting industrial investment. This economic climate makes financing large purchases more difficult for Jungheinrich’s clients.

Rising personnel costs, driven by collective wage agreements in Germany and a shortage of skilled professionals in areas like automation engineering, further pressure Jungheinrich's profitability. German industrial wage increases averaged around 4-5% in 2024, adding to operational expenses and the challenge of attracting specialized talent.

SWOT Analysis Data Sources

This Jungheinrich SWOT analysis is built on a foundation of robust data, including the company's audited financial statements, comprehensive market research reports, and expert industry analyses to ensure a thorough and accurate strategic evaluation.