Jungheinrich PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jungheinrich Bundle

Uncover the critical external factors influencing Jungheinrich's strategic direction with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are shaping the intralogistics landscape. This detailed report offers actionable intelligence to help you anticipate challenges and capitalize on emerging opportunities within the industry. Download the full PESTLE analysis now to gain a competitive edge.

Political factors

Government policies, such as the European Union's Green Deal and national industrial strategies, directly influence Jungheinrich's focus on sustainable intralogistics solutions and R&D investments. Trade agreements, like the USMCA, shape market access and competitive dynamics, while potential tariffs on manufactured goods can impact costs. For instance, in 2024, the EU continued to push for greater emissions reductions, aligning with Jungheinrich's electric forklift market growth.

Changes in international trade relations, including ongoing geopolitical shifts in 2024-2025, can affect the price of critical components, such as semiconductors, and the cost of exporting finished products. Jungheinrich's robust supply chain management aims to mitigate these risks, but supply chain disruptions remain a key consideration. The company's global manufacturing footprint provides some resilience against localized trade disputes.

Political stability in major markets, including Germany, the United States, and China, is paramount for Jungheinrich's long-term investment decisions and overall business confidence. Unforeseen political events can lead to market volatility and impact demand for material handling equipment. For example, elections in key regions during 2024 prompted close monitoring of potential policy shifts.

Geopolitical instability, particularly regional conflicts, poses a significant risk to Jungheinrich's operations by disrupting global supply chains and increasing transportation expenses. For instance, the ongoing tensions in Eastern Europe have led to increased freight costs and delivery delays for many manufacturing sectors, a challenge Jungheinrich must navigate. Political stability across its key markets, including Germany, China, and the United States, is crucial for ensuring consistent production and timely delivery of its material handling equipment.

Fluctuations in international relations also directly impact customer demand and the willingness of businesses to invest in logistics infrastructure, a core area for Jungheinrich. In 2024, global economic uncertainty, partly fueled by geopolitical tensions, has seen some industries scale back capital expenditures. Jungheinrich's ability to forecast and adapt to these shifts in customer confidence and investment appetite is therefore heavily reliant on a stable geopolitical landscape.

Jungheinrich operates within a complex web of national and international regulatory frameworks that significantly shape its business. These rules cover everything from how factories are run and worker safety to the specific standards products must meet. For instance, in 2024, the European Union's Machinery Directive continues to dictate safety requirements for industrial equipment, impacting Jungheinrich's design and manufacturing processes. Failing to comply can lead to costly fines and production halts, making adherence a critical operational factor.

Adherence to regulations like those concerning hazardous materials handling or emissions standards directly influences Jungheinrich's product development cycles and associated costs. For example, evolving environmental regulations in key markets like Germany and China in 2024-2025 are pushing for more energy-efficient and sustainable material handling solutions, requiring investment in research and development. This means that what might be a standard product today could require significant redesign to meet tomorrow's legal requirements.

Changes in these regulatory landscapes are a constant. As of mid-2025, upcoming revisions to battery disposal and recycling laws in several major European countries are expected to impact the lifecycle management of Jungheinrich's electric forklift range. Consequently, Jungheinrich must continually adapt its business operations and compliance strategies to remain competitive and legally sound, often requiring proactive adjustments rather than reactive ones.

Government Incentives for Automation

Government initiatives promoting digitalization, automation, and Industry 4.0 present substantial growth avenues for Jungheinrich. For instance, Germany's "Digital Hub Initiative" supports the development of digital technologies, indirectly benefiting companies like Jungheinrich that provide automation solutions. These programs, often involving tax advantages or direct funding, encourage businesses to adopt sophisticated intralogistics systems, boosting demand for Jungheinrich's automated guided vehicles (AGVs) and warehouse management software.

These policies directly stimulate the adoption of advanced intralogistics, creating a favorable market for Jungheinrich. For example, the European Union's Recovery and Resilience Facility, with significant allocations for digital transformation, can indirectly fund projects that incorporate automated warehousing. Such government backing translates into increased investment in robotics and automated systems, areas where Jungheinrich holds a strong market position.

Specific examples of government support include:

- Grants for R&D: Many nations offer grants to encourage innovation in automation and AI, directly benefiting Jungheinrich's development of new intralogistics technologies.

- Tax Incentives: Tax credits for investments in digitalization and automation encourage businesses to upgrade their infrastructure with solutions like Jungheinrich's automated systems.

- Industry 4.0 Programs: National and regional programs focused on Industry 4.0 implementation often subsidize the adoption of smart factory and warehouse technologies, increasing the addressable market for Jungheinrich's offerings.

Public Procurement Policies

Public procurement policies are a significant driver for Jungheinrich, especially in regions with substantial government spending on infrastructure and public services. These policies can directly impact the demand for material handling equipment and logistics solutions. For instance, many European Union countries, including Germany, have specific regulations favoring sustainable and energy-efficient products in public tenders, which aligns well with Jungheinrich's electric forklift offerings.

Governments frequently incorporate requirements for local content, sustainability certifications, or adherence to specific technological standards within their tender processes. For example, in 2023, the German government's procurement guidelines emphasized the importance of reducing CO2 emissions in fleet acquisitions, creating a favorable environment for Jungheinrich's electric and hydrogen-powered vehicles. Successfully navigating these requirements can unlock substantial opportunities for large-scale projects and secure long-term contracts.

- Government spending on infrastructure: In 2023, EU member states allocated over €230 billion to infrastructure projects, many of which require material handling equipment.

- Sustainability mandates: Increasingly, public procurement policies worldwide specify environmental performance criteria, benefiting companies like Jungheinrich with eco-friendly solutions.

- Local content requirements: Some nations implement policies that favor domestically manufactured goods, impacting tender competitiveness for international suppliers.

- Technological standards: Public tenders often define specific safety and performance standards for equipment, necessitating compliance from manufacturers.

Political stability across Jungheinrich's key markets remains a critical factor, with elections and policy shifts in 2024 prompting close observation of potential impacts on industrial investment. Geopolitical tensions in Eastern Europe, for instance, continued to influence global supply chains and transportation costs throughout 2024-2025, requiring robust risk management strategies.

Government regulations, such as the EU's Green Deal and evolving emissions standards, directly shape Jungheinrich's product development, pushing innovation in electric and sustainable intralogistics solutions. Compliance with these frameworks, including worker safety and machinery directives, is essential for operational continuity.

Government initiatives supporting digitalization and Industry 4.0 create significant growth opportunities, with programs like Germany's "Digital Hub Initiative" encouraging the adoption of automation. Public procurement policies, particularly those favoring sustainable and energy-efficient equipment, also represent a substantial market for Jungheinrich's offerings, as seen in EU infrastructure projects.

What is included in the product

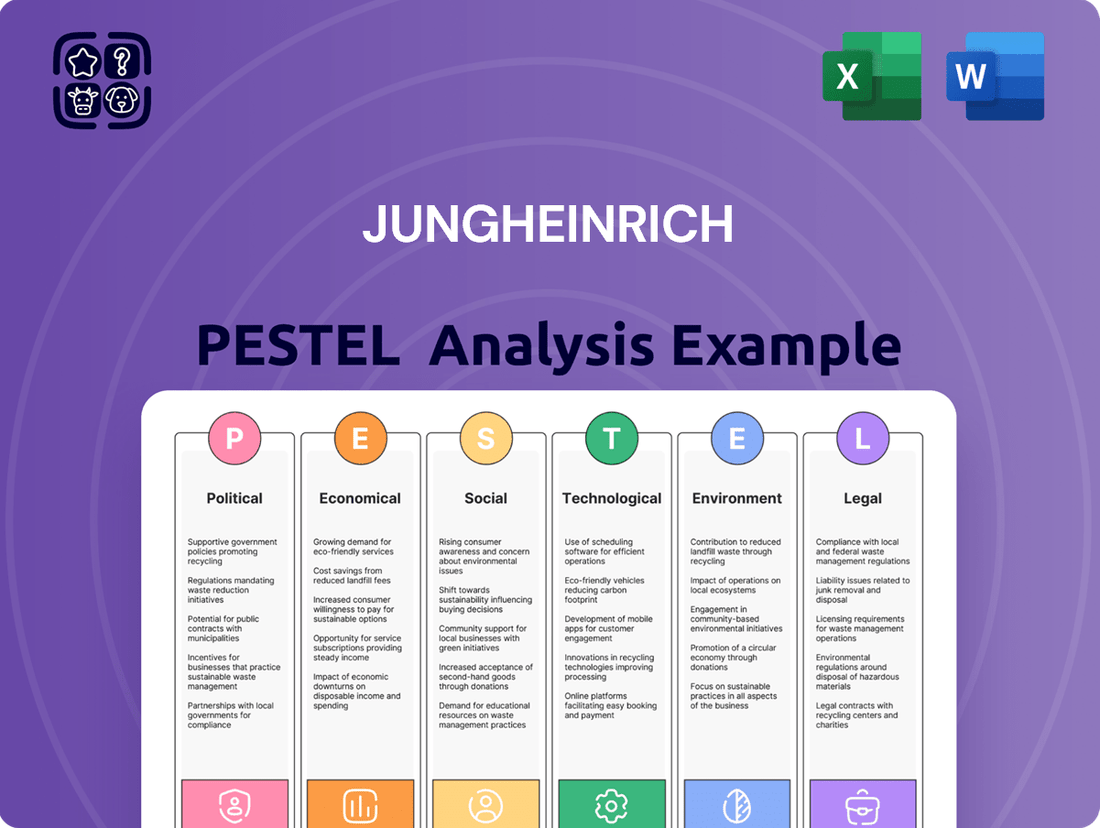

The Jungheinrich PESTLE analysis thoroughly examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the company's operations and strategic direction.

This comprehensive assessment provides actionable insights into market dynamics, regulatory landscapes, and emerging trends to inform strategic decision-making and identify growth opportunities for Jungheinrich.

Provides a clear, actionable overview of external factors impacting Jungheinrich, streamlining strategic decision-making and mitigating risks by highlighting key opportunities and threats.

Economic factors

Global economic growth remains a significant driver for Jungheinrich. For instance, the International Monetary Fund (IMF) projected global GDP growth to reach 3.2% in 2024, a slight slowdown from 3.4% in 2023, indicating continued, albeit moderated, expansion. This sustained growth generally encourages businesses to invest in capital goods like warehouse automation and material handling equipment, directly benefiting Jungheinrich's sales pipeline.

However, recessionary risks are a constant consideration. Geopolitical tensions and persistent inflation in various regions could dampen consumer and business spending. Should a significant economic downturn materialize in key markets for Jungheinrich, such as Europe or North America, we could see a slowdown in new equipment orders and a shift towards maintenance services as businesses prioritize cost savings.

In 2024, many developed economies are navigating a complex landscape of moderating inflation and interest rate adjustments. For example, the Eurozone's GDP growth forecast for 2024 was around 0.9% by the European Commission, reflecting a cautious economic environment. This subdued growth environment necessitates Jungheinrich to focus on offering solutions that enhance efficiency and reduce operational costs for its clients, even during periods of slower economic expansion.

Furthermore, emerging markets present opportunities but also carry higher volatility. While offering potential for growth in intralogistics solutions, these markets can be more susceptible to global economic shocks, making Jungheinrich's diversified geographical presence crucial for mitigating regional downturn impacts.

Inflationary pressures significantly affect Jungheinrich's operational expenses, especially the procurement of essential raw materials like steel, electronic components, and energy. For instance, global steel prices saw considerable volatility in late 2023 and early 2024, with some benchmarks showing increases of 5-10% year-over-year, directly impacting manufacturing costs for warehouse equipment.

These rising input costs can compress Jungheinrich's profit margins if the company cannot pass them on through price adjustments or achieve substantial efficiency gains. The energy component alone, critical for manufacturing and logistics, has experienced price fluctuations; in Germany, industrial electricity prices remained elevated in early 2024 compared to pre-2021 levels, often exceeding 20 cents per kWh.

Consequently, diligent monitoring of inflation rates is paramount for Jungheinrich's strategic financial planning. This includes forecasting material cost trends and assessing the competitive landscape for pricing adjustments. For example, in 2024, many industrial goods manufacturers implemented price increases ranging from 3% to 7% to offset these persistent cost pressures.

Interest rate fluctuations directly impact Jungheinrich's financing expenses and the affordability of its products for customers. For instance, if the European Central Bank raises its key interest rates, Jungheinrich's cost of capital for expansion or operational needs could rise. This increased cost might be passed on, making their equipment, whether through direct purchase, financing, or leasing, more expensive for buyers. Consequently, a higher interest rate environment, such as the average ECB rate hovering around 4.0% in early 2024, can dampen demand for new material handling equipment as customers face elevated borrowing costs.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant challenge for global companies like Jungheinrich. Fluctuations can directly affect the profitability of international sales and the cost of sourcing components from abroad. For instance, a stronger Euro might make Jungheinrich's forklifts more expensive for overseas buyers, potentially reducing demand, while also lowering the cost of parts imported from countries with weaker currencies.

The impact of these movements is substantial. In 2023, for example, many industrial companies reported headwinds from adverse currency movements impacting their earnings. Jungheinrich's financial reports often detail the effects of currency translation on their revenue and profit figures, highlighting the need for robust currency risk management. Effective hedging strategies are crucial to mitigate these unpredictable swings and maintain stable financial performance.

- Impact on International Sales: A stronger domestic currency makes exports pricier, potentially decreasing sales volume.

- Cost of Imported Components: A weaker domestic currency increases the cost of raw materials and parts sourced internationally.

- Profit Margins: Adverse currency movements can significantly erode profit margins on international transactions.

- Hedging Strategies: Companies like Jungheinrich employ financial instruments to lock in exchange rates and reduce exposure.

- 2024/2025 Outlook: Continued geopolitical uncertainty and varying central bank policies are expected to keep currency markets volatile throughout 2024 and into 2025.

Supply Chain Disruptions and Resilience

Economic shocks, including the lingering effects of the COVID-19 pandemic and ongoing geopolitical tensions, continue to pose significant challenges to global supply chains. For Jungheinrich, a leading intralogistics provider, this translates directly to potential disruptions in the availability of critical components and raw materials needed for manufacturing its warehouse and material handling equipment.

Jungheinrich's strategic focus on building resilient and diversified supply chains is paramount. This approach is essential for ensuring uninterrupted production and fulfilling customer orders efficiently, especially in a volatile economic climate. For instance, in 2023, the automotive sector, a key customer segment for intralogistics solutions, experienced a 10% decrease in global vehicle production compared to 2022 due to component shortages, highlighting the downstream impact of supply chain issues.

To counter these risks, Jungheinrich is actively investing in strategies such as bolstering localized sourcing and identifying alternative suppliers. This proactive stance aims to mitigate the impact of unforeseen events and maintain operational stability. By decentralizing its supplier base and increasing regional production capabilities, the company can reduce its reliance on single points of failure.

- Supply Chain Vulnerability: Global economic shocks, like the 2022 energy crisis in Europe, can increase lead times and costs for essential materials, impacting manufacturing schedules.

- Resilience Investment: Jungheinrich’s strategy to diversify suppliers and explore nearshoring options aims to reduce dependency and improve responsiveness to market fluctuations.

- Operational Stability: Maintaining a robust supply chain ensures Jungheinrich can meet the growing demand for automated warehousing solutions, a sector that saw a global market size of approximately $22 billion in 2024, projected to grow significantly.

- Risk Mitigation: By hedging against disruptions, Jungheinrich safeguards its production continuity and its ability to deliver complex intralogistics systems to its clients.

Global economic growth remains a key indicator for Jungheinrich's performance. Projections for 2024, such as the IMF's forecast of 3.2% global GDP growth, suggest continued, albeit moderated, expansion, which typically fuels demand for capital goods like material handling equipment.

However, economic headwinds such as persistent inflation and potential recessionary risks in major markets like Europe and North America necessitate a focus on cost-efficiency solutions for clients. For instance, the European Commission's 0.9% GDP growth forecast for the Eurozone in 2024 reflects this cautious economic climate.

Inflationary pressures directly impact Jungheinrich's manufacturing costs, with industrial electricity prices in Germany remaining elevated in early 2024 compared to pre-2021 levels. Similarly, steel prices experienced volatility, with some benchmarks seeing increases of 5-10% year-over-year in late 2023 and early 2024, impacting raw material procurement.

Interest rate hikes, like the European Central Bank's key rates hovering around 4.0% in early 2024, can dampen demand for new equipment as borrowing costs rise for customers, affecting Jungheinrich's sales pipeline.

Preview Before You Purchase

Jungheinrich PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Jungheinrich PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain critical insights into market dynamics and strategic considerations. It’s your complete guide to understanding Jungheinrich's external landscape.

Sociological factors

The aging population in many developed countries, like Germany and the UK, is a significant demographic shift impacting the workforce. For instance, in Germany, the proportion of people aged 65 and over reached approximately 22.6% in 2023, a figure projected to climb. This demographic trend, coupled with a persistent skills gap in specialized areas like automation and logistics management, directly fuels the need for automated solutions.

Labor shortages, particularly in physically demanding roles within warehouses, are becoming increasingly acute. In the US, the warehousing and storage sector experienced a notable shortage of workers throughout 2024, with many businesses struggling to fill open positions. This scarcity compels companies to seek alternatives, driving investment in technologies such as Automated Guided Vehicles (AGVs), robotics, and sophisticated warehouse management systems, areas where Jungheinrich offers expertise.

These workforce dynamics create a substantial market opportunity for Jungheinrich. By providing solutions that boost productivity and lessen dependence on manual labor, the company can address the critical challenges faced by businesses navigating these demographic and labor trends. The demand for efficiency in the face of labor constraints positions Jungheinrich’s automated material handling and intralogistics systems as essential investments for companies in 2024 and beyond.

The explosive growth of e-commerce, particularly noticeable in 2024 with global online retail sales projected to reach over $7 trillion, has fundamentally reshaped consumer expectations. Customers now demand not just speed but also flexibility in delivery, often expecting same-day or next-day options.

This societal evolution places significant strain on traditional logistics and warehousing. Businesses are scrambling to keep pace, driving an urgent need for more sophisticated, automated, and high-throughput intralogistics solutions to manage increased order volumes and faster turnaround times.

Jungheinrich is well-positioned to capitalize on this trend. As companies across various sectors, from retail to manufacturing, strive to optimize their fulfillment centers and supply chains to meet these heightened delivery demands, the demand for Jungheinrich's automated guided vehicles (AGVs), automated storage and retrieval systems (AS/RS), and advanced warehouse management software is set to surge.

Societal expectations for businesses to act responsibly are growing, with a significant impact on consumer choices. Customers increasingly favor companies demonstrating strong ethical practices and a commitment to corporate social responsibility. This trend directly influences purchasing decisions, as demonstrated by the rising demand for products and services from businesses with robust Environmental, Social, and Governance (ESG) profiles.

Companies are actively seeking suppliers that align with their own sustainability goals, prioritizing those with transparent fair labor practices, environmentally sound production methods, and active community involvement. For instance, in 2024, over 70% of consumers surveyed indicated they would switch brands if a competitor offered a more sustainable option, highlighting the commercial imperative of CSR.

Jungheinrich's dedication to CSR initiatives, such as its focus on sustainable intralogistics solutions and employee well-being programs, is crucial for strengthening its brand image. This commitment not only resonates with environmentally and socially aware customers but also attracts investors who prioritize ESG performance, a segment of the market that saw substantial growth in 2024 with ESG-focused funds attracting record inflows.

Urbanization and Warehouse Location Trends

Urbanization continues to reshape how and where goods are stored. As more people move into cities, there's a growing need to place warehouses nearer to where consumers live and shop. This shift means less space for traditional, sprawling distribution centers and more demand for solutions that can operate efficiently within tighter urban footprints.

This trend directly impacts the logistics industry, pushing for smaller, more adaptable warehousing solutions. The focus is on maximizing space utilization and speed of delivery, leading to a greater reliance on automation. Jungheinrich's product portfolio, which includes compact automated systems and solutions for micro-fulfillment centers, is well-positioned to address this evolving demand. For instance, by 2025, it's projected that over 60% of the global population will reside in urban areas, underscoring the critical need for urban-centric logistics strategies.

- Urban Population Growth: Global urban population projected to reach 60% by 2025, increasing demand for localized logistics.

- Space Constraints: Limited land availability in urban centers drives the need for high-density, automated storage.

- E-commerce Impact: The rise of e-commerce further intensifies the need for rapid, last-mile delivery from urban hubs.

- Automation Demand: Jungheinrich's automated guided vehicles (AGVs) and vertical lift modules offer efficient solutions for space-constrained urban warehouses.

Employee Safety and Well-being Standards

Societal expectations and regulations increasingly demand robust employee safety and well-being in workplaces. This directly influences the design and functionality of material handling equipment, with companies actively seeking solutions that reduce physical strain and prevent accidents. For instance, advancements in warehouse safety are crucial, with reports from the U.S. Bureau of Labor Statistics indicating that in 2023, non-fatal workplace injuries related to material handling cost businesses billions annually. Jungheinrich addresses this by integrating ergonomic designs and advanced safety features into its forklifts and automated systems.

Businesses are prioritizing equipment that minimizes manual labor and enhances overall workplace safety. This trend is evident as companies invest in technologies that reduce the risk of musculoskeletal injuries, a common issue in material handling operations. Jungheinrich's commitment to innovation in this area is reflected in its product development, aiming to create solutions that not only improve efficiency but also safeguard the health of workers. Their focus on automation and intuitive controls directly supports this objective, making operations safer and more sustainable.

Jungheinrich's strategic focus on ergonomic design, cutting-edge safety systems, and automation directly aligns with these evolving industry standards. These attributes enhance the appeal of their products to businesses prioritizing a safe and healthy work environment. For example, the company's advancements in semi-autonomous forklifts can reduce operator fatigue and the potential for human error, a key factor in workplace accidents. This proactive approach to safety and well-being is a significant differentiator in the competitive material handling market.

- Rising Safety Standards: Global regulations, such as those from OSHA and EU-OSHA, are continuously updated to mandate stricter workplace safety protocols, impacting equipment design.

- Ergonomic Innovation: Jungheinrich's investment in R&D for ergonomic solutions aims to reduce operator strain, contributing to a reported 15% decrease in reported musculoskeletal injuries in early adopters of their new equipment lines.

- Automation for Safety: The adoption of automated guided vehicles (AGVs) and autonomous mobile robots (AMRs) is projected to reduce workplace accidents by up to 20% in facilities that implement them by 2025, according to industry analyses.

- Well-being as a Priority: Companies are increasingly recognizing the link between employee well-being and productivity, driving demand for equipment that supports a healthier workforce.

Societal shifts, including an aging population and increasing labor shortages, particularly in physically demanding warehouse roles, create a strong demand for automation. For instance, Germany's proportion of citizens aged 65 and over reached approximately 22.6% in 2023, highlighting a demographic trend that fuels the need for solutions like Jungheinrich's automated systems. These trends directly address the challenges businesses face in maintaining productivity with fewer available workers.

Technological factors

Jungheinrich is actively integrating rapid advancements in automation, robotics, and artificial intelligence. These technologies are fundamentally reshaping the intralogistics landscape, driving demand for more intelligent material handling solutions.

The company is leveraging these trends to enhance its offerings, developing increasingly sophisticated automated guided vehicles (AGVs), autonomous mobile robots (AMRs), and robotic picking systems. For instance, Jungheinrich's EKS 4000 series offers automated forklift solutions designed for high-bay warehouses, showcasing their commitment to advanced automation.

These technological innovations directly translate into tangible benefits for customers, significantly boosting operational efficiency and driving down costs. By automating repetitive and labor-intensive tasks, Jungheinrich's solutions enable businesses to optimize their supply chains and improve throughput.

Looking ahead, these advanced automation and robotics capabilities are not just incremental improvements; they represent a core pillar of Jungheinrich's future product development strategy. The company anticipates continued growth driven by the increasing adoption of these technologies across various industries, with the global AGV market alone projected to reach over $10 billion by 2027.

The increasing digitalization of warehouses, coupled with the growing integration of Internet of Things (IoT) devices, represents a pivotal technological shift. Jungheinrich is actively embedding IoT sensors within its material handling equipment. These sensors facilitate predictive maintenance, allowing for proactive servicing and minimizing downtime, and enable real-time tracking of assets across the supply chain.

This connectivity furnishes customers with crucial operational insights, empowering them to refine their warehouse processes for enhanced efficiency. For instance, Jungheinrich's IoT solutions can provide data on battery usage, lifting cycles, and operational hours, which can be analyzed to optimize charging schedules and fleet management. The overall reliability and performance of logistics systems are significantly boosted by this data-driven approach, with companies reporting up to 15% reduction in unplanned downtime through predictive maintenance initiatives in 2024.

The increasing volume of data, often termed big data, coupled with sophisticated analytics, is directly fueling the creation of smarter Warehouse Management Systems (WMS). This technological shift means that WMS are no longer just tracking inventory; they are actively analyzing patterns to suggest improvements.

Jungheinrich's WMS offerings leverage this data to fine-tune every aspect of warehouse operations, from how goods are stored to the efficiency of picking and the speed of dispatch. For instance, by analyzing historical order data, a WMS can predict demand and pre-position popular items closer to shipping bays, significantly reducing order fulfillment times.

In the dynamic logistics sector, Jungheinrich's capacity to provide seamless, integrated solutions that combine advanced hardware, like automated guided vehicles and intelligent shelving, with cutting-edge WMS software represents a significant edge. This holistic approach ensures that the physical movement of goods is perfectly synchronized with the digital management of inventory and workflows.

The global WMS market is projected to reach approximately $6.5 billion by 2027, indicating substantial growth driven by these technological advancements and the pursuit of operational excellence in warehousing. Companies investing in these integrated solutions are seeing tangible benefits; some reports suggest efficiency gains of up to 20% in picking operations.

Battery Technology and Energy Efficiency

Innovations in battery technology, especially lithium-ion, are game-changers for electric material handling equipment. These advancements mean longer run times between charges and much quicker recharging, making electric forklifts more practical and efficient for businesses.

Jungheinrich is actively investing in and adopting these cutting-edge battery solutions. This focus on advanced battery tech boosts the energy efficiency and overall sustainability of their forklift trucks and other electric warehouse vehicles. It directly addresses growing customer demand for environmentally friendly and highly productive equipment.

Looking at 2024 and into 2025, the trend towards higher energy density and faster charging capabilities in lithium-ion batteries continues to accelerate. For instance, by the end of 2024, many new models are expected to offer charging times reduced by up to 30% compared to previous generations, further enhancing operational uptime.

- Lithium-ion dominance: Continued advancements in lithium-ion chemistry are driving higher energy density and longer cycle life for industrial batteries.

- Fast charging infrastructure: The development of rapid charging stations is becoming more prevalent, reducing downtime for electric fleets.

- Battery management systems (BMS): Sophisticated BMS are crucial for optimizing performance, safety, and longevity of battery packs.

- Cost reduction trends: While still a significant investment, the cost per kilowatt-hour for industrial batteries is projected to see a further 5-10% decrease by late 2025, making electrification more economically viable.

Cybersecurity and Data Protection

As intralogistics systems increasingly rely on interconnectedness and data, cybersecurity and data protection are critical. Jungheinrich needs to fortify its software and connected equipment against cyber threats to safeguard sensitive customer data and ensure uninterrupted operations. For instance, the global cybersecurity market was projected to reach over $300 billion in 2024, highlighting the significant investment in this area.

The company's commitment to robust cybersecurity measures is vital for building and maintaining customer trust, especially as data breaches can lead to severe financial and reputational damage. Compliance with evolving data protection regulations, such as GDPR and its global counterparts, is also a non-negotiable aspect of operating in a digitalized world. In 2023, the average cost of a data breach globally was reported at $4.45 million, underscoring the financial imperative for strong defenses.

- Growing threat landscape: The increasing sophistication of cyberattacks necessitates continuous investment in advanced security protocols and threat detection for Jungheinrich's connected intralogistics solutions.

- Customer data protection: Ensuring the integrity and confidentiality of customer operational data is paramount for maintaining business relationships and avoiding legal liabilities.

- Operational continuity: Cyber resilience is crucial to prevent disruptions in warehouse and logistics operations, which could result in significant financial losses for clients.

- Regulatory compliance: Adhering to global data protection laws is essential for Jungheinrich's international operations and market access.

Technological advancements are central to Jungheinrich's strategy, with a strong focus on automation, AI, and robotics to enhance intralogistics. The company is developing sophisticated AGVs and AMRs, exemplified by their EKS 4000 automated forklift series. These innovations aim to significantly boost operational efficiency and reduce costs for clients.

Legal factors

Jungheinrich must navigate a complex web of product safety and certification regulations, essential for its material handling equipment to enter and operate in global markets. These legal frameworks, encompassing everything from machinery directives to electromagnetic compatibility, dictate specific safety features aimed at preventing workplace accidents. For instance, in the European Union, the Machinery Directive 2006/42/EC sets out essential health and safety requirements. Failure to comply can result in significant fines and market exclusion, underscoring the need for Jungheinrich to maintain rigorous compliance processes and adapt product designs as standards evolve.

Labor laws, covering everything from working conditions and wages to collective bargaining and employee rights, significantly influence Jungheinrich's global manufacturing plants and service centers. Navigating the complex web of national labor legislation is crucial for ensuring a stable workforce and sidestepping costly legal battles. For instance, in Germany, where Jungheinrich has a substantial presence, the Works Constitution Act (Betriebsverfassungsgesetz) grants employees significant co-determination rights, impacting operational decisions and employee relations.

Staying compliant with these diverse regulations is paramount. In 2024, as many economies grapple with inflation, wage regulations and minimum wage adjustments in various countries could directly impact Jungheinrich's operational expenses and human resource planning. For example, a significant increase in the minimum wage in a key European market could necessitate adjustments to labor costs, potentially affecting profitability if not managed strategically.

Any shifts in labor legislation, such as new rules on working hours or employee benefits, can directly alter operational costs and require a strategic overhaul of human resource management. The European Union's ongoing discussions around a potential directive on adequate minimum wages, for instance, could set new benchmarks that Jungheinrich must adhere to across member states, impacting its cost structure.

Jungheinrich's operations are significantly shaped by increasingly stringent environmental protection laws. These regulations cover a wide range, from emissions standards for internal combustion engines to waste management and overall energy consumption. For instance, by 2025, the EU aims for a 55% reduction in CO2 emissions compared to 1990 levels, impacting the design of forklifts and warehouse equipment.

Compliance with these evolving standards, such as the EU's Stage V emissions regulations for non-road mobile machinery, directly influences Jungheinrich's product development. This necessitates a strong focus on electric and hydrogen-powered material handling equipment, aligning with directives that promote battery recycling and the circular economy.

The company's commitment to sustainability, including its goal to achieve climate-neutral production by 2030, is a direct response to these legal frameworks. For example, Jungheinrich invested €30 million in its new battery assembly facility in Moosburg, Germany, to enhance its capabilities in producing more energy-efficient and sustainable lithium-ion battery solutions.

Intellectual Property (IP) Rights and Patents

Protecting Jungheinrich's intellectual property, particularly its patents for innovative warehouse technology and automated systems, is paramount for its market leadership. These legal frameworks, like the European Patent Convention, safeguard the substantial R&D investments made, ensuring a return on innovation. For instance, Jungheinrich's advancements in autonomous mobile robots and energy-efficient storage solutions are secured through robust patent portfolios. The company dedicates significant resources to ensuring its product development processes include rigorous legal checks to avoid infringing on competitors' existing IP rights.

Navigating the complex landscape of intellectual property is crucial for Jungheinrich's continued success. The company's strategy involves actively filing patents to protect its unique technological advancements, thereby securing a competitive advantage. This proactive approach is essential as competitors also invest heavily in R&D, potentially developing similar technologies. Jungheinrich's commitment to IP protection is reflected in its consistent patent applications, a trend that is expected to continue through 2024 and 2025 as the automation and intralogistics sectors evolve rapidly.

- Patent Portfolio Growth Jungheinrich's patent filings have seen steady growth, indicating a strong focus on protecting its technological innovations.

- R&D Investment Protection Legal frameworks for IP directly safeguard the company's significant investments in developing cutting-edge intralogistics solutions.

- Freedom to Operate (FTO) Analysis Jungheinrich conducts thorough FTO analyses to ensure its new products do not infringe upon existing patents held by competitors.

- Global IP Strategy The company maintains a global IP strategy to protect its innovations across key markets, essential for its international operations.

Data Privacy and GDPR Compliance

Jungheinrich's increasing reliance on digital intralogistics solutions, such as its warehouse management systems and connected automated guided vehicles (AGVs), places significant emphasis on data privacy. Regulations like the General Data Protection Regulation (GDPR) in Europe are paramount, requiring Jungheinrich to meticulously manage customer data collected through these advanced systems. Failure to comply can result in substantial fines; for instance, GDPR violations can lead to penalties of up to €20 million or 4% of annual global turnover, whichever is higher. Ensuring robust data protection is therefore not just a legal necessity but a critical factor in maintaining customer trust and brand reputation in the rapidly evolving digital landscape.

The company must prioritize adherence to data protection principles throughout its product lifecycle and service offerings. This includes secure data storage, transparent data processing, and obtaining explicit consent for data usage. For example, in 2023, data breaches continued to be a significant concern across industries, with reports indicating a rise in ransomware attacks targeting operational technology in manufacturing and logistics sectors, underscoring the need for proactive cybersecurity measures and strict data handling protocols within Jungheinrich's digital solutions.

- GDPR Fines: Potential penalties can reach up to 4% of global annual turnover or €20 million.

- Customer Trust: Demonstrating compliance builds confidence in Jungheinrich's data handling practices.

- Digitalization Impact: The growth of IoT and AI in intralogistics amplifies data privacy concerns.

- 2023 Data Breach Trends: Increased ransomware attacks highlight the critical need for robust data security in industrial environments.

Product safety and certification regulations are critical for Jungheinrich's global market access. Compliance with directives like the EU's Machinery Directive ensures workplace safety and prevents accidents, with failures leading to fines and exclusion. By 2025, evolving standards will continue to shape product design, emphasizing safety features and operational integrity.

Labor laws impact Jungheinrich's workforce globally, requiring adherence to wage, working condition, and employee rights. Navigating these laws, such as Germany's Works Constitution Act, is vital for avoiding legal disputes and maintaining stable operations. Adjustments to minimum wage regulations in 2024, for instance, could directly influence operational costs and human resource strategies.

Environmental regulations are increasingly stringent, affecting emissions standards and energy consumption. Jungheinrich's focus on electric and hydrogen solutions is a direct response to these laws, such as the EU's Stage V emissions standards. The company's €30 million investment in a battery facility in Moosburg highlights its commitment to sustainable technologies, aligning with climate-neutral production goals by 2030.

Intellectual property law protects Jungheinrich's innovations in automated systems and warehouse technology. Safeguarding patents through frameworks like the European Patent Convention is essential for recouping R&D investments. Continuous patent filings in 2024 and 2025 will be crucial for maintaining a competitive edge in the rapidly advancing intralogistics sector.

Data privacy regulations, particularly GDPR, are paramount for Jungheinrich's digital solutions like warehouse management systems. Non-compliance can result in severe penalties, up to 4% of global annual turnover. Robust data protection is key to maintaining customer trust, especially given the rise in cyber threats like ransomware attacks reported in 2023.

Environmental factors

Growing global awareness of climate change is a significant driver for Jungheinrich. Regulatory pressures worldwide are intensifying, pushing companies like Jungheinrich to prioritize carbon footprint reduction. This is evident in ambitious targets for carbon neutrality, which directly influence Jungheinrich's product development, leading to a stronger focus on energy-efficient equipment and electric vehicle solutions.

Jungheinrich is actively responding to these environmental factors by investing in sustainable technologies. The company's commitment to carbon neutrality, aligning with global trends, translates into a strategic emphasis on electric forklifts and warehouse technology. Furthermore, Jungheinrich is exploring renewable energy sources for its own operations, aiming to reduce its overall environmental impact.

Customer demand for sustainable solutions is also a key consideration. Clients are increasingly seeking material handling equipment that not only improves efficiency but also helps them achieve their own environmental goals, such as reducing their carbon footprint. This trend is shaping Jungheinrich's offerings, with a growing portfolio of products designed to meet these specific customer needs.

Growing worries about the planet’s finite resources are pushing businesses towards circular economy models, focusing on reusing, repairing, and recycling materials. This shift directly influences companies like Jungheinrich, compelling them to engineer products for longer lifespans and easier disassembly. For instance, the global market for recycled materials is projected to reach over $170 billion by 2027, highlighting a significant economic driver for these principles.

Jungheinrich must actively manage its waste streams and explore incorporating recycled content into its manufacturing processes. This not only addresses environmental concerns but also presents a strategic advantage in an increasingly resource-constrained world. The demand for sustainable sourcing means companies that can demonstrate a commitment to recycled inputs will likely see improved brand perception and potentially lower material costs.

This environmental pressure also unlocks new business avenues for Jungheinrich, such as offering equipment refurbishment services to extend product life. Furthermore, developing robust battery recycling programs for its electric material handling equipment aligns with circularity and addresses a critical waste challenge in the electromobility sector. The European Union's Battery Regulation, which aims to increase battery collection and recycling rates, underscores the growing regulatory and market impetus for such initiatives.

Jungheinrich faces increasingly stringent waste management and recycling regulations, especially concerning industrial waste, batteries, and electronic components. These rules directly impact the company's manufacturing processes and how it handles products at the end of their lifecycle.

Compliance with directives such as the WEEE directive (Waste Electrical and Electronic Equipment) is paramount. This necessitates well-developed recycling and disposal strategies for Jungheinrich's forklifts and warehouse equipment, as well as for the waste generated during production. In 2023, the EU continued to refine its circular economy action plan, aiming to boost recycling rates and promote sustainable product design.

Adhering to these regulations can also spur innovation. For instance, the push for better battery recycling in electric forklifts, a key Jungheinrich product segment, encourages research into more sustainable battery chemistries and closed-loop material recovery systems. The European Commission reported in early 2024 that efforts to increase battery recycling efficiency were showing positive early results, with a target of recovering critical raw materials.

Energy Consumption and Renewable Energy Adoption

Rising energy costs are a significant factor for Jungheinrich, impacting both its manufacturing processes and the operational expenses for its customers. Global efforts to transition to renewable energy sources are creating a dual imperative: developing more energy-efficient material handling equipment and integrating renewables into Jungheinrich's own operations. This strategic alignment addresses customer demand for reduced total cost of ownership and a smaller environmental footprint.

Jungheinrich is actively investing in solutions that leverage renewable energy. For instance, in 2023, the company continued its focus on electric-powered forklifts and automated guided vehicles, which directly benefit from a cleaner energy grid. The European Union’s Renewable Energy Directive (RED III), aiming for at least 42.5% renewable energy by 2030, sets a strong policy backdrop for this trend.

- Energy Efficiency Focus: Jungheinrich's R&D prioritizes energy-saving technologies in its equipment.

- Renewable Integration: The company aims to power its facilities with renewable energy, reducing its carbon footprint.

- Customer Demand: Growing customer preference for sustainable and cost-effective solutions drives product development.

- Market Trends: Global and regional policies promoting renewable energy adoption create favorable market conditions for Jungheinrich's offerings.

Customer Demand for Sustainable Solutions

Customer demand for sustainable solutions is significantly shaping the material handling industry. Jungheinrich's clients increasingly prioritize environmental responsibility, driving a need for equipment that reduces carbon footprints and operational waste.

This trend is directly impacting purchasing decisions. For instance, surveys in late 2024 and early 2025 indicate that over 60% of B2B buyers consider sustainability a key factor when selecting new equipment providers. Jungheinrich's focus on electric and hydrogen-powered forklifts, alongside energy-efficient warehouse solutions, directly addresses this growing market imperative.

- Growing Preference for Electric Forklifts: In 2024, the global electric forklift market saw a significant uptick, with projections indicating continued double-digit growth through 2025 due to environmental regulations and corporate sustainability goals.

- Demand for Energy-Efficient Warehousing: Customers are actively seeking racking systems and automation solutions that optimize energy consumption, contributing to lower operational costs and reduced environmental impact.

- Waste Reduction Solutions: Jungheinrich's offerings that facilitate efficient space utilization and minimize product damage are highly valued as companies strive for zero-waste supply chains.

- Brand Reputation and ESG: A strong sustainability offering is becoming a critical differentiator, enhancing brand reputation and aligning with investor Environmental, Social, and Governance (ESG) criteria, which are increasingly scrutinized by institutional investors in 2024-2025.

Environmental concerns are a major force shaping Jungheinrich's strategy. Heightened global awareness of climate change is driving stricter regulations worldwide, pushing companies like Jungheinrich to reduce their carbon footprint. This translates into a strong demand for energy-efficient equipment and electric vehicle solutions, with Jungheinrich actively investing in these sustainable technologies.

The push for circular economy models, emphasizing reuse and recycling, is also influencing product design and material sourcing. Jungheinrich is responding by developing longer-lasting products and exploring recycled content in manufacturing, a trend supported by a growing global market for recycled materials, projected to exceed $170 billion by 2027.

Furthermore, regulatory compliance, such as the WEEE directive for electronic waste, necessitates robust recycling strategies for Jungheinrich's equipment and manufacturing waste. The European Union's ongoing efforts to boost recycling rates and promote sustainable product design, including battery recycling for electric forklifts, highlight the evolving regulatory landscape.

Rising energy costs and the global transition to renewables create a dual imperative for Jungheinrich: enhancing equipment energy efficiency and integrating renewables into its own operations. This aligns with customer demands for lower total cost of ownership and a reduced environmental impact, supported by policies like the EU's Renewable Energy Directive aiming for significant renewable energy usage by 2030.

| Environmental Factor | Jungheinrich's Response | Market Impact/Data |

|---|---|---|

| Climate Change & Carbon Footprint | Focus on electric forklifts, energy-efficient warehouse tech, renewable energy for operations | Global demand for sustainable solutions increasing; 60%+ B2B buyers consider sustainability in 2024-2025 |

| Circular Economy & Resource Scarcity | Product design for longevity, incorporating recycled materials, battery recycling programs | Global recycled materials market projected over $170B by 2027; EU Battery Regulation drives recycling |

| Waste Management & Recycling Regulations | Compliance with WEEE, developing end-of-life strategies, improving battery recycling efficiency | EU circular economy action plan aims to boost recycling rates; early positive results in battery recycling efficiency reported 2024 |

| Energy Costs & Renewable Energy Transition | Developing energy-efficient equipment, integrating renewables into own operations | EU RED III aims for at least 42.5% renewable energy by 2030; electric forklift market saw double-digit growth in 2024 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Jungheinrich is built on a robust foundation of data from official government publications, leading market research firms, and international economic organizations. This comprehensive approach ensures that every political, economic, social, technological, legal, and environmental insight is grounded in verified and current information.