Jungheinrich Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jungheinrich Bundle

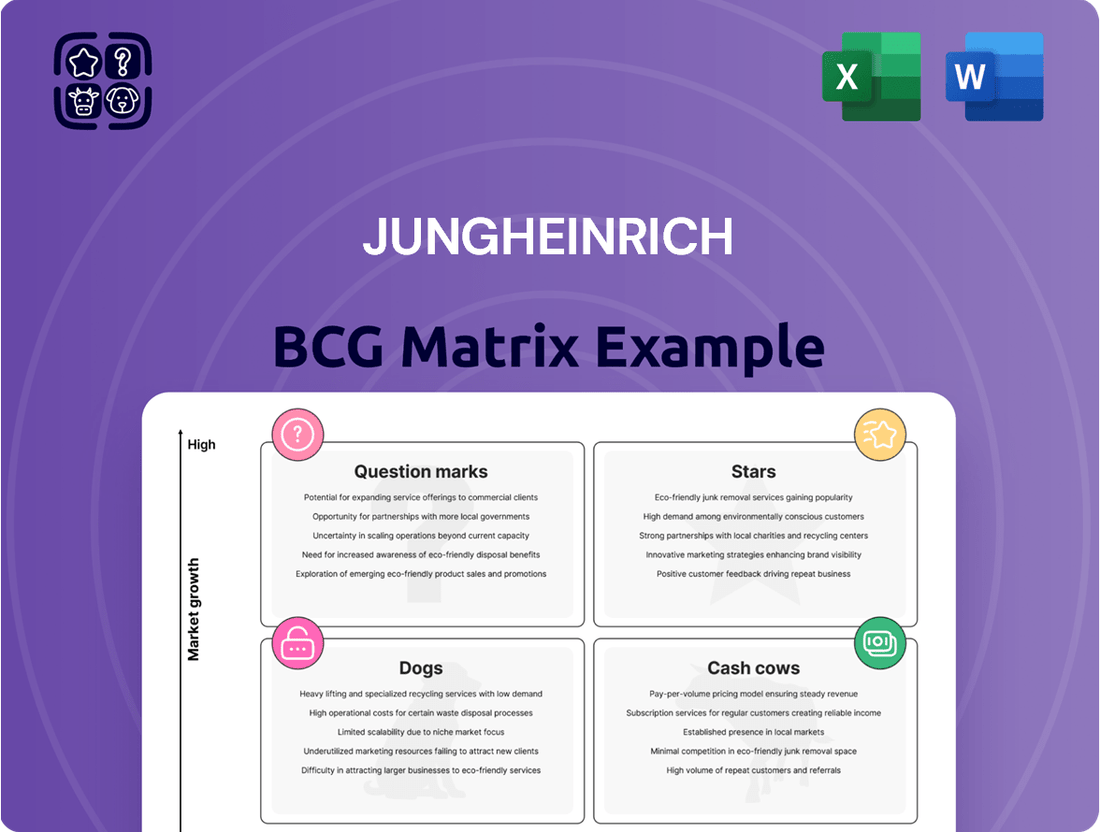

Curious about Jungheinrich's strategic positioning? Our BCG Matrix preview highlights key product categories, revealing their market share and growth potential. See which of their offerings are driving growth and which might need a closer look.

This glimpse into Jungheinrich's product portfolio is just the beginning. To truly understand their competitive landscape and make informed decisions, you need the full picture.

Purchase the complete Jungheinrich BCG Matrix to gain a detailed quadrant-by-quadrant analysis, identifying their Stars, Cash Cows, Dogs, and Question Marks.

Unlock actionable insights and a clear roadmap for resource allocation and future investment by acquiring the full report.

Don't miss out on the opportunity to leverage this powerful strategic tool for your own business planning.

Stars

Jungheinrich is a major contender in the booming AGV and AMR market, a sector seeing impressive growth worldwide, particularly in Europe. The company's commitment to expanding its automation offerings is evident through strategic moves like acquiring arculus GmbH, a notable player in the AMR technology space.

These automated solutions are crucial for addressing the escalating demand for warehouse automation, fueled by the rise of e-commerce and persistent labor shortages. This positions AGVs and AMRs as key growth drivers with significant market share potential for Jungheinrich.

In 2024, the global warehouse automation market, encompassing AGVs and AMRs, was projected to reach over $10 billion, with an anticipated compound annual growth rate exceeding 15% in the coming years. Jungheinrich's proactive investment and acquisition strategy in this area directly taps into this dynamic market trend.

Jungheinrich's integrated logistics systems and software solutions are a strong contender in the Stars category. As intralogistics grows more intricate, the demand for Jungheinrich's combined material handling equipment with advanced warehouse management software (WMS) and integrated logistics systems is substantial. The company is strategically connecting manual and automated processes, a move that positions it well in this rapidly expanding market. This includes developing digital fleet management tools and sophisticated software platforms to meet evolving customer needs.

Jungheinrich is a clear leader in intralogistics, particularly with its advanced lithium-ion powered forklifts. This technology is driving significant growth, with the global electric forklift market expected to reach $55.3 billion by 2027, a compound annual growth rate of 8.3%. Jungheinrich's commitment to innovation, including its 2024 product launches featuring integrated lithium-ion systems, firmly places these forklifts in the Stars category of the BCG matrix.

E-commerce and Warehouse Automation Solutions

The explosive growth of e-commerce, amplified by the demand for seamless omnichannel experiences, is a major catalyst for automated intralogistics. Jungheinrich is strategically positioning itself in this high-demand sector by expanding its offerings in automated warehouses and robotics. This focus on e-commerce-tailored solutions represents a significant growth avenue for the company, with ambitious targets for market share capture.

Jungheinrich's investment in automation is directly addressing the need for faster, more efficient order fulfillment critical for online retail. The company's portfolio includes automated guided vehicles (AGVs) and automated storage and retrieval systems (AS/RS), designed to optimize warehouse operations. For instance, in 2023, the global warehouse automation market was valued at approximately $20 billion and is projected to grow substantially, with e-commerce being a key contributor.

- E-commerce Growth: Global e-commerce sales are projected to reach over $8 trillion by 2025, fueling the need for efficient warehouse operations.

- Automation Investment: Jungheinrich is increasing its R&D spending on automation technologies to meet this demand.

- Market Penetration: The company aims to capture a larger share of the growing warehouse automation market, particularly within the e-commerce logistics segment.

- Robotics Focus: Jungheinrich is enhancing its robotics solutions to provide end-to-end automation for fulfillment centers.

Global Expansion in North America and Asia-Pacific

Jungheinrich's Strategy 2030+ places significant emphasis on expanding its global footprint, with a keen focus on North America and the dynamic Asia-Pacific (APAC) region. The company actively seeks to bolster its revenue contribution from these high-growth markets, recognizing their substantial potential for future development and increased market share. This strategic push is evident in their recent activities, underscoring a commitment to becoming a dominant player in these key geographies.

To solidify its presence, Jungheinrich has pursued strategic acquisitions, such as the notable purchase of Storage Solutions in the United States. This move is designed to accelerate market penetration and leverage existing infrastructure and customer bases within North America. Concurrently, the establishment of new experience centers across the APAC region signifies a direct investment in customer engagement and brand visibility, aiming to capture a larger segment of this rapidly evolving market.

- North American Growth: Jungheinrich aims to increase its revenue share in North America through strategic initiatives and acquisitions, evidenced by the purchase of Storage Solutions.

- APAC Market Focus: The company is investing in the Asia-Pacific region, establishing new experience centers to enhance customer reach and build brand presence.

- Revenue Diversification: Expansion into these key regions is crucial for Jungheinrich's strategy to diversify its revenue streams and reduce reliance on traditional European markets.

- Market Share Ambitions: These expansion efforts are directly tied to Jungheinrich's objective of capturing significant market share in both North America and the Asia-Pacific by 2030.

Jungheinrich's integrated intralogistics solutions and advanced software platforms represent key 'Stars' in their portfolio. These offerings cater to increasingly complex warehouse needs, combining material handling equipment with sophisticated warehouse management systems. The company's focus on digital fleet management and interconnected logistics solutions directly addresses the growing demand for seamless operational integration.

Jungheinrich's advanced lithium-ion powered forklifts are also firmly positioned as 'Stars'. The global electric forklift market is experiencing robust growth, with Jungheinrich's innovative product launches in 2024, featuring integrated lithium-ion technology, aligning perfectly with this trend. This strategic investment in cutting-edge power solutions drives significant market appeal.

The company's expansion into automated guided vehicles (AGVs) and automated storage and retrieval systems (AS/RS) further solidifies its 'Star' status, particularly in the context of booming e-commerce. These solutions are designed to enhance order fulfillment efficiency, a critical factor for online retail. The global warehouse automation market, heavily influenced by e-commerce, is projected for substantial growth, with Jungheinrich actively investing to capture market share.

Jungheinrich's strategic global expansion, particularly in North America and the APAC region, positions its international operations as 'Stars'. The acquisition of Storage Solutions in the US and the establishment of experience centers in APAC demonstrate a clear commitment to penetrating high-growth markets. This geographic diversification is vital for increasing revenue and market share, with a strong focus on increasing revenue contribution from these regions by 2030.

| Product/Service Area | BCG Category | Key Growth Drivers | Market Data (2024/Projections) |

|---|---|---|---|

| Integrated Intralogistics & Software | Star | Demand for complex warehouse automation, digital transformation | Global warehouse automation market projected >$10 billion in 2024, >15% CAGR |

| Lithium-ion Forklifts | Star | Shift to electric power, demand for energy efficiency | Global electric forklift market projected $55.3 billion by 2027, 8.3% CAGR |

| AGVs & AS/RS | Star | E-commerce growth, need for faster fulfillment | Global warehouse automation market valued ~$20 billion in 2023, significant e-commerce contribution |

| North America & APAC Operations | Star | Market penetration strategies, strategic acquisitions | Targeting increased revenue share in these high-growth regions by 2030 |

What is included in the product

The Jungheinrich BCG Matrix evaluates product portfolio performance by categorizing units into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth.

The Jungheinrich BCG Matrix streamlines strategic analysis by visually categorizing business units, simplifying complex portfolio decisions.

Cash Cows

Standard electric counterbalanced forklift trucks represent a classic cash cow for Jungheinrich. With over a million of their electric trucks already in operation worldwide, Jungheinrich boasts significant, long-standing expertise in this sector. This mature product line operates within a stable market, where the company's strong market position ensures consistent cash flow.

The widespread adoption of these forklifts across numerous industries, coupled with Jungheinrich's established market share, fuels their reliable revenue generation. In 2024, the global forklift market, valued at approximately $50 billion, continues to see electric models gain traction, with Jungheinrich well-positioned to capitalize on this trend.

Jungheinrich's after-sales services, encompassing maintenance, repair, and spare parts, function as a robust cash cow. The company's substantial global installed base of material handling equipment translates into a consistent and highly profitable revenue stream from these essential support functions. This recurring demand ensures operational continuity for their customers, solidifying these services as a predictable and stable profit generator for Jungheinrich.

Jungheinrich's short-term rental and used equipment business acts as a stable cash cow within its portfolio. This segment addresses customer demands for flexibility and cost-effectiveness by offering a broad selection of rental options and pre-owned machinery. In 2024, the demand for flexible material handling solutions continued to grow, with rental fleet utilization rates remaining strong across Europe.

This business model benefits from Jungheinrich's extensive existing equipment lifecycle. By refurbishing and reselling used equipment, the company capitalizes on its assets, generating consistent revenue streams. This approach also insulates it from the volatility often seen in new equipment sales, making it a predictable contributor to overall profitability.

Traditional Pallet Trucks and Warehouse Stackers

Traditional pallet trucks and warehouse stackers, including manual and electric variants, form a core product segment for Jungheinrich. These fundamental material handling tools, while operating in a market with potentially slower growth rates than advanced automated systems, benefit from widespread adoption and consistent utility. This ensures a reliable and substantial cash flow for the company.

In 2024, Jungheinrich's extensive portfolio of traditional material handling equipment continued to be a significant contributor to its revenue and profitability. The company reported robust sales figures for its pallet trucks and stackers, underscoring their enduring demand in logistics and warehousing operations. This segment, despite facing competition, remains a cornerstone of Jungheinrich's business, reflecting its deep market penetration and the essential nature of these products for everyday warehouse functions.

- Market Penetration: Traditional pallet trucks and stackers have achieved high market penetration across various industries.

- Cash Generation: Their essential utility and steady demand translate into strong and consistent cash flow for Jungheinrich.

- Sales Contribution: In 2024, these foundational products continued to represent a significant portion of Jungheinrich's overall sales.

- Industry Staples: They remain critical for daily operations in warehouses and distribution centers globally.

Conventional Racking and Storage Systems

Conventional racking and storage systems represent a cornerstone of Jungheinrich's offerings, acting as a vital component for efficient warehouse operations. These are the bedrock solutions that enable businesses to organize and access their inventory effectively.

Jungheinrich's extensive portfolio in this area has secured a significant market share. This dominance stems from the fundamental need for such systems across virtually all warehousing and logistics environments, making them a consistent revenue generator.

In 2024, the global warehouse automation market, which includes racking systems, was valued at approximately USD 25.3 billion and is projected to grow steadily. Jungheinrich's established presence in this segment positions its conventional racking and storage systems as reliable cash cows, contributing to stable financial performance in a mature but essential market.

- High Market Share: Jungheinrich commands a substantial portion of the conventional racking and storage systems market due to their widespread adoption and necessity.

- Stable Revenue Generation: These systems provide a consistent and predictable income stream, reflecting their role as foundational warehouse infrastructure.

- Mature Market Segment: While the market for these systems is well-established, their ongoing demand ensures continued profitability for Jungheinrich.

- Significant Cash Flow Contribution: The reliability and broad applicability of these solutions make them a major contributor to the company's overall cash flow.

Jungheinrich's after-sales services, encompassing maintenance, repair, and spare parts, function as a robust cash cow. The company's substantial global installed base of material handling equipment translates into a consistent and highly profitable revenue stream from these essential support functions. This recurring demand ensures operational continuity for their customers, solidifying these services as a predictable and stable profit generator for Jungheinrich.

The global market for forklift after-sales services is substantial, with Jungheinrich's extensive installed base of over 1 million electric trucks providing a strong foundation for its service revenue. In 2024, companies across industries continue to rely on efficient material handling, driving consistent demand for maintenance and spare parts, which Jungheinrich is well-positioned to meet.

This segment benefits from high customer loyalty and the critical nature of equipment uptime. Jungheinrich's established service network and expertise ensure that these offerings remain a highly profitable and stable contributor to the company's cash flow, capitalizing on the lifecycle of its sold equipment.

| Service Area | 2024 Market Trend | Jungheinrich's Position | Cash Flow Impact |

| Maintenance & Repair | High demand due to fleet age and operational necessity | Extensive service network, skilled technicians | Consistent, recurring revenue |

| Spare Parts | Steady demand for replacement components | Large inventory, efficient logistics | Reliable profit margin |

| Fleet Management Solutions | Growing interest in optimizing fleet performance | Integrated digital services | Potential for increased service revenue |

What You’re Viewing Is Included

Jungheinrich BCG Matrix

The comprehensive Jungheinrich BCG Matrix report you're previewing is the identical, fully formatted document you will receive upon purchase, offering immediate strategic insights. This isn't a sample; it's the complete, analysis-ready file designed to empower your business planning with expert-driven market segmentation. Once purchased, this robust report will be instantly accessible for your use in presentations, strategic reviews, or internal decision-making. You can confidently acquire this professionally designed BCG Matrix, ready to be integrated into your core business strategy without any further modifications or limitations.

Dogs

While Jungheinrich champions electric forklifts, a few older internal combustion (IC) engine models might still be around, perhaps in niche applications or older customer fleets. The global push for sustainability and stricter emissions rules, like the Euro 7 standards coming into play for vehicles in Europe, is making these non-electric options less attractive. This trend means demand is shrinking and their market share is falling.

These IC engine forklifts could become what's called a 'cash trap'. They cost more to run due to fuel and maintenance, and because the market is moving away from them, they don't have much potential for future growth. For instance, while exact figures for Jungheinrich's specific IC forklift portfolio are not publicly detailed, the broader materials handling equipment market saw a significant shift, with electric forklifts accounting for over 70% of new sales in many developed regions by 2024.

Highly specialized manual handling equipment, especially those with very low sales volumes and little market differentiation, often find themselves in the Dogs quadrant of the BCG Matrix. These products, while potentially serving a dedicated customer base, typically lack the broad appeal or innovative edge needed for significant growth. For instance, a niche piece of equipment designed for a very specific industrial process might see its market shrink as technology advances or industries consolidate.

In 2024, Jungheinrich, like many industrial equipment manufacturers, likely reviewed its portfolio for such underperforming items. Products in this category might struggle with profitability due to high customization costs and limited economies of scale. If a particular manual handling solution, say a custom-built pallet lifter for a now-defunct manufacturing process, only generated a few thousand euros in revenue in the last fiscal year and showed no signs of market resurgence, it would be a prime candidate for divestment or discontinuation.

Legacy software systems, particularly older warehouse and fleet management solutions, often present significant challenges. These systems, frequently proprietary, lack the modern integration capabilities and cloud-based scalability that are essential in today's rapidly evolving logistics landscape. This makes them ill-equipped to compete effectively with newer, more agile alternatives that leverage advanced technologies.

The cost of maintaining these legacy systems can become disproportionately high when viewed against their declining market share and limited growth potential. For instance, companies may find themselves dedicating substantial IT resources to keep these outdated platforms operational, diverting funds that could be invested in more innovative and future-proof solutions. This situation is akin to a product in the Dogs quadrant of the BCG matrix, where low growth and low market share necessitate a careful re-evaluation of investment.

Products in Geographically Declining Markets

Jungheinrich's 2024 annual report highlighted challenges in established regions like Germany and North America, which directly affected their revenue streams. Products that are heavily concentrated in these specific, shrinking geographic markets, and lack significant expansion into growing regions, are likely to be categorized as Dogs within the BCG matrix. This classification stems from their limited growth potential and the increasing difficulty in maintaining or expanding market share in these areas.

For instance, if a specific line of Jungheinrich's forklift trucks saw its primary demand in sectors experiencing economic contraction within Germany, and failed to gain traction in emerging Asian markets, it would fit the Dog profile. Jungheinrich reported a 2024 revenue of €4.7 billion, with the European market, including Germany, remaining their largest segment. However, a slowdown in industrial investment in Germany, a key driver for material handling equipment, could significantly impact products tied to that specific demand.

- Low Market Growth: Products dependent on mature or declining economies may experience stagnant or negative growth.

- Shrinking Market Share: In geographies with reduced overall demand, maintaining or increasing share becomes increasingly difficult.

- Reduced Investment: Companies often de-prioritize or divest Dog products to reallocate resources to more promising ventures.

- Operational Inefficiencies: Products in declining markets might face higher per-unit costs due to lower production volumes.

Discontinued Product Lines or Models

Jungheinrich's strategic review might identify product lines with declining relevance. For instance, older models of manual pallet trucks or specific diesel-powered forklifts could be phased out as the market shifts towards electric and automated solutions. This aligns with the "Dogs" category in the BCG matrix, where these products would have low market share and little to no growth potential.

The company may cease production of these items to reallocate resources to more promising areas. For example, if a particular series of internal combustion engine forklifts saw a significant drop in new orders in 2024, Jungheinrich might strategically discontinue it. This allows for a focus on expanding their electric and lithium-ion powered offerings, which are experiencing higher demand.

- Phased-out models: Older, less efficient internal combustion engine forklift series.

- Low market share: Products with a diminishing customer base and minimal new sales.

- Strategic refocus: Divesting resources from mature or obsolete product categories.

- Example scenario: Discontinuation of a specific diesel model that saw a 15% decline in sales in the first half of 2024 compared to the previous year.

Products categorized as Dogs in Jungheinrich's BCG matrix represent offerings with low market share and low market growth potential. These are typically older technologies or niche products facing declining demand. For example, a specific line of older, manual pallet trucks might fall into this category as the market increasingly favors automated or electric solutions.

Jungheinrich’s strategic decisions in 2024 likely involved evaluating these 'Dog' products for potential divestment or discontinuation to reallocate resources. Their 2024 revenue of €4.7 billion underscores the importance of focusing on high-growth segments like electric and automated warehousing solutions.

These products often incur higher maintenance costs relative to their revenue generation. A specific diesel-powered forklift model that saw a 15% year-over-year sales decline in the first half of 2024 in a mature European market would be a prime example of a Dog product, indicating a need for strategic review.

The company’s focus on expanding its electric and lithium-ion powered portfolio means legacy internal combustion engine (ICE) models, especially those with dwindling sales volumes, are candidates for the Dogs quadrant. This strategic shift aligns with global sustainability trends and stricter emission regulations.

| Product Category Example | Market Share (Estimated) | Market Growth Rate (Estimated) | Strategic Implication | 2024 Revenue Impact (Illustrative) |

|---|---|---|---|---|

| Older Diesel Forklifts (Specific Models) | Low | Negative | Discontinue/Divest | Minor negative contribution |

| Manual Pallet Trucks (Niche Variants) | Low | Stagnant | Evaluate for phasing out | Negligible |

| Legacy Warehouse Management Software | Low | Declining | Replace/Upgrade | Minimal/Deteriorating |

Question Marks

Jungheinrich is actively integrating AI and advanced telematics into its product line, exemplified by AI-powered navigation and obstacle detection in their Automated Guided Vehicles (AGVs) and sophisticated digital fleet management systems. This push places them squarely in the high-growth market of intelligent automation solutions.

While the market for these AI-driven logistics technologies is expanding rapidly, Jungheinrich's current market share within these very specific, emerging AI applications may still be relatively modest. Significant investment is therefore necessary to solidify its position and achieve market leadership in these nascent areas.

The global AI in logistics market was valued at approximately $1.8 billion in 2023 and is projected to reach over $7.5 billion by 2030, growing at a CAGR of around 22%. This substantial growth underscores the potential for Jungheinrich’s investments in AI and telematics to yield significant returns.

Jungheinrich's strategic focus currently centers on aggressive expansion in North America and the Asia-Pacific region. However, venturing into less developed geographical markets, where their presence is currently minimal, presents a classic question mark scenario.

These nascent markets, while offering significant long-term growth potential, necessitate considerable upfront investment in infrastructure, distribution networks, and localized marketing strategies. For instance, in 2024, the global material handling equipment market, which Jungheinrich operates within, saw varied growth rates across regions, with emerging economies showing promising but volatile expansion.

Gaining a meaningful market share in these new territories requires a tailored approach, potentially involving partnerships or acquisitions to accelerate market penetration. The return on these investments is uncertain, and success hinges on Jungheinrich's ability to adapt its business model to local economic conditions and competitive landscapes.

Jungheinrich's introduction of the 'AntOn by Jungheinrich' brand, a collaboration with EP Equipment, positions it to aggressively capture market share in the high-growth electric counterbalance and warehouse truck segment. This strategic move, commencing in 2025, targets a crucial area where Jungheinrich is currently building its presence from a nascent stage. The brand's focus on competitively priced electric solutions aims to disrupt the market and attract a broader customer base.

Specialized Robotics Beyond AGVs/AMRs (e.g., advanced pick-and-place robots)

Jungheinrich's foray into specialized robotics, such as advanced pick-and-place robots and collaborative robots (cobots), represents a strategic expansion beyond their established Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs). These advanced solutions target high-growth segments within warehouse automation, promising increased efficiency and flexibility for intricate tasks. While the overall market for these specialized robots is expanding rapidly, Jungheinrich's specific market share in these niche areas may still be in its nascent stages, necessitating continued investment and potentially strategic alliances to solidify its competitive position.

The market for advanced pick-and-place robots and cobots is experiencing significant growth. For instance, the global cobots market was projected to reach approximately $10.3 billion by 2027, exhibiting a compound annual growth rate (CAGR) of around 33.6%. Similarly, the pick-and-place robot market is also on an upward trajectory, driven by the demand for automation in e-commerce fulfillment and manufacturing. Jungheinrich's presence in these segments, while potentially smaller than their AGV/AMR market share, positions them to capture future growth.

- Market Growth: The global cobot market is a prime example of a high-growth area, with projections indicating substantial expansion in the coming years.

- Niche Focus: Specialized robots like advanced pick-and-place units cater to specific, often complex, logistical challenges within warehouses and distribution centers.

- Investment Needs: To compete effectively in these developing niches, Jungheinrich may need to allocate further resources for research, development, and market penetration.

- Strategic Partnerships: Collaborations or acquisitions could accelerate Jungheinrich's entry and expansion into these specialized robotic sectors, leveraging existing expertise and technology.

Hydrogen Fuel Cell Forklifts

While Jungheinrich has a strong foothold in lithium-ion technology for forklifts, the industry is also seeing a significant push towards hydrogen fuel cell solutions for enhanced sustainability. If Jungheinrich were to introduce or is developing nascent hydrogen fuel cell forklifts, this segment would likely be categorized as a Question Mark in the BCG matrix. This is due to the technology's high growth potential, driven by environmental regulations and demand for zero-emission logistics, but currently represents a low market share for the company.

Significant investment in research and development is crucial for hydrogen fuel cell technology to mature and achieve wider market adoption, mirroring the trajectory of other emerging sustainable technologies. For instance, the global hydrogen fuel cell market for material handling equipment was projected to reach several billion dollars by 2030, indicating substantial future growth. Jungheinrich's strategic decisions in this area will determine if these hydrogen forklifts can transition from a Question Mark to a Star performer.

- High Growth Potential: The market for zero-emission material handling equipment, including hydrogen fuel cell forklifts, is expanding rapidly due to environmental concerns and regulatory pressures.

- Low Market Share: Jungheinrich's current market share in hydrogen fuel cell forklifts is likely minimal, reflecting the early stage of this technology within their product portfolio.

- R&D Investment: Significant capital and research efforts are required to refine hydrogen fuel cell technology, improve infrastructure, and drive down costs for broader market acceptance.

- Market Adoption Challenges: Overcoming hurdles such as the availability of hydrogen refueling infrastructure and the initial cost of the technology are key to realizing its full market potential.

Jungheinrich's ventures into nascent markets, such as less developed geographical regions or emerging technologies like hydrogen fuel cells, represent classic Question Mark scenarios. These areas offer high growth potential but require substantial investment for market penetration and development, with uncertain returns.

The company's strategic expansion into new territories and its potential development of hydrogen fuel cell forklifts highlight these Question Marks. Success in these segments hinges on adapting to local conditions, significant R&D, and overcoming market adoption challenges, such as infrastructure development.

For example, the global material handling equipment market in emerging economies showed promising but volatile growth in 2024, underscoring the risks and rewards. Similarly, the hydrogen fuel cell market for material handling is projected for significant expansion, but Jungheinrich's current share is likely minimal.

To transition these Question Marks into successful Stars, Jungheinrich must strategically allocate resources for market entry, technological advancement, and building a strong presence, potentially through partnerships or acquisitions.

BCG Matrix Data Sources

Our Jungheinrich BCG Matrix leverages comprehensive data, including internal financial reports, market share analysis, and industry growth projections, to provide an accurate strategic overview.