Ishizuka Glass SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ishizuka Glass Bundle

Ishizuka Glass possesses a strong brand reputation and a diverse product portfolio, but faces intense competition and potential supply chain disruptions. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind Ishizuka Glass's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Ishizuka Glass offers a wide array of products, including glass bottles for beverages and pharmaceuticals, stylish tableware for homes and restaurants, and diverse plastic packaging solutions. This broad product mix is a significant strength, as it spreads risk across multiple consumer and industrial markets.

Ishizuka Glass holds a significant advantage as a prominent player in Japan's glass packaging sector. This established presence offers a solid foundation for revenue generation and market influence within the country.

The Japanese glass packaging market is anticipated to expand, reaching an estimated USD 5.42 billion by 2033, with a projected compound annual growth rate of 4.10% between 2025 and 2033. Ishizuka Glass is well-positioned to capitalize on this domestic market growth.

Ishizuka Glass demonstrates a strong commitment to environmental sustainability, evident in its development of eco-friendly products and manufacturing processes. The company's focus on producing recycled PET resin directly addresses the growing market demand for circular economy solutions.

This dedication is further underscored by Ishizuka Glass's proactive approach to setting CO2 emission reduction targets, aligning with global efforts to combat climate change. Such initiatives not only bolster the company's brand image but also enhance its market appeal among environmentally conscious consumers and investors.

Robust Financial Performance in FY2024

Ishizuka Glass showcased impressive financial results in fiscal year 2024. The company achieved a revenue of JP¥57.9 billion, marking a 2.0% increase. This growth underscores the company's ability to expand its market presence and sales.

Net income saw a substantial jump, reaching JP¥4.71 billion. This translates to a healthy profit margin of 8.1%, indicating efficient cost management and strong operational execution. Such profitability provides a solid base for future strategic initiatives and shareholder returns.

- Revenue Growth: 2.0% increase to JP¥57.9 billion in FY2024.

- Net Income: Reached JP¥4.71 billion in FY2024.

- Profit Margin: Achieved a robust 8.1% in FY2024.

Innovation in Advanced Glass Technology

Ishizuka Glass excels through its innovation in advanced glass technology, developing materials with enhanced durability and aesthetic appeal. This includes specialized functional glass, such as antimicrobial surfaces and high-strength variants, which cater to niche market demands.

The company's commitment to research and development is a key strength, enabling product differentiation. For instance, their ongoing investment in R&D, which saw a notable increase in their fiscal year 2023 R&D expenditure, allows them to explore and penetrate specialized markets requiring cutting-edge glass solutions.

- Focus on functional materials: Development of antimicrobial and high-strength glass.

- R&D investment: Significant allocation of resources to drive technological advancements.

- Product differentiation: Creation of unique offerings that stand out in the market.

- Market expansion potential: Ability to tap into new, specialized industry segments.

Ishizuka Glass's diverse product portfolio, spanning beverage bottles, tableware, and plastic packaging, effectively mitigates risk across various sectors. Their strong position within the growing Japanese glass packaging market, projected to reach USD 5.42 billion by 2033, provides a stable revenue base and significant market influence.

The company's commitment to sustainability, including recycled PET resin production and CO2 emission reduction targets, appeals to environmentally conscious consumers and investors. Financially, Ishizuka Glass demonstrated robust performance in FY2024, with revenue increasing by 2.0% to JP¥57.9 billion and net income reaching JP¥4.71 billion, yielding an 8.1% profit margin.

Innovation in advanced glass technology, such as antimicrobial and high-strength variants, allows for product differentiation and access to specialized markets. This focus is supported by consistent investment in research and development, ensuring a pipeline of cutting-edge solutions.

| Metric | FY2024 Value | Growth/Change |

|---|---|---|

| Revenue | JP¥57.9 billion | +2.0% |

| Net Income | JP¥4.71 billion | Significant Increase |

| Profit Margin | 8.1% | Healthy |

What is included in the product

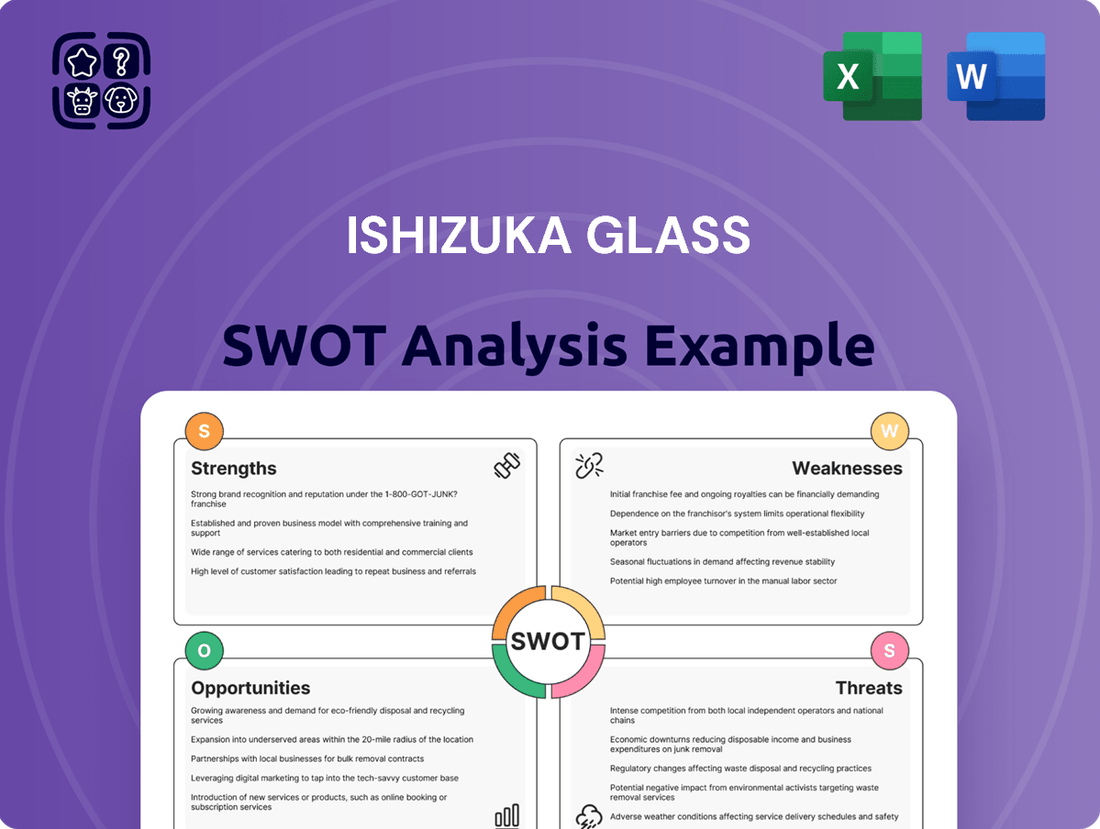

Delivers a strategic overview of Ishizuka Glass’s internal and external business factors, highlighting its strengths in glass manufacturing and opportunities in emerging markets while addressing weaknesses in technological innovation and threats from global competition.

Helps Ishizuka Glass quickly identify and address weaknesses by providing a clear, actionable framework for strategic improvement.

Weaknesses

Ishizuka Glass's reliance on glass and plastic manufacturing makes it vulnerable to shifts in raw material and energy costs. For instance, soda ash, a key component in glass production, saw price increases in early 2024 due to supply chain disruptions and increased demand. Similarly, energy prices, particularly natural gas which is crucial for furnace operations, can significantly impact operational expenses. These fluctuations directly affect production costs, potentially squeezing profit margins if not effectively managed through pricing strategies or hedging.

Ishizuka Glass's glass bottle segment is set for a significant operational challenge with a planned three-month production halt beginning in October 2024. This extended downtime is attributed to essential dissolution furnace renewal, a critical but disruptive process.

This necessary maintenance is projected to temporarily reduce production capacity, directly impacting the company's ability to meet sales demand and generate revenue during the fourth quarter of 2024 and potentially into early 2025. The financial implications of this temporary production pause need careful consideration.

The establishment of a new manufacturing facility for Japan Parison, a subsidiary of Ishizuka Glass, necessitates significant upfront capital expenditure. These initial costs, while crucial for expanding production capacity and future market penetration, are projected to be substantial, potentially impacting the company's immediate financial flexibility.

Competition from Alternative Packaging Materials

The packaging industry's increasing embrace of alternative materials, such as paper and advanced bioplastics, presents a significant weakness for Ishizuka Glass. This shift, fueled by growing consumer demand for sustainable options and stricter environmental regulations, directly challenges glass's traditional market share. For instance, the global paper packaging market was projected to reach approximately $350 billion by 2024, indicating a substantial and growing alternative.

Ishizuka Glass faces intensified competition in segments where its core products, glass containers, are increasingly substituted by more eco-friendly alternatives. This is particularly evident in the food and beverage sector, where lightweight, recyclable paperboard and molded pulp are gaining traction. The company's reliance on glass could lead to a decline in demand if it doesn't adapt its product portfolio to meet evolving market preferences for sustainability.

- Sustainability Push: Growing environmental concerns are driving demand for paper-based packaging, a direct competitor to glass.

- Regulatory Landscape: Evolving regulations favoring recyclable and biodegradable materials can disadvantage traditional glass packaging.

- Market Share Erosion: Alternative materials offer lighter weight and often lower carbon footprints, potentially leading to market share loss for Ishizuka Glass in key segments.

High Capital Expenditure Requirements

Ishizuka Glass faces significant financial hurdles due to the inherently capital-intensive nature of glass manufacturing. Maintaining and upgrading its facilities, including essential processes like furnace renewals, demands substantial investment. For instance, in fiscal year 2023, Ishizuka Glass reported capital expenditures of ¥17.2 billion, a notable portion of which is directed towards facility improvements and capacity enhancements.

These considerable outlays can strain the company's cash flow, requiring meticulous financial management and strategic planning to ensure that these investments support, rather than hinder, sustainable growth and operational efficiency.

- High Capital Outlay: Glass manufacturing requires substantial investment in machinery, plant infrastructure, and ongoing maintenance.

- Furnace Renewal Costs: Scheduled furnace renewals, critical for operational continuity, represent a significant and recurring capital expenditure.

- Cash Flow Impact: Large capital expenditures can temporarily reduce available cash, impacting liquidity and potentially limiting other strategic initiatives.

- Financial Planning Necessity: Robust financial planning is essential to manage these high costs and secure funding for necessary upgrades and expansions.

Ishizuka Glass's vulnerability to raw material and energy price fluctuations directly impacts its profitability. For example, the cost of soda ash, a key glass ingredient, saw upward pressure in early 2024. Similarly, energy prices, particularly natural gas for furnace operations, are critical cost drivers. These volatile costs necessitate robust cost management strategies.

The company's planned three-month production halt for its glass bottle segment starting October 2024, due to essential dissolution furnace renewal, will temporarily reduce output and revenue. This downtime, critical for long-term operational health, poses a short-term challenge to meeting sales targets in late 2024 and early 2025.

The increasing adoption of alternative packaging materials like paper and bioplastics presents a significant weakness. This trend, driven by sustainability demands and regulations, directly challenges glass's market share. The global paper packaging market's projected growth to around $350 billion by 2024 highlights this competitive pressure.

Ishizuka Glass's capital-intensive nature, exemplified by ¥17.2 billion in capital expenditures in fiscal year 2023, requires substantial ongoing investment for facility maintenance and upgrades. These high costs can strain cash flow and necessitate careful financial planning to balance operational needs with growth initiatives.

Same Document Delivered

Ishizuka Glass SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at Ishizuka Glass's strategic positioning.

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Ishizuka Glass's Strengths, Weaknesses, Opportunities, and Threats.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, providing a thorough examination of Ishizuka Glass's competitive landscape.

Opportunities

The global sustainable packaging market is experiencing robust growth, projected to reach an estimated $479.4 billion by 2027, driven by heightened consumer awareness and regulatory pressures. Ishizuka Glass's established capabilities in producing glass containers, a highly recyclable material, and its advancements in recycled PET (rPET) align perfectly with this burgeoning demand.

The growing consumer preference for premium and aesthetically pleasing products across food, beverage, and cosmetics sectors presents a significant opportunity for Ishizuka Glass. This trend fuels demand for high-quality, visually appealing glass packaging that elevates brand image. For instance, the global premium food packaging market was valued at approximately $25 billion in 2023 and is projected to grow, indicating strong potential for specialized glass solutions.

Ishizuka Glass is strategically prioritizing Digital Transformation (DX) to foster a more adaptable organizational culture. This focus is expected to streamline operations and boost competitiveness across its diverse product lines, from glass containers to specialty glass.

By embracing DX, Ishizuka Glass aims to unlock significant gains in operational efficiency. For example, in 2023, many manufacturing companies saw efficiency improvements of 10-15% through targeted automation and data analytics, a benchmark Ishizuka Glass could strive for.

Successful DX implementation can directly translate into improved customer engagement and faster product development cycles. This is critical in the competitive packaging and electronics materials markets where agility is key to market share.

Development of New Functional Glass Materials

Ishizuka Glass's commitment to developing novel functional glass materials, including antimicrobial and enhanced durability variants, is a significant opportunity. This R&D focus allows the company to tap into emerging markets and applications previously out of reach.

These advancements translate into higher-margin products, offering a strategic path to diversify revenue beyond their established packaging and tableware segments. For instance, the demand for specialized glass in the healthcare and electronics sectors is projected for robust growth through 2025.

- Expansion into High-Value Niches: Opportunities exist in sectors requiring specialized glass properties, such as medical devices and advanced electronics.

- Revenue Diversification: Developing unique functional glass can reduce reliance on traditional, potentially commoditized markets.

- Innovation-Driven Growth: Investing in R&D for materials like self-cleaning or impact-resistant glass can command premium pricing.

- Market Differentiation: Offering proprietary functional glass solutions provides a competitive edge against rivals focused on standard products.

International Market Expansion for Tableware

Ishizuka Glass has a significant opportunity to grow its international presence with its ADERIA GLASS tableware brand. By actively participating in global events like the National Restaurant Association Show in Chicago, the company can showcase its high-quality products to a wider audience. This strategic move is designed to tap into new customer segments and boost export sales, contributing to overall revenue growth.

The global tableware market is projected to reach approximately $28.4 billion by 2027, indicating substantial room for expansion. Ishizuka Glass's participation in international trade fairs in 2024 and 2025 provides a direct avenue to capitalize on this growth.

- Global Market Growth: The international tableware sector is expanding, offering fertile ground for ADERIA GLASS.

- Trade Show Engagement: Participation in shows like the National Restaurant Association Show directly connects Ishizuka Glass with potential international buyers.

- Revenue Diversification: Expanding into new markets can reduce reliance on domestic sales and increase overall export revenue.

- Brand Recognition Abroad: Increased international visibility can build brand equity and customer loyalty in key overseas markets.

Ishizuka Glass can capitalize on the growing demand for sustainable packaging, particularly in glass and rPET, as the global market is projected to reach $479.4 billion by 2027. The company's focus on digital transformation offers a pathway to enhanced operational efficiency, with industry benchmarks suggesting potential improvements of 10-15% through automation and data analytics. Furthermore, developing specialized functional glass materials for sectors like healthcare and electronics presents an opportunity for higher-margin products and market differentiation.

Threats

The intensifying global focus on reducing plastic waste and promoting circular economy principles presents a significant threat to Ishizuka Glass's plastic product lines. Many countries, including those in the European Union and parts of Asia, are enacting stricter regulations, such as bans on single-use plastics and mandates for minimum recycled content in packaging. For instance, the EU's Single-Use Plastics Directive, implemented in phases from 2021, aims to curb plastic pollution, impacting product design and material sourcing.

Non-compliance with these evolving regulations could translate into substantial operational challenges for Ishizuka Glass. This might include increased costs associated with sourcing compliant materials, modifying production processes, or facing penalties and fines for non-adherence. Furthermore, a failure to adapt to these regulatory shifts could lead to a diminished market demand for their plastic products if competitors are more agile in meeting new environmental standards.

Ishizuka Glass operates in a fiercely competitive Japanese market for glass and plastic packaging and tableware. Numerous well-established companies vie for market share, creating significant pricing pressures. For instance, in 2024, the domestic glass container market faced increased competition from both domestic and international suppliers, impacting profit margins for players like Ishizuka Glass.

Global supply chains continue to be a significant concern, with events like the Red Sea shipping crisis in early 2024 causing delays and increased freight costs for many industries, including glass manufacturing. These disruptions can directly impact Ishizuka Glass by potentially delaying the arrival of essential raw materials, such as soda ash and silica, or hindering the timely delivery of finished goods to international markets, thereby affecting production timelines and overall cost efficiency.

Shifting Consumer Preferences Away from Plastics

A significant threat for Ishizuka Glass is the intensifying consumer demand for products free from plastics. This trend, particularly strong in eco-aware demographics, could directly impact sales of their plastic packaging. For instance, a 2024 survey indicated that 65% of consumers are actively seeking plastic-free alternatives for everyday goods. This shift necessitates a strategic pivot towards more sustainable materials, potentially affecting market share if adaptation is slow.

Ishizuka Glass faces a challenge as consumers increasingly favor plastic-free options, driven by environmental concerns. This growing preference, evident in markets like Europe where single-use plastic bans are expanding, could lead to a decline in demand for their plastic packaging solutions. For example, the global market for sustainable packaging is projected to grow at a CAGR of 6.5% from 2024 to 2030, highlighting a significant opportunity for competitors offering alternatives.

- Growing Consumer Demand for Plastic-Free Alternatives: A significant portion of the market is actively seeking alternatives to plastic packaging due to environmental concerns.

- Impact on Plastic Packaging Sales: This trend can directly reduce demand for Ishizuka Glass's plastic packaging products, especially in environmentally conscious regions.

- Market Shift Towards Sustainability: The global sustainable packaging market is expanding rapidly, with projections indicating substantial growth in the coming years.

- Need for Material Innovation: Ishizuka Glass must continuously innovate its material offerings to align with evolving consumer preferences and regulatory landscapes.

Economic Downturns and Reduced Consumer Spending

Economic downturns pose a significant threat to Ishizuka Glass. A slowdown or recession can curb consumer spending on discretionary items, directly affecting sales of tableware and decorative glass. For instance, during the COVID-19 pandemic's initial phases in 2020, global consumer spending saw a notable contraction, impacting durable goods purchases.

Furthermore, industries that rely on Ishizuka's packaging solutions, such as food and beverage or cosmetics, may also reduce their orders during economic hardship. This could lead to lower production volumes and squeezed profit margins for the company. In 2023, while some sectors showed resilience, persistent inflation and rising interest rates in major economies continued to pressure consumer budgets, a trend that could extend into 2024 and 2025.

- Reduced consumer spending on non-essential goods like tableware.

- Decreased demand from key industrial sectors for packaging solutions.

- Potential for lower sales volumes and profitability due to economic contraction.

The increasing global push for sustainability and circular economy principles directly challenges Ishizuka Glass's plastic product lines. Stricter regulations, like bans on single-use plastics and mandates for recycled content, are becoming more common. For example, the EU's Single-Use Plastics Directive, with phased implementation from 2021, impacts material sourcing and product design.

Failure to adapt to these evolving environmental standards could result in higher operational costs for Ishizuka Glass, including expenses for compliant materials and process modifications. Non-compliance might also lead to penalties and a reduced market appeal for their plastic offerings if competitors are more responsive to new environmental demands.

Intensifying consumer preference for plastic-free products is a significant threat, particularly impacting their plastic packaging sales. Surveys in 2024 indicated that a substantial majority of consumers are actively seeking alternatives to plastic. This trend necessitates strategic shifts towards sustainable materials, potentially affecting market share if adaptation is slow.

Economic downturns can significantly impact Ishizuka Glass by reducing consumer spending on discretionary items like tableware and decorative glass. Industries relying on their packaging solutions may also scale back orders during economic contractions, leading to lower production volumes and squeezed profit margins. Persistent inflation and rising interest rates in major economies in 2023 and extending into 2024 continue to pressure consumer budgets.

SWOT Analysis Data Sources

This Ishizuka Glass SWOT analysis is built upon a foundation of reliable data, including their official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic overview.