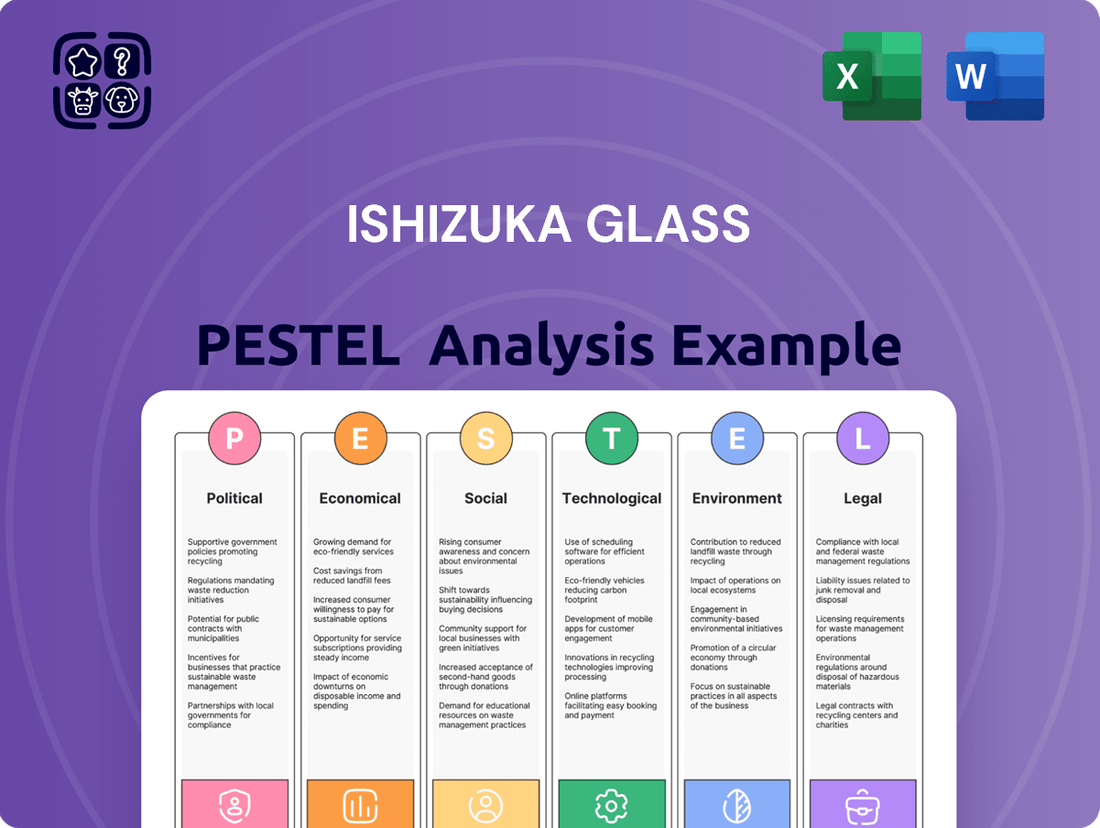

Ishizuka Glass PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ishizuka Glass Bundle

Navigate the complex global landscape affecting Ishizuka Glass with our expert PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping their future. Gain a strategic advantage by uncovering key opportunities and risks. Download the full PESTLE analysis now for actionable intelligence to inform your own market strategy.

Political factors

Japan's government is intensifying efforts to curb plastic waste and boost decarbonization through stricter recycling mandates. A key proposal, presented by the Ministry of Economy, Trade and Industry (METI), will soon require major manufacturers, particularly in packaging and containers, to incorporate recycled plastics into their products. This move is expected to be enacted through revisions to existing laws during the upcoming Diet session.

Japan's push for a circular economy, focusing on extending product life and cutting waste, is gaining momentum. This transition is supported by government initiatives aimed at boosting recycling rates, such as the Act on Promotion of Resource Circulation, enacted in 2022, which sets targets for material recycling and aims to reduce final disposal volumes by 2030.

These policies encourage businesses, including glass manufacturers like Ishizuka Glass, to prioritize resource efficiency and explore innovative recycling technologies. For instance, the government provides subsidies and tax incentives for companies investing in advanced sorting and reprocessing of materials, aligning with the national goal of achieving a 60% recycling rate for plastic packaging by 2030.

Global environmental awareness is increasingly shaping trade policies, potentially impacting the competitiveness of Japanese firms like Ishizuka Glass if they don't prioritize sustainable practices. For instance, the EU's Carbon Border Adjustment Mechanism (CBAM), implemented in October 2023, could impose costs on imported goods based on their embedded carbon emissions, affecting companies with less green production processes.

The Japanese government's focus on increasing recycled plastic usage is a key driver for decarbonization, especially considering that a significant portion of Japan's plastic waste, around 57% in 2021 according to the Ministry of the Environment, is incinerated, releasing CO2. This policy encourages manufacturers to invest in eco-friendly materials and innovative packaging solutions to align with international standards and navigate evolving trade landscapes.

Government Support for Green Procurement

The Japanese government is a strong proponent of green procurement, actively favoring products certified under its Act on Promoting Green Procurement. This initiative is designed to boost the acquisition of environmentally friendly goods and services by public institutions.

This governmental push translates into tangible financial advantages for manufacturers who meet stringent environmental benchmarks. For instance, companies demonstrating compliance with these standards can benefit from subsidies and preferential treatment in government tenders.

Such policies create a favorable environment for companies like Ishizuka Glass. The financial backing and market incentives associated with green procurement encourage further investment in developing and producing sustainable glass products and implementing eco-conscious manufacturing methods.

- Government Mandates: The Act on Promoting Green Procurement sets clear guidelines for public entities to prioritize environmentally sound products.

- Financial Incentives: Manufacturers adhering to green standards may qualify for government subsidies, tax breaks, and preferential loan terms.

- Market Opportunities: Increased demand from government contracts for certified green products provides a significant market advantage for compliant companies.

- R&D Stimulation: The policy framework encourages innovation in sustainable materials and production processes, driving technological advancements in the glass industry.

Policy on Food Contact Materials

Japan's Ministry of Health, Labor and Welfare (MHLW) is implementing a significant overhaul of its food contact material regulations, shifting to a positive list system for chemicals in synthetic resins by June 2025. This means only explicitly approved substances will be permitted in plastics and other polymers used for food and beverage packaging. This regulatory change directly impacts Ishizuka Glass's product lines that utilize these materials, requiring careful adherence to the newly established list.

The finalized structure of this positive list by the MHLW signifies a proactive move towards enhanced consumer safety in Japan's food industry. For Ishizuka Glass, this necessitates a thorough review and potential reformulation of its plastic food and beverage containers to ensure compliance with the approved chemical components. The company's commitment to product safety will be paramount in navigating this evolving regulatory landscape.

The positive list system aims to harmonize Japan's regulations with international standards, providing greater clarity and predictability for manufacturers. Ishizuka Glass will need to monitor updates to this list closely and potentially invest in research and development to adapt its material sourcing and product formulations. This policy is expected to drive innovation in safer, more sustainable food contact materials across the industry.

Japan's government is actively promoting decarbonization and a circular economy, which directly influences Ishizuka Glass through mandates to increase recycled plastic content in products. The Ministry of Economy, Trade and Industry (METI) is pushing for revisions to laws that will require major manufacturers to use more recycled plastics, a move expected to be enacted soon.

These policies, including the Act on Promotion of Resource Circulation, aim to boost recycling rates and reduce waste, encouraging companies like Ishizuka Glass to invest in efficient resource use and advanced recycling technologies. The government also offers financial incentives such as subsidies and tax breaks for companies adopting eco-friendly practices.

Furthermore, the Ministry of Health, Labor and Welfare's (MHLW) upcoming shift to a positive list system for food contact materials by June 2025 requires Ishizuka Glass to ensure its packaging complies with approved chemical substances, potentially driving innovation in safer materials.

The EU's Carbon Border Adjustment Mechanism (CBAM), effective from October 2023, also presents a political factor, potentially impacting Japanese firms like Ishizuka Glass if their production processes are carbon-intensive, thereby encouraging a focus on sustainable manufacturing to maintain competitiveness.

What is included in the product

This PESTLE analysis provides a comprehensive evaluation of the external macro-environmental factors impacting Ishizuka Glass, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats within Ishizuka Glass's operating landscape.

A clear, actionable PESTLE analysis for Ishizuka Glass that cuts through complexity, enabling faster identification of opportunities and mitigation of threats.

Provides a visually organized PESTLE framework for Ishizuka Glass, simplifying the assessment of external factors and streamlining strategic decision-making.

Economic factors

Japan's economy is projected for modest growth, with real GDP expected to expand by around 1.1% to 1.2% in the 2025/26 financial year. This steady, though not rapid, expansion suggests a stable operating environment for businesses like Ishizuka Glass.

Despite past inflationary pressures impacting consumer budgets, a robust labor market and anticipated wage increases are poised to bolster domestic consumption. This trend is favorable for Ishizuka Glass's consumer-facing product lines.

Fluctuations in the cost of raw materials like soda ash, limestone, and petroleum-based resins directly impact Ishizuka Glass's production expenses. These global commodity prices, influenced by geopolitical events and demand shifts, create volatility in manufacturing costs.

For instance, Ishizuka Glass reported a notable decline in operating profit for the fiscal year ending March 2025, with factors including rising raw material expenses contributing to this performance.

The stability of the global supply chain for these essential inputs is also critical; disruptions can lead to unexpected cost increases and affect Ishizuka Glass's ability to maintain consistent pricing and profitability.

The Japanese green packaging market is experiencing robust expansion, fueled by heightened consumer environmental consciousness and increasingly strict government regulations. This sector, valued at an estimated USD 14.9 billion in 2024, is anticipated to reach USD 24.1 billion by 2033, demonstrating a compound annual growth rate of 5.5% between 2025 and 2033.

This upward trend signifies a considerable opportunity for Ishizuka Glass, especially given the company's strategic emphasis on developing and marketing environmentally friendly products. The increasing demand for sustainable packaging solutions aligns directly with Ishizuka Glass's product portfolio and future growth strategy.

Impact of Exchange Rates

Exchange rates significantly influence Ishizuka Glass's operations. A stronger Japanese yen, for instance, could help mitigate the impact of rising import costs for raw materials, a benefit for manufacturers like Ishizuka Glass that depend on overseas supplies. However, this same currency strength can make Japanese exports more expensive for international buyers, potentially impacting sales volume.

Currency fluctuations present a direct challenge to Ishizuka Glass's competitiveness in global markets. For example, if the yen strengthens considerably against currencies like the US dollar or Euro, the price of Ishizuka Glass's products sold in those regions would effectively increase for foreign customers, potentially leading to reduced demand. Conversely, a weaker yen could boost export competitiveness by making products more affordable abroad.

- Export Competitiveness: In early 2024, the yen traded around 150 JPY to 1 USD, a level that can make Japanese goods pricier internationally compared to periods with a weaker yen.

- Import Costs: A stronger yen in late 2023 helped to temper the cost of imported materials, though global commodity price volatility remains a factor.

- Risk Management: Ishizuka Glass likely employs hedging strategies to manage the financial risks associated with volatile exchange rates impacting its international revenue and raw material procurement costs.

Competition in Glass and Plastic Sectors

The Japanese markets for glass and plastic products are highly competitive, featuring a mix of large, established corporations and niche, specialized firms. Ishizuka Glass navigates this landscape across multiple product categories, notably in packaging and tableware.

The increasing global and domestic emphasis on sustainable materials and novel product innovations further fuels this competitive environment. This trend necessitates significant investment in research and development and the formation of strategic alliances to maintain market position.

For instance, the broader Japanese plastics industry saw a production volume of approximately 10.5 million metric tons in 2023, according to industry reports, highlighting the scale of operations and the potential for intense competition. Similarly, the glass packaging sector is characterized by strong demand from the food and beverage industries, where product differentiation and cost-effectiveness are key competitive factors.

- Intense Market Presence: Both domestic and international players vie for market share in Japan's glass and plastic sectors.

- Segment-Specific Rivalry: Ishizuka Glass encounters direct competition in key areas like glass containers for beverages and cosmetics, as well as in plastic components for automotive and electronics.

- Sustainability as a Differentiator: Companies are investing heavily in eco-friendly materials and production processes, with Japanese consumers showing increasing preference for sustainable options, impacting market dynamics.

- Innovation Drive: The push for advanced functionalities, such as lightweighting in plastics and enhanced durability in glass, requires continuous R&D expenditure and fosters competition through technological advancements.

Japan's economic outlook for 2025/26 indicates modest GDP growth around 1.1% to 1.2%, providing a stable backdrop for Ishizuka Glass. Despite past inflation, rising wages are expected to boost domestic consumption, benefiting Ishizuka's consumer-facing products.

Fluctuations in raw material costs, such as soda ash and petroleum-based resins, directly impact Ishizuka Glass's manufacturing expenses. For example, rising material costs contributed to a decline in operating profit for the fiscal year ending March 2025.

The Japanese green packaging market is a significant growth area, projected to expand from USD 14.9 billion in 2024 to USD 24.1 billion by 2033, a trend Ishizuka Glass is well-positioned to capitalize on with its focus on eco-friendly products.

Exchange rate volatility poses a challenge, as a stronger yen can increase export prices for Ishizuka Glass while potentially lowering import costs for raw materials. For instance, the yen's strength around 150 JPY to 1 USD in early 2024 impacts international pricing.

| Economic Factor | Impact on Ishizuka Glass | Data Point/Trend |

|---|---|---|

| GDP Growth (Japan) | Stable operating environment | Projected 1.1%-1.2% growth for 2025/26 |

| Domestic Consumption | Increased demand for consumer products | Supported by anticipated wage increases |

| Raw Material Costs | Increased production expenses | Contributed to operating profit decline in FY ending March 2025 |

| Green Packaging Market | Growth opportunity for sustainable products | Expected to reach USD 24.1 billion by 2033 (CAGR 5.5% 2025-2033) |

| Exchange Rates (JPY/USD) | Affects export competitiveness and import costs | Yen around 150 JPY/USD in early 2024 |

Same Document Delivered

Ishizuka Glass PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Ishizuka Glass delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing crucial insights for strategic planning. You'll gain a clear understanding of the external forces shaping Ishizuka Glass's operations and future prospects.

Sociological factors

Japanese consumers are showing a significant shift towards environmental consciousness. Surveys from 2024 reveal that over 70% of Japanese shoppers actively prefer products featuring biodegradable and eco-friendly packaging. This trend is a strong indicator of evolving consumer values.

Furthermore, a substantial 78% of Japanese consumers report considering the environmental impact of a product during their purchasing decisions. This high percentage underscores the growing importance of sustainability in the market and directly influences corporate strategies.

This escalating consumer demand for sustainable options creates a clear imperative for businesses to adopt greener packaging solutions. For Ishizuka Glass, which already emphasizes environmental sustainability, this societal trend presents a direct opportunity to align its offerings with market expectations and potentially increase its market share.

The burgeoning e-commerce market in Japan, projected to reach ¥29.5 trillion by the end of 2024 according to the Ministry of Economy, Trade and Industry, directly fuels the demand for robust and user-friendly packaging. Ishizuka Glass's glass containers and packaging solutions are integral to ensuring the safe transit of goods ordered online, from food and beverages to cosmetics.

Furthermore, evolving Japanese consumer lifestyles, characterized by an increasing emphasis on convenience and home delivery services, further shape product demand. This shift means Ishizuka Glass may see heightened interest in smaller, single-serving glass packaging or innovative designs that cater to busy urban professionals and families seeking ease in their daily routines.

Japan's demographic shift, with its population shrinking by 0.53% in 2023, directly impacts Ishizuka Glass by potentially reducing the overall demand for packaged goods and, by extension, the need for its packaging materials. This aging trend also means a smaller pool of available workers, pushing companies like Ishizuka Glass to prioritize automation and invest in training to retain and develop their existing talent.

Health and Safety Consciousness

Consumers are increasingly prioritizing health and safety, directly impacting how products, particularly food and beverage packaging, are designed and manufactured. This heightened awareness means Ishizuka Glass must ensure its glass containers meet rigorous standards to protect consumer well-being.

Government regulations underscore this trend. For instance, Japan's Food Sanitation Act was revised to implement a positive list system for food contact materials, setting strict guidelines for substances that can be used in packaging. Ishizuka Glass’s commitment to these regulations is crucial for maintaining consumer trust and market access.

- Consumer Demand for Safe Packaging: Growing public concern over chemicals leaching from packaging materials drives demand for safer alternatives, favoring glass.

- Regulatory Compliance: Adherence to evolving food safety laws, such as Japan's positive list system for food contact materials, is non-negotiable for manufacturers like Ishizuka Glass.

- Brand Reputation: Meeting and exceeding these health and safety expectations directly influences consumer perception and brand loyalty for companies utilizing Ishizuka Glass products.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for corporate social responsibility are increasingly stringent, with a particular emphasis on human rights and transparent environmental stewardship. Consumers and investors alike are scrutinizing companies' ethical footprints. For instance, in 2023, a significant majority of consumers reported that they consider a company's social and environmental impact when making purchasing decisions, with some studies showing figures as high as 70%.

Ishizuka Glass is actively responding to these evolving expectations. The company has formalized its commitment through the establishment of a dedicated Human Rights Working Group and the publication of a comprehensive Human Rights Policy. This proactive approach demonstrates a clear understanding of the need to integrate ethical considerations into its core operations. Such initiatives are crucial for building and maintaining stakeholder trust in an era of heightened social awareness.

These efforts directly contribute to enhancing Ishizuka Glass's brand reputation and fostering deeper trust among its diverse stakeholder base. A strong CSR performance can translate into tangible business benefits, including improved customer loyalty and a more attractive proposition for investors. Companies that prioritize these aspects often see a positive correlation with long-term financial stability and market resilience.

- Growing Consumer Demand: Over 70% of consumers consider social and environmental impact when buying, highlighting a critical market driver.

- Proactive Governance: Ishizuka Glass's Human Rights Working Group and Policy signal a commitment to ethical business practices.

- Reputation Enhancement: Strong CSR performance builds brand equity and strengthens relationships with customers, employees, and investors.

- Stakeholder Trust: Transparency in human rights and environmental practices is key to securing and maintaining stakeholder confidence.

Societal expectations are increasingly focused on health, safety, and ethical business practices. A significant majority of consumers, upwards of 70% in recent 2023 surveys, now factor a company's social and environmental impact into their purchasing decisions. This rising consumer consciousness directly influences demand for packaging that is not only functional but also perceived as safe and responsibly produced.

Ishizuka Glass's proactive stance, evidenced by its Human Rights Working Group and published Human Rights Policy, demonstrates a commitment to meeting these evolving societal demands. Such initiatives are crucial for building and maintaining stakeholder trust, directly impacting brand reputation and fostering customer loyalty.

Furthermore, the emphasis on sustainability and ethical sourcing is not limited to consumers; investors and business partners are also scrutinizing corporate behavior. Companies that align with these values, like Ishizuka Glass, are better positioned for long-term success and market resilience.

| Societal Factor | Impact on Ishizuka Glass | Supporting Data (2023-2024) |

|---|---|---|

| Consumer Demand for Safety & Sustainability | Increased preference for glass packaging due to perceived safety and eco-friendliness. | Over 70% of consumers consider social/environmental impact; 78% consider environmental impact in purchasing. |

| Ethical Business Practices & CSR | Enhanced brand reputation and stakeholder trust through transparent human rights and environmental policies. | Ishizuka Glass established Human Rights Working Group and Policy. |

| Demographic Shifts | Potential impact on overall demand for packaged goods; need for workforce adaptation. | Japan's population shrinking by 0.53% in 2023. |

Technological factors

Glass manufacturing is seeing major shifts with technologies like 3D printing and precision molding. These allow for incredibly detailed and custom glass items, opening up new design avenues and boosting efficiency. For instance, advancements in robotic automation are streamlining production lines, contributing to faster turnaround times and reduced labor costs.

Beyond design, there's a strong push towards sustainability. New energy-efficient production methods are being adopted, and the increased use of cullets, or recycled glass, is a key strategy for reducing the carbon footprint of glass products. In 2024, the global glass recycling rate saw a slight uptick, with many manufacturers aiming to incorporate 30-50% recycled content in their new products to meet environmental targets.

Technological progress is driving the creation of new green packaging, especially for plastics. Innovations include using materials that break down naturally, come from plants, or are made from recycled sources. For instance, by 2024, the global bioplastics market was projected to reach over $60 billion, showcasing significant investment in these alternatives.

Companies are pouring resources into research to develop eco-friendly plastic substitutes and enhance recycling. This includes advanced methods like chemical recycling, which breaks down plastic waste into its original building blocks, enabling true circularity. In 2023, investments in advanced recycling technologies saw a notable uptick, with several major chemical companies announcing new plant constructions and partnerships.

New glass products are emerging with enhanced functionalities, such as self-cleaning coatings, anti-reflective coatings, and enhanced security laminated glass. For instance, the global smart glass market was valued at approximately USD 5.3 billion in 2023 and is projected to reach USD 11.4 billion by 2028, growing at a CAGR of 16.5% during the forecast period.

Smart glass technologies, allowing dynamic control of light and privacy, are gaining traction, driven by IoT integration. This innovation is expanding the application areas for glass beyond traditional uses in construction and automotive sectors, moving into consumer electronics and specialized industrial applications.

Automation and Digitalization in Operations

Ishizuka Glass is actively embracing digitalization and automation to enhance its operational efficiency. The company has identified the promotion of digitalization as a core management objective, signaling a strategic shift towards modernizing its production and business processes. This focus aims to reduce manual intervention, thereby minimizing human error and increasing overall productivity.

The implementation of technologies like barcode scanning is a prime example of this strategy in action. These systems are crucial for accurate inventory tracking and efficient glass sorting, ensuring smoother workflows from raw material handling to finished product dispatch. Such advancements are vital for maintaining competitiveness in the fast-paced glass manufacturing sector.

- Digitalization as a Key Management Issue: Ishizuka Glass has explicitly stated ‘promotion of digitalization’ as a primary management goal.

- Operational Streamlining: Technologies like barcode scanning are being deployed for inventory tracking and glass sorting, improving efficiency.

- Error Reduction: Automation and digitalization are expected to significantly decrease errors within production processes.

- Efficiency Gains: The overarching aim is to boost overall operational efficiency across the company’s various functions.

Research and Development Investment

Ishizuka Glass actively invests in research and development, aiming to stay at the forefront of glass technology and innovation. This commitment is vital for developing cutting-edge products and maintaining a competitive edge in the global market. Their focus on R&D allows them to adapt to evolving industry trends and customer needs.

A key aspect of their R&D strategy involves developing environmentally sustainable glass solutions. This includes exploring novel applications such as anti-bacterial sheets designed for PET bottles and glass jars, which address growing consumer demand for hygiene and safety. These initiatives underscore their dedication to responsible production and product development.

- Focus on Environmental Sustainability: Ishizuka Glass prioritizes R&D for eco-friendly glass products.

- New Venture Development: Actively exploring products like anti-bacterial sheets for packaging.

- Market Competitiveness: R&D investment is crucial for adapting to market demands and maintaining leadership.

Technological advancements are reshaping glass manufacturing, with innovations like 3D printing and precision molding enabling intricate custom designs and improved efficiency. Automation is streamlining production lines, leading to faster output and reduced labor costs. The global smart glass market, valued at approximately USD 5.3 billion in 2023, is projected to reach USD 11.4 billion by 2028, highlighting the growing demand for functional glass.

| Technology Area | Impact on Glass Industry | Example/Data Point |

|---|---|---|

| 3D Printing & Precision Molding | Customization, Efficiency | Enables intricate designs and faster production. |

| Robotic Automation | Streamlined Production, Cost Reduction | Reduces labor costs and increases turnaround times. |

| Smart Glass Technology | Enhanced Functionality, New Applications | Market projected to grow from USD 5.3 billion (2023) to USD 11.4 billion (2028). |

| Digitalization & Barcode Scanning | Operational Efficiency, Error Reduction | Improves inventory tracking and sorting for Ishizuka Glass. |

Legal factors

The Japanese Packaging Recycling Act, established in 1995, places a significant responsibility on companies that manufacture or import packaging materials exceeding specific thresholds. This legislation requires these businesses to actively engage in recycling initiatives or contribute financially through recycling fees. For Ishizuka Glass, a key player in both glass and plastic packaging, this law directly influences its operational strategies and cost structures related to waste management and material sourcing.

Japan is moving towards mandatory recycled plastic usage for major manufacturers, driven by a proposed revision to its resource utilization law. This legislation will compel companies to establish and report on specific recycled plastic targets, facing potential corrective actions if targets aren't met.

The ultimate goal is ambitious: all plastic packaging must be either reused or recycled by 2035, a significant driver for companies like Ishizuka Glass to innovate their material sourcing and production processes.

Japan's Food Sanitation Act, updated to implement a positive list system for chemicals in synthetic resins for food contact materials starting June 2025, will significantly impact packaging regulations. This system mandates that only pre-approved substances can be utilized, raising the bar for safety and hygiene in food and beverage packaging.

Ishizuka Glass, a key player in producing containers for food-related applications, must adapt its material sourcing and production processes to align with these new, stricter requirements. Compliance is crucial to maintain market access and consumer trust in their products.

Labor Laws and Working Conditions

Japan's labor laws, primarily governed by the Labour Standards Act, set strict parameters for working hours, minimum wages, overtime compensation, and various leave entitlements. These regulations are dynamic, with significant updates implemented in 2024 and further revisions anticipated for 2025. Ishizuka Glass, like all employers in Japan, must meticulously adhere to these evolving legal frameworks to ensure fair treatment and compliance.

Key recent and upcoming changes focus on strengthening employer accountability and adapting to modern work arrangements. For instance, 2024 saw enhanced notification requirements for employers regarding employment terms, providing greater clarity for employees. Furthermore, rules surrounding fixed-term employment have been refined, and new provisions are being introduced to better support childcare needs and formalize remote work policies, impacting how companies like Ishizuka Glass manage their workforce.

- Enhanced Employer Notification: 2024 revisions increased the detail employers must provide regarding employment conditions.

- Fixed-Term Employment Clarity: Regulations on contract renewals and conditions for fixed-term workers have been clarified.

- Childcare Support Expansion: New provisions aim to bolster support for employees with childcare responsibilities.

- Remote Work Guidelines: Emerging regulations will provide a clearer framework for remote and hybrid work arrangements.

Extended Producer Responsibility (EPR) Schemes

New Extended Producer Responsibility (EPR) regulations are increasingly impacting businesses, especially in Asia. Japan, for instance, is strengthening its focus on producer accountability for packaging waste. Companies are now mandated to collect and report data on the volume of packaging they introduce into the market.

These EPR schemes often require financial contributions towards recycling and waste management infrastructure. For example, the full implementation of Japan's EPR Packaging Scheme, anticipated in 2024, follows initial regulations introduced in 2023, signaling a significant shift towards corporate environmental stewardship.

The financial implications for companies like Ishizuka Glass can be substantial, as they will bear a direct cost for the end-of-life management of their packaging. This regulatory trend is global, with many countries adopting similar frameworks to promote a circular economy and reduce landfill waste.

- Increased Compliance Costs: Companies must invest in data tracking and reporting systems for packaging materials.

- Recycling Fees: Financial contributions to national or regional recycling funds will become a standard operating expense.

- Product Design Impact: Regulations may incentivize the use of more recyclable or reusable packaging materials.

- Supply Chain Scrutiny: Greater emphasis will be placed on the entire lifecycle of packaging, from production to disposal.

Japan's evolving legal landscape presents significant operational considerations for Ishizuka Glass, particularly concerning environmental regulations and labor laws. The nation's commitment to a circular economy is evident in strengthened Extended Producer Responsibility (EPR) schemes, which are increasingly mandating corporate accountability for packaging waste, with full implementation of Japan's EPR Packaging Scheme expected in 2024, building on 2023 regulations.

Furthermore, upcoming revisions to resource utilization laws, anticipated in 2024-2025, will likely introduce mandatory recycled plastic usage targets for major manufacturers, alongside stricter food contact material regulations effective June 2025. These legal shifts necessitate proactive adaptation in material sourcing and production processes to ensure compliance and maintain market access.

Labor laws are also seeing dynamic updates, with 2024 revisions enhancing employer notification requirements and clarifying rules around fixed-term employment, while new provisions are emerging to better support childcare and formalize remote work policies through 2025. Adherence to these evolving frameworks is critical for Ishizuka Glass to ensure fair labor practices and operational integrity.

Environmental factors

Japan is significantly ramping up its commitment to tackling plastic waste, setting ambitious targets for reduction and enhanced recycling. This national push is a key environmental factor influencing businesses like Ishizuka Glass.

A major development is the government's intention to mandate the use of recycled plastics by major manufacturers. The overarching goal is to ensure all plastic packaging is either reused or recycled by 2035, a deadline that necessitates substantial operational shifts across industries.

For Ishizuka Glass, this directly impacts its plastic product segment. The company will face increased pressure and opportunity to integrate more recycled plastic content into its offerings, aligning with Japan's circular economy ambitions.

Ishizuka Glass Group has set an ambitious 2050 Environmental Vision targeting Net Zero emissions, underscoring a strong commitment to carbon neutrality. This vision is being actively pursued through concrete actions aimed at reducing Scope 1 and 2 emissions.

Key initiatives involve consolidating and rationalizing production processes to enhance efficiency and lower energy consumption. Furthermore, the company is implementing plans for significant energy savings during scheduled equipment maintenance, with a focus on 2024 and subsequent years, demonstrating a proactive approach to environmental impact reduction.

Ishizuka Glass, like much of the glass industry, is increasingly integrating circular economy principles. This means a stronger focus on using recycled glass and even repurposed plastics in their manufacturing processes. For example, by 2024, many European countries have seen significant increases in glass recycling rates, with some reaching over 70%, driving demand for recycled content.

The company is investing in new technologies to improve the collection, processing, and reuse of these materials. This is partly driven by consumer demand for sustainable products; a 2025 survey indicated that over 60% of consumers consider a company's environmental impact when making purchasing decisions.

This shift aims to boost resource efficiency and drastically cut down on waste generation. The goal is to create a more closed-loop system, reducing reliance on virgin raw materials and minimizing the environmental footprint of their operations.

Demand for Eco-Friendly Packaging Materials

The Japanese market is seeing a pronounced increase in the demand for eco-friendly packaging. This trend is fueled by growing environmental awareness among consumers and stricter regulations. Companies are increasingly seeking packaging that is biodegradable, made from recycled materials, or derived from plant-based sources.

This shift is particularly evident in sectors like food and beverage and personal care, where consumer choices are heavily influenced by sustainability. For instance, a 2024 survey indicated that over 70% of Japanese consumers consider eco-friendly packaging a key factor when making purchasing decisions.

Ishizuka Glass is actively responding to this demand by prioritizing environmental sustainability in its product development. This includes exploring and implementing new materials and designs that align with these evolving market expectations. The company aims to offer solutions that not only meet functional requirements but also contribute to a reduced environmental footprint.

- Growing Consumer Preference: Over 70% of Japanese consumers prioritize eco-friendly packaging in purchasing decisions (2024 data).

- Sectoral Shift: Food, beverage, and personal care industries are leading the adoption of sustainable packaging materials.

- Material Innovation: Focus on biodegradable, plant-based, and recycled content materials to meet market needs.

- Ishizuka Glass Strategy: Product development is aligned with environmental sustainability to capture this growing market segment.

Energy Consumption in Manufacturing

Manufacturing glass and plastic products, like those Ishizuka Glass produces, inherently requires significant amounts of energy, particularly for the high-temperature melting processes. This energy intensity directly impacts operational costs and environmental performance. In 2023, the industrial sector globally accounted for approximately 30% of total final energy consumption, with manufacturing processes being a major contributor.

Ishizuka Glass is actively working to mitigate its environmental impact by focusing on optimizing energy consumption across its production lines. This includes investing in more efficient machinery and refining operational procedures to minimize waste heat and electricity usage. For instance, improvements in furnace design can lead to substantial energy savings, potentially reducing energy input per ton of glass produced by several percentage points.

A crucial element of Ishizuka Glass's strategy to reduce energy demand and lower carbon emissions involves the increased incorporation of cullets, or recycled glass, into its production. Using cullets significantly lowers the energy required for melting compared to virgin raw materials. In fact, for every 10% increase in cullet usage, energy consumption for melting can decrease by approximately 2-3%. This not only conserves energy but also reduces the need for mining raw materials, further contributing to a smaller environmental footprint.

- Energy Intensity: Glass and plastic manufacturing are energy-demanding sectors.

- Optimization Efforts: Ishizuka Glass is implementing measures to enhance energy efficiency in its manufacturing.

- Cullet Utilization: Recycling glass (cullets) is a key strategy to reduce melting energy and emissions.

- Energy Savings: A 10% rise in cullet use can cut melting energy needs by 2-3%.

Japan's aggressive plastic waste reduction targets, aiming for all plastic packaging to be reusable or recycled by 2035, directly influence Ishizuka Glass's plastic product lines. The company is compelled to integrate more recycled plastic content, aligning with the nation's circular economy goals.

Ishizuka Glass's 2050 Net Zero emissions target drives initiatives to reduce Scope 1 and 2 emissions through process consolidation and energy savings, particularly noted in 2024 maintenance schedules.

The increasing demand for eco-friendly packaging in Japan, with over 70% of consumers prioritizing it in 2024, pushes Ishizuka Glass to innovate with biodegradable, plant-based, and recycled materials, especially in the food and beverage sectors.

The glass industry's energy intensity, with manufacturing contributing significantly to global energy consumption (around 30% in 2023), necessitates Ishizuka Glass's focus on energy efficiency and cullet usage. A 10% increase in cullet use can reduce melting energy by 2-3%.

| Environmental Factor | Impact on Ishizuka Glass | Key Data/Initiative |

|---|---|---|

| Plastic Waste Reduction Targets | Increased use of recycled plastics in product lines | Japan's 2035 goal for all plastic packaging to be reusable/recycled |

| Carbon Neutrality Goals | Focus on reducing Scope 1 & 2 emissions | 2050 Net Zero target; energy savings in 2024 maintenance |

| Eco-Friendly Packaging Demand | Product development with sustainable materials | 70%+ Japanese consumers prioritize eco-packaging (2024); growth in food/beverage sectors |

| Energy Consumption in Manufacturing | Drive for energy efficiency and cullet use | Industrial sector ~30% of global final energy consumption (2023); 10% cullet use reduces melting energy by 2-3% |

PESTLE Analysis Data Sources

Our Ishizuka Glass PESTLE Analysis is built on a comprehensive review of data from reputable sources, including government economic reports, industry-specific market research, and international environmental policy updates. This ensures each factor is grounded in current, fact-based insights.