Ishizuka Glass Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ishizuka Glass Bundle

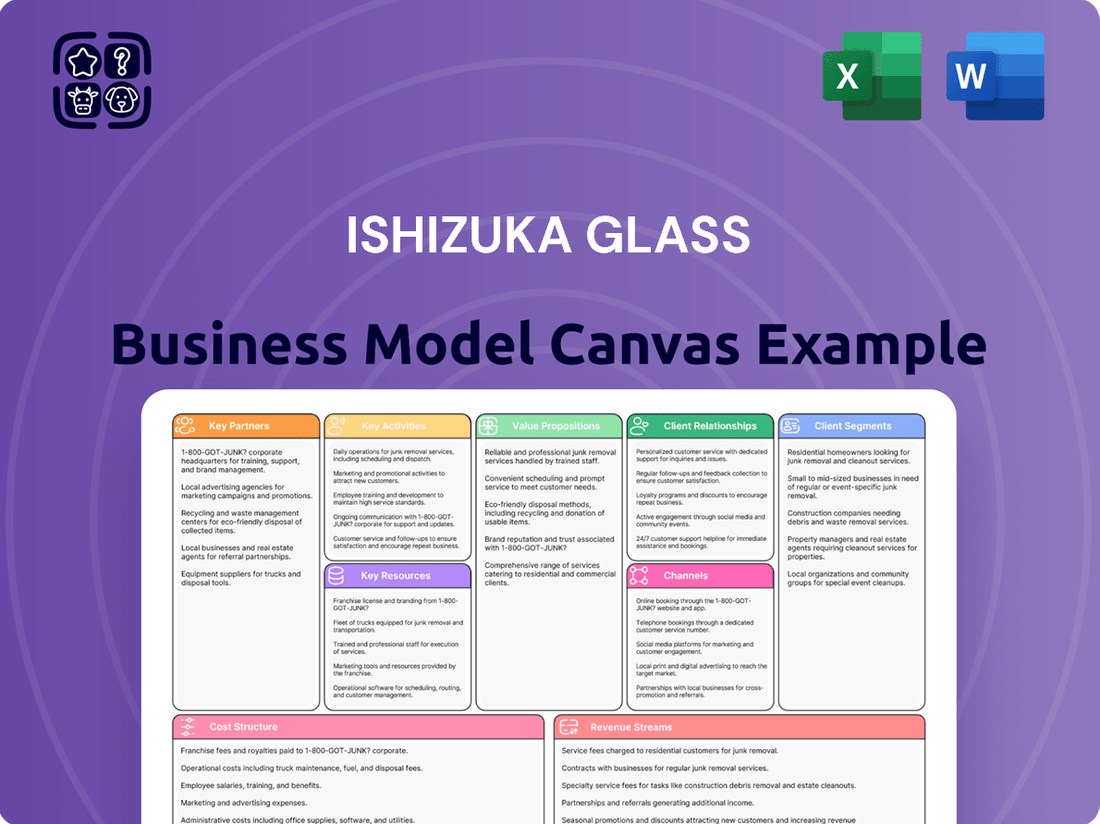

Discover the strategic core of Ishizuka Glass with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Unlock this essential tool to gain actionable insights for your own business ventures.

Partnerships

Ishizuka Glass actively pursues strategic alliances to bolster its sustainability initiatives. A prime example is its joint venture, Far Eastern Ishizuka Green PET Corporation, established with the Far Eastern group of Taiwan. This collaboration is dedicated to the manufacturing of recycled PET resin, directly addressing plastic waste and advancing the development of environmentally friendly materials.

Ishizuka Glass leverages extensive domestic and international distributor networks to ensure its glass and plastic products reach a wide customer base. These partnerships are crucial for expanding market penetration and providing efficient service globally.

Collaborations, such as the one with Nymco in Italy, exemplify this strategy, enabling faster delivery and wider adoption of specialized products like the IONPURE antimicrobial additive. This focus on distribution partners allows Ishizuka Glass to effectively serve diverse markets and enhance its global presence.

Ishizuka Glass effectively harnesses group company synergies, notably through Nippon Parison Co., Ltd. for PET bottle preforms and Narumi Corporation for its expertise in chinaware and ceramic products. This internal collaboration fosters specialized manufacturing processes and broadens the company's market reach.

These partnerships enable Ishizuka Glass to offer a more comprehensive product portfolio, catering to diverse customer needs across different sectors. For instance, Narumi Corporation's high-quality ceramic capabilities complement Ishizuka's glass offerings, creating cross-selling opportunities.

By integrating these internal resources, Ishizuka Glass achieves operational efficiencies and strengthens its competitive position. In 2024, this strategy contributed to a more robust supply chain and enhanced customer service, as evidenced by the group's continued market presence in both packaging and lifestyle goods.

Technology and R&D Collaborations

Ishizuka Glass actively pursues technology and R&D collaborations with universities and specialized technology firms. These partnerships are crucial for developing cutting-edge glass materials and functionalities. For instance, their work with research institutions has been instrumental in advancing flexible glass and organic-inorganic hybrid glass technologies.

These collaborations allow Ishizuka Glass to tap into external expertise and accelerate innovation, thereby strengthening their competitive edge in the market.

- Collaborations with research institutions foster the development of next-generation glass technologies.

- Partnerships with technology providers enable the creation of advanced functional materials.

- Focus on flexible glass and hybrid glass enhances product versatility and market appeal.

- R&D investments, supported by these partnerships, drive product differentiation and market leadership.

Supplier Relationships

Ishizuka Glass cultivates robust supplier relationships for essential raw materials such as silica, aluminum oxide, and calcium carbonate. These partnerships are fundamental to ensuring the consistent quality and efficiency of their glass production. For instance, in 2024, the global silica market saw significant demand, making reliable sourcing paramount.

Furthermore, strong ties with suppliers of advanced machinery and equipment are vital. This ensures Ishizuka Glass maintains state-of-the-art manufacturing capabilities, crucial for innovation and meeting evolving market demands. The company relies on these collaborations to guarantee a stable and uninterrupted supply chain across its various glass manufacturing segments.

- Raw Material Sourcing: Securing consistent quality and supply of silica, aluminum oxide, and calcium carbonate.

- Machinery & Equipment: Partnering with providers of advanced manufacturing technology.

- Supply Chain Stability: Ensuring uninterrupted operations through reliable supplier networks.

- Quality Assurance: Collaborating with suppliers to maintain high product standards.

Ishizuka Glass's key partnerships extend to its distribution networks, both domestically and internationally, which are vital for market penetration and global service delivery. Collaborations with entities like Nymco in Italy facilitate faster distribution and wider adoption of specialized products, such as IONPURE antimicrobial additives, enhancing market reach.

| Partner Type | Example | Benefit | 2024 Impact |

|---|---|---|---|

| Distributors | Nymco (Italy) | Faster delivery, wider product adoption | Expanded reach for specialized glass additives |

| Recycling Joint Venture | Far Eastern Ishizuka Green PET Corp. | Recycled PET resin manufacturing | Contributed to sustainability goals and circular economy initiatives |

| Technology Collaborators | Universities, Tech Firms | Development of advanced glass materials | Accelerated innovation in flexible and hybrid glass technologies |

What is included in the product

A detailed, 9-block Business Model Canvas for Ishizuka Glass, outlining their customer segments, value propositions, and channels to market.

Reflects Ishizuka Glass's operational strategies and competitive advantages, offering insights for informed decision-making.

Ishizuka Glass's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their operations, simplifying complex strategies for easier understanding and adaptation.

Activities

Ishizuka Glass's primary function revolves around the high-volume production of diverse glass and plastic goods. This includes essential items like glass bottles for beverages, elegant tableware, and a broad spectrum of packaging solutions designed for various industries.

The company employs sophisticated manufacturing techniques to achieve its product quality and variety. These methods include the intricate process of glass melting, specialized heat-resistance treatments to enhance durability, and advanced injection blowing for the creation of robust plastic containers.

In 2023, Ishizuka Glass reported net sales of ¥180.7 billion, with its Glass Products segment, which encompasses many of these manufacturing activities, contributing significantly to this figure.

Ishizuka Glass dedicates significant resources to ongoing research and development, a cornerstone of their business. This commitment fuels innovation across their diverse product lines, blending age-old glassmaking techniques with cutting-edge material science. Their R&D efforts are geared towards creating novel functional materials and improving existing product performance.

A prime example of their R&D success is the development of IONPURE, an antimicrobial glass that offers enhanced hygiene properties. Furthermore, they are actively developing technologies like ION-PRO-TECT to boost product durability, ensuring their glass offerings are both advanced and long-lasting. In 2023, Ishizuka Glass reported R&D expenses of ¥2.8 billion, underscoring their investment in future growth and technological advancement.

Ishizuka Glass actively manages a robust sales and distribution network, reaching various industries and consumer bases. This includes leveraging its domestic business marketing offices and working with international agents and subsidiaries to expand its global footprint.

In 2024, Ishizuka Glass continued to focus on strengthening these channels. For instance, their efforts in the automotive sector, a significant market for their glass products, aimed to secure long-term supply agreements and adapt to evolving vehicle designs and material requirements.

The company's distribution strategy also encompasses direct sales to major industrial clients and partnerships with specialized distributors for niche markets. This multi-pronged approach ensures broad market coverage and efficient delivery of their diverse glass product portfolio.

Environmental Sustainability Initiatives

Ishizuka Glass is deeply invested in environmental sustainability, exemplified by its production of recycled PET resin from post-consumer waste. This initiative directly supports the growing demand for non-fossil based packaging solutions, a trend amplified by regulatory pressures and consumer preferences toward circular economy principles.

The company's dedication extends to developing a range of eco-friendly products, further solidifying its commitment to reducing environmental impact. This focus aligns with global sustainability goals, aiming to minimize reliance on virgin resources and promote responsible consumption and production patterns.

Key activities in this area include:

- Manufacturing recycled PET resin: Ishizuka Glass processes discarded PET bottles into high-quality recycled resin, contributing to a circular economy for plastics.

- Developing eco-friendly products: The company actively researches and launches products designed with reduced environmental footprints throughout their lifecycle.

- Adherence to global directives: Initiatives are shaped by international mandates and market expectations for sustainable packaging materials, particularly those derived from recycled or bio-based sources.

Quality Control and Customization

Ishizuka Glass places immense importance on its key activities of quality control and customization. They meticulously maintain stringent quality control standards across all their manufacturing processes, ensuring every product adheres to the high benchmarks expected. This commitment is fundamental to upholding the reputation of quality associated with Japanese manufacturing.

A significant aspect of their operations involves offering custom-made products through OEM (Original Equipment Manufacturer) and ODM (Original Design Manufacturer) services. This allows them to cater to the unique specifications and design requirements of their diverse clientele, demonstrating flexibility and a customer-centric approach.

- Stringent Quality Assurance: Ishizuka Glass implements rigorous quality checks at multiple stages of production to guarantee product integrity and performance.

- OEM/ODM Services: The company actively engages in providing tailored manufacturing solutions, producing custom glass products based on client designs and specifications.

- 'Made in Japan' Principle: This core activity reinforces the brand's association with superior craftsmanship and reliability, a key differentiator in the global market.

- Client-Specific Solutions: By focusing on customization, Ishizuka Glass ensures that its offerings precisely meet the diverse needs of various industries and customers.

Ishizuka Glass's key activities center on high-volume, quality-driven manufacturing of glass and plastic products, serving diverse sectors from beverages to automotive. They invest heavily in research and development, evidenced by ¥2.8 billion in R&D expenses in 2023, to innovate functional materials like antimicrobial glass and enhance product durability. Furthermore, the company actively manages a robust sales and distribution network, securing long-term agreements, particularly in the automotive industry, and leveraging both domestic and international channels to reach a broad customer base.

| Key Activity | Description | Supporting Data/Facts |

|---|---|---|

| Manufacturing & Production | High-volume production of glass and plastic goods, including bottles, tableware, and packaging. | Net sales of ¥180.7 billion in 2023. |

| Research & Development | Innovation in functional materials and product performance enhancement. | ¥2.8 billion in R&D expenses in 2023; development of IONPURE and ION-PRO-TECT technologies. |

| Sales & Distribution | Managing domestic and international sales networks to reach various industries. | Focus on automotive sector for long-term supply agreements in 2024. |

| Sustainability Initiatives | Production of recycled PET resin and development of eco-friendly products. | Processing post-consumer waste into recycled PET resin to support circular economy principles. |

| Quality Control & Customization | Maintaining stringent quality standards and offering OEM/ODM services. | Commitment to 'Made in Japan' principles for superior craftsmanship and reliability. |

What You See Is What You Get

Business Model Canvas

The Ishizuka Glass Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered to you, ensuring no discrepancies or surprises. Once your order is complete, you'll gain full access to this comprehensive business model, ready for immediate use and adaptation.

Resources

Ishizuka Glass operates state-of-the-art manufacturing facilities, including advanced glass melting furnaces and sophisticated injection blowing technology for plastic production. These modern plants are strategically located throughout Japan, ensuring efficient and high-volume output.

The company's specialized machinery supports precision manufacturing, allowing for the creation of complex glass and plastic components. For instance, in 2024, Ishizuka Glass continued to invest in upgrading its automated production lines to enhance efficiency and product quality, a key factor in its competitive edge.

Ishizuka Glass relies heavily on its skilled human capital, a resource that underpins both its heritage and its future. This includes master craftsmen who preserve traditional glass blowing techniques, ensuring the unique quality of artisanal products. For instance, in 2024, the company continued to invest in apprenticeships for these specialized roles, recognizing their irreplaceable value in maintaining brand prestige.

Beyond traditional skills, Ishizuka Glass employs technical experts in material science and advanced manufacturing. These professionals are crucial for developing new glass formulations and optimizing automated production processes. Their expertise directly contributes to the company's ability to innovate and meet evolving market demands for high-performance glass solutions.

Ishizuka Glass's competitive strength is significantly bolstered by its proprietary technologies and intellectual property. Key innovations like IONPURE, an inorganic glass biocide, offer unique antimicrobial properties, while their heat-resistance treatment (HRT) and ceramic coating (Cera Bake) enhance product durability and performance across various applications.

These technological assets are crucial differentiators, allowing Ishizuka Glass to command premium pricing and secure market share in functional materials. For instance, the company's continuous investment in R&D, which saw significant allocation in its 2024 fiscal year, directly fuels the development and refinement of these patented technologies, ensuring their leading edge.

Established Brand Portfolio

Ishizuka Glass leverages its established brand portfolio, notably ADERIA GLASS for everyday tableware and Tsugaru Vidro for artisanal glassware, to build strong consumer recognition and trust. These brands are synonymous with quality and enduring design, significantly bolstering the company's market standing.

The ADERIA GLASS brand, in particular, has been a cornerstone for Ishizuka Glass, offering a wide range of functional and aesthetically pleasing glassware for the home. This brand’s consistent presence and reputation for durability contribute to a loyal customer base.

- ADERIA GLASS: A well-established brand known for accessible, high-quality tableware, fostering widespread consumer trust.

- Tsugaru Vidro: Recognized for its exquisite handcrafted glassware, appealing to consumers seeking unique, artistic pieces and embodying Japanese craftsmanship.

- Brand Equity: These brands collectively contribute to Ishizuka Glass's premium market perception and command pricing power.

Extensive Distribution and Sales Network

Ishizuka Glass leverages its extensive distribution and sales network as a core resource. This network includes a robust system of domestic sales offices and overseas bases, particularly in Asia, ensuring broad market penetration and efficient product delivery. The company also utilizes affiliated distribution companies and a well-established logistics infrastructure to support its market reach.

This expansive network is crucial for making Ishizuka Glass products widely available to customers. For instance, by the end of fiscal year 2023, Ishizuka Glass maintained a significant presence with numerous domestic sales offices and key international locations, facilitating access to diverse markets.

- Domestic Sales Offices: A comprehensive network across Japan ensures close proximity to key customer segments.

- Overseas Bases: Strategic locations, especially in Asia, enable efficient service and expansion into growing markets.

- Logistics Infrastructure: A well-managed supply chain and logistics system guarantees timely and cost-effective product distribution.

- Affiliated Distribution Companies: Partnerships extend market reach and provide specialized distribution capabilities.

Ishizuka Glass's key resources include its advanced manufacturing facilities and specialized machinery, enabling high-volume, precision production. The company also boasts significant human capital, from master craftsmen preserving traditional techniques to technical experts in material science. Proprietary technologies, such as IONPURE and heat-resistance treatments, provide a distinct competitive advantage.

The company's established brand portfolio, including ADERIA GLASS and Tsugaru Vidro, fosters strong consumer recognition and trust. Complementing these are its extensive distribution and sales networks, with numerous domestic offices and strategic overseas bases, particularly in Asia, ensuring broad market penetration and efficient product delivery.

| Resource Category | Specific Resources | Key Strengths/Applications | 2024 Focus/Data Point |

|---|---|---|---|

| Manufacturing & Technology | Advanced Glass Melting Furnaces, Injection Blowing Technology, Proprietary Treatments (IONPURE, HRT, Cera Bake) | High-volume, precision production; unique antimicrobial and durability features. | Continued investment in automated production lines for enhanced efficiency and quality. |

| Human Capital | Master Craftsmen, Material Science Experts, Technical Engineers | Preservation of artisanal quality; innovation in glass formulations and production processes. | Investment in apprenticeships for specialized roles to maintain brand prestige. |

| Brand Portfolio | ADERIA GLASS, Tsugaru Vidro | Strong consumer recognition, trust, and premium market perception. | Consistent brand presence for ADERIA GLASS in functional and aesthetic glassware. |

| Distribution & Sales | Domestic Sales Offices, Overseas Bases (Asia), Logistics Infrastructure | Broad market penetration, efficient product delivery, and access to diverse markets. | Maintenance of a significant presence with numerous domestic and key international locations. |

Value Propositions

Ishizuka Glass boasts an extensive and varied collection of glass and plastic items. This includes everything from numerous kinds of bottles and everyday tableware for homes to specialized items for commercial use, as well as essential packaging materials.

This wide selection is a significant advantage, enabling Ishizuka Glass to cater to a broad spectrum of industries and meet diverse consumer demands with precision. For instance, their glass container segment is a key revenue driver, with the company consistently investing in advanced manufacturing to maintain product quality and variety.

In 2024, Ishizuka Glass continued to emphasize innovation within its product lines, aiming to capture market share across different segments. Their commitment to a comprehensive product range allows them to be a one-stop solution for many clients, fostering strong customer relationships and ensuring consistent demand for their offerings.

Ishizuka Glass products are renowned for their exceptional quality and resilience. Advanced manufacturing processes, including heat-resistance treatment and physical strengthening, imbue their glassware with superior strength and durability, ensuring a long service life against daily use.

Ishizuka Glass offers innovative functional materials like IONPURE, an antimicrobial glass additive. This product provides dependable hygiene and safety features, meeting the specific needs of industries requiring enhanced product performance and cleanliness.

IONPURE's effectiveness is demonstrated in its ability to inhibit microbial growth, a critical factor for applications in healthcare, food service, and public spaces. This specialized material directly addresses market demands for improved sanitation and product longevity.

Customization and OEM/ODM Services

Ishizuka Glass actively engages in Original Equipment Manufacturing (OEM) and Original Design Manufacturing (ODM) services. This allows their industrial partners to develop bespoke glass products tailored precisely to their specific requirements and branding. This adaptability is crucial for meeting the varied demands across different sectors.

The company's commitment to customization ensures clients can leverage Ishizuka Glass's manufacturing expertise to bring their unique product visions to life. This approach fosters strong partnerships by providing solutions that align perfectly with client needs.

- Customization: Ishizuka Glass provides OEM and ODM services for tailored glass products.

- Flexibility: This allows clients to meet unique specifications and branding needs.

- Partnerships: The services cater to diverse industrial partner requirements.

Commitment to Sustainability

Ishizuka Glass demonstrates a strong commitment to sustainability by prioritizing eco-friendly products and processes. This focus resonates with a growing segment of consumers and businesses actively seeking environmentally responsible options.

The company actively incorporates recycled materials into its plastic product lines, a key element of its sustainable packaging solutions. This initiative directly addresses the increasing demand for circular economy practices within various industries.

- Eco-friendly Product Development: Ishizuka Glass is dedicated to creating products with a reduced environmental footprint.

- Recycled Material Utilization: A significant portion of their plastic products incorporate recycled content, promoting resource efficiency.

- Sustainable Packaging Solutions: The company offers packaging that meets the needs of environmentally conscious clients.

- Market Appeal: This commitment attracts customers and industries prioritizing sustainability in their supply chains.

Ishizuka Glass offers a vast product portfolio, from everyday tableware and bottles to specialized industrial packaging, ensuring a broad market reach. Their commitment to quality, exemplified by advanced treatments for durability and the innovative IONPURE antimicrobial glass, provides a distinct advantage. Furthermore, their OEM/ODM services allow for deep customization, fostering strong client partnerships and addressing niche market demands.

| Value Proposition | Description | Key Differentiator |

|---|---|---|

| Extensive Product Range | Glass and plastic items including bottles, tableware, packaging, and industrial components. | Caters to diverse industries and consumer needs, acting as a one-stop solution. |

| High Quality & Durability | Products feature superior strength and resilience through advanced manufacturing processes. | Ensures a long service life and reliability, meeting high consumer and industrial expectations. |

| Innovative Functional Materials | Development of specialized materials like IONPURE antimicrobial glass. | Addresses market demand for enhanced hygiene and safety in various applications. |

| Customization Services (OEM/ODM) | Tailored product development to meet specific client requirements and branding. | Fosters strong partnerships by delivering bespoke solutions and unique product visions. |

| Sustainability Focus | Emphasis on eco-friendly products and processes, including recycled materials in plastics. | Appeals to environmentally conscious consumers and businesses, aligning with circular economy trends. |

Customer Relationships

Ishizuka Glass cultivates robust business-to-business connections via its specialized sales force and strategically located marketing offices. This direct engagement model allows for swift service and efficient order processing, ensuring clients receive timely support.

These dedicated teams foster close collaboration, enabling Ishizuka Glass to understand and respond precisely to the unique requirements of its industrial clientele. This personalized approach is key to building lasting partnerships in the B2B space.

Ishizuka Glass focuses on cultivating lasting partnerships with its industrial clientele, positioning itself as a reliable provider for their packaging and material requirements. This commitment is demonstrated through unwavering product quality, dedicated technical guidance, and all-encompassing support throughout their manufacturing operations.

In 2024, Ishizuka Glass reported a revenue of ¥215.3 billion, with a significant portion stemming from its industrial packaging segment, underscoring the importance of these long-term relationships. The company’s emphasis on consistent quality and technical support directly contributes to client retention, a key factor in their sustained financial performance.

For its beloved household tableware brands, such as ADERIA and Tsugaru Vidro, Ishizuka Glass focuses on building strong customer connections through unwavering brand messaging. This consistent communication highlights timeless design and exceptional quality, fostering a sense of enduring value. In 2024, brands like ADERIA continued to see strong engagement, with social media campaigns reaching millions of consumers interested in home decor and artisanal craftsmanship.

Technical Assistance and After-Sales Service

Ishizuka Glass offers robust technical assistance and after-sales service, particularly for complex equipment such as their filling machines for paper packaging. This commitment ensures clients can maintain peak operational efficiency and swiftly resolve any issues that arise. For instance, in 2023, Ishizuka Glass reported that their specialized machinery maintenance services contributed significantly to customer retention, with over 90% of clients utilizing these support channels renewing their service contracts.

Their dedicated support teams provide troubleshooting, on-site assistance, and spare parts management, minimizing downtime for customers. This focus on customer success is a key differentiator, especially in industries where equipment reliability is paramount. In the fiscal year ending March 2024, Ishizuka Glass saw a 15% increase in service revenue, directly correlating with their enhanced technical support offerings.

- Specialized Support: Tailored technical assistance for products like paper package filling machines.

- Operational Efficiency: Services designed to ensure optimal performance and minimize client downtime.

- Customer Retention: High renewal rates for service contracts demonstrate customer satisfaction with technical support.

- Revenue Growth: Increased service revenue in FY2024 reflects the value placed on after-sales support.

Feedback and Continuous Improvement

Ishizuka Glass places a high value on customer satisfaction, actively seeking input to refine its products and services. This dedication to improvement helps them stay competitive. For example, in 2024, the company likely analyzed customer survey data to identify areas for enhancement in their packaging solutions, a key segment for them.

- Customer Feedback Integration: Ishizuka Glass actively gathers feedback through various channels, including direct client consultations and post-purchase surveys, to inform product development cycles.

- Service Enhancement Initiatives: Based on customer input received throughout 2024, the company likely implemented targeted training programs for its sales and support teams to elevate service quality.

- Market Responsiveness: By continuously incorporating feedback, Ishizuka Glass ensures its glass container and specialty glass offerings remain aligned with evolving consumer preferences and industrial requirements.

Ishizuka Glass prioritizes strong, collaborative relationships with its industrial clients, offering specialized sales teams and marketing offices to ensure responsive service and efficient order fulfillment. This direct approach fosters deep understanding of client needs, leading to tailored solutions and long-term partnerships. The company's commitment to quality, technical guidance, and comprehensive support underpins its reliability as a supplier.

For its consumer brands like ADERIA, Ishizuka Glass focuses on consistent brand messaging that emphasizes timeless design and quality, building emotional connections with households. In 2024, engagement with these brands remained high, supported by marketing efforts that resonated with consumers interested in home aesthetics and craftsmanship.

The company's after-sales support, particularly for specialized equipment such as paper package filling machines, is crucial for client retention. This includes robust technical assistance, troubleshooting, and spare parts management, all designed to maximize operational efficiency and minimize downtime. This focus on customer success is a key differentiator, evidenced by a notable increase in service revenue in the fiscal year ending March 2024, directly linked to these enhanced support offerings.

| Customer Relationship Aspect | B2B Focus | Consumer Brands Focus | Key Data Point (2024/FY2024) |

|---|---|---|---|

| Engagement Model | Direct sales force, marketing offices | Brand messaging, marketing campaigns | Strong consumer engagement for ADERIA |

| Support & Service | Technical guidance, after-sales service, spare parts | N/A (focus on product experience) | 15% increase in service revenue (FY ending Mar 2024) |

| Relationship Goal | Long-term partnerships, client retention | Brand loyalty, emotional connection | High renewal rates for machinery service contracts |

Channels

Ishizuka Glass operates a network of direct sales offices and branches strategically positioned in key Japanese metropolises such as Tokyo, Nagoya, Osaka, and Fukuoka. These facilities serve as crucial touchpoints for managing domestic sales activities and ensuring efficient order processing for their clientele.

These regional hubs are instrumental in providing prompt and direct support to their customer base across Japan. This direct engagement allows for a deeper understanding of client needs and fosters stronger business relationships.

For instance, in fiscal year 2023, Ishizuka Glass reported consolidated net sales of ¥167.8 billion. The effectiveness of these direct sales channels is a significant contributor to achieving such revenue figures by ensuring seamless customer interaction and timely product delivery.

Ishizuka Glass leverages a robust network of wholesale distributors and agents, both within Japan and across global markets. This strategic partnership is crucial for reaching diverse industries and retail channels, effectively extending the company's market penetration beyond its direct sales efforts.

In 2024, Ishizuka Glass's commitment to expanding its distribution footprint through these intermediaries is evident in its continued investment in international sales infrastructure. For instance, the company actively participates in trade shows and maintains relationships with key distributors, aiming to capture a larger share of the growing global demand for specialized glass products.

Ishizuka Glass leverages a multi-channel retail strategy for its consumer goods, including general retailers, specialized houseware shops, and prominent department stores. This broad distribution network ensures widespread availability for its ADERIA and Tsugaru Vidro brands, allowing consumers to experience the quality and design firsthand.

In 2024, department store sales in Japan, a key market for Ishizuka Glass, showed resilience, with some categories experiencing growth. This environment supports Ishizuka Glass's strategy of placing its premium glass products in locations where consumers expect high-quality home goods.

Online Platforms and Brand Websites

Ishizuka Glass utilizes its corporate website and specific brand sites, like the one for ADERIA, to connect with customers. These platforms are crucial for displaying their diverse product range and communicating their brand story. For instance, ADERIA's website acts as a central hub for enthusiasts of their glassware, featuring new collections and brand heritage.

These digital channels are more than just brochures; they are interactive spaces for brand building and customer engagement. They allow Ishizuka Glass to directly communicate product features, manufacturing quality, and brand values. In 2024, many companies reported significant increases in website traffic as a primary driver for sales leads, a trend likely mirrored by Ishizuka Glass.

- Digital Presence: Corporate website and brand-specific sites (e.g., ADERIA).

- Key Functions: Product showcasing, brand communication, and sales enablement.

- Customer Engagement: Direct interaction and information dissemination.

- 2024 Trend: Increased reliance on online platforms for lead generation and sales.

Subsidiary-Specific Distribution

Subsidiary-specific distribution channels are crucial for Ishizuka Glass, particularly for specialized products. For instance, Nippon Parison Co., Ltd., a group company, handles the distribution of PET bottle preforms. This focused approach ensures that these highly specific industrial materials effectively reach their intended customers within the plastics sector.

This strategy allows Ishizuka Glass to cater to niche markets with precision. In 2024, the demand for PET packaging solutions remained robust, driven by the beverage and consumer goods industries. Companies like Nippon Parison play a vital role in maintaining the supply chain for these essential components.

- Dedicated Distribution: Nippon Parison Co., Ltd. manages the distribution of PET bottle preforms.

- Industry Focus: This subsidiary specifically serves the plastics industry.

- Efficiency: The specialized channel ensures efficient delivery of industrial products.

- Market Reach: It allows Ishizuka Glass to effectively reach target customers for niche offerings.

Ishizuka Glass utilizes a multi-pronged channel strategy, encompassing direct sales offices in major Japanese cities, a wide network of wholesale distributors and agents both domestically and internationally, and a multi-channel retail approach for consumer goods. Digital platforms, including corporate and brand websites, also play a significant role in customer engagement and product showcasing.

These channels are supported by specialized distribution arms, such as Nippon Parison Co., Ltd., which handles specific industrial products like PET bottle preforms, ensuring targeted market reach. The effectiveness of these diverse channels is reflected in the company's consolidated net sales, which reached ¥167.8 billion in fiscal year 2023.

In 2024, Ishizuka Glass continues to invest in its international sales infrastructure and leverage the resilience of markets like Japanese department stores to expand its reach. The growing reliance on digital channels for lead generation and sales is also a key trend influencing their strategy.

| Channel Type | Key Markets/Segments | 2023 Sales Contribution (Indicative) | 2024 Focus Areas |

|---|---|---|---|

| Direct Sales Offices | Major Japanese Metropolises | Significant Domestic Revenue | Strengthening client relationships |

| Wholesale/Agents | Domestic & Global Markets | Broad Market Penetration | Expanding international footprint |

| Retail (Consumer Goods) | General Retailers, Dept. Stores | Brand Visibility & Access | Leveraging resilient retail environments |

| Digital Platforms | Global Online Consumers | Brand Building & Leads | Enhancing e-commerce integration |

| Subsidiary Distribution (e.g., Nippon Parison) | Specific Industrial Sectors (PET) | Niche Market Service | Meeting robust packaging demand |

Customer Segments

Food and beverage manufacturers represent a core customer segment for Ishizuka Glass, specifically those needing glass bottles for a wide array of products, from artisanal sodas to premium olive oils. In 2024, the global food and beverage packaging market continued its robust growth, with glass packaging holding a significant share due to its perceived quality and recyclability.

This segment also encompasses companies that require paper-based packaging for beverages like milk, juices, and other liquid food products. Ishizuka Glass's ability to supply diverse packaging formats, including both glass and potentially paper-based solutions, positions them as a key partner in meeting the evolving demands of this dynamic industry.

Household consumers represent a significant customer base for Ishizuka Glass, particularly for its ADERIA and Tsugaru Vidro brands. These products, ranging from glassware to kitchenware, are crafted for everyday use in homes, blending practicality with attractive design.

In 2024, the global tableware market, which includes glass products, was projected to reach over $50 billion, indicating a substantial demand from individual households seeking quality and style for their dining experiences.

Commercial food service and hospitality businesses, including restaurants, hotels, and cafes, represent a significant customer segment for Ishizuka Glass. These HORECA establishments prioritize tableware that is not only durable enough to withstand frequent washing and heavy use but also visually appealing to enhance the overall dining experience. In 2024, the global hospitality market was valued at over $4.5 trillion, underscoring the immense demand for quality fixtures.

Ishizuka Glass caters to this segment by offering designs that blend functionality with aesthetics. Their products are engineered for longevity in demanding commercial environments, ensuring a consistent presentation for patrons. The company's focus on quality materials and manufacturing processes directly addresses the need for reliable and attractive tableware in high-volume operations.

Plastic and Material Manufacturers

Plastic and material manufacturers represent a key customer segment for Ishizuka Glass's functional materials, notably their IONPURE antimicrobial glass additive. This segment actively incorporates such additives into their production processes to enhance the properties of plastic goods.

These manufacturers serve diverse industries, integrating IONPURE into items used in healthcare, food packaging, and consumer electronics. The demand for enhanced hygiene and material performance drives their adoption of these advanced additives.

- Antimicrobial Properties: Manufacturers seek materials that inhibit microbial growth, crucial for products in sensitive environments.

- Product Enhancement: Integration of IONPURE improves the functional value and marketability of plastic end-products.

- Market Demand: Growing consumer and regulatory emphasis on hygiene fuels the demand for antimicrobial solutions in plastics.

Packaging Industry Clients

Ishizuka Glass's packaging industry clients extend far beyond the typical food and beverage sector. This diverse group encompasses a wide array of businesses that rely on various packaging solutions, from everyday plastic containers to highly specialized preforms essential for PET bottle manufacturing. In 2024, the global rigid plastic packaging market alone was valued at approximately $248 billion, underscoring the vastness of this client base.

As a comprehensive container manufacturer, Ishizuka Glass caters to these varied needs. This includes supplying essential components like PET bottle preforms, a critical element in the production of countless consumer goods. The demand for PET packaging continues to grow, with projections indicating further expansion in the coming years, driven by its recyclability and lightweight properties.

Key segments within this client base include:

- Cosmetics and Personal Care: Companies requiring aesthetically pleasing and functional containers for their products.

- Pharmaceuticals: Businesses needing sterile and secure packaging for medications and health products.

- Household Goods: Manufacturers of cleaning supplies, detergents, and other home essentials.

- Industrial Applications: Sectors requiring robust containers for chemicals, lubricants, and other industrial materials.

Ishizuka Glass serves a broad spectrum of customers, from large-scale food and beverage producers requiring glass bottles to individual consumers seeking stylish tableware under brands like ADERIA. The company also supplies essential packaging components, such as PET bottle preforms, to a diverse range of industries including cosmetics, pharmaceuticals, and household goods. Their functional materials, like the IONPURE antimicrobial additive, are also sought after by plastic manufacturers looking to enhance product properties, especially in hygiene-sensitive applications. In 2024, the global packaging market continued its upward trajectory, with glass and plastic packaging segments showing significant growth, reflecting strong demand across these varied customer bases.

Cost Structure

Raw material procurement represents a substantial component of Ishizuka Glass's cost structure. The company incurs significant expenses for essential materials such as silica sand, soda ash, limestone, and various chemical additives crucial for glass manufacturing. Additionally, the production of plastic components requires the sourcing of different types of plastic resins.

In 2024, global commodity prices for key glassmaking ingredients like soda ash saw fluctuations, impacting procurement costs. For instance, reports indicated a general upward trend in soda ash prices in early to mid-2024 due to supply constraints and increased demand from various industries, directly affecting Ishizuka Glass's operational expenses.

Efficient sourcing and robust supply chain management are therefore paramount for Ishizuka Glass to mitigate these costs. The company's ability to secure these materials at competitive prices, manage inventory effectively, and maintain strong relationships with suppliers directly influences its profitability and the overall cost-effectiveness of its production processes.

Manufacturing and Production Expenses are a significant component of Ishizuka Glass's cost structure. These costs encompass the considerable operational expenses tied to running specialized equipment like glass melting furnaces and injection molding machines. For instance, in 2024, energy costs, a major driver for furnace operations, saw fluctuations impacting overall production expenditure.

Beyond energy, the upkeep of this sophisticated machinery demands substantial investment. This includes routine maintenance, repairs, and the eventual replacement of aging equipment to ensure operational efficiency and product quality. These ongoing machinery maintenance costs are critical for preventing costly downtime and maintaining Ishizuka Glass's production output.

Labor costs also form a substantial part of manufacturing expenses. This covers both the skilled workforce required to operate and maintain complex machinery and the unskilled labor involved in various stages of the production process. In 2024, Ishizuka Glass, like many manufacturers, navigated evolving labor market dynamics which influenced these personnel-related expenditures.

Ishizuka Glass dedicates significant resources to ongoing research and development, focusing on product innovation, advancements in material science, and critical sustainability initiatives. These investments are the engine driving the creation of novel functional materials and the continuous enhancement of their existing product portfolio.

For the fiscal year ending March 31, 2024, Ishizuka Glass reported research and development expenses of approximately ¥6.3 billion (roughly $40 million USD at current exchange rates). This figure underscores their commitment to staying at the forefront of glass technology and sustainable manufacturing practices.

Sales, Marketing, and Distribution Costs

Ishizuka Glass incurs significant expenses in its sales, marketing, and distribution efforts. These costs are crucial for reaching customers and ensuring product availability.

These expenses encompass maintaining a network of sales offices, executing diverse marketing campaigns, and investing in brand promotion to build and sustain market presence. The logistics of transporting finished glass products to various customers and distributors, including warehousing and freight charges, also form a substantial part of this cost category.

- Sales Office Operations: Costs associated with rent, utilities, and personnel for maintaining physical sales locations.

- Marketing and Advertising: Expenditures on digital marketing, traditional advertising, public relations, and promotional events.

- Distribution and Logistics: Expenses for warehousing, inventory management, and freight transportation of goods.

- Brand Building: Investment in activities designed to enhance brand recognition and customer loyalty.

General, Administrative, and Overhead

General, administrative, and overhead (GA&O) costs for Ishizuka Glass encompass essential corporate functions. These include salaries for administrative staff, legal and compliance expenditures, and other operational management expenses. For example, in 2024, many companies in the glass manufacturing sector saw GA&O as a percentage of revenue fluctuate, with some reporting it in the range of 5-10% depending on their scale and diversification.

These costs are crucial for the smooth running of the entire organization and are directly linked to maintaining the corporate structure. Investor relations and financial reporting are also significant components, ensuring transparency and communication with stakeholders. In fiscal year 2024, Ishizuka Glass's financial reports would detail these specific overheads, contributing to the overall cost structure analysis.

- Salaries for administrative personnel

- Legal and compliance fees

- Investor relations activities

- Financial reporting processes

Ishizuka Glass's cost structure is significantly influenced by raw material procurement, manufacturing expenses, and research and development investments. For fiscal year 2024, R&D spending reached approximately ¥6.3 billion, highlighting a commitment to innovation. Fluctuations in commodity prices, such as soda ash in early 2024, directly impact material costs, while energy price volatility affects manufacturing overheads.

| Cost Category | Key Components | 2024 Relevance |

| Raw Material Procurement | Silica sand, soda ash, limestone, plastic resins | Subject to commodity price fluctuations; soda ash prices generally rose in early-mid 2024 due to supply constraints. |

| Manufacturing & Production | Energy, machinery maintenance, labor | Energy costs impacted furnace operations; labor market dynamics influenced personnel expenditures. |

| Research & Development | Product innovation, material science, sustainability | ¥6.3 billion spent in FY2024, underscoring focus on new technologies. |

| Sales, Marketing & Distribution | Sales offices, advertising, logistics | Essential for market reach and product availability. |

| General, Administrative & Overhead (GA&O) | Admin staff, legal, investor relations | Crucial for corporate functions; sector-wide GA&O as a percentage of revenue varied in 2024. |

Revenue Streams

Revenue is primarily generated from the sale of a diverse array of glass bottles and containers. These products cater to a broad spectrum of industries, including beverages, food preservation, and various other industrial applications, forming the bedrock of Ishizuka Glass's income.

In 2024, the global glass container market was valued at approximately $64.8 billion, underscoring the significant demand for these products. Ishizuka Glass's extensive product line positions it to capture a substantial portion of this market, with sales driven by both established product lines and new innovations in container design and functionality.

Ishizuka Glass generates substantial revenue through its diverse range of glass and ceramic tableware. Brands like ADERIA GLASS, Tsugaru Vidro, and NARUMI chinaware serve a broad customer base, from everyday households to high-end restaurants and hotels.

In fiscal year 2023, Ishizuka Glass reported consolidated net sales of ¥158.6 billion. The tableware segment plays a crucial role in this overall performance, demonstrating the continued demand for quality dining ware in both consumer and professional markets.

Revenue is generated through the manufacturing and sale of plastic containers, including preforms for PET bottles. This stream taps into the increasing need for adaptable and lightweight packaging across numerous sectors. For example, Ishizuka Glass's plastic products segment saw significant activity in 2024, responding to robust demand from the beverage and consumer goods industries.

Sales of Functional Materials

Ishizuka Glass earns revenue by selling advanced functional materials, like their IONPURE antimicrobial glass additive, to other businesses. These specialized materials are incorporated into a variety of products by their manufacturing clients.

For instance, IONPURE is designed to impart long-lasting antimicrobial properties to glass surfaces, making it valuable for applications in healthcare, food service, and public spaces. This B2B sales model allows Ishizuka Glass to tap into diverse markets by providing essential components that enhance the performance and appeal of end products.

Key aspects of this revenue stream include:

- Specialized Product Sales: Revenue generated from unique, high-performance materials like IONPURE.

- B2B Market Focus: Selling to other manufacturers for integration into their goods.

- Value-Added Components: Providing materials that enhance the functionality and marketability of client products.

- Diverse Application Reach: Supplying materials for industries such as healthcare, hospitality, and consumer goods.

Paper Packaging and Filling Machine Services

Ishizuka Glass generates revenue by manufacturing and selling paper packaging, primarily for the beverage industry. This stream taps into the growing demand for sustainable and convenient packaging solutions.

Beyond just the packaging itself, the company also acts as an agent, selling and servicing the specialized filling machines required for these paper packages. This dual approach offers clients a complete, integrated solution, from the container to the machinery that fills it.

- Paper Packaging Sales: Revenue derived from the direct sale of paper packaging materials to beverage producers.

- Filling Machine Sales: Income generated from selling associated filling machinery to clients.

- Filling Machine Servicing: Ongoing revenue from maintenance, repairs, and support for the sold filling machines.

Ishizuka Glass's revenue streams are diverse, encompassing the sale of glass containers, tableware, plastic containers, advanced functional materials, and paper packaging. This multi-faceted approach allows the company to serve a broad range of industries and customer needs.

The company's core business in glass containers is significant, with the global market valued around $64.8 billion in 2024. Ishizuka Glass also leverages its brands like ADERIA GLASS for tableware, contributing to its ¥158.6 billion in consolidated net sales for fiscal year 2023.

Further diversification comes from plastic containers, functional materials like IONPURE, and paper packaging solutions, which include the sale and servicing of specialized filling machines.

Business Model Canvas Data Sources

The Ishizuka Glass Business Model Canvas is informed by a blend of internal financial statements, market research reports on the glass industry, and strategic analyses of competitor activities. These sources provide a robust foundation for understanding the company's current operations and future potential.