Ishizuka Glass Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ishizuka Glass Bundle

Ishizuka Glass operates within a competitive landscape shaped by the bargaining power of its buyers and the intensity of rivalry among existing players. Understanding these forces is crucial for navigating the glass manufacturing industry.

The complete report reveals the real forces shaping Ishizuka Glass’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Ishizuka Glass is shaped by the availability and concentration of raw material sources. For glass production, critical inputs like silica sand, soda ash, and limestone can face supply chain volatility or be sourced from a limited number of providers, thereby strengthening supplier leverage.

The bargaining power of suppliers for Ishizuka Glass is influenced by the significant switching costs associated with changing providers for essential raw materials or specialized components. These costs can encompass re-tooling manufacturing equipment, the rigorous process of re-qualifying new materials to meet quality standards, and the potential disruption to production lines during the transition. For example, if Ishizuka Glass relies on a specific type of high-purity silica for its premium glass products, finding and vetting an alternative supplier could involve extensive research and development, potentially delaying product launches and increasing operational expenses.

The bargaining power of suppliers for Ishizuka Glass is influenced by the uniqueness of their inputs. For instance, if a supplier provides highly specialized glass compositions or advanced polymer resins that are not readily available elsewhere, they can command greater leverage. This is particularly true if these materials are proprietary and critical to Ishizuka Glass's ability to innovate and differentiate its products in the market.

Supplier Power 4

The bargaining power of suppliers for Ishizuka Glass is influenced by their potential to integrate forward into glass or plastic manufacturing. This threat, while less probable for basic raw material providers, becomes a significant concern when dealing with suppliers of highly specialized components, potentially increasing their leverage.

For instance, in 2024, the global specialty chemicals market, which supplies crucial additives for glass production, saw significant consolidation. Companies like Dow Inc. reported strong performance in their packaging and specialty plastics segments, hinting at the potential for such players to explore further vertical integration if margins in their core businesses become less attractive.

- Forward Integration Threat: Suppliers in specialized component areas for glass manufacturing could leverage their expertise to enter Ishizuka Glass's core markets.

- Market Dynamics: The 2024 performance of major chemical suppliers indicates a potential for strategic shifts towards vertical integration.

- Impact on Ishizuka Glass: Increased supplier power could lead to higher input costs or reduced product customization options for Ishizuka Glass.

Supplier Power 5

The bargaining power of suppliers for Ishizuka Glass is significantly influenced by broader economic trends. For instance, global commodity prices directly affect the cost of essential raw materials like silica sand and soda ash. In 2024, the International Monetary Fund (IMF) projected a slight increase in global commodity prices, which could translate to higher input costs for glass manufacturers.

Energy prices represent another critical factor. Glass production is energy-intensive, making Ishizuka Glass particularly susceptible to fluctuations in natural gas and electricity costs. As of early 2024, European natural gas prices, while down from their 2022 peaks, remained volatile due to geopolitical factors, potentially increasing supplier leverage and operational expenses for Ishizuka Glass.

- Global commodity prices: Expected to see modest increases in 2024, impacting raw material costs.

- Energy costs: Volatile energy markets, particularly natural gas, pose a risk to Ishizuka Glass's operational expenses.

- Supplier concentration: The availability of a limited number of key raw material or energy providers can amplify their bargaining power.

- Switching costs: High costs or technical difficulties in switching suppliers for specialized raw materials or energy sources strengthen supplier positions.

The bargaining power of suppliers for Ishizuka Glass is shaped by the concentration of raw material sources and the potential for forward integration. For instance, in 2024, the specialty chemicals market saw consolidation, with companies like Dow Inc. performing strongly in segments relevant to packaging, indicating a possible avenue for vertical integration by suppliers. This, coupled with significant switching costs for specialized inputs and the impact of volatile energy prices, such as fluctuating natural gas costs in early 2024, generally grants suppliers considerable leverage over Ishizuka Glass.

| Factor | Impact on Ishizuka Glass | 2024 Data/Trend |

| Supplier Concentration | Increased leverage for fewer suppliers | Specialty chemicals market consolidation |

| Switching Costs | High costs to change suppliers | Re-tooling, re-qualification, production disruption |

| Input Uniqueness | Greater power for proprietary materials | Critical for product differentiation |

| Forward Integration | Potential for suppliers to enter Ishizuka's market | Possible strategic shift by chemical suppliers |

| Commodity Prices | Higher raw material costs | IMF projected slight increase in global commodity prices |

| Energy Prices | Increased operational expenses | Volatile European natural gas prices in early 2024 |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Ishizuka Glass's position in the global glassware and specialty materials markets.

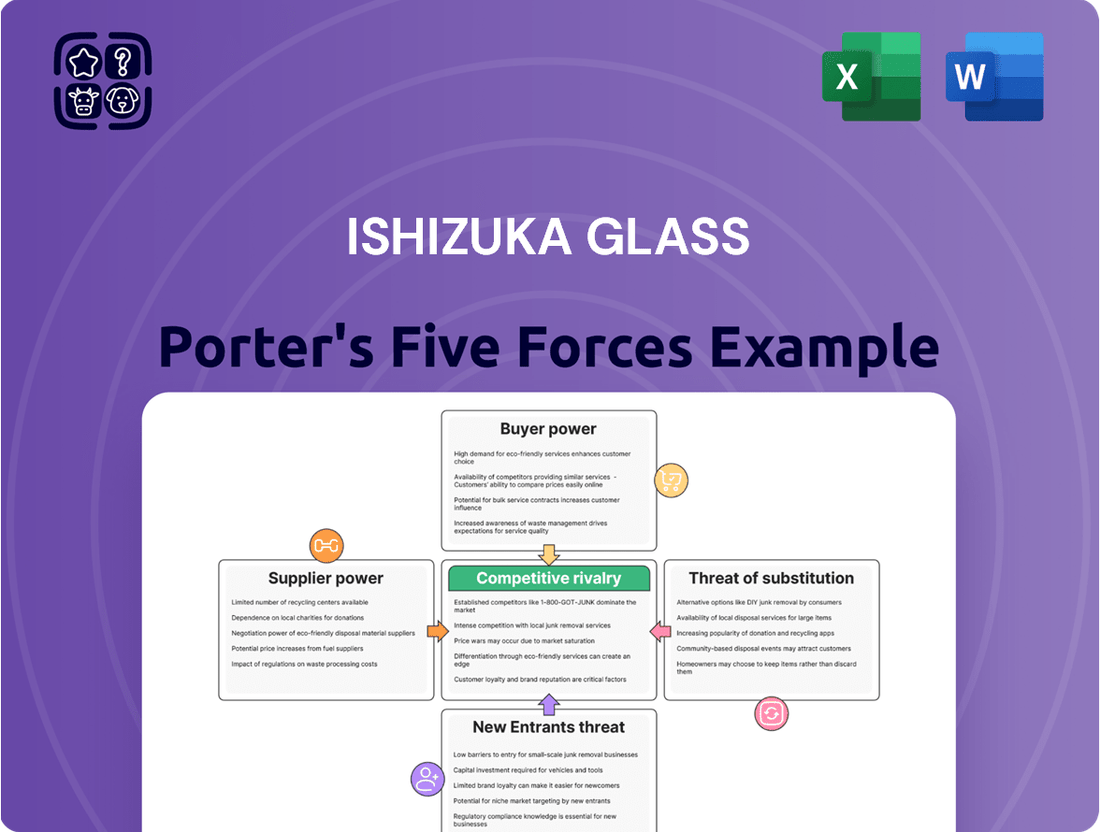

A visual representation of the five forces, allowing for immediate identification of competitive pressures on Ishizuka Glass.

Customers Bargaining Power

Ishizuka Glass's customer base is broad, spanning beverages, food, tableware, and other packaging sectors. This diversity can limit the bargaining power of any single customer group, as no one segment dominates the company's sales. For instance, in 2024, the food and beverage industry represented a significant portion of global packaging demand, but Ishizuka's varied product lines mean that a disruption in one area might be offset by stability in another.

However, the presence of large corporate clients within these industries presents a counterbalancing force. These major buyers, due to their substantial order volumes, possess considerable leverage. They can negotiate for more favorable pricing, customized product specifications, or extended payment terms, directly impacting Ishizuka Glass's profitability and operational flexibility.

The bargaining power of customers for Ishizuka Glass is influenced by the degree of standardization in its glass and plastic packaging. When products are similar across manufacturers, customers face lower switching costs, allowing them to readily shift to competitors offering more attractive pricing. For instance, if Ishizuka Glass produces widely available glass bottles or plastic containers without unique features, buyers can leverage this to negotiate better terms.

Customers' ability to negotiate lower prices significantly impacts Ishizuka Glass. In competitive sectors like consumer packaged goods, where packaging represents a substantial part of the overall cost, buyers will push hard for price reductions. This downward pressure is amplified when customers have many alternative suppliers or can easily switch to different packaging materials.

Buyer Power 4

The bargaining power of customers for Ishizuka Glass is influenced by the threat of backward integration. Large buyers, such as major beverage or food companies, possess the potential to produce their own glass or plastic packaging if sourcing from external suppliers like Ishizuka Glass becomes prohibitively expensive or unreliable. This capability, though requiring significant capital investment, directly strengthens their negotiating position.

- Customer Concentration: The packaging industry often sees a few large customers dominating demand, giving them significant leverage.

- Switching Costs: If customers can easily switch to alternative packaging suppliers or materials with minimal disruption, their bargaining power increases.

- Availability of Substitutes: The presence of alternative packaging materials (like plastic, metal, or cartons) can reduce reliance on glass, empowering buyers.

- Price Sensitivity: For customers where packaging is a substantial cost component, price becomes a critical negotiation point, enhancing their power.

Buyer Power 5

Buyer power is a significant factor for Ishizuka Glass, particularly as consumer demand for sustainable packaging grows. In 2024, this trend is pushing companies like Ishizuka Glass to innovate in areas like recyclable glass and the use of recycled plastics. Customers are increasingly willing to choose brands that demonstrate environmental responsibility, giving them leverage to influence product development and material sourcing.

The increasing awareness and demand for eco-friendly packaging solutions directly impact Ishizuka Glass. For instance, a significant portion of consumers in developed markets, including Japan, now actively seek out products with minimal environmental impact. This translates to a stronger bargaining position for these buyers, who can pressure manufacturers to adopt more sustainable practices.

- Growing Demand for Sustainability: Consumers are prioritizing environmentally friendly products, influencing Ishizuka Glass's material choices.

- Customer Leverage: The ability to choose greener alternatives empowers buyers to demand more responsible packaging.

- Market Trends: In 2024, the Japanese market, among others, shows a clear preference for recyclable glass and recycled plastics.

- Supplier Pressure: This buyer preference can force Ishizuka Glass to invest more in sustainable manufacturing processes.

Ishizuka Glass's customer bargaining power is a mixed bag. While a diverse customer base in 2024, spanning food, beverage, and tableware, might dilute individual customer influence, large corporate clients wield significant power due to their volume. This leverage allows them to negotiate pricing and customization, directly impacting Ishizuka's margins.

The ease with which customers can switch to competitors or alternative packaging materials significantly amplifies their bargaining power. When Ishizuka's products are highly standardized, buyers face low switching costs, making price a primary negotiation point. This is particularly true in cost-sensitive sectors where packaging represents a substantial expense.

The growing consumer demand for sustainability in 2024 also empowers customers. Buyers increasingly favor brands with eco-friendly packaging, giving them leverage to push Ishizuka Glass towards more responsible material sourcing and manufacturing, such as increased use of recycled glass and plastics.

| Factor | Impact on Ishizuka Glass | Customer Leverage |

|---|---|---|

| Customer Diversity | Reduces reliance on any single customer. | Moderate |

| Large Corporate Clients | Significant negotiation power due to volume. | High |

| Switching Costs | Low for standardized products, increasing buyer power. | High |

| Sustainability Demand | Customers can influence material and process choices. | Increasing |

What You See Is What You Get

Ishizuka Glass Porter's Five Forces Analysis

This preview showcases the complete Ishizuka Glass Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape within the glass manufacturing industry. The document you see here is precisely what you will receive immediately after purchase, ensuring no discrepancies or missing information. You can confidently expect to download this professionally formatted and insightful analysis, ready for your strategic planning needs.

Rivalry Among Competitors

Competitive rivalry within the Japanese glass and plastic packaging sector is notably high, with established players like Toyo Glass, Fujitsu Glass, and Hoya Corporation actively competing. This fragmentation means Ishizuka Glass faces constant pressure to innovate and maintain market share against these strong, experienced competitors. For instance, in 2023, the Japanese packaging market saw significant investment in sustainable materials, a trend all major players are racing to capitalize on.

The Japanese glass packaging sector is expected to grow at a compound annual growth rate of 4.10% between 2025 and 2033. While this growth is positive, it might not be substantial enough for all existing players to expand easily, potentially intensifying rivalry.

In such a market, companies like Ishizuka Glass often find themselves needing to capture market share from competitors to achieve significant growth, leading to more aggressive strategies and price competition.

Competitive rivalry within the glass industry, particularly for companies like Ishizuka Glass, is significantly influenced by how well they can differentiate their products. Ishizuka Glass actively works to stand out by investing in advanced glass technologies, developing eco-friendly and sustainable product lines, and offering a broad range of items from everyday tableware to specialized industrial glass and packaging solutions. This diversification is designed to build unique value propositions that are harder for rivals to replicate.

However, the intensity of this rivalry hinges on the ease with which competitors can mimic these innovations and product features. If advancements in areas like heat resistance, lightweighting, or specialized coatings can be quickly copied, the competitive pressure remains elevated. For instance, while Ishizuka Glass might highlight its advanced automotive glass capabilities, if other major players in the automotive glass sector can achieve similar performance metrics or cost efficiencies, the pricing and market share battles will likely continue to be fierce.

Competitive Rivalry 4

Competitive rivalry in the glass and plastic container industry, where Ishizuka Glass operates, is intense. High fixed costs for manufacturing facilities and machinery mean companies are driven to maintain high production volumes. This can lead to aggressive pricing strategies, especially when demand softens or capacity exceeds market needs, creating price wars that erode profit margins for all players.

For instance, the global glass packaging market experienced significant competition, with major players frequently engaging in price adjustments to secure market share. In 2024, reports indicated that overcapacity in certain regions, particularly in Asia, intensified price competition, forcing manufacturers to optimize operational efficiency to remain competitive.

- High fixed costs: Manufacturing glass and plastic containers requires substantial investment in plants and equipment, compelling firms to maximize capacity utilization.

- Price sensitivity: When supply outstrips demand, companies often resort to price reductions to move inventory, leading to price wars and reduced profitability.

- Industry consolidation: The intense competition has also driven some consolidation, with larger, more efficient players acquiring smaller ones to gain economies of scale and market leverage.

- Innovation pressure: Rivalry also spurs innovation in product design, material efficiency, and sustainability, as companies seek differentiation beyond price.

Competitive Rivalry 5

Ishizuka Glass faces intense competition as it actively pursues innovation and market expansion through initiatives like its mid-term management plan, Tackling New Domains. This proactive approach, including participation in international trade shows, highlights the industry's dynamic nature where companies constantly seek new markets and product niches to maintain a competitive edge.

The glass container industry, where Ishizuka Glass operates, is characterized by numerous players, both domestic and international, vying for market share. For instance, in the broader packaging sector, companies like Amcor and Berry Global are significant competitors, often engaging in strategic acquisitions to consolidate their positions and expand their product portfolios. Ishizuka Glass's own financial reports often detail investments in research and development, a clear indicator of the pressure to differentiate and innovate in a crowded marketplace.

- Innovation as a Differentiator: Ishizuka Glass's commitment to R&D, as seen in its mid-term plans, directly combats competitive pressures by aiming for unique product offerings.

- Market Expansion Efforts: Participation in global trade fairs is a strategic move to identify and capture new customer segments, directly challenging rivals in emerging markets.

- Industry Consolidation Trends: The broader packaging industry has seen consolidation, with major players acquiring smaller ones, increasing the competitive intensity for independent firms like Ishizuka Glass.

- Price Sensitivity: In many segments of the glass container market, price remains a critical factor, forcing all competitors to focus on operational efficiency and cost management.

Competitive rivalry in the glass and plastic packaging sector is intense, driven by numerous players and high fixed costs, compelling companies like Ishizuka Glass to maintain high production volumes and often engage in price competition. The Japanese glass packaging market, projected to grow at a 4.10% CAGR between 2025 and 2033, means existing players must actively capture market share, leading to more aggressive strategies. In 2024, overcapacity in some regions, particularly Asia, intensified price competition globally, pushing manufacturers to optimize efficiency.

Ishizuka Glass counters this by focusing on innovation and product differentiation, such as advanced glass technologies and sustainable lines, to build unique value propositions. However, the ease with which competitors can replicate these advancements means rivalry remains elevated, especially in segments like automotive glass where performance parity can lead to continued price and market share battles.

| Key Competitor Actions | Impact on Ishizuka Glass | 2024 Market Trend |

| Investment in sustainable materials | Pressure to innovate and offer eco-friendly alternatives | Increased demand for sustainable packaging solutions |

| Price adjustments to secure market share | Need for cost optimization and efficient operations | Intensified price competition due to overcapacity |

| Product feature replication | Continuous R&D investment for differentiation | Focus on unique value propositions beyond basic functionality |

SSubstitutes Threaten

Alternative packaging materials like rigid plastics, flexible plastics, paper, paperboard, and metal present a considerable threat to Ishizuka Glass, particularly within the diverse Japanese packaging sector. These substitutes can offer compelling advantages in cost, weight, or resilience, appealing to specific customer needs and potentially diverting demand.

The growing consumer and industrial demand for environmentally friendly and lighter packaging options poses a significant threat to traditional glass. While glass boasts high recyclability, innovations in biodegradable plastics and advanced lightweight metal alloys are emerging as strong contenders, potentially diverting market share away from glass manufacturers like Ishizuka Glass.

Technological advancements are making alternative packaging materials more competitive. For instance, improvements in flexible plastics, like enhanced barrier properties, and stronger paper-based containers can offer performance comparable to glass. This innovation directly challenges glass's traditional advantages in product protection and shelf life.

Threat of Substitution 4

The threat of substitutes for Ishizuka Glass is significant, especially in packaging. When alternative materials like plastic or metal offer a better price-performance ratio, customers are inclined to switch, particularly for high-volume, lower-margin products. For instance, the global plastic packaging market was valued at approximately USD 370 billion in 2023 and is projected to grow, indicating a strong and accessible substitute.

This substitution pressure is amplified as consumers increasingly demand sustainable and cost-effective packaging solutions.

- Price Sensitivity: Lower-cost substitutes directly impact Ishizuka Glass's pricing power in competitive markets.

- Performance Parity: If substitutes match glass's performance in key areas like barrier properties or recyclability, the switch becomes more appealing.

- Market Trends: Growing demand for lightweight and shatter-resistant packaging favors materials like advanced plastics.

- Innovation in Alternatives: Continuous advancements in materials science for plastics and metals present ever-improving substitutes.

Threat of Substitution 5

Ishizuka Glass's dual involvement in glass and recycled plastic production offers a degree of internal mitigation against material substitution. By utilizing recycled plastics, the company can present a more sustainable alternative within its own product lines, potentially reducing the immediate pressure from substitutes for certain applications.

However, the broader threat of substitution persists from entirely different material categories or innovative reusable systems. For instance, the increasing adoption of advanced composites or novel packaging solutions could still present a challenge to Ishizuka Glass's traditional glass offerings, even with its plastic initiatives. In 2023, the global market for sustainable packaging materials, including recycled plastics, saw significant growth, indicating a broader industry shift that could impact market share for all material types.

- Internal Mitigation: Ishizuka Glass's use of recycled plastics in its manufacturing partially counters substitution within its own material portfolio.

- External Threat: The company still faces substitution risks from alternative materials like advanced composites and innovative reusable packaging systems.

- Market Context: The growing demand for sustainable packaging solutions in 2023 highlights the competitive landscape where material choices are increasingly scrutinized.

The threat of substitutes for Ishizuka Glass is substantial, particularly from alternative packaging materials like plastics, paper, and metal. These substitutes often provide advantages in cost, weight, and durability, making them attractive to consumers and industries. For example, the global plastic packaging market was valued at approximately USD 370 billion in 2023, showcasing the scale of these alternatives.

Innovations in materials science are continually enhancing the performance of substitutes, enabling them to match or even surpass glass in certain applications. This includes advancements in barrier properties for flexible plastics and the development of lightweight yet robust metal alloys. Such progress directly challenges glass's traditional market position.

The increasing consumer preference for lightweight and eco-friendly packaging further fuels the demand for substitutes. While glass is recyclable, the perception and convenience of lighter, often single-use, alternatives can sway market preferences, especially in high-volume sectors.

| Substitute Material | Key Advantages | Market Trend Relevance |

| Rigid and Flexible Plastics | Lightweight, cost-effective, versatile | Growing demand for convenience and lower-cost packaging |

| Paper and Paperboard | Biodegradable, recyclable, good for dry goods | Increasing focus on sustainable and renewable materials |

| Metal (Aluminum, Steel) | Durable, excellent barrier properties, highly recyclable | Used for beverages and specialty food packaging, often perceived as premium |

Entrants Threaten

The threat of new entrants for Ishizuka Glass is relatively low, primarily due to the significant capital requirements in the glass and plastic manufacturing sectors. Establishing a new glass manufacturing facility, for instance, demands substantial investment in specialized machinery, large-scale production plants, and advanced technology. In 2024, the global glass manufacturing market alone was valued at over $700 billion, underscoring the scale of investment needed to compete effectively.

Established players like Ishizuka Glass leverage significant economies of scale, particularly in manufacturing and raw material sourcing. For instance, in 2023, the global glass packaging market, a key segment for Ishizuka, was valued at approximately $54.5 billion, with large-scale producers benefiting from bulk purchasing power that new entrants would find difficult to replicate.

New entrants face substantial capital requirements to build modern production facilities and achieve comparable output levels. The upfront investment for a new, high-capacity glass manufacturing plant can easily run into hundreds of millions of dollars, creating a formidable barrier to entry.

Furthermore, securing reliable and cost-effective supply chains for raw materials like sand, soda ash, and limestone is crucial. Ishizuka Glass, with its long-standing relationships and high purchase volumes, likely secures more favorable terms than a newcomer, impacting the latter's cost competitiveness.

The threat of new entrants for Ishizuka Glass is moderate, primarily due to significant brand loyalty and entrenched customer relationships within the food, beverage, and household sectors. These established partnerships, built over Ishizuka's long history, make it challenging for newcomers to secure initial market access and trust.

Ishizuka Glass's deep-rooted reputation in Japan, cultivated over decades, acts as a formidable barrier. New entrants would face substantial hurdles in replicating this level of brand recognition and perceived reliability, which are crucial for securing contracts with major clients in its core markets.

Threat of New Entrants 4

The threat of new entrants for Ishizuka Glass is moderate. Established players have cultivated deep relationships and preferential access to distribution channels and supply networks, making it difficult and costly for newcomers to replicate these extensive systems. For instance, securing favorable terms with major retailers or automotive manufacturers, who rely on consistent and high-volume glass supply, presents a significant hurdle for any new glass producer.

Newcomers would likely face substantial upfront investment to build comparable distribution infrastructure or negotiate entry into existing networks. This barrier is amplified by the capital-intensive nature of glass manufacturing itself, requiring significant investment in plant, equipment, and technology.

- Distribution Network Barriers: Established companies like Ishizuka Glass benefit from long-standing relationships with distributors and direct sales channels, often secured through volume commitments and exclusive agreements.

- Capital Requirements: The significant capital needed for state-of-the-art manufacturing facilities and advanced R&D in areas like specialty glass formulations acts as a deterrent.

- Brand Loyalty and Reputation: Years of consistent quality and service have built strong brand loyalty among Ishizuka Glass's customer base, a reputation difficult for new entrants to quickly establish.

- Economies of Scale: Existing large-scale operations allow established firms to achieve lower per-unit production costs, making it challenging for smaller, new entrants to compete on price.

Threat of New Entrants 5

The threat of new entrants for Ishizuka Glass is moderate, largely due to significant regulatory hurdles and substantial capital investment requirements. Industries like glass manufacturing, which Ishizuka operates within, face stringent environmental compliance mandates, particularly concerning emissions and waste management. Navigating these complex regulations can be a costly and time-consuming process for any new player looking to enter the market.

These compliance requirements act as a considerable barrier. For instance, in 2024, the European Union continued to strengthen its environmental regulations, impacting manufacturing processes and necessitating significant upfront investment in cleaner technologies. Companies like Ishizuka Glass must continuously adapt to these evolving standards, a challenge that can deter smaller or less capitalized new entrants.

- Capital Intensity: Establishing glass manufacturing facilities requires immense upfront capital for machinery, infrastructure, and technology.

- Regulatory Compliance: Meeting environmental standards (e.g., emissions control, waste disposal) adds significant cost and complexity.

- Economies of Scale: Existing players benefit from established production volumes, making it difficult for new entrants to compete on cost.

- Brand Loyalty and Distribution: Building brand recognition and securing reliable distribution channels takes time and resources.

The threat of new entrants for Ishizuka Glass is generally considered moderate. The significant capital investment required for state-of-the-art glass manufacturing facilities, coupled with the need to establish robust supply chains and distribution networks, presents a substantial barrier. For example, the global glass container market, a key area for Ishizuka, was valued at over $60 billion in 2024, indicating the scale of operations and investment needed to compete effectively.

Existing players benefit from economies of scale, which lower per-unit production costs and enhance price competitiveness. Ishizuka Glass, with its established production volumes, can likely source raw materials more affordably than a new entrant. Furthermore, strong brand loyalty and long-standing customer relationships, particularly in sectors like food and beverage, make it difficult for newcomers to gain market share. The company's reputation, built over decades, is a valuable intangible asset that deters new competition.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High upfront investment for plant, machinery, and technology. | Significant financial hurdle. |

| Economies of Scale | Lower production costs for established, high-volume producers. | Price disadvantage for new entrants. |

| Brand Loyalty & Reputation | Established customer trust and recognition. | Difficulty in securing initial customers. |

| Distribution Channels | Existing relationships with distributors and retailers. | Challenges in market access and logistics. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Ishizuka Glass is built upon a robust foundation of data, including Ishizuka Glass's annual reports and investor relations materials, alongside industry-specific market research from firms like IBISWorld and Glass Worldwide.

We also incorporate macroeconomic data from sources such as the World Bank and government trade statistics to contextualize the competitive landscape and inform our assessment of buyer and supplier power.