Iron Mountain SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Iron Mountain Bundle

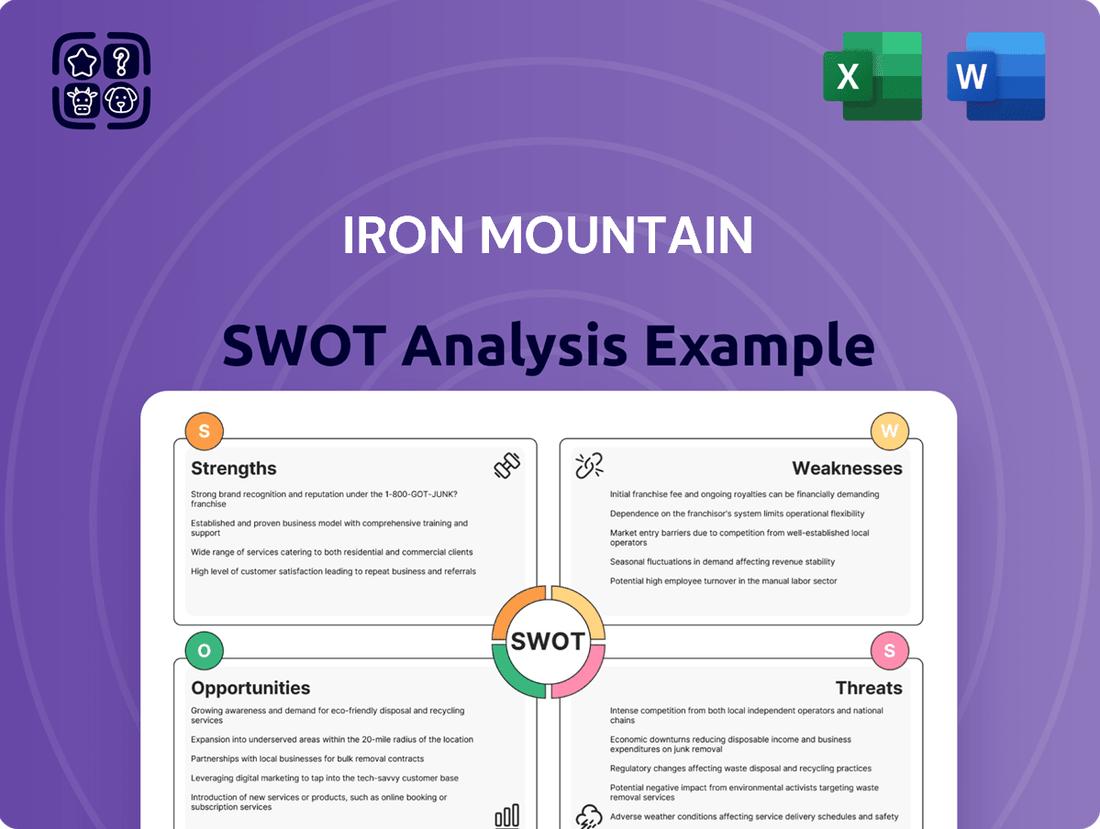

Iron Mountain's strategic positioning is clear, but are you fully aware of the competitive landscape and potential growth avenues? Our comprehensive SWOT analysis dives deep into their strengths, weaknesses, opportunities, and threats, offering a nuanced view of their market standing.

Unlock the full potential of your strategic planning by purchasing the complete Iron Mountain SWOT analysis. This in-depth report provides actionable insights, expert commentary, and an editable format perfect for investors, analysts, and business leaders looking to make informed decisions.

Strengths

Iron Mountain holds a dominant global position in information management, a strength underscored by its service to a substantial number of Fortune 1000 companies. This leadership is built upon a vast operational footprint, spanning 61 countries and providing a robust platform for its comprehensive suite of services.

Iron Mountain benefits from exceptionally strong customer relationships, boasting a remarkable retention rate of around 98%. This high level of loyalty underscores the deep trust and reliability customers place in Iron Mountain's services, ensuring a predictable and stable revenue base.

Iron Mountain's strategic pivot towards high-growth digital and data center services is a significant strength. By 2025, these segments are anticipated to contribute a substantial portion of the company's overall revenue, reflecting a successful adaptation to evolving market demands. This focus is bolstering its market position.

The company is actively expanding its data center capacity, with significant investments planned. Furthermore, Iron Mountain is integrating AI-driven solutions into its service offerings, enhancing efficiency and creating new value propositions for clients. These initiatives are crucial for its continued success.

Commitment to Sustainability and ESG Initiatives

Iron Mountain is actively pursuing ambitious sustainability goals, including achieving net-zero emissions and sourcing 100% clean electricity for its data centers. This commitment is further demonstrated by its plans for fleet electrification, aiming for a significant reduction in its carbon footprint. These initiatives not only address environmental concerns but also bolster Iron Mountain's reputation among clients prioritizing ESG performance.

The company's focus on ESG is a significant strength, resonating with a growing market demand for sustainable business practices. By investing in clean energy and emission reduction, Iron Mountain positions itself favorably with environmentally conscious customers and investors alike. This proactive approach to sustainability can lead to enhanced brand loyalty and a competitive edge in the market.

- Net-Zero Emissions Target: Iron Mountain has set a clear target for achieving net-zero emissions, demonstrating a long-term vision for environmental responsibility.

- 100% Clean Electricity for Data Centers: The company is committed to powering its data center operations exclusively with clean electricity sources.

- Fleet Electrification: Iron Mountain is investing in electrifying its vehicle fleet, a key step in reducing operational emissions.

- Enhanced Brand Reputation: These ESG efforts contribute to a positive brand image, attracting clients and talent who value sustainability.

Innovation in Information Management and Digital Transformation

Iron Mountain is a leader in information management, with significant investments in digital transformation. They are expanding services beyond physical records to include cloud storage, data analytics, and cybersecurity solutions. This strategic shift aims to help clients manage and leverage their digital assets effectively.

The company's commitment to innovation is evident in its development of AI-powered platforms like InSight DXP. These platforms are designed to unlock data value, automate business processes, and ensure regulatory compliance in today's complex digital environment. For instance, by Q1 2024, Iron Mountain reported a 10% year-over-year increase in revenue from its digital solutions segment, highlighting the growing demand for these services.

- Investing in AI and data analytics to enhance customer offerings.

- Expanding into cloud storage and cybersecurity services.

- Developing platforms like InSight DXP for workflow automation and compliance.

- Digital solutions revenue saw a 10% YoY increase in Q1 2024.

Iron Mountain's established global infrastructure and deep client relationships are foundational strengths. Serving a significant portion of Fortune 1000 companies, the company benefits from a 98% customer retention rate, ensuring a stable revenue stream.

The company's strategic expansion into digital and data center services is a key growth driver. By 2025, these segments are projected to represent a substantial revenue contribution, reflecting a successful adaptation to market shifts.

Iron Mountain's proactive approach to sustainability, targeting net-zero emissions and 100% clean electricity for data centers, enhances its brand appeal and competitive positioning. Investments in fleet electrification further underscore this commitment, aligning with increasing market demand for ESG-conscious partners.

Innovation is a core strength, with the development of AI-powered platforms like InSight DXP enhancing data management and workflow automation. This digital transformation focus is already yielding results, with digital solutions revenue increasing by 10% year-over-year in Q1 2024.

| Metric | Value | Period | Significance |

|---|---|---|---|

| Customer Retention Rate | ~98% | Ongoing | Indicates strong customer loyalty and stable revenue. |

| Digital Solutions Revenue Growth | 10% YoY | Q1 2024 | Demonstrates successful market adaptation and demand for new services. |

| Fortune 1000 Clients Served | Substantial | Ongoing | Highlights market leadership and trust from major corporations. |

What is included in the product

Analyzes Iron Mountain’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear breakdown of Iron Mountain's strategic landscape, highlighting opportunities and mitigating threats for more effective decision-making.

Weaknesses

Iron Mountain's continued reliance on its legacy physical storage business presents a notable weakness. While this segment offers stability, it faces secular headwinds from increasing digitalization across various sectors. For instance, in the first quarter of 2024, Iron Mountain reported that its Global Records and Information Management segment, which includes physical storage, accounted for a substantial portion of its revenue, though the company is actively diversifying.

Iron Mountain's extensive global footprint, operating in 61 countries, inherently exposes the company to significant foreign currency fluctuation risks. These fluctuations can directly impact reported earnings and the overall financial health of the company.

For instance, in the first quarter of 2025, Iron Mountain reported a notable decline in net income, with a substantial portion of this decrease being directly attributed to unfavorable foreign currency movements. This highlights the tangible financial consequences of operating across diverse currency landscapes.

Iron Mountain's aggressive expansion of its data center capacity, a key growth strategy, necessitates significant upfront capital investment. For instance, the company has been actively investing in its xScale data center portfolio, with substantial capital deployed in 2023 and planned for 2024. This high capital expenditure, while crucial for future revenue streams, can place pressure on free cash flow in the near to medium term.

Challenges in AI Integration and Data Quality

Iron Mountain's successful AI integration hinges on the quality and interoperability of its vast data. Poor data quality can significantly hinder the effectiveness of AI solutions, potentially leading to inaccurate insights and operational inefficiencies. For instance, if metadata isn't consistently generated or data hygiene practices are lacking, the AI's ability to manage and leverage information effectively is compromised.

The rapid evolution of generative AI presents both opportunities and hurdles. While promising for tasks like metadata creation, its current maturity level for critical data hygiene processes means there's a risk of implementation challenges. This could slow down the anticipated benefits of AI adoption, impacting the speed at which new efficiencies are realized.

- Data Quality Dependency: AI effectiveness is directly tied to the accuracy and consistency of information managed.

- Interoperability Issues: Seamlessly connecting AI with diverse legacy systems remains a significant technical hurdle.

- Generative AI Maturity: Current generative AI capabilities for critical data tasks like metadata generation and hygiene are still developing, posing implementation risks.

Competitive Landscape in Digital Services and Data Centers

The digital services and data center arenas are fiercely contested. Iron Mountain contends with a multitude of specialized technology firms and major cloud providers, all vying for dominance in cloud storage, data analytics, and cybersecurity. This intense competition, particularly from companies with more focused tech offerings, could indeed squeeze Iron Mountain's pricing power and erode its market share in these rapidly expanding sectors.

For instance, in the global data center market, projected to reach over $400 billion by 2028, Iron Mountain competes with hyperscale providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, who often benefit from massive economies of scale and established ecosystems. While Iron Mountain leverages its existing infrastructure for colocation, these cloud giants offer integrated, end-to-end digital solutions that present a significant challenge.

- Intense Competition: Faces established tech giants and specialized providers in digital services and data centers.

- Pricing Pressure: Competitors with different business models can exert downward pressure on pricing.

- Market Share Risk: Specialized tech companies may capture a larger share of the growing digital services market.

Iron Mountain's significant debt load, a result of its acquisition strategy and capital-intensive growth, presents a financial vulnerability. High leverage increases interest expenses and limits financial flexibility, especially during economic downturns. For example, as of Q1 2024, Iron Mountain's total debt stood at approximately $10.5 billion, requiring careful management of its debt-to-equity ratio.

The company's reliance on physical media storage, while still a substantial revenue driver, faces long-term decline due to digital transformation trends. This necessitates a continuous and costly pivot to newer, digital-first services to offset potential revenue erosion in its core legacy business.

Iron Mountain's ability to effectively integrate acquired companies and technologies is crucial. Failure to achieve synergy or facing integration challenges can dilute the value of acquisitions and hinder the realization of strategic benefits, impacting overall operational efficiency.

Same Document Delivered

Iron Mountain SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This ensures transparency and that you know exactly what you're getting. Purchase unlocks the complete, detailed analysis.

Opportunities

The escalating need for secure, adaptable data center services and hybrid cloud setups offers a prime avenue for Iron Mountain's expansion. The company's strategic investments in increasing its data center footprint are already yielding positive results, with significant pre-leasing activity for its upcoming facilities underscoring the strong market appetite for these offerings.

The ongoing digital transformation across sectors presents a significant avenue for Iron Mountain’s growth. As businesses increasingly rely on digital solutions, the demand for secure and efficient data management services escalates. This trend is further amplified by the widespread adoption of artificial intelligence and machine learning, creating a fertile ground for specialized digital offerings.

Iron Mountain’s InSight DXP platform, enhanced with AI capabilities, is strategically positioned to capitalize on this opportunity. The platform's ability to manage and extract value from vast datasets directly addresses the evolving needs of organizations navigating digital complexities. For instance, in 2024, many companies are investing heavily in AI to streamline operations and gain competitive advantages, a trend Iron Mountain can directly support.

The ever-changing global data privacy landscape, with regulations like GDPR and CCPA, coupled with escalating cybersecurity threats, significantly boosts the demand for Iron Mountain's secure information management and data destruction services. This complex environment necessitates robust solutions, playing directly into Iron Mountain's core competencies.

Iron Mountain's established expertise in navigating intricate compliance requirements and implementing stringent security protocols offers a distinct competitive edge. For instance, in 2024, businesses globally are expected to spend over $200 billion on cybersecurity solutions, highlighting the immense market opportunity for trusted providers like Iron Mountain.

Strategic Acquisitions and Partnerships

Iron Mountain's strategic acquisition history, including the 2023 purchase of Regency Technologies for its IT asset disposition (ITAD) capabilities, demonstrates a clear path for growth. This move not only expanded its service portfolio but also bolstered its global reach in a key growth area. Continued, well-chosen acquisitions and partnerships are crucial for solidifying its market leadership and diversifying revenue streams in the evolving data management landscape.

- Acquisition of Regency Technologies: Expanded ITAD services and global footprint in 2023.

- Market Expansion: Opportunities to acquire or partner with companies in emerging markets or adjacent service areas.

- Portfolio Diversification: Strategic M&A can introduce new revenue streams, such as advanced data analytics or specialized digital archiving solutions.

- Synergistic Partnerships: Collaborating with cloud providers or cybersecurity firms can enhance integrated service offerings.

Leveraging Sustainability for Business Growth

Iron Mountain's robust dedication to sustainability, demonstrated by its 2030 clean energy targets and net-zero aspirations, presents a significant opportunity for business expansion. This commitment can serve as a powerful competitive advantage, attracting clients who prioritize environmental responsibility.

This strong ESG (Environmental, Social, and Governance) stance can open doors to new revenue streams, particularly in areas like green data center solutions and the sustainable management of asset lifecycles. For instance, in 2023, Iron Mountain reported a 75% renewable energy usage across its global data center operations, a figure poised to grow as they advance towards their 100% goal by 2030.

Leveraging this sustainability focus can:

- Attract a growing segment of environmentally conscious customers.

- Differentiate Iron Mountain from competitors in the data center and information management sectors.

- Drive innovation in sustainable practices, potentially leading to cost savings and new service offerings.

- Enhance brand reputation and stakeholder value by aligning with global sustainability trends.

The increasing demand for digital transformation and cloud services provides a significant growth avenue for Iron Mountain. The company's expansion into data centers, supported by strong pre-leasing activity in 2024, highlights market confidence. Furthermore, evolving data privacy regulations and cybersecurity threats bolster the need for Iron Mountain's secure information management solutions, a market expected to see continued investment in 2024.

Iron Mountain's strategic acquisitions, like Regency Technologies in 2023, expand its IT asset disposition capabilities and global reach. The company's commitment to sustainability, with a goal of 100% renewable energy for data centers by 2030 and 75% achieved in 2023, also positions it favorably with environmentally conscious clients and can drive innovation in green services.

| Opportunity Area | Description | Supporting Data/Trend | Potential Impact |

|---|---|---|---|

| Data Center Expansion | Meeting demand for secure, hybrid cloud data center services. | Strong pre-leasing activity for new facilities in 2024. | Increased recurring revenue, market share growth. |

| Digital Transformation | Leveraging AI and digital solutions for data management. | Growing reliance on digital solutions across industries. | Enhanced service offerings, new client acquisition. |

| Regulatory Compliance & Security | Providing secure information management and data destruction. | Global cybersecurity spending projected over $200 billion in 2024. | Strengthened competitive position, increased service demand. |

| Strategic Acquisitions & Partnerships | Expanding ITAD and exploring adjacent service areas. | Acquisition of Regency Technologies (2023) for ITAD. | Portfolio diversification, enhanced global reach. |

| Sustainability Initiatives | Offering green data center solutions and sustainable asset management. | 75% renewable energy usage in data centers (2023), targeting 100% by 2030. | Attracting ESG-focused clients, brand differentiation. |

Threats

The evolving landscape of global data privacy and security regulations, including the EU AI Act and numerous US state-level privacy laws, presents a growing challenge. These regulations demand significant attention and resources to ensure adherence.

Failure to comply with these stringent rules can result in substantial financial penalties, legal repercussions, and damage to Iron Mountain's reputation. For instance, GDPR fines can reach up to 4% of global annual revenue, a significant risk for any data-reliant company.

This necessitates ongoing and increasing investment in compliance infrastructure, personnel, and training to mitigate these risks effectively. Staying ahead of these regulatory shifts is crucial for operational continuity and maintaining client trust.

The relentless march of technology, especially in areas like cloud storage and AI-driven data management, presents a significant threat. Competitors leveraging these advancements could offer more agile and cost-effective solutions, potentially eroding Iron Mountain's market share in its traditional physical records management sector. For instance, the global cloud computing market was projected to reach over $1.3 trillion by 2024, highlighting the scale of digital transformation impacting all industries.

Failure to adapt swiftly to innovations in digital transformation, automation, and data analytics could render Iron Mountain's legacy services less relevant. This rapid pace of change means that if the company doesn't invest strategically in its digital capabilities, its competitive advantage, particularly in emerging digital offerings, could be significantly weakened, impacting future revenue streams and growth potential.

Economic uncertainties, particularly a potential downturn in late 2024 or 2025, could significantly curb corporate IT and information management expenditures. This would directly affect Iron Mountain's revenue streams, especially in its more profitable digital transformation and data center solutions, as clients might delay or reduce crucial investments.

Cybersecurity Breaches and Data Loss Incidents

Iron Mountain, despite its robust security measures, remains vulnerable to cybersecurity breaches and data loss, given its role as a guardian of extensive sensitive physical and digital information. Such incidents pose a significant risk, potentially leading to severe reputational damage, substantial financial penalties, and a critical erosion of customer trust. For instance, the global cost of data breaches averaged $4.35 million in 2024, according to IBM's Cost of a Data Breach Report, highlighting the immense financial implications.

The potential impact extends beyond immediate financial losses. A major breach could disrupt operations, necessitate costly remediation efforts, and trigger regulatory investigations, further compounding the challenges. In 2024, the average time to identify and contain a data breach was 200 days, indicating the prolonged exposure and potential for escalating damage.

- Reputational Damage: Loss of trust from clients entrusting sensitive data.

- Financial Penalties: Fines from regulatory bodies for non-compliance or breaches.

- Operational Disruption: Downtime and recovery costs following an incident.

- Customer Attrition: Clients moving to more secure competitors.

Geopolitical Risks and Global Supply Chain Disruptions

Iron Mountain's extensive global footprint, operating in over 50 countries, inherently exposes it to a range of geopolitical risks. These include the potential impact of escalating trade wars, as seen with ongoing trade tensions between major economies, which could lead to increased tariffs and operational costs. Political instability in key regions where Iron Mountain has significant operations can also disrupt service delivery and create uncertainty for expansion plans.

Furthermore, the company is susceptible to global supply chain disruptions, a vulnerability highlighted by events such as the COVID-19 pandemic and more recent geopolitical conflicts. These disruptions can affect the availability and cost of essential resources, including transportation and technology components, impacting Iron Mountain's ability to maintain efficient operations and serve its international client base. For instance, a significant slowdown in global shipping, as experienced in 2021-2022, could directly affect the logistics of moving physical records and deploying new digital solutions across borders.

- Geopolitical Exposure: Operating in over 50 countries presents inherent risks from trade disputes, political unrest, and varying regulatory environments.

- Supply Chain Vulnerability: Global disruptions, like shipping delays or component shortages, can impact operational efficiency and the cost of services.

- International Growth Hindrance: Political instability or trade barriers could impede Iron Mountain's ability to expand its services or acquire new clients in affected regions.

The intensifying regulatory environment, particularly concerning data privacy and security, poses a significant threat. Non-compliance with evolving laws like the EU AI Act or various US state privacy regulations can lead to severe financial penalties, with GDPR fines potentially reaching 4% of global annual revenue, and reputational damage. This necessitates continuous investment in compliance infrastructure and personnel to mitigate these risks and maintain client trust.

Rapid technological advancements, especially in cloud storage and AI, present a competitive challenge. Companies leveraging these innovations could offer more agile and cost-effective solutions, potentially impacting Iron Mountain's traditional physical records management market share. The global cloud computing market's projected growth to over $1.3 trillion by 2024 underscores the transformative impact of digital solutions.

Economic downturns, anticipated in late 2024 or 2025, could reduce corporate spending on IT and information management, directly affecting Iron Mountain's revenue, particularly for its digital transformation and data center services. Clients might postpone or scale back critical investments during such periods.

Cybersecurity threats remain a critical vulnerability, given the sensitive nature of the data Iron Mountain manages. Data breaches can result in substantial financial losses, averaging $4.35 million globally in 2024, alongside severe reputational damage and loss of customer trust. The extended average time to identify and contain breaches, around 200 days in 2024, amplifies the potential damage.

| Threat Category | Specific Risk | Potential Impact | Example Data/Fact |

| Regulatory Compliance | Data Privacy & Security Laws | Financial Penalties, Reputational Damage | GDPR fines up to 4% of global revenue; US state privacy laws increasing complexity. |

| Technological Disruption | Cloud & AI Advancements | Erosion of Market Share, Reduced Competitiveness | Global cloud market projected >$1.3 trillion by 2024. |

| Economic Downturn | Reduced IT/Information Management Spend | Decreased Revenue, Delayed Investments | Anticipated economic slowdown in late 2024/2025. |

| Cybersecurity | Data Breaches & Loss | Financial Losses, Reputational Harm, Loss of Trust | Global data breach cost averaged $4.35 million in 2024; 200 days to identify/contain breaches. |

SWOT Analysis Data Sources

This Iron Mountain SWOT analysis is built upon a robust foundation of data, including their latest financial filings, comprehensive market research reports, and expert industry commentary. This ensures a well-rounded and accurate assessment of their current standing.