Iron Mountain Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Iron Mountain Bundle

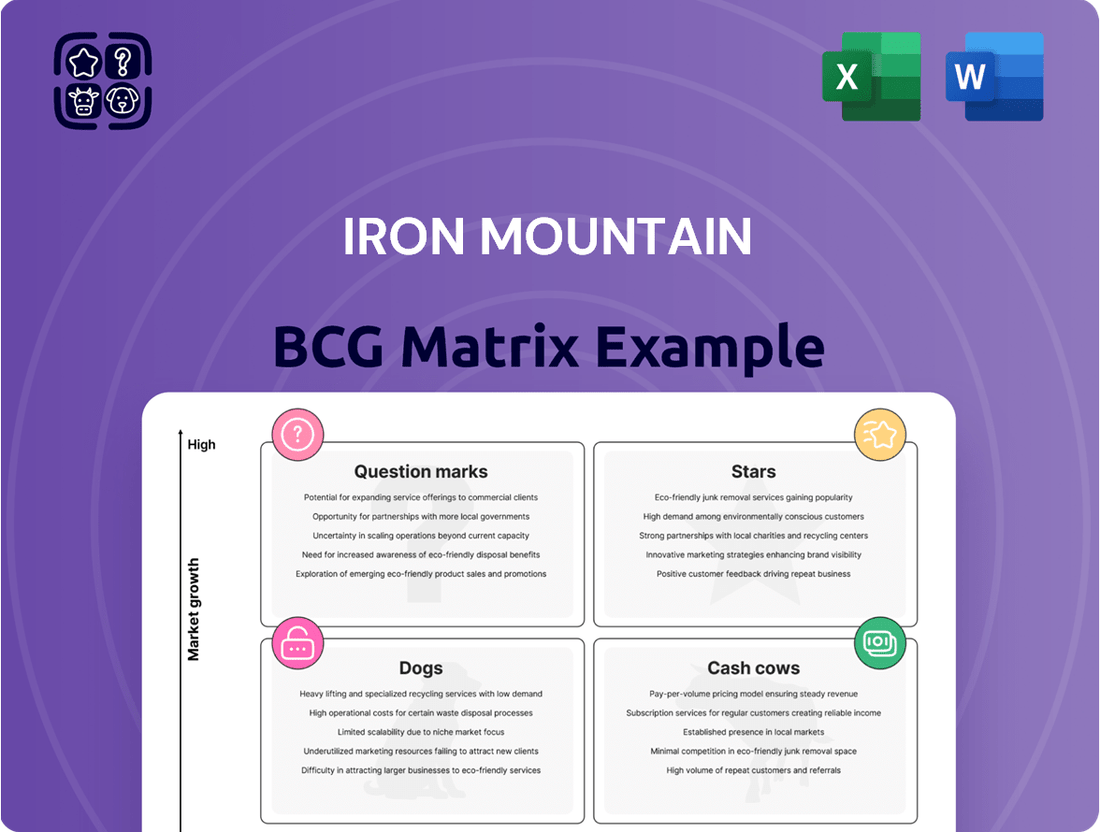

Uncover the strategic potential of Iron Mountain's product portfolio with a glimpse into its BCG Matrix. See which offerings are poised for growth and which might require a closer look.

This preview offers a snapshot, but the full BCG Matrix report provides a comprehensive breakdown of Stars, Cash Cows, Dogs, and Question Marks, along with actionable insights to optimize your investment strategy.

Purchase the complete Iron Mountain BCG Matrix today to gain a clear, data-driven roadmap for maximizing profitability and market share.

Stars

Iron Mountain's data center business is a clear Star in its BCG Matrix. In 2024, this segment experienced a remarkable 25% revenue growth, hitting $620 million, with Q4 2024 alone showing a 24% revenue increase. This robust performance underscores its position as a high-growth, high-market-share entity.

The company's commitment to expanding its data center capacity is evident, with a roughly 50% year-over-year increase. Crucially, 94% of its under-construction assets are already leased, signaling strong market demand and securing future revenue streams. This high occupancy rate is a testament to the business's competitive advantage.

Looking ahead, the data center segment is poised for continued strong performance. Projections indicate an additional 125 megawatts in leasing activity for 2025, further solidifying its Star status. This ongoing expansion and high demand suggest sustained growth and profitability for Iron Mountain in this sector.

The Asset Lifecycle Management (ALM) business is a standout performer, experiencing a significant 119% revenue surge in 2024. This robust growth is further evidenced by a 22% organic increase in the first quarter of 2025, showcasing sustained momentum.

This segment's success is driven by strong contributions from both enterprise and hyperscale clients. Strategic moves, such as the acquisition of Regency Technologies in early 2024, have significantly bolstered Iron Mountain's position as a leader in IT asset disposition.

Iron Mountain's digital solutions, powered by AI, represent a significant growth area, with an annual run rate surpassing $500 million. These offerings, including the InSight Digital Experience Platform, are designed to streamline operations and improve data management.

The platform's AI capabilities are crucial for businesses seeking to automate workflows and ensure compliance in an increasingly digital world. This focus on AI readiness positions Iron Mountain to capture substantial market share in digital transformation services.

Hyperscale Data Center Offerings

Iron Mountain's hyperscale data center offerings are a key component of its growth strategy, targeting major global hyperscalers. This focus capitalizes on the surging demand for cloud computing and the infrastructure needed to support artificial intelligence. The company's commitment to this segment is evident in its expansion efforts, aiming to capture a significant share of this lucrative market.

Strategic moves, like its joint venture with Ooredoo in the Middle East, underscore Iron Mountain's ambition to broaden its reach in critical, high-growth geographic areas. These partnerships are designed to accelerate the development and deployment of hyperscale facilities, meeting the evolving needs of cloud providers. The company is actively investing to build out its capacity in these key markets.

- Market Growth: The global hyperscale data center market is projected to grow significantly, driven by cloud adoption and AI workloads. For instance, the market was valued at approximately $250 billion in 2023 and is expected to reach over $600 billion by 2030, according to industry analysts.

- Strategic Expansion: Iron Mountain's expansion into new regions, such as the Middle East through its Ooredoo partnership, allows it to tap into underserved or rapidly developing markets. This venture aims to build multiple hyperscale data centers, enhancing Iron Mountain's global footprint.

- Customer Focus: By serving large global hyperscalers, Iron Mountain benefits from long-term, high-volume contracts, providing revenue stability and predictable growth. These clients require massive capacity and advanced connectivity, areas where Iron Mountain is investing heavily.

- Investment in Capacity: The company is allocating substantial capital towards developing new data center sites and expanding existing ones to meet the increasing demand from its hyperscale clients. This investment is crucial for maintaining its competitive edge in this capital-intensive industry.

Secure Shredding and ITAD Services

Iron Mountain's secure shredding and IT asset disposition (ITAD) services are a key component of its Asset Lifecycle Management strategy, fitting into the Stars quadrant of the BCG Matrix. These services are experiencing robust growth, driven by escalating data privacy regulations and a growing emphasis on corporate environmental responsibility. For instance, the global IT asset disposition market was valued at approximately $19.4 billion in 2023 and is projected to reach $32.1 billion by 2028, indicating a strong upward trend.

The strategic acquisition of Regency Technologies in 2023 significantly enhanced Iron Mountain's ITAD capabilities and market standing. This move allows Iron Mountain to offer more comprehensive solutions for data security and the environmentally sound disposal of retired IT equipment, directly addressing the needs of businesses facing increasing compliance burdens and sustainability mandates.

- Growing Market Demand: The ITAD market is expanding rapidly, with projections indicating continued strong growth through 2028.

- Regulatory Tailwinds: Increasing data privacy laws worldwide are a significant driver for secure ITAD services.

- Acquisition Synergy: The Regency Technologies acquisition strengthens Iron Mountain's service offering and competitive edge in ITAD.

- Sustainability Focus: Businesses are increasingly seeking partners like Iron Mountain to manage the environmental impact of their IT assets.

Iron Mountain's data center business, particularly its hyperscale offerings, is a clear Star. In 2024, this segment saw a 25% revenue increase, reaching $620 million, with 94% of under-construction capacity already leased. This segment is projected to add another 125 megawatts in leasing activity for 2025, demonstrating its high-growth, high-market-share status.

The Asset Lifecycle Management (ALM) business, especially IT asset disposition (ITAD), also shines as a Star. ALM experienced a 119% revenue surge in 2024, bolstered by strategic acquisitions like Regency Technologies. The global ITAD market, valued at $19.4 billion in 2023, is expected to reach $32.1 billion by 2028, highlighting the strong tailwinds for this service.

Digital solutions, powered by AI, represent another Star for Iron Mountain, with an annual run rate exceeding $500 million. The InSight Digital Experience Platform leverages AI to streamline operations and enhance data management, positioning Iron Mountain to capitalize on digital transformation trends.

| Business Segment | BCG Matrix Quadrant | 2024 Revenue Growth | Key Drivers |

|---|---|---|---|

| Data Centers (Hyperscale) | Star | 25% | Expanding capacity, high leasing rates, AI demand |

| Asset Lifecycle Management (ITAD) | Star | 119% | Data privacy regulations, ITAD market growth, acquisitions |

| Digital Solutions (AI) | Star | N/A (Run Rate > $500M) | AI-driven automation, digital transformation |

What is included in the product

Strategic overview of Iron Mountain's business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

A clear, visual representation of your portfolio, simplifying complex strategic decisions.

Cash Cows

Iron Mountain's secure physical records storage is a classic cash cow. This segment consistently throws off significant profits, acting as the bedrock of the company's financial stability. It benefits from a dominant position in a well-established market, meaning growth might be slow, but the revenue stream is incredibly dependable.

The loyalty of its customer base is a key indicator of this segment's strength. With a remarkable 92.7% customer retention rate reported in the third quarter of 2024, Iron Mountain demonstrates the sticky nature of its physical storage services. This high retention underscores the essential role these services play for many businesses, ensuring predictable income for the company.

Iron Mountain's broader Global Records and Information Management (RIM) business, encompassing physical storage, remains a robust cash cow. This segment consistently generates a steady revenue stream, bolstered by strong adjusted EBITDA contributions. The enduring demand for secure information management across diverse industries underpins its reliable performance.

Iron Mountain's traditional data backup and recovery services, primarily focused on physical media, remain a robust cash cow. Despite the rise of digital solutions, these services maintain a significant market share, serving a substantial portion of the Fortune 1000. This segment offers predictable revenue streams in a relatively stable market.

Information Destruction (Physical)

Iron Mountain's Information Destruction (Physical) service, a foundational offering, remains a robust cash cow. This business segment generates consistent revenue due to persistent demand driven by stringent regulatory compliance and the ever-present need for secure disposal of sensitive physical records.

While not a high-growth area, its established market position and recurring customer base ensure stable, predictable cash flow. For instance, in 2024, the demand for secure document shredding and media destruction services continued to be fueled by data privacy regulations like GDPR and CCPA, which mandate secure handling and disposal of personal information.

- Consistent Revenue: The service benefits from recurring contracts and a broad customer base across various industries.

- Low Growth, High Share: It holds a dominant market share in a mature but essential service category.

- Regulatory Driven Demand: Ongoing compliance requirements ensure a steady need for secure destruction.

- Profitability: High market share allows for efficient operations and strong profit margins.

Long-term Customer Contracts

Iron Mountain's long-term customer contracts are a significant strength, acting as a robust cash cow. The company boasts an impressive retention rate, securing approximately 95% of the Fortune 1000 companies as clients for its foundational services.

This high level of customer loyalty translates into a remarkably stable and predictable revenue stream. For instance, in 2023, Iron Mountain generated over $4.7 billion in revenue, a testament to the enduring nature of these client relationships.

- High Customer Retention: Approximately 95% of Fortune 1000 companies are long-term clients.

- Stable Cash Flow: Predictable revenue from foundational services fuels ongoing operations.

- Investment Capacity: Consistent cash generation allows for strategic reinvestment in growth initiatives.

- Market Dominance: Long-term contracts solidify Iron Mountain's position in its core markets.

Iron Mountain's secure physical records storage is a prime example of a cash cow within its BCG Matrix. This segment consistently generates substantial profits, providing a stable financial foundation for the company. Its strength lies in a dominant market position within a mature industry, ensuring reliable, albeit slow, revenue generation.

The company's Information Destruction (Physical) service also operates as a cash cow. This foundational offering benefits from consistent demand driven by regulatory compliance and the ongoing need for secure disposal of sensitive physical documents. In 2024, this demand was further amplified by data privacy regulations, ensuring a steady revenue stream.

Iron Mountain's traditional data backup and recovery services, particularly those utilizing physical media, are also classified as cash cows. Despite the shift towards digital solutions, these services maintain a significant market share, serving a substantial portion of large enterprises and offering predictable income in a stable market.

| Segment | BCG Classification | Key Characteristics | Supporting Data (2024/Recent) |

|---|---|---|---|

| Secure Physical Records Storage | Cash Cow | Dominant market share, high customer retention, stable revenue | 92.7% customer retention (Q3 2024) |

| Information Destruction (Physical) | Cash Cow | Consistent demand due to regulations, recurring revenue | Fueled by GDPR/CCPA compliance |

| Traditional Data Backup & Recovery (Physical) | Cash Cow | Significant market share in Fortune 1000, predictable income | Serves a substantial portion of Fortune 1000 |

Delivered as Shown

Iron Mountain BCG Matrix

The Iron Mountain BCG Matrix preview you see is the exact, unwatermarked document you will receive upon purchase. This comprehensive analysis, meticulously prepared by industry experts, is ready for immediate integration into your strategic planning processes. You'll gain full access to the professionally formatted report, enabling you to leverage its insights for informed decision-making without any further editing or modification required.

Dogs

Iron Mountain's legacy consumer storage services are positioned as a 'Dog' in its BCG Matrix. The company has seen a sequential decrease in consumer storage revenue, reflecting a deliberate strategic pivot towards more profitable and enterprise-focused ventures. This segment, with its historically lower growth and less strategic alignment with initiatives like Project Matterhorn, is likely being managed for cash or considered for divestment.

Basic, non-specialized document storage, lacking digital enhancements, is increasingly commoditized. This segment faces pressure from lower barriers to entry, meaning more competitors can offer similar services. For Iron Mountain, these offerings might represent a "dog" in the BCG matrix if they show low market growth and a low market share relative to their more advanced, digital solutions.

In 2024, the physical records management market, a core component of basic storage, continued to see steady demand but with limited growth potential. While Iron Mountain's overall revenue for the first quarter of 2024 reached $1.3 billion, the contribution from purely physical, unenhanced storage is likely experiencing slower growth compared to their digital transformation and cloud services. These basic storage units might require minimal new investment but also offer limited upside, making them candidates for efficiency improvements or strategic review.

Prior to strategic acquisitions, Iron Mountain's internal IT Asset Disposition (ITAD) offerings that were less advanced, geographically limited, or inefficient would have been considered weak points in their portfolio. These legacy services likely faced declining market share and limited growth prospects in the dynamic ITAD sector.

For instance, in 2023, the global ITAD market was valued at approximately $15.5 billion, with projections indicating continued growth. Offerings that couldn't keep pace with technological advancements or data security demands would have struggled to capture a significant portion of this expanding market.

Underperforming Regional Operations

Underperforming regional operations within Iron Mountain's portfolio, when viewed through the lens of a BCG Matrix, would likely fall into the Dogs category. These are segments that exhibit low growth and low market share. For instance, a specific regional facility might be struggling to gain traction in a market with limited demand for records management services or facing intense competition from local players.

These underperforming units contribute minimally to overall revenue growth and profitability. In 2023, Iron Mountain reported total revenue of $5.1 billion, but a significant portion of this revenue comes from its more successful business units. Regions with consistently low revenue growth rates, perhaps in the low single digits or even stagnant, would be indicative of a Dog status. Their profitability might also be marginal, potentially requiring significant investment to improve without a clear path to substantial returns.

- Low Market Share: A regional operation capturing less than 10% of its local market.

- Stagnant Growth: Revenue growth in a specific region failing to keep pace with the broader industry average, potentially less than 3% annually.

- Profitability Challenges: Margins in these regions may be significantly lower than the company's overall operating margin, which in 2023 was around 21%.

Non-strategic or Niche Consulting Services

Non-strategic or niche consulting services, falling into the Dogs category of the Iron Mountain BCG Matrix, represent offerings that are not central to the company's core information management and data center strategies. These could include highly specialized advisory services with limited market appeal or low demand, potentially possessing low market share and minimal contribution to overall revenue growth.

These services often struggle with scalability and may not align with Iron Mountain's broader strategic objectives, making them candidates for divestment or significant restructuring. For instance, a hypothetical niche consulting service focused on legacy document digitization for a rapidly shrinking industry segment would likely fit this description.

- Low Market Attractiveness: Services with limited growth potential or in declining markets, such as consulting on physical media archiving for industries transitioning entirely to digital.

- Minimal Strategic Alignment: Offerings that do not leverage Iron Mountain's core competencies in secure information management, data storage, or digital transformation.

- Low Revenue Contribution: Niche services that generate negligible revenue compared to the company's overall financial performance, potentially showing a decline in demand. For example, in 2023, a hypothetical niche consulting arm might have only contributed 0.5% to Iron Mountain's total revenue of approximately $4.8 billion.

- High Cost, Low Return: Services requiring specialized expertise or infrastructure that do not yield a proportionate return on investment, impacting overall profitability.

Iron Mountain's legacy consumer storage, basic physical records management, and underperforming regional operations all represent "Dogs" in its BCG Matrix. These segments are characterized by low market growth and low market share, often requiring minimal new investment but offering limited upside. For instance, in Q1 2024, Iron Mountain reported $1.3 billion in revenue, but the contribution from purely physical, unenhanced storage likely experienced slower growth compared to their digital services.

These "Dog" segments, such as niche consulting services or less advanced IT Asset Disposition (ITAD) offerings, may be managed for cash or considered for divestment. The global ITAD market, valued at roughly $15.5 billion in 2023, highlights how offerings not keeping pace with advancements would struggle. Similarly, underperforming regional facilities with stagnant revenue growth, potentially below 3% annually, contribute minimally to Iron Mountain's overall $5.1 billion in 2023 revenue.

| Segment Example | BCG Classification | Key Characteristics | Illustrative Data Point (2023/2024) |

| Legacy Consumer Storage | Dog | Low market growth, low market share, deliberate strategic pivot | Sequential decrease in consumer storage revenue |

| Basic Physical Records Management | Dog | Commoditized, low barriers to entry, limited growth potential | Steady demand but limited growth in physical records management market |

| Underperforming Regional Operations | Dog | Low growth, low market share, marginal profitability | Regional revenue growth potentially below 3% annually; overall company 2023 revenue $5.1 billion |

Question Marks

Emerging digital transformation offerings, such as new modules and features within Iron Mountain's InSight Digital Experience Platform (DXP), are positioned as question marks in the BCG matrix. These innovations, while holding significant future potential, are currently in the early stages of market penetration and require substantial investment to gain traction.

The DXP itself is considered a Star, indicating strong market leadership. However, the newest functionalities, particularly those leveraging artificial intelligence, are still building their market share and require ongoing development and marketing to solidify their position in a competitive digital landscape. For instance, Iron Mountain's 2024 investments in AI and automation are geared towards enhancing these emerging offerings.

Iron Mountain's specialized AI/ML data preparation services, particularly those focused on unlocking 'dark data,' represent a significant growth opportunity. These offerings are positioned as question marks within their BCG matrix, indicating high market growth potential but currently a relatively low market share.

The burgeoning AI and machine learning landscape fuels the demand for these services, as organizations increasingly recognize the value locked within unstructured and unutilized data. Capturing a larger slice of this emerging market necessitates considerable investment in advanced technologies and specialized talent.

For instance, the global data preparation market was valued at approximately $1.5 billion in 2023 and is projected to grow at a CAGR of over 30% through 2030, highlighting the substantial potential for Iron Mountain's new ventures in this space.

Iron Mountain's strategic expansion into new geographic data center markets, often initiated through joint ventures or smaller-scale deployments, positions these ventures as Question Marks within the BCG matrix. These new markets exhibit high growth potential, crucial for the overall data center sector's Star status. However, Iron Mountain currently holds a low market share in these nascent regions.

Advanced Cyber Recovery and Resilience Solutions

Iron Mountain's advanced cyber recovery and resilience solutions, incorporating next-generation cybersecurity alongside traditional data backup, represent a burgeoning market segment. While these sophisticated offerings are gaining traction, Iron Mountain may currently hold a modest market share. This category requires substantial investment in research and development, coupled with aggressive market penetration strategies, to ascend to the 'Star' quadrant of the BCG matrix.

The demand for robust cyber resilience is escalating. For instance, the global cybersecurity market was projected to reach $232.02 billion in 2024, with cyber recovery solutions being a critical component. Iron Mountain's advanced offerings aim to capture a larger piece of this expanding pie.

- Market Growth: The cyber resilience market is expanding rapidly due to increasing cyber threats.

- R&D Investment: Significant investment in innovation is crucial for these advanced solutions.

- Market Penetration: Efforts are needed to increase Iron Mountain's share in this competitive space.

- Future Potential: These offerings have the potential to become 'Stars' with successful strategic execution.

Strategic Acquisitions in Nascent Technologies

Strategic acquisitions in nascent technology areas that complement Iron Mountain's offerings but are in early stages of market development represent Question Marks within the Iron Mountain BCG Matrix framework. These ventures, though promising, carry inherent risks due to their unproven market traction. For instance, a hypothetical acquisition of a startup specializing in AI-driven document analysis, a nascent field, would fall into this category. Such a move aims to leverage future growth potential, but the immediate return on investment is uncertain, necessitating careful integration and substantial follow-on capital.

These acquisitions, while potentially high-growth, require integration and further investment to secure a significant market share. For example, if Iron Mountain were to acquire a company focused on quantum-resistant data encryption, a technology still in its infancy, significant resources would be needed to scale operations and establish market dominance. The success hinges on the rapid maturation of the technology and Iron Mountain's ability to effectively integrate it into its existing service portfolio, a process that often involves substantial R&D and market education efforts.

- Nascent Technology Acquisitions: Ventures into emerging tech like AI-powered data management or advanced cybersecurity solutions, which are not yet widely adopted but show significant future potential.

- Integration Challenges: The need for substantial investment and strategic planning to successfully merge new technologies and talent into Iron Mountain's existing infrastructure and business model.

- Market Penetration Risk: The uncertainty surrounding the adoption rate and competitive landscape of these new technologies, which could impact the speed and scale of market share capture.

- Future Growth Potential: Despite the risks, these acquisitions are positioned to drive future revenue streams and competitive advantage if the nascent technologies gain widespread market acceptance.

Question Marks represent emerging business areas for Iron Mountain with high growth potential but currently low market share. These require significant investment to develop and capture market position. For instance, new AI-driven data analytics tools and specialized cloud migration services fit this category.

The company's focus on expanding its digital offerings, particularly within the InSight Digital Experience Platform, means newer modules and features are classified as Question Marks. These innovations are critical for future growth but need substantial capital to gain traction in a competitive market.

Iron Mountain's strategic moves into new data center markets, often through partnerships, are also considered Question Marks. While these markets offer high growth, the company's current share is minimal, necessitating investment to build presence.

The global market for data preparation, where Iron Mountain is expanding its AI/ML services, was valued at around $1.5 billion in 2023 and is expected to grow at over 30% annually. This highlights the significant opportunity for these emerging offerings.

BCG Matrix Data Sources

Our Iron Mountain BCG Matrix is built on a foundation of robust data, integrating financial disclosures, market share analysis, and industry growth forecasts to provide strategic clarity.