Iron Mountain PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Iron Mountain Bundle

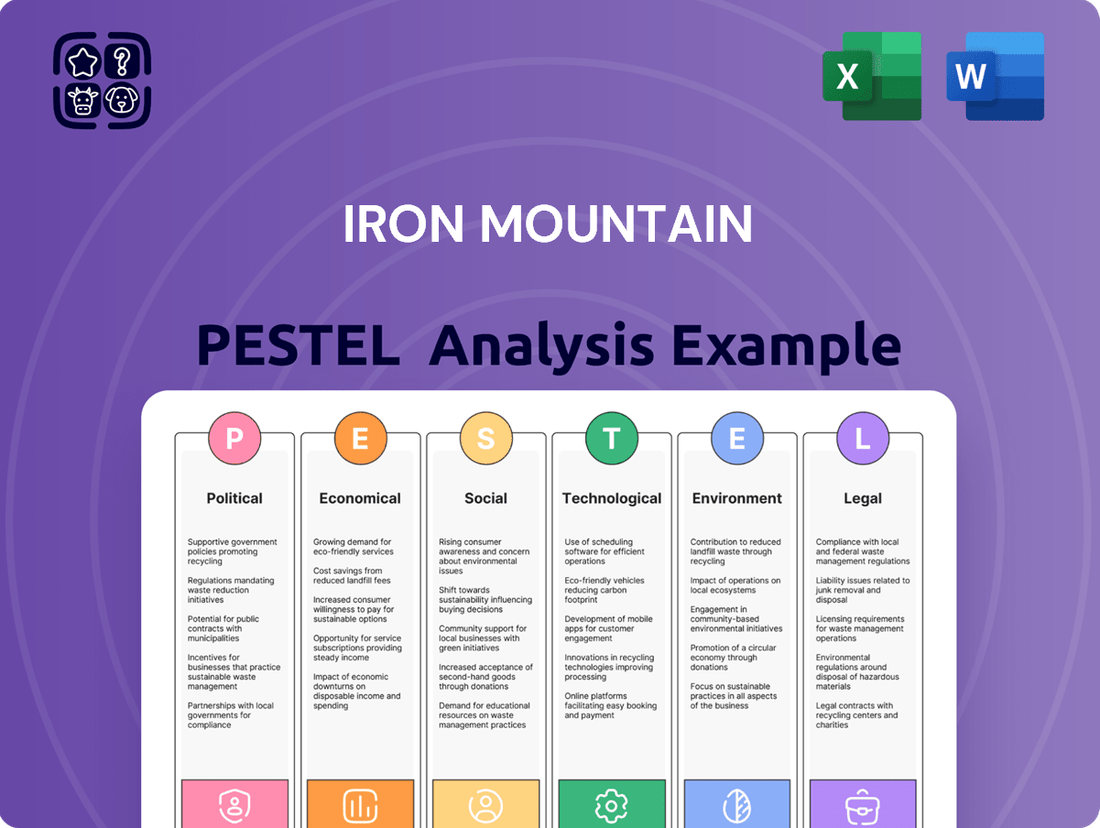

Navigate the complex external forces impacting Iron Mountain's operations with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that shape its strategic landscape. Gain a competitive edge by leveraging these expert insights to inform your own business decisions. Download the full version now for actionable intelligence.

Political factors

Iron Mountain's digital solutions and data center operations are directly impacted by evolving data privacy and security regulations worldwide. Compliance with frameworks like the GDPR in Europe and the CCPA/CPRA in California requires significant investment in data protection technologies and processes, affecting operational costs and risk profiles.

The financial implications of these regulations are substantial. For instance, the potential fines for GDPR violations can reach up to 4% of annual global turnover or €20 million, whichever is higher, underscoring the critical need for robust compliance measures. This necessitates ongoing expenditure on security infrastructure and personnel to safeguard sensitive client data.

Iron Mountain's global footprint, spanning over 60 countries, inherently exposes it to a complex web of geopolitical factors and varying international regulations. For instance, data localization mandates in significant markets like Brazil and China necessitate tailored operational strategies and can increase compliance costs, impacting efficiency.

Political instability in regions where Iron Mountain operates can directly affect its global supply chains and service delivery. Changes in trade agreements or the imposition of new tariffs, which are common in international relations, could disrupt the flow of goods and services, potentially hindering the company's ability to meet customer needs across its diverse international client base.

Iron Mountain's engagement with government entities is a significant political factor. A prime example is their recent $140 million contract with the U.S. Department of the Treasury, highlighting the substantial revenue potential from public sector clients. This reliance on government contracts underscores the importance of robust government relations and strict adherence to compliance standards for secure data management.

Political Contributions and Lobbying Activities

While Iron Mountain’s Global Political Contribution Policy prohibits direct corporate political donations, the company actively manages a non-partisan Political Action Committee (IMPAC). This committee supports federal congressional candidates, demonstrating a strategic engagement with the political landscape.

Iron Mountain also invests in lobbying efforts to shape policies relevant to its sectors. In 2024, the company reported significant lobbying expenditures, reflecting its commitment to advocating for a business environment conducive to the information management and data center industries.

- IMPAC Activity: Supports federal congressional candidates, aligning with the company's non-partisan stance.

- Lobbying Focus: Aims to influence policies affecting information management and data center operations.

- 2024 Expenditures: Specific lobbying spending figures highlight the company's active engagement in policy advocacy.

Cybersecurity and National Security Policies

Iron Mountain's operations are significantly influenced by national cybersecurity and national security policies. Governments worldwide are intensifying their focus on safeguarding critical infrastructure and sensitive data, which directly impacts companies like Iron Mountain that handle vast amounts of information. For instance, in 2024, the US government continued to bolster its cybersecurity initiatives, with agencies like CISA (Cybersecurity and Infrastructure Security Agency) issuing updated guidance and advisories for businesses handling sensitive data. This evolving regulatory landscape necessitates continuous investment in robust security protocols to meet stringent compliance requirements and maintain customer confidence.

The increasing emphasis on national security means that data protection is no longer just a business concern but a matter of state interest. Iron Mountain must therefore align its security strategies with national objectives, ensuring the integrity and confidentiality of the data entrusted to it. This includes staying abreast of new threats and investing in cutting-edge technologies to counter them. For example, the ongoing geopolitical tensions in 2024 and 2025 have highlighted the critical need for secure data storage solutions that are resilient against state-sponsored cyberattacks.

- Evolving Compliance: National cybersecurity policies, such as those related to data localization and cross-border data flows, directly affect how Iron Mountain manages its global data storage operations.

- Investment in Security: The company's commitment to cybersecurity, evidenced by its ongoing investments in advanced threat detection and prevention systems, is crucial for meeting national security standards.

- Customer Trust: Adherence to stringent national security mandates is paramount for maintaining customer trust, especially for clients in government and regulated industries.

- Strategic Alignment: Iron Mountain's strategic planning must incorporate national security considerations, ensuring its services contribute to broader national resilience against cyber threats.

Government contracts represent a significant revenue stream for Iron Mountain, with a notable $140 million contract secured with the U.S. Department of the Treasury in 2024. This reliance on public sector clients necessitates strict adherence to government regulations and compliance standards for data management and security.

While Iron Mountain's policy prohibits direct corporate political donations, the company maintains a non-partisan Political Action Committee (IMPAC) that supports federal congressional candidates. In 2024, Iron Mountain also reported substantial lobbying expenditures, demonstrating an active role in advocating for policies favorable to the information management and data center industries.

National cybersecurity and security policies are increasingly shaping Iron Mountain's operations. The company must continuously invest in robust security protocols to meet stringent compliance requirements, especially as governments like the U.S. continue to bolster cybersecurity initiatives, impacting how sensitive data is handled and protected.

What is included in the product

This Iron Mountain PESTLE analysis examines the impact of political, economic, social, technological, environmental, and legal factors on the company's operations and strategic planning.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable strategy.

Economic factors

As a REIT, Iron Mountain's financial health is closely tied to interest rate movements. For instance, the Federal Reserve’s target range for the federal funds rate, which stood at 5.25% to 5.50% as of early 2024, directly influences borrowing costs. Higher rates can increase Iron Mountain's cost of capital, making new projects like data center expansions more expensive.

These rate shifts also affect investor perceptions of REITs. When interest rates rise, bonds become more attractive relative to dividend-paying stocks like REITs, potentially dampening investor demand for Iron Mountain's shares. This can impact its stock valuation and ability to raise capital efficiently.

Consequently, even with robust operational performance, increased interest expenses from higher rates could squeeze Iron Mountain's net income. For example, a hypothetical 1% increase in borrowing costs on its existing debt could translate to millions in additional annual interest payments, impacting profitability.

Iron Mountain's revenue is directly influenced by the health of the global economy and how much businesses are willing to spend on managing their information. When economies are strong, companies tend to invest more in secure storage, data protection, and moving towards digital systems, which benefits Iron Mountain.

For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight uptick from 2023. This general economic expansion supports increased business spending, including on critical information management services that Iron Mountain provides.

However, economic slowdowns or periods of uncertainty can cause businesses to cut back on discretionary spending, including IT and information management projects. This can lead to slower revenue growth for Iron Mountain as clients may delay upgrades or reduce service levels.

Inflationary pressures, such as increased energy prices and higher labor expenses, directly affect Iron Mountain's operational expenditures. The company's significant physical footprint and substantial employee base mean that managing these rising costs is vital for sustaining profitability and its Adjusted EBITDA margins.

For instance, in Q1 2024, Iron Mountain reported that while revenue grew, certain operational costs saw an uptick, necessitating careful cost management strategies. The company's capacity to adjust its pricing to reflect these increased expenses is a critical lever for offsetting the impact of inflation.

Currency Exchange Rate Volatility

Iron Mountain's extensive global footprint, spanning over 60 countries, makes it particularly susceptible to currency exchange rate volatility. Fluctuations in foreign currencies directly influence the reported value of its international revenues and profits when translated into U.S. dollars. For instance, during the first quarter of 2024, the company reported that foreign currency headwinds had a negative impact on its results, although specific figures were often detailed in segment reporting to isolate operational performance.

The impact of adverse foreign currency movements is a persistent challenge for Iron Mountain, affecting the translation of its earnings from various international markets. To offer a clearer view of its core business performance, the company frequently provides financial results both including and excluding the effects of foreign exchange. This practice helps stakeholders understand the underlying operational trends separate from currency market swings.

Consider the following impacts:

- Revenue Translation: A stronger U.S. dollar can reduce the reported USD value of revenues earned in weaker foreign currencies.

- Cost Translation: Conversely, a weaker U.S. dollar can increase the reported USD cost of goods and services purchased in stronger foreign currencies.

- Profit Margins: Exchange rate shifts can compress or expand profit margins on international operations, impacting overall profitability.

- Competitive Landscape: Currency fluctuations can also affect the relative pricing of Iron Mountain's services compared to local competitors in foreign markets.

Digital Transformation and Data Center Demand

The relentless march of digital transformation is a powerful engine for Iron Mountain, directly fueling demand for its data center and digital solutions. Businesses everywhere are digitizing operations, from customer interactions to internal workflows, creating a massive need for secure, scalable storage and processing power. This trend is not slowing down; in fact, it's accelerating.

The global data center market is poised for significant expansion. Projections indicate continued robust growth, with a substantial portion of this surge driven by the burgeoning adoption of artificial intelligence (AI) and machine learning (ML). These advanced technologies are data-hungry, requiring immense capacity for processing and storage, which plays directly into Iron Mountain's core offerings.

Consider these key figures shaping the landscape:

- The global data center market was valued at approximately $240 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 15% through 2030, reaching over $600 billion.

- AI workloads are predicted to consume a significant portion of data center energy by 2026, underscoring the need for specialized, high-density infrastructure.

- Iron Mountain has been actively expanding its data center footprint, with plans to add significant capacity in key markets to meet this escalating demand.

Iron Mountain’s strategic investments in expanding its data center capacity, alongside its growing digital solutions portfolio, are strategically aligned to capture a substantial share of this expanding market. The company is well-positioned to benefit as more organizations embrace digital-first strategies and the data-intensive applications that accompany them.

Economic factors significantly shape Iron Mountain's operational environment. Global economic growth, projected by the IMF to be around 3.2% in 2024, generally supports increased business spending on information management services.

However, inflation, evidenced by rising energy and labor costs in early 2024, directly impacts Iron Mountain's operating expenses, necessitating careful cost management and potential price adjustments.

Interest rate policies, such as the Federal Reserve's target range of 5.25%-5.50% in early 2024, influence borrowing costs for capital-intensive projects like data center expansion, impacting profitability and investor attractiveness.

Currency exchange rate volatility, as seen with negative foreign currency impacts reported in Q1 2024, affects the translation of Iron Mountain's international revenues and profits into U.S. dollars.

Preview the Actual Deliverable

Iron Mountain PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Iron Mountain PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain actionable insights into market dynamics and strategic considerations.

Sociological factors

The seismic shift towards hybrid and remote work models, accelerated by global events, fundamentally alters information management. Organizations now require seamless, secure digital access to critical documents and data, regardless of employee location. This trend directly fuels the demand for Iron Mountain's digital transformation and cloud storage solutions, as businesses prioritize continuity and accessibility for their distributed workforces.

In 2024, global remote work adoption remained robust, with studies indicating that over 60% of knowledge workers were engaged in some form of remote or hybrid work. This persistent trend necessitates that companies like Iron Mountain enhance their offerings to support distributed teams, ensuring that sensitive information is not only digitized but also remains secure, compliant, and easily retrievable from any location, a key driver for Iron Mountain's projected revenue growth in its digital solutions segment.

Societal awareness around data privacy and security has surged, with consumers and businesses increasingly vigilant about how their information is handled. This trend directly benefits companies like Iron Mountain, whose core offerings include secure storage, data backup, and compliant information destruction.

In 2024, a significant majority of consumers expressed concerns about their personal data online, with reports indicating over 70% are worried about data breaches. This heightened anxiety translates into greater demand for robust data protection solutions, positioning Iron Mountain’s services as essential for organizations aiming to build trust and maintain compliance.

Iron Mountain’s established reputation for stringent security protocols and adherence to regulatory frameworks like GDPR and CCPA becomes a critical differentiator. As cyber threats evolve, the company’s commitment to safeguarding sensitive information provides a competitive edge, attracting clients who prioritize reliability and peace of mind.

Customers, investors, and employees are increasingly scrutinizing corporate behavior, demanding robust corporate social responsibility (CSR) and ethical practices. Iron Mountain's dedication to sustainability, including its goal to achieve net-zero emissions by 2040, directly addresses these expectations. This commitment, alongside its diversity, equity, and inclusion initiatives, as detailed in its 2023 ESG Report, enhances its reputation and fosters stakeholder confidence.

Operating with integrity is paramount for Iron Mountain in attracting and retaining both top talent and a loyal customer base. In 2023, the company reported a 20% increase in employee participation in its volunteer programs, demonstrating a tangible commitment to community engagement. Such actions are crucial for building a positive brand image in a market where ethical conduct is a significant differentiator.

Demographic Shifts and Workforce Management

Demographic shifts are significantly reshaping the talent landscape for companies like Iron Mountain. An aging workforce in some regions may necessitate knowledge transfer programs, while a growing demand for specialized IT skills, particularly in areas like cybersecurity and cloud computing, presents a recruitment challenge. For instance, the U.S. Bureau of Labor Statistics projects a 13% growth in information technology occupations from 2023 to 2033, faster than the average for all occupations.

To address these trends, Iron Mountain must strategically invest in workforce development and cultivate a diverse and inclusive environment. This is crucial for attracting and retaining the skilled personnel needed to support its expanding portfolio, especially in high-growth sectors such as data centers and digital transformation services. In 2023, Iron Mountain reported a continued focus on employee development, with significant investments in training programs aimed at upskilling its workforce for emerging technologies.

- Aging Workforce: Companies need strategies for knowledge retention and succession planning.

- Demand for IT Skills: A critical need exists for cybersecurity, cloud, and data analytics expertise.

- Workforce Development: Investment in training and upskilling is essential for future service delivery.

- Diversity and Inclusion: Fostering an inclusive culture is key to attracting and retaining a broad talent pool.

Customer Expectations for Integrated Solutions

Customers today expect more than just basic storage; they want comprehensive solutions that handle both their physical and digital information seamlessly. This means managing everything from legacy paper documents to cloud-based data with a single, trusted partner.

Iron Mountain is well-positioned to meet this demand. Their offerings span secure physical records storage, advanced data center solutions, and IT asset disposition, effectively bridging the physical and digital divide. For instance, in 2023, Iron Mountain reported significant growth in its data center business, indicating a strong market appetite for integrated digital infrastructure services, alongside its traditional records management. This holistic approach is key to building lasting customer relationships and fostering loyalty.

- Integrated Services: Customers prefer providers who can manage both physical and digital information assets under one roof.

- Digital Transformation Support: Businesses are seeking partners who can assist with their digital archiving and data management needs.

- Value Enhancement: A unified approach to information lifecycle management offers greater efficiency and security, increasing customer value.

- Market Trend Alignment: Iron Mountain's strategy directly addresses the growing trend of customers seeking end-to-end information management solutions.

Societal expectations regarding data privacy and security have intensified, with consumers and businesses alike demanding greater transparency and robust protection for their information. This heightened awareness directly benefits companies like Iron Mountain, which specialize in secure storage, data backup, and compliant data destruction, aligning with the growing need for trust and regulatory adherence in information management.

In 2024, consumer concerns about personal data breaches remained a significant issue, with surveys indicating that over 70% of individuals expressed worry about their online information. This pervasive anxiety drives demand for comprehensive data protection solutions, positioning Iron Mountain's services as crucial for organizations striving to build customer confidence and ensure compliance.

Corporate social responsibility (CSR) and ethical practices are increasingly scrutinized by stakeholders, including customers, investors, and employees. Iron Mountain's commitment to sustainability, exemplified by its net-zero emissions goal by 2040 and its diversity, equity, and inclusion initiatives, directly addresses these evolving expectations. This focus on ethical conduct, as highlighted in its 2023 ESG Report, strengthens its brand reputation and fosters stakeholder trust.

Technological factors

Iron Mountain is actively embracing digital transformation, with cloud adoption being a significant technological factor. The company is investing in digital solutions and expanding its data center footprint to cater to the escalating need for secure digital information management and robust server hosting capabilities.

This strategic pivot is evident in Iron Mountain's focus on developing advanced platforms and services designed to streamline the digital conversion and ongoing management of critical business information. For instance, in 2023, Iron Mountain reported a significant increase in its data center capacity, adding new facilities to support the growing demand for cloud-based storage and processing power.

The burgeoning adoption of AI and machine learning is a significant technological driver, directly fueling the need for robust data storage and processing capabilities. These advanced technologies, from generative AI models to complex analytics, demand vast amounts of data and computational power, creating a substantial market for data center services. By 2024, the global AI market was projected to reach over $200 billion, with a significant portion of that growth attributed to the infrastructure required to support these applications.

Iron Mountain's substantial investment in its data center footprint and its focus on secure, scalable storage solutions position it to capitalize on this trend. The company's ability to provide high-density power and cooling, essential for AI workloads, makes its facilities attractive to businesses integrating AI into their operations. This technological shift means data centers are no longer just repositories but active hubs for AI-driven innovation.

The ever-changing landscape of cyber threats demands consistent investment in sophisticated security solutions. Iron Mountain needs to deploy advanced encryption, real-time threat detection, and reliable data recovery systems to safeguard both physical and digital client assets.

A strong cybersecurity framework is crucial for maintaining client confidence and adhering to stringent data privacy laws. For instance, the global average cost of a data breach reached an all-time high of $4.45 million in 2024, underscoring the financial imperative of robust protection.

Automation and Operational Efficiency

Iron Mountain's embrace of automation in information management, from physical records to digital data centers, is a key technological driver. This adoption directly boosts operational efficiency and lowers costs by streamlining workflows, minimizing errors, and accelerating service delivery. For example, in 2024, companies across various sectors reported an average cost reduction of 15-20% through intelligent automation in document processing.

Automation allows Iron Mountain to scale its services more effectively, a crucial factor in the growing volume of data and physical assets it manages. This technological advancement enables faster turnaround times and improved accuracy, directly impacting customer satisfaction and competitive positioning. By 2025, the global market for Robotic Process Automation (RPA) is projected to reach over $13 billion, highlighting the widespread investment in these efficiencies.

The impact of automation extends to reducing manual labor, which can be a significant cost center in traditional information management. This shift allows for reallocation of resources towards higher-value tasks and strategic growth initiatives. Iron Mountain's investment in AI-powered sorting and retrieval systems, for instance, can dramatically reduce the time and personnel needed for physical archive management.

- Enhanced Efficiency: Automation streamlines processes, leading to faster handling of records and data.

- Cost Reduction: By minimizing manual intervention, operational costs are significantly lowered.

- Scalability: Automated systems allow for easier expansion of services to meet growing client demands.

- Improved Accuracy: Technology reduces human error in data entry and retrieval, ensuring higher data integrity.

Innovation in Asset Lifecycle Management (ALM)

Technological innovation is reshaping Iron Mountain's Asset Lifecycle Management (ALM) services. Advancements in IT asset disposition (ITAD), data erasure, and value recovery are paramount for the company's ALM division. For instance, in 2023, the ITAD market was valued at approximately $19.5 billion globally, with projections indicating continued growth driven by data security and sustainability concerns.

Iron Mountain's strategic acquisitions, such as that of Regency Technologies, bolster its capacity to manage the complete IT asset lifecycle. This integration allows for secure handling, environmentally sound disposal, and robust data privacy protection. Regency Technologies, prior to its acquisition, was recognized for its advanced data destruction and recycling capabilities, contributing to Iron Mountain's enhanced service offering.

These technological integrations enable Iron Mountain to provide superior sustainability and value recovery for its clients. By employing cutting-edge methods for data sanitization and material reclamation, the company addresses growing customer demand for circular economy solutions. This focus on technological advancement directly supports the ALM business by ensuring compliance, minimizing environmental impact, and maximizing the residual value of retired IT assets.

- Data Erasure Technology: Advanced software and hardware solutions ensure secure and certified data destruction, meeting stringent global privacy regulations.

- Value Recovery Processes: Sophisticated refurbishment and resale channels maximize the economic return from decommissioned IT equipment.

- Environmental Compliance: Technologies for responsible e-waste recycling and material recovery minimize landfill impact and promote resource conservation.

- Supply Chain Visibility: Digital platforms offer real-time tracking and reporting throughout the asset disposition process, enhancing transparency and accountability.

Technological advancements are fundamentally reshaping how information is managed and secured, directly impacting Iron Mountain's operations and growth trajectory. The company's strategic investments in digital transformation, cloud infrastructure, and advanced data center capabilities are crucial for meeting the escalating demands of modern businesses.

The increasing reliance on AI and machine learning by businesses worldwide necessitates robust data storage and processing power, a core offering for Iron Mountain. By 2024, the global AI market was projected to exceed $200 billion, with significant investment in the underlying infrastructure required to support these technologies.

Iron Mountain's commitment to cybersecurity is also a key technological factor, with the global average cost of a data breach reaching $4.45 million in 2024. The company's deployment of advanced security solutions is vital for protecting client data and maintaining trust.

Automation, particularly in document processing and physical record management, is driving significant operational efficiencies for Iron Mountain. By 2025, the global Robotic Process Automation (RPA) market is expected to surpass $13 billion, reflecting the broad adoption of these cost-saving technologies.

Legal factors

Iron Mountain navigates a global landscape of data privacy laws, including the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), alongside the European Union's General Data Protection Regulation (GDPR). These regulations impose stringent requirements on how customer data is managed, stored, and ultimately disposed of, necessitating robust compliance frameworks. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, underscoring the financial imperative for adherence.

Iron Mountain operates within sectors burdened by stringent, industry-specific compliance mandates beyond general data privacy. For instance, its healthcare clients demand adherence to regulations like HIPAA, while financial and legal sectors have their own unique record-keeping and security protocols.

Maintaining a robust compliance framework is paramount. This involves securing and upholding numerous certifications and adhering to evolving industry standards for information security and record management, which differ significantly across sectors and geographical locations.

Navigating this complex web of regulations requires a profound and continuously updated understanding of diverse legal and regulatory landscapes. Failure to comply can lead to substantial penalties and reputational damage, underscoring the critical nature of this factor for Iron Mountain's operations and growth.

Iron Mountain's operations are heavily governed by contractual obligations and Service Level Agreements (SLAs) with its diverse clientele. These agreements are critical, outlining service parameters, data security assurances, and access procedures, necessitating rigorous legal oversight and compliance. For instance, in 2023, Iron Mountain's revenue was over $5.2 billion, underscoring the sheer volume of contractual relationships underpinning its business.

Failure to uphold these legally binding terms, whether through contract breaches or unmet SLAs, can lead to significant legal challenges and financial repercussions. These potential liabilities are a constant consideration in managing customer relationships and operational standards across its global footprint.

Intellectual Property and Technology Licensing

As Iron Mountain continues to grow its digital offerings and create new technologies, safeguarding its intellectual property and managing technology licensing are crucial. This involves protecting its own innovations while also ensuring it has the correct licenses for any technologies it uses from others. This is vital for maintaining its advantage in the market and avoiding legal issues.

In 2023, Iron Mountain reported significant investment in its digital transformation initiatives, underscoring the growing importance of its technology portfolio. The company's focus on data management and cloud solutions means that robust IP protection and strategic licensing are directly tied to its revenue streams and future growth potential. Failure to manage these effectively could lead to infringement claims or limit its ability to leverage new technologies.

- Intellectual Property Management: Iron Mountain must actively protect its patents, trademarks, and copyrights related to its digital storage, data management, and information governance solutions.

- Technology Licensing Agreements: Securing favorable terms for licensing third-party software and hardware essential for its operations is key to cost efficiency and operational capability.

- Competitive Advantage: Strong IP protection allows Iron Mountain to differentiate its services and command premium pricing, while strategic licensing ensures access to cutting-edge technology.

- Risk Mitigation: Proactive management of IP and licensing prevents costly litigation and ensures compliance with evolving technology regulations.

International Trade Laws and Cross-Border Data Flow

Iron Mountain’s global operations mean it must navigate a complex web of international trade laws, particularly those concerning cross-border data flow. For instance, the GDPR in Europe and similar regulations elsewhere impose strict rules on how data can be transferred and processed internationally. These regulations can significantly impact Iron Mountain's ability to offer unified data management solutions across its diverse client base.

The company's reliance on efficient data movement makes it vulnerable to shifts in these legal frameworks. A tightening of data localization requirements, for example, could necessitate costly adjustments to its infrastructure and service delivery models. As of early 2024, many nations are re-evaluating their data governance policies, presenting ongoing compliance challenges.

- GDPR Compliance: Strict regulations in the EU and UK govern data transfers, impacting how Iron Mountain handles European client data.

- Data Localization Trends: An increasing number of countries are mandating that data be stored within their borders, complicating global data management.

- Trade Agreements: Evolving international trade agreements can influence the terms under which data services are provided across borders.

Iron Mountain must meticulously adhere to a growing number of data privacy laws, such as GDPR and CCPA/CPRA, which dictate stringent data handling, storage, and disposal practices. Non-compliance can result in substantial fines, with GDPR penalties potentially reaching 4% of global annual revenue or €20 million. Furthermore, industry-specific regulations like HIPAA for healthcare clients impose unique security and record-keeping mandates, requiring continuous adaptation and robust compliance frameworks across its diverse service offerings.

Environmental factors

Iron Mountain is making substantial strides in its environmental efforts, aiming for net-zero greenhouse gas emissions by 2040, a decade ahead of the Paris Climate Accord's target. This proactive stance necessitates considerable investment in renewable energy sources, energy-saving initiatives, and the electrification of its vehicle fleet across its worldwide operations.

The company's dedication to environmental responsibility is clearly reflected in its tangible progress in lowering Scope 1 and Scope 2 emissions. For instance, Iron Mountain reported a 12% reduction in Scope 1 and 2 emissions intensity in 2023 compared to its 2019 baseline, showcasing a consistent downward trend in its carbon footprint.

Iron Mountain is heavily focused on renewable energy procurement, especially for its data centers, which are significant energy consumers. Their core environmental strategy revolves around sourcing clean electricity to power these operations.

The company has set an ambitious goal to achieve 100% clean electricity, 100% of the time, for its data centers by 2040. Demonstrating significant progress, Iron Mountain reported an 87% renewable energy coverage globally in 2023, a substantial increase that highlights their commitment.

This strategic shift towards greener energy sources is vital for reducing Iron Mountain's overall carbon footprint. It also directly addresses growing customer expectations for environmentally responsible data storage and management solutions.

Iron Mountain's secure shredding and Asset Lifecycle Management (ALM) services are integral to promoting a circular economy. By handling the responsible disposition of IT assets and facilitating the recycling of materials like paper and cardboard, the company directly supports resource recovery and waste reduction efforts for its clients.

In 2023, Iron Mountain reported recycling over 1.2 billion pounds of paper, a testament to its significant contribution to waste diversion and resource conservation. This volume underscores the company's commitment to helping clients achieve their zero-waste and landfill diversion targets.

Sustainable Building Standards and Certifications

Iron Mountain is actively integrating sustainable building standards into its infrastructure strategy, aiming for BREEAM certifications for all new co-location data centers from 2025 onwards. This focus on green building principles is designed to significantly reduce the environmental footprint of its facilities, emphasizing energy conservation and responsible resource management.

This proactive approach aligns with growing market demand for environmentally conscious operations. For instance, the global green building market was valued at approximately $104.5 billion in 2020 and is projected to reach over $190 billion by 2027, indicating a strong trend towards sustainability that Iron Mountain is capitalizing on.

- BREEAM Certification Goal: All new co-location data centers to achieve BREEAM certification starting in 2025.

- Environmental Focus: Minimizing environmental impact through energy efficiency and sustainable resource utilization.

- Market Trend: Growing global demand for green buildings, with the market expected to exceed $190 billion by 2027.

Customer and Investor Demand for ESG Transparency

Customers and investors increasingly expect clear communication about a company's environmental, social, and governance (ESG) performance. Iron Mountain addresses this by releasing annual Sustainability Reports, following frameworks such as the Global Reporting Initiative (GRI), to detail its progress and pledges.

This commitment to transparency fosters confidence and highlights Iron Mountain's dedication to ethical operations, which directly impacts investment choices and collaborative ventures. For instance, in its 2023 Sustainability Report, Iron Mountain detailed a 25% reduction in Scope 1 and 2 greenhouse gas emissions compared to its 2019 baseline, showcasing a tangible step towards environmental responsibility.

The demand for ESG data is not just a trend; it's becoming a critical factor in financial analysis and corporate reputation. By providing detailed ESG reports, Iron Mountain positions itself favorably in a market where sustainability is a key differentiator.

Iron Mountain's environmental strategy is geared towards significant carbon footprint reduction, targeting net-zero emissions by 2040. This involves substantial investments in renewable energy, energy efficiency, and fleet electrification. The company reported an 87% renewable energy coverage globally in 2023, a key step towards its goal of 100% clean electricity for data centers by 2040.

The company's commitment to a circular economy is evident in its shredding and Asset Lifecycle Management services, which promote responsible IT asset disposition and material recycling. In 2023, Iron Mountain recycled over 1.2 billion pounds of paper, contributing significantly to waste diversion.

Furthermore, Iron Mountain is integrating sustainable building practices, with all new co-location data centers planned to achieve BREEAM certification from 2025. This aligns with the growing global demand for green buildings, a market projected to exceed $190 billion by 2027.

Transparency in environmental, social, and governance (ESG) performance is maintained through annual Sustainability Reports. These reports, often following frameworks like the Global Reporting Initiative (GRI), detail progress and commitments, such as the 25% reduction in Scope 1 and 2 greenhouse gas emissions reported in 2023 compared to a 2019 baseline.

| Environmental Metric | Target/Goal | 2023 Status/Progress | Notes |

|---|---|---|---|

| Net-Zero Emissions | By 2040 | On track | Aligned with Paris Agreement, but a decade ahead |

| Scope 1 & 2 Emissions Intensity | Reduction from 2019 baseline | 12% reduction reported | Shows consistent downward trend |

| Renewable Energy Coverage (Data Centers) | 100% by 2040 | 87% globally | Significant increase demonstrating commitment |

| Paper Recycling | Support zero-waste goals | 1.2 billion pounds recycled | Highlights contribution to circular economy |

| New Co-location Data Centers | BREEAM Certification | From 2025 onwards | Focus on sustainable building standards |

PESTLE Analysis Data Sources

Our Iron Mountain PESTLE Analysis is grounded in a comprehensive review of official government publications, reputable financial news outlets, and leading industry research firms. This approach ensures that our insights into political stability, economic trends, and technological advancements are both accurate and timely.