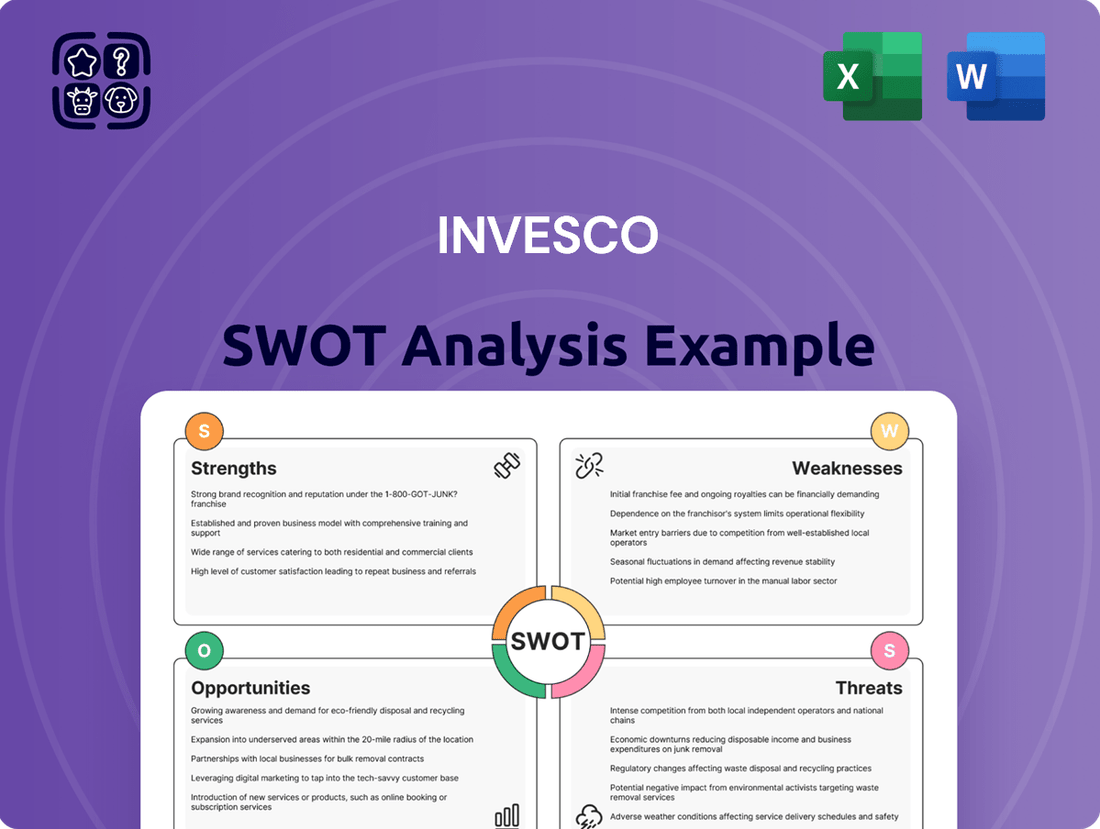

Invesco SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Invesco Bundle

Invesco's market position is shaped by its robust brand recognition and diverse product offerings, but also faces challenges from increasing competition and evolving investor preferences. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Invesco's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Invesco boasts a significant global footprint, operating in over 20 countries and serving a diverse clientele that includes institutional investors, retail customers, and financial advisors. This broad reach, as of early 2025, allows Invesco to tap into various economic cycles and market opportunities worldwide.

This expansive international presence, with operations spanning North America, Europe, and Asia, diversifies Invesco's revenue streams and mitigates risks associated with any single regional downturn. For instance, in the fiscal year ending September 2024, approximately 40% of Invesco's total operating revenue was generated outside the Americas, highlighting its global diversification.

Invesco's broad investment capabilities are a significant strength, offering a comprehensive range of strategies across equities, fixed income, alternatives, and multi-asset solutions. This diversity allows the firm to meet a wide spectrum of client needs and risk tolerances.

As of the first quarter of 2024, Invesco managed approximately $1.6 trillion in assets under management, showcasing the scale and breadth of its product offerings. This extensive product suite not only attracts a diverse client base but also aids in client retention by providing solutions for various market cycles and investment objectives.

Invesco's strength lies in its comprehensive offering of both actively managed funds and a robust exchange-traded fund (ETF) platform. This dual strategy allows them to cater to a broad investor base, from those seeking specialized active management to investors favoring the cost-effectiveness and diversification of ETFs. This approach positions Invesco to benefit from the continued growth in both market segments.

As of Q1 2024, Invesco reported approximately $1.6 trillion in assets under management (AUM), with a significant portion allocated to its ETF offerings, demonstrating the market's appetite for their passive solutions. Simultaneously, their active management expertise continues to attract substantial capital, showcasing a balanced strength in capturing diverse investment preferences.

Strong Brand Recognition and Reputation

Invesco benefits from significant brand recognition and a solid reputation as an independent investment management firm. This established presence, cultivated over decades, translates into a high level of trust among its diverse client base, from individual investors to institutional entities.

The company's long-standing commitment to investment expertise and a client-first philosophy has built considerable brand equity. This is a crucial differentiator in the highly competitive asset management landscape, helping to attract and retain business. For instance, as of the first quarter of 2024, Invesco reported $1.6 trillion in assets under management, a testament to the trust placed in its brand and services.

- Established Reputation: Invesco is recognized globally for its investment acumen and client service.

- Brand Equity: Strong brand recognition fosters trust and acts as a magnet for new clients.

- Market Presence: As of Q1 2024, Invesco managed $1.6 trillion in assets, reflecting its significant market standing.

- Competitive Advantage: Brand strength provides a distinct edge in attracting and retaining assets in a crowded industry.

Scale and Resources

Invesco's considerable scale, managing approximately $1.5 trillion in assets as of early 2024, translates directly into significant economies of scale. This allows for more efficient deployment of capital across technology, research capabilities, and its extensive global distribution network.

These substantial resources fuel continuous investment in key areas. Invesco can attract and retain top talent, upgrade its technological infrastructure, and drive product development, all of which are crucial for maintaining a competitive edge and fostering operational efficiency in the dynamic asset management landscape.

- Economies of Scale: Managing over $1.5 trillion in assets provides cost advantages in technology, research, and distribution.

- Investment Capacity: Significant resources enable ongoing investment in talent acquisition and development.

- Infrastructure Enhancement: Funds are allocated to maintain and improve global operational infrastructure.

- Product Innovation: Resources support the development of new and evolving investment products to meet market demand.

Invesco's extensive global presence, operating in over 20 countries as of early 2025, allows it to capitalize on diverse market opportunities and economic cycles. This broad international reach, with significant revenue generation outside the Americas (around 40% in FY2024), diversifies income and mitigates regional risks.

The firm's strength lies in its comprehensive investment capabilities, offering a wide array of strategies across asset classes, from equities and fixed income to alternatives and multi-asset solutions. This broad product suite, managing approximately $1.6 trillion in assets under management (AUM) as of Q1 2024, caters to a diverse client base with varied needs and risk appetites.

Invesco effectively balances actively managed funds with a strong ETF platform, appealing to a wide spectrum of investors. This dual approach, supported by $1.6 trillion in AUM in Q1 2024, allows them to capture growth in both market segments.

A well-established reputation and strong brand equity, built on decades of client-focused service, foster significant trust. This brand strength, evidenced by $1.6 trillion in AUM in Q1 2024, provides a crucial competitive advantage in attracting and retaining clients.

The company's substantial scale, managing over $1.5 trillion in assets in early 2024, generates significant economies of scale. This enables efficient investment in technology, research, talent, and global distribution, bolstering its competitive position.

| Strength | Description | Supporting Data (as of early 2025/Q1 2024) |

|---|---|---|

| Global Footprint | Operations in over 20 countries, diversifying revenue and mitigating regional risk. | Approx. 40% of operating revenue generated outside Americas (FY2024). |

| Broad Investment Capabilities | Comprehensive strategies across equities, fixed income, alternatives, and multi-asset. | Managed approx. $1.6 trillion in AUM (Q1 2024). |

| Balanced Product Offering | Strong presence in both active management and ETFs. | Significant portion of $1.6 trillion AUM (Q1 2024) in ETFs. |

| Brand Recognition & Reputation | Established trust and client-first philosophy leading to high brand equity. | Managed approx. $1.6 trillion in AUM (Q1 2024), reflecting client trust. |

| Economies of Scale | Cost advantages from managing substantial assets. | Managed over $1.5 trillion in assets (early 2024), enabling investment in tech, research, and distribution. |

What is included in the product

Delivers a strategic overview of Invesco’s internal strengths and weaknesses alongside external market opportunities and threats.

Offers a clear, actionable SWOT breakdown to identify and address strategic challenges.

Weaknesses

Invesco's significant reliance on its assets under management (AUM) makes its revenue highly sensitive to global financial market performance. For instance, during periods of market volatility, such as the broad market declines seen in early 2022, a substantial drop in AUM directly translates to reduced management fees and, consequently, lower profitability for the company.

Invesco, like many in the asset management sector, contends with significant fee pressure, especially in the booming passive investment space. This trend directly squeezes profit margins. For instance, average expense ratios for U.S. equity ETFs dropped to 0.17% in 2024, down from 0.20% in 2023, highlighting the competitive pricing environment.

This ongoing margin compression necessitates a sharp focus on operational efficiency and the development of unique, value-added services to stand out. Without effective cost management and clear differentiation, maintaining profitability becomes increasingly challenging for firms like Invesco.

Invesco faces significant challenges due to the intricate and ever-changing regulatory landscape across the globe. Navigating these diverse rules demands substantial investment in compliance measures, which can divert crucial resources away from strategic growth and innovation.

The financial services industry is subject to intense regulatory scrutiny, and Invesco is no exception. For instance, in 2023, the financial sector globally saw increased focus on areas like ESG reporting and digital asset regulation, leading to higher compliance burdens for firms like Invesco. These ongoing compliance efforts represent a considerable operational cost and a potential risk if not managed effectively.

Operational Efficiency and Cost Structure

Invesco, despite its considerable global reach, might encounter hurdles in streamlining its operational efficiency. Managing a vast array of products and services across different regions can lead to complexities that impact cost-effectiveness. For instance, in the first quarter of 2024, Invesco reported operating expenses of $1.3 billion, highlighting the substantial overheads associated with its scale.

A potentially high cost structure could put pressure on Invesco's profitability, particularly as the asset management industry faces headwinds. Fee compression, driven by increased competition and a shift towards lower-cost passive investments, means that every dollar spent on operations has a greater impact on the bottom line. This environment necessitates a constant focus on cost optimization to maintain healthy margins.

- Global Operations Complexity: Invesco's presence in numerous countries and its diverse product offerings can create inefficiencies if not managed effectively.

- Cost Base Pressure: Rising operational costs, coupled with declining fee revenues, can significantly impact Invesco's profit margins in the competitive asset management landscape.

- Impact of Fee Compression: The industry trend of lower management fees on investment products directly challenges firms like Invesco to control their expense ratios.

Talent Retention in a Competitive Industry

Invesco operates in an investment management landscape where securing and keeping top-tier talent, particularly skilled portfolio managers and analysts, is a significant hurdle. The industry's intense competition, with other asset managers, agile hedge funds, and disruptive fintech companies vying for the same individuals, presents a constant challenge to Invesco's ability to retain its most valuable personnel. This can directly affect the quality of investment strategies and, consequently, overall performance.

The financial services sector, as of early 2024, continued to see high demand for specialized investment professionals. For instance, reports indicated that bonuses for top-performing portfolio managers in certain asset classes could reach upwards of 50% of base salary, a clear indicator of the competitive talent market. Invesco, like its peers, must navigate these elevated compensation expectations and the allure of potentially more flexible or innovative work environments offered by competitors.

- High Demand for Specialized Skills: The need for expertise in areas like quantitative analysis, ESG investing, and alternative assets drives up the cost and difficulty of talent acquisition and retention.

- Competitive Compensation and Benefits: Other financial firms, including private equity and venture capital, often offer more lucrative packages, making it harder for traditional asset managers like Invesco to compete.

- Impact of Fintech Innovation: Fintech companies are attracting talent with promises of cutting-edge technology and a different work culture, potentially drawing away experienced investment professionals.

- Risk of Performance Degradation: The inability to retain key talent can lead to a loss of institutional knowledge, disrupt investment strategies, and ultimately impact fund performance and client satisfaction.

Invesco's substantial global footprint, while a strength, also presents a significant weakness in terms of operational complexity. Managing diverse product lines and regulatory environments across numerous countries can lead to inefficiencies and higher overhead costs. For example, in Q1 2024, Invesco reported operating expenses of $1.3 billion, underscoring the scale of costs involved in its global operations.

The asset management industry's trend of fee compression, particularly in passive investing, directly impacts Invesco's profitability. As average ETF expense ratios continue to fall, reaching 0.17% for U.S. equity ETFs in 2024, Invesco faces pressure to control its own expense ratios to maintain healthy margins.

The intense competition for top talent in the financial sector poses another considerable weakness. With other asset managers, hedge funds, and fintech firms actively recruiting, Invesco must offer competitive compensation and benefits, which can be substantial. For instance, bonuses for top portfolio managers can reach 50% of base salary, highlighting the high cost of retaining key personnel.

Preview Before You Purchase

Invesco SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing the actual Invesco SWOT analysis, ensuring you know exactly what you're getting. The complete, in-depth report is unlocked immediately after purchase.

Opportunities

The global demand for Environmental, Social, and Governance (ESG) compliant investment products is experiencing significant expansion. As of early 2025, assets under management in ESG funds have surpassed $50 trillion worldwide, indicating a strong shift in investor priorities.

Invesco is well-positioned to capitalize on this trend by further developing and actively marketing its existing ESG offerings. This strategic alignment with growing investor preferences can attract substantial new capital, reinforcing its market presence.

Emerging markets present a substantial avenue for growth in asset management, driven by increasing disposable incomes and the ongoing development of financial systems. Invesco can leverage this by strategically increasing its footprint and tailoring its investment products to cater to these burgeoning economies, thereby accessing new customer bases and broadening its income sources.

Invesco's embrace of digital transformation and AI integration presents significant growth opportunities. By leveraging advanced technologies, the firm can streamline operations, refine investment strategies through sophisticated data analytics, and deepen client relationships with personalized offerings. This strategic focus is crucial for staying ahead in a rapidly evolving financial landscape.

For instance, AI-powered tools can analyze vast datasets to identify emerging market trends and potential investment opportunities far more efficiently than traditional methods. This capability is critical as the global AI market is projected to reach over $1.5 trillion by 2030, with significant applications in financial services.

Consolidation in the Asset Management Industry

The asset management sector remains quite fragmented, offering Invesco a prime chance to grow through strategic mergers and acquisitions. By bringing smaller or specialized firms into the fold, Invesco can boost its assets under management (AUM), broaden its service offerings, and benefit from increased operational efficiency.

For instance, the global asset management industry's AUM was projected to reach $145 trillion by the end of 2025, according to PwC. This vast market size underscores the potential for consolidation to unlock significant value.

- Increased AUM: Acquiring firms directly adds to Invesco's total assets under management, enhancing its market position and revenue potential.

- Expanded Capabilities: Mergers can bring in new investment strategies, technologies, or client bases that Invesco might not possess internally.

- Economies of Scale: Combining operations often leads to cost savings through shared resources, reduced overhead, and greater bargaining power.

- Market Share Growth: Consolidation is a direct route to capturing a larger share of the growing global asset management market.

Demand for Personalized Investment Solutions

The financial landscape is shifting, with investors increasingly seeking personalized strategies that go beyond one-size-fits-all products. This trend presents a significant opportunity for Invesco to innovate and cater to these evolving demands. By developing more bespoke portfolios, direct indexing capabilities, and hyper-personalized advisory services, Invesco can capture a larger share of this growing market segment.

For instance, the global wealth management market is projected to reach $100 trillion by 2025, with a significant portion of this growth driven by demand for customized solutions. Invesco's ability to offer tailored investment experiences, potentially leveraging AI and data analytics, positions it well to meet this demand.

- Growing Demand: Investor preferences are moving towards bespoke financial solutions.

- Invesco's Advantage: Opportunity to offer direct indexing and hyper-personalized advisory services.

- Market Potential: The global wealth management market is expanding rapidly, with customization as a key driver.

The increasing global focus on Environmental, Social, and Governance (ESG) investing presents a substantial opportunity for Invesco to expand its market share. The firm can leverage its existing ESG product suite and further develop innovative solutions to attract the growing pool of capital directed towards sustainable investments. This alignment with investor priorities is crucial for capturing new assets and reinforcing its competitive position.

Threats

The financial services landscape is rapidly evolving with the emergence of fintech and robo-advisors. These platforms offer automated, low-cost investment solutions that are increasingly appealing to a broad range of investors, particularly those who are price-sensitive. This trend directly challenges traditional asset managers like Invesco, as these digital disruptors can attract significant assets under management with streamlined, technology-first approaches.

By mid-2024, the robo-advisor market continued its expansion, with several platforms managing billions in assets. For instance, Betterment, a prominent robo-advisor, reported managing over $30 billion in assets by early 2024. This demonstrates the growing investor confidence in automated financial advice, which often comes with significantly lower fees compared to traditional human-advised portfolios. This competitive pressure could potentially impact Invesco's market share and fee revenue if it doesn't adapt its offerings.

Global economic downturns, such as the potential for a recession in major economies in 2024-2025 due to persistent inflation and rising interest rates, pose a significant threat. Geopolitical instability, including ongoing conflicts and trade tensions, further exacerbates market volatility. This environment can lead to substantial drops in asset values, directly impacting Invesco's assets under management (AUM), which stood at approximately $1.5 trillion as of Q1 2024, and consequently, its profitability.

Invesco faces potential headwinds from evolving regulatory landscapes. New or more stringent financial regulations, particularly concerning investor protection, data privacy, and capital adequacy, could significantly elevate Invesco's compliance costs and operational complexities. For instance, the ongoing discussions around ESG (Environmental, Social, and Governance) disclosure requirements could necessitate substantial investments in data collection, reporting infrastructure, and personnel training, directly impacting operational efficiency and potentially squeezing profit margins.

Cybersecurity Risks

Invesco, like all financial institutions, grapples with significant cybersecurity risks. The constant evolution of cyber threats poses a persistent challenge, requiring continuous investment in robust security measures to protect sensitive client data and manage vast financial transactions. A breach could have devastating consequences, impacting not only financial stability but also Invesco's hard-earned reputation and client confidence.

The financial services industry experienced a notable increase in cyberattacks in recent years. For instance, reports from 2023 indicated a substantial rise in ransomware attacks targeting financial firms, with average recovery costs escalating. This trend underscores the critical need for Invesco to maintain state-of-the-art defenses against sophisticated actors seeking to exploit vulnerabilities for financial gain or disruption.

- Data Breaches: Unauthorized access to client information, including personal and financial details, leading to identity theft and fraud.

- Financial Losses: Direct costs from fraud, recovery expenses, regulatory fines, and potential litigation following an attack.

- Reputational Damage: Erosion of client trust and market confidence due to security failures, impacting client retention and new business acquisition.

- Operational Disruption: Interruption of critical business functions, affecting service delivery and trading activities.

Passive Investing Dominance

The growing preference for passive investment strategies, especially Exchange Traded Funds (ETFs), poses a significant threat. This trend, which saw global ETF assets reach an estimated $10 trillion by the end of 2024, directly impacts Invesco's active management segment by intensifying fee competition and potentially dampening demand for its higher-fee products. While Invesco does offer ETFs, a faster-than-anticipated acceleration in this shift could challenge the core of its active management business.

This dominance of passive investing means that Invesco faces:

- Increased Fee Pressure: As more assets flow into low-cost passive funds, the pressure to lower fees on active strategies intensifies.

- Reduced Demand for Active Management: Investors increasingly question the value proposition of active funds when passive options deliver comparable or better returns at a lower cost.

- Competitive Landscape Shift: The rise of passive investing favors firms with a strong, low-cost ETF offering, potentially disadvantaging traditional active managers like Invesco if they cannot adapt quickly enough.

- Market Share Erosion: A sustained shift towards passive could lead to a gradual erosion of Invesco's market share in core investment areas.

The increasing popularity of passive investment strategies, particularly ETFs, presents a significant challenge to Invesco's core active management business. With global ETF assets projected to exceed $10 trillion by year-end 2024, this trend intensifies fee competition and could diminish demand for Invesco's higher-fee products. This shift necessitates a strategic response to maintain market relevance and profitability.

Invesco faces intensified fee pressure as a larger portion of assets moves into low-cost passive funds. This environment challenges the value proposition of active management, potentially leading to reduced demand for these strategies. The competitive landscape is shifting, favoring firms with robust, low-cost ETF offerings, which could result in market share erosion for traditional active managers if they do not adapt swiftly.

| Threat Category | Specific Risk | Impact on Invesco | Data Point/Trend |

| Competition | Rise of Passive Investing & ETFs | Intensified fee pressure, reduced demand for active management | Global ETF assets estimated to reach $10 trillion by end of 2024 |

| Technology | Fintech & Robo-Advisors | Market share erosion, pressure on fee revenue | Robo-advisor Betterment managing over $30 billion in assets by early 2024 |

| Economic | Global Downturns & Volatility | Decreased AUM, reduced profitability | Invesco's AUM approximately $1.5 trillion as of Q1 2024 |

| Regulatory | Evolving Regulations (e.g., ESG) | Increased compliance costs, operational complexity | Ongoing discussions on ESG disclosure requirements |

| Cybersecurity | Data Breaches & Cyberattacks | Financial losses, reputational damage, operational disruption | Reports of substantial rise in ransomware attacks on financial firms in 2023 |

SWOT Analysis Data Sources

This Invesco SWOT analysis is built upon a robust foundation of data, drawing from Invesco's official financial filings, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded view of the company's internal capabilities and external environment.