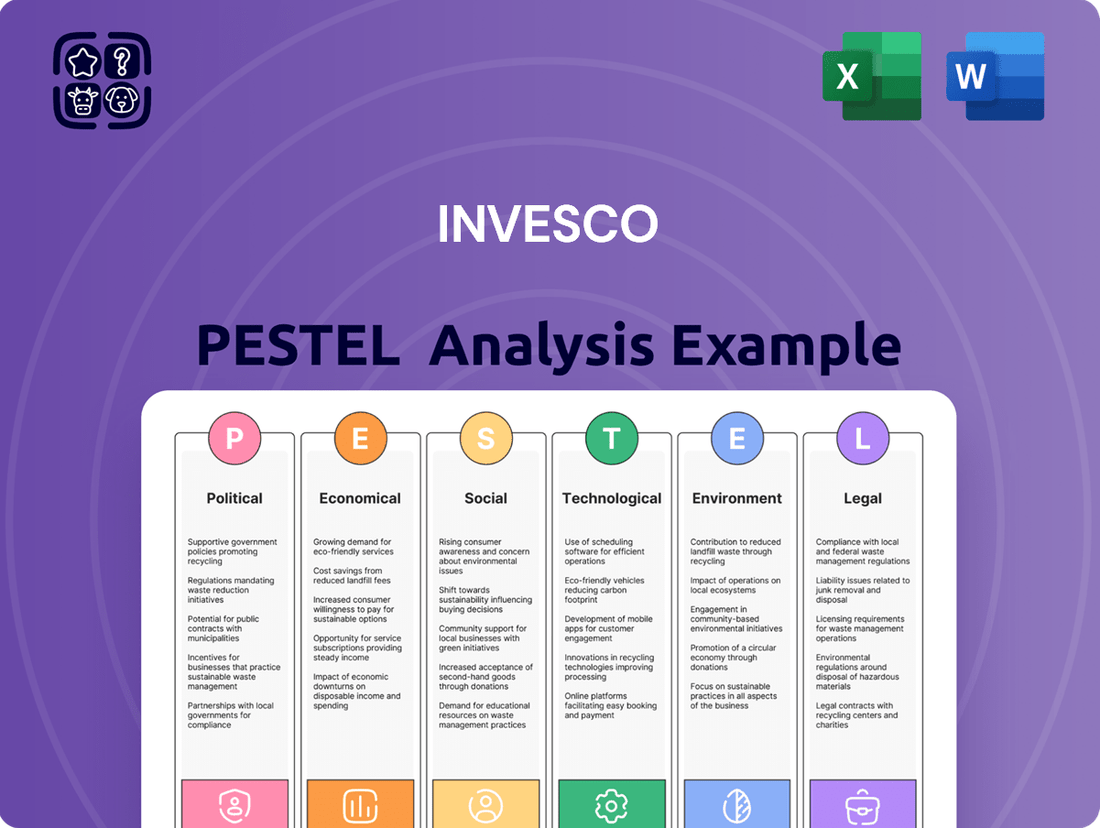

Invesco PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Invesco Bundle

Unlock the strategic advantages Invesco holds by understanding the political, economic, social, technological, legal, and environmental forces at play. Our expertly crafted PESTLE analysis provides the critical context needed to navigate the complex financial landscape. Gain the foresight to anticipate market shifts and capitalize on emerging opportunities. Download the full PESTLE analysis now and empower your strategic decision-making.

Political factors

Invesco, a global investment manager, navigates a complex web of government policies and regulations across its operating regions. For example, the US Federal Reserve's monetary policy decisions, such as interest rate adjustments in 2024 and anticipated moves in 2025, directly affect investment strategies and asset valuations.

Changes in fiscal policy, like tax reforms or government spending initiatives in key markets such as the UK or the EU, can significantly alter investment flows and market sentiment. These shifts influence Invesco's ability to manage assets and generate returns for its clients.

Moreover, evolving trade agreements and geopolitical stances, particularly concerning major economies like China and the US, create both opportunities and risks. For instance, a shift towards protectionist trade policies could lead to increased market volatility, impacting Invesco's global portfolio management.

Geopolitical tensions, such as ongoing conflicts and heightened diplomatic friction, pose significant challenges for global markets. For instance, the continued conflict in Eastern Europe, which began in early 2022, has had a ripple effect, contributing to energy price volatility and supply chain disruptions throughout 2024. These events make it difficult for companies like Invesco to accurately price assets and manage risk, as the duration and impact of such events are inherently unpredictable, often leading to swift and substantial market downturns.

Invesco must actively manage the multifaceted risks arising from geopolitical instability. Increased credit, market, operational, liquidity, and funding risks are all heightened during periods of global unrest. For example, in 2024, heightened tensions in the Middle East have led to increased shipping insurance costs and rerouting of trade, impacting global logistics and potentially affecting the performance of various investment portfolios managed by Invesco.

The financial services sector faces a dynamic regulatory landscape. Upcoming US elections in late 2024 present a significant variable, potentially altering agency leadership and enforcement priorities, which could impact Invesco's compliance strategies.

Recent judicial decisions have introduced a new layer of complexity by potentially curtailing the authority of federal regulators. This could slow or reshape the implementation of new rules, requiring firms like Invesco to adapt their operational frameworks to a less predictable environment.

ESG Policy and Anti-ESG Sentiment

The global ESG investment landscape is undergoing significant shifts, influenced by diverse political climates. Europe remains at the forefront of ESG adoption, with strong regulatory frameworks driving demand. Conversely, the US market is experiencing increasing fragmentation, partly due to political polarization and a rise in anti-ESG sentiment, which has led to legislative actions in some states. This creates a complex environment for asset managers like Invesco, requiring careful navigation of varying disclosure requirements and political pressures that can shape ESG product development and integration strategies.

Invesco must adapt to these diverging political influences. For instance, in 2023, several US states enacted laws or policies restricting ESG considerations in state pension funds, impacting billions in assets under management. Meanwhile, the EU's Sustainable Finance Disclosure Regulation (SFDR) continues to evolve, imposing stricter reporting obligations on financial market participants. This divergence means Invesco's approach to ESG integration and product offerings needs to be geographically tailored to comply with differing regulatory demands and to effectively serve investor preferences across these varied political landscapes.

- Divergent Regulatory Environments: Europe's robust ESG regulations contrast with the US's more fragmented and politically influenced approach to ESG investing.

- Anti-ESG Movement Impact: Political opposition in parts of the US has led to tangible actions against ESG integration, affecting investment strategies and product availability.

- Disclosure Challenges: Navigating varying disclosure requirements, such as the EU's SFDR and potential future US regulations, poses a significant operational challenge for global asset managers.

- Market Fragmentation: The US market's increasing division on ESG issues necessitates flexible strategies for Invesco to cater to different investor segments and state-level mandates.

International Trade and Protectionism

International trade policies, including tariffs and export controls, significantly influence the global investment management sector. For instance, sudden shifts in US trade policy, such as unexpected tariff announcements, can create market volatility and impede cross-border capital movements, making it harder for firms to plan and affecting investor confidence. Invesco, with its worldwide operations, must closely monitor these evolving trade dynamics to adjust its investment approaches.

These trade disruptions can lead to increased costs for financial services firms and create uncertainty in global markets. For example, the imposition of tariffs can raise the cost of doing business internationally, impacting asset management fees and the overall profitability of cross-border investments. The World Trade Organization reported a notable increase in trade-restrictive measures globally in 2023, underscoring the growing challenges.

- Trade Policy Volatility: Abrupt changes in trade agreements or the introduction of new tariffs can quickly alter the landscape for international investments, impacting asset valuations and capital flows.

- Protectionist Measures: An increase in protectionist policies can lead to higher operational costs for global financial firms and limit their ability to access certain markets or talent.

- Impact on Cross-Border Flows: Trade tensions can directly affect the movement of capital across borders, influencing foreign direct investment and portfolio investment patterns.

- Geopolitical Risk Premium: Escalating trade disputes often contribute to a higher geopolitical risk premium, which can depress global equity markets and increase demand for safe-haven assets.

Government policies and regulations are pivotal for Invesco's operations. Monetary policy shifts, like the US Federal Reserve's interest rate decisions in 2024 and anticipated adjustments in 2025, directly influence investment strategies and asset valuations. Fiscal policies, including tax reforms and government spending in key markets like the UK and EU, can significantly alter investment flows and market sentiment, impacting Invesco's asset management capabilities.

Geopolitical events and trade agreements create both opportunities and risks. For instance, the ongoing conflict in Eastern Europe has contributed to energy price volatility and supply chain disruptions throughout 2024, complicating asset pricing and risk management for global firms like Invesco. Heightened tensions in the Middle East in 2024 also increased shipping insurance costs and rerouted trade, affecting global logistics and investment portfolios.

The financial services sector faces a dynamic regulatory landscape, with upcoming US elections in late 2024 potentially altering agency leadership and enforcement priorities. Judicial decisions that may curtail federal regulator authority add another layer of complexity, requiring firms to adapt to a less predictable environment.

The divergence in ESG investment approaches, driven by political climates, presents challenges. While Europe maintains strong ESG regulations, the US market is fragmented due to political polarization and anti-ESG sentiment, leading to legislative actions in some states. This necessitates geographically tailored strategies for Invesco to comply with differing disclosure requirements and political pressures.

What is included in the product

This Invesco PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company, providing a comprehensive overview of its external operating environment.

A clean, summarized version of the full Invesco PESTLE analysis for easy referencing during meetings or presentations, alleviating the pain of sifting through lengthy reports.

Economic factors

The global economy is projected to see moderate growth in 2024 and 2025, with the IMF forecasting 3.2% in 2024 and 3.1% in 2025. Inflationary pressures are easing globally, though they remain a key concern for central banks. For instance, US inflation was around 3.4% in April 2024, down from its 2022 peak, while Eurozone inflation stood at 2.4% in April 2024. These trends directly impact asset valuations and the attractiveness of various investment classes.

Invesco's investment strategy must account for these global economic dynamics. Central banks, like the Federal Reserve and the European Central Bank, are navigating a delicate balance, aiming to curb inflation without triggering a recession. Their interest rate policies significantly influence borrowing costs and investment returns across markets.

Regional economic performance is varied, creating a complex landscape for investors. Emerging markets, for example, often exhibit higher growth potential but also greater volatility compared to developed economies. This necessitates a nuanced approach, with Invesco likely employing differentiated strategies to capitalize on opportunities while managing risks in diverse geographic areas.

Interest rates, a key lever for central banks like the US Federal Reserve, directly shape the landscape for fixed income investments and the overall cost of borrowing for businesses. These rates are pivotal in determining the returns on bonds and other debt instruments, influencing Invesco's portfolio management strategies.

Market sentiment is currently leaning towards potential interest rate reductions in major economies, including the United States, throughout 2024 and into 2025. This anticipation can significantly alter investment strategies as investors adjust their positions in anticipation of lower borrowing costs and potentially higher asset valuations.

For Invesco, fluctuations in interest rates pose a direct challenge to its revenue streams, particularly from money market funds and other fixed income products. High volatility or a sustained period of low rates can compress yields, impacting net income and overall profitability for the asset management firm.

Invesco's revenue is directly tied to its Assets Under Management (AUM). Strong market performance, as seen with the S&P 500’s rise of over 24% in 2023, coupled with healthy net inflows, fuels AUM growth. For instance, Invesco reported total AUM of $1.57 trillion as of March 31, 2024, indicating a robust market environment benefiting the firm.

Conversely, market downturns or net outflows can significantly depress AUM, directly impacting the investment management fees Invesco collects. The ongoing trend towards lower-cost passive investment vehicles, like ETFs, also exerts pressure on fee structures, leading to fee compression across the industry and for Invesco.

Alternative Investments and Private Markets Growth

Investors are actively pursuing diversification and potentially higher returns by allocating capital to alternative assets such as private debt, private equity, and real estate. This shift is driven by a search for uncorrelated returns and opportunities beyond traditional public markets.

The prominence of alternative investments in client portfolios is projected to grow significantly through 2025, with a notable increase in engagement from younger investor demographics. This suggests a long-term structural shift in investment preferences.

To effectively capture this expanding market, Invesco must strategically broaden its product offerings and deepen its expertise in these alternative asset classes. This includes developing robust investment strategies and building strong operational capabilities.

- Growing Demand: Data from Preqin in late 2024 indicated that global private equity fundraising reached $750 billion in the trailing twelve months, showcasing robust investor appetite.

- Younger Investor Interest: Surveys from 2024 revealed that over 60% of millennial investors expressed interest in adding alternative investments to their portfolios.

- Market Expansion: The global alternative investment market is forecast to reach $23 trillion by 2027, highlighting substantial growth potential.

- Invesco's Opportunity: Expanding into areas like private credit, where assets under management are expected to exceed $2.7 trillion by 2028, presents a significant opportunity for Invesco.

Mergers & Acquisitions (M&A) and Industry Consolidation

Mergers and acquisitions (M&A) activity in the investment and wealth management sectors has shown a moderated pace in the first half of 2024. Despite this, a resurgence of M&A is anticipated throughout 2025, especially in high-growth segments like private markets and artificial intelligence. This strategic consolidation is driven by firms aiming to build specialized expertise, expand into new territories, or achieve greater scale.

This ongoing industry consolidation directly shapes Invesco's competitive environment and its avenues for strategic expansion. For instance, the first quarter of 2024 saw a notable increase in deal value for financial services M&A compared to the previous year, indicating underlying momentum.

- Industry Consolidation: Investment and wealth management firms are actively merging or acquiring to gain market share and operational efficiencies.

- Growth Areas: Private markets and AI-focused investment strategies are key targets for M&A in 2025.

- Strategic Imperative: Firms are pursuing M&A to acquire niche capabilities, enter new markets, or achieve economies of scale.

- Competitive Impact: This trend influences Invesco's competitive positioning and potential for inorganic growth.

Global economic growth is projected to be moderate in 2024 and 2025, with the IMF forecasting 3.2% and 3.1% respectively. Inflation is easing but remains a focus for central banks, impacting interest rate decisions. These factors directly influence investment returns and asset valuations for firms like Invesco.

Interest rate policies by major central banks, such as the US Federal Reserve, are crucial. Anticipated rate reductions in 2024-2025 could boost asset prices and alter investment strategies, affecting Invesco's fixed income products and overall profitability.

The shift towards alternative investments, including private equity and debt, is a significant trend, with millennials showing increased interest. This growing demand, evidenced by $750 billion in global private equity fundraising in the twelve months leading up to late 2024, presents a substantial opportunity for Invesco to expand its offerings.

| Economic Indicator | 2024 Projection | 2025 Projection | Source |

|---|---|---|---|

| Global GDP Growth | 3.2% | 3.1% | IMF |

| US Inflation (April 2024) | 3.4% | N/A | Bureau of Labor Statistics |

| Eurozone Inflation (April 2024) | 2.4% | N/A | Eurostat |

| Global Private Equity Fundraising (TTM) | $750 Billion | N/A | Preqin (late 2024) |

Full Version Awaits

Invesco PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Invesco PESTLE Analysis provides a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting the company. You can be confident that the detailed insights and strategic analysis presented will be delivered to you without any changes.

Sociological factors

Demographic shifts significantly shape investor behavior. For instance, the growing influence of Gen Z and Millennials, who are projected to control substantial wealth in the coming years, is a key trend. These younger demographics, often digitally native, show a strong preference for technology and AI-driven financial advice, as well as a keen interest in alternative investments like private markets and cryptocurrencies. By 2030, Millennials are expected to inherit trillions in wealth, further amplifying their impact on investment trends.

Invesco must therefore adapt its strategies to align with these evolving preferences. This includes developing and promoting products that cater to the demand for digital-first advisory services and expanding access to private market opportunities. A proactive approach to incorporating AI in client interactions and investment solutions will be crucial for Invesco to remain competitive and capture the growing interest of these younger, tech-savvy investor segments.

Investors increasingly expect financial services tailored to their unique circumstances, moving away from one-size-fits-all solutions. This shift is particularly pronounced among high-net-worth and mass affluent segments, who are actively seeking personalized investment strategies and advice.

Invesco's strategy must therefore prioritize the development of customized offerings that cater to this demand for personalization. Blending human financial expertise with advanced technological capabilities will be crucial to delivering these bespoke solutions effectively.

For instance, as of early 2025, surveys indicate that over 60% of affluent investors are willing to pay a premium for personalized financial advice, highlighting the market's strong appetite for client-centric approaches in asset management.

Despite some regulatory hurdles and a recent ESG backlash, sustainable investing continues to be a significant focus for many asset managers. This trend is fueled by a strong belief in its long-term performance potential and the growing demand for greater regulatory disclosure around environmental, social, and governance (ESG) factors. For instance, a 2024 survey indicated that over 70% of institutional investors planned to increase their ESG allocations in the coming year.

Younger generations, specifically Millennials and Gen Z, are increasingly vocal about aligning their investments with their values. They show a greater willingness to support companies and products that demonstrate strong sustainability credentials and are often prepared to pay a premium for such offerings. Data from early 2025 suggests that assets under management in sustainable funds targeting these demographics have seen a year-over-year growth of 15%.

Invesco's dedication to sustainable investing, evidenced by its expanding suite of ESG-focused solutions, positions it well to capture this growing investor interest. By offering a diverse range of products that cater to these evolving preferences, Invesco can attract and retain clients who prioritize both financial returns and positive societal impact.

Workforce Dynamics and Talent Management

Demographic shifts are reshaping the workforce, potentially causing labor shortages and widening skills gaps. This necessitates a proactive approach to talent management for firms like Invesco to ensure they have the right people with the necessary expertise. The ability to attract and retain top investment professionals is crucial for maintaining Assets Under Management (AUM) and driving revenue growth.

Hybrid work models have become prevalent, with many asset management firms adopting them. However, there's a noticeable trend towards encouraging employees to return to the office more frequently. This recalibration of work arrangements can impact employee satisfaction and retention, requiring careful consideration by Invesco to balance flexibility with in-office collaboration.

- Labor Shortages: The aging population in many developed economies, coupled with lower birth rates, is contributing to a shrinking pool of available workers, potentially impacting Invesco's ability to fill critical roles.

- Skills Gaps: Rapid technological advancements in finance, such as AI and data analytics, are creating a demand for new skill sets that the current workforce may not possess, requiring significant investment in training and development.

- Hybrid Work Impact: While offering flexibility, the long-term effects of hybrid models on company culture, innovation, and employee productivity are still being assessed, posing a challenge for Invesco in optimizing its operational structure.

- Talent Retention: Invesco's success hinges on retaining its high-performing investment professionals. Reports from 2024 indicate that competitive compensation, career development opportunities, and a positive work environment are key factors in preventing talent attrition within the asset management sector.

Financial Literacy and Investor Education

Financial literacy remains a significant hurdle for many, despite a surge in interest from younger demographics. Invesco can leverage this by expanding access to educational resources and user-friendly investment tools, particularly targeting demographics historically underserved in finance.

For instance, data from 2024 indicated that a substantial portion of individuals, especially those under 30, felt they lacked the necessary knowledge to invest confidently. Invesco's initiatives in this area could directly address this gap.

- Growing Investor Interest: A notable increase in retail investor participation, particularly among Gen Z and Millennials, has been observed in 2024.

- Financial Literacy Gap: Surveys in early 2025 continue to highlight a persistent gap in financial knowledge, with many young adults reporting low confidence in investment decisions.

- Underserved Markets: Women and minority groups often exhibit lower financial literacy rates, presenting a key opportunity for targeted educational outreach.

- Digital Engagement: The increasing reliance on digital platforms for financial information and transactions in 2024-2025 means Invesco can effectively reach these demographics online.

Societal values are increasingly influencing investment decisions, with a growing emphasis on ethical and sustainable practices. This trend is particularly strong among younger generations who prioritize aligning their portfolios with their personal values. For instance, a 2024 survey revealed that over 70% of institutional investors planned to increase their ESG allocations, reflecting a broader market shift.

Invesco's commitment to ESG solutions aligns with this societal demand, positioning the firm to attract clients seeking both financial returns and positive impact. The growth in assets managed within sustainable funds targeting younger demographics, showing a 15% year-over-year increase by early 2025, underscores the market opportunity.

Financial literacy remains a critical concern, with many individuals, especially younger ones, lacking confidence in their investment knowledge. Invesco can capitalize on this by offering accessible educational resources and user-friendly tools, particularly for historically underserved groups.

The evolving nature of work, including the prevalence of hybrid models, presents both opportunities and challenges for talent management. Invesco must strategically balance flexibility with in-office collaboration to attract and retain top investment professionals amidst potential labor shortages and skills gaps, a critical factor for maintaining AUM and driving revenue.

Technological factors

Artificial Intelligence and Machine Learning are fundamentally reshaping investment management. These technologies are powering predictive analytics, streamlining decision-making, and significantly boosting operational efficiency. For instance, by 2025, a substantial shift is anticipated, with numerous firms transitioning from AI exploration to widespread integration, impacting core business operations. Generative AI, in particular, is poised to revolutionize sales and distribution strategies.

To thrive in this evolving landscape, Invesco must strategically implement AI solutions across its operations. This requires a strong foundation in data management and governance to ensure the effective and ethical deployment of these powerful tools. Successful adoption hinges on a firm's ability to manage vast datasets and maintain rigorous oversight.

The asset management sector is rapidly embracing digital and direct-to-consumer distribution. This shift is fueled by a desire for increased efficiency and evolving investor expectations. For Invesco, this digital evolution is key to lowering operational costs and expanding its reach cost-effectively, especially as younger demographics show a greater comfort with technology-driven financial guidance.

As financial services, including those offered by Invesco, continue their digital transformation, the threat of cyberattacks looms larger than ever. The increasing reliance on cloud computing, data analytics, and online client portals amplifies the potential attack surface.

Cyber incidents can inflict significant damage. For instance, a 2024 report indicated that the average cost of a data breach in the financial sector reached $5.9 million, a substantial increase from previous years. Such breaches can lead to operational disruptions, regulatory fines, and severe reputational damage, directly impacting Invesco's profitability and client confidence.

Consequently, investing in and maintaining robust cybersecurity infrastructure is not merely a compliance requirement but a strategic imperative for firms like Invesco. Effective measures are crucial for safeguarding sensitive client data, ensuring business continuity, and preserving the trust essential for long-term success in the competitive financial landscape.

Blockchain and Tokenization

Blockchain and tokenization are rapidly advancing, presenting significant opportunities for asset managers like Invesco. These technologies can unlock new investment products and allow investors greater diversification. For instance, the global tokenization market is projected to reach $16 trillion by 2030, according to some industry estimates, highlighting the immense potential for new asset classes.

Tokenization can also create novel return streams and improve portfolio construction. It allows for the fractional ownership of previously illiquid assets, such as real estate or fine art, making them accessible to a broader investor base and potentially enhancing capital raising for issuers. By mid-2024, several major financial institutions were actively piloting tokenized securities, indicating a growing mainstream adoption.

- Blockchain's potential to reduce transaction costs and settlement times in asset management is substantial, potentially improving efficiency for Invesco.

- Tokenization can democratize access to alternative assets, expanding Invesco's product offerings and investor reach.

- The regulatory landscape for tokenized assets is evolving, with significant developments expected in 2024-2025 that Invesco must monitor closely.

Data Analytics and Infrastructure

Invesco's ability to leverage advanced technologies like AI hinges on a strong data foundation. This includes robust data governance and control mechanisms to ensure accuracy and compliance. The financial services sector saw a significant uptick in data analytics investments, with global spending projected to reach over $300 billion by 2025, highlighting the industry's commitment to data-driven insights.

Building and maintaining the right infrastructure is crucial for Invesco. This allows for the effective management of diverse asset classes and the harnessing of data to inform strategic decisions. For instance, in 2024, many asset managers are investing heavily in cloud-based data platforms to enhance scalability and analytical capabilities, enabling more personalized client solutions.

- Data Governance is Key: Effective AI and technology adoption requires strong data governance and control frameworks.

- Rising Analytics Investment: The industry is increasing investment in data analytics, with global spending expected to exceed $300 billion by 2025.

- Infrastructure for Diversity: Invesco must build and maintain infrastructure to manage various asset classes and utilize data effectively.

- Informed Decision-Making: Robust data infrastructure enables better decision-making and the development of customized client solutions.

Technological advancements are rapidly transforming the asset management industry, demanding continuous adaptation from firms like Invesco. The integration of Artificial Intelligence and Machine Learning is becoming standard for enhancing predictive analytics and operational efficiency, with widespread adoption expected by 2025.

Digitalization is also a major force, enabling direct-to-consumer distribution models that lower costs and expand reach, particularly appealing to younger, tech-savvy investors. Furthermore, emerging technologies like blockchain and tokenization are creating new investment opportunities and improving transaction efficiency, with the tokenization market anticipated to reach significant valuations in the coming years.

However, this digital shift also magnifies cybersecurity risks, as evidenced by the substantial average cost of data breaches in the financial sector, projected to continue rising. Protecting sensitive data and ensuring business continuity through robust cybersecurity measures is therefore paramount for maintaining client trust and operational integrity.

| Technology | Impact on Asset Management | Key Data/Projections |

|---|---|---|

| AI & Machine Learning | Enhanced analytics, operational efficiency, predictive capabilities | Widespread integration expected by 2025; Generative AI to revolutionize sales. |

| Digitalization & Direct-to-Consumer | Lower operational costs, expanded reach, personalized client solutions | Growing comfort among younger demographics with tech-driven guidance. |

| Blockchain & Tokenization | New investment products, improved transaction efficiency, fractional ownership | Global tokenization market projected to reach $16 trillion by 2030; Pilots by major institutions in 2024. |

| Cybersecurity | Risk mitigation, data protection, client trust maintenance | Average cost of data breach in finance: ~$5.9 million (2024 report). |

Legal factors

Invesco navigates a labyrinth of global financial regulations, a landscape constantly reshaped by evolving oversight. For instance, the European Union's Markets in Financial Instruments Directive II (MiFID II), fully implemented in 2018, significantly increased transparency and reporting requirements across the investment management sector, impacting Invesco's operational costs and product development.

The push for enhanced disclosure and new rules, such as those governing open banking and overdraft fees, demands continuous adaptation. In 2023, the U.S. Consumer Financial Protection Bureau (CFPB) continued its focus on overdraft fees, proposing new rules that could impact fee structures for financial institutions, a factor Invesco must consider in its product offerings and client agreements.

Maintaining strict compliance with these ever-changing regulations is paramount for Invesco to avoid substantial penalties and, crucially, to retain its operating licenses. Failure to adapt could lead to significant financial repercussions and reputational damage, impacting investor confidence.

In 2025, the effectiveness of ESG regulations is under intense scrutiny. Key compliance reports under the Corporate Sustainability Reporting Directive (CSRD) and the Sustainable Disclosure Regulation (SDR) are due, alongside the ongoing implementation of the European Securities and Markets Authority's (ESMA) naming rule for sustainable funds. This period marks a critical juncture for Invesco and its peers to demonstrate adherence to evolving environmental, social, and governance standards.

Invesco faces increasing pressure to substantiate its ESG-related claims and commitments. To avoid accusations of greenwashing, the company must provide clear, verifiable evidence of its sustainable practices. This includes transparent reporting on how ESG factors are integrated into investment strategies and product offerings.

Furthermore, regulatory frameworks are increasingly mandating enhanced disclosures concerning nature and biodiversity. This trend reflects a growing awareness of the interconnectedness between financial markets and ecological systems, requiring companies like Invesco to provide more granular data on their environmental impact and dependencies.

Consumer protection laws, like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), directly influence Invesco's data handling and client communication strategies. These regulations, increasingly stringent globally, mandate robust data privacy measures and transparent financial disclosures, impacting how Invesco collects, stores, and utilizes client information, especially as digital and AI tools become more prevalent in client interactions.

Invesco's adherence to these evolving consumer protection frameworks is paramount for maintaining client trust and brand reputation. For instance, the CCPA, which grants California consumers rights over their personal data, requires companies to be explicit about data collection and usage, a principle that extends to financial services. Failure to comply can result in significant fines, as seen with other financial institutions facing penalties for data breaches and privacy violations.

Anti-Trust and Competition Laws

The asset management sector is experiencing a notable trend of consolidation, which naturally draws the attention of anti-trust and competition regulators. Invesco's strategic maneuvers, particularly its engagement in mergers and acquisitions (M&A), must be carefully navigated within these legal boundaries to uphold fair market practices and ensure overall market integrity.

For instance, the global asset management industry saw significant M&A activity in 2023 and early 2024, with deals often scrutinized for their potential impact on market concentration. Regulators in major markets like the US and EU are increasingly focused on preventing anti-competitive behavior that could harm investors through higher fees or reduced choice.

- Regulatory Scrutiny: Increased M&A activity in asset management heightens the risk of anti-trust investigations.

- Market Concentration: Regulators monitor deals to prevent excessive market share accumulation by single entities.

- Fair Competition: Invesco must ensure its M&A strategies do not stifle competition or create monopolies.

- Compliance Costs: Navigating anti-trust regulations can involve significant legal fees and potential delays for transactions.

Intellectual Property Protection

Invesco's reliance on technological advancements, especially in AI and digital platforms, makes robust intellectual property (IP) protection paramount. This encompasses safeguarding patents for proprietary AI algorithms, software, trade secrets, and copyrighted materials. In the rapidly evolving financial technology landscape, strong IP rights are essential for Invesco to maintain its market differentiation and competitive advantage.

The firm's investment in R&D, which saw significant allocation in 2024, directly fuels the creation of valuable IP. For instance, Invesco's development of advanced data analytics tools, powered by AI, requires vigilant protection against infringement. Failure to adequately protect these innovations could erode Invesco's unique selling propositions and impact its long-term profitability.

- Patents: Protecting novel AI algorithms and financial modeling techniques developed by Invesco.

- Copyrights: Safeguarding proprietary software code and digital platform interfaces.

- Trade Secrets: Maintaining confidentiality of internal processes and proprietary data sets crucial for algorithmic trading and client insights.

- Enforcement: Actively monitoring and pursuing legal action against any unauthorized use or replication of Invesco's intellectual property.

Invesco must navigate evolving ESG disclosure mandates, with 2025 deadlines for CSRD and SDR compliance, and ESMA's naming rule for sustainable funds. Demonstrating verifiable ESG claims is critical to combat greenwashing, as regulators increasingly demand transparency on nature and biodiversity impacts.

Environmental factors

Accelerating climate change, with phenomena like the record-breaking global average temperatures in 2023, presents significant financially material risks to investments. These risks manifest through extreme weather events, impacting supply chains, asset values, and operational continuity for portfolio companies.

Invesco, as an investment manager, must integrate climate risk assessment into its governance and investment strategies, focusing on both mitigation and adaptation. This involves understanding how climate change affects portfolio companies, for example, through increased insurance costs or regulatory pressures, and actively engaging with them on sustainability improvements.

Invesco views ESG and sustainability integration as fundamental to long-term value creation and risk management, aligning with client objectives. They are actively expanding their sustainable investment offerings across diverse asset classes, tailoring solutions to meet evolving client demands.

The market for labelled bonds, such as green bonds, is experiencing significant growth and increased transparency, bolstered by new regulatory frameworks. For instance, the global green bond market issuance was projected to reach over $1 trillion in 2024, a substantial increase from previous years, reflecting growing investor appetite for sustainable assets.

The growing global emphasis on sustainability is driving significant concern over the responsible use of natural resources and the shift towards a circular economy model. This transition is fundamentally reshaping how businesses operate and how investors allocate capital.

Invesco's investment strategies are likely to increasingly favor companies demonstrating strong resource efficiency and a commitment to circularity. For instance, the World Economic Forum projects that adopting circular economy principles could unlock $4.5 trillion in economic value by 2030, presenting a clear opportunity for growth.

By identifying and investing in such forward-thinking companies, Invesco can aim to capitalize on the upside potential of the green transition while simultaneously mitigating long-term risks associated with dwindling resource availability and escalating commodity prices.

Nature and Biodiversity Considerations

Investor focus on nature and biodiversity is sharpening, spurred by new regulations and frameworks such as the Taskforce on Nature-related Financial Disclosures (TNFD), the Corporate Sustainability Reporting Directive (CSRD), and the Sustainable Finance Disclosure Regulation (SFDR). This heightened awareness means that Invesco's investment choices will likely lean more towards industries that actively contribute to preserving ecosystems and promoting sustainable land management practices.

The global economic impact of nature loss is significant, with the World Economic Forum estimating that over half of the world's GDP, or $44 trillion, is moderately or highly dependent on nature. This underscores the financial imperative for investors to consider biodiversity risks and opportunities.

- TNFD Adoption: As of early 2025, a growing number of financial institutions are signaling their intent to adopt TNFD recommendations, indicating a shift towards integrating nature-related risks into their investment analysis.

- Biodiversity Credits Market: The market for biodiversity credits is nascent but projected to grow substantially, potentially reaching billions of dollars by 2030, offering new avenues for investing in nature restoration.

- Corporate Reporting: Under CSRD, companies in the EU are increasingly required to report on their environmental impacts, including biodiversity, providing investors with more granular data for decision-making.

Regulatory and Reporting on Environmental Impact

Companies are facing a growing wave of regulations demanding greater transparency about their environmental impact. For instance, the Corporate Sustainability Reporting Directive (CSRD) in Europe, which began applying to large companies in 2024, requires extensive disclosure on environmental matters. Similarly, the Sustainable Disclosure Regulation (SDR) in the UK is enhancing reporting standards for financial products.

This regulatory shift directly impacts Invesco. The firm must ensure it has robust systems to gather, analyze, and report reliable environmental data, both for its own operational footprint and for the companies it invests in. Access to high-quality, verifiable environmental information is crucial for Invesco to meet these new compliance obligations and to make sound investment decisions based on a clear understanding of sustainability risks and opportunities.

- Increased Disclosure Burden: Regulations like CSRD and SDR mandate more detailed environmental reporting.

- Data Reliability is Key: Invesco needs access to trustworthy environmental data for compliance.

- Informed Decision-Making: Transparent environmental data supports better investment analysis.

- Operational and Investment Impact: Reporting requirements affect both Invesco's operations and its investment strategies.

Environmental factors are increasingly shaping investment landscapes, with climate change and resource scarcity posing material risks. For instance, 2023 saw record global temperatures, highlighting the financial implications of extreme weather on supply chains and asset values.

The push for sustainability is driving growth in areas like green bonds, with global issuance projected to exceed $1 trillion in 2024, signaling strong investor demand for eco-friendly assets.

Investor focus is also shifting towards nature and biodiversity, influenced by frameworks like the TNFD. The World Economic Forum estimates that over half of global GDP, or $44 trillion, is dependent on nature, underscoring the financial risks of its degradation.

New regulations such as the CSRD in Europe, effective for large companies from 2024, mandate greater environmental transparency, requiring firms like Invesco to enhance their data collection and reporting capabilities.

| Factor | 2024/2025 Data Point | Implication for Invesco |

|---|---|---|

| Climate Change Impact | Record global temperatures in 2023; increased frequency of extreme weather events. | Risk assessment for portfolio companies, focus on resilience and adaptation strategies. |

| Sustainable Finance Market | Global green bond market projected to exceed $1 trillion in 2024. | Expansion of sustainable investment offerings, capitalizing on growing investor demand. |

| Nature and Biodiversity | $44 trillion of global GDP depends on nature (WEF estimate). | Integration of nature-related risks and opportunities into investment analysis, engagement with TNFD principles. |

| Regulatory Transparency | CSRD implementation for large companies from 2024; SDR in the UK. | Need for robust environmental data management and reporting for compliance and informed decision-making. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously constructed using data from reputable sources including the World Bank, IMF, and various national statistical offices. We also incorporate insights from leading market research firms and industry-specific publications to ensure a comprehensive view.