Invesco Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Invesco Bundle

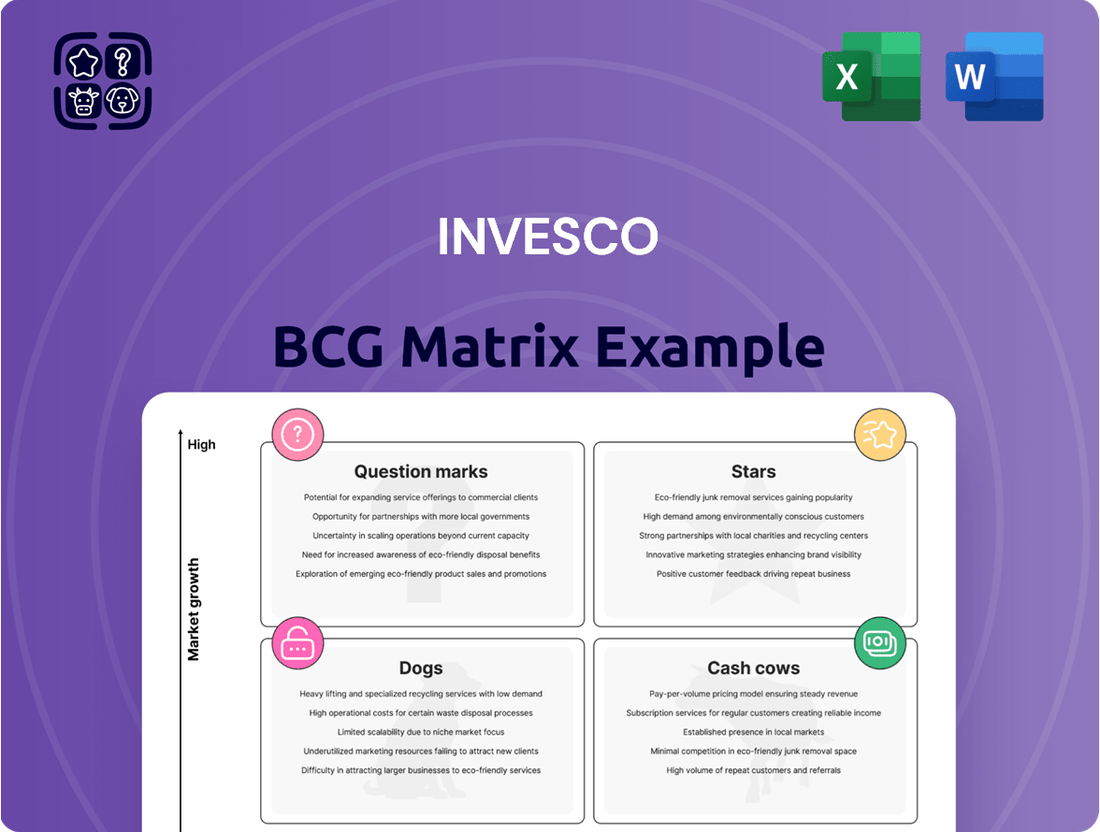

Uncover the strategic positioning of Invesco's product portfolio with this insightful BCG Matrix preview. See which offerings are thriving "Stars," which are reliable "Cash Cows," and which require a closer look as "Question Marks." Purchase the full version for a comprehensive analysis, detailed quadrant placements, and actionable strategies to optimize your investment decisions and drive future growth.

Stars

The Invesco QQQ Trust (QQQ) firmly occupies the 'Star' quadrant of the BCG Matrix. Its status is cemented by its substantial market share as one of the most actively traded ETFs in the United States, reflecting significant investor demand. QQQ's strategic focus on the Nasdaq-100 index, which comprises innovative and high-growth technology and biotech companies, positions it for continued expansion.

QQQ has demonstrated a consistent ability to outperform broader market indices, such as the S&P 500, over extended timeframes. This strong performance underscores its high growth potential within a dynamic and evolving market landscape. For instance, as of early 2024, QQQ has delivered impressive year-to-date returns, often surpassing broader market averages, a trend that has been observed across multiple years.

Further validating its 'Star' status are its accolades, including a coveted 5-star rating from Morningstar, a testament to its historical performance and risk-adjusted returns. With a track record spanning over 25 years, QQQ has established itself as a resilient and leading investment vehicle, consistently capturing investor interest in growth-oriented sectors.

Invesco's exchange-traded funds (ETFs) and index strategies are a clear 'Star' in their business model, showing robust growth and increasing popularity among investors. This segment consistently attracts significant long-term capital, bolstering Invesco's overall assets under management.

The company's commitment to this area is evident in its continuous expansion of ETF products. This includes a growing suite of actively managed ETFs and those incorporating environmental, social, and governance (ESG) factors, signaling a strategic push into high-demand markets.

Invesco's Fundamental Fixed Income segment is positioned as a Star, fueled by robust net inflows and a favorable outlook for the bond market heading into 2025. The firm identifies compelling opportunities within this asset class, anticipating sustained strong demand as growth, inflation, and monetary policy continue to moderate.

This positive trajectory is further bolstered by Invesco's strategic product development, evidenced by recent launches of actively managed fixed income ETFs. These new offerings highlight the company's dedication to expanding its footprint and capturing growth within the fixed income space.

Invesco Alerian Galaxy Crypto Economy ETF (SATO)

The Invesco Alerian Galaxy Crypto Economy ETF (SATO) is classified as a 'Star' within the BCG Matrix due to its significant presence in the burgeoning blockchain and cryptocurrency sector. This classification is supported by its impressive year-to-date performance in 2024, demonstrating strong growth potential.

SATO offers investors diversified exposure to companies actively participating in the digital asset ecosystem. This includes firms engaged in cryptocurrency mining, the development of blockchain infrastructure, and those involved in the trading and holding of cryptocurrencies.

The ETF's robust performance underscores the increasing investor appetite and the substantial opportunities present in the digital asset market. This positions SATO as a key player in a high-growth, emerging industry.

- High Growth Potential: The ETF's exposure to the rapidly expanding blockchain and cryptocurrency market, evidenced by strong 2024 year-to-date returns, places it in a high-growth category.

- Diversified Exposure: SATO provides access to a range of companies within the crypto economy, including miners, infrastructure providers, and digital asset traders, mitigating single-asset risk.

- Market Leadership: Its performance indicates a strong position in an emerging market, reflecting significant investor interest and the increasing mainstream adoption of digital assets.

- Emerging Market Dynamics: The ETF captures the dynamic nature of the digital asset space, characterized by innovation and evolving market trends.

ESG-focused ETFs (e.g., Invesco ESG NASDAQ 100 ETF)

Invesco ESG-focused ETFs, exemplified by the Invesco ESG NASDAQ 100 ETF, are considered Stars within the BCG Matrix. This classification stems from their operation in the rapidly expanding sustainable investing sector, a market anticipated to reach $53 trillion by 2025. These ETFs are well-positioned to capitalize on the growing investor appetite for environmentally and socially conscious investment vehicles, reflecting a significant market opportunity.

Invesco's commitment to expanding its ESG product suite underscores its strategic alignment with prevailing market trends and evolving investor preferences. This proactive approach ensures that their offerings remain competitive and relevant in a dynamic financial landscape.

- Market Growth: The global sustainable investment market is projected to reach $53 trillion by 2025, indicating a substantial growth runway for ESG-focused ETFs.

- Investor Demand: There is a demonstrable and increasing demand from investors seeking to align their portfolios with environmental, social, and governance principles.

- Strategic Positioning: ETFs like the Invesco ESG NASDAQ 100 ETF are strategically placed to benefit from this demand by offering exposure to companies that meet ESG criteria.

- Product Development: Invesco's ongoing enhancement of its ESG offerings demonstrates a clear strategy to capture market share in this high-growth segment.

Invesco's exchange-traded funds (ETFs) and index strategies are a clear Star in their business model, showing robust growth and increasing popularity among investors. This segment consistently attracts significant long-term capital, bolstering Invesco's overall assets under management.

The company's commitment to this area is evident in its continuous expansion of ETF products. This includes a growing suite of actively managed ETFs and those incorporating environmental, social, and governance (ESG) factors, signaling a strategic push into high-demand markets.

The Invesco QQQ Trust (QQQ) firmly occupies the 'Star' quadrant of the BCG Matrix. Its status is cemented by its substantial market share as one of the most actively traded ETFs in the United States, reflecting significant investor demand. QQQ's strategic focus on the Nasdaq-100 index, which comprises innovative and high-growth technology and biotech companies, positions it for continued expansion.

QQQ has demonstrated a consistent ability to outperform broader market indices, such as the S&P 500, over extended timeframes. This strong performance underscores its high growth potential within a dynamic and evolving market landscape. For instance, as of early 2024, QQQ has delivered impressive year-to-date returns, often surpassing broader market averages, a trend that has been observed across multiple years.

| Invesco Product/Strategy | BCG Category | Key Performance Indicator (2024 Data) | Market Trend | Rationale |

| Invesco QQQ Trust (QQQ) | Star | Strong Year-to-Date Returns (often outperforming S&P 500) | High demand for tech and growth stocks | Dominant market share, consistent outperformance, focus on innovative sectors. |

| Invesco ESG-focused ETFs | Star | Growing AUM in sustainable investing segment | Global sustainable investment market projected to reach $53 trillion by 2025 | Capitalizes on increasing investor demand for ESG-aligned investments. |

| Invesco Alerian Galaxy Crypto Economy ETF (SATO) | Star | Impressive Year-to-Date Performance | Emerging and high-growth digital asset market | Diversified exposure to blockchain and cryptocurrency companies. |

| Invesco Fundamental Fixed Income | Star | Robust Net Inflows | Favorable outlook for bond market, moderating growth and inflation | Strategic product development in actively managed fixed income ETFs. |

What is included in the product

The Invesco BCG Matrix offers a strategic framework to analyze a company's product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth.

This analysis guides investment decisions, suggesting where to invest, hold, or divest to optimize resource allocation and maximize profitability.

The Invesco BCG Matrix offers a clear, one-page overview, instantly relieving the pain of complex portfolio analysis.

Cash Cows

Invesco's established multi-asset solutions, especially those with a long history of steady returns and substantial assets under management (AUM), are prime examples of Cash Cows within the BCG framework. These offerings, such as their balanced funds or income-focused portfolios, consistently generate significant fee-based revenue for Invesco. For instance, as of early 2024, Invesco's overall AUM stood at hundreds of billions of dollars, with a significant portion attributed to these mature product lines.

Many of Invesco's actively managed mutual funds, particularly those with substantial assets and a consistent track record, function as cash cows within the BCG matrix. These funds, despite market shifts towards lower fees, continue to be lucrative due to their large, loyal client bases and established reputations, generating significant management fees. For instance, as of late 2024, Invesco's actively managed equity funds collectively managed hundreds of billions of dollars, contributing substantially to the firm's revenue stream with relatively low ongoing marketing spend.

Invesco's institutional client relationships are a prime example of a Cash Cow. These long-standing partnerships, often spanning decades, are characterized by substantial and stable asset bases, leading to predictable, recurring advisory fees. For instance, as of Q1 2024, Invesco reported that its institutional segment managed a significant portion of its total AUM, contributing consistently to revenue.

While the growth rate in attracting new institutional clients might be moderate compared to other segments, the deep-rooted nature of these existing relationships ensures reliable and substantial revenue streams. This stability allows Invesco to leverage these established partnerships for consistent profitability.

Developed Fixed Income Offerings (excluding high-growth areas)

Invesco's developed fixed income offerings, excluding high-growth areas, function as cash cows within its product portfolio. These mature, established products generate steady revenue streams, contributing significantly to the firm's profitability without demanding substantial new investment.

These offerings provide stable income and capital preservation, appealing to investors seeking reliable returns. For instance, Invesco manages a substantial portion of its assets within these less dynamic, yet profitable, fixed income segments.

- Mature Fixed Income Products: These are Invesco's well-established bond funds and strategies that have a long track record and consistent performance.

- Consistent Income Generation: They provide predictable interest payments to investors, forming a reliable revenue source for Invesco.

- Low Capital Intensity: Unlike growth-oriented products, these cash cows require minimal new capital infusion to maintain their market position and profitability.

- Global Asset Management: Invesco's broader fixed income platform, which includes these cash cows, manages over $491 billion globally as of early 2024.

Global Distribution Network

Invesco's expansive global distribution network acts as a significant Cash Cow. This robust infrastructure allows Invesco to efficiently deliver its investment products and services to a wide array of clients across numerous geographic regions.

The established presence in over 20 countries underpins this consistent revenue generation, as it leverages existing channels without demanding considerable new capital outlays for market penetration. This allows for stable and predictable income streams.

- Global Reach: Operates in over 20 countries, ensuring broad client access.

- Efficient Distribution: Leverages established infrastructure for cost-effective product delivery.

- Stable Revenue: Generates consistent income with minimal need for new investment.

- Client Diversification: Serves a varied client base across different markets.

Invesco's established multi-asset solutions, particularly those with a long history of steady returns and substantial assets under management (AUM), are prime examples of Cash Cows within the BCG framework. These offerings, such as their balanced funds or income-focused portfolios, consistently generate significant fee-based revenue for Invesco. For instance, as of early 2024, Invesco's overall AUM stood at hundreds of billions of dollars, with a significant portion attributed to these mature product lines.

Many of Invesco's actively managed mutual funds, particularly those with substantial assets and a consistent track record, function as cash cows within the BCG matrix. These funds continue to be lucrative due to their large, loyal client bases and established reputations, generating significant management fees. For instance, as of late 2024, Invesco's actively managed equity funds collectively managed hundreds of billions of dollars, contributing substantially to the firm's revenue stream with relatively low ongoing marketing spend.

Invesco's institutional client relationships are a prime example of a Cash Cow. These long-standing partnerships, often spanning decades, are characterized by substantial and stable asset bases, leading to predictable, recurring advisory fees. For instance, as of Q1 2024, Invesco reported that its institutional segment managed a significant portion of its total AUM, contributing consistently to revenue.

Invesco's developed fixed income offerings, excluding high-growth areas, function as cash cows within its product portfolio. These mature, established products generate steady revenue streams, contributing significantly to the firm's profitability without demanding substantial new investment. For instance, Invesco manages a substantial portion of its assets within these less dynamic, yet profitable, fixed income segments.

| Product Type | BCG Classification | Key Characteristics | 2024 Data Point |

|---|---|---|---|

| Multi-Asset Solutions | Cash Cow | Steady returns, substantial AUM, fee-based revenue | Significant portion of hundreds of billions in total AUM |

| Actively Managed Equity Funds | Cash Cow | Large client base, established reputation, consistent track record | Hundreds of billions in AUM, substantial revenue contribution |

| Institutional Client Relationships | Cash Cow | Long-standing partnerships, stable asset bases, recurring advisory fees | Significant portion of total AUM managed by institutional segment |

| Developed Fixed Income Offerings | Cash Cow | Mature products, predictable income, low capital intensity | Substantial assets managed in less dynamic, profitable segments |

Full Transparency, Always

Invesco BCG Matrix

The Invesco BCG Matrix report you are previewing is the identical, fully-formatted document you will receive upon purchase. This means you'll gain immediate access to a professionally designed strategic tool, ready for immediate application in your business planning. No watermarks, no placeholder text—just the complete analysis you need to make informed decisions about your product portfolio.

Dogs

Underperforming legacy equity funds, characterized by a history of failing to beat their benchmarks or competitors and facing net outflows, are prime candidates for the 'Dog' category in the Invesco BCG Matrix. These funds typically operate in a saturated market where attracting new investors is a significant challenge, leading to a low market share.

As of early 2024, many actively managed equity funds have struggled to justify their fees, with a significant portion failing to outperform passive index funds. For instance, data from S&P Dow Jones Indices consistently shows a majority of active funds underperforming their benchmarks over longer periods. This persistent underperformance, coupled with declining assets under management due to investor redemptions, solidifies their position as 'Dogs'.

Investment strategies that are no longer aligned with current market trends or investor preferences, thus possessing low market share and growth potential, can be categorized as 'Dogs' within the Invesco BCG Matrix framework. These might include highly specialized funds that have seen their appeal wane or those concentrated in sectors experiencing secular decline. For instance, funds solely focused on legacy print media or specific types of fossil fuels, which have faced declining revenues and investor interest, could be considered 'Dogs'.

These 'Dog' strategies often experience minimal inflows and may require disproportionate resources to maintain, leading to stagnant or negative returns. In 2024, the shift towards ESG (Environmental, Social, and Governance) investing means that strategies not incorporating these principles, or those heavily invested in industries with poor ESG ratings, are increasingly falling into this category. For example, a fund with significant holdings in companies with high carbon emissions and poor labor practices might struggle to attract new capital and could be divested by existing investors seeking more sustainable options.

High-cost, low-value active funds, often characterized by expense ratios exceeding 1% and consistently underperforming their benchmarks, are increasingly becoming a concern. For example, data from 2024 indicates that a significant portion of actively managed equity funds failed to beat their passive counterparts, with many charging fees that eat into already modest returns. These funds can be seen as dogs in the Invesco BCG Matrix, struggling to attract new assets and facing client attrition due to their inability to justify their fees.

In an investment landscape where passive strategies, like index funds and ETFs, offer broad market exposure at a fraction of the cost, these high-fee, underperforming active funds are particularly vulnerable. By mid-2024, the average expense ratio for actively managed funds remained substantially higher than for passive options, creating a significant hurdle for active managers to overcome. This cost disadvantage, coupled with a failure to deliver alpha, positions these funds as potential cash traps, draining investor capital without providing commensurate value.

Some Traditional Mutual Funds Facing ETF Headwinds

Certain traditional actively managed mutual funds are indeed facing significant headwinds as investors increasingly favor the lower fees and tax efficiency of Exchange Traded Funds (ETFs). This shift is particularly pronounced in categories where passive indexing has proven highly effective.

While the broader mutual fund industry is not a 'Dog' in the BCG matrix sense, specific legacy funds struggling with outflows and declining Assets Under Management (AUM) in a low-growth environment can be categorized as such. For instance, by the end of 2023, actively managed U.S. equity funds experienced net outflows totaling $107 billion, a stark contrast to the $320 billion in net inflows into U.S. equity ETFs during the same period.

- Outflows in Active Equity Funds: By the end of 2023, actively managed U.S. equity funds saw outflows of $107 billion.

- ETF Inflows: Concurrently, U.S. equity ETFs attracted $320 billion in net inflows in 2023.

- Fee Compression: The persistent demand for lower expense ratios is a primary driver of this reallocation away from traditional mutual funds.

Select International Market Funds with Limited Appeal

Funds targeting niche international markets with persistent economic downturns or political turmoil often exhibit low investor demand and subpar returns. These are the "Dogs" in the Invesco BCG Matrix framework. For instance, a fund focused on a small emerging market experiencing hyperinflation, like Zimbabwe in recent years, would likely fall into this category.

Such funds typically possess a low market share within their investment universe and face dim growth prospects. Consider a hypothetical fund specializing in a single, politically unstable nation that has seen its GDP contract by an average of 5% annually over the past five years. This scenario points towards divestiture or a substantial strategic overhaul.

- Low Market Share: Funds in this category might hold less than 1% of assets under management within their specific regional or sector focus.

- Limited Growth Prospects: Economic forecasts for these markets often predict sub-2% annual GDP growth for the next decade, hindering fund performance.

- Poor Historical Returns: Over the last three years, such funds may have delivered negative annualized returns, significantly underperforming broader market indices.

- Reduced Investor Interest: Flows into these funds have likely been negative for several consecutive quarters, indicating a lack of investor confidence.

Funds categorized as 'Dogs' in the Invesco BCG Matrix are those with low market share and low growth potential, often characterized by underperformance and investor outflows. These are typically legacy products or strategies that no longer resonate with current market demands or investor preferences.

In 2024, the persistent underperformance of many actively managed equity funds, failing to beat benchmarks and facing net outflows, solidifies their 'Dog' status. For instance, S&P Dow Jones Indices data consistently shows a majority of active funds lagging their benchmarks over time, a trend exacerbated by high fees that erode already modest returns.

Strategies misaligned with evolving market trends, such as those heavily invested in declining sectors or lacking ESG integration, also fall into the 'Dog' category. Funds focused on legacy print media or those with significant holdings in high-carbon industries, for example, face dwindling investor interest and capital, as seen with the shift towards sustainable investing throughout 2024.

The stark contrast between outflows from active equity funds and inflows into ETFs in 2023 highlights this trend, with active U.S. equity funds experiencing $107 billion in outflows while U.S. equity ETFs attracted $320 billion. This reallocation underscores the challenge for 'Dog' funds to attract new capital and maintain relevance in a cost-conscious market.

| Category | Characteristics | 2024 Outlook | Example | Supporting Data |

| Dogs | Low Market Share, Low Growth Potential, Underperformance, Outflows | Continued pressure from passive investing and fee compression | Legacy actively managed equity funds, niche international funds in struggling economies | Active U.S. equity funds saw $107B outflows in 2023; ETFs attracted $320B. Majority of active funds underperformed benchmarks in 2024. |

Question Marks

Invesco's recent launches, like the Core Fixed Income ETF (GTOC) and Intermediate Municipal ETF (INTM), signify a strategic push into active fixed income ETFs. As of early 2024, these newer products are still building their presence in a competitive landscape.

These ETFs are designed to offer active management in specific fixed income segments, aiming to capture investor interest beyond passive strategies. Their success will depend on demonstrating value through performance and attracting substantial assets under management (AUM) to compete effectively.

Invesco's foray into spot digital asset ETFs, including the Invesco Galaxy Bitcoin ETF (BTCO) and Invesco Galaxy Ethereum ETF (QETH), alongside the anticipated Invesco Galaxy Solana ETF, positions them in a rapidly expanding yet inherently volatile sector. These products represent Invesco's strategic move to capture a share of the burgeoning digital asset market.

Operating within this high-growth, nascent environment presents both significant opportunities and considerable risks. While these ETFs offer investors a regulated avenue to gain exposure to an emerging asset class with substantial upside potential, their long-term success hinges on navigating market volatility and evolving regulatory landscapes. For instance, as of early 2024, Bitcoin ETFs saw substantial inflows, demonstrating investor appetite for regulated digital asset exposure.

Invesco is actively pursuing growth in private markets and alternative investments, recognizing their significant potential. A key move is their partnership with Barings, aimed at expanding their U.S. wealth management channels into these less traditional asset classes.

While these sectors offer substantial growth prospects, Invesco's current market share in private markets may be smaller compared to its established public market offerings. This strategic push requires considerable capital allocation and client engagement to establish these initiatives as future high-performing 'Stars' in their product portfolio.

New Thematic ETFs Beyond Established Areas

New thematic ETFs venturing into highly specific or emerging areas, such as the burgeoning fields of quantum computing or advanced materials, can be considered as 'Question Marks' within the Invesco BCG Matrix framework. These funds, while innovative, typically begin with a low market share due to their niche focus and the need to educate investors on their potential. For instance, ETFs targeting specific sub-sectors of AI or the circular economy are examples of this category.

The success of these 'Question Mark' ETFs hinges on their ability to gain traction and demonstrate strong performance in their respective nascent markets. For example, a thematic ETF focused on the development of lab-grown meat, a relatively new area, would fall into this classification. Its growth trajectory will depend on investor education and the overall adoption rate of the underlying technology or trend it represents.

- Emerging Themes: ETFs focusing on areas like space exploration technology or the metaverse are prime examples of 'Question Marks'.

- Low Initial Market Share: These funds often start with minimal assets under management, reflecting their specialized nature and the early stage of investor awareness.

- Performance Monitoring: Close observation of their performance is crucial to assess if they can evolve into 'Stars' by capturing significant market share as the themes mature.

- Investor Education: The challenge lies in building investor confidence and understanding for these novel investment opportunities.

Expansion in Emerging Geographic Markets

Invesco's strategic push into emerging geographic markets, while crucial for future expansion, carries inherent challenges. These regions, often characterized by rapidly growing economies, present significant opportunities for market share gains. However, Invesco typically enters these markets with a nascent presence, necessitating substantial capital allocation towards establishing local operations, tailoring product offerings to specific consumer needs, and building robust distribution networks. For instance, in 2024, Invesco continued to invest in markets like India and Southeast Asia, recognizing their long-term potential, but also acknowledging the need for patient capital deployment to build market penetration.

The success of this expansion hinges on Invesco's ability to navigate intense local competition and the unique complexities of each market. This includes understanding diverse regulatory landscapes, cultural nuances, and consumer preferences. For example, in 2023, Invesco's AUM in emerging markets grew by 12%, but this growth was uneven, with some markets requiring more intensive support than others. The firm’s strategy involves building strong local partnerships and adapting its investment strategies to resonate with local investor demands.

- High Growth Potential: Emerging markets offer substantial long-term growth prospects, driven by expanding middle classes and increasing disposable incomes.

- Initial Low Market Share: Invesco often starts with a limited market share in these regions, requiring focused efforts to build brand recognition and customer loyalty.

- Investment Requirements: Significant investment is needed for local infrastructure, product adaptation, and marketing to effectively compete.

- Competitive Landscape: Overcoming established local players and understanding market-specific dynamics are critical for success.

Question Marks in Invesco's portfolio represent new or niche products with low market share but high growth potential, requiring careful strategic decisions. These could include innovative thematic ETFs or products targeting emerging asset classes.

The success of these Question Marks hinges on their ability to gain investor traction and demonstrate competitive performance. For example, Invesco's venture into digital asset ETFs, while promising, still requires significant market development to become established leaders.

Invesco's strategic focus on areas like private markets and emerging geographic regions also places many of their current offerings in the Question Mark category. These ventures demand substantial investment and time to cultivate market share and achieve profitability.

The critical question for these products is whether they can transition from low market share to high market share, becoming Stars in Invesco's lineup. This transition depends on market acceptance, regulatory clarity, and the firm's ability to effectively market and manage these evolving investment vehicles.

| Product Category | Market Share (Illustrative) | Growth Potential (Illustrative) | Strategic Consideration |

|---|---|---|---|

| Thematic ETFs (e.g., Space Exploration) | Low | High | Monitor performance, educate investors, potential to become a Star. |

| Digital Asset ETFs (e.g., Bitcoin ETF) | Growing | High | Navigate volatility, regulatory landscape, build AUM. |

| Emerging Market Funds | Low to Moderate | High | Sustained investment in local presence, product adaptation. |

| Private Markets Funds | Low | High | Capital allocation, client engagement, long-term development. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial statements, market research reports, and industry growth forecasts to provide a clear strategic overview.