Invesco Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Invesco Bundle

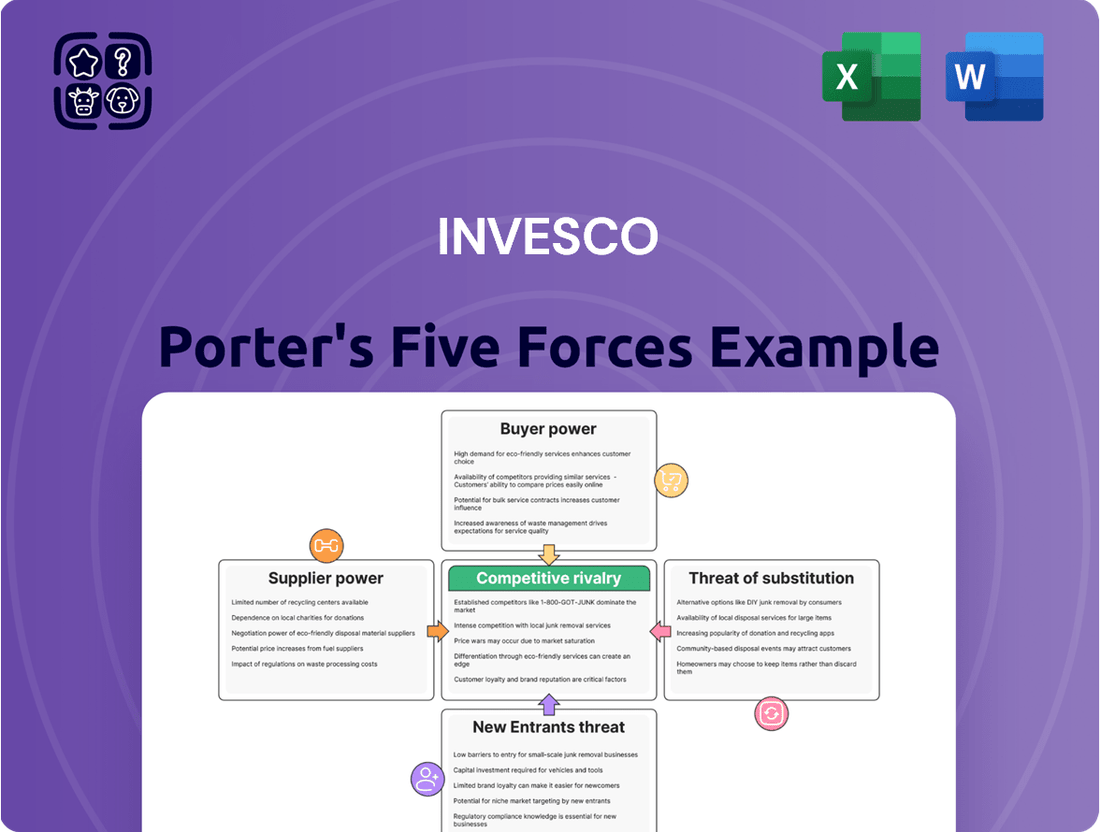

Understanding the competitive landscape is crucial for any investor. Our Invesco Porter's Five Forces Analysis breaks down the key pressures like buyer power and the threat of new entrants, offering a clear view of the industry's dynamics.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Invesco’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Invesco's reliance on specialized technology and data providers for critical functions like trading, portfolio management, analytics, and cybersecurity grants these suppliers significant bargaining power. If these software solutions are unique, possess high switching costs, or if the providers hold a dominant market share, they can dictate terms and pricing, impacting Invesco's operational efficiency and costs.

Human capital, particularly the expertise of portfolio managers and analysts, significantly impacts Invesco's operational effectiveness and competitive edge. The bargaining power of these highly skilled professionals is amplified when there's a limited pool of talent with specialized knowledge in areas like quantitative analysis or emerging market strategies.

In 2024, the demand for experienced investment professionals remained robust, driven by market volatility and the need for sophisticated risk management. For instance, firms often face intense competition for top-tier talent, leading to higher compensation packages and retention challenges, which directly translates to increased bargaining power for these individuals.

The bargaining power of suppliers in custodial and prime brokerage services for Invesco is influenced by the concentration of major providers. In 2024, the global prime brokerage market is dominated by a few large financial institutions, such as JPMorgan Chase, Goldman Sachs, and Morgan Stanley, which can exert significant influence. These services are critical for operational efficiency and regulatory adherence, making switching providers a complex and costly endeavor for firms like Invesco.

Marketing and Distribution Channels

The bargaining power of suppliers in marketing and distribution channels for Invesco is influenced by external agencies, advertising platforms, and third-party networks. These suppliers hold sway when they control access to crucial client segments or provide specialized marketing services that Invesco heavily relies upon. For instance, major advertising platforms like Google and Meta can exert pressure through pricing and access, impacting Invesco's reach and cost of customer acquisition. In 2024, digital advertising spend globally was projected to exceed $600 billion, highlighting the significant influence of these platforms.

Suppliers offering highly specialized marketing analytics or unique distribution partnerships can also command greater power. If Invesco's marketing success is significantly dependent on a particular agency's creative output or a specialized distribution network's ability to reach niche investor groups, these suppliers gain leverage. The complexity and cost of building proprietary marketing and distribution capabilities mean Invesco often relies on external providers, thereby increasing their bargaining power.

- Advertising Platforms: Major digital advertising platforms like Google and Meta have significant power due to their vast reach and data analytics capabilities, influencing Invesco's customer acquisition costs.

- External Marketing Agencies: Agencies with proven track records in financial services marketing or access to specific investor demographics can leverage their expertise to negotiate favorable terms.

- Distribution Networks: Third-party financial advisors, wealth management platforms, or financial media outlets that distribute Invesco's products hold power if they represent a substantial portion of Invesco's sales or AUM growth.

- Specialized Services: Providers of niche marketing technologies or data analytics crucial for targeted campaigns possess bargaining power if their services are difficult to replicate internally.

Regulatory and Compliance Services

The bargaining power of suppliers for regulatory and compliance services significantly impacts Invesco. Specialized legal firms and compliance consultants possess considerable leverage due to the intricate and constantly changing financial regulations. Their expertise is crucial, and the penalties for non-compliance, such as hefty fines or reputational damage, amplify their importance.

The complexity of global financial markets and the increasing stringency of regulations, like those stemming from the Dodd-Frank Act or evolving ESG (Environmental, Social, and Governance) reporting standards, mean Invesco relies heavily on these external providers. For instance, in 2024, the financial services industry continued to grapple with adapting to new data privacy regulations and cybersecurity mandates, requiring specialized legal and IT compliance support.

- High Dependency: Invesco's need for expert advice on navigating complex regulatory frameworks like MiFID II or the SEC's evolving disclosure requirements grants suppliers significant power.

- Specialized Knowledge: The niche expertise required for compliance in areas such as anti-money laundering (AML) and Know Your Customer (KYC) procedures limits the pool of qualified service providers.

- Consequences of Non-Compliance: The severe financial and reputational risks associated with regulatory breaches empower suppliers who ensure adherence. For example, a single compliance failure could lead to millions in fines, as seen in past industry cases.

- Evolving Landscape: The continuous introduction of new regulations, such as those concerning digital assets or sustainable finance, necessitates ongoing engagement with specialized consultants, reinforcing their bargaining strength.

Suppliers of specialized technology and data are a key factor in Invesco's operational costs and efficiency. When these providers offer unique solutions with high switching costs, or dominate their market, they gain significant leverage to dictate terms and pricing.

The bargaining power of Invesco's suppliers is amplified by the concentration in certain sectors, such as prime brokerage services. In 2024, a few large financial institutions, including JPMorgan Chase and Goldman Sachs, dominated this market, giving them substantial influence over firms like Invesco.

Invesco's reliance on external marketing and distribution channels, like major advertising platforms such as Google and Meta, grants these suppliers considerable power. With global digital ad spend projected to exceed $600 billion in 2024, these platforms can impact Invesco's customer acquisition costs through their pricing and access control.

The bargaining power of suppliers in regulatory and compliance services is substantial due to the complexity and evolving nature of financial regulations. Invesco's need for specialized legal and IT support to navigate mandates, such as data privacy and cybersecurity, reinforces the leverage of these expert providers.

| Supplier Category | Key Influencing Factors | 2024 Market Context/Data |

|---|---|---|

| Technology & Data Providers | Uniqueness of solutions, switching costs, market share | High demand for AI and data analytics tools in finance |

| Prime Brokerage Services | Market concentration, criticality of services | Dominated by a few major global banks |

| Marketing & Distribution | Control over client access, specialized reach | Digital ad spend exceeding $600 billion globally |

| Regulatory & Compliance Services | Expertise in complex regulations, consequences of non-compliance | Increased focus on ESG and data privacy regulations |

What is included in the product

Analyzes the competitive intensity and profitability of the asset management industry for Invesco by examining threats from new entrants, buyer and supplier power, and substitute products.

Effortlessly pinpoint competitive threats and opportunities with a visual, easy-to-understand breakdown of each Porter's Five Forces.

Customers Bargaining Power

Institutional clients, including large pension funds, endowments, and sovereign wealth funds, wield considerable bargaining power. Their substantial asset bases, often in the billions, allow them to negotiate aggressively on fees. For instance, as of early 2024, major pension funds frequently seek fee structures below 0.50% for large mandates, a stark contrast to retail investor fees.

These sophisticated investors possess deep investment knowledge and can easily conduct due diligence to switch asset managers, creating a constant pressure for Invesco to offer competitive pricing and tailored solutions. Their ability to move significant capital quickly means asset managers must remain attentive to their demands for performance and service.

Retail investors, while individually small, collectively wield considerable bargaining power. Their ability to easily switch between investment platforms and products, often with minimal fees, exerts pressure on financial service providers. This is evident in the increasing demand for low-cost index funds and commission-free trading, a trend that has significantly reshaped the brokerage industry.

Financial advisors and wealth managers hold considerable sway as intermediaries for retail and high-net-worth clients. Their ability to direct substantial client assets to specific asset managers makes them powerful customers. These advisors actively seek competitive investment products, strong operational support, and favorable fee arrangements, influencing the offerings and pricing within the asset management industry.

Access to Information and Alternatives

Customers today have unprecedented access to information about fund performance, fees, and what competitors are offering. This transparency significantly shifts the balance of power towards them.

The ease with which investors can compare and switch between a vast array of investment strategies, from passive ETFs to actively managed funds, amplifies their bargaining clout. For instance, in 2024, the global ETF market continued its robust growth, with assets under management reaching new highs, indicating a strong preference for accessible and comparable investment vehicles.

- Information Accessibility: Online platforms and financial news outlets provide readily available data on fund metrics, expense ratios, and historical returns.

- Comparison Tools: Numerous websites and applications allow for easy side-by-side comparisons of investment products.

- Product Proliferation: The sheer volume of investment options, including low-cost index funds, actively managed funds, and alternative investments, gives customers more choices.

- Switching Costs: Generally low switching costs in the investment industry allow customers to move assets with relative ease if dissatisfied with current offerings.

Fee Sensitivity and Product Commoditization

Customers in highly competitive markets, particularly for commoditized products like passive ETFs and index funds, are increasingly sensitive to fees. This fee sensitivity allows them to exert significant bargaining power, as they can easily switch providers to secure lower costs. For example, as of early 2024, the average expense ratio for U.S. equity index funds was around 0.05%, a testament to competitive pressures driving down fees.

- Fee Pressure: The average expense ratio for U.S. equity index funds hovered near 0.05% in early 2024, reflecting intense competition.

- Customer Leverage: High fee sensitivity empowers customers to demand lower costs, driving down profitability for asset managers.

- Market Dynamics: In commoditized segments, performance and cost are key differentiators, amplifying customer bargaining power.

Customers possess substantial bargaining power due to readily available information, low switching costs, and a proliferation of investment choices. This allows them to demand lower fees and better service, especially in competitive segments like passive ETFs. For instance, by early 2024, the average expense ratio for U.S. equity index funds was around 0.05%, highlighting intense fee pressure.

| Customer Segment | Bargaining Power Drivers | Impact on Invesco |

|---|---|---|

| Institutional Investors | Large asset bases, deep knowledge, low switching costs | Fee negotiation pressure, demand for tailored solutions |

| Retail Investors | Ease of switching platforms, access to low-cost products | Pressure to offer competitive pricing and user-friendly platforms |

| Financial Advisors | Control over client assets, demand for product quality and support | Need for strong product offerings, competitive fees, and robust advisor support |

Same Document Delivered

Invesco Porter's Five Forces Analysis

This preview showcases the complete Invesco Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within the asset management industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no discrepancies or missing information. You can confidently download and utilize this comprehensive analysis to inform your strategic decisions.

Rivalry Among Competitors

The competitive rivalry among diversified global asset managers is fierce, with giants like BlackRock, Vanguard, Fidelity, and State Street directly challenging Invesco. These firms boast extensive product suites, massive assets under management (AUM), and a worldwide presence, intensifying the battle for market share across numerous asset classes and client types.

As of early 2024, BlackRock managed approximately $10 trillion in AUM, Vanguard oversaw over $8.5 trillion, and Fidelity held around $4.5 trillion. This concentration of assets among a few key players means Invesco faces formidable competition for investor capital and talent, requiring continuous innovation and strategic differentiation to maintain its competitive edge.

Specialized boutique firms and niche players exert significant competitive pressure by focusing on specific asset classes like alternative investments or private equity, or by adhering to distinct investment styles. These smaller entities can challenge larger, more diversified asset managers through highly differentiated product offerings and, often, superior performance within their chosen specialties.

For instance, the alternative investment sector, which includes private equity and hedge funds, saw substantial growth leading up to 2024. Data from Preqin indicated that global private equity fundraising reached approximately $1.2 trillion in 2023, demonstrating the attractiveness and potential for high returns in these niche areas, which boutique firms are well-positioned to capitalize on.

The passive investment sector, where Invesco is a major player, is intensely competitive. Exchange-traded funds (ETFs) and index funds are the battlegrounds, with giants like Vanguard and BlackRock (iShares) setting a brisk pace. This space thrives on economies of scale and aggressive price competition, meaning providers must constantly innovate to stay relevant.

Bank-Owned and Insurance-Owned Asset Managers

Competitive rivalry among bank-owned and insurance-owned asset managers is intense. These entities leverage their established financial institution parentage, benefiting from integrated distribution networks and deep existing client relationships. For instance, many large banks and insurance companies have dedicated wealth management arms that naturally funnel assets into their affiliated investment management divisions.

This inherent advantage allows them to attract and retain substantial assets under management (AUM). By the end of 2023, the asset management arms of major global banks and insurance firms reported significant AUM figures, often in the hundreds of billions or even trillions of dollars, reflecting their scale and market penetration.

- Captive Distribution: Banks and insurers can utilize their branch networks, financial advisors, and existing customer bases as built-in channels for their asset management products.

- Client Base Leverage: They can cross-sell investment products to their banking or insurance customers, creating a symbiotic relationship that drives asset growth.

- Brand Trust: The established trust and recognition of large financial institutions can translate into greater confidence for investors choosing their asset management services.

- Scale and Resources: These firms often possess greater financial resources for marketing, technology investment, and talent acquisition compared to independent managers.

Digital Investment Platforms and Robo-Advisors

The rise of digital investment platforms and robo-advisors has significantly intensified competition for traditional asset managers, especially in the retail segment. These platforms provide automated, low-cost investment solutions that directly challenge established players on fees and accessibility. For instance, by mid-2024, many robo-advisors were managing tens of billions of dollars in assets, demonstrating their growing market share and influence.

While not always directly competing for large institutional mandates, these digital disruptors exert considerable fee pressure. Their streamlined operations and technology-driven approach allow them to offer services at a fraction of the cost of traditional advisory models. This forces established firms to re-evaluate their fee structures and service offerings to remain competitive. By the end of 2023, the assets under management for robo-advisors in the US alone surpassed $500 billion, a clear indicator of their market penetration.

- Fee Compression: Robo-advisors typically charge annual management fees of 0.25% to 0.50%, compared to the 1% or higher often seen with traditional advisors.

- Accessibility: Many platforms offer low or no minimum investment requirements, opening up investing to a broader audience.

- Technological Advancement: These platforms leverage algorithms for portfolio management, rebalancing, and tax-loss harvesting, offering efficient and automated services.

- Market Share Growth: The global robo-advisory market is projected to reach over $3 trillion in assets under management by 2027, signaling continued disruption.

The competitive landscape for asset managers is incredibly crowded, with giants like BlackRock, Vanguard, and Fidelity wielding massive assets under management, often in the trillions. This intense rivalry forces Invesco to constantly innovate and differentiate its offerings to capture investor capital. Boutique firms specializing in niche areas like alternatives also pose a significant threat, as evidenced by the approximately $1.2 trillion raised in global private equity in 2023.

The passive investment space, particularly ETFs, is another battleground where Invesco faces aggressive competition from firms like BlackRock's iShares, often characterized by economies of scale and price wars. Furthermore, bank- and insurance-owned asset managers leverage captive distribution channels and established client bases, managing hundreds of billions to trillions in assets, creating a strong competitive advantage.

Digital platforms and robo-advisors are also disrupting the market, especially for retail investors. By mid-2024, many robo-advisors managed tens of billions in assets, offering low fees (often 0.25%-0.50%) and high accessibility, which puts pressure on traditional managers to adapt their fee structures and service models.

SSubstitutes Threaten

The threat of substitutes for traditional asset management is amplified by the rise of direct investing. Individuals can now bypass professional managers entirely, opting to invest directly in stocks, bonds, or real estate through accessible online brokerage platforms. This trend is supported by a significant increase in retail investor participation; for instance, in 2024, the number of individual investors actively trading on major exchanges continued to grow, with many leveraging user-friendly digital tools.

The threat of alternative investment vehicles is a significant consideration for Invesco. Products like private equity, venture capital, and hedge funds, which often cater to sophisticated investors, can divert substantial capital away from traditional mutual funds and ETFs. For instance, the global private equity market size was estimated to be over $12 trillion in 2023, demonstrating a substantial pool of assets seeking returns outside conventional public markets.

Direct real estate investments also pose a competitive threat, especially for investors seeking tangible assets and potential rental income. While Invesco offers real estate-focused ETFs and mutual funds, direct ownership or private real estate funds represent a different investment paradigm. The U.S. commercial real estate market alone is valued in the trillions, indicating the vastness of this alternative asset class.

These alternatives can offer diversification benefits and potentially higher returns, albeit often with higher risk, illiquidity, and fees. As investors increasingly seek tailored solutions and alpha generation, the allure of these non-traditional avenues can diminish the market share for standard asset management products. Invesco must continually innovate and adapt its offerings to remain competitive against this evolving landscape.

Robo-advisory services represent a significant threat of substitutes, particularly for investors prioritizing low costs and simplicity. These automated platforms, powered by algorithms, offer diversified portfolios at fees often substantially lower than traditional actively managed funds. For instance, in 2024, many leading robo-advisors maintained management fees in the range of 0.25% to 0.50%, a stark contrast to the 1% or higher often charged by human advisors or actively managed mutual funds.

Cash and Savings Instruments

The threat of substitutes for Invesco's core business, primarily investment management services, is significantly influenced by the availability and attractiveness of cash and savings instruments. When market volatility increases or interest rates rise, investors may shift capital towards these alternatives for capital preservation and liquidity.

These instruments, such as high-yield savings accounts and Certificates of Deposit (CDs), offer a safe haven for funds, albeit with lower growth potential compared to market-linked investments. For instance, as of mid-2024, average high-yield savings account rates have climbed significantly, with some exceeding 4.5%, making them a more compelling option for risk-averse investors.

- Capital Preservation: Cash and savings instruments prioritize the safety of principal, appealing to investors concerned about market downturns.

- Liquidity: Funds held in these instruments are readily accessible, offering immediate availability for unexpected needs.

- Interest Rate Sensitivity: Rising interest rates, a trend observed in 2023 and continuing into 2024, make these options more attractive relative to riskier investments.

- Yield Competitiveness: The yield offered by savings accounts and CDs directly competes with the potential returns from investment products, especially for shorter-term investment horizons.

Real Assets and Commodities

Investors might bypass asset managers like Invesco by investing directly in physical assets such as gold, silver, oil, or even art. These real assets can serve as a hedge against inflation, with gold prices, for instance, showing a notable increase in early 2024, reaching record highs in nominal terms.

The appeal of these direct investments lies in their tangible nature and potential for diversification away from traditional stocks and bonds. For example, the commodities market saw significant price volatility in 2024, driven by geopolitical events and supply chain concerns, offering a different risk-return profile.

- Direct Investment in Physical Assets: Bypassing traditional financial instruments for tangible assets like precious metals, energy, or collectibles.

- Inflation Hedging: Real assets are often sought for their potential to preserve purchasing power during inflationary periods.

- Diversification Benefits: Offering exposure outside conventional financial markets, potentially reducing overall portfolio risk.

- Market Performance Data (Illustrative): Gold prices saw significant gains in early 2024, touching new nominal highs, reflecting investor interest in safe-haven assets.

The threat of substitutes for traditional asset management is multifaceted, encompassing direct investing, alternative investment vehicles, and even simpler cash instruments. The rise of user-friendly digital platforms has empowered individual investors to bypass intermediaries, directly accessing markets. Furthermore, alternative assets like private equity and real assets such as gold offer diversification and inflation hedging, attracting capital away from conventional products. Robo-advisors also present a low-cost, automated alternative, particularly appealing to cost-conscious investors.

| Substitute Category | Key Characteristics | Investor Appeal | Market Trend/Data (2024) |

|---|---|---|---|

| Direct Investing | Online brokerage platforms, ETFs, individual stocks/bonds | Lower fees, control, accessibility | Continued growth in retail investor participation |

| Alternative Investments | Private equity, venture capital, hedge funds, real estate | Potential for higher returns, diversification | Global private equity market exceeding $12 trillion (2023 est.) |

| Cash & Savings Instruments | High-yield savings accounts, CDs | Capital preservation, liquidity, rising interest rates | High-yield savings rates often exceeding 4.5% |

| Real Assets | Gold, silver, oil, art | Inflation hedge, tangible asset, diversification | Gold prices reached record nominal highs in early 2024 |

| Robo-Advisors | Automated portfolio management | Low fees, simplicity, accessibility | Management fees typically 0.25%-0.50% |

Entrants Threaten

Regulatory and compliance barriers significantly deter new entrants in asset management. Establishing a firm requires navigating complex licensing procedures, stringent reporting mandates, and robust investor protection laws. For instance, in the US, the Securities and Exchange Commission (SEC) imposes extensive registration and ongoing compliance obligations, with firms managing over $100 million in assets typically needing to register. These requirements translate into substantial upfront costs and ongoing operational expenses, making it challenging for smaller or less capitalized entities to compete.

Brand reputation and investor trust are paramount in asset management, acting as significant barriers to entry. New firms struggle to gain traction against established players with decades of proven performance and widespread recognition. Building this trust requires substantial, long-term investment in marketing and client service, a hurdle many newcomers find difficult to overcome.

Entering the asset management industry, particularly in areas where established players like Invesco operate, demands significant upfront capital. Think about the costs involved: building robust technology infrastructure for trading and client reporting, extensive marketing campaigns to build brand recognition, and attracting top-tier talent in portfolio management and research. These are not trivial expenses; they represent substantial barriers to entry.

Existing giants in the financial sector, including Invesco, already enjoy considerable economies of scale. This means they can spread their fixed costs over a much larger asset base. For instance, in 2023, Invesco managed approximately $1.5 trillion in assets. This scale allows them to offer more competitive management fees to clients and to invest heavily in cutting-edge technology and ongoing research and development. For a new entrant, matching these cost efficiencies and investment capabilities is a formidable challenge, making it difficult to compete on price and innovation.

Distribution Channel Access

New entrants face significant hurdles in accessing established distribution channels within the asset management industry. Gaining traction with financial advisor networks, institutional consultants, and direct-to-consumer platforms requires substantial investment and time to build trust and secure placement. For instance, in 2024, the average time for a new fund to achieve widespread advisor adoption can extend over several years, often necessitating extensive marketing and sales efforts.

Securing 'shelf space' on these platforms is a critical barrier. This involves not only product quality but also strong relationships and demonstrated track records, which are difficult for newcomers to replicate quickly. Many established asset managers in 2024 leverage decades-old relationships with key gatekeepers, making it challenging for emerging firms to break in.

- Limited Access to Advisor Networks: Financial advisors often favor products from established firms with proven performance and extensive support services, making it hard for new entrants to get their products recommended.

- Institutional Consultant Hurdles: Consultants, who advise large pension funds and endowments, typically have rigorous due diligence processes that new managers struggle to pass without a significant existing client base or a highly differentiated strategy.

- Platform Gatekeepers: Direct-to-consumer platforms, while seemingly open, often curate their offerings, favoring managers with brand recognition or those willing to pay for prominent placement, creating a barrier for emerging players.

- Resource Intensity: Building the necessary sales teams, marketing collateral, and compliance infrastructure to effectively engage with these channels demands substantial capital, often exceeding the resources available to nascent firms.

Talent Acquisition and Retention

The threat of new entrants in the asset management space, particularly concerning talent acquisition and retention, is substantial. New firms face considerable hurdles in attracting and keeping highly skilled investment professionals, such as experienced portfolio managers and research analysts. Established players like Invesco leverage their significant financial resources, strong brand recognition, and robust career development programs to secure and retain top talent. For instance, in 2024, the average compensation for a senior portfolio manager in the US could easily exceed $200,000 annually, plus substantial bonuses tied to performance, a figure difficult for nascent firms to match consistently.

This talent gap creates a significant barrier to entry. New entrants struggle to compete with the established infrastructure and attractive compensation packages offered by larger, more reputable firms. The ability to offer comprehensive benefits, advanced research tools, and clear paths for professional growth is crucial in a competitive market. A survey of financial professionals in early 2024 indicated that career advancement opportunities and compensation were the top two drivers for job satisfaction and retention, highlighting the challenge for new firms trying to build a competitive talent pool.

Furthermore, the cost of acquiring and retaining this specialized talent can be prohibitively high for startups. Building a team of seasoned professionals requires not only competitive salaries but also investment in training, compliance, and support staff. This financial burden, coupled with the need to demonstrate a proven track record, makes it difficult for new entities to effectively challenge incumbents like Invesco, which in 2023 managed over $1.4 trillion in assets, affording them considerable leverage in the talent market.

- Talent Scarcity: Highly sought-after investment professionals are often loyal to established firms due to better compensation and career progression.

- Compensation Wars: New entrants must offer significantly higher compensation and benefits to lure talent away from established players.

- Reputational Barrier: Top talent often prefers to join firms with a strong brand and proven track record, which new firms lack.

- Retention Challenges: Even if talent is acquired, retaining them against the allure of established firms with better long-term incentives is a constant struggle.

The threat of new entrants in asset management is significantly mitigated by high capital requirements, regulatory hurdles, and the need for established trust. New firms must invest heavily in technology, marketing, and compliance, often exceeding the resources of startups. For instance, in 2024, the cost of establishing a compliant operational framework for a new asset manager can easily run into hundreds of thousands of dollars, before even considering client acquisition.

Economies of scale enjoyed by incumbents like Invesco, which managed approximately $1.5 trillion in assets in 2023, create a substantial cost advantage. This scale allows for lower fees and greater investment in research and talent, making it difficult for new players to compete on price or innovation. Furthermore, established distribution channels and brand recognition, built over years, act as formidable barriers that new entrants struggle to penetrate effectively.

| Barrier Type | Description | Example Metric (2024) | Impact on New Entrants |

|---|---|---|---|

| Capital Requirements | Cost of technology, marketing, compliance, and talent acquisition. | ~$250,000+ for initial setup and licensing. | High; requires significant upfront funding. |

| Regulatory Compliance | Navigating licensing, reporting, and investor protection laws. | SEC registration for firms >$100M AUM. | High; complex and costly to manage. |

| Brand & Trust | Building reputation and client confidence. | Years of proven performance and client relationships. | Very High; difficult to replicate quickly. |

| Economies of Scale | Cost advantages from large asset base. | Invesco's $1.5T AUM (2023) enables lower operating costs per dollar managed. | High; new entrants cannot match cost efficiencies. |

| Distribution Channels | Accessing advisor networks and institutional consultants. | Average 2-3 years for new funds to gain widespread advisor adoption. | High; requires extensive sales and marketing efforts. |

| Talent Acquisition | Attracting and retaining skilled investment professionals. | Senior PM compensation >$200,000 + bonus in the US. | High; difficult to compete with established compensation packages. |

Porter's Five Forces Analysis Data Sources

Our Invesco Porter's Five Forces analysis leverages a comprehensive suite of data sources, including Invesco's own internal market research, industry-specific reports from leading analysts, and publicly available financial filings. This multi-faceted approach ensures a robust understanding of competitive dynamics.