Intuitive Surgical Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intuitive Surgical Bundle

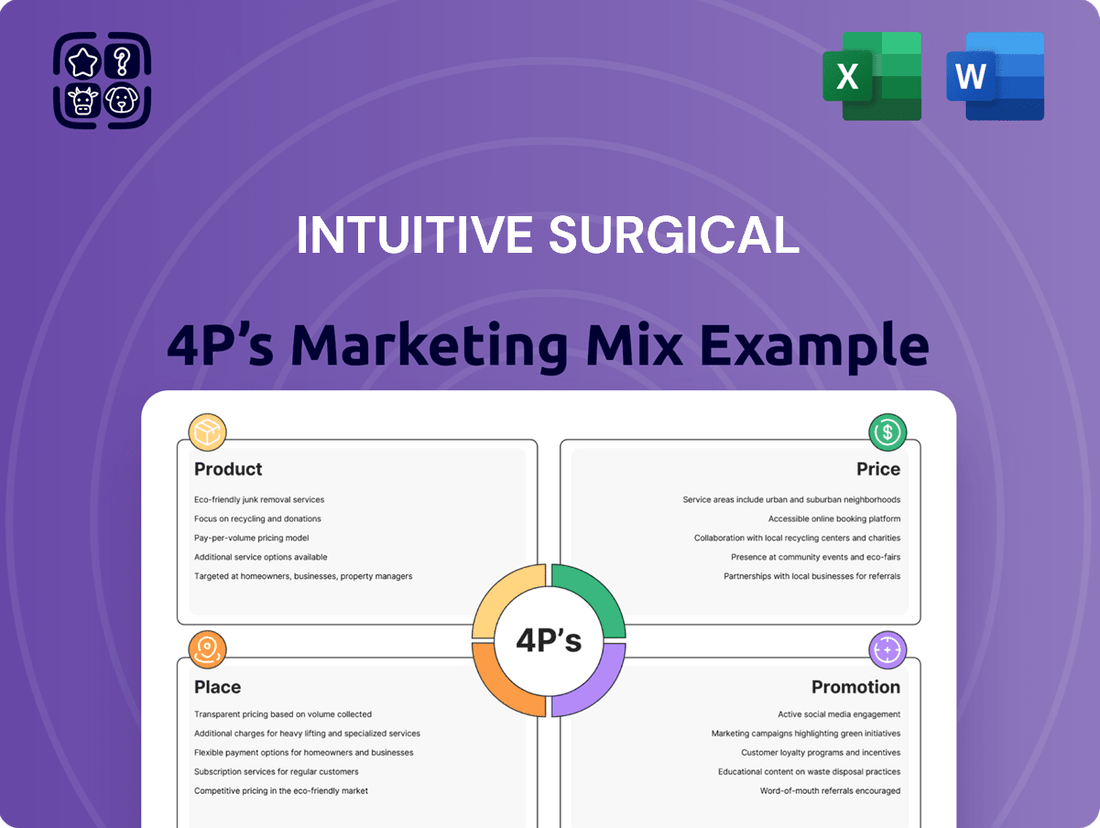

Intuitive Surgical's dominance in robotic surgery is built on a powerful 4Ps marketing mix. Their innovative da Vinci Surgical System (Product) commands a premium price point (Price), reflecting its advanced technology and patient benefits. This sophisticated product is strategically placed through direct sales and partnerships within leading healthcare institutions (Place), while extensive training and support form a core part of their promotional strategy (Promotion).

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Intuitive Surgical's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into a market leader.

Product

The da Vinci surgical system, Intuitive Surgical's core product, represents a significant advancement in minimally invasive surgery. This robotic platform empowers surgeons with greater precision and control during complex operations, leading to better patient outcomes.

Intuitive Surgical's commitment to innovation is evident in the da Vinci 5 system, released in 2024. This latest iteration boasts substantially enhanced computing power and introduces crucial features like force feedback, offering surgeons a more intuitive and responsive surgical experience across more than 40 procedure types.

Intuitive Surgical's product strategy extends beyond the da Vinci robotic systems to include a vital array of instruments and accessories. These are not just add-ons; they are critical consumables for every procedure performed on the da Vinci platform.

These essential tools, such as specialized stapling and energy devices, are a powerhouse for Intuitive's revenue. In fact, they accounted for a substantial 61% of the company's total revenue in 2024. This highlights their importance in the overall financial health of the company.

This reliance on recurring revenue from instruments and accessories forms a cornerstone of Intuitive's business model. It provides a predictable and stable cash flow, which is invaluable for long-term financial planning and investment.

Intuitive Surgical's Ion endoluminal system represents a strategic expansion into diagnostic procedures, complementing its surgical robotics. This platform facilitates minimally invasive lung biopsies, offering a less invasive approach for patients and clinicians.

The growth trajectory of the Ion platform is robust, with a significant 52% increase in procedure volume observed in the second quarter of 2025. This surge underscores increasing adoption and integration into diagnostic workflows, contributing positively to Intuitive's overall financial performance.

Comprehensive Services and Support

Intuitive Surgical provides a comprehensive suite of services designed to maximize the value of its robotic-assisted surgical systems. This includes extensive, global training programs for surgeons and hospital staff, ensuring proficiency and safe adoption of their technology. For instance, in 2023, Intuitive Surgical reported training over 16,000 healthcare professionals, highlighting their commitment to user education.

Beyond initial training, the company offers robust support encompassing installation, ongoing maintenance, and repair services. This ensures system uptime and reliability, critical factors for surgical departments. Their service model contributes significantly to customer retention and satisfaction, reinforcing the overall value proposition of the da Vinci system.

- Global Training Network: Intuitive Surgical operates training centers and provides remote support worldwide, accommodating diverse healthcare systems.

- System Maintenance: Proactive and reactive maintenance services are offered to ensure optimal performance and minimize downtime of their surgical robots.

- Progressive Learning: Surgeons can access advanced training modules and resources to continuously refine their skills and explore new applications.

- Customer Support: Dedicated support teams are available to assist with technical inquiries and operational challenges, fostering long-term partnerships.

Digital Intelligence and AI Integration

Intuitive Surgical is heavily investing in digital intelligence and AI to enhance its da Vinci surgical systems. This integration is a core part of their product strategy, aiming to make surgery more precise and outcomes more predictable. For example, the da Vinci 5 system boasts a remarkable 10,000-fold increase in computing power compared to previous generations.

This enhanced computing power fuels advanced features like Case Insights, which provides surgeons with detailed analysis of surgical performance metrics. Additionally, smart instruments such as SureForm staplers leverage AI to make real-time adjustments during procedures, improving consistency and reducing variability. These advancements are designed to elevate surgical training, support critical decision-making in the operating room, and ultimately drive more reproducible patient outcomes.

- Enhanced Computing Power: The da Vinci 5 system features 10,000x more computing power, enabling sophisticated AI applications.

- AI-Driven Insights: Features like Case Insights analyze surgical performance to inform and improve techniques.

- Real-time Adjustments: Instruments like SureForm staplers utilize AI for dynamic adjustments during procedures.

- Outcome Improvement: The goal is to improve training, support real-time decisions, and ensure consistent, reproducible surgical results.

Intuitive Surgical's product portfolio centers on the da Vinci surgical systems, a line of robotic platforms designed for minimally invasive procedures. These systems, including the recently launched da Vinci 5 in 2024, offer enhanced precision and control, with the latest model featuring a 10,000-fold increase in computing power and haptic feedback. The product strategy also heavily relies on a recurring revenue stream from a wide array of specialized instruments and accessories, which constituted 61% of total revenue in 2024. Furthermore, the Ion endoluminal system is expanding the company's reach into diagnostic procedures, demonstrating robust growth with a 52% increase in procedure volume in Q2 2025.

| Product Category | Key Features/Innovations | 2024/2025 Data Points |

|---|---|---|

| da Vinci Surgical Systems | Robotic-assisted minimally invasive surgery | da Vinci 5 released in 2024 with enhanced computing power and force feedback. |

| Instruments & Accessories | Consumables for da Vinci procedures | Accounted for 61% of total revenue in 2024. |

| Ion Endoluminal System | Minimally invasive lung biopsy platform | 52% increase in procedure volume in Q2 2025. |

What is included in the product

This analysis offers a comprehensive breakdown of Intuitive Surgical's marketing strategies, examining how its innovative robotic surgery systems (Product), premium pricing model (Price), global distribution and training networks (Place), and extensive educational and advocacy efforts (Promotion) create a powerful market position.

Condenses the complex 4Ps of Intuitive Surgical's marketing into a clear, actionable framework, alleviating the pain of understanding their market strategy.

Simplifies the strategic application of the 4Ps for Intuitive Surgical, offering a readily understandable blueprint for effective marketing planning.

Place

Intuitive Surgical employs a direct sales strategy, delivering its da Vinci and Ion robotic surgery systems directly to hospitals and healthcare facilities worldwide. This approach fosters robust customer relationships and enables the provision of tailored support. In the second quarter of 2025, the company successfully placed 395 da Vinci systems, expanding its global installed base to a significant 10,488 units.

Intuitive Surgical boasts an impressive global reach, with its da Vinci surgical systems now operating in over 74 countries, surpassing an installed base of 10,000 units globally. This extensive network underscores the widespread adoption and trust in their robotic-assisted surgical technology.

The company is strategically broadening its international footprint, demonstrating significant expansion in key emerging markets such as India and South Korea. This focus on new territories highlights a commitment to making advanced surgical solutions accessible worldwide.

Further solidifying its European presence, Intuitive announced in January 2025 the acquisition of distributor businesses in Italy, Spain, Portugal, Malta, and San Marino. This move signifies a direct market entry strategy, aiming to enhance customer support and market penetration within these vital European nations.

Intuitive Surgical employs a hybrid distribution strategy, leveraging both direct sales forces and partnerships with third-party distributors to reach hospitals and surgical centers globally. This approach ensures broad market penetration while allowing for specialized support in different regions.

The company's strategic move to acquire distributor businesses in key European markets, with a planned completion in 2026, underscores a commitment to gaining greater control over its distribution network. This acquisition is expected to foster a deeper understanding of local customer needs and streamline logistical operations, potentially boosting sales efficiency.

Supply Chain and Manufacturing Optimization

Intuitive Surgical is significantly scaling its manufacturing capabilities to meet escalating global demand for its da Vinci surgical systems and Ion lung cancer diagnostic platform. This strategic expansion includes the inauguration of a new, state-of-the-art facility in Parvomay, Bulgaria, in July 2025. This Bulgarian site will initially concentrate on producing 3D endoscopes, a critical component for their advanced robotic surgery systems, with further expansion planned.

Further bolstering its production capacity, Intuitive plans to open new manufacturing facilities in 2025. These new sites, located in California, will focus on assembling the da Vinci 5 and Ion systems, ensuring a robust supply chain for these key product lines. Additionally, the company is establishing new endoscope manufacturing operations in Germany, diversifying its production footprint and enhancing its ability to serve European markets efficiently.

- Manufacturing Expansion: New facilities for da Vinci 5 and Ion systems in California opening in 2025.

- Global Footprint: New endoscope manufacturing locations in Germany and Bulgaria established.

- Bulgarian Facility: State-of-the-art plant in Parvomay, Bulgaria, inaugurated July 2025, initially for 3D endoscopes.

- Demand Support: Investments aim to optimize production and support the growing global rollout of Intuitive's systems.

Installed Base and Customer Entrenchment

Intuitive Surgical's substantial installed base of da Vinci surgical systems is a cornerstone of its market strategy. By the close of 2024, this base exceeded 10,600 systems, and by June 30, 2025, it had grown to 10,488 units. This vast network of deployed systems represents a significant barrier to entry for competitors and creates high switching costs for hospitals. The deep integration of da Vinci systems into hospital workflows, coupled with the considerable investment in specialized training and infrastructure, fosters strong customer loyalty and entrenches Intuitive's position.

This extensive installed base directly translates into recurring revenue streams and predictable demand for the company's high-margin instruments, accessories, and ongoing service contracts. The sheer number of systems in operation ensures a consistent need for these consumables and support services, reinforcing Intuitive's market dominance and providing a stable foundation for future growth.

- Installed Base Growth: Over 10,600 systems by end of 2024, reaching 10,488 by June 30, 2025.

- High Switching Costs: Significant hospital investment in training and infrastructure creates customer stickiness.

- Recurring Revenue: Ensures continuous demand for instruments, accessories, and services.

- Market Entrenchment: Solidifies Intuitive's dominant market position through deep customer relationships.

Intuitive Surgical's "Place" strategy centers on expanding its global reach and ensuring its da Vinci and Ion systems are accessible to healthcare providers. The company's extensive installed base, exceeding 10,600 systems by the end of 2024, demonstrates this widespread placement. This physical presence in hospitals worldwide, further strengthened by new facilities and strategic acquisitions, underpins recurring revenue and market dominance.

| Metric | End of 2024 | Q2 2025 |

|---|---|---|

| da Vinci Systems Placed | > 10,600 | 10,488 |

| Countries with Systems | > 74 | N/A |

| New European Acquisitions | Planned (Italy, Spain, Portugal, etc.) | Announced (Jan 2025) |

Full Version Awaits

Intuitive Surgical 4P's Marketing Mix Analysis

The preview you see here is the actual, complete Intuitive Surgical 4P's Marketing Mix Analysis document you’ll receive instantly after purchase. This means you know exactly what you're getting, with no hidden surprises or missing information. You can confidently proceed with your purchase, knowing the detailed analysis is yours to use immediately.

Promotion

Intuitive Surgical’s promotion strategy strongly highlights the tangible clinical outcomes and patient benefits derived from their da Vinci surgical system. This focus is crucial for demonstrating value to healthcare providers and patients alike. The company consistently emphasizes reduced pain, shorter hospital stays, and quicker recovery times, all key drivers for adopting new surgical technologies.

The company backs these claims with a wealth of data and research, showcasing the da Vinci system's effectiveness. For instance, studies have indicated that robotic-assisted procedures can lead to lower rates of complications and improved functional outcomes for patients in various surgical specialties. This data-driven approach validates the system's efficacy and its potential for cost-effectiveness in the long run, aligning with healthcare systems' increasing focus on value-based care.

Intuitive Surgical places a significant emphasis on surgeon training and education as a core promotional strategy. They offer progressive learning pathways designed to equip surgeons and their care teams with the necessary skills to effectively utilize the da Vinci surgical systems. This dedication is evident in their track record, having trained over 76,000 surgeons globally on their advanced robotic platforms.

Intuitive Surgical actively cultivates its industry presence and thought leadership by participating in key healthcare conferences. For instance, their presence at the J.P. Morgan Healthcare Conference in January 2024 allowed them to showcase their latest robotic-assisted surgery innovations and engage directly with investors and industry leaders.

Through these engagements, Intuitive Surgical consistently highlights its technological advancements, reinforcing its market leadership. Their presentations often detail the expanding applications of their da Vinci systems and the company's strategic vision for the future of minimally invasive surgery, solidifying their reputation as pioneers.

Investor Relations and Financial Communications

Intuitive Surgical prioritizes investor relations and financial communication through various channels. The company regularly hosts earnings calls, publishes annual reports, and issues press releases to keep its diverse investor base informed about financial results, new product introductions, and strategic direction.

This commitment to transparency is evident in their consistent reporting of strong financial performance. For instance, Intuitive Surgical reported impressive Q1 and Q2 2025 results, showcasing significant revenue increases and substantial growth in procedures performed. These updates are crucial for building investor confidence and enhancing market awareness.

- Robust Investor Outreach: Utilizes earnings calls, annual reports, and press releases for consistent financial and strategic updates.

- Key Performance Highlights: Regularly communicates strong Q1 and Q2 2025 earnings, emphasizing revenue and procedure growth.

- Building Confidence: Fosters investor trust and market recognition through transparent and frequent communication.

Digital Tools for Performance Insights

Intuitive Surgical actively uses digital tools to provide performance insights, enhancing the value proposition for hospitals. These digital capabilities, incorporating AI and machine learning, are designed to offer program-enhancing data.

Tools such as Case Insights meticulously analyze surgical performance metrics. This data is crucial for improving training programs and refining surgical techniques, directly contributing to better patient outcomes.

This strategic use of digital platforms highlights Intuitive's commitment to advancing surgical practice and efficiency. It demonstrates a clear focus on the system's value extending far beyond the physical robot.

- AI-driven analytics: Intuitive's digital tools leverage artificial intelligence to process complex surgical data.

- Performance metric analysis: Platforms like Case Insights provide detailed breakdowns of surgical performance.

- Training and technique enhancement: The insights generated help hospitals optimize surgeon training and improve surgical methods.

- Value beyond hardware: This digital offering showcases the system's contribution to overall surgical efficiency and advancement.

Intuitive Surgical's promotion strategy centers on demonstrating the tangible clinical benefits of its da Vinci surgical system, emphasizing patient outcomes like reduced pain and faster recovery. The company supports these claims with robust data, showcasing improved functional results and lower complication rates, which aligns with the growing demand for value-based healthcare. Their promotional efforts also heavily feature comprehensive surgeon training programs, having educated over 76,000 surgeons globally, underscoring a commitment to effective system utilization.

Price

Intuitive Surgical's da Vinci surgical systems, including the latest da Vinci 5, are priced at a premium, reflecting their cutting-edge technology and significant clinical advantages. This strategy is validated by the higher average selling prices observed for newer models, demonstrating market acceptance of advanced features.

The substantial investment in research and development, estimated to be billions of dollars over the years, underpins this premium pricing. The unique value proposition, offering enhanced precision and minimally invasive capabilities, justifies the cost for healthcare providers seeking superior patient outcomes.

Intuitive Surgical's business model thrives on recurring revenue from consumables and services, a critical component of its marketing strategy. This predictable income stream, often likened to the 'razor-and-blade' model, is generated through the sale of instruments, accessories, and essential services needed for each da Vinci surgical system procedure.

In 2024, this recurring revenue was particularly robust, with instruments and accessories alone contributing a significant 61% of the company's total revenue. This highlights the ongoing demand for these disposable and semi-disposable items, which are integral to the utilization of their robotic surgical platforms and provide a stable financial foundation.

Intuitive Surgical recognizes the significant capital investment required for da Vinci systems. To address this, they provide flexible acquisition models, notably operating leases, which can be structured as usage-based agreements. This approach lowers the initial financial barrier for hospitals.

In 2024, the company saw substantial adoption through these flexible models, with 776 da Vinci systems placed under operating leases. Of these, a considerable 467 were specifically usage-based leases, demonstrating a strong market preference for payment structures tied to actual system utilization.

Value-Based Pricing Justification

Intuitive Surgical's value-based pricing for its da Vinci surgical systems centers on the tangible benefits hospitals derive. This includes not only the potential for increased surgical revenue streams but also significant cost reductions stemming from fewer complications and shorter patient recovery times. For instance, studies have indicated that robotic-assisted procedures can lead to reduced hospital readmission rates, directly impacting a hospital's bottom line.

The company actively supports this pricing by demonstrating the da Vinci system's cost-effectiveness compared to traditional surgical methods. This is often substantiated through published clinical data and customized financial analysis tools provided to hospital partners. These analyses highlight the long-term economic advantages, making the initial investment in robotic technology a strategic decision for many healthcare institutions.

- Increased Surgical Revenue: Hospitals can perform more procedures, potentially at higher reimbursement rates for complex robotic-assisted surgeries.

- Reduced Complication Rates: Data from 2024 indicates that certain robotic-assisted procedures have shown a decrease in post-operative complications compared to open surgery, leading to lower treatment costs.

- Shorter Patient Stays: Faster recovery times associated with minimally invasive robotic surgery can reduce per-patient hospital costs and improve bed availability.

- Cost-Effectiveness: A 2025 market analysis projected that for specific procedures, the total cost of care for robotic-assisted surgery could be competitive or lower than traditional approaches when considering all associated expenses.

Consideration of External Factors and Market Dynamics

Intuitive Surgical's pricing is also shaped by external forces like competitor pricing and market demand. The company's strong market position and high customer switching costs allow for significant pricing power. However, potential headwinds include tariffs and limitations on capital budgets in various regions.

For 2025, Intuitive Surgical projects a non-GAAP gross profit margin between 66% and 67%. This forecast specifically accounts for the estimated impact of tariffs, highlighting their influence on the company's cost structure and pricing considerations.

- Competitor Pricing: While Intuitive Surgical dominates, emerging robotic surgery competitors influence pricing strategies.

- Market Demand: Growing adoption of minimally invasive procedures globally supports current pricing levels.

- Economic Conditions: Fluctuations in global economic health and healthcare spending impact capital equipment purchases.

- Tariffs and Regulations: Trade policies and import duties can directly affect the cost of goods and, consequently, pricing.

Intuitive Surgical's pricing strategy for its da Vinci systems is a sophisticated blend of premium positioning, value-based justification, and flexible acquisition models designed to maximize adoption and recurring revenue. The company leverages its technological leadership to command higher prices, which are further supported by the demonstrable clinical and economic benefits these systems offer to hospitals.

The financial structure of their sales is heavily reliant on recurring revenue from consumables and services, a model that provides significant stability. This is evident in the substantial contribution of instruments and accessories to their overall revenue, underscoring the ongoing need for these items with each procedure.

To mitigate the high upfront cost, Intuitive Surgical offers operating leases, including usage-based options, which proved highly popular in 2024, with 467 usage-based leases placed. This flexibility makes advanced surgical technology accessible to a wider range of healthcare providers.

The company actively demonstrates the cost-effectiveness of its systems by highlighting reduced complications and shorter patient stays, factors that contribute to a more favorable total cost of care. For 2025, Intuitive Surgical projects a non-GAAP gross profit margin between 66% and 67%, reflecting their pricing power and cost management, even with anticipated tariff impacts.

| Pricing Factor | 2024/2025 Data Point | Impact on Pricing |

|---|---|---|

| System Price Premium | Reflects cutting-edge technology and clinical advantages. | Justifies higher initial investment for advanced capabilities. |

| Recurring Revenue Contribution | Instruments & Accessories: 61% of total revenue (2024). | Supports ongoing demand and predictable income stream, enabling competitive system pricing. |

| Flexible Acquisition Models | 776 systems placed under operating leases (2024), with 467 usage-based. | Lowers initial financial barrier, driving adoption and long-term revenue. |

| Value-Based Benefits | Reduced readmission rates, shorter patient stays, potential for increased surgical revenue. | Supports premium pricing by demonstrating clear ROI for hospitals. |

| Gross Profit Margin Projection | 66%-67% (non-GAAP) for 2025. | Indicates strong pricing power and efficient cost management, factoring in tariffs. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Intuitive Surgical is grounded in a comprehensive review of public financial disclosures, including SEC filings and annual reports, alongside investor presentations and press releases. We also incorporate insights from industry reports and competitive analyses to ensure a thorough understanding of their market strategy.