Intuitive Surgical Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intuitive Surgical Bundle

Curious about Intuitive Surgical's product portfolio? This preview offers a glimpse into their potential Stars, Cash Cows, Dogs, and Question Marks. Unlock the full strategic advantage by purchasing the complete BCG Matrix for detailed quadrant analysis and actionable insights.

Don't just guess where Intuitive Surgical's innovations stand; know it. The full BCG Matrix provides a data-driven roadmap to optimize your investments and product development strategies. Get the complete picture and drive smarter business decisions today.

Stars

The da Vinci 5 system, unveiled in March 2024, represents Intuitive Surgical's latest innovation and is positioned as a key growth engine. This advanced robotic surgical platform boasts over 150 improvements, including crucial force-sensing capabilities, heightened precision, superior visualization, and refined ergonomics, all designed to elevate surgeon performance and patient outcomes.

With a full market rollout planned for the US in 2025, the da Vinci 5 is anticipated to be a significant catalyst for Intuitive Surgical's future expansion. Analysts project that this technological leap will solidify the company's market leadership and drive substantial revenue growth in the coming years.

Intuitive Surgical is seeing impressive growth in its da Vinci procedures globally. In 2024, there was a significant 17% jump in procedures, and for 2025, the company anticipates a continued strong performance with an estimated increase of 15.5% to 17%.

This expansion isn't limited to one area; it's particularly noteworthy in international markets for non-urology procedures. Additionally, the US market is showing robust adoption in general surgery, highlighting the increasing versatility and acceptance of robotic-assisted surgery across different medical fields and regions.

The revenue generated from instruments and accessories is a cornerstone of Intuitive Surgical's financial success. In the first quarter of 2025, this segment saw a robust 18% increase, reaching $1.37 billion. This vital revenue stream represented a significant 61% of Intuitive's total revenue for the year 2024.

These essential consumables, required for every da Vinci surgical procedure, form a predictable and high-margin recurring revenue base. This consistent cash flow is fundamental to Intuitive Surgical's ongoing expansion and market leadership.

Installed Base Expansion

Intuitive Surgical's installed base of da Vinci surgical systems is a key driver of its success. By the end of 2024, the company had surpassed 10,600 installed systems, with this number climbing to 10,488 systems by the second quarter of 2025. This growth represents a robust year-over-year increase of approximately 14-15%.

This expanding installed base is crucial because it directly translates into higher procedure volumes. More systems in use mean more surgeries are being performed using Intuitive's technology. This consistent demand fuels predictable revenue streams from instruments and accessories, which are essential for each procedure.

- Installed Base Growth: Over 10,600 systems by end of 2024, reaching 10,488 by Q2 2025.

- Year-over-Year Increase: Approximately 14-15% growth in installed systems.

- Impact on Revenue: Drives increased procedure volumes and consistent demand for instruments and accessories.

- Market Position: Solidifies Intuitive Surgical's leadership in the robotic-assisted surgery market.

Research and Development Investment

Intuitive Surgical's commitment to innovation is evident in its substantial research and development (R&D) investments. In 2024, the company allocated $1.15 billion to R&D, representing a significant 13.5% of its revenue. This robust funding is crucial for maintaining its technological edge in the competitive robotic-assisted surgery market.

This continuous investment fuels the development of advanced features, including AI-driven capabilities, and the creation of entirely new surgical systems. Such forward-thinking initiatives are key to Intuitive Surgical's strategy of staying ahead of competitors and ensuring a strong pipeline of future products.

The company's R&D efforts are focused on:

- Enhancing existing robotic systems with new functionalities.

- Developing next-generation surgical platforms.

- Integrating artificial intelligence for improved surgical precision and insights.

- Expanding the range of procedures addressable by their technology.

The da Vinci 5 system, launched in March 2024, is positioned as a Star within Intuitive Surgical's BCG Matrix, representing a high-growth, high-market-share product. Its advanced features, including force sensing and enhanced visualization, are driving significant adoption. The company's substantial R&D investment, $1.15 billion in 2024, fuels its continuous innovation, ensuring the da Vinci 5 and future products maintain market leadership.

| Product | Market Growth | Market Share | BCG Category |

| da Vinci 5 System | High | High | Star |

| Instruments & Accessories | High (18% Q1 2025) | High | Star (as a revenue driver) |

| Installed Base Growth (14-15% YoY) | High | High | Star (enabler) |

What is included in the product

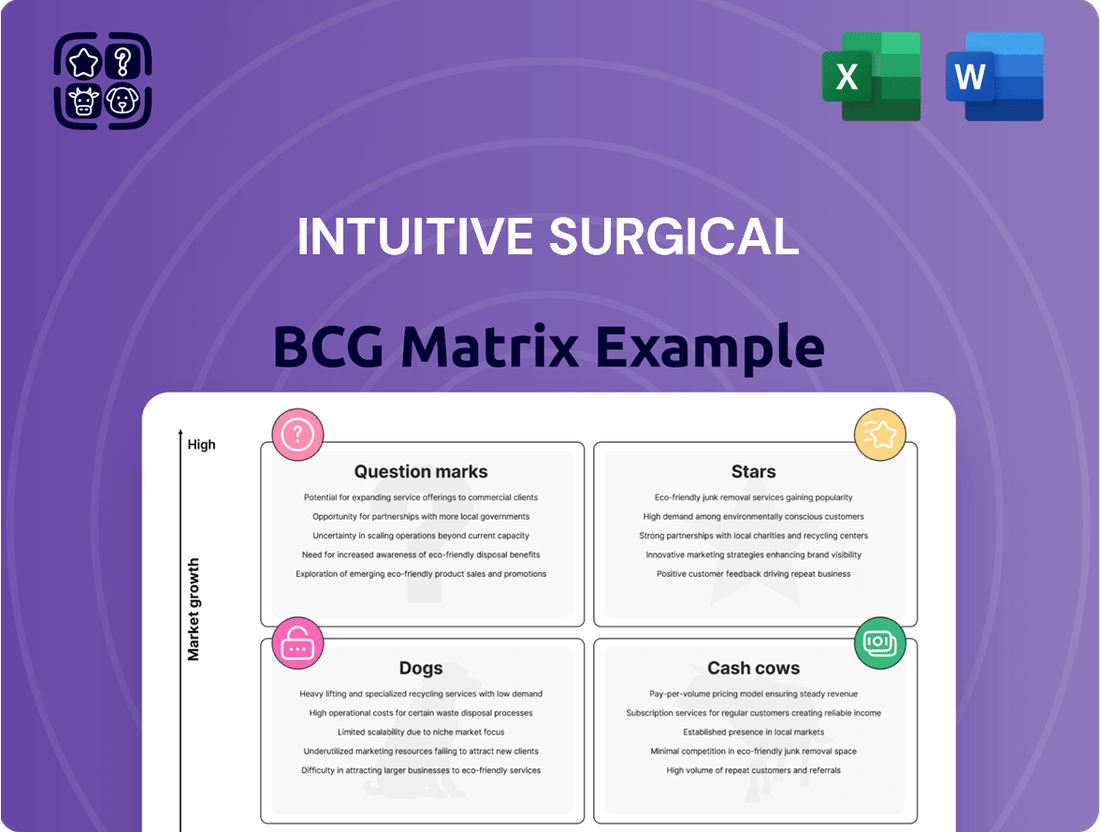

The Intuitive Surgical BCG Matrix analyzes its product portfolio, categorizing innovations into Stars, Cash Cows, Question Marks, and Dogs.

This framework guides strategic decisions on investment, divestment, and resource allocation for each product category.

A clear BCG Matrix visualizes Intuitive Surgical's product portfolio, simplifying strategic decisions and reducing the pain of resource allocation.

Cash Cows

The da Vinci Surgical System, particularly in its established urology and gynecology applications, represents a prime example of a cash cow for Intuitive Surgical. These mature markets have seen significant adoption, leading to consistent and substantial cash generation. In 2023, Intuitive Surgical reported that over 1.5 million procedures were performed using their systems globally, with a significant portion in these established fields.

Intuitive Surgical's Services and Training Programs are a cornerstone of their business, acting as a powerful Cash Cow. These offerings ensure healthcare providers can effectively utilize their robotic systems, fostering widespread adoption and ongoing engagement.

The company's commitment to comprehensive training, including extensive surgeon programs, builds a significant competitive advantage. This robust support infrastructure generates highly predictable, recurring revenue streams, allowing Intuitive Surgical to reliably generate cash from its established customer base.

Proprietary consumables, like the instruments and accessories for the da Vinci surgical systems, are a significant cash cow for Intuitive Surgical. These items are crucial for every procedure, generating consistent, high-margin revenue. For instance, in 2023, Intuitive Surgical reported that instrument and accessory revenue grew by 18% year-over-year, reaching $2.05 billion.

Hospitals are essentially locked into buying these consumables because the da Vinci systems are highly specialized. The cost and complexity of switching to a different robotic surgery platform are substantial, creating high switching costs. This dependency ensures a predictable and highly profitable revenue stream for Intuitive Surgical, as demonstrated by the consistent growth in this segment.

Long-standing Customer Relationships

Intuitive Surgical's long-standing customer relationships are a cornerstone of its success, acting as a significant cash cow. These deep-rooted connections with hospitals and surgeons, nurtured over decades, translate into a remarkably loyal customer base. This loyalty is not merely based on satisfaction but also on the substantial investments made by healthcare institutions.

The extensive installed base of da Vinci surgical systems, coupled with the significant capital expenditure and ongoing commitment to staff training and workflow integration, creates formidable barriers to entry for potential competitors. For instance, as of the first quarter of 2024, Intuitive Surgical reported a global installed base of 7,735 da Vinci systems. This widespread adoption means hospitals are deeply invested in the Intuitive ecosystem, ensuring continued demand for their instruments, accessories, and services, which are crucial revenue streams.

- Installed Base Growth: Intuitive Surgical's installed base of da Vinci systems reached 7,735 units by Q1 2024, demonstrating consistent expansion and customer commitment.

- High Switching Costs: Hospitals face significant costs and operational disruptions in switching from the established da Vinci platform, reinforcing customer retention.

- Recurring Revenue: The ongoing need for instruments, accessories, and servicing for the large installed base generates substantial and predictable recurring revenue, a hallmark of a cash cow.

- Market Dominance: Decades of relationship building have solidified Intuitive's dominant market position, making it the go-to choice for robotic-assisted surgery.

Established Market Leadership

Intuitive Surgical's established market leadership, particularly in the burgeoning surgical robotics sector, firmly places its da Vinci system in the Cash Cows quadrant of the BCG Matrix. In 2024, the company commanded an impressive nearly 60% share of the global market, a testament to its two-and-a-half decades of pioneering innovation and market development. This commanding presence translates directly into significant pricing power and substantial economies of scale.

The company's mature product lines, primarily the da Vinci surgical system, are consistent revenue generators. This sustained demand, coupled with efficient manufacturing processes, allows Intuitive Surgical to extract significant cash flow.

- Market Share Dominance: Holds nearly 60% of the global surgical robotics market in 2024.

- Long-Term Leadership: Over 25 years of experience building its market position.

- Pricing Power: Established leadership allows for strong control over pricing.

- Economies of Scale: Efficient production drives down costs and boosts cash flow.

Intuitive Surgical's da Vinci systems, particularly in urology and gynecology, are undisputed cash cows, generating consistent revenue from a large, loyal customer base. The company's dominance, with nearly 60% of the global surgical robotics market in 2024, combined with high switching costs for hospitals, ensures predictable cash flow. This market leadership is built on over 25 years of innovation and strong customer relationships.

| Product/Service | BCG Quadrant | Key Financial Driver | 2024 Data Point |

|---|---|---|---|

| da Vinci Surgical Systems (Mature Markets) | Cash Cow | High Procedure Volume, Recurring Instrument Sales | Installed base: 7,735 systems (Q1 2024) |

| Services and Training | Cash Cow | Predictable Recurring Revenue, High Customer Retention | Instrument & accessory revenue grew 18% in 2023 |

| Proprietary Consumables (Instruments & Accessories) | Cash Cow | Essential for Procedures, High-Margin Sales | Instrument & accessory revenue reached $2.05 billion in 2023 |

What You See Is What You Get

Intuitive Surgical BCG Matrix

The Intuitive Surgical BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks or demo content will be present in your final download, ensuring you get a professional, ready-to-use strategic analysis. You can trust that the insights and presentation style shown here are precisely what you’ll gain access to for your business planning needs. This comprehensive report is designed to provide immediate strategic clarity for your decision-making processes.

Dogs

Older da Vinci System models, while still operational, are likely positioned as Cash Cows or potentially Dogs in Intuitive Surgical's BCG Matrix as newer, more advanced systems like da Vinci 5 emerge. These older units may experience a slowdown in new installations as healthcare facilities prioritize the latest technology, leading to a more stable but less dynamic market presence.

With the introduction of da Vinci 5, which offers enhanced capabilities and potentially improved patient outcomes, older models could see their market share in new placements decrease. While they continue to generate revenue from existing installations and service contracts, their growth potential is significantly limited, placing them in a low-growth quadrant.

Intuitive Surgical's BCG Matrix might categorize certain ancillary products or nascent innovations as 'dogs' if they haven't gained widespread clinical acceptance or substantial market traction. These offerings, while potentially innovative, would represent areas where investment yields minimal returns, consuming resources without contributing significantly to revenue or the company's overall growth trajectory. For instance, a specialized robotic accessory for a niche surgical procedure that sees very low uptake would fit this description.

Niche or specialized instruments for very specific surgical procedures, like certain advanced neurosurgical tools or highly customized orthopedic implants, can fall into the 'Dogs' category of the BCG matrix. These products often have a low market share because the procedures they support are performed infrequently, and their growth prospects are limited by the inherent rarity of those procedures.

For instance, a specialized robotic instrument designed for a single, complex spinal fusion technique might only be used in a handful of hospitals globally. While crucial for patient outcomes in those specific instances, its limited application means it's unlikely to become a major revenue generator for Intuitive Surgical. In 2024, such instruments might represent less than 1% of the company's total instrument revenue, with projected growth rates below 5% annually.

These 'Dog' products are often maintained to offer a complete surgical solution and demonstrate the breadth of Intuitive Surgical's capabilities, rather than as primary growth drivers. Their continued existence serves to support existing customers and potentially attract new ones who value a comprehensive portfolio, even if these specific items have minimal sales volume.

Discontinued or Phased-Out Products

In the context of Intuitive Surgical's BCG Matrix, products or services that have been discontinued or phased out would fall into the 'dogs' quadrant. These are items that no longer receive significant investment or promotional focus, often due to technological advancements making them obsolete or a decline in market demand. The company's strategy for these products typically involves managing their decline, providing support for existing customers until their end-of-life, and reallocating resources to more promising ventures.

While Intuitive Surgical is known for its innovative robotic surgical systems, specific discontinued products are not publicly detailed in a way that directly maps to a BCG matrix analysis. However, the principle applies to any older generation robotic instruments or accessories that have been superseded by newer, more capable models. For instance, if an older da Vinci Surgical System accessory had limited adoption or was replaced by a more efficient component, it would represent a 'dog' in their portfolio.

The company's focus remains on its high-growth products, such as the da Vinci SP system and its expanding instrument portfolio. As of the first quarter of 2024, Intuitive Surgical reported a 10% increase in system placements, indicating a strong emphasis on current and future technologies rather than maintaining products with diminishing market relevance. This strategic reallocation of capital is a hallmark of managing a 'dog' product line effectively.

- Technological Obsolescence: Older instrument models or accessories that are no longer competitive due to advancements in robotic surgery technology.

- Lack of Market Demand: Products that did not achieve significant market penetration or have seen their demand wane as newer alternatives emerged.

- Strategic Shifts: Products phased out as the company refocuses its research and development efforts on next-generation surgical platforms and solutions.

- Resource Reallocation: Funds and personnel are redirected from these 'dog' products to support and develop high-growth areas within the company's portfolio.

Underperforming Regional Markets

Certain regional markets for Intuitive Surgical, particularly those experiencing intense local competition or navigating complex reimbursement landscapes, could be classified as Dogs in the BCG Matrix. These areas might exhibit slower adoption rates for robotic-assisted surgery compared to more established markets.

For instance, while Intuitive Surgical saw strong global revenue growth, specific emerging markets might lag due to factors like lower healthcare infrastructure investment or a higher concentration of competing surgical technologies. This could translate to a relatively low market share in these particular geographies.

For example, if a particular European region faces significant pricing pressures from local competitors or has slower regulatory approval for new da Vinci system features, it might represent an underperforming market. This necessitates a strategic decision on whether to divest or attempt a turnaround.

- Underperforming Markets: Regions with high competitive intensity or significant economic headwinds.

- Low Growth & Share: Characterized by slower adoption and a smaller market presence relative to global averages.

- Strategic Re-evaluation: Requires careful analysis to determine the future of investment in these specific areas.

Products or services that have low market share and low growth potential are considered Dogs in the BCG Matrix. For Intuitive Surgical, this could include older, less advanced da Vinci system models or specialized instruments with limited adoption. These offerings may consume resources without generating significant returns.

For example, niche surgical instruments designed for rare procedures might fall into this category. While crucial for specific patient needs, their limited application restricts market share and growth. In 2024, such instruments likely represent a small fraction of overall revenue, with minimal projected annual growth.

These 'Dog' products are often maintained for portfolio completeness or to support existing customer needs, rather than as primary revenue drivers. Intuitive Surgical's strategy involves managing these products' decline and reallocating resources to more promising, high-growth areas like newer da Vinci systems.

The company's focus on innovation and expanding the capabilities of its core platforms means that products with declining relevance are strategically managed. This ensures capital is directed towards areas with higher potential for market leadership and financial returns.

Question Marks

The Ion endoluminal system, while experiencing strong growth with 271 placements in 2024 and 54 systems in Q2 2025, is still in its early stages compared to Intuitive Surgical's established da Vinci platform. Its position in the BCG matrix would likely be a 'Question Mark' due to its high growth potential in the expanding bronchoscopy market, yet it currently represents a smaller market share for the company.

The da Vinci SP Single-Port platform, a key innovation for minimally invasive procedures, saw significant growth with 96 placements in 2024 and an additional 23 systems deployed in Q2 2025. This platform addresses a burgeoning market within minimally invasive surgery.

While the da Vinci SP is gaining traction, its installed base and market share remain smaller than Intuitive Surgical's established multiport da Vinci systems. The company is actively pursuing strategies to broaden its clinical applications and increase adoption, notably with the introduction of the SP stapler.

Intuitive Surgical is making substantial investments in digital and AI-driven enhancements for its robotic surgery systems. Features like Case Insights, which analyzes surgical data to improve outcomes, and SureForm staplers, offering advanced tissue management, represent this push. These innovations are poised for significant growth by boosting surgical effectiveness and streamlining procedures.

While these digital and AI tools show immense promise, their market penetration and revenue generation are still in their nascent phases. This positions them squarely in the question mark quadrant of the BCG matrix, demanding continued R&D and market development to unlock their full potential and transition them into stars.

Telesurgery Capabilities

Intuitive Surgical is actively developing and demonstrating telesurgery capabilities, positioning itself within a high-growth, emerging market for remote surgical assistance. This technology holds the potential to dramatically increase access to specialized medical care, particularly in underserved areas.

However, the current market penetration and revenue generated from telesurgery are still relatively low. This places it in the question mark category of the BCG matrix, necessitating significant investment in infrastructure development and navigating complex regulatory landscapes to achieve wider adoption and commercial success.

- Market Potential: Telesurgery represents a nascent but rapidly expanding market, with projections indicating substantial growth in the coming years as technology matures and adoption increases.

- Investment Needs: Significant capital is required to build out the necessary technological infrastructure, including advanced robotics, high-speed communication networks, and robust cybersecurity measures.

- Regulatory Hurdles: Establishing clear regulatory pathways for remote procedures is crucial for widespread implementation and patient safety, a process that is still evolving.

- Current Status: While pilot programs and early-stage deployments are occurring, telesurgery is not yet a major revenue driver for Intuitive Surgical, reflecting its current position as an area of future growth and development.

Future Surgical Robotics Platforms Beyond da Vinci

Intuitive Surgical's exploration into novel surgical robotics platforms beyond its established da Vinci and Ion systems positions these as significant question marks within its portfolio. These ventures are inherently high-risk, high-reward, aiming to pioneer new surgical approaches and applications.

Currently, these nascent platforms have a minimal market presence, reflecting their developmental stage. They necessitate substantial and continuous investment, with no assurance of future market success or profitability.

- New Platform Development: Intuitive Surgical is actively investing in R&D for next-generation robotic surgical systems, potentially targeting new specialties or minimally invasive techniques.

- Market Uncertainty: These future platforms represent unproven markets, carrying significant risk due to the lack of established demand and potential competitor entry.

- High Investment Needs: Substantial capital is required for research, development, clinical trials, and market penetration, demanding sustained financial commitment.

- Potential for Disruption: Successful development could lead to significant market disruption and establish Intuitive Surgical as a leader in entirely new surgical domains.

The Ion endoluminal system, while experiencing strong growth with 271 placements in 2024, is still in its early stages compared to Intuitive Surgical's established da Vinci platform. Its position as a question mark is due to its high growth potential in the expanding bronchoscopy market, yet it currently represents a smaller market share for the company.

Intuitive Surgical's digital and AI-driven enhancements, such as Case Insights, are also question marks. While showing immense promise for improving surgical outcomes, their market penetration and revenue generation are still in nascent phases, demanding continued R&D and market development.

Telesurgery capabilities, though positioned within a high-growth emerging market, remain question marks due to low current penetration and revenue. Significant investment in infrastructure and navigating evolving regulatory landscapes are needed for wider adoption.

Novel surgical robotics platforms beyond current offerings are inherently high-risk, high-reward question marks. These ventures require substantial investment with no guarantee of future market success, but hold the potential for significant disruption.

BCG Matrix Data Sources

Our Intuitive Surgical BCG Matrix is built on a foundation of verified market intelligence, integrating financial disclosures, industry research, and competitor benchmarking for strategic clarity.