Intuitive Surgical Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intuitive Surgical Bundle

Discover the intricate strategy behind Intuitive Surgical's dominance in robotic surgery with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a masterclass in innovation and market penetration.

Unlock the full strategic blueprint behind Intuitive Surgical's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Intuitive Surgical's core partnerships are with healthcare providers and hospitals worldwide. These collaborations are essential for placing their da Vinci and Ion surgical systems within operating rooms, driving their ongoing use, and widening access to less invasive procedures.

In 2024, Intuitive Surgical continued to deepen these relationships, focusing on how their technology can help hospitals achieve key objectives like better patient results and lower healthcare expenses. This strategic alignment ensures the systems are not just installed but actively utilized to improve surgical care.

Intuitive Surgical's success hinges on deep collaborations with surgeons and clinical professionals. These partnerships are crucial for refining their robotic-assisted surgical systems, ensuring the technology meets the evolving needs of the operating room. For instance, feedback from thousands of surgeons using the da Vinci system directly informs future product iterations and feature enhancements.

To facilitate this, Intuitive Surgical invests heavily in comprehensive training programs. In 2023, they conducted numerous training sessions, equipping thousands of surgeons and their teams with the skills necessary for safe and effective robotic surgery. This commitment to education is vital for the widespread adoption and optimal utilization of their platforms, driving clinical excellence.

These strong relationships not only bolster product development but also actively expand the reach of robotic-assisted procedures. By empowering clinicians, Intuitive Surgical fosters a culture of innovation and continuous improvement, ultimately leading to better patient outcomes and the further integration of their technology into standard surgical practice.

Intuitive Surgical actively partners with academic and research institutions to drive the evolution of minimally invasive surgery. These collaborations are crucial for developing new surgical techniques and validating their efficacy through rigorous clinical studies. For instance, research often focuses on expanding the applications of their da Vinci Surgical System beyond current specialties.

These academic ties fuel innovation, enabling Intuitive to explore novel robotic capabilities and gather robust data. This evidence-based approach ensures that their platforms continuously improve, offering enhanced patient outcomes and surgeon experience. Such partnerships are foundational to maintaining their leadership in robotic-assisted surgery.

Technology and Component Suppliers

Intuitive Surgical's success hinges on its relationships with technology and component suppliers. These partnerships are critical for sourcing the highly specialized parts needed for their da Vinci surgical systems, instruments, and accessories. For instance, in 2023, Intuitive Surgical reported that its cost of revenue was $2.4 billion, a significant portion of which is attributable to the components and manufacturing processes reliant on these suppliers. Ensuring a stable and high-quality supply chain is paramount for maintaining product innovation and availability.

These key partnerships are vital for several reasons:

- Supply Chain Stability: Reliable suppliers ensure a consistent flow of essential components, preventing production delays and maintaining the availability of their complex surgical robots.

- Product Quality and Innovation: Collaboration with specialized suppliers allows Intuitive Surgical to access cutting-edge technologies and high-quality materials, directly impacting the performance and advancement of their surgical systems.

- Cost Management: Strong supplier relationships can lead to better pricing and terms, contributing to the overall cost-effectiveness of their manufacturing operations.

Distributors and Sales Organizations (International)

Intuitive Surgical leverages a network of international distributors and its own direct sales organizations to extend its global reach. These partnerships are crucial for effectively marketing and selling its advanced robotic surgical systems and associated consumables across numerous countries.

These collaborations are especially vital for navigating the complex and varied regulatory approval processes and distinct market dynamics present in regions outside the United States. By working with local partners, Intuitive Surgical can better adapt its strategies to meet regional needs and compliance requirements.

- Global Market Penetration: Intuitive Surgical’s international partnerships enable access to over 70 countries, facilitating the widespread adoption of its da Vinci Surgical System.

- Regulatory Navigation: Distributors and sales teams are instrumental in managing the diverse regulatory hurdles in markets such as Europe, Asia, and Latin America, ensuring compliance and market entry.

- Sales and Support Infrastructure: These entities provide essential on-the-ground sales expertise and customer support, critical for building relationships and driving system adoption in new territories.

Intuitive Surgical's strategic alliances with academic and research institutions are fundamental to advancing robotic surgery. These collaborations drive the development of novel surgical techniques and the expansion of da Vinci system applications into new medical fields.

In 2024, Intuitive Surgical continued to foster these partnerships, focusing on clinical validation and the exploration of next-generation robotic capabilities. This commitment to research ensures their technology remains at the forefront of surgical innovation, supported by robust scientific evidence.

These academic ties are critical for generating data that supports the efficacy and benefits of robotic-assisted procedures, ultimately influencing clinical practice and patient care globally.

What is included in the product

A comprehensive, pre-written business model tailored to Intuitive Surgical's strategy, focusing on advanced robotic surgical systems and their ecosystem.

Covers customer segments (hospitals, surgeons), channels (direct sales, training), and value propositions (precision, minimally invasive procedures) in full detail.

Intuitive Surgical's Business Model Canvas acts as a pain point reliever by providing a clear, visual framework that simplifies the complex ecosystem of robotic surgery, making it easier to identify and address challenges in customer relationships and value propositions.

Activities

Intuitive Surgical dedicates substantial resources to Research and Development, a cornerstone of its strategy. For instance, in 2023, the company reported R&D expenses of $1.7 billion, reflecting a significant commitment to advancing robotic-assisted surgery.

This investment fuels the creation of next-generation surgical systems, such as the highly anticipated da Vinci 5, alongside innovative instruments and sophisticated software upgrades. These advancements are crucial for maintaining their position as a technological leader in the field.

By consistently pushing the boundaries of what's possible, Intuitive Surgical expands the functional capacity and application range of its existing and future robotic platforms, ensuring continued market relevance and competitive advantage.

Intuitive Surgical's core manufacturing activity involves the precise assembly of its sophisticated da Vinci and Ion robotic surgical systems. This requires highly specialized processes and skilled labor to ensure the quality and reliability of these complex medical devices.

The company also focuses on the high-volume production of a wide array of instruments and accessories essential for the operation of its surgical platforms. Efficiently managing this diverse product line is key to supporting the widespread adoption of their technology.

Scaling manufacturing capacity is a critical ongoing activity for Intuitive Surgical to meet the ever-increasing global demand for its minimally invasive surgical solutions. In 2023, the company shipped 776 da Vinci systems, a 13% increase compared to 2022, highlighting the need for expanded production capabilities.

Intuitive Surgical drives global adoption of its da Vinci surgical systems through a robust sales and marketing infrastructure. This involves dedicated direct sales forces engaging with hospitals and healthcare systems worldwide to showcase the advantages of robotic-assisted surgery.

Strategic marketing campaigns are crucial, focusing on educating potential customers about the clinical and economic benefits of their solutions. For instance, in 2023, Intuitive Surgical reported total revenue of $7.16 billion, with a significant portion attributed to the increasing adoption of their systems driven by these sales and marketing activities.

Customer Training and Support Services

Intuitive Surgical's commitment to customer success is demonstrated through its extensive training programs. These programs are designed to equip surgeons and their support staff with the knowledge and skills necessary for the safe and effective operation of their robotic surgical systems. For instance, in 2023, Intuitive Surgical continued to expand its global training infrastructure, offering a mix of in-person and remote learning modules to accommodate diverse customer needs.

Beyond initial training, ongoing support is a cornerstone of their business model. This includes critical services like system installation, routine maintenance, and prompt technical assistance. Such comprehensive support ensures minimal downtime and maximizes the utilization of their advanced technology, fostering strong customer relationships. The company's service revenue, which is closely tied to these support activities, saw continued growth through 2023, reflecting the ongoing need for these essential functions.

- Surgeon and Care Team Training: Providing in-depth education for optimal system utilization and patient safety.

- Installation and Maintenance: Ensuring seamless integration and reliable performance of robotic systems.

- Technical Assistance: Offering timely support to address any operational challenges and maintain system uptime.

- Global Training Infrastructure: Expanding access to learning resources worldwide to support a growing customer base.

Regulatory Compliance and Clinical Trials

Intuitive Surgical dedicates significant resources to navigating intricate global regulatory landscapes. This involves securing and maintaining approvals for its robotic-assisted surgical systems and instruments from bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). In 2024, the company continued its focus on expanding the approved uses of its da Vinci systems, which requires ongoing engagement with regulatory agencies.

Conducting rigorous clinical trials is a cornerstone of Intuitive Surgical's strategy to demonstrate the safety and efficacy of its technologies. These trials are crucial for obtaining new product clearances and expanding indications for existing systems. The data generated from these studies supports regulatory submissions and provides evidence for healthcare providers and payers.

- Regulatory Approvals: Securing and maintaining FDA and EMA clearances for da Vinci systems and accessories.

- Clinical Trial Execution: Designing and conducting studies to validate new surgical procedures and system enhancements.

- Global Compliance: Adhering to diverse regulatory requirements across key international markets to facilitate product availability and expansion.

Intuitive Surgical's Key Activities are centered around innovation, manufacturing, sales, training, and regulatory compliance. They invest heavily in R&D to develop advanced robotic surgical systems, instruments, and software, as seen with their $1.7 billion R&D spend in 2023. Manufacturing focuses on the precise assembly of da Vinci and Ion systems and their accessories, scaling to meet global demand, evidenced by a 13% increase in da Vinci system shipments in 2023. Their sales and marketing efforts drive adoption by highlighting clinical and economic benefits, contributing to their $7.16 billion revenue in 2023. Comprehensive training programs and ongoing technical support ensure effective system utilization and customer satisfaction, with expanding global training infrastructure in 2023.

Full Document Unlocks After Purchase

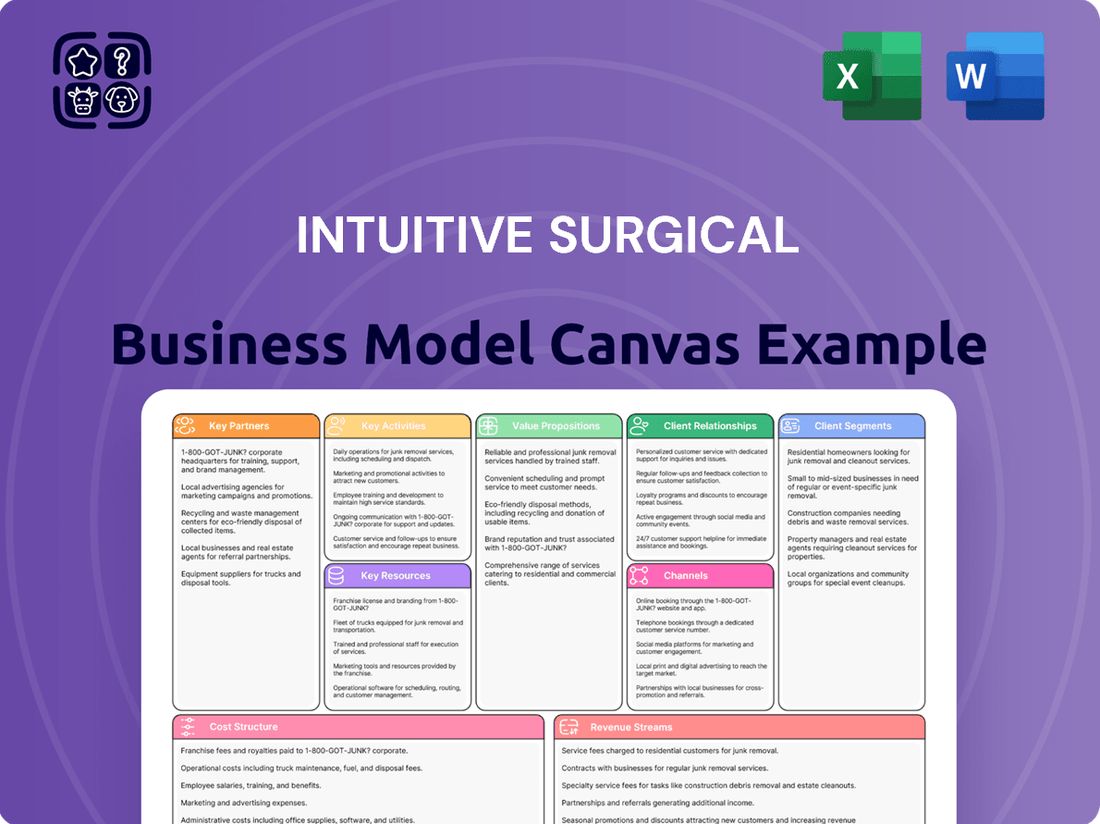

Business Model Canvas

The preview you see is an exact representation of the Intuitive Surgical Business Model Canvas you will receive upon purchase. This is not a sample or mockup; it's a direct glimpse into the comprehensive document that will be yours. You'll gain full access to this professionally structured and ready-to-use analysis, ensuring you get precisely what you're previewing.

Resources

Intuitive Surgical's robust portfolio of patents and trademarks forms a critical cornerstone of its business model, creating a powerful competitive advantage. This intellectual property shields their groundbreaking robotic-assisted surgical systems, ensuring their innovations remain protected and solidifying their market leadership.

As of late 2024, Intuitive Surgical actively manages thousands of patents globally, a testament to their continuous investment in research and development. These patents cover a wide array of technologies, from the intricate mechanics of their da Vinci Surgical System to the software algorithms that enhance surgical precision and control, effectively building a formidable barrier to entry for competitors.

Intuitive Surgical's key resources are its advanced robotic surgical systems, including the established da Vinci platform, the Ion endoluminal system, and the recently released da Vinci 5. These proprietary technologies are the bedrock of their business, enabling complex minimally invasive surgeries and driving significant revenue through system sales and recurring instrument and accessory usage.

The da Vinci systems, which have been a market leader for years, continue to see adoption. For instance, in the first quarter of 2024, Intuitive Surgical placed 157 new da Vinci systems, contributing to a global installed base of 9,173 systems. This robust installed base underpins the recurring revenue stream from disposable instruments and accessories, which is crucial to their financial model.

The Ion system, designed for minimally invasive lung biopsies, represents an expansion into new procedural areas. While specific revenue figures for Ion are often bundled, its increasing placement and utilization highlight Intuitive's strategy to broaden its technological reach and capitalize on emerging surgical needs, further solidifying its position as a leader in robotic-assisted procedures.

Intuitive Surgical's core strength lies in its highly specialized workforce, encompassing R&D engineers, clinical specialists, and sales professionals. This talent pool is fundamental to the company's innovation engine, directly contributing to the development and refinement of its robotic surgical systems.

The expertise of these individuals is crucial for providing robust customer support and training, ensuring successful adoption and utilization of their complex medical devices. In 2024, Intuitive Surgical continued to invest heavily in its human capital, recognizing that skilled personnel are paramount for maintaining its competitive edge and driving market expansion in the minimally invasive surgery sector.

Global Installed Base of Systems

Intuitive Surgical's extensive and expanding global installed base of da Vinci and Ion surgical systems is a core asset. This network of systems in hospitals worldwide is crucial for generating consistent, recurring revenue streams. These revenues primarily come from the sale of necessary instruments, accessories, and ongoing service contracts.

By the first quarter of 2025, Intuitive Surgical had surpassed an impressive milestone, with its global installed base exceeding 10,000 systems. This significant number underscores the widespread adoption and trust in their robotic surgical technology across various medical institutions.

- Installed Base Growth: The installed base of da Vinci and Ion systems has steadily increased, reaching over 10,000 systems as of Q1 2025.

- Recurring Revenue Driver: This large installed base directly fuels recurring revenue through the sale of instruments, accessories, and service agreements.

- Market Penetration: The installed base reflects deep market penetration and widespread acceptance of robotic-assisted surgery in healthcare facilities globally.

- Strategic Asset: The installed base represents a significant competitive advantage and a stable foundation for future growth and innovation.

Proprietary Data and AI Capabilities

Intuitive Surgical leverages its massive repository of surgical data, amassed from millions of da Vinci system procedures, as a cornerstone of its artificial intelligence strategy. This extensive, proprietary dataset is instrumental in developing and refining advanced features, offering unique insights into surgical techniques and patient outcomes.

This unique data asset directly fuels ongoing product enhancement, allowing Intuitive to continuously improve the capabilities of its robotic surgical systems. The insights derived from this data are critical for developing next-generation AI-powered surgical tools and analytics.

- Proprietary Surgical Data: Millions of procedures performed on da Vinci systems generate a vast and unique dataset.

- AI-Driven Enhancements: This data fuels Intuitive's AI strategy, enabling advanced features and predictive analytics.

- Product Development Engine: The dataset is a critical resource for ongoing product improvement and innovation.

- Competitive Advantage: The sheer volume and specificity of this data create a significant barrier to entry for competitors.

Intuitive Surgical's intellectual property, including thousands of global patents, is a paramount key resource. This IP protects their robotic surgical systems, like the da Vinci and Ion platforms, fostering a strong market position and deterring competitors.

The company's highly skilled workforce, comprising engineers, clinical specialists, and sales teams, is another vital asset. Their expertise drives innovation, supports customer adoption, and maintains Intuitive's competitive edge in the rapidly evolving field of robotic surgery.

Intuitive Surgical's extensive global installed base of over 10,000 systems as of Q1 2025 is a critical resource. This network generates substantial recurring revenue from instruments, accessories, and service, underpinning their financial stability and market leadership.

The vast repository of surgical data from millions of procedures is a unique and powerful key resource. This proprietary data fuels AI development, enhancing system capabilities and providing a significant competitive advantage through continuous product improvement.

| Key Resource | Description | 2024/2025 Data Point |

|---|---|---|

| Intellectual Property | Patents and trademarks protecting robotic surgical systems. | Thousands of global patents actively managed. |

| Human Capital | Specialized workforce in R&D, clinical support, and sales. | Continued heavy investment in personnel for innovation and market expansion. |

| Installed Base | Global network of da Vinci and Ion surgical systems. | Exceeded 10,000 systems installed by Q1 2025. |

| Surgical Data | Proprietary data from millions of robotic procedures. | Drives AI strategy, product enhancement, and next-generation tool development. |

Value Propositions

The da Vinci Surgical System provides surgeons with magnified 3D vision and instruments that mimic the human wrist, offering unparalleled dexterity and precision. This translates to significantly improved outcomes in complex procedures, allowing for minimally invasive approaches where previously open surgery was the only option.

In 2024, Intuitive Surgical's systems continue to be instrumental in advancing surgical capabilities across numerous specialties. The system's ability to perform intricate maneuvers with minimal tremor and greater range of motion directly contributes to reduced patient trauma and faster recovery times, a key value proposition for both patients and healthcare providers.

Intuitive Surgical's da Vinci systems are central to their value proposition of minimally invasive care. This technology allows surgeons to perform complex procedures through tiny incisions, leading to significant benefits for patients. For instance, patients undergoing minimally invasive surgery often experience shorter hospital stays and quicker returns to normal activities compared to traditional open surgery.

The advantages for patients are clear: reduced post-operative pain, less scarring, and a lower risk of infection. These outcomes directly contribute to an improved patient experience and better overall recovery. In 2024, the widespread adoption of these techniques continued to underscore their impact on patient well-being.

Intuitive Surgical's da Vinci systems are designed to elevate patient care by fostering better clinical outcomes across a wide array of surgical fields. Research consistently highlights the positive influence of these robotic-assisted procedures on patient recovery and overall results.

These advanced technologies are specifically engineered to bolster safety during intricate surgical procedures. For instance, in 2023, Intuitive Surgical reported that over 15 million procedures had been performed using their da Vinci systems globally, underscoring the widespread adoption and demonstrated benefits in enhancing surgical precision and patient safety.

Comprehensive Ecosystem of Products and Services

Intuitive Surgical offers a comprehensive ecosystem designed to support minimally invasive surgery from start to finish. This includes their da Vinci surgical systems, a vast array of specialized instruments and accessories tailored for various procedures, and ongoing support services. This integrated approach provides healthcare providers with a complete, end-to-end solution.

This holistic offering is crucial for healthcare institutions looking to adopt and optimize robotic-assisted surgery. For instance, in 2023, Intuitive Surgical reported total revenue of $7.1 billion, with a significant portion driven by their systems and recurring revenue from instruments and accessories, underscoring the value of this comprehensive model.

- Integrated Surgical Solutions: da Vinci systems, instruments, and accessories form a cohesive surgical platform.

- Extensive Instrument Portfolio: A broad range of single-use and reusable instruments cater to diverse surgical specialties.

- Ongoing Support and Training: Comprehensive customer support, including training programs and maintenance services, ensures optimal system utilization.

- Holistic Value Proposition: This complete ecosystem simplifies adoption and enhances surgical outcomes for healthcare providers.

Economic Value for Healthcare Systems

Intuitive Surgical's da Vinci systems offer healthcare systems significant economic value by potentially reducing the length of hospital stays. For instance, studies have indicated that robotic-assisted procedures can lead to shorter recovery times compared to traditional open surgery, translating into fewer inpatient days and associated costs.

Beyond shorter stays, the systems contribute to lower overall costs of care by minimizing complications. Reduced rates of post-operative infections and other adverse events mean fewer resources are spent on managing these issues, ultimately improving the financial health of the hospital.

The enhanced operational efficiency derived from da Vinci procedures further bolsters economic value. Faster procedure times and quicker patient recovery can allow hospitals to increase patient throughput, maximizing the utilization of surgical suites and staff.

- Reduced Length of Stay: Studies show robotic surgery can decrease inpatient days, lowering per-patient costs.

- Fewer Complications: Minimally invasive techniques often lead to lower rates of post-operative issues, saving on treatment expenses.

- Improved Efficiency: Faster recovery and potential for increased patient volume enhance overall hospital operational and financial performance.

Intuitive Surgical's value proposition centers on providing advanced robotic-assisted surgical systems that enhance patient outcomes and surgeon capabilities. The da Vinci system offers unparalleled precision, 3D visualization, and instrument dexterity, enabling minimally invasive procedures with reduced patient trauma and faster recovery times. This technological advantage translates to significant benefits for both patients and healthcare providers, solidifying Intuitive Surgical's position as a leader in surgical innovation.

| Value Proposition Component | Description | Key Benefit |

|---|---|---|

| Enhanced Surgical Precision | Magnified 3D vision and wristed instruments | Improved accuracy in complex procedures |

| Minimally Invasive Approach | Smaller incisions and reduced patient trauma | Faster recovery, less pain, and reduced scarring |

| Improved Clinical Outcomes | Greater dexterity and control for surgeons | Better patient results and reduced complications |

| Comprehensive Ecosystem | Systems, instruments, accessories, and support | End-to-end solution for healthcare providers |

Customer Relationships

Intuitive Surgical fosters direct customer connections via specialized sales and clinical support. These teams offer tailored help, system showcases, and continuous advice to healthcare facilities and surgeons.

In 2023, Intuitive Surgical reported that its da Vinci system installed base grew to over 7,700 systems globally, underscoring the reach of these dedicated support structures.

This direct engagement is crucial for driving adoption and ensuring optimal use of their advanced robotic surgical systems, leading to strong customer loyalty and repeat business.

Intuitive Surgical cultivates deep customer relationships through its comprehensive training and education programs. These initiatives are designed to equip surgeons, residents, and entire care teams with the necessary skills to effectively utilize their robotic-assisted surgical systems.

By investing in extensive training pathways, Intuitive Surgical ensures users gain proficiency and confidence in the technology. This commitment fosters long-term loyalty and establishes a strong foundation for ongoing support and product adoption.

For example, in 2023, Intuitive Surgical reported training over 100,000 healthcare professionals globally, underscoring the scale of their educational outreach and its importance in building lasting customer partnerships.

Intuitive Surgical cultivates enduring customer ties through comprehensive long-term service and maintenance contracts. These agreements are crucial for ensuring the consistent performance and longevity of their da Vinci surgical systems, offering clients peace of mind and predictable operational costs.

These contracts provide essential technical support, remote system monitoring, and timely repairs, minimizing downtime and maximizing the return on investment for hospitals and surgical centers. For instance, in 2023, Intuitive Surgical reported that approximately 70% of their installed base was covered by service contracts, highlighting their importance in the business model.

Data-Driven Insights and Program Support

Intuitive Surgical enhances customer relationships by offering hospitals data-driven insights and program support. This means leveraging digital tools to provide analytics that help optimize robotic surgery programs, demonstrating clear value to their partners.

This focus on tangible results strengthens the bond between Intuitive and its hospital clients. For instance, by analyzing procedure data, hospitals can identify areas for improved efficiency and patient outcomes, directly linking Intuitive's technology to enhanced performance.

- Program Optimization: Hospitals utilize Intuitive's analytics to refine surgical workflows and resource allocation.

- Performance Benchmarking: Data allows hospitals to compare their robotic surgery performance against industry standards.

- Enhanced Training and Support: Insights inform targeted training programs for surgical teams.

- Demonstrated ROI: Analytics showcase the financial and clinical benefits of robotic surgery adoption.

Collaborative Innovation and Feedback Loops

Intuitive Surgical deeply values surgeon input, making it a cornerstone of their product evolution. This is evident in how feedback directly shapes upgrades and new systems, ensuring clinical relevance. For instance, the development of the da Vinci 5 system heavily incorporated insights from practicing surgeons.

This collaborative strategy fosters a continuous improvement cycle. By actively engaging with healthcare professionals, Intuitive Surgical can anticipate and address emerging clinical challenges and opportunities. This ensures their technology remains at the forefront of minimally invasive surgery.

- Surgeon Feedback Integration: Direct input from surgeons is a key driver for Intuitive Surgical's product development, exemplified by the da Vinci 5 system.

- Clinical Needs Alignment: This collaborative approach ensures that ongoing innovations and system upgrades are closely aligned with the evolving demands of clinical practice.

- Enhanced User Experience: By incorporating feedback, Intuitive Surgical aims to create more intuitive and effective surgical tools, ultimately benefiting patient outcomes.

Intuitive Surgical prioritizes building strong relationships through dedicated sales and clinical support teams who offer tailored assistance and system demonstrations. These direct interactions are vital for driving adoption and ensuring optimal system use, fostering loyalty.

Their commitment extends to comprehensive training programs for surgeons and staff, equipping them with the skills for robotic surgery. In 2023, over 100,000 healthcare professionals globally received training, highlighting the scale of this engagement.

Long-term service and maintenance contracts are also key, ensuring system uptime and predictable costs, with around 70% of their installed base covered by these agreements in 2023. This focus on ongoing support solidifies customer partnerships.

Furthermore, Intuitive Surgical provides hospitals with data-driven insights to optimize their robotic surgery programs, demonstrating tangible value and reinforcing the benefits of their technology.

Channels

Intuitive Surgical relies heavily on its direct sales force to connect with hospitals and healthcare systems globally. This team is responsible for marketing and selling the da Vinci and Ion surgical systems, along with their associated instruments and accessories. This direct approach allows for in-depth discussions and the ability to craft solutions specifically suited to each customer's needs.

In 2023, Intuitive Surgical reported revenue of $7.1 billion, with a significant portion driven by the sales and servicing of their robotic surgical systems. The direct sales model enables them to build strong relationships with surgeons and hospital administrators, fostering trust and facilitating the adoption of their advanced technology.

Intuitive Surgical's dedicated training centers and on-site programs are key channels for educating surgeons and clinical staff on da Vinci system usage. These educational initiatives are fundamental to driving system adoption and expanding the user base, ensuring proficient operation and maximizing patient benefit.

In 2023, Intuitive Surgical reported a significant number of training hours delivered globally, with over 150,000 healthcare professionals trained on their robotic systems. This investment in education directly supports the growth and effective utilization of their advanced surgical technology.

Intuitive Surgical leverages online platforms and digital engagement to enhance its offerings. The company provides extensive online educational resources for surgeons and hospital staff, facilitating continuous learning and skill development.

Digital tools and integrated capabilities streamline hospital operations and improve da Vinci system performance. These connected offerings include platforms for program analytics, allowing hospitals to track key metrics and optimize their surgical workflows.

In 2024, Intuitive Surgical continued to invest in its digital infrastructure, recognizing the growing importance of remote learning and data-driven insights in the healthcare sector. This focus supports their mission to advance minimally invasive surgery.

Industry Conferences and Medical Exhibitions

Intuitive Surgical actively participates in key industry conferences and medical exhibitions. These events are crucial for demonstrating their da Vinci surgical system's advancements and fostering direct engagement with surgeons, hospital administrators, and other healthcare professionals. For instance, their presence at the American College of Surgeons Clinical Congress and the Association of periOperative Registered Nurses (AORN) Global Surgical Conference & Expo allows for showcasing new technologies and gathering valuable market feedback.

These exhibitions serve as primary channels for lead generation and building brand awareness within the medical community. In 2024, Intuitive Surgical continued its robust presence at these events, leveraging them to highlight clinical outcomes and the economic benefits of robotic-assisted surgery. This strategic engagement directly supports their customer acquisition and retention efforts.

Key benefits derived from these channels include:

- Showcasing Innovation: Demonstrating the latest features and capabilities of the da Vinci system to a targeted audience.

- Lead Generation: Directly interacting with potential customers to identify and cultivate sales opportunities.

- Disseminating Clinical Evidence: Presenting research and data that supports the efficacy and value of their surgical solutions.

- Market Intelligence: Gathering insights into competitor activities and evolving customer needs.

Investor Relations and Public Communications

Investor Relations and Public Communications act as a crucial channel for conveying Intuitive Surgical's performance and vision to the financial community. This involves sharing key financial data and strategic updates through channels like annual reports and earnings calls. For instance, in 2023, Intuitive Surgical reported a revenue of $7.15 billion, a significant increase from previous years, demonstrating robust growth that is communicated to investors.

These communications build trust and shape the company's reputation, directly influencing investor confidence and, consequently, its valuation. The transparency in reporting, including details on instrument and accessory revenue which grew to $3.27 billion in 2023, helps stakeholders understand the drivers of success.

- Communicating Financial Health: Annual reports and quarterly earnings calls provide detailed financial statements, including revenue growth and profitability metrics, to keep investors informed.

- Strategic Direction: Public communications outline the company's long-term strategy, R&D investments, and market expansion plans, guiding investor expectations.

- Reputation Management: Consistent and transparent communication fosters trust and enhances Intuitive Surgical's standing in the investment community.

- Stakeholder Engagement: These channels facilitate dialogue with investors, analysts, and other stakeholders, ensuring alignment and understanding of the company's value proposition.

Intuitive Surgical's channels are multifaceted, encompassing direct sales, robust training programs, digital engagement, industry events, and investor relations. These elements collectively support the company's mission to advance minimally invasive surgery by ensuring widespread adoption, proficient use, and strong stakeholder confidence.

The direct sales force is crucial for building relationships and tailoring solutions, while training centers and online resources ensure users are well-equipped. Industry events showcase innovation and generate leads, with investor relations maintaining transparency and trust.

In 2023, Intuitive Surgical's revenue reached $7.15 billion, underscoring the effectiveness of these channels in driving sales and global reach. The company's commitment to training, with over 150,000 professionals trained in 2023, highlights the importance of educational channels.

Continued investment in digital infrastructure in 2024 further solidifies their reach and support capabilities.

Customer Segments

Hospitals and healthcare systems are the core customers for Intuitive Surgical. This includes major hospitals, large integrated delivery networks, and prominent academic medical centers. These organizations are keen on adopting advanced technologies like robotic-assisted surgical systems to enhance patient care and achieve better surgical results.

In 2024, the demand for minimally invasive surgery, often facilitated by robotic systems, continued to grow. Hospitals are investing in these platforms to attract top surgical talent and offer cutting-edge procedures, aiming to improve patient recovery times and reduce complications.

Surgeons and their entire surgical teams are central to Intuitive Surgical's success. Their direct interaction with the da Vinci system means their training and comfort are paramount. In 2023, Intuitive reported over 14,000 da Vinci systems installed globally, highlighting the vast number of surgical professionals who rely on these platforms.

The proficiency of these teams directly impacts patient outcomes and the adoption rate of robotic-assisted surgery. Intuitive invests heavily in training programs, recognizing that a well-trained surgeon and staff are more likely to utilize the system effectively and advocate for its continued use. This focus ensures that the technology translates into tangible benefits in the operating room.

Government and public health organizations play a crucial role by shaping reimbursement policies and healthcare mandates that directly influence the adoption and accessibility of robotic-assisted surgery. For instance, in 2024, many national health services continue to evaluate the cost-effectiveness of such technologies as part of their broader public health initiatives, impacting funding availability.

Their decisions regarding healthcare coverage and the promotion of specific surgical techniques can significantly affect Intuitive Surgical's market penetration and revenue streams. These entities often drive public health agendas that may favor minimally invasive procedures, thereby creating a favorable environment for robotic systems.

Ambulatory Surgical Centers (ASCs)

Ambulatory Surgical Centers (ASCs) are increasingly adopting robotic-assisted surgery, driven by the demand for more efficient and cost-effective outpatient procedures. These centers are keen on expanding their service offerings with advanced minimally invasive techniques.

The shift towards outpatient care continues to fuel growth in the ASC sector. For instance, the U.S. ASC market was valued at approximately $35 billion in 2023 and is projected to grow significantly. ASCs are particularly attracted to technologies that can reduce patient recovery times and length of stay, directly impacting their operational efficiency and profitability.

- Growing Demand: Minimally invasive procedures are on the rise, pushing ASCs to adopt advanced surgical technologies.

- Cost-Effectiveness: ASCs prioritize solutions that offer a strong return on investment and reduce overall healthcare costs.

- Efficiency Focus: The segment seeks to streamline surgical workflows and improve patient throughput.

International Markets (e.g., Asia, Europe)

Healthcare providers and systems in international markets are crucial for Intuitive Surgical's expansion. Regions like Asia-Pacific and Europe offer substantial growth potential as these markets increasingly adopt minimally invasive surgical techniques. The company's da Vinci surgical systems are being integrated into hospital infrastructures worldwide, reflecting a growing demand for advanced robotic surgery.

In 2024, Intuitive Surgical continued to see strong performance in its international segments. For instance, the company reported that its installed base of da Vinci systems outside the United States grew, indicating increased adoption by hospitals in these key regions. This expansion is driven by a combination of factors including rising healthcare expenditures, an aging population, and a growing awareness of the benefits of robotic-assisted surgery.

Key international customer segments include:

- Major hospital networks and academic medical centers in Europe: These institutions often lead in adopting new technologies and have established reimbursement pathways for robotic surgery.

- Expanding private healthcare providers in Asia-Pacific: Countries like South Korea, Japan, and Australia are seeing significant investment in advanced medical technologies, with Intuitive Surgical systems being a prime example.

- Government-funded healthcare systems in select European countries: These systems are increasingly recognizing the long-term cost-effectiveness and patient outcome improvements offered by robotic surgery.

Intuitive Surgical's customer base extends beyond hospitals to include the surgeons and their teams who directly operate the da Vinci systems. The company's focus on surgeon training and proficiency is critical for the effective utilization and advocacy of robotic surgery. In 2023, Intuitive had over 14,000 da Vinci systems installed globally, underscoring the extensive reach among surgical professionals.

Government and public health organizations are also key stakeholders, influencing the adoption of robotic surgery through reimbursement policies and healthcare mandates. In 2024, these entities continue to assess the cost-effectiveness of advanced technologies, impacting funding and accessibility. Their decisions on healthcare coverage and the promotion of minimally invasive procedures directly shape market penetration and revenue for Intuitive Surgical.

Ambulatory Surgical Centers (ASCs) represent a growing segment, driven by the trend towards outpatient procedures and the pursuit of efficiency. The U.S. ASC market, valued around $35 billion in 2023, is a key area for growth, with ASCs seeking technologies that enhance patient recovery and operational profitability. This segment prioritizes cost-effectiveness and streamlined workflows.

International healthcare providers and systems are vital for Intuitive Surgical's global expansion, particularly in regions like Asia-Pacific and Europe. In 2024, the company observed continued growth in its installed base outside the United States, reflecting increased adoption by hospitals driven by rising healthcare expenditures and an aging population.

| Customer Segment | Key Characteristics | 2023/2024 Relevance |

| Hospitals & Healthcare Systems | Adoption of advanced technology, improved patient care, better surgical outcomes | Continued investment in robotic platforms to attract talent and offer cutting-edge procedures. |

| Surgeons & Surgical Teams | Direct users of da Vinci systems, require training and comfort | Over 14,000 da Vinci systems installed globally (2023), highlighting extensive reliance by surgical professionals. |

| Government & Public Health Organizations | Shape reimbursement policies, influence healthcare mandates | Evaluating cost-effectiveness of robotic surgery in 2024 as part of public health initiatives. |

| Ambulatory Surgical Centers (ASCs) | Demand for efficient outpatient procedures, cost-effectiveness | U.S. ASC market valued ~ $35 billion in 2023; seeking technologies for faster recovery and operational efficiency. |

| International Markets | Asia-Pacific, Europe; growing adoption of minimally invasive surgery | Strong international performance in 2024, with growth in installed base outside the U.S. |

Cost Structure

Intuitive Surgical heavily invests in Research and Development, dedicating a significant portion of its costs to innovation. This spending fuels the creation of next-generation surgical systems, advanced instruments, and sophisticated software. In 2024 alone, the company reported $1.15 billion in R&D expenses.

This substantial R&D outlay is a cornerstone of their strategy to maintain a leading edge in robotic-assisted surgery. It ensures their existing product lines are continuously improved and that they can introduce groundbreaking technologies to the market.

Manufacturing and production costs are a significant component for Intuitive Surgical, encompassing the raw materials, intricate components, skilled labor, and factory overhead required to build their advanced da Vinci and Ion surgical systems, along with their essential instruments and accessories. For instance, in 2023, Intuitive Surgical reported cost of revenue at $2.5 billion, a notable increase from $2.1 billion in 2022, reflecting these production expenses.

Factors like the rising costs of specialized facilities and potential impacts from tariffs can directly influence the company's gross margins, making efficient supply chain management and production processes crucial for profitability.

Intuitive Surgical invests significantly in its direct sales force, marketing campaigns, and participation in key industry events to drive market penetration and acquire new customers. These expenses are crucial for educating the market about its robotic-assisted surgical systems and building relationships with healthcare providers.

Establishing and maintaining a robust global distribution network also represents a substantial cost. This includes logistics, warehousing, and support infrastructure necessary to deliver and service their complex medical devices worldwide, ensuring timely access for hospitals and surgeons.

In 2023, Intuitive Surgical reported $1.47 billion in selling, general, and administrative (SG&A) expenses, a significant portion of which directly reflects these sales, marketing, and distribution efforts. This figure highlights the company's commitment to expanding its market reach and supporting its growing customer base.

Service and Support Operations

Intuitive Surgical incurs substantial expenses in its Service and Support Operations. These costs are driven by the need to maintain a highly skilled workforce of field service engineers and technical support staff who ensure the optimal functioning of their complex robotic surgical systems worldwide. In 2023, for instance, the company reported approximately $1.6 billion in revenue from its service segment, underscoring the significant investment required to support its installed base.

Key cost drivers within this area include:

- Field Service Engineers: Salaries, training, travel, and equipment for engineers who perform installations, preventative maintenance, and repairs on da Vinci Surgical Systems.

- Technical Support: Costs associated with customer service centers, remote diagnostics, and troubleshooting to address customer inquiries and issues promptly.

- Spare Parts and Inventory: Maintaining an adequate supply of replacement parts to ensure minimal downtime for surgical systems.

- Training and Education: Developing and delivering training programs for surgeons, operating room staff, and hospital biomedical engineers on system usage and maintenance.

Training and Education Program Costs

Intuitive Surgical incurs significant expenses in developing and delivering comprehensive training programs. These costs are crucial for ensuring surgeons and clinical staff are proficient with their robotic systems.

Key components of this cost structure include:

- Development of Training Materials: Creating curriculum, procedural guides, and digital learning modules.

- Simulation Platforms: Investment in and maintenance of advanced robotic simulators that mimic real surgical environments.

- Clinical Education Staff: Salaries and ongoing professional development for trainers and clinical specialists.

- Logistics and Travel: Costs associated with bringing trainees to training centers or sending instructors to customer sites.

For instance, in 2023, Intuitive Surgical reported $676 million in "General, Administrative, and Marketing" expenses, which would encompass a substantial portion of these training and education investments, alongside other operational overheads.

Intuitive Surgical's cost structure is heavily influenced by its substantial investment in research and development, manufacturing, sales and marketing, and service and support. These areas represent the core expenses in delivering and maintaining their advanced robotic surgical systems.

In 2023, the company's cost of revenue was $2.5 billion, reflecting the direct costs of producing their sophisticated medical devices. Selling, general, and administrative expenses amounted to $1.47 billion, encompassing sales, marketing, and broader operational overheads. The company also reported $1.15 billion in R&D expenses for 2024, highlighting their commitment to innovation.

| Cost Category | 2023 Expense (USD Billions) | Key Drivers |

|---|---|---|

| Cost of Revenue | 2.5 | Manufacturing, components, labor |

| R&D Expenses | 1.15 (2024) | Innovation, new systems, software |

| SG&A Expenses | 1.47 | Sales force, marketing, distribution |

| Service & Support | (Implied from service revenue of $1.6B) | Field engineers, technical support, training |

Revenue Streams

Intuitive Surgical generates substantial revenue through the sale or lease of its advanced robotic surgical platforms, including the da Vinci surgical systems, the Ion endoluminal system, and the recently launched da Vinci 5. These initial system placements form a significant portion of the company's upfront earnings, providing healthcare facilities with cutting-edge technology.

Instruments and accessories sales represent Intuitive Surgical's most substantial recurring revenue, a direct result of the consumables needed for each robotic-assisted surgery. This creates a classic razor-and-blade business model, where the initial purchase of the da Vinci surgical system is complemented by ongoing sales of essential, often single-use, components.

In 2024, this critical revenue stream generated approximately $5.08 billion, underscoring its importance to the company's financial performance and the sticky nature of its customer relationships.

Recurring revenue flows in from service contracts, which cover essential maintenance, repairs, and technical support for the vast installed base of da Vinci surgical systems. These agreements are crucial for ensuring high system uptime and maintaining strong customer satisfaction by keeping their sophisticated equipment running smoothly.

In 2023, Intuitive Surgical reported that its revenue from instruments and accessories, which are often tied to service and system utilization, reached $2.3 billion. This highlights the significant contribution of these ongoing revenue streams to the company's overall financial health and stability.

Software and Digital Solutions

Intuitive Surgical is expanding its software and digital solutions, which are becoming a significant revenue stream. These offerings include subscriptions and fees for advanced analytics platforms, integrated digital tools, and software upgrades designed to enhance surgical program insights and efficiency. For instance, in 2023, the company reported that its da Vinci system placements continued to grow, with 772 new systems placed, contributing to the recurring revenue generated from these digital services.

These digital capabilities are crucial for providing value-added services to healthcare providers. They offer data-driven insights into surgical performance, patient outcomes, and operational efficiency, which are increasingly sought after in modern healthcare. This focus on digital integration aims to create a more connected and intelligent surgical ecosystem.

- Subscription-based access to advanced analytics and data insights.

- Fees for integrated digital tools that enhance surgical workflow and training.

- Revenue from software upgrades and maintenance for digital platforms.

- Potential for future revenue from new digital service offerings and data monetization.

Training and Education Fees

Intuitive Surgical generates revenue through dedicated training and education programs, which are often bundled with system purchases but also stand as a distinct revenue stream. As the installed base of da Vinci Surgical Systems expands, the need for new surgeon certification and ongoing professional development fuels consistent demand for these educational services.

These programs are crucial for ensuring surgeons are proficient with the technology, thereby maximizing its utility and adoption. For instance, in 2023, Intuitive Surgical reported that over 11,000 healthcare professionals participated in their training programs, underscoring the significant volume of this service.

- Dedicated Training Programs: Revenue from specialized courses and certification for surgeons and operating room staff.

- Growing Installed Base: Increased system placements necessitate ongoing training for new users.

- Professional Development: Continued education for existing users to enhance skills and introduce new procedures.

- Certification Revenue: Fees associated with certifying surgeons and technical personnel on da Vinci systems.

Intuitive Surgical's revenue streams are diverse, encompassing system sales, instruments and accessories, service contracts, and increasingly, software and digital solutions. The company also generates income from specialized training programs, ensuring proficient use of its robotic platforms.

In 2024, instruments and accessories, a key recurring revenue driver, contributed approximately $5.08 billion. Service contracts further bolster this by providing essential maintenance and support for the extensive installed base of da Vinci systems.

The company's strategic expansion into software and digital solutions, including advanced analytics and integrated tools, represents a growing revenue segment. These digital offerings enhance surgical insights and operational efficiency for healthcare providers.

| Revenue Stream | 2023 Data (Approx.) | 2024 Data (Approx.) |

|---|---|---|

| Instruments & Accessories | $2.3 billion | $5.08 billion |

| System Placements | 772 new systems | [Data not available for 2024 system placements] |

| Training Programs | 11,000+ healthcare professionals trained | [Data not available for 2024 training numbers] |

Business Model Canvas Data Sources

The Intuitive Surgical Business Model Canvas is informed by a blend of internal financial reports, market research on robotic surgery adoption, and competitive analysis of medical device manufacturers. These sources provide a comprehensive view of the company's operations and market position.