Intuitive Surgical Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intuitive Surgical Bundle

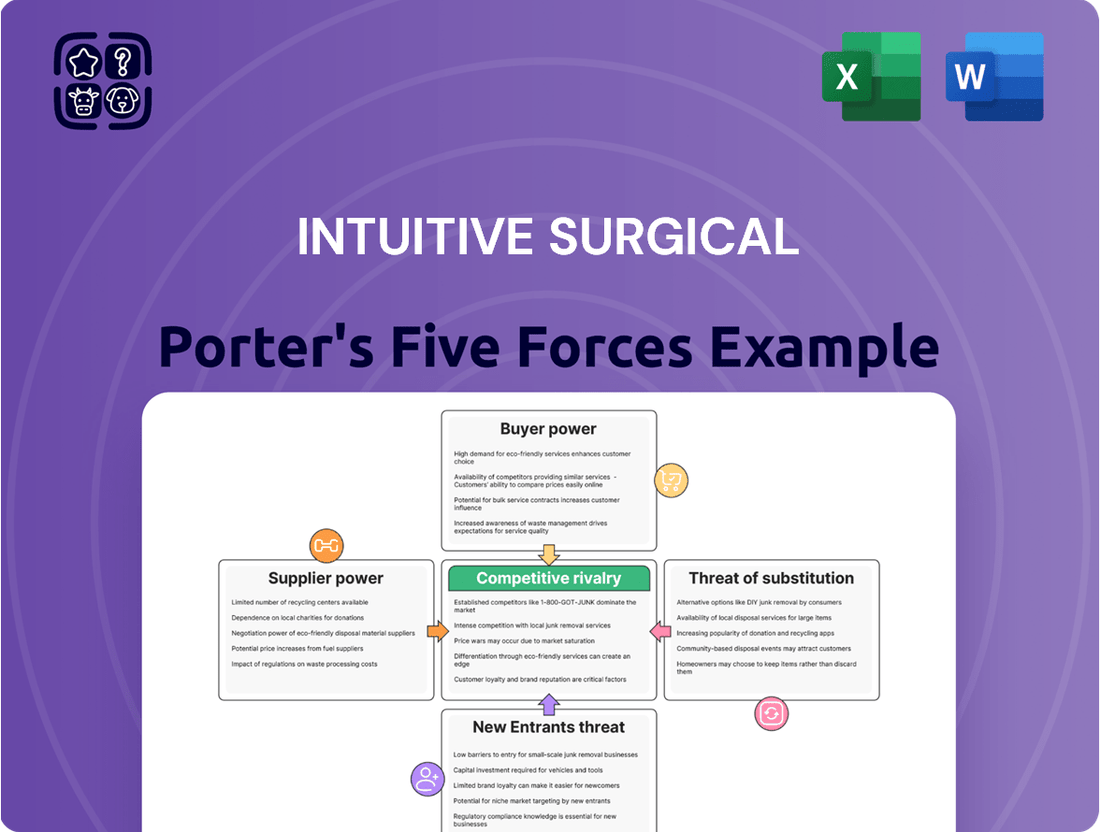

Intuitive Surgical, a leader in robotic-assisted surgery, navigates a complex competitive landscape. Understanding the intensity of rivalry, the power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for strategic decision-making.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Intuitive Surgical’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Intuitive Surgical benefits from a moderate to low bargaining power of suppliers. This is largely because the company exercises significant control over its supply chain by manufacturing many of its components in-house. This vertical integration reduces its reliance on external vendors for critical parts.

Furthermore, Intuitive Surgical strategically sources common components from a variety of suppliers. For instance, in 2023, the company reported sourcing a broad range of electronic and mechanical parts from numerous global manufacturers, diversifying its supplier base and thereby diminishing the leverage of any single supplier.

Switching costs for Intuitive Surgical, particularly concerning their da Vinci surgical system components, can be substantial. These costs include not only the financial outlay for new equipment and integration but also the significant time investment required for retraining surgeons and staff, as well as revalidating new suppliers and their parts within a highly regulated medical device environment.

While these switching costs could theoretically empower suppliers, Intuitive Surgical's proactive approach to managing these relationships is key. The company's substantial market share and ongoing innovation in robotic surgery likely provide leverage in negotiating terms and ensuring component quality, thereby mitigating excessive supplier power.

The uniqueness of inputs plays a crucial role in supplier bargaining power. If suppliers provide highly specialized components or possess critical intellectual property, their leverage increases significantly. This can lead to higher costs or limited availability for the buyer.

Intuitive Surgical, however, often mitigates this by fostering internal innovation. Their substantial investment in research and development, particularly in robotics and advanced surgical technologies, allows them to create proprietary solutions. This internal development reduces their dependence on external suppliers for unique or patented inputs, thereby weakening supplier bargaining power.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into manufacturing robotic surgical systems is a minimal concern for Intuitive Surgical. This is largely due to the substantial capital investment, advanced technological capabilities, and stringent regulatory approvals needed to enter and compete in this specialized medical device sector. For instance, developing a new robotic surgical platform requires extensive R&D, clinical trials, and FDA clearance, a process that can cost hundreds of millions of dollars and take many years.

This high barrier to entry significantly limits the ability of Intuitive Surgical's current suppliers to become direct competitors. Suppliers of components, such as specialized robotic arms or advanced imaging sensors, typically lack the integrated expertise and market access necessary to develop and market complete surgical systems. As of 2024, the global market for surgical robots is dominated by a few established players, indicating the difficulty for new entrants to gain traction.

- High Capital Requirements: Developing and launching a robotic surgical system demands significant financial resources, often exceeding $500 million for research, development, and regulatory processes.

- Technological Expertise Gap: Suppliers usually specialize in specific components, lacking the end-to-end system design, software integration, and clinical application knowledge required for robotic surgery.

- Regulatory Hurdles: Gaining approval from bodies like the FDA for new medical devices, especially complex robotic systems, is a lengthy and costly process, deterring potential new entrants.

- Limited Supplier Power: The inability of suppliers to easily integrate forward reduces their bargaining power, as they are unlikely to become viable direct competitors to Intuitive Surgical.

Importance of Intuitive Surgical to Suppliers

Intuitive Surgical's dominant market share in robotic surgery makes it a critical customer for its component suppliers. This substantial demand grants Intuitive Surgical considerable leverage when negotiating pricing and terms, thereby diminishing the bargaining power of these suppliers.

Suppliers who depend heavily on Intuitive Surgical for a significant portion of their revenue find their ability to dictate terms weakened. For instance, specialized medical device manufacturers producing unique components for the da Vinci surgical system may face pressure on profit margins due to Intuitive Surgical's purchasing volume.

The company's scale of operations, evidenced by its consistent revenue growth, such as reporting $7.1 billion in revenue for 2023, allows it to negotiate favorable contracts. This financial strength translates into greater power over its supply chain, ensuring it secures necessary components at competitive prices.

- Significant Customer Base: Intuitive Surgical's vast installed base of surgical systems worldwide translates into consistent and high-volume orders for its suppliers.

- Negotiating Leverage: The company's substantial purchasing power allows it to negotiate favorable pricing and terms with suppliers, limiting their ability to charge premium prices.

- Supplier Dependence: Many suppliers are highly reliant on Intuitive Surgical for a significant portion of their business, making them more amenable to the company's demands.

Intuitive Surgical generally faces low bargaining power from its suppliers. This is due to its vertical integration, diverse sourcing of common parts, and the high barriers to entry for suppliers wanting to compete directly.

The company's substantial revenue, reported at $7.1 billion for 2023, coupled with its significant market share, gives it considerable negotiating power. This scale allows Intuitive Surgical to secure components at competitive prices, limiting supplier leverage.

The high costs and technical expertise required to produce components for Intuitive Surgical's advanced robotic systems also limit the number of qualified suppliers, further reducing their collective bargaining power.

| Factor | Intuitive Surgical's Position | Impact on Supplier Bargaining Power |

| Supplier Concentration | Low; diverse sourcing for common parts | Low |

| Importance of Volume to Supplier | High; Intuitive Surgical is a major customer | Low |

| Switching Costs for Intuitive Surgical | High (due to integration, retraining) | Low (mitigated by company strategy) |

| Supplier Differentiation | Low for common parts; High for specialized components | Moderate |

| Threat of Forward Integration by Suppliers | Very Low; high barriers to entry in robotic surgery | Very Low |

What is included in the product

This analysis dissects Intuitive Surgical's competitive environment by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors.

Quickly assess competitive pressures and identify strategic opportunities by visualizing Intuitive Surgical's Porter's Five Forces in a dynamic, interactive dashboard.

Customers Bargaining Power

Hospitals, the main buyers of Intuitive Surgical's da Vinci systems, face a significant financial hurdle. The initial price tag for a da Vinci system can fall anywhere between $600,000 and $2.5 million. This substantial upfront expenditure, coupled with ongoing costs for service contracts and disposable instruments, creates a strong lock-in effect.

This high initial capital investment effectively reduces the bargaining power of customers. Once a hospital has committed such a large sum to a da Vinci system, switching to a competitor's technology becomes a financially daunting prospect, making them less likely to exert significant pressure on pricing or terms.

Hospitals face substantial hurdles when considering a switch from Intuitive Surgical's da Vinci system. The investment in the robotic platform itself is considerable, but the true barrier lies in the extensive training required for surgeons. With over 76,000 surgeons globally trained on the da Vinci system as of recent reports, retraining for a new platform would be both time-consuming and costly, significantly increasing switching costs.

This deep integration of training and technology creates an entrenched ecosystem for Intuitive Surgical. The disruption to surgical schedules, ongoing patient care, and the need for new procedural protocols makes transitioning to a competitor's system a complex and often prohibitive undertaking for healthcare institutions.

Intuitive Surgical's da Vinci Surgical System stands as a highly specialized and unique offering in the realm of robotic-assisted surgery. Its advanced capabilities provide surgeons with unparalleled precision and control, setting it apart from conventional surgical methods.

The scarcity of direct substitutes that can replicate the da Vinci system's distinct features significantly curtails the bargaining power of its customers. Hospitals and surgical centers seeking these advanced functionalities have limited alternatives, strengthening Intuitive Surgical's market position.

Recurring Revenue from Consumables and Services

Intuitive Surgical's reliance on recurring revenue from instruments, accessories, and services significantly strengthens its position against customers. This 'razor-and-blade' model ensures that once a hospital invests in a da Vinci surgical system, they become dependent on Intuitive for ongoing, essential supplies. For instance, in 2023, instruments and accessories, along with services, constituted approximately 76% of Intuitive Surgical's total revenue, highlighting the substantial recurring income stream.

This dependence on consumables and services diminishes the bargaining power of customers. They cannot easily switch to alternative suppliers for these critical components without disrupting their surgical operations or invalidating their system warranties. This lock-in effect means customers have less leverage to negotiate prices or terms for these recurring purchases.

- Recurring Revenue Dominance: Instruments, accessories, and services represented a substantial portion, around 76%, of Intuitive Surgical's revenue in 2023.

- 'Razor-and-Blade' Model: The business model creates customer dependency on Intuitive for essential, ongoing supplies after the initial system purchase.

- Reduced Customer Leverage: This dependency limits customers' ability to negotiate prices or seek alternative suppliers for critical surgical consumables.

Improved Patient Outcomes and Clinical Benefits

The enhanced clinical benefits of robotic-assisted surgery, such as those offered by Intuitive Surgical's da Vinci system, significantly reduce customer bargaining power. For instance, studies have shown that robotic procedures can lead to shorter hospital stays and fewer complications.

These improved patient outcomes translate into tangible cost savings for hospitals through reduced readmissions and post-operative care. This makes the value proposition of Intuitive's technology compelling, even with its initial investment, thereby lessening the pressure hospitals can exert on pricing.

- Reduced Hospital Stays: Robotic-assisted procedures often result in patients being discharged sooner, decreasing overall hospital resource utilization.

- Lower Complication Rates: Enhanced precision in robotic surgery can lead to fewer adverse events, saving on costly treatments for complications.

- Faster Patient Recovery: Quicker recovery times mean patients return to normal activities sooner, a key benefit for both patients and healthcare providers.

Customers, primarily hospitals, face substantial switching costs due to the significant capital investment in Intuitive Surgical's da Vinci systems and the extensive surgeon training involved. As of recent reports, over 76,000 surgeons globally are trained on the da Vinci system, making retraining a costly and time-consuming endeavor.

The scarcity of viable substitutes that offer comparable precision and control further limits customer bargaining power. This technological differentiation, coupled with the recurring revenue from instruments and services which accounted for approximately 76% of Intuitive's 2023 revenue, creates a strong lock-in effect.

The enhanced clinical benefits, such as shorter hospital stays and fewer complications associated with robotic-assisted surgery, strengthen Intuitive's value proposition. These improved patient outcomes translate into cost savings for hospitals, reducing their leverage to negotiate prices.

| Factor | Impact on Bargaining Power | Supporting Data (2023/Recent) |

| Switching Costs (System & Training) | Lowers Customer Bargaining Power | 76,000+ surgeons trained on da Vinci |

| Availability of Substitutes | Lowers Customer Bargaining Power | Limited direct competitors with comparable features |

| Recurring Revenue Dependence | Lowers Customer Bargaining Power | Instruments/Services = ~76% of 2023 Revenue |

| Clinical Benefits & Cost Savings | Lowers Customer Bargaining Power | Shorter hospital stays, reduced complications |

What You See Is What You Get

Intuitive Surgical Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You're viewing a comprehensive Porter's Five Forces analysis of Intuitive Surgical, detailing the competitive landscape and strategic positioning of the company in the surgical robotics market. This analysis covers the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products, providing a thorough understanding of the industry's dynamics.

Rivalry Among Competitors

Intuitive Surgical has long been the undisputed leader in robotic surgery, with its da Vinci system commanding a substantial global market share, estimated at around 60% in 2024. This dominance stems from years of innovation and market penetration.

However, this strong position is now facing growing pressure from a range of emerging competitors. Major medical device players such as Medtronic, which offers its Hugo system, and Johnson & Johnson, with its Ottava platform, are actively challenging Intuitive Surgical's market leadership. Additionally, nimble smaller companies like CMR Surgical and Stryker are also making significant inroads.

Intuitive Surgical's commitment to research and development is a significant driver of its competitive strength. In 2024, the company allocated $1.15 billion to R&D, fueling a continuous cycle of innovation.

This substantial investment allows Intuitive Surgical to consistently introduce cutting-edge technologies. The recent launch of the da Vinci 5 system, boasting enhanced AI capabilities and greater processing power, exemplifies this dedication to staying ahead of the curve in a competitive landscape.

Intuitive Surgical enjoys a formidable competitive advantage through its vast installed base of da Vinci robotic surgical systems. By the close of 2024, the company had deployed over 10,600 systems worldwide, creating a significant network effect.

Furthermore, its comprehensive surgeon training programs have equipped more than 76,000 surgeons with the expertise to operate these systems. This deep integration within the surgical community and the high level of specialized training required act as substantial barriers to entry for potential competitors, fostering strong customer loyalty.

Market Growth and Expansion

The global surgical robotics market is set for substantial expansion, with projections indicating a rise from $11 billion in 2024 to $30 billion by 2031. This growth trajectory, coupled with the concurrent expansion of minimally invasive surgery, suggests ample room for multiple participants. However, this burgeoning market will likely foster intense competition as companies vie for significant market share.

The competitive rivalry is amplified by the market's attractiveness, drawing in both established players and new entrants. Companies are investing heavily in research and development to differentiate their offerings and capture a larger portion of this expanding pie. This dynamic can lead to aggressive pricing strategies and rapid innovation cycles.

- Market Growth: The surgical robotics market is expected to grow from $11 billion in 2024 to $30 billion by 2031.

- Minimally Invasive Surgery: This segment is also experiencing rapid expansion, fueling robotics adoption.

- Competitive Landscape: While growth accommodates multiple players, intense competition for market share is anticipated.

- Innovation Focus: Companies are prioritizing R&D to gain a competitive edge in this dynamic sector.

Strategic Partnerships and Acquisitions

Competitive rivalry intensifies as key players pursue strategic partnerships and acquisitions to bolster their market standing. Medtronic's acquisition of Mazor Robotics in 2020 for approximately $1.7 billion, for instance, significantly expanded its robotic-assisted surgery capabilities. Similarly, Johnson & Johnson's development of its Ottava robotic surgical system underscores a commitment to innovation and market expansion.

These moves highlight a dynamic environment where companies proactively seek to broaden their product portfolios and enhance their geographical reach. This consolidation and collaboration trend reshapes the competitive landscape, pushing rivals to adapt and innovate to maintain or improve their market share.

- Medtronic's acquisition of Mazor Robotics: A move to bolster robotic-assisted surgery offerings.

- Johnson & Johnson's Ottava system: Demonstrates ongoing investment in robotic surgery technology.

- Market Consolidation: Indicates a trend towards fewer, larger players with broader capabilities.

The surgical robotics market is experiencing robust growth, projected to reach $11 billion in 2024 and expand to $30 billion by 2031. This expansion attracts significant competition from established giants like Medtronic and Johnson & Johnson, as well as emerging players like CMR Surgical. Intuitive Surgical, despite its 60% market share in 2024, faces increasing rivalry fueled by substantial R&D investments, such as Intuitive's $1.15 billion in 2024, and strategic moves like acquisitions. These factors create a dynamic environment where innovation and market penetration are key to maintaining leadership.

| Competitor | Key Robotic System | 2024 Market Presence Notes |

|---|---|---|

| Intuitive Surgical | da Vinci Systems | Estimated 60% market share; over 10,600 systems deployed globally. |

| Medtronic | Hugo™ Robotic-Assisted Surgery System | Acquired Mazor Robotics in 2020 for approx. $1.7 billion; expanding offerings. |

| Johnson & Johnson | Ottava™ robotic surgical system | Significant investment in developing advanced robotic platforms. |

| CMR Surgical | Versius Surgical Robotic System | Emerging competitor making inroads with innovative technology. |

SSubstitutes Threaten

Traditional open surgery continues to be a significant substitute for robotic-assisted procedures, particularly in situations demanding extreme complexity or in regions with limited access to advanced robotic technology. For instance, while Intuitive Surgical's da Vinci system is widely adopted, the cost of these systems can be a barrier, making open surgery a more viable option for many healthcare facilities.

Despite the advancements in minimally invasive techniques, open surgery remains prevalent for certain intricate operations where its familiarity and established protocols are still preferred. However, the overall shift is undeniably towards less invasive methods, driven by documented improvements in patient recovery times and reduced post-operative discomfort, a trend that has been accelerating in recent years.

Conventional laparoscopic surgery presents a significant threat as a substitute for robotic-assisted procedures. It's a more affordable, minimally invasive option for many surgeries where robotic systems are employed.

While robotic surgery excels in complex cases, such as certain colorectal cancer surgeries, studies in 2024 continue to show comparable outcomes for many other procedures. In some specific scenarios, traditional laparoscopy even demonstrates superior results.

The expanding minimally invasive surgery (MIS) market, fueled by innovations beyond robotics, poses a significant threat of substitution. For instance, advancements in high-definition imaging and sophisticated electrosurgical tools are making traditional laparoscopic procedures more effective and accessible, potentially limiting the perceived necessity of robotic assistance in certain applications.

The rise of single-port laparoscopy, a technique that uses a single incision, offers another alternative that could siphon demand from multi-port robotic systems. This trend is supported by data showing increasing adoption of these less invasive, non-robotic approaches across various surgical specialties.

Pharmaceutical Interventions

The rise of pharmaceutical interventions, particularly GLP-1 receptor agonists like semaglutide and tirzepatide, presents a significant threat of substitutes for Intuitive Surgical. These medications have shown considerable efficacy in weight management, potentially reducing the demand for bariatric surgeries, a key area for da Vinci system adoption.

This trend directly impacts Intuitive Surgical by offering an alternative to surgical procedures. For instance, in 2024, the market for weight loss drugs is projected to reach tens of billions of dollars, indicating a substantial shift in patient and physician preference towards pharmacological solutions for obesity. This could directly translate to fewer patients opting for bariatric surgery, thereby decreasing the utilization of Intuitive Surgical's robotic systems.

- GLP-1 drugs offer a non-invasive alternative to bariatric surgery.

- The global obesity drug market is experiencing rapid growth, with significant advancements in GLP-1 agonists.

- Reduced demand for bariatric procedures may lower the need for da Vinci surgical systems in this segment.

- This pharmaceutical trend represents a direct substitute that could erode Intuitive Surgical's market share in weight management interventions.

Emerging Technologies and Future Innovations

The medical technology sector is a hotbed of innovation, with constant advancements shaping the future of patient care. Consider the rapid progress in AI-driven surgical platforms, which are becoming increasingly sophisticated. These emerging technologies represent a significant threat of substitutes for current robotic surgery systems.

Looking ahead, the development of nanobots for minimally invasive procedures and enhanced visualization techniques could offer entirely new approaches to surgery. This ongoing evolution means that what is considered cutting-edge today might be superseded by more efficient or cost-effective alternatives tomorrow. For instance, by 2024, the global medical robotics market was projected to reach over $18 billion, indicating substantial investment in this area, which fuels the development of potential substitutes.

- AI-Powered Microsurgery: Research into AI that can assist or even perform microsurgical tasks independently.

- Nanotechnology in Medicine: The potential for microscopic robots to perform internal diagnostics and repairs.

- Advanced Visualization: Innovations in augmented reality and real-time imaging that could improve traditional surgery.

While robotic surgery is a leader, conventional laparoscopic surgery remains a strong substitute. It's more accessible and cost-effective for many procedures, and advancements in its technology, like improved imaging and instruments, continue to enhance its capabilities. This means that for a significant portion of surgeries, particularly those not requiring the highest level of robotic dexterity, laparoscopy offers a compelling alternative.

The threat of substitutes is amplified by the growing adoption of less invasive, non-robotic techniques like single-port laparoscopy. Furthermore, the burgeoning pharmaceutical market, especially with the success of GLP-1 drugs for weight management, directly impacts Intuitive Surgical by offering a non-surgical alternative to bariatric procedures, a key market for their systems. By 2024, the weight loss drug market was projected to reach tens of billions of dollars, highlighting this significant shift.

| Substitute Type | Key Characteristics | Impact on Intuitive Surgical | 2024 Market Insight |

|---|---|---|---|

| Traditional Open Surgery | Familiar, established protocols, lower initial cost | Still preferred for extreme complexity or in cost-sensitive regions | Remains a fallback for procedures where robotic systems are not feasible or cost-justified. |

| Conventional Laparoscopy | Minimally invasive, more affordable than robotics | Competes directly for procedures where robotic advantages are marginal. | Advancements in imaging and tools increase its effectiveness, broadening its appeal. |

| Single-Port Laparoscopy | Single incision, less invasive than multi-port robotic systems | Siphons demand from robotic systems for specific procedures. | Increasing adoption across surgical specialties. |

| Pharmaceutical Interventions (e.g., GLP-1s) | Non-invasive, effective for weight management | Reduces demand for bariatric surgery, a key robotic market. | Projected tens of billions in market value for weight loss drugs in 2024. |

| Emerging Technologies (AI, Nanobots) | Potential for greater precision, new treatment modalities | Future threat of displacement by more advanced or efficient systems. | Global medical robotics market projected over $18 billion in 2024, driving innovation. |

Entrants Threaten

The threat of new entrants into the robotic surgery market is significantly mitigated by the extraordinarily high capital investment required. Developing a sophisticated robotic surgical system, akin to Intuitive Surgical's da Vinci, demands substantial upfront funding for cutting-edge research and development. For instance, bringing a new medical device to market can easily cost hundreds of millions of dollars.

Furthermore, the ongoing research and development costs associated with enhancing robotic surgical technology are immense. Companies must continuously innovate to improve precision, introduce new functionalities, and ensure patient safety, creating a perpetual need for significant financial resources. This high barrier to entry effectively deters many potential competitors from even attempting to enter the market.

Intuitive Surgical's extensive intellectual property, boasting over 7,000 global patents and hundreds more in development, presents a significant hurdle for potential new entrants. This robust patent portfolio, particularly concerning minimally invasive surgical devices and robotics, makes it exceedingly challenging for competitors to design and market similar technologies without risking infringement.

The medical device sector, particularly for sophisticated surgical equipment like Intuitive Surgical's da Vinci system, is heavily burdened by rigorous regulatory approval pathways. Obtaining clearance from bodies such as the U.S. Food and Drug Administration (FDA) is a protracted and expensive undertaking, effectively deterring many potential new competitors.

Brand Reputation and Established Relationships

Intuitive Surgical's formidable brand reputation, cultivated over decades, acts as a significant barrier for new entrants. This reputation is built on trust and proven performance within the surgical community.

The company has fostered deep-seated relationships with hospitals and surgeons, creating a loyal customer base. This established network makes it difficult for newcomers to penetrate the market and secure early adopters.

Furthermore, Intuitive Surgical boasts an extensive installed base of da Vinci surgical systems, estimated to be over 7,000 systems globally as of late 2023. This widespread adoption, coupled with a large pool of trained surgeons, creates inertia that new competitors must overcome.

- Brand Loyalty: Decades of reliable performance have cemented Intuitive Surgical's reputation.

- Established Networks: Strong relationships with healthcare providers are a key differentiator.

- Installed Base: A large number of existing da Vinci systems presents a significant hurdle for rivals.

- Surgeon Training: The extensive network of trained surgeons further solidifies market dominance.

Need for Comprehensive Training and Support Infrastructure

New entrants face a significant hurdle in replicating Intuitive Surgical's established training and support network. Developing comprehensive, globally accessible training programs for surgeons and establishing a robust service infrastructure are massive undertakings.

Hospitals demand extensive, reliable support for complex surgical systems, a commitment that new players must demonstrate from the outset. This necessity acts as a substantial barrier, deterring potential competitors who lack the resources or foresight to build such critical infrastructure.

For instance, Intuitive Surgical's da Vinci system boasts a vast installed base, necessitating a large and highly skilled field service organization. As of 2023, Intuitive reported over 7,700 da Vinci systems installed worldwide, each requiring ongoing maintenance and support.

- Training Investment: New entrants must invest heavily in surgeon education, mirroring Intuitive's established training centers and programs.

- Support Infrastructure: Building a global network of service technicians and spare parts depots is crucial and costly.

- Hospital Requirements: Healthcare facilities prioritize proven reliability and immediate support, making it difficult for unproven entrants to gain trust.

- Scale of Operations: Competing with Intuitive's existing scale in service and training requires immense capital and logistical expertise.

The threat of new entrants in the robotic surgery market is considerably low due to the immense capital investment required to develop and launch sophisticated systems. Companies like Intuitive Surgical have invested billions over decades, creating a significant financial barrier. The need for extensive R&D, manufacturing capabilities, and global distribution networks means only well-funded entities can realistically consider entering.

Regulatory hurdles, particularly FDA approval, add substantial time and cost, effectively deterring many potential competitors. Intuitive Surgical's extensive patent portfolio, exceeding 7,000 global patents, further complicates market entry by limiting the ability to develop similar, non-infringing technologies.

The established brand loyalty, deep hospital relationships, and a vast installed base of over 7,700 da Vinci systems (as of 2023) create significant switching costs and inertia for potential new entrants. Overcoming this established ecosystem requires not only technological parity but also a superior value proposition and extensive market penetration efforts.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High R&D, manufacturing, and distribution costs. | Significant financial barrier, limiting entrants to well-capitalized firms. |

| Intellectual Property | Over 7,000 global patents held by Intuitive Surgical. | Makes it difficult to develop competing technologies without infringement risk. |

| Regulatory Approval | Lengthy and costly FDA approval process for medical devices. | Deters new entrants due to time, expense, and uncertainty. |

| Brand & Relationships | Decades of trust and established hospital/surgeon networks. | Creates customer loyalty and makes market penetration challenging. |

| Installed Base & Training | Over 7,700 installed da Vinci systems and extensive surgeon training programs. | High switching costs and established expertise create inertia for new players. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Intuitive Surgical leverages data from annual financial reports, investor presentations, and industry-specific market research from firms like IBISWorld and Statista. We also incorporate insights from regulatory filings and competitor press releases to provide a comprehensive view of the competitive landscape.