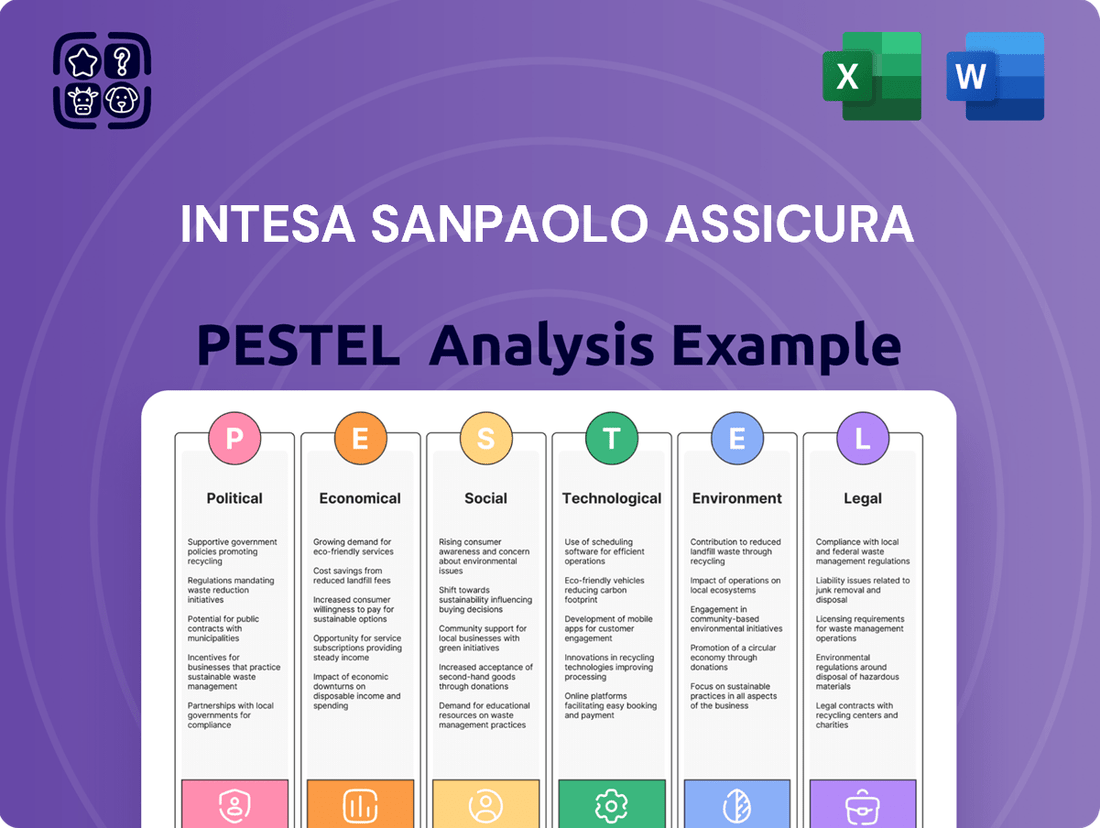

Intesa Sanpaolo Assicura PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intesa Sanpaolo Assicura Bundle

Navigate the complex external forces shaping Intesa Sanpaolo Assicura's future with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, social demographics, environmental regulations, and legal frameworks present both challenges and opportunities. Gain a strategic advantage by uncovering actionable insights crucial for informed decision-making.

Unlock the full potential of your strategy by downloading our detailed PESTLE analysis of Intesa Sanpaolo Assicura. This expert-crafted report provides a deep dive into the external landscape, empowering you to anticipate market changes and identify growth avenues. Invest in clarity and secure your competitive edge today.

Political factors

The Italian government's regulatory framework significantly influences the insurance sector, directly affecting Intesa Sanpaolo Assicura. Recent legislative actions, like the 2024 Budget Law, are introducing new mandates for insurance companies.

These changes include the requirement for specific coverage for catastrophic risks, which is expected to open new avenues for business but also necessitates adjustments in operational compliance and risk management for insurers like Intesa Sanpaolo Assicura.

The stability and clarity of the regulatory landscape are paramount for Intesa Sanpaolo Assicura. Recent shifts, such as the implementation of the Corporate Sustainability Reporting Directive (CSRD) in Italy via Decree 125/2024, mandate more rigorous ESG disclosures for financial entities. This directive, fully applicable to large companies from January 1, 2024, requires significant adaptation in reporting and operational processes.

Broader geopolitical tensions and the Italian government's evolving economic policies significantly shape the insurance landscape. While European insurers have demonstrated a degree of resilience, projections for 2025 indicate that moderate economic growth coupled with escalating geopolitical risks will likely introduce headwinds.

Specifically, the Italian government's budgetary considerations, which may include potential new levies targeting the insurance sector, directly influence profitability and necessitate careful strategic adjustments for companies like Intesa Sanpaolo Assicura. For instance, Italy's 2024 budget law included a 0.5% tax on insurance premiums, a factor that could impact net earnings.

Consumer Protection Initiatives

Political factors significantly influence the insurance landscape, with a growing emphasis on consumer protection. Italy's establishment of the Insurance Arbitrator exemplifies this trend, aiming to provide accessible and cost-effective dispute resolution for policyholders. Intesa Sanpaolo Assicura must adapt its operations to align with these enhanced consumer rights, ensuring robust complaint handling procedures.

This regulatory shift underscores a broader political commitment to increasing transparency and fairness within the insurance market. Such initiatives can lead to stricter oversight and potentially impact product development and pricing strategies. For Intesa Sanpaolo Assicura, proactive engagement with these evolving consumer protection frameworks is crucial for maintaining trust and operational compliance.

- Increased Regulatory Scrutiny: New consumer protection bodies like the Insurance Arbitrator in Italy signal a heightened level of governmental oversight in the insurance sector.

- Focus on Dispute Resolution: The political drive towards efficient and affordable dispute resolution mechanisms means insurers must invest in improved customer service and complaint management.

- Impact on Customer Relations: Intesa Sanpaolo Assicura will need to integrate these new avenues for consumer recourse into its customer interaction strategies to ensure compliance and satisfaction.

- Market Confidence: Strong consumer protection measures are often politically motivated to bolster public confidence in the financial services industry, which can indirectly benefit well-regulated entities.

EU Directives and Harmonization

Intesa Sanpaolo Assicura, operating within the broader Intesa Sanpaolo Group, navigates a landscape shaped by EU directives and ongoing harmonization efforts in financial services. These regulations significantly impact its operational framework and strategic planning.

Key directives like Solvency II continue to mold capital requirements and risk management practices for insurers across the EU. For instance, Solvency II, implemented in 2016, mandates robust capital adequacy and governance standards. In 2024, the European Insurance and Occupational Pensions Authority (EIOPA) continued its work on the Solvency II review, focusing on areas like risk sensitivity and proportionality, which directly affects insurers like Intesa Sanpaolo Assicura.

Furthermore, directives concerning Environmental, Social, and Governance (ESG) reporting are increasingly influential. The Corporate Sustainability Reporting Directive (CSRD), which began applying to large companies in 2024, requires extensive disclosure on sustainability matters. This pushes Intesa Sanpaolo Assicura to integrate ESG considerations into its business model, product development, and investment strategies, aiming for greater transparency and accountability in line with evolving European Union standards.

- Solvency II: Dictates capital adequacy and risk management frameworks for EU insurers, with ongoing reviews in 2024 focusing on refinement.

- ESG Reporting: Directives like CSRD, effective from 2024 for many companies, mandate detailed sustainability disclosures, influencing Intesa Sanpaolo Assicura's reporting and strategy.

- Harmonization Efforts: The EU's push for a more integrated financial services market creates a consistent regulatory environment, impacting cross-border operations and product offerings.

Political stability and government policies in Italy and the EU directly impact Intesa Sanpaolo Assicura's operations. The Italian government's 2024 budget law introduced a 0.5% tax on insurance premiums, a move that could affect net earnings for insurers. Furthermore, Italy's commitment to consumer protection is evident in initiatives like the Insurance Arbitrator, requiring insurers to enhance complaint handling procedures and transparency.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental forces impacting Intesa Sanpaolo Assicura, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights for strategic decision-making, highlighting potential threats and opportunities within the insurance sector.

A clear, actionable summary of Intesa Sanpaolo Assicura's PESTLE analysis, highlighting key external factors that impact its strategy, thus alleviating the pain of navigating complex market dynamics.

Economic factors

The interest rate environment is a critical factor for insurers like Intesa Sanpaolo Assicura. Higher rates generally boost investment returns, especially for long-term liabilities common in life insurance. For instance, European insurers saw improved profitability in 2024 due to rising yields, with the average yield on government bonds across the Eurozone increasing significantly compared to previous years.

However, the outlook for 2025 suggests a shift. Projections indicate a potential decline in interest rates as central banks may pivot towards easing monetary policy. This anticipated drop in yields presents a challenge for Intesa Sanpaolo Assicura, as it could compress investment income and impact the profitability of its life insurance portfolio, necessitating a strategic review of asset allocation.

Economic growth is a significant driver for the insurance sector. In Italy and the broader Eurozone, a healthy economy typically translates to increased consumer spending and business investment, both of which boost demand for various insurance products, from life and health to property and casualty coverage. For instance, Italy's GDP growth was around 0.7% in 2023 and is projected to be around 0.7% again in 2024, with a slight uptick to approximately 1.0% anticipated for 2025, according to European Commission forecasts. This moderate growth trajectory suggests a stable, rather than booming, demand environment.

This projected moderate economic expansion for 2025 could influence premium rates, particularly in the non-life insurance market. As economic activity picks up, so does the potential for risk, which usually supports premium growth. However, if growth remains steady rather than accelerating rapidly, it might lead to more competitive pricing and moderating premium rate increases as insurers vie for market share in a less dynamic expansion phase. For example, the non-life insurance sector in Europe has seen premium growth, but the pace can be influenced by economic cycles.

Intesa Sanpaolo Assicura's strategic focus on wealth management and protection products aligns well with this economic outlook. These areas often demonstrate resilience and can offer stronger revenue generation potential even during periods of moderate economic growth. The company's reported growth in commissions from these segments, as seen in their financial reports, underscores a deliberate strategy to capitalize on areas where consumer and business needs for financial security and asset growth remain robust, irrespective of sharp economic upturns.

Inflation directly impacts claims costs in the non-life insurance sector, as the cost of repairs, medical services, and replacement goods rises. Insurers like Intesa Sanpaolo Assicura must adjust their premium rates to keep pace with this claims inflation to ensure profitability. For instance, in Italy, non-life insurance prices saw an increase of 4.5% in the year leading up to March 2024, a move to counter rising claims expenses.

The speed at which these premium adjustments can be implemented varies across European markets, affecting insurers' ability to absorb increased claims costs promptly. Intesa Sanpaolo Assicura's non-life business performance is therefore closely tied to its success in managing these inflationary pressures on claims. Effective cost management strategies are vital for maintaining the health of this segment.

Mandatory Insurance and Market Expansion

The Italian government's mandate for natural disaster insurance for businesses, effective from 2025, creates a significant expansion opportunity for Intesa Sanpaolo Assicura. This new regulation is projected to boost premium income within the property and casualty (P&C) segment, especially for policies covering catastrophic events.

This legislative push is anticipated to generate substantial new business for insurers. For instance, preliminary analyses suggest the mandatory coverage could add several hundred million euros in annual premiums to the Italian insurance market. Intesa Sanpaolo Assicura, with its established presence, is well-positioned to capture a significant share of this newly created demand.

- Mandatory Coverage: Italian companies will be required to hold natural disaster insurance from 2025.

- Market Growth: This is expected to drive additional premium growth in the P&C sector.

- Catastrophe Focus: The expansion will particularly benefit insurers offering catastrophe coverage.

- Economic Impact: The initiative aims to bolster economic resilience against natural hazards.

Competition and Market Dynamics

The Italian insurance sector is characterized by intense competition, particularly in natural disaster coverage where a few dominant groups hold significant market share. Intesa Sanpaolo Assicura, benefiting from its parent banking group's vast branch network, utilizes this for effective distribution. However, it must contend with established insurance giants and agile insurtech startups that are increasingly disrupting traditional models.

Key competitive factors include pricing, product innovation, and customer service. For instance, in 2023, the Italian insurance market saw premiums for property and casualty insurance, which includes natural disaster coverage, grow by approximately 4.5%, indicating a dynamic and responsive market. Intesa Sanpaolo Assicura's strategy often involves cross-selling insurance products through its banking channels, a common tactic to gain an edge.

- Market Concentration: A few large insurers dominate natural disaster coverage in Italy.

- Distribution Channels: Intesa Sanpaolo Assicura leverages its banking network, but faces competition from digital-first insurtechs.

- Competitive Landscape: The market is dynamic, with ongoing price and innovation competition from both traditional and new players.

- Premium Growth: The P&C insurance segment, relevant to natural disaster coverage, experienced around 4.5% premium growth in 2023.

The interest rate environment is a critical factor for insurers like Intesa Sanpaolo Assicura. Higher rates generally boost investment returns, especially for long-term liabilities common in life insurance. For instance, European insurers saw improved profitability in 2024 due to rising yields, with the average yield on government bonds across the Eurozone increasing significantly compared to previous years.

However, the outlook for 2025 suggests a shift. Projections indicate a potential decline in interest rates as central banks may pivot towards easing monetary policy. This anticipated drop in yields presents a challenge for Intesa Sanpaolo Assicura, as it could compress investment income and impact the profitability of its life insurance portfolio, necessitating a strategic review of asset allocation.

Intesa Sanpaolo Assicura's strategic focus on wealth management and protection products aligns well with this economic outlook. These areas often demonstrate resilience and can offer stronger revenue generation potential even during periods of moderate economic growth. The company's reported growth in commissions from these segments, as seen in their financial reports, underscores a deliberate strategy to capitalize on areas where consumer and business needs for financial security and asset growth remain robust, irrespective of sharp economic upturns.

Inflation directly impacts claims costs in the non-life insurance sector, as the cost of repairs, medical services, and replacement goods rises. Insurers like Intesa Sanpaolo Assicura must adjust their premium rates to keep pace with this claims inflation to ensure profitability. For instance, in Italy, non-life insurance prices saw an increase of 4.5% in the year leading up to March 2024, a move to counter rising claims expenses.

The speed at which these premium adjustments can be implemented varies across European markets, affecting insurers' ability to absorb increased claims costs promptly. Intesa Sanpaolo Assicura's non-life business performance is therefore closely tied to its success in managing these inflationary pressures on claims. Effective cost management strategies are vital for maintaining the health of this segment.

The Italian government's mandate for natural disaster insurance for businesses, effective from 2025, creates a significant expansion opportunity for Intesa Sanpaolo Assicura. This new regulation is projected to boost premium income within the property and casualty (P&C) segment, especially for policies covering catastrophic events.

This legislative push is anticipated to generate substantial new business for insurers. For instance, preliminary analyses suggest the mandatory coverage could add several hundred million euros in annual premiums to the Italian insurance market. Intesa Sanpaolo Assicura, with its established presence, is well-positioned to capture a significant share of this newly created demand.

- Mandatory Coverage: Italian companies will be required to hold natural disaster insurance from 2025.

- Market Growth: This is expected to drive additional premium growth in the P&C sector.

- Catastrophe Focus: The expansion will particularly benefit insurers offering catastrophe coverage.

- Economic Impact: The initiative aims to bolster economic resilience against natural hazards.

The Italian insurance sector is characterized by intense competition, particularly in natural disaster coverage where a few dominant groups hold significant market share. Intesa Sanpaolo Assicura, benefiting from its parent banking group's vast branch network, utilizes this for effective distribution. However, it must contend with established insurance giants and agile insurtech startups that are increasingly disrupting traditional models.

Key competitive factors include pricing, product innovation, and customer service. For instance, in 2023, the Italian insurance market saw premiums for property and casualty insurance, which includes natural disaster coverage, grow by approximately 4.5%, indicating a dynamic and responsive market. Intesa Sanpaolo Assicura's strategy often involves cross-selling insurance products through its banking channels, a common tactic to gain an edge.

- Market Concentration: A few large insurers dominate natural disaster coverage in Italy.

- Distribution Channels: Intesa Sanpaolo Assicura leverages its banking network, but faces competition from digital-first insurtechs.

- Competitive Landscape: The market is dynamic, with ongoing price and innovation competition from both traditional and new players.

- Premium Growth: The P&C insurance segment, relevant to natural disaster coverage, experienced around 4.5% premium growth in 2023.

The technological landscape presents both opportunities and challenges for Intesa Sanpaolo Assicura. The increasing adoption of digital channels and data analytics can enhance customer engagement, streamline operations, and enable personalized product offerings. For example, many European insurers are investing heavily in AI and machine learning to improve underwriting accuracy and claims processing efficiency, with digital sales channels accounting for a growing percentage of new business in 2024.

However, the rapid pace of technological change also necessitates continuous investment in IT infrastructure and cybersecurity measures to protect sensitive customer data and maintain operational resilience. The threat of cyberattacks remains a significant concern, with the financial services sector being a prime target. Insurers need to stay ahead of evolving threats to safeguard their operations and reputation.

The integration of advanced analytics and AI is also transforming product development and risk assessment. Insurers can now leverage vast datasets to identify emerging risks and develop innovative insurance solutions tailored to specific customer needs. For instance, telematics data is increasingly used in motor insurance to offer usage-based pricing, rewarding safer drivers. This trend is expected to continue growing through 2025.

Furthermore, the rise of insurtechs is driving innovation and competition. These agile companies often leverage technology to offer more flexible and customer-centric insurance products, challenging traditional players. Intesa Sanpaolo Assicura must adapt its strategies to compete effectively, potentially through partnerships or by developing its own digital-first offerings to capture market share in this evolving environment.

Environmental factors are increasingly influencing the insurance industry, particularly concerning climate change and natural disasters. Intesa Sanpaolo Assicura, like other insurers, faces rising claims costs due to more frequent and severe weather events. For example, Europe experienced a significant increase in insured losses from natural catastrophes in 2023 compared to the previous year, a trend that is expected to persist.

The legal framework governing the insurance sector is crucial for Intesa Sanpaolo Assicura's operations. This includes regulations related to consumer protection, solvency requirements, and data privacy. For instance, the Solvency II directive in Europe sets stringent capital requirements for insurers, ensuring their financial stability. Compliance with these regulations is paramount.

Changes in legislation can significantly impact product design, pricing, and distribution strategies. For example, new consumer protection laws might require more transparent policy terms and conditions, affecting how products are marketed. The Italian government's recent initiatives, such as the mandatory natural disaster insurance from 2025, represent a direct legal influence on the P&C market.

Furthermore, the legal landscape surrounding digital operations, including cybersecurity and data protection, is constantly evolving. Intesa Sanpaolo Assicura must adhere to strict data privacy laws like GDPR, which govern the collection, processing, and storage of personal information. Non-compliance can lead to substantial fines and reputational damage.

The political stability and government policies also play a vital role. Government support for specific sectors, tax policies, and trade agreements can all influence the insurance market. For example, favorable tax treatment for long-term savings products can boost demand for life insurance. Political decisions regarding economic stimulus or austerity measures also have a direct impact on consumer spending and business investment.

- Mandatory Coverage: Italian companies will be required to hold natural disaster insurance from 2025.

- Market Growth: This is expected to drive additional premium growth in the P&C sector.

- Catastrophe Focus: The expansion will particularly benefit insurers offering catastrophe coverage.

- Economic Impact: The initiative aims to bolster economic resilience against natural hazards.

The Italian insurance sector is characterized by intense competition, particularly in natural disaster coverage where a few dominant groups hold significant market share. Intesa Sanpaolo Assicura, benefiting from its parent banking group's vast branch network, utilizes this for effective distribution. However, it must contend with established insurance giants and agile insurtech startups that are increasingly disrupting traditional models.

Key competitive factors include pricing, product innovation, and customer service. For instance, in 2023, the Italian insurance market saw premiums for property and casualty insurance, which includes natural disaster coverage, grow by approximately 4.5%, indicating a dynamic and responsive market. Intesa Sanpaolo Assicura's strategy often involves cross-selling insurance products through its banking channels, a common tactic to gain an edge.

- Market Concentration: A few large insurers dominate natural disaster coverage in Italy.

- Distribution Channels: Intesa Sanpaolo Assicura leverages its banking network, but faces competition from digital-first insurtechs.

- Competitive Landscape: The market is dynamic, with ongoing price and innovation competition from both traditional and new players.

- Premium Growth: The P&C insurance segment, relevant to natural disaster coverage, experienced around 4.5% premium growth in 2023.

Full Version Awaits

Intesa Sanpaolo Assicura PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Intesa Sanpaolo Assicura covers all critical external factors impacting its operations. You'll gain insights into Political, Economic, Social, Technological, Legal, and Environmental influences, providing a complete strategic overview.

Sociological factors

Italy's demographic landscape is undergoing significant changes, with an aging population and rising private healthcare expenses directly impacting insurance product demand. This trend is fueling a greater need for health insurance solutions, a key area for Intesa Sanpaolo Assicura to address.

In 2023, Italy's population aged 65 and over reached approximately 24.1% of the total, a figure projected to continue growing. Simultaneously, out-of-pocket healthcare spending has seen an upward trend, pushing individuals to seek private insurance coverage for medical services.

These demographic shifts necessitate that Intesa Sanpaolo Assicura strategically develops and refines its life and non-life insurance offerings. Adapting to the evolving needs of an older demographic and those seeking enhanced healthcare protection is crucial for market relevance and sustained growth.

Consumer preferences are rapidly evolving, with a strong lean towards digital-first and highly personalized insurance interactions. This shift means customers expect seamless online management of policies and straightforward digital claims processing.

Intesa Sanpaolo Assicura is actively addressing this by investing in its digital capabilities. For instance, in 2024, the company reported a significant increase in digital channel usage for customer service inquiries, highlighting the demand for convenient online solutions.

The company's strategic focus on an omnichannel approach, blending digital touchpoints with traditional channels, is a direct response to these changing consumer behaviors. This integration aims to provide a consistent and accessible customer journey across all platforms, ensuring Intesa Sanpaolo Assicura remains competitive in a digitally driven market.

The financial literacy of Intesa Sanpaolo Assicura's customer base significantly influences their engagement with sophisticated insurance offerings. In Italy, a 2023 survey indicated that while general financial knowledge is improving, a substantial portion of the population still struggles with understanding complex financial products, a trend likely mirrored in insurance uptake.

Intesa Sanpaolo Assicura's strategic advantage lies in its integration with the broader Intesa Sanpaolo banking group. This allows for leveraging the extensive branch network, which serves as a critical channel for direct customer engagement and personalized financial education. By offering in-person guidance, the bank can effectively demystify insurance policies, thereby enhancing customer comprehension and fostering greater adoption of its products.

Societal Expectations for ESG

Societal pressure is increasingly pushing companies, including financial services firms like Intesa Sanpaolo Assicura, to actively showcase their commitment to Environmental, Social, and Governance (ESG) principles. This trend reflects a broader shift where stakeholders demand transparency and tangible action on issues ranging from climate change to social equity.

The Intesa Sanpaolo Group, a parent entity to Intesa Sanpaolo Assicura, has explicitly integrated ESG into its strategic roadmap, specifically its 2022-2025 Business Plan. This plan emphasizes a strong focus on social impact and climate action, signaling a clear direction for its subsidiaries.

The Group's commitment is backed by concrete targets and initiatives. For instance, within its 2022-2025 Business Plan, Intesa Sanpaolo aims to:

- Increase investments in sustainable and impact solutions by €40 billion.

- Reduce its direct and indirect greenhouse gas emissions by 42% compared to 2019 levels by 2025.

- Achieve carbon neutrality in its direct operations by 2030.

These ambitious goals demonstrate a proactive approach to meeting societal expectations for responsible corporate behavior, which in turn influences customer loyalty and investor sentiment towards Intesa Sanpaolo Assicura.

Trust and Reputation

Trust is a cornerstone of any financial service, and Intesa Sanpaolo Assicura benefits significantly from its association with the broader Intesa Sanpaolo Group. This banking giant, a dominant force in Italy, already commands substantial public confidence, which can be readily transferred to its insurance arm. As of the first quarter of 2024, Intesa Sanpaolo Group reported total assets exceeding €1 trillion, underscoring its stability and established presence, which directly bolsters trust in its subsidiary operations.

The established reputation of the Intesa Sanpaolo brand acts as a powerful endorsement for Intesa Sanpaolo Assicura. Customers are more inclined to engage with an insurer backed by a trusted banking institution, reducing perceived risk. This symbiotic relationship allows Intesa Sanpaolo Assicura to tap into a pre-existing reservoir of goodwill, facilitating customer acquisition and retention in a competitive market.

- Brand Association: Intesa Sanpaolo Assicura leverages the strong, established trust in the parent Intesa Sanpaolo Group.

- Reputational Capital: The group's long history and market leadership in Italy provide a solid foundation of credibility.

- Customer Confidence: Existing banking customers of Intesa Sanpaolo are more likely to trust and choose its insurance products.

- Market Stability: The sheer size and financial strength of the Intesa Sanpaolo Group (over €1 trillion in assets as of Q1 2024) contribute to a perception of reliability.

Societal shifts towards digital engagement and personalized services are paramount for Intesa Sanpaolo Assicura. By Q1 2024, digital channel usage for customer interactions within the Intesa Sanpaolo Group saw a notable increase, reflecting customer preference for convenience. The company's investment in an omnichannel strategy directly addresses this evolving consumer behavior, aiming to provide seamless digital and physical touchpoints.

The growing emphasis on ESG principles is a significant societal factor influencing Intesa Sanpaolo Assicura. The parent Intesa Sanpaolo Group's 2022-2025 Business Plan outlines ambitious targets, including a €40 billion increase in sustainable investments and a 42% reduction in greenhouse gas emissions by 2025. This commitment to social responsibility and environmental stewardship is crucial for maintaining stakeholder trust and market relevance.

Trust in the Intesa Sanpaolo brand, bolstered by the group's substantial financial standing (over €1 trillion in assets as of Q1 2024), provides a critical advantage. This established reputation facilitates customer confidence and loyalty for Intesa Sanpaolo Assicura, enabling it to leverage the banking group's existing goodwill in a competitive insurance market.

Technological factors

Intesa Sanpaolo Assicura is actively participating in its parent company's extensive digital transformation, a key component of the 2022-2025 Business Plan. This strategic shift involves modernizing core IT infrastructure, including a significant move towards cloud-based solutions, to build a more agile and efficient operational framework.

The insurer is enhancing its omnichannel capabilities, aiming to provide a unified and intuitive customer journey. This means customers can interact seamlessly whether they prefer digital channels like mobile apps and websites or traditional in-person interactions, ensuring a consistent brand experience.

By investing in these technological advancements, Intesa Sanpaolo Assicura is positioning itself to better meet evolving customer expectations for digital engagement and personalized service delivery in the competitive insurance market.

The Italian insurtech market is rapidly expanding, with a notable surge in the adoption of advanced technologies. In 2024, investments in insurtech startups in Italy were projected to reach €500 million, reflecting strong investor confidence and a dynamic innovation landscape. This growth is fueled by the increasing integration of artificial intelligence, big data analytics, and blockchain technology across the insurance value chain.

Intesa Sanpaolo Assicura can capitalize on these technological advancements to significantly enhance its operations. For instance, AI-powered analytics can refine risk assessment models, leading to more accurate pricing and reduced underwriting losses. By leveraging big data, the company can gain deeper customer insights, enabling the creation of highly personalized insurance products and services, thereby boosting customer satisfaction and loyalty.

Furthermore, the implementation of blockchain technology offers opportunities for greater transparency and efficiency in claims processing and fraud detection. As of late 2024, several Italian insurers reported a 15% reduction in claims processing times through blockchain pilots. Intesa Sanpaolo Assicura's strategic embrace of these insurtech innovations positions it to achieve greater operational agility and a more competitive edge in the evolving insurance sector.

As digitalization accelerates, the imperative for strong cybersecurity and data protection escalates significantly. Intesa Sanpaolo Assicura must prioritize these measures to safeguard sensitive customer information in an increasingly interconnected digital landscape.

Intesa Sanpaolo's commitment to cybersecurity is a cornerstone of its digital transformation, directly impacting Assicura's ability to maintain customer trust. In 2024, the financial services sector experienced a notable rise in cyber threats, with data breaches costing an average of $4.45 million globally, underscoring the critical need for robust defenses.

Artificial Intelligence and Advanced Analytics

Intesa Sanpaolo Assicura is heavily investing in artificial intelligence and advanced analytics, recognizing them as crucial technological drivers for both operational efficiency and future growth within the insurance industry. These investments are designed to streamline processes and unlock new revenue streams.

The company's strategic focus on leveraging AI and advanced analytics is particularly aimed at enhancing cost management and developing more sophisticated, customer-centric insurance offerings. This technological push is expected to provide a significant competitive advantage.

- AI-driven underwriting: Intesa Sanpaolo Assicura is implementing AI to refine underwriting processes, leading to more accurate risk assessment and potentially lower claims costs.

- Personalized customer experiences: Advanced analytics are being employed to understand customer behavior better, enabling the creation of tailored insurance products and improved service delivery.

- Operational efficiency gains: The adoption of AI is projected to automate routine tasks, reducing operational expenses and freeing up human resources for more complex strategic initiatives.

- Data-driven product development: By analyzing vast datasets, the company aims to identify emerging market needs and develop innovative insurance solutions that meet evolving consumer demands.

Cloud Computing and IT Infrastructure Modernization

Intesa Sanpaolo Assicura is actively migrating its IT infrastructure to the cloud as a cornerstone of its digital transformation strategy. This move is designed to enhance scalability and operational efficiency, crucial for adapting to evolving market demands and customer expectations in the insurance sector.

This modernization effort is foundational for Intesa Sanpaolo Assicura's ability to rapidly deploy innovative digital services and new insurance products. For instance, cloud adoption enables faster development cycles for digital platforms, allowing the company to respond more agilely to competitive pressures and emerging customer needs.

The benefits of cloud computing for Intesa Sanpaolo Assicura include improved data analytics capabilities, which can lead to more personalized insurance offerings and better risk assessment. This technological shift is also expected to reduce IT operational costs, freeing up resources for investment in product development and customer experience initiatives.

- Scalability: Cloud infrastructure allows Intesa Sanpaolo Assicura to adjust IT resources up or down based on demand, ensuring optimal performance during peak periods and cost savings during lulls.

- Efficiency: Modernized IT systems streamline operations, reducing manual processes and improving the speed of service delivery for policyholders and intermediaries.

- Innovation: The cloud provides a flexible environment for testing and launching new digital services, such as AI-powered claims processing or personalized policy management tools.

- Cost Optimization: Migrating to the cloud can lead to significant savings on hardware maintenance, energy consumption, and data center management.

Intesa Sanpaolo Assicura is leveraging advanced technologies like AI and big data analytics to enhance its operations. In 2024, Italian insurtech investments were projected at €500 million, showcasing a vibrant innovation ecosystem. These technologies are crucial for refining risk assessment, personalizing customer experiences, and improving operational efficiency, with blockchain pilots showing a 15% reduction in claims processing times by late 2024.

The insurer's digital transformation includes a significant shift to cloud-based IT infrastructure, aiming for greater scalability and efficiency. This modernization supports the rapid deployment of digital services and new products, with cloud adoption expected to improve data analytics and reduce IT costs. Cybersecurity is paramount, especially given that data breaches in the financial sector cost an average of $4.45 million globally in 2024.

| Key Technological Drivers | Impact on Intesa Sanpaolo Assicura | Supporting Data/Trends (2024-2025) |

| Artificial Intelligence & Advanced Analytics | Improved risk assessment, personalized offerings, operational efficiency | Projected €500M insurtech investment in Italy (2024); AI-driven underwriting and customer segmentation |

| Cloud Migration | Enhanced scalability, agility, and cost optimization for IT infrastructure | Foundation for rapid digital service deployment; potential IT operational cost reductions |

| Blockchain Technology | Increased transparency and efficiency in claims processing and fraud detection | Pilots showing up to 15% reduction in claims processing times (late 2024) |

| Cybersecurity | Safeguarding customer data and maintaining trust amidst rising threats | Global average cost of data breaches in financial services: $4.45M (2024) |

Legal factors

A pivotal legal shift for Intesa Sanpaolo Assicura is the Italian Budget Law 2024, which mandates that all companies must secure insurance coverage for catastrophic events starting January 1, 2025. This legislation effectively establishes a compulsory insurance market for such risks.

This new requirement presents a significant opportunity for Intesa Sanpaolo Assicura to expand its offerings and market share in a previously less developed segment. However, it also places a direct obligation on insurers like Intesa Sanpaolo Assicura to develop and provide these specific catastrophic risk policies, ensuring adequate capacity and coverage are available to all businesses.

Intesa Sanpaolo Assicura must navigate a complex web of EU and national ESG reporting mandates. The recent implementation of the EU Corporate Sustainability Reporting Directive (CSRD) through Italy's Legislative Decree 125/2024 significantly elevates the company's disclosure obligations. This directive requires detailed reporting across a broad spectrum of environmental, social, and governance factors, impacting how Intesa Sanpaolo Assicura communicates its sustainability performance to stakeholders.

The CSRD, effective for large companies from January 1, 2024, for financial year 2023 reporting, demands standardized sustainability reporting, moving beyond voluntary disclosures. This regulatory shift means Intesa Sanpaolo Assicura needs robust data collection and governance frameworks to ensure compliance and provide transparent, comparable information on its ESG impacts and risks. Failure to comply could lead to reputational damage and potential penalties.

The introduction of the Insurance Arbitrator (Arbitro Assicurativo) in January 2025 mandates that Intesa Sanpaolo Assicura refine its internal procedures for handling policyholder complaints. This new out-of-court system is designed to offer a swifter and more cost-effective resolution for insurance-related disagreements, potentially impacting the company's customer service and claims management costs.

Solvency II and Capital Requirements

As an insurance entity operating within the European Union, Intesa Sanpaolo Assicura is subject to the stringent Solvency II directive. This framework mandates specific capital requirements and robust risk management practices, directly impacting the company's financial stability and operational strategies. For instance, as of the first quarter of 2024, the European Insurance and Occupational Pensions Authority (EIOPA) reported an average Solvency Capital Requirement (SCR) ratio across EU insurers of approximately 220%, indicating a generally well-capitalized sector, though individual company ratios can vary significantly based on their risk profiles.

The continuous evolution of Solvency II regulations presents an ongoing challenge and opportunity for Intesa Sanpaolo Assicura. Regulatory bodies frequently review and update these measures, necessitating proactive adaptation in capital allocation and risk mitigation strategies to ensure sustained compliance and competitive positioning. These updates can influence everything from investment strategies to product development, ensuring the company remains agile in a dynamic legal landscape.

- Solvency II Compliance: Intesa Sanpaolo Assicura must adhere to capital adequacy and risk management standards set by the Solvency II directive.

- Regulatory Evolution: Ongoing reviews and potential updates to Solvency II measures will require continuous adjustments to the company's financial and operational frameworks.

- Capital Requirements Impact: The directive dictates the amount of capital insurers must hold to cover potential losses, influencing investment and business decisions.

- Risk Management Standards: Solvency II imposes rigorous requirements on how insurance companies identify, measure, monitor, manage, and report their risks.

Data Protection and Privacy Laws (GDPR)

The General Data Protection Regulation (GDPR) remains a cornerstone of data privacy in the European Union, significantly influencing Intesa Sanpaolo Assicura's operations concerning customer data. Strict adherence to GDPR is paramount not only for avoiding substantial fines, which can reach up to 4% of annual global turnover or €20 million, whichever is higher, but also for fostering and retaining customer confidence.

Intesa Sanpaolo Assicura must navigate evolving interpretations and enforcement trends of GDPR. For instance, in 2024, regulatory bodies are increasingly scrutinizing data processing activities, particularly concerning consent mechanisms and data breach notifications. Failure to comply can lead to reputational damage and loss of market share.

- GDPR Fines: Penalties can reach 4% of global annual turnover or €20 million.

- Customer Trust: Compliance is vital for maintaining strong customer relationships.

- Regulatory Scrutiny: 2024 sees heightened focus on consent and breach reporting.

The Italian Budget Law 2024 mandates catastrophic event insurance for all companies from January 1, 2025, creating a new compulsory market segment for Intesa Sanpaolo Assicura. This necessitates developing specialized policies and ensuring adequate coverage capacity. Furthermore, the EU Corporate Sustainability Reporting Directive (CSRD), implemented in Italy via Legislative Decree 125/2024, significantly increases Intesa Sanpaolo Assicura's ESG disclosure obligations, requiring robust data frameworks for compliance and transparency.

The introduction of the Insurance Arbitrator in January 2025 requires Intesa Sanpaolo Assicura to enhance its complaint resolution processes for more efficient out-of-court dispute settlement. Adherence to the EU's Solvency II directive remains critical, dictating capital requirements and risk management, with EIOPA reporting an average SCR ratio of approximately 220% for EU insurers in Q1 2024, highlighting the sector's capitalization. Ongoing Solvency II reviews demand continuous adaptation in financial and operational strategies.

The General Data Protection Regulation (GDPR) continues to shape Intesa Sanpaolo Assicura's data handling, with potential fines up to 4% of global annual turnover or €20 million. In 2024, regulatory scrutiny on consent and data breach notifications intensifies, making compliance crucial for customer trust and market reputation.

| Legal Factor | Impact on Intesa Sanpaolo Assicura | Key Dates/Data |

| Italian Budget Law 2024 | Mandatory catastrophic event insurance market creation | Effective January 1, 2025 |

| EU CSRD (Legislative Decree 125/2024) | Increased ESG disclosure obligations, enhanced reporting frameworks | Effective for large companies from January 1, 2024 (FY 2023 reporting) |

| Insurance Arbitrator | Refinement of complaint handling procedures | Effective January 2025 |

| Solvency II Directive | Capital adequacy and risk management standards | Average EU insurer SCR ratio ~220% (Q1 2024) |

| GDPR | Data privacy compliance, potential fines up to 4% global turnover or €20 million | Heightened scrutiny on consent and breach reporting in 2024 |

Environmental factors

Italy's vulnerability to natural disasters, including floods, landslides, and earthquakes, is amplified by climate change, leading to an increasing frequency of these events. For Intesa Sanpaolo Assicura, this translates directly into a greater burden on its non-life insurance offerings, potentially driving up claim payouts and introducing more unpredictability into its financial performance.

A new Italian law, effective from 2025, mandates that companies secure insurance against natural disasters. This legislative change directly confronts the escalating financial repercussions of climate change, presenting a substantial new market opportunity for Intesa Sanpaolo Assicura.

However, this regulatory shift also introduces complexities for the insurer, particularly concerning the accurate pricing of these climate risk policies and the robust assessment of associated risks. The Italian government has earmarked €50 million for the initial phase of this mandatory insurance scheme, aiming to bolster resilience against events like floods and earthquakes, which are becoming more frequent and severe.

Intesa Sanpaolo Group is actively pursuing a net-zero emissions target by 2050 across its loan, investment, and insurance portfolios, demonstrating a deep commitment to environmental, social, and governance (ESG) principles. This strategic direction is crucial for aligning with global sustainability goals and managing climate-related risks.

Intesa Sanpaolo Assicura is embedding these sustainability considerations into its core business operations and product development. For instance, offering protection for natural disasters directly supports resilience against environmental changes, a key aspect of sustainable finance and a growing concern for insurers and their clients.

Climate-Related Disclosure Requirements

New regulations are pushing companies like Intesa Sanpaolo Assicura to be more transparent about their environmental impact. For instance, Italy's adoption of the Corporate Sustainability Reporting Directive (CSRD) mandates detailed reporting on Environmental, Social, and Governance (ESG) factors. This includes clearly outlining how climate-related risks affect the company's financial health and operations.

Intesa Sanpaolo Assicura must therefore bolster its climate-related financial disclosures to meet these evolving sustainability reporting standards. This involves a thorough assessment and clear communication of the financial implications stemming from climate change, aligning with both regulatory demands and stakeholder expectations for greater accountability.

- CSRD Implementation: Italy's CSRD implementation requires comprehensive ESG reporting, including climate risks.

- Financial Impact Disclosure: Companies must disclose the financial consequences of ESG issues, particularly climate change.

- Enhanced Climate Disclosures: Intesa Sanpaolo Assicura needs to improve its reporting on climate-related financial matters.

- Sustainability Reporting: These disclosures are a key component of the company's overall sustainability strategy and reporting framework.

'Green' Product Development and Demand

The demand for 'green' insurance products is on the rise, reflecting increasing consumer and business awareness of environmental issues. Intesa Sanpaolo Assicura is well-positioned to meet this demand by innovating its offerings.

Developing insurance solutions that specifically address climate resilience and promote sustainable practices for both individuals and businesses presents a significant opportunity. This includes products that cover risks associated with extreme weather events or incentivize eco-friendly investments and operations.

- Growing Market: The global market for sustainable insurance is projected to reach hundreds of billions of dollars by 2030, driven by regulatory pressures and customer preference.

- Product Innovation: Intesa Sanpaolo Assicura can introduce policies covering renewable energy projects, carbon capture technologies, and sustainable agriculture.

- Customer Engagement: Promoting these 'green' products can enhance brand reputation and attract a segment of the market increasingly prioritizing environmental responsibility in their purchasing decisions.

Italy's increasing exposure to climate-related natural disasters, such as floods and earthquakes, presents a growing challenge for insurers like Intesa Sanpaolo Assicura, potentially increasing claims and financial volatility. A new Italian law from 2025 mandates natural disaster insurance, creating a significant market opportunity but also requiring sophisticated risk pricing and assessment, with the government allocating €50 million initially to support this initiative. The growing demand for 'green' insurance products, driven by heightened environmental awareness, positions Intesa Sanpaolo Assicura to innovate with policies that foster climate resilience and sustainable practices, aligning with the group's net-zero emissions target by 2050.

| Environmental Factor | Impact on Intesa Sanpaolo Assicura | Opportunity/Challenge | Data Point/Example |

|---|---|---|---|

| Climate Change & Natural Disasters | Increased claims for non-life insurance, potential financial unpredictability. | Challenge: Higher payouts. Opportunity: New mandatory insurance market. | Italy's vulnerability to floods, landslides, earthquakes amplified by climate change. |

| Mandatory Natural Disaster Insurance (2025) | New revenue stream, but requires advanced risk assessment and pricing. | Opportunity: Market expansion. Challenge: Accurate risk modeling. | €50 million government allocation for initial phase of mandatory insurance. |

| Growing Demand for Green Insurance | Potential for product innovation and enhanced brand reputation. | Opportunity: Market differentiation and customer acquisition. | Global sustainable insurance market projected to reach hundreds of billions by 2030. |

| ESG Reporting & Transparency (CSRD) | Need for enhanced climate-related financial disclosures. | Challenge: Compliance and robust reporting. Opportunity: Investor confidence. | Italy's adoption of CSRD mandates detailed ESG reporting, including climate risks. |

PESTLE Analysis Data Sources

Our Intesa Sanpaolo Assicura PESTLE analysis is meticulously constructed using data from official regulatory bodies, reputable financial institutions like the IMF and World Bank, and leading market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape impacting the insurance sector.