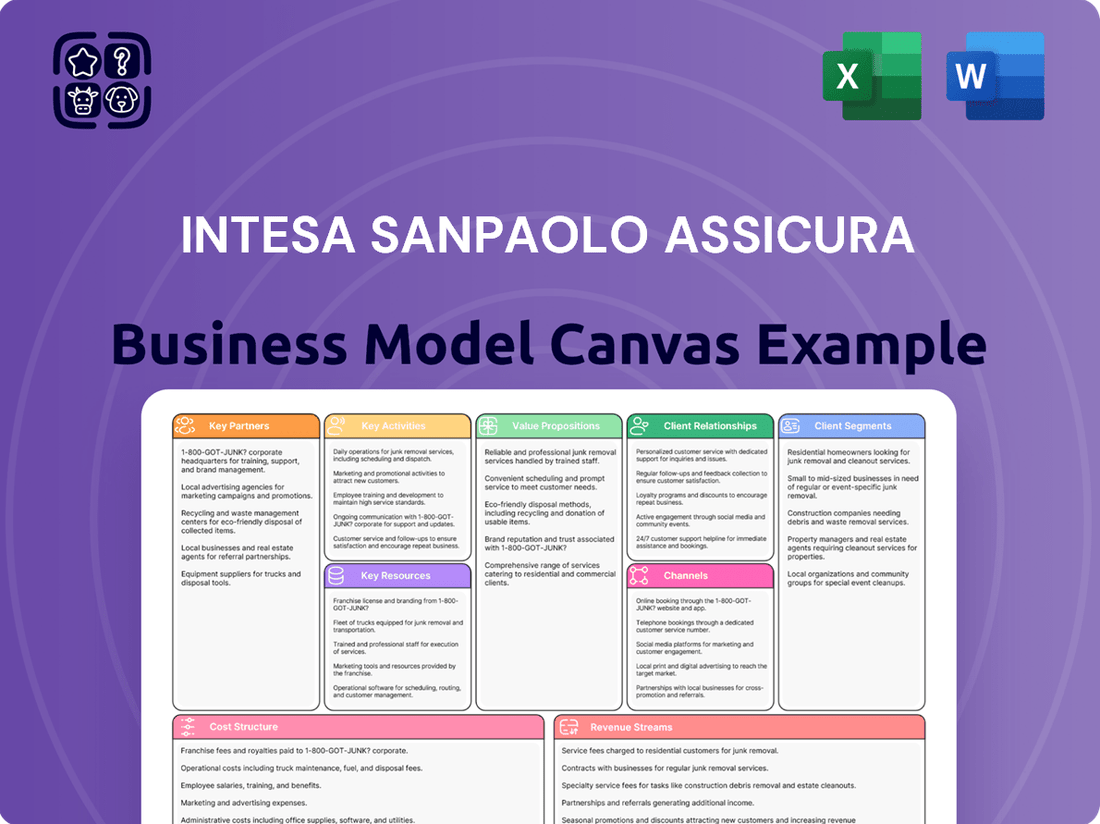

Intesa Sanpaolo Assicura Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intesa Sanpaolo Assicura Bundle

Intesa Sanpaolo Assicura's Business Model Canvas reveals a robust strategy built on strong customer relationships and a diverse product portfolio. It details how they leverage key partnerships and efficient cost structures to deliver value in the insurance market. Understand the core components that drive their success and gain a competitive edge.

Partnerships

Intesa Sanpaolo Assicura's most crucial partnerships are with other entities within the Intesa Sanpaolo Group, particularly its banking arm. This synergy is fundamental to its distribution strategy.

This close relationship facilitates the extensive cross-selling of insurance products directly through the bank's widespread branch network. By tapping into established customer relationships and the inherent trust in the Intesa Sanpaolo brand, Assicura gains significant market access.

This integrated bancassurance model is a key driver of Intesa Sanpaolo Assicura's substantial market penetration and broad customer reach, a strategy that has proven highly effective in the Italian insurance landscape.

Intesa Sanpaolo Assicura actively cultivates strategic alliances with technology and fintech providers to bolster its digital prowess and drive innovation. These collaborations are instrumental in developing sophisticated digital platforms, facilitating cloud migration, and integrating advanced technologies such as Artificial Intelligence.

These partnerships are essential for streamlining operations, elevating the customer experience, and accelerating the digital evolution of its insurance products and services. For instance, in 2024, Intesa Sanpaolo Assicura continued to invest in digital transformation initiatives, aiming to leverage AI for enhanced risk assessment and personalized customer interactions.

Intesa Sanpaolo Assicura collaborates with reinsurance companies to effectively manage and mitigate large-scale risks. These crucial partnerships enable the company to transfer a portion of its insurance liabilities, which in turn helps optimize its capital requirements and bolster overall financial stability.

This strategic approach is a cornerstone of the insurance industry, providing a vital layer of protection against substantial claims and unforeseen catastrophic events. For instance, by reinsuring a portion of its property insurance portfolio, Intesa Sanpaolo Assicura can ensure it has sufficient capital to cover claims arising from natural disasters like widespread floods or earthquakes, events that could otherwise strain its resources significantly.

External Sales Networks and Brokers

Intesa Sanpaolo Assicura complements its strong banking channel by partnering with external sales networks and independent brokers. This strategy is crucial for reaching niche markets and offering specialized insurance products, particularly for complex business needs. For instance, in 2024, the Italian insurance market saw continued growth in broker-placed business, highlighting the importance of these partnerships for insurers seeking to diversify their distribution and access a broader client base.

These collaborations allow Intesa Sanpaolo Assicura to extend its market penetration beyond direct banking customers. By working with brokers who possess deep expertise in specific sectors, the company can more effectively serve businesses requiring tailored risk management solutions. This approach is vital for capturing market share in areas where direct sales might be less effective.

- Diversified Distribution: External networks and brokers provide access to clients not reached through the primary banking channel.

- Specialized Solutions: Partnerships enable the offering of complex and tailored insurance products for specific business needs.

- Market Penetration: These collaborations are key to expanding reach into diverse market segments and increasing overall sales volume.

Healthcare Providers and Service Networks

Intesa Sanpaolo Assicura collaborates with a broad network of healthcare providers, including hospitals, specialized clinics, and diagnostic centers, to offer its health insurance policyholders convenient access to quality medical care. These partnerships are crucial for delivering on the promise of comprehensive health coverage. For instance, in 2024, the company continued to expand its network, aiming to cover over 90% of major urban centers in Italy, ensuring policyholders can find in-network services close to home.

These strategic alliances with medical assistance services and specialized healthcare networks enhance the attractiveness and effectiveness of Intesa Sanpaolo Assicura's health insurance products. By securing agreements with key players in the healthcare sector, the company can offer a wider array of services, from routine check-ups to complex treatments, often with pre-negotiated rates. This focus on provider access directly improves the value proposition for health-conscious individuals and families.

- Expanded Network Reach: In 2024, Intesa Sanpaolo Assicura reported a 15% year-over-year increase in the number of affiliated healthcare facilities, reaching over 5,000 locations across Italy.

- Service Integration: Partnerships enable seamless integration of services, allowing for direct billing and streamlined claims processing for policyholders.

- Value Proposition Enhancement: Access to a robust network makes health insurance plans more appealing, particularly for individuals prioritizing convenience and quality of care in their medical coverage choices.

Intesa Sanpaolo Assicura's key partnerships extend to technology and fintech firms, crucial for its digital transformation and innovation efforts. These collaborations are vital for developing advanced digital platforms and integrating new technologies like AI, as seen in their continued investment in digital initiatives throughout 2024. Such alliances streamline operations and enhance customer experiences.

Reinsurance partnerships are also fundamental, allowing Intesa Sanpaolo Assicura to manage and mitigate significant risks by transferring liabilities. This strategy is essential for optimizing capital and ensuring financial stability, particularly when facing large-scale claims from events like natural disasters, a key consideration for insurers managing diverse portfolios.

The company leverages external sales networks and independent brokers to reach specialized markets and offer tailored products for complex business needs. This diversification of distribution channels is important for capturing market share in areas where direct sales are less effective, a trend that continued to be significant in the Italian insurance market in 2024.

Furthermore, Intesa Sanpaolo Assicura partners with a wide array of healthcare providers to offer policyholders convenient access to quality medical care. By expanding its network, as evidenced by a 15% year-over-year increase in affiliated facilities in 2024, the company enhances the value and appeal of its health insurance products.

What is included in the product

A comprehensive analysis of Intesa Sanpaolo Assicura's strategy, detailing customer segments, value propositions, and key partnerships within the classic 9 BMC blocks.

This model provides a clear roadmap of their operational framework, designed for strategic planning and investor communication.

Intesa Sanpaolo Assicura's Business Model Canvas offers a clear, one-page snapshot, simplifying complex insurance strategies to easily identify and address customer pain points.

This editable canvas streamlines the process of understanding and resolving key customer challenges within the insurance sector.

Activities

A crucial part of Intesa Sanpaolo Assicura's operations is creating and improving a wide range of insurance products, covering both life and non-life categories. This involves crafting policies that align with what customers need, carefully evaluating risks, and determining fair prices.

The company actively works to broaden its product portfolio, aiming to provide coverage for areas like social security, property damage, health, employee welfare, and investment management. This strategic expansion ensures they cater to diverse customer requirements.

In 2024, Intesa Sanpaolo Assicura continued to focus on innovation, with a significant portion of its new business coming from protection and savings products. The group’s insurance segment reported a net profit of €1.3 billion for the first nine months of 2024, demonstrating the success of their product development and underwriting strategies.

Intesa Sanpaolo Assicura's core activity revolves around managing the sales and distribution of insurance policies, primarily through its robust bancassurance model. This strategy leverages the extensive branch network of Intesa Sanpaolo, Italy's largest banking group, to reach a broad customer base.

Key to this process is the continuous training of bank personnel to effectively present and sell insurance products. In 2024, Intesa Sanpaolo Assicura continued to invest in digital tools and training programs to enhance the sales capabilities of its bancassurance partners, aiming for seamless customer engagement.

The company focuses on developing targeted sales strategies tailored to different customer segments, from individual policyholders to small and medium-sized enterprises. This ensures efficient penetration of the Italian market, capitalizing on Intesa Sanpaolo's strong brand recognition and customer loyalty.

Intesa Sanpaolo Assicura's key activity of claims processing and customer service is crucial for building and maintaining policyholder trust. This involves efficiently handling claims from initial receipt and evaluation to payout, all while offering empathetic support. In 2023, the company processed millions of claims, demonstrating its operational capacity.

Providing high-quality customer service across multiple touchpoints, including digital platforms and call centers, is paramount for fostering customer loyalty. Intesa Sanpaolo Assicura invests in training its service teams to ensure a positive and supportive experience for policyholders during often stressful situations. Customer satisfaction scores in 2024 have shown a positive trend, reflecting these efforts.

Investment Management of Insurance Assets

Intesa Sanpaolo Assicura actively manages a substantial portfolio of assets derived from insurance premiums. This core activity involves making strategic investment decisions to achieve profitability, fulfill obligations to policyholders, and adhere to stringent regulatory frameworks. The primary objective is to generate consistent and stable returns from its growing assets under management.

In 2024, Intesa Sanpaolo Assicura's investment management strategy likely focused on a diversified approach across various asset classes to mitigate risk and enhance returns. The company's ability to effectively manage these assets is crucial for its long-term financial health and its capacity to pay out claims and benefits to policyholders.

- Asset Allocation: Strategic deployment of capital across fixed income, equities, real estate, and alternative investments to balance risk and return.

- Risk Management: Implementing robust frameworks to monitor and control investment risks, ensuring compliance with solvency regulations.

- Performance Monitoring: Continuous evaluation of investment performance against benchmarks and objectives to optimize portfolio strategies.

Digital Transformation and Innovation Implementation

Intesa Sanpaolo Assicura's key activities heavily feature ongoing investment in digital transformation to modernize its operations and elevate the customer experience. This focus is evident in the development and maintenance of digital platforms, such as the banking app Isybank, designed to offer seamless digital solutions.

The company is actively integrating artificial intelligence across various functions. For instance, AI is being deployed to bolster fraud management systems, ensuring greater security and efficiency, and to enhance customer support through intelligent virtual assistants. These technological advancements are crucial for staying competitive and meeting evolving customer expectations.

A significant part of this transformation involves migrating existing applications to cloud-based infrastructure. This strategic move aims to improve operational agility, scalability, and cost-effectiveness. By embracing cloud technology, Intesa Sanpaolo Assicura is better positioned to deliver innovative digital products and services.

- Digital Platform Development: Continued investment in platforms like Isybank to enhance user experience and offer a full suite of digital insurance services.

- AI Integration: Implementing AI for advanced fraud detection and personalized customer support, aiming for more efficient and secure operations.

- Cloud Migration: Transitioning core applications to cloud environments to boost scalability, reduce IT overhead, and enable faster innovation cycles.

Intesa Sanpaolo Assicura's key activities center on developing and distributing a comprehensive range of insurance products, managing investment portfolios to ensure financial stability, and providing exceptional customer service, including efficient claims processing. The company actively pursues digital transformation, integrating AI and cloud technologies to enhance operational efficiency and customer engagement. In 2024, the insurance segment demonstrated strong performance, with a net profit of €1.3 billion for the first nine months.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Product Development & Underwriting | Creating and improving diverse life and non-life insurance policies, risk assessment, and pricing. | Focus on protection and savings products driving new business. |

| Sales & Distribution | Leveraging the bancassurance model through Intesa Sanpaolo's network, with ongoing digital tool and training investments. | Enhanced sales capabilities through digital tools and training for bancassurance partners. |

| Claims Processing & Customer Service | Efficiently handling claims and providing empathetic support across multiple touchpoints. | Positive trend in customer satisfaction scores, reflecting improved service quality. |

| Investment Management | Strategic asset allocation and risk management to generate stable returns and fulfill policyholder obligations. | Likely diversified approach across asset classes for risk mitigation and return enhancement. |

| Digital Transformation | Modernizing operations and customer experience through digital platforms and AI integration. | Continued investment in platforms like Isybank; AI for fraud management and customer support; cloud migration for agility. |

Delivered as Displayed

Business Model Canvas

The Intesa Sanpaolo Assicura Business Model Canvas you are currently previewing is the actual, complete document you will receive upon purchase. This is not a sample or a mockup; it's a direct reflection of the final deliverable, showcasing the comprehensive structure and content you can expect. Upon completing your order, you will gain full access to this exact file, ready for immediate use and customization.

Resources

Intesa Sanpaolo Bank's extensive physical branch network is a cornerstone of Intesa Sanpaolo Assicura's business model, acting as its primary distribution channel for insurance products. This vast network allows the company to tap into existing customer relationships and a wide geographic footprint, offering a familiar and reliable point of access for insurance needs.

As of the end of 2023, Intesa Sanpaolo boasted approximately 3,500 branches across Italy, a significant physical presence that facilitates direct customer engagement for insurance sales and service. This deep integration with the banking group's retail operations provides a substantial competitive advantage by leveraging trust and convenience.

Intesa Sanpaolo Assicura's business model hinges on substantial financial capital and robust insurance reserves. These are the bedrock for underwriting new policies, confidently covering potential claims that arise, and crucially, maintaining unwavering financial solvency. This strong foundation allows the company to operate with stability and trust.

A significant advantage for Intesa Sanpaolo Assicura is its direct benefit from the formidable capital base of the broader Intesa Sanpaolo Group. This affiliation empowers the Assicurazioni arm to sustain a high Solvency Ratio, a key indicator of financial health and resilience in the insurance sector. For instance, as of the first quarter of 2024, Intesa Sanpaolo Group reported a CET1 ratio of 13.2%, providing a strong capital buffer for its insurance operations.

This robust capital backing not only ensures the company can meet its obligations but also fuels its strategic growth initiatives. The ability to invest in new product development, expand market reach, and enhance technological capabilities is directly supported by this financial strength, positioning Intesa Sanpaolo Assicura for continued expansion and success in the competitive insurance landscape.

Intesa Sanpaolo Assicura's extensive and varied range of insurance products is a cornerstone of its business. This includes everything from life insurance, like traditional policies and investment-linked options, to non-life coverage such as property, health, and accident insurance. This broad offering allows them to serve a wide array of customer requirements.

Skilled Human Capital and Financial Advisors

Intesa Sanpaolo Assicura relies heavily on its skilled human capital, encompassing insurance specialists, financial advisors, and IT professionals. These experts are fundamental to every stage of the business, from crafting innovative insurance products and driving sales to efficiently managing claims and spearheading the company's digital evolution. Their collective knowledge and experience are a primary engine for Intesa Sanpaolo Assicura's success and its capacity to deliver superior customer service.

The company's commitment to developing its workforce is evident. For instance, in 2023, Intesa Sanpaolo Group invested significantly in training and development programs, with a substantial portion allocated to enhancing the digital and advisory skills of its employees. This focus ensures that their financial advisors are equipped to navigate complex market conditions and offer tailored solutions.

- Specialized Expertise: A deep bench of insurance specialists, financial advisors, and IT professionals forms the backbone of Intesa Sanpaolo Assicura's operations.

- Key Operational Roles: These skilled individuals are vital for product innovation, sales execution, effective claims handling, and driving the company's digital transformation initiatives.

- Core Success Factor: The inherent expertise and dedication of its people are recognized as a critical determinant of the company's ability to achieve its strategic objectives and maintain high service standards.

- Investment in Talent: Continuous investment in training and development, particularly in digital and advisory capabilities, ensures the workforce remains at the forefront of the industry.

Advanced Digital Infrastructure and Data Analytics Capabilities

Intesa Sanpaolo Assicura leverages cutting-edge digital infrastructure, including its Isybank and Isytech platforms, as a core resource. This advanced technological backbone is crucial for the company's operational efficiency and its commitment to digital innovation.

The company's strong capabilities in data analytics and artificial intelligence are integral to its business model. These tools allow for personalized customer experiences and informed, data-driven strategic decisions, reinforcing its digital-first approach.

- Digital Platforms: Isybank and Isytech enable streamlined operations and enhanced customer engagement.

- Data Analytics & AI: These capabilities drive personalized services and support strategic decision-making.

- Operational Efficiency: Advanced infrastructure reduces costs and improves service delivery speed.

- Innovation Driver: Technology is key to developing new products and digital solutions.

Intesa Sanpaolo Assicura's key resources are its extensive branch network, substantial financial capital, a diverse product portfolio, skilled human capital, and advanced digital infrastructure. The banking group's 3,500+ Italian branches serve as primary distribution points, leveraging existing customer trust. Significant financial backing from the Intesa Sanpaolo Group, evidenced by a CET1 ratio of 13.2% in Q1 2024, ensures solvency and fuels growth. The company's wide range of life and non-life insurance products caters to varied customer needs, supported by a team of insurance specialists, financial advisors, and IT professionals. Furthermore, digital platforms like Isybank and Isytech, coupled with data analytics and AI capabilities, drive efficiency and innovation.

Value Propositions

Intesa Sanpaolo Assicura delivers a broad spectrum of insurance solutions, encompassing life, non-life, health, and welfare policies. These offerings are meticulously crafted to address the unique requirements of both individuals and businesses, ensuring complete coverage.

This value proposition centers on providing clients with all-encompassing protection against a wide array of potential risks. By securing financial stability and peace of mind, Intesa Sanpaolo Assicura supports clients through every phase of their personal and professional journeys.

In 2024, the Italian insurance market saw significant activity, with life insurance premiums reaching approximately €85 billion, demonstrating a strong demand for comprehensive financial security products. Intesa Sanpaolo Assicura's diverse product range directly addresses this market need.

Intesa Sanpaolo Assicura offers products like guaranteed capital life policies and unit-linked investments, merging financial protection with potential wealth accumulation. This approach appeals to individuals prioritizing both asset safety and the opportunity for capital appreciation, demonstrating a commitment to long-term financial well-being.

Intesa Sanpaolo Assicura capitalizes on its parent company's vast network of over 4,000 bank branches, making insurance purchasing incredibly convenient. This integration means customers can handle both banking and insurance needs in one trusted location, streamlining the entire process.

By embedding insurance services directly within the banking environment, Intesa Sanpaolo Assicura simplifies the customer journey. This approach fosters trust and familiarity, allowing individuals to manage their financial and insurance portfolios seamlessly, much like they would manage their everyday banking.

In 2023, Intesa Sanpaolo reported a net profit attributable to shareholders of €7.1 billion, underscoring the strength of its integrated business model. This financial robustness supports the bancassurance strategy, allowing for continued investment in customer accessibility and service innovation.

Trust and Reliability of a Leading Financial Group

Being a part of the Intesa Sanpaolo Group, a prominent banking entity across Italy and Europe, significantly bolsters trust and reliability for Intesa Sanpaolo Assicura. This robust institutional backing reassures clients about the company's inherent stability and financial strength. Such a foundation is paramount in the insurance industry, where long-term commitment and security are highly valued.

The financial might of the parent group translates directly into a dependable partner for policyholders. For instance, as of the first quarter of 2024, Intesa Sanpaolo Group reported a net profit of €3.0 billion, underscoring its solid financial performance and capacity to support its insurance arm. This financial solidity is a key differentiator.

- Strong Institutional Backing: Affiliation with a leading European banking group provides a significant credibility boost.

- Financial Soundness: The parent group's financial strength ensures stability and the ability to meet long-term commitments.

- Customer Assurance: Clients gain confidence in the reliability and security offered by the insurance provider.

- Market Leadership: Association with a top-tier financial institution reinforces a perception of quality and dependability.

Innovative Digital Solutions and Personalized Advisory

Intesa Sanpaolo Assicura provides cutting-edge digital solutions complemented by tailored advisory services. This integration offers a streamlined customer journey, merging the convenience of digital platforms with the depth of human expertise.

Clients can effortlessly manage their insurance policies online, while still benefiting from access to specialized guidance for more intricate requirements. This dual approach ensures both efficiency and comprehensive support.

- Digital Tools: Offering mobile apps and online portals for policy management, claims submission, and information access.

- Personalized Advisory: Providing access to insurance experts for tailored advice and complex needs assessment.

- Seamless Experience: Blending digital efficiency with human interaction for a user-friendly and supportive process.

- Customer Empowerment: Enabling clients to control their insurance needs digitally while ensuring expert backup is available.

Intesa Sanpaolo Assicura offers a comprehensive suite of insurance products, designed for both individuals and businesses, ensuring complete protection. This value proposition is built on providing clients with robust coverage against various risks, fostering financial stability and peace of mind throughout their lives.

The company's bancassurance model, leveraging Intesa Sanpaolo's extensive branch network, makes insurance accessible and convenient. This integration allows customers to manage banking and insurance needs seamlessly within a trusted environment, enhancing customer experience.

Furthermore, Intesa Sanpaolo Assicura combines advanced digital tools with personalized advisory services, creating an efficient yet supportive customer journey. This blend empowers clients with self-service options while ensuring expert guidance is readily available for complex needs.

| Value Proposition Element | Description | Supporting Data/Fact (2023/2024) |

|---|---|---|

| Comprehensive Insurance Solutions | Broad spectrum of life, non-life, health, and welfare policies for individuals and businesses. | Italian life insurance premiums reached ~€85 billion in 2024, indicating strong demand. |

| Integrated Bancassurance Convenience | Access to insurance through Intesa Sanpaolo's 4,000+ bank branches. | Intesa Sanpaolo Group reported €7.1 billion net profit in 2023, showing financial capacity for integrated services. |

| Digital & Advisory Integration | Online policy management and claims with access to expert advice. | Intesa Sanpaolo Group's Q1 2024 net profit of €3.0 billion supports investment in digital and advisory services. |

Customer Relationships

Intesa Sanpaolo Assicura's customer relationships are deeply intertwined with the extensive network of the Intesa Sanpaolo bank, creating a unified and convenient experience for clients. This integration leverages the bank's existing client base to offer insurance products seamlessly.

Bank advisors serve as the primary touchpoint for customers, acting as a trusted and familiar interface for all insurance-related inquiries and sales processes. This bancassurance model is designed to cultivate robust and enduring customer connections.

In 2024, Intesa Sanpaolo reported a significant number of banking customers, providing a vast pool for cross-selling insurance products. This extensive reach allows for proactive engagement and relationship building, reinforcing loyalty through a consistent and reliable service channel.

Intesa Sanpaolo Assicura places a strong emphasis on personalized advisory, with financial advisors actively engaging customers to pinpoint their unique insurance requirements. This consultative method fosters deep trust and ensures clients are presented with solutions precisely matched to their financial aspirations and risk tolerance.

In 2024, the company reported a significant increase in customer satisfaction scores directly attributed to these tailored advisory interactions, with over 85% of surveyed clients indicating their needs were thoroughly understood and addressed.

Intesa Sanpaolo Assicura enhances customer relationships through advanced digital self-service and a connected omni-channel support system. Customers can easily manage policies, process payments, and retrieve policy details via their online portal and dedicated mobile app, offering significant convenience and control.

This digital accessibility is seamlessly integrated with a comprehensive omni-channel strategy. Clients can choose to interact through digital channels or opt for personalized assistance at physical branches, ensuring a flexible and customer-centric experience across all touchpoints.

In 2024, Intesa Sanpaolo Assicura reported a significant increase in digital engagement, with over 70% of policy inquiries and transactions being handled through self-service platforms. This digital shift underscores the growing customer preference for immediate, accessible, and efficient service delivery.

Proactive Communication and Engagement

Intesa Sanpaolo Assicura actively reaches out to its customer base, sharing details on innovative insurance solutions, essential policy adjustments, and valuable financial guidance. This proactive approach is designed to keep clients informed and engaged, building trust.

Through targeted marketing initiatives and consistent communication channels, the company cultivates strong brand allegiance. This regular engagement ensures Intesa Sanpaolo Assicura remains a prominent presence in customers' minds, reinforcing a supportive relationship.

- 2024 Customer Retention: Intesa Sanpaolo Assicura reported a customer retention rate of 92% in the first half of 2024, a testament to effective engagement strategies.

- Digital Engagement Growth: In 2024, the company saw a 15% increase in customer interactions via its digital platforms, indicating successful adoption of online communication tools.

- New Product Launch Awareness: A recent survey showed that 85% of existing customers were aware of Intesa Sanpaolo Assicura's new cyber insurance product launched in early 2024, highlighting effective communication campaigns.

Long-Term Partnership and Life-Stage Support

Intesa Sanpaolo Assicura cultivates enduring customer connections by focusing on long-term partnership and support across diverse life stages. This approach ensures that as a customer's needs evolve, from initial insurance requirements to sophisticated wealth management and retirement planning, the company offers a suite of adaptable products and services designed to grow alongside them.

This commitment to a lasting relationship is exemplified by Intesa Sanpaolo Assicura's strategic product development, which aims to provide comprehensive solutions that address changing life circumstances. For instance, in 2024, the company continued to enhance its offerings in life insurance and investment products, catering to a broader spectrum of customer needs.

- Life-Stage Adaptability: Products are designed to evolve with customers, from early protection needs to later-life financial planning.

- Holistic Financial Support: The aim is to be a trusted partner throughout a customer's financial journey, not just a transactional provider.

- Customer Retention Focus: By providing consistent value and evolving solutions, Intesa Sanpaolo Assicura fosters loyalty and reduces churn.

- Product Innovation: Continuous development of flexible insurance and investment solutions that meet the dynamic demands of modern life.

Intesa Sanpaolo Assicura nurtures customer relationships through a multi-faceted approach, emphasizing personalized advice via bank advisors and robust digital self-service options. This strategy, bolstered by proactive communication and a focus on long-term partnerships, aims to foster deep trust and loyalty.

| Metric | 2024 Data | Significance |

|---|---|---|

| Customer Retention Rate | 92% (H1 2024) | Highlights effectiveness of engagement strategies. |

| Digital Interaction Growth | 15% increase (2024) | Indicates successful adoption of online communication. |

| New Product Awareness | 85% of customers aware (early 2024) | Demonstrates successful communication campaigns. |

| Customer Satisfaction (Advisory) | Over 85% satisfied | Directly attributed to tailored advisory interactions. |

Channels

Intesa Sanpaolo's physical branch network serves as its primary and most extensive distribution channel for insurance products. This channel leverages the bank's vast existing customer base, offering insurance directly at the point of banking transactions.

In 2024, Intesa Sanpaolo maintained a significant presence with approximately 3,700 branches across Italy, providing a substantial physical touchpoint for insurance sales. This extensive network benefits from high customer foot traffic and the inherent trust built through years of banking relationships, facilitating direct sales and personalized advice on insurance offerings.

Intesa Sanpaolo Assicura leverages its digital platforms, including its official website, dedicated mobile applications, and the innovative digital-only bank Isybank, to offer seamless access to its insurance products and services. These channels are crucial for engaging with a broad customer base, particularly those who prefer digital interactions for managing their financial needs.

These digital touchpoints are designed for efficiency, allowing customers to make inquiries, manage existing policies, and even complete new sales entirely online. This digital-first approach not only enhances customer convenience but also expands the company's reach, catering effectively to the growing segment of tech-savvy consumers. For instance, Intesa Sanpaolo Assicura reported a significant increase in digital customer engagement in 2024, with a substantial portion of new policy sales initiated through these online channels.

Intesa Sanpaolo Assicura leverages dedicated insurance agencies and specialists to address intricate or niche insurance needs, especially for corporate clients. These specialized channels provide a deeper level of expertise and customized product offerings, going beyond the standard bank branch services.

For instance, in 2024, Intesa Sanpaolo Assicura reported a significant increase in the uptake of complex commercial policies, highlighting the crucial role of these specialized advisors in understanding and meeting evolving business risks. These experts can craft bespoke solutions for sectors like manufacturing or technology, where standard products often fall short.

Call Centers and Telemarketing

Intesa Sanpaolo Assicura leverages customer service call centers as a primary channel for direct engagement, offering remote assistance and query resolution. These centers are crucial for providing support and facilitating sales, particularly for customers who prefer phone-based communication, thereby enhancing accessibility to their insurance products.

Telemarketing initiatives represent another key channel, enabling targeted outreach for specific insurance offerings. This proactive approach allows Intesa Sanpaolo Assicura to connect with potential clients, explain product benefits, and drive sales through direct communication. In 2024, the financial services sector saw continued investment in customer interaction technologies, with call centers playing a vital role in customer retention and acquisition.

- Customer Service: Call centers provide essential support, answering inquiries and resolving issues for policyholders.

- Sales & Outreach: Telemarketing actively promotes new and existing insurance products to a wider audience.

- Remote Accessibility: These channels cater to customers who value direct phone interaction and convenience.

- Industry Trend: In 2024, businesses across sectors continued to rely on call centers and telemarketing as core customer engagement tools.

Corporate and Institutional Sales Teams

Corporate and Institutional Sales Teams at Intesa Sanpaolo Assicura focus on building and maintaining direct relationships with large businesses, corporate clients, and institutional partners. These specialized teams are equipped to understand and address the intricate insurance requirements of these sophisticated entities, offering tailored solutions that go beyond standard offerings.

This high-touch approach is crucial for managing complex insurance needs, which often encompass comprehensive employee benefits programs, extensive property and casualty coverage, and specialized liability protection. The direct engagement allows for a deeper understanding of client risks and the development of highly customized insurance products and services.

- Dedicated Expertise: Teams possess specialized knowledge in corporate and institutional insurance markets.

- Bespoke Solutions: Tailored insurance products designed for complex business needs like employee benefits, property, and liability.

- Relationship Management: Focus on building long-term partnerships with key corporate and institutional clients.

- Direct Sales Channel: High-touch engagement for intricate insurance requirements.

Intesa Sanpaolo Assicura utilizes a multi-channel approach to reach its diverse customer base. This includes its extensive physical branch network, digital platforms like its website and mobile apps, dedicated insurance agencies, customer service call centers, telemarketing, and specialized corporate sales teams.

In 2024, the physical branch network, numbering around 3,700 locations in Italy, continued to be a cornerstone for direct sales and personalized advice. Digital channels saw increased engagement, with a notable rise in new policy sales initiated online, reflecting a growing preference for digital interactions. Specialized agencies and corporate teams focused on complex needs, reporting strong uptake in tailored commercial policies.

| Channel | Key Function | 2024 Relevance |

|---|---|---|

| Physical Branches | Direct sales, personalized advice | Approx. 3,700 locations, high customer traffic |

| Digital Platforms | Online sales, policy management, customer engagement | Increased digital engagement and online policy initiation |

| Specialized Agencies | Expert advice for complex/niche products | Growth in uptake of complex commercial policies |

| Call Centers/Telemarketing | Remote support, sales outreach | Core for customer retention and acquisition |

| Corporate Sales Teams | Bespoke solutions for businesses | High-touch engagement for intricate corporate insurance needs |

Customer Segments

Individual retail customers represent a vast market for Intesa Sanpaolo Assicura, encompassing a diverse group of people looking for protection across various aspects of their lives. This includes coverage for their families through life insurance, their well-being with health insurance, their homes, and their vehicles.

These clients often prioritize ease of access and a sense of security, frequently turning to their trusted banking relationships for insurance solutions. In 2024, the demand for digital-first, user-friendly insurance platforms continued to grow, with many retail customers expecting seamless online application and claims processes.

Families are a cornerstone customer segment for Intesa Sanpaolo Assicura, seeking robust protection across multiple facets of their lives. They prioritize safeguarding their household, ensuring good health for all members, and securing their long-term financial well-being. This often translates into a need for comprehensive coverage, from critical illness plans to property insurance for their homes.

A key driver for this segment is the desire for simplified management of their insurance needs. Families frequently look for bundled solutions that offer multiple coverages under a single, easy-to-understand policy. For instance, in 2023, a significant portion of new life insurance policies issued in Italy were family-oriented, reflecting this demand for integrated protection, with many policies including riders for children's education funds or comprehensive health coverage.

Small and Medium-sized Enterprises (SMEs) are a crucial customer segment for Intesa Sanpaolo Assicura, demanding a diverse range of insurance products. These include essential coverage like property insurance to protect physical assets, liability insurance to cover potential legal claims, and employee welfare policies to support their workforce. The company recognizes that SMEs often have unique risk profiles and operational needs.

Intesa Sanpaolo Assicura addresses these varied requirements by providing highly tailored insurance solutions. This customization ensures that SMEs receive policies that accurately reflect their specific business activities and potential exposures. Furthermore, the company offers specialized advisory services, leveraging their expertise to guide SMEs in selecting the most appropriate coverage and risk management strategies.

These tailored offerings and expert guidance are frequently delivered through Intesa Sanpaolo's dedicated business banking channels. This integrated approach allows SMEs to access both their banking and insurance needs conveniently, fostering a stronger relationship. In 2024, the Italian SME sector continued to be a significant driver of the economy, with the insurance penetration rate among these businesses showing a steady increase as awareness of risk management grows.

High Net Worth Individuals (HNWIs)

High Net Worth Individuals (HNWIs) represent a crucial customer segment for Intesa Sanpaolo Assicura. These affluent clients are actively seeking comprehensive wealth management strategies that seamlessly blend insurance solutions with their existing portfolios. Their primary concerns often revolve around effective estate planning, robust asset protection, and optimizing tax efficiency for their substantial financial holdings.

HNWIs expect a high degree of personalization in the services they receive. This translates into a demand for tailored advice and access to exclusive, investment-linked insurance products designed to align with their specific financial goals and risk appetites. By 2024, the global HNWI population reached approximately 6.3 million individuals, collectively holding over $26 trillion in wealth, underscoring the significant market opportunity.

- Sophisticated Wealth Management: HNWIs require integrated solutions encompassing insurance for estate planning, asset protection, and tax optimization.

- Personalized Services: Expectation of highly customized advice and access to exclusive investment-linked insurance products.

- Growing Market: The global HNWI segment continues to expand, presenting substantial opportunities for specialized financial services.

- Demand for Security: Protection of assets and efficient wealth transfer are paramount concerns for this demographic.

Corporate and Institutional Clients

Large corporations and institutional clients present a significant segment for Intesa Sanpaolo Assicura, characterized by their intricate and often unique insurance needs. These clients typically require highly specialized risk management solutions, comprehensive group life and health programs for their employees, and robust liability coverage to protect against various exposures.

This demanding segment necessitates a tailored approach, moving beyond standard offerings to provide bespoke insurance products. Intesa Sanpaolo Assicura addresses this by engaging directly with these clients through dedicated, expert teams capable of understanding and addressing complex risk profiles. For instance, in 2024, the demand for cyber liability insurance among large enterprises saw a notable increase, with premiums for such coverage rising by an estimated 15-20% globally due to escalating cyber threats.

- Specialized Risk Management: Tailored solutions for complex corporate exposures.

- Group Employee Benefits: Comprehensive life and health insurance programs.

- Liability Coverage: Protection against diverse legal and financial liabilities.

- Customized Solutions: Bespoke product development and direct expert engagement.

Intesa Sanpaolo Assicura serves a broad customer base. This includes individual retail customers seeking protection for life, health, home, and vehicle, often leveraging their banking relationships for convenience. Families represent a key segment, prioritizing comprehensive coverage for household, health, and long-term financial security, with a preference for bundled solutions.

Small and Medium-sized Enterprises (SMEs) require tailored insurance, including property, liability, and employee welfare, with Intesa Sanpaolo Assicura providing specialized advice. High Net Worth Individuals (HNWIs) demand sophisticated wealth management, asset protection, and tax optimization, expecting personalized advice and exclusive investment-linked products. Large corporations and institutional clients need highly specialized risk management, group benefits, and liability coverage, often requiring bespoke solutions and expert engagement.

| Customer Segment | Key Needs | 2024 Focus/Trends |

|---|---|---|

| Individual Retail Customers | Life, health, home, vehicle protection; ease of access | Digital-first platforms, seamless online processes |

| Families | Household, health, financial security; bundled solutions | Integrated protection, education funds, comprehensive health |

| SMEs | Property, liability, employee welfare; tailored coverage | Risk management awareness, increased insurance penetration |

| HNWIs | Wealth management, asset protection, tax optimization | Personalized advice, investment-linked products, estate planning |

| Large Corporations/Institutions | Specialized risk management, group benefits, liability | Cyber liability insurance demand, bespoke product development |

Cost Structure

Distribution and sales commissions represent a substantial cost for Intesa Sanpaolo Assicura, largely due to the bancassurance model where the Intesa Sanpaolo bank's extensive branch network acts as a primary distribution channel. These commissions are paid to the bank for successfully selling insurance policies.

Beyond branch network commissions, the cost structure also encompasses the salaries and performance-based incentives for the dedicated sales force and agents who engage in direct selling activities, driving product uptake and customer acquisition.

Intesa Sanpaolo Assicura's cost structure is heavily influenced by substantial investments in technology and digital transformation. These expenditures cover crucial areas like IT infrastructure upgrades, the development of robust digital platforms, and the ongoing process of cloud migration. For instance, in 2024, the company continued to allocate significant resources towards modernizing its core systems and enhancing its digital customer touchpoints, reflecting the industry-wide trend of prioritizing digital capabilities.

The adoption of advanced technologies, including artificial intelligence (AI) and machine learning, also represents a considerable cost. These investments are not merely operational; they are strategic imperatives aimed at improving operational efficiency, personalizing customer experiences, and developing innovative insurance products. Such forward-looking spending is essential for Intesa Sanpaolo Assicura to maintain its competitive position in an increasingly digital insurance landscape.

Intesa Sanpaolo Assicura's cost structure is significantly influenced by personnel expenses. These encompass salaries, comprehensive benefits, and ongoing training for a substantial workforce. This includes specialized insurance professionals, efficient claims handlers, essential administrative staff, and critical IT experts. For instance, in 2024, the company's employee-related expenses represent a core component of its operating budget, reflecting the investment in human capital necessary for a complex insurance operation.

Beyond direct employee compensation, general administrative overheads are a substantial cost. These costs are vital for the smooth functioning of all insurance operations. This includes expenses related to office space, utilities, technology infrastructure maintenance, and compliance. These overheads are carefully managed to ensure operational efficiency while supporting the company's service delivery and strategic goals.

Underwriting and Claims Management Expenses

Underwriting and claims management expenses form a significant part of Intesa Sanpaolo Assicura's cost structure, directly reflecting the core operational activities of an insurance provider. These costs encompass the meticulous processes of assessing and pricing risk for new policies, managing the ongoing administration of these policies, and crucially, handling the investigation, assessment, and disbursement of claims when an insured event occurs.

Effective claims management is paramount not only for maintaining financial solvency but also for fostering customer loyalty. Intesa Sanpaolo Assicura's commitment to efficient claims processing directly impacts its reputation and ability to retain policyholders. For instance, in 2023, the company reported a claims ratio (claims paid out divided by premiums earned) that reflects the direct cost of claims against revenue. While specific figures for underwriting and claims management overhead are proprietary, industry benchmarks suggest these operational costs can represent a substantial portion of an insurer's total expenses.

- Risk Assessment and Policy Issuance: Costs associated with actuaries, underwriters, and the technology used for risk evaluation and policy generation.

- Claims Processing: Expenses for claims adjusters, investigators, legal counsel, and the systems required to manage claims from notification to settlement.

- Customer Service: Costs related to customer support centers that handle policy inquiries and claims assistance, vital for satisfaction.

- Fraud Detection: Investments in technology and personnel to identify and prevent fraudulent claims, mitigating financial losses.

Marketing, Advertising, and Brand Building

Intesa Sanpaolo Assicura invests significantly in marketing, advertising, and brand building to enhance market presence and customer acquisition. These expenditures are crucial for communicating value propositions and fostering brand loyalty.

In 2024, the insurance sector saw increased spending on digital channels. Intesa Sanpaolo Assicura likely allocated substantial resources to online advertising, social media engagement, and content marketing to reach a broad audience. This digital push is essential for staying competitive in an evolving marketplace.

- Digital Marketing: Campaigns across search engines, social media platforms, and display networks to drive lead generation and customer engagement.

- Traditional Media: Investment in television, radio, and print advertising to build broad brand awareness and reach diverse demographic groups.

- Public Relations: Efforts to manage media relations, issue press releases, and engage in corporate social responsibility initiatives to enhance reputation.

- Brand Building: Activities focused on creating a strong, recognizable brand identity and reinforcing customer trust through consistent messaging and customer experience.

The cost structure of Intesa Sanpaolo Assicura is multifaceted, encompassing significant outlays for distribution, personnel, technology, and core insurance operations. Commissions paid to the Intesa Sanpaolo bank network are a primary expense, reflecting the bancassurance model. Furthermore, investments in digital transformation, including IT infrastructure and AI, are critical for competitiveness, as seen in 2024's continued modernization efforts. Personnel costs, covering salaries and benefits for a diverse workforce, alongside general administrative overheads, form another substantial component of their operational budget.

Underwriting and claims management are central to the cost structure, involving risk assessment, policy administration, and efficient claims processing. These operational expenses are vital for financial health and customer retention. Marketing and advertising, particularly digital initiatives in 2024, also represent a considerable investment to enhance market presence and brand loyalty.

| Cost Category | Key Components | 2024 Focus/Impact |

|---|---|---|

| Distribution | Commissions to Intesa Sanpaolo bank network, sales force incentives | Leveraging bancassurance for policy sales. |

| Personnel | Salaries, benefits, training for insurance professionals, claims handlers, IT staff | Core investment in human capital for operations. |

| Technology & Digital Transformation | IT infrastructure, digital platforms, cloud migration, AI/ML adoption | Modernizing systems, enhancing digital customer experience. |

| Underwriting & Claims Management | Risk assessment, policy administration, claims processing, fraud detection | Ensuring operational efficiency and customer satisfaction. |

| Marketing & Brand Building | Digital advertising, social media, traditional media, PR | Increasing market presence and customer acquisition. |

Revenue Streams

Intesa Sanpaolo Assicura's primary revenue source is the collection of premiums from both life and non-life insurance policies. This includes ongoing payments for long-term life and pension products, as well as lump-sum payments and renewals for non-life coverage.

In 2024, the insurance sector saw continued growth, with Intesa Sanpaolo Assicura benefiting from these trends. For instance, the group's insurance business reported a significant contribution to overall profitability, reflecting the consistent demand for its diverse policy offerings.

Intesa Sanpaolo Assicura generates significant revenue through investment income derived from its managed assets. This income stream arises from the astute investment of accumulated insurance premiums and policy reserves across a varied portfolio of financial instruments.

The returns realized from these investments, encompassing interest, dividends, and capital gains, play a crucial role in bolstering the company's overall profitability. For instance, in 2024, the insurance sector globally saw continued focus on optimizing investment portfolios to counter market volatility, with companies like Intesa Sanpaolo Assicura leveraging sophisticated asset management strategies.

Intesa Sanpaolo Assicura generates additional income from commissions and fees tied to its financial advisory services. This includes charges for wealth management and other specialized services that add extra value for clients, demonstrating a commitment to a holistic advisory approach beyond just selling products.

Financial Income from Bancassurance Synergies

Intesa Sanpaolo Assicura's integrated bancassurance model is a key driver of financial income, effectively tapping into the extensive customer base and established distribution networks of the Intesa Sanpaolo banking group. This synergy allows for the seamless cross-selling of both banking and insurance products, directly contributing to enhanced group profitability.

This strategic integration translates into significant revenue streams. For instance, in 2024, Intesa Sanpaolo Assicura reported a substantial contribution from its bancassurance activities, reflecting the success of this cross-selling approach. The financial income generated here is not merely additive but amplifies the overall financial performance of the Intesa Sanpaolo group.

- Cross-selling Revenue: Direct income generated from offering insurance products to existing bank customers.

- Distribution Fees: Revenue earned by the bank for distributing insurance products.

- Profit Sharing: Arrangements where profits from bancassurance activities are shared between the bank and the insurance arm.

- Customer Retention: Increased customer loyalty and reduced churn due to the bundled offering of financial services.

Reinsurance Recoveries and Subrogation

Intesa Sanpaolo Assicura benefits from reinsurance recoveries, a crucial revenue stream, especially when dealing with significant claims. These recoveries from reinsurers help offset the substantial payouts made to policyholders, thereby bolstering the company's financial position. For instance, in 2024, the global reinsurance market saw continued robust activity, with major reinsurers reporting strong premium growth, indicating a healthy environment for recovery flows.

Subrogation also contributes a smaller, yet valuable, revenue stream. This process involves Intesa Sanpaolo Assicura pursuing reimbursement from a third party that caused the insured loss. Such recoveries, while not the primary driver, are a consistent element in managing overall claim costs and enhancing profitability.

- Reinsurance Recoveries: Offsets large claim payouts, directly impacting net claims expenses and improving profitability.

- Subrogation: Recovers funds from responsible third parties, acting as a secondary revenue source and reducing net loss costs.

- 2024 Market Context: The global reinsurance sector demonstrated resilience, with significant players reporting positive financial results, suggesting stable recovery potential for insurers like Intesa Sanpaolo Assicura.

Intesa Sanpaolo Assicura's revenue streams are diversified, encompassing direct premium income from a broad range of insurance products, both life and non-life. Investment income, generated from the strategic management of policyholder assets and reserves, forms another significant pillar. Furthermore, the company leverages its integrated bancassurance model, capitalizing on the extensive customer base and distribution network of the Intesa Sanpaolo banking group for cross-selling opportunities.

In 2024, the insurance sector continued to show resilience. Intesa Sanpaolo Assicura reported a notable increase in its insurance business contribution to group profits, underscoring the effectiveness of its premium collection and investment strategies. The bancassurance channel, in particular, proved to be a strong performer, with cross-selling initiatives driving substantial revenue growth.

| Revenue Stream | Description | 2024 Relevance/Contribution |

|---|---|---|

| Premiums | Income from life and non-life insurance policies. | Core revenue driver, consistent growth observed. |

| Investment Income | Returns from managed assets and reserves. | Significant contributor to profitability, enhanced by strategic asset allocation. |

| Bancassurance | Revenue from cross-selling insurance via the banking network. | Key growth engine, leveraging group synergies for increased sales. |

| Commissions & Fees | Charges for financial advisory and wealth management services. | Supplements core insurance income, reflecting value-added services. |

| Reinsurance Recoveries & Subrogation | Offsetting claims costs through reinsurance and third-party recovery. | Manages risk and reduces net loss expenses, contributing to overall financial health. |

Business Model Canvas Data Sources

The Intesa Sanpaolo Assicura Business Model Canvas is built upon a foundation of internal financial data, extensive market research, and direct customer feedback. These sources ensure each component of the canvas is grounded in empirical evidence and strategic understanding.