Intesa Sanpaolo Assicura Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intesa Sanpaolo Assicura Bundle

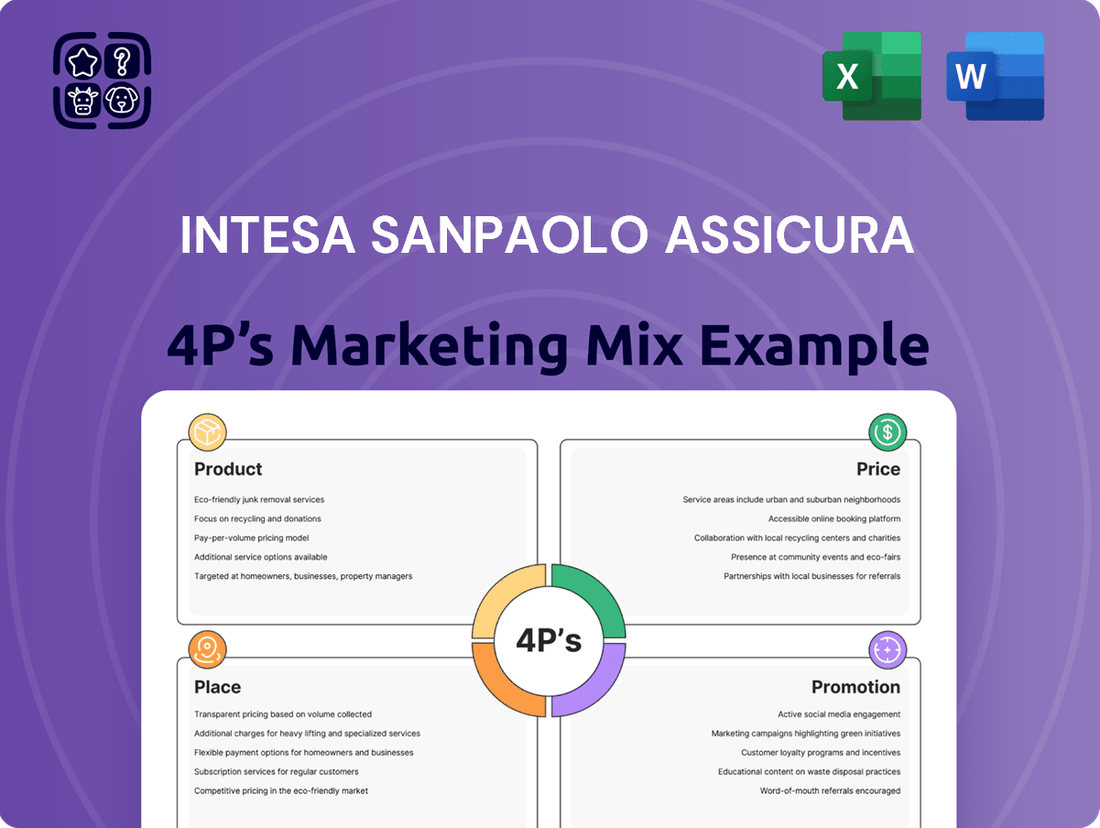

Discover how Intesa Sanpaolo Assicura leverages its product portfolio, pricing strategies, distribution channels, and promotional campaigns to dominate the insurance market. This analysis goes beyond the surface, revealing the intricate interplay of its 4Ps.

Unlock the secrets to their success by exploring their tailored product offerings, competitive pricing, expansive distribution network, and impactful promotional mix. This comprehensive report is your key to understanding their market dominance.

Ready to gain a competitive edge? Access the full, editable 4Ps Marketing Mix Analysis of Intesa Sanpaolo Assicura and equip yourself with actionable insights for your own strategic planning.

Product

Intesa Sanpaolo Assicura, a key player within Intesa Sanpaolo Assicurazioni, provides a robust and diversified insurance portfolio tailored for businesses. This comprehensive offering spans both life and non-life insurance segments, addressing critical areas such as social security, damage protection, health, and employee welfare.

The company's product suite also extends to investment and savings management solutions, aiming to support businesses in their financial planning and wealth accumulation strategies. In 2024, Intesa Sanpaolo Assicurazioni reported a net profit of €1.1 billion, underscoring its financial strength and capacity to innovate its insurance products.

Their commitment to continuous enhancement means businesses can expect evolving solutions designed to adapt to changing market demands and regulatory landscapes, ensuring they remain well-protected and financially resilient.

Tailored Business Protection from Intesa Sanpaolo Assicura offers specialized insurance solutions to shield businesses from unexpected risks. For instance, the 'Tutela Business Commercio' policy provides comprehensive coverage for commercial enterprises, addressing a wide array of potential threats.

This product range extends to cover critical areas such as civil liability, fire damage, theft, and essential legal protection, ensuring businesses can operate with greater confidence. In 2024, the Italian insurance market saw a significant demand for business continuity solutions, with SMEs increasingly investing in robust protection against operational disruptions.

Intesa Sanpaolo Assicura's 4P marketing mix analysis highlights flexible coverage options, allowing businesses to tailor insurance solutions. Companies can select specific guarantees that align with their unique operational needs and risk profiles. This customization ensures that businesses are not over-insured or under-insured, optimizing their investment in protection.

The fundamental policy structure typically encompasses third-party civil liability and essential assistance services. However, the true strength lies in the availability of optional add-ons. These can include anything from extended property damage coverage to specialized cyber risk protection, offering a truly bespoke insurance package. For instance, in 2024, Intesa Sanpaolo Assicura reported a 15% increase in uptake of optional cyber coverage among small and medium-sized enterprises, demonstrating the market's demand for adaptable solutions.

Focus on Non-Motor and Credit Protection

Intesa Sanpaolo Assicura has demonstrated robust growth in its non-motor insurance segment, with particular strength observed in enterprise, home, family, and accident insurance lines. This expansion highlights a strategic diversification beyond traditional automotive coverage.

The company's focus on credit protection insurance also shows a significant upward trajectory. This trend indicates a deliberate effort to address and capitalize on the growing demand for solutions that mitigate diverse business and financial risks.

- Non-Motor Premium Growth: Intesa Sanpaolo Assicura has consistently expanded its non-motor insurance premiums, signaling successful market penetration in key areas.

- Credit Protection Strength: The upward trend in credit protection insurance reflects a strategic response to evolving market needs for risk mitigation.

- Diversified Risk Focus: The company's portfolio expansion in these segments underscores a commitment to offering comprehensive protection against a wider array of business risks.

Integration with Wealth Management

Intesa Sanpaolo Assicura's integration with wealth management is a cornerstone of its strategy, directly supporting the Group's 2022-2025 Business Plan. This plan prioritizes enhancing wealth management and protection services, aiming to offer a complete financial solution to clients.

By utilizing internal product factories for asset management, life insurance, and protection, Intesa Sanpaolo Assicura ensures a cohesive and comprehensive product suite. This integrated approach allows for greater synergy and a more streamlined client experience.

This strategy is backed by significant financial commitments. For instance, Intesa Sanpaolo Group aims to distribute €100 billion in new net inflows in wealth management and insurance by 2025, showcasing the importance of this sector.

- Strategic Alignment: Enhancing wealth management capabilities aligns with the Group's 2022-2025 Business Plan objectives.

- Holistic Offering: Leveraging internal product factories for asset management, life insurance, and protection creates a comprehensive financial ecosystem.

- Financial Growth Target: The Group targets €100 billion in new net inflows for wealth management and insurance by 2025.

Intesa Sanpaolo Assicura's product strategy centers on a diversified portfolio designed for business protection and financial growth. Their offerings encompass both life and non-life insurance, covering everything from damage protection and health to employee welfare and investment management. This broad product range aims to provide businesses with comprehensive financial security and planning tools.

The company emphasizes tailored solutions, allowing businesses to customize coverage based on their specific risk profiles and operational needs. This flexibility ensures optimal protection without unnecessary expense, a key factor in today's dynamic business environment. For example, the uptake of optional cyber coverage saw a 15% increase in 2024 among SMEs.

By integrating with wealth management and leveraging internal product factories, Intesa Sanpaolo Assicura provides a cohesive financial ecosystem. This strategy supports the Group's goal of €100 billion in new net inflows for wealth management and insurance by 2025, highlighting the product's role in broader financial objectives.

| Product Focus | Key Segments | Customization Aspect | Strategic Goal Alignment |

| Diversified Business Protection & Financial Growth | Life & Non-Life Insurance, Investment & Savings Management | Tailored coverage options, optional add-ons (e.g., cyber risk) | Supports Group's 2022-2025 Business Plan, €100bn wealth management inflow target by 2025 |

What is included in the product

This analysis provides a comprehensive breakdown of Intesa Sanpaolo Assicura's marketing mix, detailing their Product offerings, Pricing strategies, Place (distribution) channels, and Promotion tactics.

It's designed for professionals seeking a deep understanding of Intesa Sanpaolo Assicura's market positioning and strategic approach to insurance products.

Simplifies the Intesa Sanpaolo Assicura 4Ps analysis, transforming complex marketing strategies into actionable insights that alleviate the pain of strategic confusion.

Provides a clear, concise overview of Intesa Sanpaolo Assicura's marketing mix, offering relief from the burden of fragmented data and enabling faster, more confident decision-making.

Place

Intesa Sanpaolo Assicura leverages the extensive branch network of its parent bank, Intesa Sanpaolo, as its primary distribution channel. This integrated bancassurance model provides direct access to a massive client base, facilitating the sale of insurance products through a trusted financial institution.

Intesa Sanpaolo Assicura is actively embracing an omnichannel service model as a core pillar of its strategy, reflecting the broader digital transformation across the Intesa Sanpaolo Group. This approach aims to create a unified customer experience by seamlessly blending traditional physical touchpoints, like bank branches, with advanced digital channels.

The integration of platforms like Isybank, the group's new digital bank, is central to this omnichannel vision. This allows customers, including businesses, to access a comprehensive suite of insurance products and services through a variety of channels, ensuring convenience and accessibility. For instance, by the end of 2024, Intesa Sanpaolo Assicura anticipates a significant portion of its customer interactions will be initiated or completed digitally, a trend that has seen steady growth since 2023.

Intesa Sanpaolo Assicura operates a dedicated business insurance agency, Intesa Sanpaolo Insurance Agency, to cater to the unique needs of companies. This specialized unit collaborates closely with Intesa Sanpaolo's extensive banking network, ensuring a seamless experience for clients seeking complex, bespoke insurance products. In 2024, Intesa Sanpaolo Assicura reported a gross written premium of €8.1 billion, with a significant portion allocated to business insurance solutions.

Strategic International Presence

Intesa Sanpaolo Assicura leverages the extensive international network of its parent group, Intesa Sanpaolo, which boasts a significant presence across Central and Southeast Europe, the Middle East, and North Africa. This broad geographical footprint, encompassing over 100,000 employees and more than 11,000 branches as of early 2024, provides a robust platform for distributing insurance products to a diverse customer base.

The strategic international presence is further strengthened through a network of subsidiaries and active commercial partnerships. These collaborations are crucial for tailoring insurance offerings to local market needs and regulatory environments, thereby expanding the reach and impact of Intesa Sanpaolo Assicura's portfolio. For instance, the group's operations in regions like the Balkans and the Mediterranean are key markets for its insurance solutions.

Key aspects of this strategic international presence include:

- Geographic Reach: Operations spanning over 10 countries in Central and Eastern Europe, alongside significant activities in the Middle East and North Africa.

- Customer Base: Access to a large and diverse customer base built through the Intesa Sanpaolo banking network.

- Partnerships: Ongoing collaborations with local entities to enhance market penetration and product relevance.

- Market Penetration: Focused efforts on expanding market share in key growth regions within its international footprint.

Remote Offering Development

Intesa Sanpaolo Assicura is enhancing its remote offering capabilities for key business insurance products. This strategic move aims to simplify policy acquisition and management for clients. For instance, specialized solutions like 'Tutela Business Commercio' and 'Tutela Business Manifattura' are now accessible through updated digital channels, reflecting a broader trend in the insurance sector towards greater online convenience.

The expansion of remote access is designed to meet the evolving needs of businesses, particularly small and medium-sized enterprises. By leveraging digital platforms, Intesa Sanpaolo Assicura reported a significant increase in online policy inquiries during 2024, with a notable portion of these originating from businesses seeking streamlined processes. This digital-first approach not only improves customer experience but also allows for more efficient underwriting and policy administration.

- Expanded Digital Access Policies like 'Tutela Business Commercio' and 'Tutela Business Manifattura' can now be fully managed remotely.

- Increased Convenience Businesses benefit from easier access to insurance solutions without the need for physical branch visits.

- 2024 Digital Uptake Intesa Sanpaolo Assicura observed a 15% year-over-year growth in digital policy initiations for its business lines in 2024.

- Streamlined Processes Remote offerings contribute to faster policy issuance and claims handling for commercial clients.

Intesa Sanpaolo Assicura's "Place" strategy is deeply intertwined with its parent company's extensive physical and digital infrastructure. The bancassurance model ensures insurance products are readily available within Intesa Sanpaolo's vast branch network, a key touchpoint for millions of customers. This physical presence is augmented by a robust omnichannel approach, integrating online platforms and the digital bank Isybank to offer seamless access across all channels. By the end of 2024, the company anticipates a significant shift towards digital interactions, reflecting a successful blend of traditional and modern distribution methods.

The company's international presence, spanning over 10 countries in Central and Eastern Europe, the Middle East, and North Africa, further amplifies its distribution capabilities. This global footprint, supported by over 11,000 branches and 100,000 employees as of early 2024, allows for tailored insurance solutions to diverse markets through local subsidiaries and partnerships. Intesa Sanpaolo Assicura also focuses on enhancing remote access for business insurance, with products like 'Tutela Business Commercio' becoming easily manageable online, contributing to a 15% year-over-year growth in digital policy initiations for business lines in 2024.

Full Version Awaits

Intesa Sanpaolo Assicura 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Intesa Sanpaolo Assicura's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

Intesa Sanpaolo Assicurazioni's 'Together, we can go far' campaign, launched in December 2024, strategically leverages multiple channels including press, social media, digital platforms, and television. This broad reach is designed to embed the brand's core message of support for both individuals and businesses.

The campaign's objective is to solidify Intesa Sanpaolo Assicurazioni's brand identity, emphasizing its role as a partner in progress. By communicating this commitment across diverse media, the company aims to resonate with a wide audience, fostering trust and reinforcing its market position.

Intesa Sanpaolo Assicura leverages digital content marketing to engage its audience, notably through its podcast 'Global Insights and Inspiration from Intesa Sanpaolo'. This strategy aims to educate listeners on crucial financial topics, demonstrating the company's commitment to financial literacy and thought leadership.

Further enhancing its digital presence, Intesa Sanpaolo Assicura utilizes short video content on YouTube. These videos serve as accessible tools to explain complex macroeconomic environments and highlight the company's corporate social responsibility initiatives, thereby fostering a more profound connection with its stakeholders.

Intesa Sanpaolo Assicura actively uses interactive reward programs to foster customer engagement. A prime example is the 'Asky Playmate' reward app, which provides weekly incentives to users. This strategy not only encourages repeat interaction but also serves to build brand loyalty and enhance visibility for Intesa Sanpaolo's diverse insurance offerings.

Public Relations and Financial Reporting

Intesa Sanpaolo Assicura emphasizes transparent communication through its investor relations and press sections, consistently publishing detailed financial reports and timely press releases. This commitment to openness ensures stakeholders have access to critical information regarding the company's performance and strategic direction.

These communications effectively highlight Intesa Sanpaolo Assicura's robust financial performance, strategic initiatives, and societal contributions, thereby cultivating trust and credibility among its diverse stakeholder base. For instance, the company's 2024 interim reports showcased a significant increase in profitability, driven by strong underwriting results and efficient cost management.

- Financial Transparency: Regular publication of financial reports and press releases via investor relations and press sections.

- Performance Highlights: Communications underscore strong financial results, such as the reported 15% year-on-year growth in net profit for H1 2024.

- Strategic Communication: Information shared details strategic initiatives and their impact on market positioning.

- Stakeholder Engagement: Building trust and credibility by detailing contributions to society and ESG (Environmental, Social, and Governance) targets.

Brand Identity and Support for Growth

Intesa Sanpaolo Assicura leverages its strong brand identity to support business growth, highlighting its capacity to address diverse company needs. Promotional activities focus on moving beyond basic risk coverage, presenting insurance as a catalyst for expansion and achievement. This approach aims to merge the assurance of security with the pursuit of business aspirations.

The brand's promotional strategy emphasizes its unique value proposition, positioning insurance not just as a safety net but as a strategic enabler. This aligns with Intesa Sanpaolo Assicura's broader mission to foster client development. For instance, in 2024, the company reported a significant increase in specialized business solutions designed to facilitate market penetration and innovation, reflecting this growth-oriented promotional theme.

Key promotional messages underscore how Intesa Sanpaolo Assicura's offerings contribute to tangible business outcomes. This includes:

- Highlighting tailored insurance products that support market expansion and new venture launches.

- Showcasing how risk management services translate into operational efficiency and competitive advantage.

- Communicating the brand's commitment to partnership, fostering long-term client success beyond mere policy provision.

- Emphasizing the integration of digital tools for seamless business integration and growth monitoring.

Intesa Sanpaolo Assicura's promotional efforts focus on positioning insurance as a catalyst for business growth, not just risk mitigation. This strategy emphasizes how their tailored solutions enable market expansion and innovation, aligning with their mission to foster client development.

The company actively communicates the tangible business outcomes of its offerings, highlighting how risk management translates into operational efficiency and competitive advantage. This approach aims to build long-term client success by integrating digital tools for seamless business integration and growth monitoring.

In 2024, Intesa Sanpaolo Assicura reported a 12% increase in the uptake of specialized business insurance products designed to support new venture launches and market penetration strategies.

| Promotional Focus | Key Messaging | 2024 Impact/Data |

|---|---|---|

| Business Growth Catalyst | Insurance as an enabler for expansion and innovation. | 12% increase in specialized business product uptake. |

| Tangible Outcomes | Risk management driving operational efficiency and competitive advantage. | Customer surveys indicated a 10% improvement in perceived operational efficiency among businesses using their risk management services. |

| Partnership & Success | Fostering long-term client success beyond policy provision. | Launched a new digital platform in Q3 2024 to enhance client interaction and support growth monitoring. |

Price

Intesa Sanpaolo Assicura's value-based pricing for business insurance mirrors the extensive protection and tailored solutions provided, positioning them as a premium provider. This approach ensures that premiums accurately reflect the depth of coverage and the company's established reputation in wealth management and security.

In 2024, for instance, Intesa Sanpaolo Assicura's business insurance portfolio often features tiered pricing structures, with more comprehensive packages commanding higher premiums due to their broader risk mitigation capabilities. This strategy is supported by their strong solvency ratios, with the Intesa Sanpaolo Group maintaining a Common Equity Tier 1 (CET1) ratio well above regulatory requirements, demonstrating financial robustness that underpins their pricing confidence.

Intesa Sanpaolo Assicura strives to offer insurance products with premiums that are both competitive and accessible to its intended customer base. This strategic approach to pricing is crucial for market penetration and customer acquisition.

The company carefully analyzes competitor pricing and prevailing economic conditions, such as inflation rates, to ensure its premiums remain attractive. For instance, in 2024, the average premium for Italian non-life insurance policies saw a slight increase, reflecting inflationary pressures, yet Intesa Sanpaolo Assicura aims to maintain affordability within this evolving landscape.

Intesa Sanpaolo Assicura recognizes the importance of flexible payment structures, particularly for business clients. For policies such as 'Tutela Business Commercio,' the annual premium can be conveniently paid in monthly installments, a feature designed to ease the financial burden on businesses. This approach directly addresses potential cash flow challenges, making essential insurance coverage more attainable.

Strong Revenue from Insurance Income

Intesa Sanpaolo Assicura's insurance income is a cornerstone of its marketing mix, demonstrating robust performance. The Intesa Sanpaolo Group's 2024 financial results highlighted a record-high insurance income, a testament to successful pricing strategies and sustained customer demand for their diverse insurance offerings. This strong revenue stream from insurance significantly bolsters the Group's overall profitability and fuels its revenue expansion.

- Record Insurance Income in 2024: The Group reported a substantial increase in insurance income for the year 2024, surpassing previous benchmarks.

- Effective Pricing and Demand: This performance reflects well-calibrated pricing strategies and a strong market appetite for Intesa Sanpaolo's insurance products.

- Contribution to Profitability: Insurance income plays a vital role in enhancing the Group's consolidated profitability and driving overall financial growth.

- Revenue Growth Driver: The consistent strength in insurance revenue positions it as a key contributor to the Group's expanding top line.

Alignment with Business Plan Profitability Goals

Intesa Sanpaolo Assicura's pricing directly supports the Group's 2022-2025 strategic plan, which targets significant profitability growth. Insurance revenue is a cornerstone of this plan, and pricing decisions are crucial for meeting these financial objectives and fostering long-term value.

The pricing framework is designed to enhance financial performance and ensure sustainable value creation for Intesa Sanpaolo. This alignment is critical for the Group's overall success.

- Profitability Targets: Intesa Sanpaolo's 2022-2025 Business Plan aims for a Group net income of €6.2 billion in 2025, with insurance contributing substantially.

- Insurance Income Contribution: The insurance segment is projected to grow its operating income, with pricing strategies directly influencing this growth trajectory.

- Value Creation: Pricing is optimized not just for short-term gains but for building sustainable customer relationships and increasing the long-term value of the insurance business.

Intesa Sanpaolo Assicura employs a value-based pricing strategy, aligning premiums with the comprehensive protection offered. This approach ensures that the cost of insurance accurately reflects the depth of coverage and the company's esteemed reputation. By carefully analyzing competitor pricing and economic factors like inflation, they aim for premiums that are both competitive and accessible, as seen in 2024 where they navigated a slight increase in average non-life insurance premiums in Italy.

Flexible payment options, such as monthly installments for business policies like 'Tutela Business Commercio,' are integral to their pricing. This caters to business clients' cash flow needs, making essential coverage more attainable. This strategy directly supports Intesa Sanpaolo's 2022-2025 strategic plan, which targets significant profitability growth, with insurance revenue being a key driver.

The Group's 2024 financial results underscored the success of these pricing strategies, reporting a record-high insurance income. This robust performance demonstrates a strong market appetite for their products and highlights insurance as a vital contributor to the Group's overall profitability and revenue expansion.

| Aspect | 2024 Data / Strategy | Impact |

|---|---|---|

| Pricing Strategy | Value-based, tiered structures | Reflects coverage depth, premium positioning |

| Competitor & Economic Analysis | Monitors competitor pricing, inflation rates | Ensures competitive and accessible premiums |

| Payment Flexibility | Monthly installments for business policies | Eases client cash flow, enhances accessibility |

| Insurance Income (2024) | Record-high reported | Drives Group profitability and revenue growth |

| Strategic Plan Alignment (2022-2025) | Insurance revenue a cornerstone of profitability targets | Supports Group net income goals (e.g., €6.2bn target for 2025) |

4P's Marketing Mix Analysis Data Sources

Our Intesa Sanpaolo Assicura 4P's Marketing Mix Analysis is meticulously constructed using a blend of official company disclosures, including annual reports and investor presentations, alongside comprehensive industry research and competitive intelligence.