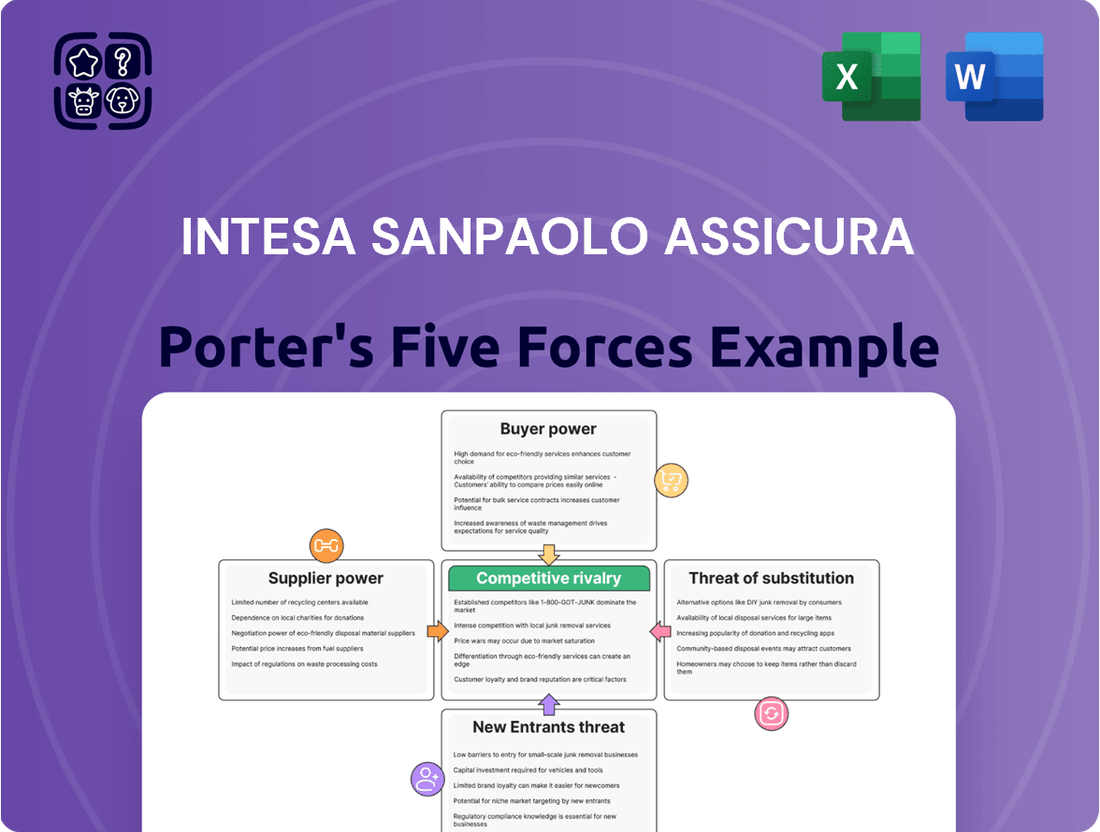

Intesa Sanpaolo Assicura Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intesa Sanpaolo Assicura Bundle

Intesa Sanpaolo Assicura faces moderate competitive rivalry, driven by a fragmented market and the presence of established players. The threat of new entrants is somewhat limited by regulatory hurdles and capital requirements, but the digital shift could lower barriers. Buyer power is considerable, as customers can readily compare insurance products and switch providers.

The complete report reveals the real forces shaping Intesa Sanpaolo Assicura’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of reinsurance providers for Intesa Sanpaolo Assicura can range from moderate to high. This is largely due to the specialized nature of reinsurance for complex risks, where the expertise of these providers is vital for Intesa Sanpaolo Assicura's risk diversification and capital management strategies. While Intesa Sanpaolo Assicura's substantial size likely affords it considerable negotiating leverage due to its premium volume, dependence on a limited number of key reinsurers can still empower those reinsurers to influence pricing and contract terms.

The global reinsurance market offers a degree of choice, but for specific or high-demand coverages, reinsurers can indeed dictate terms. For instance, in 2024, the property catastrophe reinsurance market experienced significant price increases following a series of costly natural disasters, demonstrating the suppliers' ability to exert upward pressure on costs when capacity is constrained.

The bargaining power of technology and IT service providers for Intesa Sanpaolo Assicura is on the rise. This is driven by the insurance industry's increasing dependence on sophisticated tools like advanced analytics, artificial intelligence (AI), and cloud computing for everything from streamlining operations to enhancing customer interactions and combating fraud. As of 2024, the global IT services market is projected to reach over $1.3 trillion, highlighting the significant scale and influence of these providers.

While the IT sector boasts numerous vendors, the specialized nature of insurance software and proprietary platforms can lead to vendor lock-in. This situation grants these suppliers greater leverage, as switching costs can be substantial for Intesa Sanpaolo Assicura. The company's need for robust digital systems to manage its widespread branch network and online services makes securing dependable and forward-thinking IT partners a critical necessity.

The continuous digital transformation occurring across the insurance landscape further amplifies the importance and potential power of these technology suppliers. In 2024, the insurtech market is experiencing robust growth, with investments in AI and data analytics within the insurance sector showing a significant upward trend, underscoring the critical role these providers play.

Actuarial and specialized consulting services wield considerable bargaining power within the insurance sector, including for entities like Intesa Sanpaolo Assicura. This strength stems from the deeply specialized knowledge and stringent regulatory landscape that define the industry. The demand for expertise in areas such as product design, risk evaluation, pricing strategies, and solvency assessments creates a limited pool of highly qualified professionals and firms, making them essential partners.

The reliance of Intesa Sanpaolo Assicura on these expert consultants for crucial strategic and operational guidance directly impacts their ability to negotiate terms. The bespoke nature of many consulting projects further diminishes the ease of finding direct substitutes, amplifying the suppliers' influence. For instance, in 2024, the global management consulting market was valued at approximately $300 billion, with specialized financial and actuarial consulting forming a significant and high-value segment, reflecting the premium placed on such expertise.

Claims Management and Adjusting Firms

The bargaining power of claims management and adjusting firms for Intesa Sanpaolo Assicura can be influenced by the nature of the claims handled. For routine, high-volume claims, a competitive market with numerous providers generally limits the suppliers' leverage. However, for complex or large-scale claims requiring specialized expertise, these firms can command greater power due to their indispensable skills.

Intesa Sanpaolo Assicura's reliance on external adjusting firms for specific needs, or dependence on regional networks and niche loss adjusters, can significantly amplify supplier bargaining power. The efficiency and quality of these outsourced services directly impact Intesa Sanpaolo Assicura's operational costs and customer satisfaction, making supplier relationships crucial.

- Market Concentration: In markets with fewer specialized claims adjusters, their bargaining power increases, especially for niche or complex claims.

- Switching Costs: High costs associated with changing claims management partners can lock Intesa Sanpaolo Assicura into existing supplier relationships, increasing supplier leverage.

- Supplier Differentiation: The unique expertise or technological capabilities of certain claims management firms can give them a stronger negotiating position.

- Importance of Claims Function: If claims processing is a critical differentiator for Intesa Sanpaolo Assicura, the bargaining power of its claims management suppliers may be higher.

Investment Management Services

For life insurance products like unit-linked policies, Intesa Sanpaolo Assicura depends on investment management. This service is often handled internally by the Intesa Sanpaolo Group or outsourced to external asset managers. The bargaining power of these suppliers can be considered moderate.

External investment managers gain some leverage through their brand reputation, past performance, and specialized knowledge in managing specific asset classes. For example, a manager with a strong track record in emerging market equities might command better terms.

However, as a significant institutional investor, Intesa Sanpaolo Assicura possesses substantial negotiating power regarding fees and contract conditions. The parent bank's robust financial infrastructure also enables strong in-house investment management capabilities, thereby lessening dependence on outside providers.

- Supplier Dependence: Moderate, varying based on internal vs. external management.

- External Manager Influence: Tied to brand, performance, and specialized expertise.

- Intesa Sanpaolo's Leverage: High due to scale and internal capabilities.

- Fee Negotiation: Intesa Sanpaolo Assicura typically negotiates favorable terms.

The bargaining power of suppliers for Intesa Sanpaolo Assicura is a key factor influencing its operational costs and profitability. This power varies significantly across different supplier categories, from reinsurance and IT services to actuarial consulting and investment management.

Reinsurance providers, especially for specialized risks, can exert considerable influence, particularly when market capacity is tight. For instance, the property catastrophe reinsurance market saw significant price hikes in 2024 due to increased claims from natural disasters. Similarly, specialized IT and actuarial consultants hold strong positions due to the critical, often proprietary, nature of their services and the high switching costs involved. The global IT services market exceeded $1.3 trillion in 2024, with insurtech investments in AI and data analytics also showing strong growth, underscoring the leverage these tech providers possess.

Investment managers' power is more moderate, balanced by Intesa Sanpaolo Assicura's substantial scale and internal capabilities, allowing for strong fee negotiations. Claims management firms' power depends on the complexity of claims and market concentration of specialized adjusters.

| Supplier Category | Key Factors Influencing Bargaining Power | Example Data/Trend (2024) |

| Reinsurance Providers | Specialization, market capacity, concentration | Property catastrophe reinsurance prices increased |

| IT & Technology Providers | Specialization, vendor lock-in, industry growth | Global IT services market > $1.3 trillion; strong insurtech growth |

| Actuarial & Consulting Services | Specialized knowledge, regulatory complexity, limited pool | Global management consulting market ~$300 billion (financial segment significant) |

| Claims Management Firms | Claim complexity, market concentration, switching costs | Power increases with claim complexity and niche provider reliance |

| Investment Managers | Reputation, performance, Intesa Sanpaolo's scale | Intesa Sanpaolo's scale allows for strong fee negotiation |

What is included in the product

This analysis unpacks the competitive landscape for Intesa Sanpaolo Assicura by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the insurance sector.

Gain immediate clarity on competitive pressures within the Italian insurance market, allowing Intesa Sanpaolo Assicura to proactively address threats and capitalize on opportunities.

Customers Bargaining Power

Customers in the insurance sector, particularly for everyday products like car insurance, often prioritize price. This makes them inclined to search for the most favorable deals available. For instance, in 2024, a significant portion of consumers actively used online comparison tools to evaluate different insurance policies, demonstrating a clear preference for cost-effectiveness.

The proliferation of digital platforms and comparison websites has significantly boosted this price sensitivity. These tools allow consumers to easily compare numerous insurance providers side-by-side, creating a transparent marketplace. This ease of comparison directly impacts Intesa Sanpaolo Assicura, compelling them to offer competitive pricing to secure and keep their customer base.

While factors like brand reputation contribute to customer retention, substantial price discrepancies can quickly undermine loyalty. The ability for customers to switch providers with minimal effort means that even established insurers must remain vigilant about their pricing strategies to avoid losing market share to more affordable competitors.

For many common insurance products, the effort and expense involved in moving from one provider to another are minimal. This low barrier to switching significantly amplifies the bargaining power of customers.

Customers can readily switch insurers, especially at policy renewal times, if they believe they can find better pricing or service. For instance, in the Italian insurance market, a significant portion of customers shop around annually for auto or home insurance, indicating a low propensity to remain with a provider solely due to inertia.

While Intesa Sanpaolo Assicura benefits from its bank distribution channel, which offers a point of contact, the inherent ease of switching means customers are not deeply entrenched. The administrative hassle for individuals to change their insurance provider is typically negligible, further empowering their decision-making.

Customers today have an abundance of information at their fingertips. Digital platforms, from price comparison sites to social media, allow them to easily research insurance products, compare prices, and read reviews of various insurers. This transparency means customers are more knowledgeable than ever, empowering them to seek out the best value.

For Intesa Sanpaolo Assicura, this heightened customer awareness is a key factor in their bargaining power. In 2024, the global digital insurance market was valued at over $20 billion, showcasing the significant shift towards online comparison and purchasing. This trend means Intesa Sanpaolo Assicura needs to ensure its offerings are not only competitive but also clearly differentiated to capture customer attention.

Heterogeneous Customer Needs

Intesa Sanpaolo Assicura faces varying customer bargaining power stemming from heterogeneous needs. While basic insurance needs are common, the complexity and volume of business for large corporate clients or high-net-worth individuals grant them greater negotiating leverage.

This means Intesa Sanpaolo Assicura must often tailor its products, which, while necessary, can also open the door for more direct price or service negotiations with these significant clients. For instance, in 2024, the insurance industry saw a trend where large group policies negotiated significant discounts, reflecting this power dynamic.

- Diverse Client Base: Intesa Sanpaolo Assicura serves both individual consumers and large corporations, each with distinct needs and purchasing power.

- Volume and Complexity Drive Power: Larger clients, by virtue of the volume of premiums or the complexity of their risk, can command more favorable terms.

- Customization as a Negotiation Point: The need to customize policies for specific client requirements can inadvertently strengthen the client's position in negotiations.

- Collective Power of Individuals: While individual smaller customers have less sway, their collective demand and potential for switching insurers can exert indirect pressure on pricing and service.

Strong Brand and Distribution Network of Parent Bank

While customers possess considerable influence, Intesa Sanpaolo Assicura leverages the robust brand recognition and expansive branch network of its parent, Intesa Sanpaolo bank. This integration acts as a buffer against some customer bargaining power. For instance, existing bank clients often find it both convenient and reassuring to procure insurance through their established banking relationship, diminishing their inclination to seek alternatives. This integrated distribution strategy fosters customer loyalty and provides a trusted touchpoint, potentially lessening the perceived effort involved in exploring other insurance providers.

The inherent convenience of this bundled offering can, for certain customer segments, outweigh minor price variations. In 2024, Intesa Sanpaolo Assicura reported a significant portion of its new business originating from existing banking customers, underscoring the effectiveness of this cross-selling strategy. This embedded distribution model creates a degree of customer stickiness, making it less likely for them to switch providers for minor cost savings.

- Brand Strength: Intesa Sanpaolo's established reputation for financial stability and customer service enhances trust in its insurance products.

- Distribution Reach: The extensive network of Intesa Sanpaolo branches across Italy provides a readily accessible and familiar channel for insurance sales.

- Customer Loyalty: Existing banking relationships create a natural inclination for customers to consider Intesa Sanpaolo Assicura, reducing the effort to compare prices.

- Convenience Factor: Bundling banking and insurance services simplifies financial management for customers, making it an attractive option.

Customers, especially for common insurance like auto or home policies, are highly price-sensitive and actively seek the best deals. In 2024, the widespread use of online comparison tools by consumers highlights this trend, making cost a primary driver for switching providers. This ease of comparison, facilitated by digital platforms, empowers individuals to exert significant bargaining power by demanding competitive pricing from Intesa Sanpaolo Assicura.

The ability for customers to switch insurers with minimal hassle, particularly at renewal periods, further amplifies their influence. While Intesa Sanpaolo Assicura benefits from its bank distribution channel, the low switching costs mean customers aren't deeply entrenched. This allows them to readily explore alternative, potentially cheaper, options, forcing Intesa Sanpaolo Assicura to maintain competitive pricing strategies.

For large corporate clients or high-net-worth individuals, bargaining power is even greater due to the volume and complexity of their insurance needs. These clients often negotiate tailored policies and significant discounts, a trend observed across the insurance industry in 2024. Intesa Sanpaolo Assicura must therefore adapt its offerings to meet the specific demands of these influential customer segments.

| Customer Segment | Bargaining Power Factors | Impact on Intesa Sanpaolo Assicura |

| Individual Consumers (e.g., Auto/Home Insurance) | Price sensitivity, ease of switching, access to comparison tools | Pressure for competitive pricing, need for clear value proposition |

| Large Corporate Clients | Volume of premiums, complexity of risk, need for customized solutions | Negotiation of favorable terms, potential for tailored product development |

| High-Net-Worth Individuals | Demand for specialized coverage, personalized service expectations | Requirement for bespoke product offerings, higher service standards |

Same Document Delivered

Intesa Sanpaolo Assicura Porter's Five Forces Analysis

This preview displays the comprehensive Intesa Sanpaolo Assicura Porter's Five Forces Analysis, presenting a detailed examination of competitive forces within the insurance sector. The document you are viewing is the exact, professionally formatted report you will receive immediately upon purchase, offering actionable insights into the industry's landscape. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, ready for your strategic planning needs.

Rivalry Among Competitors

The Italian insurance sector presents a dynamic competitive scene, featuring a blend of established domestic giants, global insurers, and bank-linked entities. This creates a high level of rivalry across the market.

Despite the numerous players, a handful of major groups like Generali, UnipolSai, and Poste Vita command substantial market shares, indicating a concentrated competitive structure at the higher echelons. Intesa Sanpaolo Assicura navigates this landscape, vying for business in both life and non-life insurance categories. In 2024, the Italian insurance market saw premium growth, with life insurance premiums reaching approximately €70 billion and non-life premiums around €35 billion, underscoring the scale of competition.

The competitive intensity is further amplified by the presence of both niche insurance providers and bancassurance models, which leverage banking distribution channels to offer insurance products, adding another layer of complexity to the rivalry.

Competitive rivalry within the insurance sector, particularly for Intesa Sanpaolo Assicura, is a dual-edged sword of price and innovation. In more standardized non-life insurance areas, price becomes a critical differentiator, compelling companies to maintain lean operations and cost efficiency. For instance, the Italian non-life insurance market saw a competitive pricing environment in 2023, with average premium growth for motor insurance remaining modest, around 2-3%, indicating pressure on insurers to offer attractive rates.

However, this rivalry isn't solely about cost. Insurers are constantly pushing the boundaries through product innovation. This includes crafting novel insurance policies, creating attractive product bundles, and developing cutting-edge digital platforms to enhance customer experience and stand out. Intesa Sanpaolo Assicura, with its inherent advantage of a strong banking network, can leverage this to offer integrated solutions, thereby creating unique value propositions that go beyond mere price competition.

The continuous drive to introduce new value propositions ensures that competitive pressure remains a constant factor. In 2024, the trend towards embedded insurance, where insurance is offered as part of another product or service, is expected to intensify this innovation-driven rivalry. Companies that successfully blend competitive pricing with distinct, digitally-enabled product offerings are best positioned to capture market share.

Competitive rivalry is fierce in optimizing distribution channels, with insurers employing a mix of traditional agents, bancassurance, direct online sales, and strategic partnerships. Intesa Sanpaolo Assicura benefits significantly from its established bancassurance network, a key differentiator.

However, the landscape demands continuous adaptation as competitors invest heavily in digital platforms and explore new partnership models. For instance, in 2024, the Italian insurance market saw continued growth in digital sales, with some direct insurers reporting over 30% of new business originating online. This compels Intesa Sanpaolo Assicura to further refine its multi-channel strategy to maintain its competitive edge and ensure effective customer reach and engagement across all touchpoints.

Regulatory Landscape and M&A Activity

The Italian insurance sector operates under a stringent regulatory framework overseen by IVASS (Istituto per la Vigilanza sulle Assicurazioni). This body dictates capital requirements, consumer protection measures, and market conduct, directly influencing how companies compete and manage their operations. For instance, IVASS's Solvency II directive requires insurers to hold sufficient capital to cover potential losses, a burden that can be particularly challenging for smaller, less capitalized entities.

Compliance with these regulations incurs significant costs, impacting profitability and potentially creating barriers to entry for new players. These costs are a constant factor in strategic planning for all insurers, including Intesa Sanpaolo Assicura, as they navigate the operational landscape.

Mergers and acquisitions have been a notable trend in the Italian insurance market, driven by a desire for increased market share and the pursuit of operational efficiencies. This consolidation reshapes the competitive environment, often resulting in fewer, but larger and more powerful, rivals for established players like Intesa Sanpaolo Assicura. For example, in 2023, the Italian insurance market saw several significant M&A discussions and smaller-scale acquisitions aimed at consolidating portfolios and expanding reach.

- Regulatory Oversight: IVASS mandates capital adequacy (Solvency II) and consumer protection rules, increasing compliance costs and influencing competitive dynamics.

- M&A Trends: Consolidation is prevalent as larger insurers acquire smaller ones to gain market share and achieve economies of scale.

- Impact on Competition: While M&A can reduce the number of competitors, it often leads to the emergence of larger, more formidable rivals that intensify rivalry.

Brand Reputation and Customer Trust

In the insurance industry, a strong brand reputation and deep customer trust are fundamental competitive advantages. Intesa Sanpaolo Assicura leverages the established credibility of its parent, the Intesa Sanpaolo Group, a major banking institution. This affiliation provides a significant advantage in building customer confidence and fostering loyalty.

Competitors actively work to cultivate trust through consistent delivery of quality service, transparent policies, and efficient claims processing. For instance, in 2024, customer satisfaction scores for leading insurers often exceeded 80%, highlighting the importance of these factors.

- Brand Equity: Intesa Sanpaolo Assicura benefits from the substantial brand equity of the Intesa Sanpaolo Group, which translates to immediate customer recognition and trust.

- Customer Trust: Building and maintaining customer trust is a continuous effort, driven by reliable service, transparency, and effective claims management.

- Competitive Differentiation: A trusted parent brand serves as a critical differentiator in the insurance market, where long-term relationships are highly valued.

- Market Perception: In 2024, surveys indicated that over 70% of insurance consumers considered brand reputation a key factor in their purchasing decisions.

Competitive rivalry is intense in the Italian insurance market, with Intesa Sanpaolo Assicura facing competition from large domestic groups, global players, and bank-linked insurers. This dynamic environment necessitates a dual focus on competitive pricing, especially in non-life segments where average motor insurance premium growth hovered around 2-3% in 2023, and continuous product innovation. The push for embedded insurance in 2024 further fuels this innovation-driven competition, rewarding companies that blend cost-effectiveness with digital-first offerings.

The market is characterized by a strong emphasis on brand reputation and customer trust, areas where Intesa Sanpaolo Assicura leverages its parent group's established credibility. In 2024, over 70% of consumers considered brand reputation crucial for purchase decisions, reinforcing the importance of reliable service and transparent dealings. This competitive landscape is also shaped by regulatory oversight from IVASS and ongoing consolidation through mergers and acquisitions, which create larger, more formidable rivals.

| Key Competitive Factors | Description | Intesa Sanpaolo Assicura's Position | 2023/2024 Data Point |

| Price Competition | Crucial in standardized products; requires operational efficiency. | Leverages bancassurance for integrated value propositions. | Motor insurance premium growth ~2-3% (2023). |

| Product Innovation | Developing new policies, bundles, and digital platforms. | Utilizes banking network for unique, integrated solutions. | Trend towards embedded insurance intensifying (2024). |

| Brand & Trust | Essential for customer loyalty and acquisition. | Benefits from strong parent brand credibility. | >70% of consumers cite brand as key factor (2024). |

| Distribution Channels | Mix of agents, bancassurance, direct sales, partnerships. | Strong bancassurance network is a key differentiator. | Digital sales >30% of new business for some direct insurers (2024). |

SSubstitutes Threaten

For larger businesses, self-insurance or establishing captive insurers presents a significant threat of substitution to traditional commercial insurance. These arrangements allow companies to manage their own risks, potentially cutting costs and gaining greater control over the claims process. For instance, in 2023, the global captive insurance market was valued at approximately $100 billion, indicating a substantial segment of businesses already utilizing these alternatives.

This trend is particularly relevant for Intesa Sanpaolo Assicura's corporate clients. As of early 2024, the increasing complexity of risk management and the desire for greater financial flexibility are driving more enterprises to consider retaining risk internally. The economic feasibility of self-insurance hinges on a company's size, the diversity of its risks, and its available capital reserves.

Government social security and welfare programs represent a significant threat of substitutes for private insurance. In Italy, for instance, the state provides comprehensive healthcare services, unemployment benefits, and pension schemes that can fulfill basic needs, thereby reducing the demand for comparable private insurance products like health, income protection, and certain life insurance policies. For example, the Italian public healthcare system, Servizio Sanitario Nazionale (SSN), offers universal coverage, meaning many citizens may see less need for private health insurance for essential medical care.

This public provision directly competes with private insurers, particularly for individuals seeking foundational coverage rather than enhanced benefits or specialized plans. While private insurance can offer greater flexibility, higher coverage limits, and faster access to services, the availability of state-provided alternatives means consumers may choose to rely solely on these public safety nets, limiting the market penetration of private offerings in these segments. The perceived adequacy of public support can therefore dampen the perceived value of private insurance for basic security needs.

The rise of preventative measures and robust risk management services presents a significant threat of substitutes for traditional non-life insurance products. For example, advancements in smart home technology, such as sophisticated alarm systems and surveillance, can directly reduce the likelihood of property damage or theft, potentially lessening the demand for homeowner's insurance. Similarly, the integration of advanced driver-assistance systems (ADAS) in vehicles, a trend that gained considerable traction in 2024, aims to prevent accidents, thereby impacting the market for auto insurance.

Insurers like Intesa Sanpaolo Assicura are actively responding to this trend by expanding their service offerings to include risk mitigation advice and solutions. This strategic shift, which saw the insurance sector increasingly focus on customer-centric risk management in 2024, blurs the traditional boundaries between insurance as a product and insurance as a service. While this can enhance customer loyalty, it also acknowledges the underlying threat that these proactive measures pose to the volume of claims-driven insurance business.

Alternative Risk Transfer (ART) Mechanisms

Beyond traditional insurance, alternative risk transfer (ART) mechanisms like catastrophe bonds and insurance-linked securities are increasingly serving as substitutes for managing large-scale or specialized risks, particularly for institutional clients. These financial instruments reroute risk to capital markets, bypassing traditional reinsurers. For example, the catastrophe bond market saw significant issuance in 2024, with total market capacity estimated to be around $40 billion by mid-year, demonstrating a growing appetite for these non-traditional risk financing solutions.

While Intesa Sanpaolo Assicura primarily targets retail and small-to-medium enterprise (SME) clients, the broader insurance industry's embrace of ART reflects a significant shift. This trend could eventually influence product development or create competitive pressure, even for insurers with different client focuses. These ART mechanisms offer diverse structures for risk financing, providing capital markets access for risk mitigation.

The growing acceptance and innovation in ART signify a broader market evolution. Key ART mechanisms include:

- Catastrophe Bonds: Securities that transfer specific risks, like natural disasters, to investors.

- Insurance-Linked Securities (ILS): A broader category encompassing cat bonds and other instruments tied to insurance risks.

- Derivatives: Financial contracts whose value is derived from underlying insurance or catastrophe events.

Financial Planning and Savings Products

For life insurance products that also serve as savings or investment vehicles, a significant threat comes from a wide array of alternative financial planning and pure savings options. These are readily available from banks, independent asset managers, and increasingly, from fintech platforms.

Customers aiming to grow their wealth or plan for retirement have numerous choices beyond traditional life insurance policies with investment components. They might prefer direct investments in mutual funds, individual stocks, or even simple, secure bank deposits, especially if market returns are strong and their risk tolerance is lower.

While Intesa Sanpaolo Assicura, as part of a larger banking group, can capitalize on internal cross-selling, it still contends with these direct competitors offering financial products. The attractiveness of these substitutes is heavily influenced by prevailing market conditions and the individual customer’s willingness to accept risk.

- Alternative Savings Vehicles: In 2024, the global fintech market for savings and investment apps is projected to reach over $2 billion, highlighting the growing accessibility of digital alternatives.

- Bank Deposits vs. Investment Products: As of early 2024, average interest rates on savings accounts in many developed markets hovered around 3-4%, making them a competitive, low-risk alternative to some investment-linked insurance products, especially during periods of market volatility.

- Direct Investment Appeal: The rise of commission-free trading platforms in 2023 and 2024 has lowered the barrier to entry for direct stock and ETF investing, directly competing with the investment component of life insurance.

- Customer Risk Appetite: During economic uncertainty, such as that experienced in late 2023 and continuing into 2024, there's a noticeable shift in customer preference towards capital preservation, boosting the appeal of bank deposits and government bonds over market-linked insurance products.

The threat of substitutes for Intesa Sanpaolo Assicura is multifaceted, impacting both life and non-life insurance segments. For life insurance, alternative savings and investment vehicles offered by banks and fintech platforms directly compete, especially as commission-free trading platforms made direct investing more accessible in 2023-2024.

In non-life insurance, preventative measures like advanced driver-assistance systems in vehicles, which saw significant traction in 2024, reduce accident likelihood, thereby impacting auto insurance demand. Similarly, alternative risk transfer mechanisms like catastrophe bonds, with an estimated market capacity of $40 billion by mid-2024, offer substitutes for managing large-scale risks.

Government social security programs, such as Italy's universal healthcare system, also act as substitutes by fulfilling basic needs, potentially lowering demand for comparable private insurance products.

| Substitute Category | Example | Market Trend/Data (2023-2024) | Impact on Intesa Sanpaolo Assicura | Key Driver |

| Alternative Savings & Investment | Fintech Investment Apps | Global fintech savings market projected over $2 billion (2024) | Competition for life insurance with investment components | Accessibility, diversification |

| Risk Mitigation Technology | Advanced Driver-Assistance Systems (ADAS) | Increased adoption in new vehicles (2024) | Reduced demand for auto insurance claims | Safety enhancement, accident prevention |

| Alternative Risk Transfer (ART) | Catastrophe Bonds | Market capacity ~ $40 billion (mid-2024) | Potential competition for reinsurance/large risk coverage | Capital markets access for risk financing |

| Government Social Programs | Public Healthcare (Italy) | Universal coverage by Servizio Sanitario Nazionale (SSN) | Reduced demand for private health insurance | Basic needs fulfillment, cost savings |

Entrants Threaten

The insurance sector's inherent capital intensity presents a formidable barrier to entry. New companies must possess substantial financial reserves to satisfy stringent solvency regulations, manage the risk of unforeseen claims, and build out essential operational capabilities. For instance, in 2024, the European Insurance and Occupational Pensions Authority (EIOPA) continued to emphasize robust capital adequacy, with Solvency II directives requiring insurers to hold sufficient capital to cover their risks. This high upfront investment requirement significantly deters potential new entrants, as they need considerable capital before they can even begin generating revenue.

The insurance industry faces significant barriers to entry due to stringent regulatory frameworks. In Italy, entities like Intesa Sanpaolo Assicura must adhere to directives from the Istituto per la Vigilanza sulle Assicurazioni Private e di Interesse Collettivo (IVASS), which mandates rigorous licensing, capital requirements, and consumer protection measures.

These compliance obligations translate into substantial upfront costs and ongoing administrative burdens for new players. For instance, establishing the necessary legal and compliance infrastructure can cost hundreds of thousands of euros, a significant deterrent for smaller or less capitalized entrants. Intesa Sanpaolo Assicura benefits from its existing robust compliance departments, which are already integrated into its operations, creating a distinct advantage.

New insurance companies face a major hurdle in establishing robust distribution channels. Building a credible network of agents, brokers, or effective digital platforms requires substantial time and significant financial investment to reach a broad customer base.

Intesa Sanpaolo Assicura leverages a distinct advantage through its parent company, Intesa Sanpaolo, which boasts an extensive and trusted branch network. This pre-existing infrastructure provides immediate access to millions of customers, a critical asset in the insurance market.

For new entrants, replicating this level of market penetration and cultivating the necessary customer trust from the ground up presents a formidable barrier. Customer loyalty in insurance is often built over many years, making it difficult for newcomers to quickly gain significant market share against established players with deep-rooted relationships.

Brand Recognition and Customer Loyalty

Brand recognition and customer trust are critical in the insurance sector. Intesa Sanpaolo Assicura benefits from the strong reputation of the Intesa Sanpaolo Group, a significant advantage in attracting and retaining clients who prioritize financial security. Newcomers must invest heavily in marketing and time to build awareness and trust in a competitive landscape.

New entrants face the substantial hurdle of overcoming established customer loyalty and ingrained purchasing habits. For instance, in 2024, the Italian insurance market, where Intesa Sanpaolo Assicura operates, saw continued dominance by established brands, with customer retention rates remaining high for those with a long-standing presence and perceived reliability.

- Customer Trust: Insurance purchases are based on long-term commitments and perceived financial security, making trust a key differentiator.

- Brand Equity: Intesa Sanpaolo Assicura leverages the established brand name and reputation of the wider Intesa Sanpaolo Group.

- Marketing Investment: New entrants require significant capital outlay for marketing to build brand awareness and compete with incumbents.

- Customer Inertia: Overcoming existing customer relationships and preferences represents a major barrier for new companies entering the market.

Emergence of Insurtech and Niche Players

The insurance landscape is evolving with the emergence of Insurtech and specialized players, presenting a nuanced threat to established firms like Intesa Sanpaolo Assicura. While high capital requirements and regulatory hurdles traditionally deter new entrants, Insurtechs are leveraging advanced technologies such as artificial intelligence, big data analytics, and blockchain to streamline operations and create innovative products. This technological adoption can effectively lower certain entry barriers, particularly within specific market niches or for novel insurance offerings. For instance, by 2024, the global Insurtech market was projected to reach hundreds of billions of dollars, demonstrating significant growth and investment.

These agile newcomers often target underserved or niche segments, offering highly customized insurance solutions that cater to specific customer needs or risk profiles. Their ability to innovate rapidly and personalize offerings can disrupt established value chains. While they may not immediately possess the scale to challenge a major insurer like Intesa Sanpaolo Assicura across its entire portfolio, their focused approach and technological prowess can lead to market share erosion in particular areas. For example, specialized Insurtechs focusing on cyber insurance or parametric insurance have seen substantial growth in recent years.

- Insurtech Growth: The global Insurtech market saw significant investment in 2023, with funding rounds reaching billions of dollars, indicating strong investor confidence in technological disruption within the insurance sector.

- Niche Market Focus: Companies like Lemonade, which uses AI for claims processing and customer service, demonstrate the potential for Insurtechs to gain traction by focusing on specific customer segments and offering a streamlined digital experience.

- Technological Advantage: The use of AI and big data by Insurtechs allows for more accurate risk assessment and personalized pricing, which can be a competitive advantage against traditional insurers.

- Partnership Opportunities: Rather than direct competition, many Insurtechs seek partnerships with established insurers, offering their technology and expertise to enhance existing services or develop new products, which can mitigate some of the threat.

The threat of new entrants for Intesa Sanpaolo Assicura is significantly mitigated by high capital requirements and stringent regulatory oversight, demanding substantial financial reserves and compliance infrastructure. Established distribution networks and strong brand loyalty, bolstered by the parent company's reputation, create formidable barriers for newcomers seeking to gain market share. While Insurtechs present a more agile challenge through technological innovation and niche market focus, their impact is often mitigated by partnerships rather than direct market displacement.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Intesa Sanpaolo Assicura is built upon a foundation of robust data, including the company's official annual reports, filings with regulatory bodies like IVASS, and industry-specific market research from firms such as S&P Global Market Intelligence and Statista.