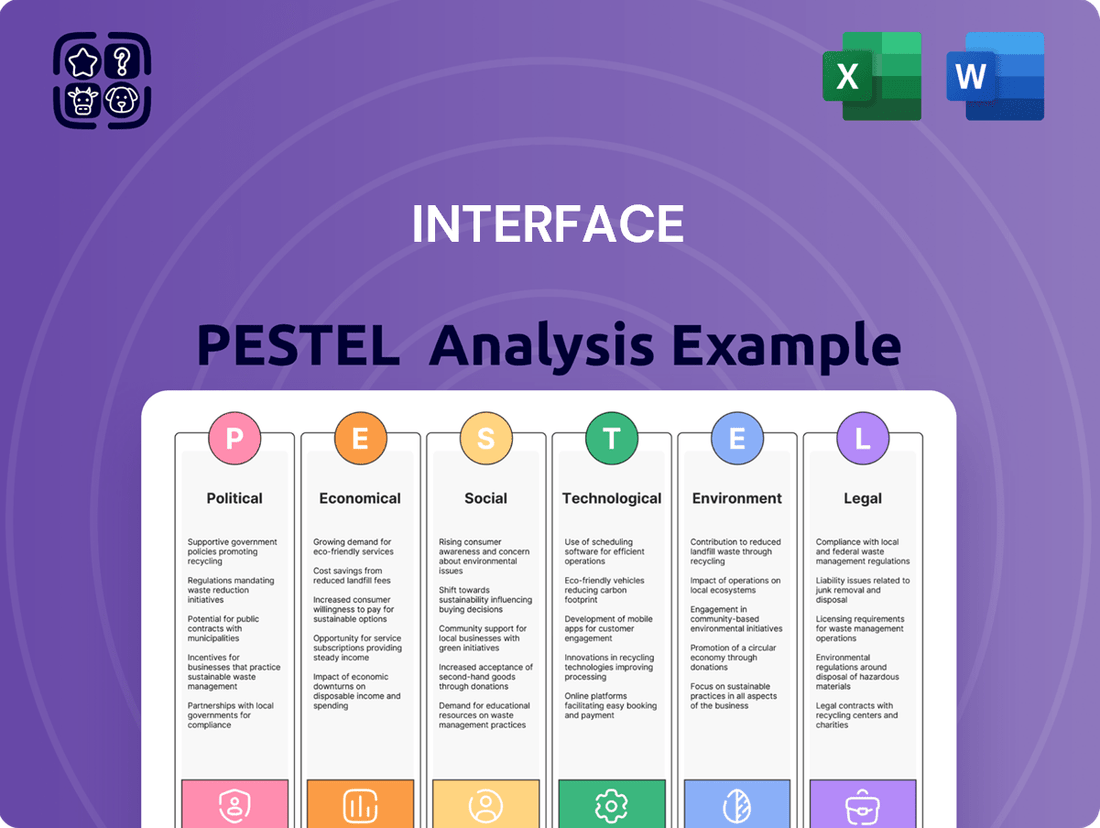

Interface PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Interface Bundle

Interface operates within a dynamic global landscape, constantly influenced by evolving political, economic, social, technological, environmental, and legal factors. Understanding these external forces is crucial for anticipating challenges and capitalizing on opportunities. Our comprehensive PESTLE analysis delves deep into these influences, providing you with the strategic foresight needed to navigate Interface's future. Unlock actionable intelligence and gain a competitive edge by downloading the full report today.

Political factors

Government policies are increasingly pushing for greener construction. For instance, by 2024, many regions have introduced or strengthened building codes requiring higher percentages of recycled content and lower embodied carbon in new commercial projects. This trend directly benefits Interface, Inc., whose commitment to materials like recycled nylon and carbon-neutral manufacturing positions them favorably.

These evolving environmental standards, such as LEED and BREEAM certifications, are becoming critical for market access, especially in institutional and large commercial sectors. Interface's proactive approach to sustainability, including its 2024 goal of sourcing 100% recycled or bio-based materials, helps it meet these stringent requirements, fostering growth and a competitive edge.

Interface, Inc. operates in a global market where international trade policies and tariffs significantly influence its operations. For instance, the imposition of tariffs on imported raw materials, such as specialty yarns and chemicals used in carpet manufacturing, directly increases Interface's cost of goods sold. In 2024, ongoing trade disputes between major economic blocs could lead to unpredictable shifts in these tariffs, impacting Interface's sourcing strategies and overall profitability.

Changes in trade agreements, such as the potential renegotiation of existing free trade pacts or the introduction of new ones, can alter market access for Interface's products. A more protectionist trade environment might lead to increased duties on finished goods exported to certain countries, making them less competitive. Conversely, favorable trade agreements can reduce barriers and open up new market opportunities for Interface's sustainable flooring solutions.

Geopolitical tensions also play a crucial role. For example, disruptions to shipping routes or political instability in key manufacturing regions can impact Interface's supply chain reliability and increase logistics costs. The company's ability to adapt to these evolving international trade dynamics is critical for maintaining its competitive edge and ensuring consistent product availability for its global customer base.

Governments worldwide are increasingly providing financial incentives to promote sustainable building practices. For instance, in 2024, the U.S. Inflation Reduction Act continues to offer significant tax credits for energy-efficient building envelopes and renewable energy installations, directly benefiting green construction projects. Interface's low-carbon flooring products, such as those made with recycled content and bio-based materials, align perfectly with these initiatives, making them more attractive to developers seeking to leverage these economic advantages.

Political Stability in Key Global Markets

Interface, Inc.'s operational continuity and market demand are significantly shaped by the political stability of the countries where it operates and sources materials. For instance, geopolitical tensions in regions crucial for raw material sourcing could lead to supply chain disruptions. In 2024, ongoing political shifts in several emerging markets, where Interface has a growing presence, present both opportunities and risks, potentially impacting demand for its flooring solutions.

Economic uncertainty and currency fluctuations stemming from political instability can directly affect Interface's sales and profitability. A prime example is the impact of unexpected policy changes in a major European market in late 2024, which led to a temporary slowdown in commercial construction, a key sector for Interface. The company's strategy to diversify manufacturing and sales operations across different geographies helps to mitigate some of these risks, ensuring resilience against localized political disturbances.

- Geopolitical Risk: Interface sources materials globally, making it susceptible to disruptions from political instability in supplier countries.

- Market Demand Impact: Political uncertainty can dampen economic activity, reducing demand for commercial building products like Interface's flooring.

- Currency Volatility: Unstable political environments often correlate with fluctuating exchange rates, impacting Interface's international revenue and costs.

- Regulatory Changes: Shifts in government policy can affect trade, environmental standards, and business operations for Interface.

Public Procurement Policies

Government procurement increasingly favors suppliers with strong environmental and social governance (ESG) credentials. For Interface, Inc., this trend presents a significant opportunity. As of early 2025, many public sector tenders, particularly for large infrastructure projects like educational institutions and healthcare facilities, explicitly incorporate sustainability metrics. Interface's established commitment to recycled content and carbon neutrality, evidenced by its numerous certifications, positions it favorably to win these contracts.

Public procurement policies are evolving to mandate ethical sourcing and fair labor practices. Interface's proactive approach to supply chain transparency and its adherence to international labor standards, which have been consistently audited and verified, directly align with these evolving requirements. This focus on responsible business conduct can provide a distinct competitive advantage when bidding for government projects, potentially leading to increased market share in the public sector.

- ESG Focus: Government tenders in 2024-2025 increasingly weigh sustainability performance.

- Competitive Edge: Interface's certifications in recycled content and carbon neutrality are key differentiators.

- Ethical Sourcing: Adherence to fair labor and transparent supply chains is a growing requirement for public contracts.

Government policies are increasingly pushing for greener construction, with many regions strengthening building codes by 2024 to require higher recycled content and lower embodied carbon. This directly benefits Interface, Inc., whose commitment to recycled nylon and carbon-neutral manufacturing aligns well with these evolving environmental standards, such as LEED and BREEAM certifications, which are critical for market access in institutional and large commercial sectors.

Interface operates in a global market where international trade policies and tariffs significantly influence its operations. For instance, tariffs on imported raw materials increase Interface's cost of goods sold, and ongoing trade disputes in 2024 could lead to unpredictable shifts impacting sourcing strategies and profitability.

Government procurement increasingly favors suppliers with strong ESG credentials. By early 2025, many public sector tenders explicitly incorporate sustainability metrics, positioning Interface's commitment to recycled content and carbon neutrality favorably for winning these contracts.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting Interface, dissecting them through Political, Economic, Social, Technological, Environmental, and Legal lenses.

It provides actionable insights for strategic decision-making, highlighting potential threats and opportunities within Interface's operating landscape.

Provides a structured framework to identify and analyze external factors, alleviating the pain of strategic uncertainty by offering clarity on market dynamics and potential disruptions.

Economic factors

Interface, Inc.'s performance is closely tied to the global economic climate, particularly the health of the commercial and institutional construction sectors. In 2024, while global GDP growth is projected to be around 2.7% according to the IMF, the construction industry faces mixed signals. A slowdown in commercial real estate development directly dampens demand for Interface's flooring solutions.

Economic downturns, such as those experienced in some regions during late 2023 and early 2024, often translate into reduced corporate spending on office renovations and new fit-outs. This directly impacts Interface's order book. For instance, a contraction in commercial construction starts in key markets can lead to a proportional decrease in sales for flooring manufacturers.

Conversely, periods of economic expansion generally fuel increased construction activity. As businesses grow and invest, demand for new office spaces and renovations rises, creating a more favorable environment for Interface. A strong global economic outlook for 2025, potentially seeing growth rebound, would likely translate into higher sales volumes for the company.

Interface's profitability is directly tied to the cost of its raw materials, which include petroleum-based components for carpet backing, recycled content, and various inputs for LVT and rubber flooring. For instance, fluctuations in the price of polypropylene, a key component derived from petroleum, can significantly impact production expenses. In late 2023 and early 2024, global oil prices experienced volatility, with Brent crude averaging around $80-85 per barrel, directly affecting the cost of these essential materials.

This volatility, driven by factors like ongoing supply chain challenges and geopolitical tensions, can force Interface to adjust its pricing strategies or absorb higher costs, thereby squeezing profit margins. For example, a sudden spike in the cost of recycled PET, a material Interface increasingly utilizes, could necessitate a review of its pricing structure for sustainable flooring options.

To counter these risks, Interface employs strategic sourcing and enters into long-term contracts for key raw materials. This approach aims to secure stable pricing and supply, providing a degree of predictability amidst the often-unpredictable commodity markets, a strategy crucial for maintaining consistent profitability in the 2024-2025 fiscal year.

Interest rate fluctuations directly impact the cost of borrowing for commercial developers and businesses involved in construction or renovation. For instance, if the Federal Reserve maintains its target interest rate in the 5.25%-5.50% range through 2024 and into early 2025, as anticipated by many analysts, this could lead to higher financing costs for Interface's clients.

Consequently, elevated interest rates can discourage new commercial building investments and large-scale renovations, potentially softening demand for Interface's flooring solutions. Affordable access to capital remains a critical factor, not only for Interface's clients undertaking projects but also for the company itself when considering operational investments or expansion.

Inflationary Pressures

Inflationary pressures can significantly affect Interface, Inc. by increasing its operational expenses, such as labor, energy, and logistics, as well as the cost of raw materials used in manufacturing. For instance, the Producer Price Index (PPI) for manufactured goods saw a notable increase in 2024, directly impacting input costs for companies like Interface.

While Interface might adjust its pricing to offset these rising costs, persistent high inflation could lead to reduced profit margins or diminish the competitiveness of its product offerings. The company's ability to manage costs effectively and implement strategic pricing adjustments is crucial for navigating an inflationary economic climate.

- Increased Input Costs: Rising costs for raw materials, energy, and transportation directly impact Interface's cost of goods sold.

- Pricing Power Challenges: Sustained inflation can strain Interface's ability to pass on all cost increases to customers without affecting demand.

- Margin Erosion Risk: If cost increases outpace price adjustments, Interface's profit margins could be negatively impacted.

Currency Exchange Rate Volatility

Currency exchange rate volatility directly impacts Interface, Inc.'s global financial results. When Interface converts revenue earned in foreign currencies, like Euros or British Pounds, back into U.S. Dollars for its financial reporting, unfavorable exchange rate movements can reduce the reported value of those earnings. For instance, if the U.S. Dollar strengthens significantly against other currencies in 2024 or 2025, Interface's international sales would translate into fewer dollars, potentially hurting its top-line growth and profitability. This exposure can also affect the price competitiveness of Interface's flooring solutions in overseas markets, as a stronger dollar makes its products more expensive for foreign buyers.

Interface actively manages this risk through various hedging strategies. These can include forward contracts or options to lock in exchange rates for future transactions. For example, if Interface anticipates significant sales in Europe in the coming months, it might enter into a forward contract to sell Euros at a predetermined rate, thereby protecting itself from a potential decline in the Euro's value against the dollar. Such financial instruments are crucial for stabilizing earnings and providing greater predictability in a global business environment. The effectiveness of these strategies will be a key factor in Interface's financial performance through 2025.

Interface's financial statements often include disclosures regarding its foreign currency exposure and hedging activities. For the fiscal year ending December 31, 2023, Interface reported that a hypothetical 10% adverse movement in foreign currency exchange rates could have impacted its pre-tax earnings by a certain amount, illustrating the tangible financial implications. Investors and analysts closely monitor these disclosures to assess the company's sensitivity to currency fluctuations and the efficacy of its risk mitigation efforts as it navigates the global economic landscape through 2024 and into 2025.

Interface's revenue is directly influenced by global economic growth, particularly in the commercial construction sector. Projections for 2024 indicated a global GDP growth of around 2.7%, but the construction industry faced varied conditions, with a slowdown in commercial real estate development impacting demand for flooring solutions.

Economic downturns can lead to reduced corporate spending on renovations, directly affecting Interface's order volumes. Conversely, economic expansion typically boosts construction activity and demand for flooring. A stronger global economic outlook for 2025 is expected to benefit Interface's sales volumes.

Fluctuations in raw material costs, such as polypropylene and recycled PET, significantly impact Interface's production expenses. For example, volatile oil prices in late 2023 and early 2024, with Brent crude averaging $80-85 per barrel, directly affected these material costs.

Interest rates also play a crucial role, influencing the cost of borrowing for Interface's clients. If interest rates remain elevated through 2024-2025, as anticipated, this could deter new construction and renovation projects, thereby softening demand for Interface's products.

| Economic Factor | Impact on Interface | 2024/2025 Data/Projections |

|---|---|---|

| Global GDP Growth | Drives demand in construction | Projected ~2.7% in 2024; potential rebound in 2025 |

| Raw Material Costs (e.g., Polypropylene) | Affects cost of goods sold | Volatile oil prices ($80-85/barrel for Brent in late 2023/early 2024) |

| Interest Rates | Impacts client investment in construction | Federal Funds Rate target 5.25%-5.50% anticipated through 2024/early 2025 |

Preview Before You Purchase

Interface PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Interface PESTLE Analysis breaks down the external factors impacting your business, providing actionable insights for strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment. You can confidently assess the Political, Economic, Social, Technological, Legal, and Environmental influences relevant to your interface strategy.

What you’re previewing here is the actual file—fully formatted and professionally structured. This Interface PESTLE Analysis is designed to be a valuable tool, offering a clear and organized framework for understanding your operating environment.

Sociological factors

Societal awareness regarding the importance of healthy indoor environments is surging, especially within commercial, healthcare, and educational facilities. This growing demand directly benefits companies like Interface, Inc. that prioritize occupant well-being.

Interface's product lines, such as nora® rubber flooring, are specifically designed with low VOC emissions and inherent hygienic qualities, catering to this trend. Their modular carpet tiles also contribute to improved indoor air quality, aligning with occupant health and green building certifications.

Societal expectations are shifting, placing a premium on Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) performance. This trend directly impacts corporate purchasing decisions, with businesses actively seeking suppliers who mirror their own sustainability commitments. For instance, a 2024 survey by Accenture found that 70% of consumers consider sustainability when making purchasing decisions, a sentiment increasingly echoed in B2B relationships.

Interface, Inc. is well-positioned due to its deep-rooted dedication to environmental stewardship and circular economy models. This proactive approach, exemplified by their 2023 achievement of carbon neutrality across their global operations, resonates strongly with clients prioritizing sustainable supply chains. Companies like Interface are not just meeting a demand; they are setting a standard for responsible business practices.

The modern workplace is undergoing a significant transformation, with a growing emphasis on hybrid work models and flexible office layouts. This shift directly influences the demand for adaptable flooring solutions that can easily be reconfigured to support diverse work styles and collaborative zones. Interface, Inc.'s modular carpet tiles and luxury vinyl tile (LVT) are well-positioned to meet these evolving needs, offering businesses the versatility to create dynamic and aesthetically pleasing environments.

Furthermore, the increasing adoption of biophilic design principles, which aim to connect occupants with nature, is driving a preference for flooring materials that mimic natural elements and prioritize sustainability. Interface's commitment to using recycled content and developing products with a low environmental impact aligns perfectly with this trend, making their offerings attractive to companies focused on employee well-being and corporate social responsibility.

Growing Consumer Awareness of Eco-Friendly Products

While Interface's direct customers are businesses, a significant societal trend is the growing consumer demand for eco-friendly products. This broader environmental consciousness trickles down, influencing commercial clients who are increasingly motivated by their own customers' and employees' expectations for sustainable operations and materials.

This heightened awareness means that businesses are more likely to specify sustainable building materials, directly benefiting Interface. For instance, a study in early 2024 indicated that over 60% of consumers consider a brand's environmental impact when making purchasing decisions, a figure that continues to climb.

- Increased Demand for Sustainable Building Materials: Businesses are responding to consumer pressure to adopt greener practices.

- Interface's Sustainability Reputation: The company's established commitment to eco-friendly products aligns well with this societal shift.

- Influence on Commercial Purchasing: End-user expectations are driving corporate procurement of sustainable goods.

- Market Advantage: Interface's existing brand equity in sustainability provides a competitive edge.

Demographic Changes and Urbanization

Demographic shifts are significantly reshaping the demand for commercial and institutional spaces. An aging population, for instance, is driving growth in healthcare facilities and senior living communities. In 2024, the global population aged 65 and over was projected to reach over 800 million, a trend that directly impacts the need for specialized flooring solutions in these environments. Changing family structures and increased urbanization also play a crucial role, with a growing preference for mixed-use developments that blend residential, retail, and office spaces.

Interface, as a global flooring manufacturer, must strategically adapt its product portfolio and marketing efforts to align with these evolving demographic and urbanizing trends. This means developing products that meet the specific requirements of sectors experiencing rapid expansion, such as healthcare and education. For example, the company’s focus on sustainable and durable flooring is particularly relevant for high-traffic educational institutions and healthcare settings where hygiene and longevity are paramount.

- Aging Population: Global population aged 65+ projected to exceed 800 million in 2024, increasing demand for healthcare and senior living spaces.

- Urbanization Trends: Continued migration to cities fuels demand for mixed-use developments, requiring versatile and aesthetically pleasing flooring.

- Evolving Space Needs: Shifts in demographics necessitate adaptable product offerings for sectors like healthcare, education, and collaborative workspaces.

- Sustainability Demand: Growing awareness among institutions and consumers for eco-friendly building materials, impacting product development and sourcing.

Societal expectations are increasingly prioritizing health and well-being, driving demand for indoor environments that support these values. This trend directly impacts flooring choices in commercial spaces, with a focus on materials that contribute to better indoor air quality and occupant comfort.

Interface's commitment to sustainability and its product innovations, such as low-VOC emitting nora® rubber flooring, align perfectly with this societal shift. The company's emphasis on circular economy principles and carbon neutrality further resonates with businesses and consumers alike, who are actively seeking environmentally responsible partners.

The growing consumer awareness of environmental impact is a significant sociological factor influencing B2B purchasing decisions. By 2024, a substantial percentage of consumers consider sustainability when buying, a sentiment that translates into corporate procurement strategies, favoring suppliers with strong ESG credentials.

Demographic changes, such as an aging global population and increased urbanization, are reshaping the demand for specific types of commercial spaces. This necessitates adaptable and specialized flooring solutions for sectors like healthcare, education, and mixed-use developments, areas where Interface's durable and aesthetically versatile products are well-suited.

| Sociological Factor | Impact on Interface | Supporting Data/Trend (2024/2025) |

|---|---|---|

| Health & Well-being Focus | Increased demand for healthy indoor environment solutions. | Surging demand for low-VOC and hygienic flooring materials. |

| Sustainability & ESG | Enhanced market advantage for eco-conscious brands. | 70% of consumers consider sustainability in purchases (Accenture, 2024); Interface achieved carbon neutrality in 2023. |

| Demographic Shifts | Growth opportunities in healthcare, education, and mixed-use developments. | Global population 65+ projected to exceed 800 million (2024), driving healthcare facility needs. |

| Workplace Transformation | Demand for flexible and adaptable office flooring solutions. | Rise of hybrid work models requires reconfigurable spaces. |

Technological factors

Ongoing innovations in material science are a significant technological factor for Interface, Inc. These advancements enable the development of flooring products with increasingly higher recycled content and the integration of bio-based materials. For instance, Interface has been a leader in incorporating recycled materials, aiming for 100% recycled content in its products by 2020, and continues to push boundaries in sustainable sourcing.

Research into new polymer technologies and advanced backing systems directly impacts product performance and durability. This includes exploring novel materials for luxury vinyl tile (LVT) and rubber flooring, enhancing their resistance to wear and tear. Such innovations not only meet Interface's sustainability targets but also extend the lifespan of their flooring solutions, offering greater value to customers.

Interface, Inc. is leveraging technological advancements to significantly enhance its manufacturing operations. The company's commitment to innovation is evident in its adoption of more energy-efficient machinery and advanced automation systems across its production facilities. These upgrades are designed to streamline processes and minimize resource consumption.

These manufacturing innovations directly contribute to Interface's sustainability goals by reducing waste and lowering its overall carbon footprint. For example, the implementation of advanced process optimization techniques has allowed for more precise material usage, leading to less waste. This focus on efficiency not only benefits the environment but also bolsters the company's cost-effectiveness.

The growing integration of smart building technologies opens doors for Interface to embed sensors and data collection into its flooring. This innovation could offer clients features like real-time occupancy tracking, aiding in energy efficiency, or even monitoring air quality for improved workplace health and safety.

Interface's strategic move into smart flooring is supported by the broader smart building market, which was projected to reach over $100 billion globally by 2025, indicating a strong demand for such integrated solutions. Collaborating with tech firms will be crucial for Interface to develop these advanced functionalities and maintain a competitive edge.

Digital Design and Visualization Tools

The integration of advanced digital design and visualization tools like Building Information Modeling (BIM) and virtual reality (VR) significantly influences how flooring specifications are made in architectural and interior design projects. Interface, Inc. needs to ensure its product data is readily available and compatible with these platforms, facilitating easier selection and visualization for designers. For instance, in 2024, the global BIM market was valued at approximately $7.5 billion, with a projected compound annual growth rate (CAGR) of over 13% through 2030, indicating a strong shift towards digital workflows.

To remain competitive, Interface must offer digital assets and tools that seamlessly integrate into designers' existing workflows. This includes providing high-quality 3D models, material libraries, and potentially augmented reality (AR) tools for on-site visualization. The increasing adoption of these technologies means that companies failing to adapt risk being overlooked in the early stages of design specification. By 2025, it's estimated that over 70% of large construction projects globally will utilize BIM to some extent.

- Digital Asset Availability: Interface must provide easily accessible and high-fidelity digital representations of its flooring products for BIM and other design software.

- VR/AR Integration: Developing or supporting VR and AR applications allows designers and clients to virtually experience flooring choices within a project context.

- Workflow Compatibility: Ensuring that digital tools and assets are compatible with industry-standard design software streamlines the specification process for architects and interior designers.

Recycling and Circular Economy Technologies

Technological advancements in recycling and material recovery are fundamental to Interface's circular economy goals. Innovations in reclaiming post-consumer carpet tiles and rubber flooring, alongside new methods for reintegrating these materials into new products, are key. Interface's commitment to closing the material loop is directly supported by investments in these cutting-edge technologies.

Interface has made significant strides in this area. For instance, their ReEntry program, which takes back used carpet tiles, has diverted millions of pounds of waste from landfills. In 2023, Interface reported that over 90% of the materials used in their new products contained recycled or bio-based content, a testament to their technological integration.

- Advanced Sorting Technologies: Developing AI-powered sorting systems to efficiently separate different material types from post-consumer waste, increasing the purity and usability of recovered materials.

- Chemical Recycling Innovations: Investing in and utilizing chemical recycling processes that can break down complex polymer structures in carpet fibers, allowing for higher-value återanvändning.

- Material Science Research: Continuous research into novel binders and manufacturing techniques that can effectively incorporate a higher percentage of recycled content without compromising product performance or aesthetics.

Interface's technological strategy centers on material innovation, aiming for enhanced sustainability and performance. Advancements in polymer science and backing systems are crucial for developing durable, high-recycled-content flooring. For example, in 2024, Interface continued to expand its use of recycled materials, building on its long-standing commitment to circularity, with over 90% of its products containing recycled or bio-based content in 2023.

The company is also integrating smart technologies into its products, anticipating the growing demand in smart buildings. By 2025, the global smart building market was projected to exceed $100 billion, presenting an opportunity for Interface to embed sensors for data collection, such as occupancy tracking for energy efficiency.

Furthermore, Interface is embracing digital design tools like BIM, which saw its global market valued at approximately $7.5 billion in 2024. Ensuring product data compatibility with these platforms is essential, as over 70% of large construction projects were expected to utilize BIM by 2025, streamlining specification for designers.

Legal factors

Interface, Inc. navigates a complex web of environmental protection laws, including those concerning emissions, waste management, and chemical usage, across its global operations. Failure to comply with these mandates, such as the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations or the U.S. EPA's Clean Air Act, can result in significant penalties and legal challenges.

Interface's commitment to sustainability, exemplified by its 2019 announcement to achieve carbon neutrality by 2040, often means exceeding baseline regulatory requirements. This forward-thinking strategy not only mitigates compliance risks but also enhances brand reputation, as seen in its ongoing efforts to reduce its carbon footprint by 50% by 2025 compared to a 2011 baseline.

Legal requirements for building codes, fire safety, and environmental certifications like LEED, BREEAM, and WELL significantly shape commercial flooring specifications. Interface must ensure its products meet or exceed these standards to access markets favoring or mandating green building certifications.

For instance, the growing demand for WELL Building Standard certified spaces, which focuses on human health and well-being, necessitates flooring solutions with low VOC emissions and enhanced air quality performance. Interface's commitment to sustainability, evident in its 2023 annual report highlighting progress towards its Climate Take Back mission, directly addresses these evolving legal and market demands.

Interface, Inc. navigates a complex web of product safety and compliance regulations across its global operations. These standards, covering everything from material composition to flammability and VOC emissions, are critical. For instance, in 2024, the company's commitment to indoor air quality is underscored by its adherence to standards like the California Air Resources Board (CARB) Phase 2 requirements for composite wood products used in its manufacturing.

Failure to meet these stringent requirements, such as those mandated by the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation for chemical safety, can result in significant financial penalties and operational disruptions. Interface's proactive approach involves rigorous testing and certification processes, ensuring products like its modular carpet tiles meet benchmarks for slip resistance and durability, thereby mitigating risks of costly recalls and reputational damage.

Labor Laws and Employment Regulations

Interface, Inc. navigates a complex web of global labor laws, requiring strict adherence to varying regulations concerning wages, working conditions, and employee benefits across its international operations. For instance, in 2024, minimum wage laws continued to evolve in key markets, impacting operational costs and employment strategies.

The company's commitment to ethical labor practices, a cornerstone of its Environmental, Social, and Governance (ESG) framework, is crucial for mitigating legal risks and safeguarding its brand reputation. This focus extends to non-discrimination policies and employee rights, including those related to unionization, ensuring fair treatment across its workforce.

- Global Compliance: Interface must adhere to diverse labor laws in countries with manufacturing and sales operations, covering wages, working conditions, and benefits.

- Ethical Labor Practices: Compliance with ethical labor standards is integral to Interface's ESG commitments, preventing legal issues and reputational damage.

- Employee Rights: Regulations on non-discrimination and unionization are critical considerations for maintaining a compliant and ethical workforce.

- Evolving Regulations: Staying abreast of changes in labor laws, such as minimum wage adjustments in 2024, is essential for operational planning.

Intellectual Property Rights

Interface, Inc. relies heavily on its intellectual property, including patents for innovative flooring materials and manufacturing techniques, and copyrights for unique design patterns, to secure its market position. Protecting these assets is paramount for maintaining a competitive edge.

Navigating the diverse global legal landscape for intellectual property rights is crucial. Interface must maintain a strong strategy for registering, monitoring, and enforcing its IP to deter infringement and preserve its distinctiveness in various markets.

- Patent Portfolio: Interface holds numerous patents globally covering its proprietary modular carpet technologies and sustainable material innovations.

- Design Registrations: The company actively registers its distinctive carpet tile designs to prevent unauthorized replication.

- Global Enforcement: Interface monitors international markets for potential IP violations and takes legal action when necessary.

Interface's legal framework is significantly influenced by product safety and environmental regulations globally, impacting material sourcing and manufacturing processes. Adherence to standards like the California Air Resources Board (CARB) Phase 2 for composite wood products, as relevant in 2024, ensures compliance and market access.

The company must also navigate international intellectual property laws to protect its innovative flooring designs and manufacturing technologies, crucial for maintaining its competitive edge. This includes actively registering and defending patents and design copyrights against infringement in key markets.

Furthermore, Interface is subject to evolving labor laws worldwide, necessitating strict compliance with wage, working condition, and employee rights regulations, a factor that influenced operational planning in 2024. Upholding ethical labor practices is integral to its ESG strategy, mitigating legal risks and reinforcing brand reputation.

Interface's commitment to sustainability aligns with and often surpasses environmental regulations, such as emissions and waste management mandates. By meeting green building certifications like LEED and WELL, the company enhances its marketability in a sector increasingly prioritizing health and well-being.

Environmental factors

Interface, Inc. faces significant environmental pressures, especially concerning climate change mitigation and reducing its carbon footprint. The company's ambitious goal of achieving carbon neutrality by 2040, a target reinforced by its 'Climate Take Back' mission, directly influences its product development and operational strategies, pushing for greater efficiency and sustainable materials.

Stakeholder scrutiny on Interface's environmental performance is intensifying, with a growing demand for transparent reporting of Scope 1, 2, and 3 emissions. For instance, in 2023, Interface reported a 29% reduction in absolute Scope 1 and 2 greenhouse gas emissions compared to its 2015 baseline, demonstrating progress in its direct operations.

Interface, Inc. is increasingly prioritizing circular economy principles due to the growing scarcity of virgin raw materials. This strategic shift involves a strong focus on utilizing recycled, renewable, and bio-based inputs in their flooring products. For instance, by 2023, Interface had achieved over 90% recycled or bio-based content in its total product portfolio, a testament to their commitment to reducing reliance on finite resources.

This commitment translates into designing products with disassembly and recycling in mind, alongside developing robust take-back programs for flooring at its end-of-life. By diverting waste from landfills and creating a closed-loop system, Interface not only mitigates environmental impact but also builds resilience against supply chain disruptions caused by resource scarcity.

Interface's commitment to managing manufacturing and end-of-life product waste is a key environmental consideration. The company's ReEntry program, a cornerstone of its waste reduction strategy, actively collects and recycles old carpet tiles. In 2023, Interface reported that its ReEntry program had diverted over 100 million pounds of carpet from landfills since its inception, showcasing a substantial impact on waste management.

Water Conservation in Manufacturing

Water scarcity is an increasingly critical issue worldwide, directly impacting manufacturing sectors. Interface, Inc., like many companies, is under significant pressure to minimize its water usage throughout its production lines and handle wastewater in an environmentally sound manner.

Adopting water-saving technologies and refining operational processes offers a dual benefit. It not only demonstrates a commitment to environmental responsibility but also leads to improved operational efficiency and a reduction in overall utility expenses. For instance, by 2023, Interface reported a 40% reduction in water withdrawal intensity compared to its 2010 baseline, showcasing tangible progress in this area.

- Global Water Stress: Over 2 billion people live in countries experiencing high water stress, a figure projected to rise.

- Manufacturing Impact: Industries are major water consumers, facing scrutiny over sustainable practices.

- Interface's Goal: Continuous reduction of water footprint in manufacturing processes is a key environmental objective.

- Efficiency Gains: Water conservation efforts often yield cost savings through reduced consumption and waste treatment.

Sustainable Sourcing and Supply Chain Transparency

Interface, Inc. faces increasing pressure to ensure its raw materials, including those for LVT and nora® rubber flooring, are sourced responsibly. This means actively avoiding deforestation, human rights abuses, and environmentally damaging extraction methods. For instance, by 2023, Interface reported that over 90% of its carpet products utilized recycled or bio-based materials, demonstrating a commitment to sustainable sourcing.

Supply chain transparency is paramount, requiring rigorous due diligence and active engagement with suppliers. This ensures that ethical and sustainable practices are upheld at every stage. Interface's 2023 Sustainability Report highlights their ongoing efforts to map and assess their key suppliers for environmental and social risks, aiming for greater visibility into their extended supply chain.

- Demand for sustainable materials: Growing consumer and regulatory emphasis on eco-friendly products.

- Supply chain auditing: Interface's 2023 data shows continued investment in supplier audits to verify responsible practices.

- Material innovation: Focus on recycled content, bio-based alternatives, and reduced carbon footprint in flooring components.

- Traceability initiatives: Efforts to track the origin of key materials like PVC and rubber to ensure ethical sourcing.

Interface's environmental strategy centers on aggressive carbon reduction and embracing circular economy principles. The company's 2040 carbon neutrality goal, driven by its Climate Take Back mission, necessitates innovation in product design and operational efficiency, with a strong emphasis on recycled and bio-based materials. By 2023, over 90% of their product portfolio incorporated such materials, significantly reducing reliance on virgin resources and diverting substantial waste from landfills.

Interface is actively addressing water scarcity by implementing water-saving technologies and improving wastewater management. This dual approach not only enhances environmental stewardship but also boosts operational efficiency and cost savings. Their efforts have yielded a notable reduction in water withdrawal intensity, with a 40% decrease reported by 2023 compared to a 2010 baseline.

Responsible sourcing is a critical environmental focus, particularly for materials in LVT and nora® rubber flooring. Interface prioritizes avoiding deforestation and environmentally harmful extraction methods, ensuring ethical practices throughout its supply chain. In 2023, the company continued its investment in supplier audits to verify these responsible practices and enhance supply chain transparency.

| Environmental Factor | Interface's Action/Goal | Key Data/Metric (as of 2023) |

|---|---|---|

| Climate Change & Carbon Footprint | Carbon Neutrality by 2040; Climate Take Back mission | 29% reduction in absolute Scope 1 & 2 GHG emissions (vs. 2015 baseline) |

| Circular Economy & Waste Reduction | Utilize recycled/bio-based content; Product end-of-life programs | Over 90% recycled or bio-based content in total product portfolio; Over 100 million pounds of carpet diverted from landfills via ReEntry program |

| Water Usage & Scarcity | Minimize water usage; Improve wastewater management | 40% reduction in water withdrawal intensity (vs. 2010 baseline) |

| Responsible Sourcing | Avoid deforestation, human rights abuses, damaging extraction | Over 90% of carpet products used recycled or bio-based materials; Ongoing supplier audits for environmental/social risks |

PESTLE Analysis Data Sources

Our PESTLE analysis is built on a robust foundation of data from reputable sources, including government publications, international organizations like the World Bank and IMF, and leading market research firms. This diverse data set ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting your industry.