Interface Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Interface Bundle

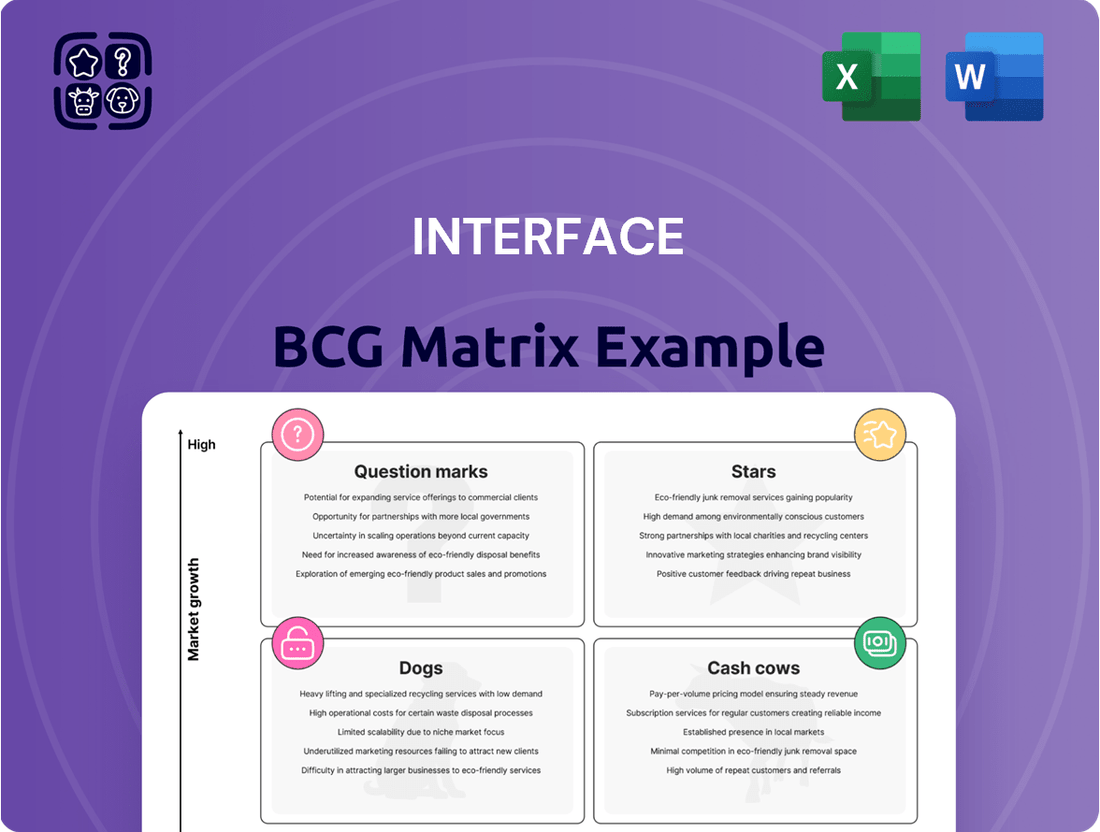

This glimpse into the BCG Matrix highlights the critical importance of understanding your product portfolio's market share and growth potential. See how this company's products are categorized as Stars, Cash Cows, Dogs, or Question Marks, and realize the power of this strategic tool for your own business. Purchase the full BCG Matrix for a comprehensive analysis, actionable insights, and a clear path to optimizing your investments and product strategy.

Stars

Interface's dedication to sustainability, exemplified by its ambitious goal of becoming carbon negative without relying on offsets, truly sets its product innovations apart. This commitment is actively demonstrated through significant reductions in its carbon footprint across various product lines. For instance, since 2019, carpet tile carbon intensity has dropped by 35%, LVT by 46%, and nora rubber by 21%.

These impressive environmental achievements directly translate into high growth potential for Interface's sustainable products. As demand for eco-friendly building materials continues to surge, driven by global trends in green construction and circular economy principles, Interface is exceptionally well-positioned to capitalize on this market shift in the commercial flooring sector.

The Americas region demonstrated robust performance for Interface, with net sales climbing 9.3% in 2024. This upward trend continued into Q1 2025, showing a 6% increase in net sales, bolstered by a strong 10% currency-neutral order growth. This signifies a significant market share within a geographically expanding market.

Interface's nora® rubber flooring is positioned as a strong contender within the BCG matrix, particularly as the company pushes for sustainability. Their development of a cradle-to-gate carbon-negative prototype, set for unveiling in 2025, highlights a commitment to innovation in the resilient flooring market. This move taps into a growing demand for durable and environmentally conscious building materials.

Healthcare and Education Segments

The Healthcare and Education segments are shining stars for Interface, demonstrating robust growth that positions them as key drivers of the company's success within the commercial flooring market. Global billings in both sectors experienced impressive double-digit growth throughout 2024, a trend that has continued with strong performance into the first quarter of 2025.

This sustained expansion highlights a significant demand for Interface's innovative flooring solutions within these critical industries. The company's strategic focus and established presence in these markets are directly contributing to its strong performance.

- Healthcare Growth: The healthcare sector saw substantial increases in flooring demand, driven by new construction and renovation projects aimed at improving patient environments and infection control.

- Education Expansion: Similarly, the education segment experienced a surge in demand, with schools and universities investing in durable, aesthetically pleasing, and acoustically beneficial flooring solutions.

- Market Position: Interface's commitment to sustainable and performance-driven products resonates strongly with the evolving needs of both healthcare facilities and educational institutions.

- Future Outlook: Continued investment and innovation in these segments are expected to maintain Interface's star status, capitalizing on ongoing market trends.

Luxury Vinyl Tile (LVT)

Interface's Luxury Vinyl Tile (LVT) products are positioned as Stars in their BCG Matrix. This is driven by Interface's commitment to sustainability, evidenced by a 46% reduction in LVT's carbon footprint since 2019, and the planned launch of new collections in 2025. These factors highlight a strategic emphasis on a rapidly expanding segment within the commercial flooring sector.

The growing market demand for LVT, attributed to its inherent durability and attractive design qualities, further solidifies its Star status. Interface's proactive approach in enhancing the environmental profile of its LVT offerings, alongside innovation through new product introductions, aligns with key market trends and consumer preferences.

- Market Growth: LVT is experiencing robust demand in the commercial flooring market.

- Sustainability Focus: Interface has significantly reduced the carbon footprint of its LVT.

- Product Innovation: New LVT collections are slated for release in 2025.

- Key Attributes: Durability and aesthetic appeal are driving LVT adoption.

Interface's nora® rubber flooring is a definite Star, especially with the company's push for sustainability. They are developing a cradle-to-gate carbon-negative prototype, set to be revealed in 2025, which is a big deal for the resilient flooring market. This taps into the increasing desire for building materials that are both tough and good for the environment.

The Healthcare and Education segments are truly shining stars for Interface, acting as major growth engines in the commercial flooring market. Both sectors saw impressive double-digit growth in global billings throughout 2024, and this strong performance has carried into the first quarter of 2025.

Interface's Luxury Vinyl Tile (LVT) products are also positioned as Stars within their BCG Matrix. This is thanks to Interface's strong commitment to sustainability, which includes a 46% reduction in LVT's carbon footprint since 2019, and the planned introduction of new collections in 2025, signaling a strategic focus on a rapidly expanding market segment.

| Product Category | BCG Matrix Position | Key Growth Drivers | Sustainability Impact | Recent Performance (2024/Q1 2025) |

|---|---|---|---|---|

| nora® Rubber Flooring | Star | Demand for durable, eco-friendly building materials; Innovation (carbon-negative prototype) | Focus on cradle-to-gate carbon negativity | Continued strong market presence |

| Healthcare Segment | Star | New construction/renovations, infection control needs | Resonates with facility requirements | Double-digit global billings growth (2024 & Q1 2025) |

| Education Segment | Star | Need for durable, aesthetic, acoustically beneficial flooring | Aligns with institutional investment priorities | Double-digit global billings growth (2024 & Q1 2025) |

| Luxury Vinyl Tile (LVT) | Star | Market demand for durability and design; Product innovation | 46% reduction in carbon footprint since 2019 | Planned new collections in 2025 |

What is included in the product

Strategic guidance on resource allocation across a product portfolio based on market share and growth.

A clear visual map of your portfolio, simplifying complex strategic decisions.

Cash Cows

Interface's modular carpet tiles, a cornerstone of their business, likely represent a Cash Cow within the BCG matrix. As the world's largest manufacturer of these tiles, Interface commands a significant share in the mature commercial flooring market.

Despite potentially slower growth in the overall soft flooring sector compared to newer materials like resilient flooring, the consistent demand for carpet tiles, coupled with Interface's strong brand recognition and established distribution networks, ensures a steady and substantial cash flow. For instance, in 2023, the global commercial carpet market was valued at approximately $25 billion, with modular carpet tiles holding a substantial portion of this.

Interface's Established Corporate Office Solutions are a prime example of a Cash Cow in the BCG Matrix. Their long-standing presence in this mature market, as of 2024, signifies a dominant position. This dominance translates into consistent cash flow generation, largely due to established brand recognition and strong customer relationships that minimize the need for heavy promotional spending.

The Americas segment stands as Interface's primary revenue engine, showcasing robust market share and sustained profitability throughout 2024 and into Q1 2025. This established dominance in a key market allows Interface to consistently generate significant cash flow, which is crucial for funding its broader strategic growth and innovation efforts across the company.

ReEntry 2.0 Recycled Program

Interface's ReEntry 2.0 program, a cornerstone of their sustainability efforts, exemplifies a cash cow within the BCG matrix. This mature initiative, focused on reclaiming and recycling carpet, generates consistent value through cost savings and a strengthened brand image.

The program's efficiency in reducing raw material expenses and its established circular economy model provide a stable revenue stream. By leveraging existing infrastructure, ReEntry 2.0 requires minimal additional investment, allowing it to generate substantial profits that can fund other business ventures.

- Cost Savings: In 2024, Interface reported that its recycling programs, including ReEntry 2.0, diverted over 130 million pounds of carpet from landfills, contributing to a significant reduction in virgin material costs.

- Brand Enhancement: The program reinforces Interface's position as a sustainability leader, attracting environmentally conscious customers and enhancing brand loyalty, which translates into sustained market share.

- Predictable Value: The consistent flow of recycled materials ensures a reliable supply chain, minimizing price volatility associated with virgin resources and providing a predictable source of value.

Legacy Product Lines with High Brand Recognition

Interface's legacy carpet tile designs and resilient flooring products, like the original modular carpet tiles introduced decades ago, often serve as its cash cows. These foundational offerings benefit from strong brand recognition among architects and designers, leading to consistent sales and a significant market share in established segments. For example, Interface reported that its legacy product lines continue to be a stable revenue generator, contributing significantly to overall profitability without requiring substantial new investment.

These established products typically demand less aggressive marketing spend compared to newer innovations. Their consistent demand, fueled by customer loyalty and familiarity, translates into reliable cash flow for the company. This allows Interface to allocate resources to growth areas while maintaining a steady income stream from these mature product lines.

- High Market Share: Legacy products often hold a dominant position in their respective market segments due to long-standing customer relationships and established specifications.

- Low Investment Needs: Reduced marketing and R&D expenditures are typical for these mature offerings, boosting their contribution to operating cash flow.

- Consistent Sales: Brand recognition and proven performance ensure a steady, predictable revenue stream, even in slower market conditions.

- Brand Loyalty: Decades of presence have cultivated trust and preference among key specifiers, ensuring continued demand.

Interface's established product lines, particularly its core modular carpet tiles, function as significant cash cows. These offerings benefit from a dominant market share in mature segments, ensuring consistent revenue generation with minimal need for substantial new investment or aggressive marketing. This allows Interface to leverage its strong brand recognition and established customer base for predictable cash flow.

| Product Category | BCG Status | Market Share | Growth Rate | Cash Flow Generation |

| Modular Carpet Tiles | Cash Cow | High | Low | High |

| Legacy Carpet Tile Designs | Cash Cow | Dominant | Stable | Strong |

| Established Corporate Office Solutions | Cash Cow | Significant | Mature | Consistent |

Preview = Final Product

Interface BCG Matrix

The BCG Matrix interface you are currently viewing is the exact, fully functional document you will receive immediately after purchase. This preview showcases the complete report, ready for your strategic analysis and business planning without any watermarks or limitations. You can be confident that the professional design and comprehensive data presented here are precisely what you'll download and utilize for your decision-making processes.

Dogs

The Europe, Africa, Asia, and Australia (EAAA) region presents a challenge within the BCG Matrix, showing a slight dip in net sales for 2024. This underperformance is further highlighted by a softer macro environment observed in the first quarter of 2025.

For products or strategies heavily reliant on the EAAA market, particularly those with a low market share within these specific geographies, a re-evaluation is warranted. Companies might consider divesting or significantly restructuring these offerings to mitigate further losses.

Products stuck with older designs or technologies often struggle to compete. Think of smartphones that haven't adopted the latest camera advancements or laptops still using older processors. These items can quickly lose their appeal, especially when newer, more innovative options flood the market.

These types of products typically find themselves in low-growth market segments, meaning the overall demand isn't increasing. Consequently, they often hold a small piece of the market share. Companies might need to spend a significant amount on advertising and promotions just to maintain their limited sales, yielding very little in return.

For instance, in 2024, the demand for feature phones, a category often characterized by outdated technology compared to smartphones, continued to decline. While they still hold a niche, their market share globally is less than 1%, and sales growth is projected to be negative in the coming years, illustrating the challenge of maintaining relevance with outdated designs.

Highly niche or specialized commercial flooring offerings, such as custom-designed antimicrobial surfaces for specific healthcare applications, often fall into the Dogs category. These products may hold a small market share and experience very low growth, as their demand is confined to a limited customer base. For instance, a company specializing in unique, hand-dyed wool carpets for luxury boutiques might find its sales stagnant, with minimal expansion prospects beyond its existing clientele.

In 2024, the market for highly specialized commercial flooring products continued to reflect this trend. While some niche segments saw minor growth, overall market penetration remained low. Companies investing heavily in research and development for these specialized items, without a clear path to broader adoption or significant price premiums, risk them becoming cash traps. This occurs when the cost of maintaining inventory, specialized production lines, or ongoing customer support outweighs the revenue generated from these low-volume sales.

Products with High Production Costs and Low Profitability

Products with high production costs and low profitability within Interface's portfolio, if they exist, would be categorized as Dogs in the BCG Matrix. These items consume significant resources for manufacturing and distribution but generate minimal profit, acting as a drag on the company's overall financial performance.

For instance, if a specific carpet tile line required specialized, expensive raw materials and a complex manufacturing process, pushing its cost of goods sold significantly higher than its market price, it could fall into this category. Such products would divert capital and management attention away from more promising areas.

- High Cost of Goods Sold (COGS): Products where manufacturing expenses, including materials and labor, consistently outpace their revenue contribution.

- Low Profit Margins: Items that, after all costs are accounted for, yield a very small percentage of profit relative to their sales price.

- Resource Drain: These products tie up capital and operational capacity without delivering substantial returns, hindering growth in other business segments.

Discontinued or Phased-Out Product Lines

Products that Interface has decided to discontinue or is in the process of phasing out, due to declining demand or strategic shifts, would fit the 'Dog' category within the Interface BCG Matrix. These items, while not generating significant new sales, may still incur residual costs related to inventory management or ongoing customer support.

For instance, if Interface's Q4 2023 sales data showed a particular flooring line experiencing a 15% year-over-year decline in revenue and representing only 1% of total sales, it would likely be classified as a Dog. This segment might still require resources for warranty claims or the liquidation of remaining stock.

- Declining Demand: Products experiencing a consistent drop in customer interest and purchasing volume.

- Strategic Reallocation: Resources are being shifted away from these underperforming lines to focus on more promising areas.

- Residual Costs: Even though sales have ceased or are minimal, there can be ongoing expenses for management and support.

- Inventory Management: The need to manage and potentially discount remaining stock to clear it out.

Dogs represent products or business units with low market share in low-growth markets. These offerings typically generate low profits or even losses, consuming more resources than they contribute. Companies often consider divesting or discontinuing these products to free up capital for more promising ventures.

For example, a specific line of custom-designed antimicrobial flooring for niche healthcare applications might fit this description. If its market share is minimal and growth prospects are limited, it would be classified as a Dog, potentially requiring significant marketing spend just to maintain its small sales volume.

In 2024, products with declining demand and minimal market penetration, such as certain legacy carpet tile designs, continued to be categorized as Dogs. These items often require substantial investment in advertising to maintain even modest sales, yielding little return.

Interface's strategic decisions in 2024 and early 2025 likely involved a review of such underperforming products, with a focus on phasing out those that drain resources without contributing to overall growth or profitability.

Question Marks

Interface's introduction of new global collections, such as those launched in June 2025, positions them as question marks within the BCG Matrix. These products enter the expanding commercial flooring market, a sector projected to reach over $60 billion globally by 2026, yet their initial market share is minimal.

The company must invest heavily in marketing and sales to elevate these new offerings. Without substantial support, they risk remaining question marks, consuming resources without generating significant returns, unlike established Stars or Cash Cows.

Interface's commitment to automation, evidenced by their investment in advanced manufacturing, positions them to explore emerging technologies in flooring. This includes smart flooring systems that can monitor environmental conditions or even generate energy, though their market share is currently nascent. The company's focus on innovation also points towards exploring advanced installation methods, potentially reducing labor costs and improving efficiency.

Interface's expansion into new, untapped geographic markets, where their brand recognition is currently low, would be classified as a Question Mark in the BCG Matrix. These markets, while potentially offering significant future growth, demand substantial upfront investment to establish a foothold and build market share.

For instance, consider Interface's potential entry into rapidly developing African nations. While specific 2024 data on Interface's presence in these markets is not publicly detailed, the broader flooring market in Africa is projected for robust growth. The African flooring market was estimated to be worth approximately $3.5 billion in 2023 and is expected to grow at a CAGR of over 5% through 2028, driven by urbanization and infrastructure development.

Carbon Negative Rubber Flooring Prototype

The carbon-negative rubber flooring prototype, set to debut in early 2025, represents a significant advancement in the sustainable building materials sector. This innovation addresses a clear market demand for environmentally responsible products, a trend that saw the global green building materials market reach an estimated USD 296.5 billion in 2023, with projections indicating continued robust growth.

However, its classification as a Question Mark within the BCG matrix stems from the inherent uncertainties surrounding its commercialization. Key factors include the scalability of its carbon-negative production process and the anticipated market adoption rate. While the prototype demonstrates technological promise, its ability to achieve widespread acceptance and profitability remains to be seen.

- Market Potential: The global sustainable flooring market is expanding, driven by increasing environmental awareness and regulations.

- Commercial Viability: Uncertainties exist regarding production costs at scale and competitive pricing against traditional flooring options.

- Production Scale: Transitioning from prototype to mass production presents significant operational and investment challenges.

- Market Adoption: Consumer and commercial buyer acceptance of a novel, carbon-negative product needs to be cultivated and proven.

Residential Flooring Segment (FLOR brand)

While Interface is renowned for its commercial carpet tiles, the FLOR brand represents its venture into the residential flooring segment, specifically premium area rugs. This market operates with distinct consumer preferences and competitive landscapes compared to commercial spaces.

The residential flooring market, while showing resilience, often sees fragmentation and a strong emphasis on design and affordability. For FLOR, if its market share within this growing residential sector remains relatively small, even with promising growth potential, it would align with the characteristics of a Question Mark in the BCG matrix.

- Market Position: FLOR operates in the residential flooring market, a segment distinct from Interface's core commercial business.

- Growth Potential: The residential flooring market, particularly for premium rugs, can offer significant growth opportunities.

- BCG Classification: If FLOR has a low market share in this potentially high-growth residential segment, it would be classified as a Question Mark.

Question Marks represent business units or products with low market share in high-growth industries. Interface's new global collections, like those introduced in mid-2025, fit this category as they enter a rapidly expanding commercial flooring market but have yet to capture significant market share. These ventures require substantial investment to gain traction and transition into Stars or Cash Cows, otherwise, they risk becoming Dogs.

Interface's exploration into emerging technologies, such as smart flooring systems with nascent market share in a high-growth sector, also classifies them as Question Marks. Similarly, expansion into developing geographic markets with low brand recognition, despite the sector's growth potential, demands significant upfront investment to build market share.

The carbon-negative rubber flooring prototype, while innovative and targeting the growing green building materials market, is a Question Mark due to uncertainties in production scalability and market adoption. Even the FLOR brand, operating in the potentially high-growth residential rug market with a currently low market share, exemplifies a Question Mark.

Interface's strategic positioning of new product lines and market entries often places them in the Question Mark quadrant of the BCG Matrix. These are typically high-growth, low-market-share ventures demanding careful resource allocation and strategic investment to realize their potential. Success hinges on transforming these nascent opportunities into market leaders.

| Product/Initiative | Market Growth | Market Share | BCG Classification | Strategic Implication |

|---|---|---|---|---|

| New Global Collections (e.g., June 2025) | High (Commercial Flooring Market >$60B by 2026) | Low | Question Mark | Requires significant investment in marketing and sales. |

| Smart Flooring Systems | High (Emerging Technology Sector) | Nascent | Question Mark | Focus on R&D and market education for adoption. |

| Carbon-Negative Rubber Flooring Prototype | High (Green Building Materials Market ~$296.5B in 2023) | Low (Pre-commercialization) | Question Mark | Address scalability and market acceptance challenges. |

| FLOR (Residential Segment) | Moderate to High (Residential Flooring Market) | Low | Question Mark | Develop distinct strategies for the residential consumer. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth rates, to provide a clear strategic overview.