Interface Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Interface Bundle

Interface's competitive landscape is shaped by powerful forces, from the bargaining power of its customers to the intense rivalry within the flooring industry. Understanding these dynamics is crucial for any business operating in or looking to enter this market.

The complete Porter's Five Forces Analysis for Interface delves into each of these pressures, revealing the underlying factors that influence profitability and strategic positioning. Don't miss out on these critical insights.

Ready to gain a comprehensive understanding of Interface's market? Unlock the full analysis to uncover actionable strategies for navigating its competitive environment and securing a sustainable advantage.

Suppliers Bargaining Power

The bargaining power of suppliers for Interface can be considered moderate. While Interface actively seeks out specialized and sustainable raw materials, which may come from a more concentrated supplier base, many of its core flooring components, such as polymers, dyes, and adhesives, are likely available from a wider array of suppliers.

Interface's commitment to recycled and bio-based materials, as highlighted in their sustainability efforts, could increase the bargaining power of suppliers providing these specific inputs. However, the company's broad sourcing strategy for other materials likely mitigates this power overall. Interface's 2024 Impact Report shows they conducted a supplier carbon maturity assessment, demonstrating proactive management of their supplier relationships and an understanding of potential leverage points.

Suppliers offering unique or patented components, especially those vital for Interface's innovative and sustainable product lines like advanced recycled content or specialized bio-polymers, can wield considerable bargaining power. This leverage is amplified if these materials are not readily available from alternative sources, directly impacting Interface's ability to maintain its competitive edge in eco-friendly flooring solutions.

The switching costs for Interface to transition to new suppliers could be substantial. If specialized materials necessitate significant re-tooling of manufacturing processes or require lengthy and complex qualification procedures, the financial and operational burden of changing suppliers becomes a key consideration, potentially increasing supplier leverage.

Interface's strategic emphasis on circular economy principles and robust internal recycling capabilities serves as a crucial countermeasure to mitigate supplier dependence. By developing in-house material processing and sourcing, the company can reduce its reliance on external, potentially high-bargaining-power suppliers, thereby strengthening its position.

The threat of suppliers moving into flooring manufacturing themselves is quite limited for Interface. This is largely because the flooring business, especially for commercial and institutional markets, demands significant investment in design, specialized manufacturing equipment, and extensive distribution networks that raw material providers usually don't possess.

Most suppliers are focused on producing chemicals or basic materials, not on the complex processes and market access needed for finished flooring products. For instance, a typical supplier of recycled PET for Interface's carpet tiles operates in a different value chain than Interface's intricate design, tufting, and finishing operations.

Availability of Substitute Inputs

The availability of substitute inputs for Interface's core flooring products is a key factor in supplier bargaining power. While generic carpet materials might have numerous suppliers, Interface's strong emphasis on sustainability and its pioneering use of eco-friendly and low-carbon materials narrows the field of eligible suppliers. This deliberate choice to prioritize specific, often proprietary, sustainable materials can inadvertently increase the bargaining leverage of those suppliers who can meet Interface's stringent environmental and performance criteria.

Interface has made significant strides in reducing the carbon footprint of its product lines through continuous innovation in both materials and manufacturing processes. For instance, by 2023, Interface reported that over 90% of its products were carbon neutral across their entire lifecycle, a testament to their material sourcing and production efficiencies. This commitment means that suppliers who can consistently provide certified low-impact raw materials, such as recycled content or bio-based polymers, are in a stronger position to negotiate terms.

- Limited Supplier Pool: Interface's focus on sustainable and low-carbon materials restricts the number of suppliers capable of meeting its specific requirements, thereby enhancing supplier bargaining power.

- Proprietary Material Needs: The company's need for specialized, often custom-developed, eco-friendly inputs means fewer suppliers can offer these unique solutions.

- Supplier Leverage: Suppliers who can consistently provide Interface with certified sustainable and low-carbon materials are better positioned to negotiate pricing and terms.

- Innovation Dependency: Interface's reliance on its suppliers for innovative, environmentally sound materials gives these suppliers a degree of influence over product development and cost.

Supplier's Importance to Interface's Business

Interface's reliance on key suppliers for specialized materials, particularly those supporting its sustainability initiatives, grants suppliers significant bargaining power. Disruptions in the supply of these critical components, essential for maintaining Interface's product quality and innovation edge, could directly hinder production and tarnish its market reputation as a sustainability leader. For instance, securing consistent access to recycled content or bio-based materials, vital for their carbon reduction goals, is paramount.

Interface's strategic focus on supply chain optimization, as highlighted in its 2024 annual report under the 'One Interface' strategy, underscores the importance of managing supplier relationships effectively. This strategy aims to create a more resilient and efficient supply network, mitigating potential risks associated with supplier dependency. The company's commitment to innovation in flooring solutions, often requiring unique inputs, further amplifies the leverage held by suppliers who can provide these specialized materials.

- Supplier Dependence: Interface depends on a select group of suppliers for specialized raw materials crucial for product quality and innovation.

- Sustainability Impact: Disruptions in the supply of materials enabling carbon reduction goals could significantly affect Interface's market standing and production.

- Strategic Management: Interface's 'One Interface' strategy in 2024 emphasizes optimizing supply chain management to address supplier leverage.

Interface's bargaining power with suppliers is moderate, leaning towards being influenced by specialized material needs. While many commodity inputs are readily available, the company's commitment to sustainability, particularly recycled and bio-based materials, narrows the supplier pool for these critical components. This focus on eco-friendly innovation means suppliers providing these unique inputs have increased leverage.

Interface's drive for carbon neutrality, with over 90% of products carbon neutral by 2023, means suppliers of certified low-impact materials are in a stronger negotiating position. The company's 2024 'One Interface' strategy highlights efforts to optimize its supply chain, acknowledging the importance of managing these supplier relationships effectively to mitigate risks associated with specialized material dependence.

| Factor | Impact on Interface | Supporting Data/Observation |

| Supplier Specialization | Increases supplier power | Need for recycled and bio-based materials limits supplier options. |

| Sustainability Goals | Increases supplier power | Suppliers of certified low-impact materials have leverage due to Interface's carbon neutrality targets (over 90% by 2023). |

| Switching Costs | Increases supplier power | Potential need for re-tooling or complex qualification for new specialized materials. |

| Interface's Mitigation | Decreases supplier power | Circular economy initiatives and internal recycling reduce reliance on external suppliers. |

What is included in the product

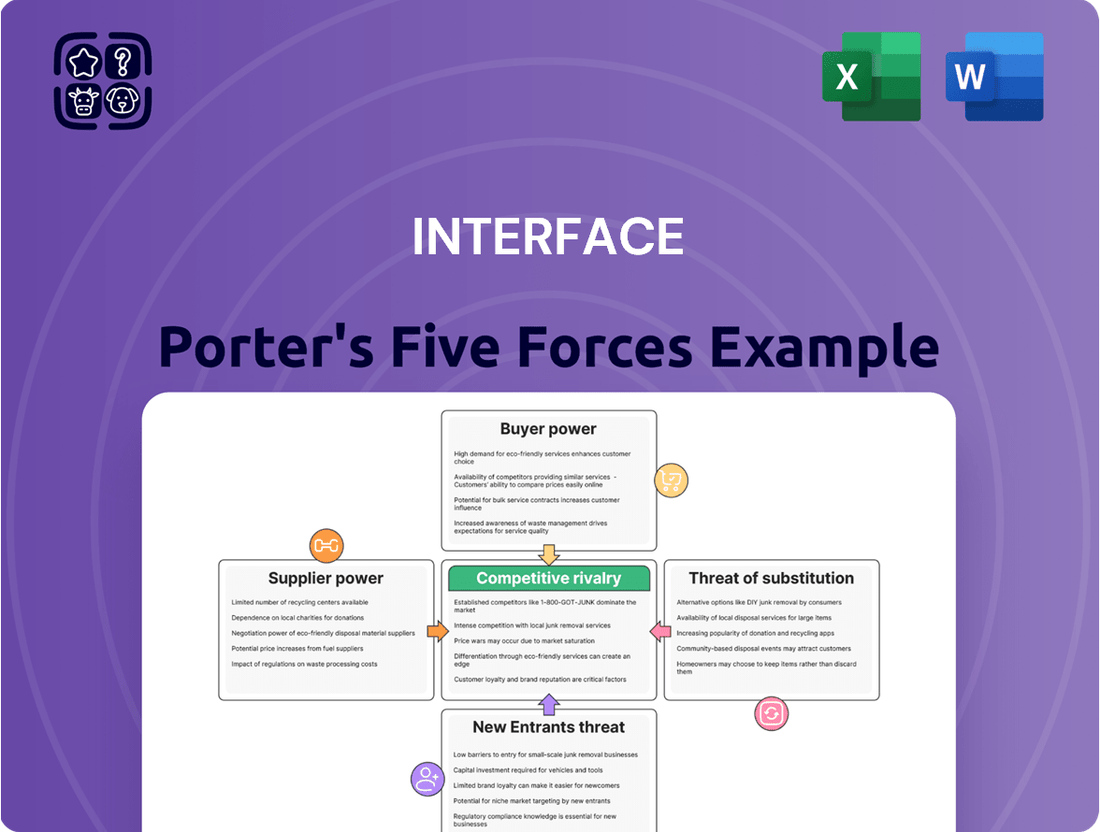

This analysis dissects the competitive forces shaping Interface's industry, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Visualize the competitive landscape at a glance, identifying key threats and opportunities to proactively address market pressures.

Customers Bargaining Power

Interface's customer base, largely comprising commercial and institutional clients, shows a mixed reaction to pricing. While budget constraints and market fluctuations can increase their sensitivity to price, the inherent value Interface provides—like long-lasting products, appealing designs, and a strong focus on sustainability—helps to mitigate this. For instance, in 2023, Interface reported net sales of $1.3 billion, indicating a significant market presence where value beyond just price is a key consideration.

The commercial flooring market is quite crowded, meaning customers often have many choices. This abundance of alternative suppliers, offering comparable product categories, naturally boosts their leverage. For instance, in 2024, the global commercial flooring market was valued at approximately $145 billion, with numerous established and emerging players vying for market share.

While this competition grants customers significant bargaining power, Interface actively works to mitigate this by building strong customer relationships. They achieve this through a combination of factors, including a well-recognized brand, a consistent focus on design innovation, and their leadership in sustainable practices, all of which contribute to fostering customer loyalty and reducing price sensitivity.

Interface serves a diverse array of commercial and institutional sectors, such as corporate offices, healthcare facilities, educational institutions, and retail environments. This broad customer base means that while individual projects can be substantial, it is unlikely that any single customer segment holds enough sway to exert disproportionate bargaining power over Interface.

The company’s sales are spread across various industries, mitigating the risk of over-reliance on any one sector. For instance, Interface saw double-digit year-over-year growth in its Global Education billings during fiscal year 2024, demonstrating the strength and breadth of its customer relationships.

Switching Costs for Customers

While switching flooring suppliers for large commercial projects can involve some logistical and design coordination, these costs are generally not a significant barrier for customers. In 2024, the flooring industry saw continued emphasis on ease of integration and project management, making transitions smoother.

The strength of long-term relationships and trust with key specifiers, such as architects and interior designers, plays a vital role in mitigating a customer's inclination to switch. These relationships are built on consistent performance and reliable service.

- Customer Loyalty: Building strong relationships with specifiers is key to retaining commercial clients.

- Switching Barriers: While some coordination is needed, switching costs in the flooring sector are typically manageable for institutional buyers.

- Interface's Strategy: Interface focuses on delivering superior flooring solutions to enhance customer retention.

Importance of Interface's Products to Customers

Flooring is a crucial element in commercial and institutional settings, influencing not just how a space looks but also how it performs and endures. Interface's offerings are key to building interiors that are not only visually appealing but also functional and sustainable, contributing to occupant well-being and productivity.

The company's commitment to reducing its carbon footprint and embracing circular economy principles resonates strongly with the increasing demand for environmentally responsible construction. This focus is particularly important as green building certifications become more prevalent.

- Criticality of Flooring: For businesses and institutions, flooring is more than just a surface; it's a foundational element impacting everything from acoustics and safety to brand image and operational efficiency.

- Interface's Value Proposition: Interface's modular carpet tiles and luxury vinyl tile (LVT) solutions offer design flexibility, ease of replacement, and enhanced durability, which are vital for high-traffic environments.

- Sustainability as a Driver: In 2023, the global green building market was valued at over $1 trillion, and this trend continues to grow, making Interface's eco-friendly products highly attractive to environmentally conscious clients.

- Customer Dependence: While customers need flooring, the specific performance, design, and sustainability attributes offered by Interface can reduce their ability to switch to alternatives without significant compromise, thus influencing their bargaining power.

Interface's customers, primarily businesses and institutions, possess moderate bargaining power due to the competitive nature of the commercial flooring market, valued at approximately $145 billion in 2024. While product differentiation through design and sustainability offers some buffer, the availability of numerous alternative suppliers means customers can often find comparable options, thereby increasing their leverage in price negotiations.

| Factor | Impact on Bargaining Power | Interface's Mitigation Strategy |

|---|---|---|

| Customer Concentration | Low; sales are diversified across many sectors. | Broad customer base reduces reliance on any single segment. |

| Switching Costs | Moderate; involve logistical and design coordination. | Focus on ease of integration and strong relationships with specifiers. |

| Product Differentiation | Moderate; Interface offers unique designs and sustainability. | Emphasis on value beyond price, fostering loyalty. |

| Price Sensitivity | Varies; influenced by budget constraints and market conditions. | Highlighting long-term value, durability, and eco-friendly credentials. |

What You See Is What You Get

Interface Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis, providing a thorough examination of competitive forces within an industry. The document you see here is the exact, professionally formatted analysis you will receive immediately upon purchase, ensuring no surprises or missing sections. You're looking at the actual deliverable, ready for immediate application to your strategic planning needs.

Rivalry Among Competitors

The commercial flooring sector is quite crowded, with many companies operating both regionally and globally. Interface faces competition from major manufacturers specializing in carpet tiles, luxury vinyl tile (LVT), and rubber flooring.

Key rivals include industry giants like Shaw Contract, Milliken, Mohawk Group, and Tarkett. These companies, alongside numerous smaller regional players, create a fragmented market where competition is particularly fierce.

The commercial flooring market is robust, expected to climb from $66.33 billion in 2024 to $84.34 billion by 2028, a 6.2% compound annual growth rate. This expansion, particularly in the rapidly growing LVT segment projected to reach $29.68 billion in 2025 from $26.01 billion in 2024, can temper intense rivalry. A larger market provides more opportunities for companies to gain share without directly confronting competitors over limited resources.

Interface distinguishes itself through a powerful commitment to design, innovation, and leading the charge in environmental sustainability, with a bold goal of becoming carbon negative by 2040, not through offsets. This focus on eco-friendly products and circular economy principles, like their ReEntry program, allows them to carve out a unique space in a market where carpet tile offerings can otherwise appear quite similar. In 2023, Interface reported net sales of $1.3 billion, showcasing the market's positive reception to their differentiated strategy.

Exit Barriers

Exit barriers in flooring manufacturing, including for companies like Interface, are substantial. The need for significant capital to establish and maintain specialized plants, advanced machinery, and robust distribution channels makes exiting the market a costly endeavor. This financial commitment effectively locks companies into the industry, leading to persistent competition among those already operating within it.

Interface's strategic investments in automation and robotics across its manufacturing facilities further exemplify these high exit barriers. Such technological upgrades represent considerable capital outlay, increasing the sunk costs associated with their operations. This focus on advanced manufacturing can make it economically challenging for Interface, or any competitor with similar investments, to simply shut down operations and divest assets without incurring substantial losses.

- High Capital Investment: Flooring manufacturing requires extensive investment in specialized plant and equipment, often running into millions of dollars.

- Established Distribution Networks: Building and maintaining relationships with distributors and retailers is a long-term, resource-intensive process that creates a barrier to leaving.

- Technological Obsolescence Risk: Divesting specialized machinery can be difficult if it has limited alternative uses, increasing the risk associated with exiting.

- Interface's Automation Investment: Interface's commitment to advanced manufacturing technologies like robotics increases its fixed costs and operational complexity, thereby raising its exit barriers.

Brand Identity and Loyalty

Interface has successfully built a robust brand identity, largely driven by its pioneering commitment to sustainability and its reputation for delivering premium commercial flooring. This strong brand perception, coupled with deep-rooted relationships with specifiers like architects and designers, fosters significant customer loyalty.

This loyalty acts as a substantial barrier to entry for competitors, as customers are often hesitant to switch from a trusted, environmentally conscious supplier. The company’s ‘One Interface’ initiative further solidifies this advantage by focusing on enhancing commercial productivity and deepening customer engagement, making it harder for rivals to lure away established clients.

- Brand Recognition: Interface is widely acknowledged for its sustainability efforts, a key differentiator in the commercial flooring market.

- Customer Loyalty: Established relationships with architects, designers, and major end-users translate into strong customer retention.

- Competitive Advantage: Brand strength and loyalty create a significant hurdle for new entrants and existing competitors seeking market share.

Interface operates in a highly competitive commercial flooring market, facing strong rivalry from established players like Shaw Contract, Milliken, Mohawk Group, and Tarkett, as well as numerous smaller regional manufacturers. This intense competition is fueled by a growing market, projected to reach $84.34 billion by 2028, with the luxury vinyl tile segment showing particularly rapid expansion.

Despite the crowded landscape, Interface differentiates itself through its strong emphasis on design, innovation, and a leading commitment to environmental sustainability, aiming for carbon negativity by 2040. This eco-conscious approach, coupled with its ReEntry program, helps carve out a unique market position. In 2023, Interface achieved net sales of $1.3 billion, indicating positive market reception to its distinct strategy.

High exit barriers, including substantial capital investment in specialized manufacturing and established distribution networks, keep companies like Interface engaged in persistent competition. Interface's own investments in automation and robotics further increase these barriers, making market exit economically challenging.

Interface's robust brand identity, built on sustainability and premium product offerings, fosters significant customer loyalty among specifiers like architects and designers. This loyalty, reinforced by initiatives like ‘One Interface,’ presents a considerable challenge for competitors seeking to gain market share.

SSubstitutes Threaten

Alternative flooring materials like hardwood, ceramic tile, laminate, and polished concrete present varying price-performance benefits when stacked against Interface's modular carpet tiles, LVT, and rubber flooring. For example, Luxury Vinyl Tile (LVT) often competes as a more budget-friendly option than genuine wood or stone, boasting good durability and simpler installation.

Interface counters this threat by maintaining a broad product range, which includes various resilient flooring choices designed to meet diverse customer needs and price points. This diversification allows them to capture market share across different segments, mitigating the impact of specific substitute materials.

In 2024, the global resilient flooring market, which includes LVT, was projected to reach over $200 billion, indicating the significant competitive landscape Interface navigates. The price-performance ratio remains a critical factor for buyers when choosing between these options.

Customers' willingness to switch to alternative flooring solutions is heavily influenced by evolving design aesthetics, the ease of upkeep, and the particular performance demands of a given area. For instance, the growing popularity of resilient flooring options like Luxury Vinyl Tile (LVT) is directly impacting the market share of traditional commercial carpets, as LVT often presents a more durable and lower-maintenance alternative in many commercial settings.

Interface actively addresses this threat by diversifying its product portfolio. Beyond its core carpet tile offerings, the company now provides LVT and its nora rubber flooring, catering to a broader spectrum of customer needs and preferences. This strategic expansion allows Interface to retain customers who might otherwise migrate to competitors offering these substitute materials, thereby capturing value across different flooring segments.

While traditional flooring like hardwood offers a classic look, newer resilient options such as luxury vinyl tile (LVT) and rubber have made significant strides. These modern materials now rival traditional choices in durability, appearance, and how easy they are to maintain. For instance, LVT, a major competitor, saw its global market size estimated to reach over $20 billion in 2023, showcasing its growing adoption.

Interface also faces competition from emerging sustainable materials like cork and bamboo. These offer eco-friendly advantages that appeal to a growing segment of environmentally conscious consumers. The global cork flooring market, for example, was projected to grow at a compound annual growth rate of over 5% through 2028, indicating a strong demand for these alternatives.

Cost of Switching to Substitutes

The expense involved when moving from one flooring solution to another for a commercial undertaking can be substantial. This includes the price of new materials, the labor required for installation, and the potential loss of productivity or revenue due to facility downtime. For instance, a large-scale office renovation might see switching costs exceeding tens of thousands of dollars, depending on the square footage and complexity of the installation.

While these switching costs aren't always insurmountable, they do act as a significant barrier, discouraging businesses from frequently changing their flooring providers or types. This inertia provides a degree of protection for established players like Interface.

Interface's product design, particularly its modular carpet tiles, offers a distinct advantage. Unlike traditional broadloom carpet, where a damaged section often requires replacing a much larger area, individual Interface tiles can be swapped out. This reduces the cost and disruption associated with repairs, making it a more attractive option for businesses concerned about ongoing maintenance expenses.

- Material Costs: New flooring materials can range from $2 to $20+ per square foot, influencing the overall expense of a switch.

- Installation Labor: Professional installation can add another $1 to $5+ per square foot.

- Downtime Costs: Facility downtime can result in lost revenue, estimated at thousands of dollars per day for many businesses.

- Ease of Replacement: Interface's modular tiles simplify repairs, potentially reducing long-term maintenance costs compared to broadloom alternatives.

Innovation in Substitute Products

The threat of substitutes for Interface is significant, fueled by ongoing innovation across the broader flooring market. This includes the emergence of hybrid flooring, smart flooring technologies that integrate sensors, and novel sustainable materials that offer alternatives to traditional carpet tiles. For instance, by 2024, the global resilient flooring market, which includes vinyl and luxury vinyl tile (LVT) – key substitutes – was projected to continue its robust growth, driven by demand for durable and aesthetically pleasing options.

These advancements extend to installation methods and design possibilities, offering consumers and businesses a wider array of choices beyond carpet. New technologies are making installation faster and more cost-effective, while innovative designs cater to evolving aesthetic preferences. This dynamic landscape means that consumers can readily switch to alternative flooring solutions if they perceive them as superior in performance, cost, or environmental impact.

Interface actively addresses this threat by making substantial investments in its own design and innovation capabilities. The company's commitment to developing cutting-edge, sustainable products, such as its recycled and bio-based materials, positions it to lead in climate progress within the industry. This proactive approach aims to ensure that Interface's offerings remain competitive and desirable, even as substitute products proliferate.

- Innovation in Hybrid and Smart Flooring: New flooring types offer enhanced durability and integrated technology.

- Sustainable Material Advancements: The development of eco-friendly alternatives challenges established products.

- Installation Technology: Innovations simplify and reduce the cost of installing competing flooring solutions.

- Interface's Response: Strategic investment in design, innovation, and sustainability to counter substitution threats.

The threat of substitutes for Interface is substantial, with alternatives like hardwood, ceramic tile, laminate, and polished concrete offering diverse price-performance advantages. Luxury Vinyl Tile (LVT), for instance, is a key competitor, often presenting a more budget-friendly and durable option than traditional materials, with its global market size estimated to reach over $20 billion in 2023.

Interface counters this by diversifying its product line to include LVT and nora rubber flooring, appealing to a wider customer base and mitigating the impact of specific substitutes. The global resilient flooring market, which includes LVT, was projected to exceed $200 billion in 2024, highlighting the competitive intensity.

Switching costs, including material expenses ($2-$20+ per sq ft), installation ($1-$5+ per sq ft), and potential downtime, can deter customers from changing flooring solutions. However, Interface’s modular carpet tiles offer an advantage through easier and less costly repairs compared to broadloom carpets.

Emerging sustainable materials like cork and bamboo also pose a threat, with the cork flooring market projected to grow over 5% annually through 2028. Interface addresses this by investing heavily in its own sustainable product development, aiming to remain competitive in an evolving market.

Entrants Threaten

The flooring manufacturing industry, especially for global players like Interface, demands significant capital for state-of-the-art manufacturing facilities, advanced machinery, and ongoing research and development. This substantial upfront investment serves as a formidable barrier for new companies looking to enter the market.

Interface's commitment to automation and robotics in its manufacturing plants, a trend accelerating in 2024, further elevates the capital requirements. For instance, companies investing in advanced manufacturing technologies can see upfront costs in the tens of millions of dollars, making it challenging for smaller, less-capitalized entrants to compete on scale and efficiency.

Interface's deeply entrenched brand loyalty, cultivated over decades of delivering high-quality, design-forward, and sustainable flooring solutions, presents a significant barrier to new entrants. This reputation is particularly strong in the commercial and institutional markets, where trust and proven performance are paramount.

Newcomers would face the daunting task of replicating Interface's established brand recognition and customer trust, a challenge amplified by Interface's ambitious commitment to carbon negativity. This sustainability leadership, a key differentiator, requires substantial investment in marketing and sales to even begin to rival Interface's standing.

Interface's established distribution channels present a significant barrier for new entrants. Their long-standing relationships with architects, designers, and contractors in the commercial sector are crucial for market access. Building these networks from scratch would require substantial time and investment, making it difficult for newcomers to compete effectively. Interface's Q1 2024 initiative to integrate their selling approach further solidifies their commercial productivity and market penetration.

Economies of Scale

Existing large manufacturers like Interface leverage significant economies of scale. This advantage in production, procurement, and distribution allows them to offer more competitive pricing and achieve higher profit margins. For instance, Interface reported net sales of $1,316 million in fiscal year 2024, underscoring its substantial operational capacity.

New entrants would face considerable difficulty matching these cost efficiencies. Without substantial production volume, it's challenging to compete effectively on price against established players. This cost disadvantage acts as a significant barrier, deterring potential new competitors from entering the market.

- Economies of Scale: Interface's substantial net sales of $1,316 million in fiscal year 2024 highlight its ability to achieve lower per-unit costs.

- Pricing Power: Lower production costs translate into more competitive pricing, a key advantage over smaller, less-established companies.

- Procurement Advantages: Large volumes allow for bulk purchasing of raw materials, further reducing input costs for established firms.

- Distribution Efficiencies: Established networks and logistics reduce shipping and handling expenses, contributing to overall cost competitiveness.

Regulatory and Sustainability Hurdles

The growing emphasis on environmental regulations and the demand for sustainable building materials act as a significant barrier to new entrants. Companies looking to enter the market must make substantial investments in eco-friendly manufacturing and materials to comply with evolving standards and consumer preferences. Interface itself has ambitious targets, aiming for science-based carbon reduction by 2030 and achieving carbon negativity by 2040, showcasing the high bar for sustainability.

These stringent environmental requirements mean that potential new competitors face considerable upfront costs and a steep learning curve in developing and implementing sustainable practices. For instance, achieving certifications for eco-friendly products, a key differentiator for Interface, requires significant time and resources, deterring less committed players. The capital expenditure needed for compliant production facilities and supply chains is a major deterrent.

- High Capital Investment: New entrants require substantial upfront capital for eco-friendly production facilities and sustainable material sourcing.

- Regulatory Compliance: Meeting increasingly strict environmental regulations necessitates ongoing investment and expertise.

- Consumer Demand for Sustainability: Growing consumer preference for green products forces new companies to prioritize sustainability from inception.

- Interface's Sustainability Leadership: Interface's established leadership in sustainability, with goals like carbon negativity by 2040, sets a high benchmark for new market participants.

The threat of new entrants in the flooring industry is moderate, primarily due to high capital requirements for manufacturing and technology adoption. Interface's significant investments in automation, as seen in its 2024 operations, create a substantial cost barrier. Furthermore, established brand loyalty and extensive distribution networks, bolstered by Interface's Q1 2024 sales initiatives, make market entry challenging for newcomers. The need to meet stringent environmental regulations and invest in sustainable practices also elevates the barriers to entry.

| Barrier Type | Description | Interface's Position | Impact on New Entrants |

|---|---|---|---|

| Capital Requirements | High cost of advanced manufacturing and R&D. | Significant investment in automation and robotics. | Deters smaller, less-capitalized entrants. |

| Brand Loyalty & Reputation | Decades of quality, design, and sustainability focus. | Strong customer trust, especially in commercial markets. | Difficult to replicate established brand recognition. |

| Distribution Channels | Established relationships with industry professionals. | Strong network with architects, designers, and contractors. | Requires substantial time and investment to build. |

| Economies of Scale | Lower per-unit costs due to high production volume. | Net sales of $1,316 million in FY 2024. | Price disadvantage for new, lower-volume competitors. |

| Environmental Regulations | Need for eco-friendly manufacturing and materials. | Commitment to carbon negativity by 2040. | High upfront costs and learning curve for compliance. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, integrating information from company annual reports, industry expert interviews, and publicly available market research to provide a comprehensive view of competitive pressures.