Interface Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Interface Bundle

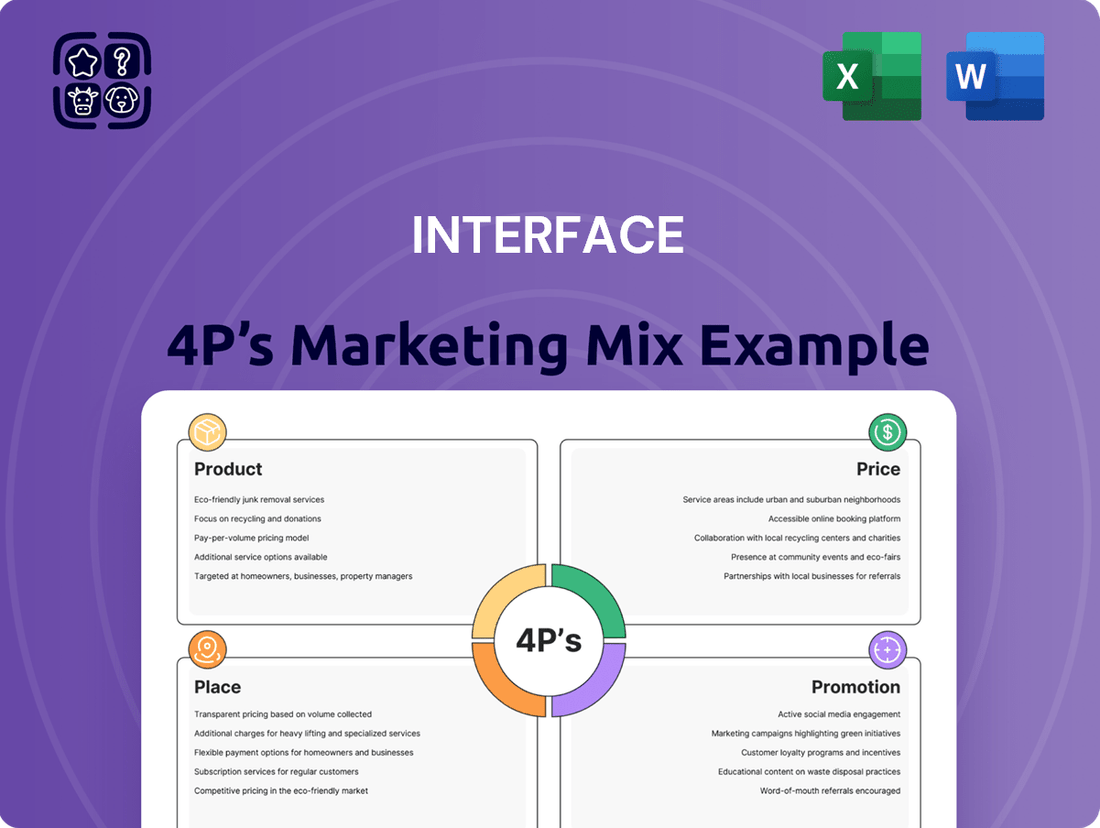

Interface's marketing success is built on a robust 4Ps strategy, meticulously aligning its innovative product offerings with strategic pricing, effective distribution, and impactful promotion. Discover how their commitment to sustainability influences every facet of their marketing mix.

Dive deeper into Interface's product innovation, pricing strategies, distribution channels, and promotional campaigns with our comprehensive 4Ps Marketing Mix Analysis. This ready-to-use report provides actionable insights, making it ideal for professionals and students alike.

Unlock the secrets behind Interface's market leadership by exploring their complete 4Ps Marketing Mix. Get instant access to a professionally written, editable analysis that breaks down their product, price, place, and promotion strategies for your learning and business planning needs.

Product

Interface's product strategy centers on its sustainable flooring solutions, primarily modular carpet tiles, luxury vinyl tile (LVT), and nora® rubber flooring. These offerings are specifically designed for commercial and institutional clients. In 2024, Interface continued to expand its portfolio, with a significant portion of its revenue derived from these eco-conscious materials, aligning with growing market demand for green building products.

Interface's dedication to innovation is powerfully demonstrated through its materials and design strategies, directly impacting its environmental footprint. Since 2019, significant reductions in carbon footprint have been achieved across product lines: carpet tile saw a 35% decrease, LVT a 46% decrease, and nora® rubber a 21% decrease. This commitment extends to pioneering new materials, with a carbon-negative rubber flooring prototype unveiled in early 2025 and the integration of captured carbon into carpet tile production.

The company consistently refreshes its offerings with new collections that align with contemporary design aesthetics. Recent examples include the Dressed Lines™ carpet tile and Lasting Impressions™ LVT collections, showcasing Interface's responsiveness to evolving market trends and consumer preferences in interior design.

Interface's primary focus for its innovative flooring solutions lies squarely within the commercial and institutional markets. This strategic concentration allows them to cater specifically to the demanding needs of diverse environments such as corporate offices, healthcare settings, educational institutions, and retail spaces.

This targeted approach is validated by Interface's strong relationships with key industry professionals. Architects, designers, facility managers, and contractors worldwide rely on Interface products, underscoring the company's established credibility and trusted brand reputation within these critical professional segments.

For instance, Interface reported that in the first quarter of 2024, their commercial segment continued to be a significant driver of revenue, with strong demand observed in the North American and European markets for sustainable and design-forward flooring options.

Performance and Aesthetics

Interface focuses on creating flooring that excels in both how it performs and how it looks. Their products are engineered not just for durability but also to enhance the environments they're installed in, promoting occupant well-being and productivity. This dual focus on performance and aesthetics is key to meeting the demanding requirements of commercial spaces.

In 2024, Interface continued to highlight how its flooring solutions contribute to a healthier and more inspiring built environment. For instance, their commitment to sustainable materials and manufacturing processes, which began decades ago, remains a core element of their product design. This approach ensures that their high-performance flooring also aligns with corporate environmental, social, and governance (ESG) goals, a growing priority for their client base.

Interface’s product strategy emphasizes:

- Enhanced User Experience: Flooring designed to improve acoustics, comfort, and overall atmosphere in commercial settings.

- Long-Term Value: Products built for resilience and longevity, reducing the need for frequent replacements and associated costs.

- Design Versatility: A wide range of styles, textures, and colors to support diverse interior design visions and brand identities.

- Sustainability Integration: Performance that doesn't compromise environmental responsibility, with many products featuring recycled content and low VOC emissions.

Integrated Portfolio and Brands

Interface offers a comprehensive and integrated product portfolio designed to meet diverse market needs. This includes their signature Interface carpet tile, durable nora rubber flooring, and the premium FLOR area rugs, showcasing a broad spectrum of flooring solutions.

This diversified approach allows Interface to serve a wider array of commercial sectors, from healthcare and education to corporate and hospitality, by addressing specific design aesthetics and performance demands. For instance, nora rubber flooring is particularly valued in high-traffic healthcare environments for its hygiene and resilience.

The company's 'One Interface' strategy is central to unifying these distinct brands. This initiative aims to streamline operations, enhance customer experience, and drive efficiencies by creating a consistent brand presence and service model across all product lines. This integration is key to their market positioning as a holistic flooring provider.

Interface reported net sales of $1.3 billion for the fiscal year 2023, reflecting the strength of their integrated product offering and market reach. Their commitment to sustainability, a core brand pillar, further enhances the appeal of their diverse portfolio to environmentally conscious buyers.

- Integrated Product Lines: Interface® carpet tile, nora® rubber flooring, and FLOR® premium area rugs.

- Market Reach: Caters to diverse commercial applications including healthcare, education, corporate, and hospitality.

- Strategic Initiative: The 'One Interface' strategy focuses on brand consistency and operational efficiencies.

- Financial Performance: Achieved net sales of $1.3 billion in fiscal year 2023.

Interface's product strategy revolves around providing sustainable and high-performance flooring solutions, primarily carpet tiles, luxury vinyl tile (LVT), and nora® rubber flooring, for commercial and institutional markets. The company's commitment to environmental responsibility is evident in its carbon footprint reductions, with carpet tile seeing a 35% decrease since 2019. New collections like Dressed Lines™ and Lasting Impressions™ demonstrate responsiveness to design trends, ensuring products offer both aesthetic appeal and long-term value.

| Product Category | Key Features | Environmental Impact (vs. 2019) | Recent Collections |

|---|---|---|---|

| Carpet Tile | Modular, sustainable materials, design versatility, improved acoustics | 35% carbon footprint reduction | Dressed Lines™ |

| Luxury Vinyl Tile (LVT) | Durable, design-forward, suitable for high-traffic areas | 46% carbon footprint reduction | Lasting Impressions™ |

| nora® Rubber Flooring | Hygienic, resilient, high-traffic performance | 21% carbon footprint reduction | Carbon-negative prototype (2025) |

What is included in the product

This analysis provides a comprehensive examination of Interface's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights into their market positioning.

It's designed for professionals seeking a detailed understanding of Interface's approach, grounded in real-world practices and competitive dynamics.

Streamlines complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for clearer decision-making.

Provides a concise framework to identify and address marketing gaps, relieving the stress of incomplete or unfocused campaigns.

Place

Interface, as a global manufacturer, leverages an extensive distribution network to serve its commercial and institutional clients across the world. This widespread reach ensures their innovative flooring solutions are accessible in diverse international markets.

The company's strategy balances a global manufacturing footprint with a keen focus on local market needs, allowing for tailored solutions and efficient delivery. This approach is vital for supporting the varied requirements of international projects and a broad client base.

In 2023, Interface reported net sales of $1.3 billion, underscoring the scale of its global operations and the effectiveness of its distribution channels in reaching a significant market share.

Interface's direct sales and commercial channels are crucial for reaching its target markets in the commercial and institutional sectors. This approach involves dedicated sales teams engaging directly with key specifiers like architects, designers, contractors, and facility managers. This direct engagement is vital for getting Interface products specified in large-scale construction and renovation projects.

The company's strategic focus on enhancing commercial productivity, as seen in its 'One Interface' strategy, directly impacts these channels. By combining selling teams and optimizing their efforts, Interface aims to improve efficiency and effectiveness in reaching and serving its customer base. This integration allows for a more cohesive and powerful approach to market penetration.

In 2023, Interface reported net sales of $1.3 billion, with a significant portion attributed to its commercial business. The company's ongoing investment in its sales force and channel development underscores the importance of direct relationships in securing major contracts and maintaining market leadership in the flooring industry.

Strategic partnerships are crucial for expanding market reach and distribution. The company's past collaboration with the Bravo Network for the 'Main Street' sector highlights a proactive approach to leveraging established networks. This willingness to explore innovative distribution channels is key to increasing market share and accessibility.

Inventory Management and Logistics Efficiency

Efficient inventory management and logistics are paramount for Interface, especially given the project-based nature of its commercial flooring business. Ensuring product availability at the right time and place directly impacts project timelines and customer satisfaction. Interface's strategic investments in supply chain optimization, including automation and robotics in its manufacturing facilities, highlight a dedication to streamlining distribution and reducing lead times.

Interface's commitment to logistics efficiency is further evidenced by its focus on supply chain visibility and resilience. For instance, in 2024, the company continued to leverage advanced analytics to forecast demand more accurately, aiming to minimize stockouts and overstock situations. This proactive approach helps manage the complexities of global sourcing and delivery, crucial for meeting diverse client needs across various geographic locations.

- Supply Chain Investment: Interface has consistently invested in modernizing its manufacturing and distribution centers, incorporating automation to speed up order fulfillment and improve accuracy.

- Inventory Optimization: Through data-driven forecasting and management systems, Interface strives to maintain optimal inventory levels, reducing carrying costs while ensuring product availability for key commercial projects.

- Logistics Network: The company manages a complex logistics network, aiming for timely and cost-effective delivery of flooring solutions to commercial clients worldwide, a critical component of its service offering.

- Sustainability in Logistics: Interface also integrates sustainable practices into its logistics, seeking to reduce the environmental impact of transportation and warehousing operations.

Online Presence and Digital Resources

Interface leverages its corporate website and dedicated investor relations portal as key digital assets. These platforms are crucial for disseminating information, showcasing their product lines, and generating leads, even though their primary focus is B2B.

These digital resources directly bolster their sales initiatives by offering potential clients in-depth product details, compelling case studies, and comprehensive sustainability reports. For instance, by early 2025, Interface's website prominently features its latest modular carpet and LVT collections, alongside detailed environmental product declarations (EPDs) for its flooring solutions.

- Website Functionality: Serves as a central hub for product information, company news, and sustainability initiatives.

- Investor Relations: Provides financial reports, stock performance data, and corporate governance information, crucial for stakeholders.

- Lead Generation: Features contact forms, product inquiry options, and downloadable resources to capture potential client interest.

- Content Marketing: Showcases case studies and project highlights, demonstrating the real-world application and impact of Interface products.

Place, within Interface's marketing mix, is defined by its extensive global distribution network and direct sales engagement. This ensures their commercial and institutional flooring solutions are accessible worldwide, supported by efficient logistics and a focus on customer relationships.

Interface's distribution strategy combines global reach with local responsiveness, a critical factor in serving diverse international markets effectively. This approach is vital for meeting the varied demands of large-scale projects and a broad client base.

The company's 2023 net sales of $1.3 billion highlight the success of its widespread operations and the effectiveness of its distribution channels in capturing market share.

Interface's direct sales teams engage with architects, designers, and facility managers, crucial for securing specifications in major construction projects.

| Distribution Channel | Key Activities | Target Audience | 2023 Performance Indicator |

|---|---|---|---|

| Global Distribution Network | Warehousing, Transportation, Partnering | Commercial & Institutional Clients Worldwide | Net Sales: $1.3 Billion (overall) |

| Direct Sales Force | Client Engagement, Specification Support, Relationship Management | Architects, Designers, Contractors, Facility Managers | Continued Investment in Sales Force |

| Digital Platforms (Website) | Product Showcasing, Lead Generation, Information Dissemination | Potential Clients, Specifiers, Stakeholders | Prominent Display of New Collections (Early 2025) |

Full Version Awaits

Interface 4P's Marketing Mix Analysis

The preview you see here is the exact same, fully completed Interface 4P's Marketing Mix Analysis document that you will receive instantly after purchase. There are no hidden surprises or missing sections. You are viewing the final, ready-to-use version, ensuring you know exactly what you're getting. This ensures a seamless and transparent purchasing experience.

Promotion

Interface's promotion strategy heavily emphasizes its sustainability leadership, particularly its commitment to becoming carbon negative by 2040. This bold goal, achieved without relying on offsets, is a cornerstone of their brand, communicated through annual Impact Reports and various marketing channels.

The company actively highlights initiatives like reducing its carbon footprint and implementing circular economy practices. For instance, their 2023 Impact Report detailed a 93% reduction in greenhouse gas emissions intensity since 1996, showcasing tangible progress toward their ambitious targets.

Interface consistently highlights its commitment to design and innovation, a key element in its marketing strategy. The company frequently launches new flooring collections, keeping its product line fresh and aligned with evolving market tastes. For instance, Interface's 2024/2025 product development pipeline continues to focus on sustainable materials and biophilic design principles, reflecting current industry trends.

This emphasis on cutting-edge design is communicated through various channels, including targeted press releases and participation in prominent industry events. Interface aims to capture the attention of architects, designers, and facility managers who value both the visual appeal and the practical performance of commercial flooring. Their design trend indices, often released annually, provide valuable insights into aesthetic directions, further solidifying their position as an innovator.

Interface's marketing and sales efforts are sharply focused on a business-to-business (B2B) clientele, specifically targeting the commercial and institutional markets. This strategic direction means direct engagement with crucial influencers and decision-makers like architects, interior designers, contractors, and facility managers who specify and procure flooring solutions.

The company's 'One Interface' strategy is a key component of this B2B approach. It leverages combined selling teams to boost commercial productivity, aiming to streamline the sales process and offer a more integrated customer experience. This unified team structure is designed to better serve the complex needs of large-scale commercial projects.

Public Relations and Industry Recognition

Interface actively uses public relations to showcase its accomplishments and strengthen its brand identity. This involves publishing detailed impact reports and actively participating in industry awards, demonstrating their commitment to excellence and innovation.

The company's dedication to sustainability has garnered significant recognition. Notably, Interface was honored with the Reuters Sustainability Award for Net Zero Leadership in 2024, a testament to their pioneering efforts in environmental responsibility.

These efforts in public relations and industry recognition are crucial for building trust and enhancing Interface's reputation. Key highlights include:

- Impact Reporting: Regularly publishing comprehensive reports detailing their social and environmental performance.

- Industry Awards: Seeking and winning accolades that validate their leadership and innovation.

- Sustainability Recognition: Achieving awards like the 2024 Reuters Sustainability Award for Net Zero Leadership.

- Brand Credibility: Leveraging these achievements to foster a strong and trusted brand image within the market.

Digital Content and Thought Leadership

Interface leverages its digital platforms, including its website and blog, to disseminate valuable content and cultivate thought leadership in sustainability and commercial design. This strategy aims to educate and engage its audience, offering resources that aid in decision-making.

The company's commitment to thought leadership is evident in its publications, such as Impact Reports and the Design Trend Index. These resources underscore Interface's expertise and commitment to environmental responsibility, a key differentiator in the market.

Interface's digital content strategy directly supports its marketing objectives by providing educational materials and insights. For instance, in 2023, their website traffic saw a significant increase, with a particular focus on content related to sustainable materials and circular economy principles, reflecting a growing customer interest in these areas.

- Website and Blog: Serves as a hub for company news, product information, and industry insights.

- Impact Reports: Detail Interface's progress and commitment to sustainability goals, often citing specific environmental metrics.

- Design Trend Index: Offers valuable research and analysis on emerging trends in commercial interior design.

- Educational Resources: Provides white papers, case studies, and articles that position Interface as a knowledgeable partner.

Interface's promotion strategy centers on its sustainability leadership, particularly its carbon negative goal by 2040, communicated through annual Impact Reports and marketing. The company highlights tangible progress, such as a 93% reduction in greenhouse gas emissions intensity since 1996 as noted in their 2023 Impact Report.

Their B2B focus targets architects and designers, emphasizing innovation and design through press releases and industry events, with 2024/2025 product development prioritizing sustainable materials and biophilic design.

Public relations efforts, including winning the 2024 Reuters Sustainability Award for Net Zero Leadership, bolster brand credibility and trust. Digital platforms like their website and blog serve as key channels for thought leadership, showcasing educational content on sustainability and design trends, with website traffic increasing significantly in 2023 for sustainability-related content.

| Promotion Focus | Key Initiatives/Channels | Supporting Data/Recognition |

|---|---|---|

| Sustainability Leadership | Carbon Negative by 2040 Goal, Impact Reports | 93% GHG Emissions Intensity Reduction (since 1996) in 2023 Impact Report |

| Design & Innovation | New Product Collections, Design Trend Index | 2024/2025 Pipeline: Sustainable Materials, Biophilic Design |

| B2B Engagement | Direct Sales, 'One Interface' Strategy | Targeting Architects, Designers, Facility Managers |

| Public Relations & Recognition | Awards, Media Outreach | 2024 Reuters Sustainability Award for Net Zero Leadership |

| Digital Content & Thought Leadership | Website, Blog, Educational Resources | Increased website traffic in 2023 for sustainability content |

Price

Interface's value-based pricing strategy likely centers on the substantial benefits its flooring solutions offer to commercial and institutional clients. This includes enhanced aesthetics, superior durability, and significant contributions to sustainability goals, all of which translate into long-term cost savings and improved brand image for customers.

While Interface does not publicly share specific price points, their market positioning indicates a premium strategy. For instance, their commitment to carbon-neutral products, like the "Climate Take Back" initiative, allows them to command higher prices by aligning with corporate environmental, social, and governance (ESG) objectives, a key value driver for many businesses in 2024 and beyond.

The company’s focus on innovation, such as their modular carpet tiles and biophilic design elements, further supports a value-based approach. These features provide flexibility in design and installation, potentially reducing project timelines and labor costs for clients, thereby increasing the overall perceived value of Interface products.

Interface operates within a fiercely competitive floorcovering industry. To maintain market appeal and profitability, their pricing must carefully balance competitor price points with consumer demand, ensuring their products are both attractive and accessible. For instance, in 2023, the global commercial flooring market was valued at approximately $150 billion, with intense price pressure across various segments.

Interface has strategically introduced more budget-friendly options in specific product categories. This move aims to broaden their customer base by capturing segments of the market that prioritize cost-effectiveness, thereby expanding their overall addressable market share. This strategy is crucial in a market where price sensitivity can significantly influence purchasing decisions, especially for large-scale commercial projects.

Interface has a history of adjusting prices to reflect changes in input costs, including raw materials, transportation, labor, and energy. For example, in late 2021, the company implemented a price increase of up to 10% on its commercial flooring products due to rising expenses.

Beyond price adjustments, Interface focuses on enhancing profit margins through operational efficiencies and improved supply chain management. These strategies aim to mitigate the impact of cost fluctuations and maintain competitive pricing.

Pricing for Different Product Categories

Interface's pricing strategy is tailored to its broad product portfolio, which encompasses carpet tiles, luxury vinyl tile (LVT), and rubber flooring. These categories naturally command different price points due to variations in raw material costs, intricate manufacturing techniques, design sophistication, and the specific market segments they target. For instance, high-performance carpet tiles with advanced sustainability features might be priced higher than standard LVT options.

The company's approach of offering differentiated products is a key driver in its pricing. This allows Interface to cater to a wider customer base and capture value across various market tiers. For example, their modular carpet tiles often represent a premium offering compared to broadloom carpet, reflecting the flexibility and design possibilities they provide. In 2023, Interface reported net sales of $1.3 billion, with pricing strategies directly influencing revenue generation across these diverse product lines.

Interface's pricing also reflects its commitment to sustainability and innovation. Products incorporating recycled content or advanced manufacturing processes may carry a premium, aligning with the growing demand for eco-conscious building materials. This strategy aims to balance competitive market positioning with the value proposition of superior performance and environmental responsibility.

- Carpet Tiles: Pricing varies based on material (e.g., nylon, polyester), face weight, backing technology, and design complexity.

- Luxury Vinyl Tile (LVT): Cost is influenced by wear layer thickness, design realism, and installation method (e.g., click-lock vs. glue-down).

- Rubber Flooring: Prices are affected by the type of rubber used (natural vs. synthetic), thickness, and any specialized features like acoustic dampening.

- Market Positioning: Premium lines with enhanced durability or unique aesthetic qualities command higher prices, supporting Interface's goal of market expansion.

Impact of 'One Interface' Strategy on Pricing

Interface's 'One Interface' strategy, designed for global consistency and streamlined operations, is anticipated to bolster profit margins. This efficiency drive could allow for more competitive pricing while safeguarding profitability.

By optimizing its supply chain and simplifying business processes, Interface can achieve better cost control. This enhanced cost management provides flexibility in pricing decisions, potentially enabling them to offer more attractive prices to customers.

- Global Alignment: The 'One Interface' strategy fosters a unified approach across all markets.

- Operational Efficiencies: Streamlining operations leads to reduced overhead and improved productivity.

- Cost Optimization: Better supply chain management directly impacts the cost of goods sold.

- Pricing Flexibility: Cost savings can translate into more competitive pricing strategies.

Interface's pricing strategy is deeply rooted in the value it delivers, focusing on long-term benefits like sustainability and design flexibility, which allows for premium positioning. While specific prices aren't public, their commitment to carbon neutrality and innovative products like modular tiles supports higher price points, aligning with ESG demands prevalent in 2024. The company balances this premium approach by offering more budget-friendly options to capture a wider market, a crucial tactic in the competitive global commercial flooring market, valued at approximately $150 billion in 2023.

Interface's pricing reflects its diverse product range, with carpet tiles, LVT, and rubber flooring each having distinct price points based on materials, manufacturing, and target markets. For instance, high-performance, eco-friendly carpet tiles typically command a higher price than standard LVT. This differentiation strategy, where modular carpet tiles often represent a premium over broadloom, contributed to Interface's net sales of $1.3 billion in 2023. Their 'One Interface' strategy aims to improve profit margins through operational efficiencies, potentially allowing for more competitive pricing while maintaining profitability.

| Product Category | Key Pricing Factors | Market Context (2023/2024) |

|---|---|---|

| Carpet Tiles | Material, face weight, backing, design complexity | Premium offerings linked to sustainability and design innovation |

| Luxury Vinyl Tile (LVT) | Wear layer thickness, design realism, installation method | Competitive segment with options ranging from budget-friendly to premium |

| Rubber Flooring | Type of rubber, thickness, specialized features | Pricing influenced by raw material costs and performance characteristics |

| Overall Strategy | Value-based, premium positioning with selective budget options | Global commercial flooring market valued at ~$150 billion, with price sensitivity a key consideration |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, financial disclosures, and direct consumer interaction points. We meticulously gather information from brand websites, product pages, and publicly available sales data to ensure accuracy.