InterDigital PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

InterDigital Bundle

Unlock the critical external factors influencing InterDigital's trajectory. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental forces shaping the company's competitive landscape. Gain a strategic advantage by understanding these dynamics. Purchase the full analysis now for actionable insights to inform your investment or business strategy.

Political factors

Government intellectual property (IP) policies are a critical factor for InterDigital, as their business hinges on patent licensing. Changes in how governments protect and enforce patents directly impact the value and revenue potential of InterDigital's extensive patent portfolio. For instance, a strengthening of patent rights globally, as seen in ongoing discussions at the World Intellectual Property Organization (WIPO) aiming to harmonize IP standards, could bolster InterDigital's licensing agreements.

Conversely, shifts towards more restrictive patentability criteria or increased scrutiny of patent assertion entities could pose challenges. The ongoing global dialogue around fair, reasonable, and non-discriminatory (FRAND) licensing terms, particularly within the context of 5G and future wireless technologies, significantly shapes InterDigital's negotiation leverage. For example, decisions by bodies like the European Commission on FRAND compliance can set precedents affecting licensing revenues worldwide.

Geopolitical tensions and ongoing trade disputes, particularly between major economic powers like the United States and China, directly impact the global supply chains for consumer electronics. These disruptions can lead to increased costs and delays for manufacturers who license InterDigital's technologies, potentially affecting their production volumes and, consequently, InterDigital's royalty revenues.

For instance, the ongoing trade friction has led to shifts in manufacturing locations and sourcing strategies within the electronics sector, creating uncertainty for licensing partners. This volatility can reduce the predictability of device sales that underpin InterDigital's revenue, highlighting the critical need for stable international trade environments.

Regulatory bodies globally are increasing their scrutiny of patent assertion practices and licensing terms, presenting a significant challenge for companies like InterDigital. This trend could lead to new legislation or investigations focused on curbing perceived 'patent abuse' or enforcing fairer licensing, potentially resulting in a more restrictive operating environment or reduced royalty rates for patent holders.

National security and technology control

Government policies focused on national security and controlling critical technologies, like advanced wireless standards such as 5G and its successors, directly shape InterDigital's R&D priorities and where its innovations can be deployed. For instance, in 2024, many nations intensified scrutiny over supply chains for telecommunications equipment, impacting how companies like InterDigital can license their intellectual property.

Export controls and restrictions on technology transfer can significantly limit the global reach of InterDigital's patented technologies and the potential for lucrative licensing deals in specific geopolitical areas. This push for domestic technological self-sufficiency, a trend observed throughout 2024 and projected into 2025, means InterDigital must navigate differing national regulations.

- National Security Focus: Governments increasingly view advanced wireless technology as a national security asset, influencing R&D direction.

- Technology Transfer Restrictions: Export controls can limit InterDigital's market access and licensing opportunities in certain countries.

- Domestic Independence Drive: Policies favoring local technology development may create both challenges and opportunities for InterDigital's global licensing strategy.

Political stability in key markets

Political stability in key markets is a crucial factor for InterDigital. For instance, geopolitical tensions in regions like Eastern Europe or the Middle East, which are significant manufacturing or consumer hubs for electronics, can directly impact supply chains and consumer spending. A 2024 report by the World Bank highlighted that increased political instability in developing economies can lead to a 1-2% reduction in GDP growth, potentially affecting the sales volume of licensed devices.

Significant policy shifts, such as changes in trade agreements or intellectual property laws in major economies like the United States or China, can also create uncertainty. For example, if a country were to implement stricter regulations on technology imports or alter its stance on patent enforcement, it could indirectly affect InterDigital's licensing revenue streams. The International Monetary Fund's 2025 outlook suggests that protectionist trade policies could shave 0.5% off global trade growth, impacting device sales.

- Impact on Licensees: Political instability can disrupt the operations of InterDigital's licensees, affecting their ability to manufacture and sell devices.

- Economic Downturns: Unstable political environments often correlate with economic downturns, reducing consumer demand for electronic products.

- Regulatory Changes: Shifts in government policies can alter the regulatory landscape for technology companies, potentially impacting licensing agreements.

- Global Stability Benefit: A stable global political climate generally fosters predictable market conditions, which is beneficial for InterDigital's recurring licensing revenue model.

Governments' increasing focus on national security significantly influences the direction of advanced wireless technology R&D, impacting InterDigital's innovation pipeline. For instance, in 2024, heightened scrutiny of telecommunications supply chains by various nations directly affected how companies could license InterDigital's intellectual property.

Export controls and restrictions on technology transfer limit InterDigital's global market access and licensing opportunities, a trend amplified by the 2024-2025 drive for domestic technological self-sufficiency. This necessitates navigating diverse national regulations for its patent portfolio.

Political instability in key markets can disrupt InterDigital's licensees' operations and consumer demand for electronic products, as noted by a 2024 World Bank report indicating that political instability can reduce GDP growth by 1-2% in developing economies. Policy shifts in major economies, such as altered stances on patent enforcement, can also create revenue uncertainty.

| Political Factor | Impact on InterDigital | 2024-2025 Relevance/Data |

| National Security Focus on Wireless Tech | Shapes R&D priorities and deployment of innovations. | Intensified scrutiny of telecom supply chains in 2024. |

| Technology Transfer Restrictions | Limits market access and licensing revenue in specific regions. | Drive for domestic tech self-sufficiency impacting global reach. |

| Geopolitical Tensions & Trade Disputes | Disrupts supply chains for licensees, affecting device sales. | Potential 0.5% reduction in global trade growth from protectionism (IMF 2025 outlook). |

| Regulatory Scrutiny of Patent Practices | Potential for new legislation or investigations affecting licensing terms. | Increased focus on patent assertion entities and FRAND compliance. |

What is included in the product

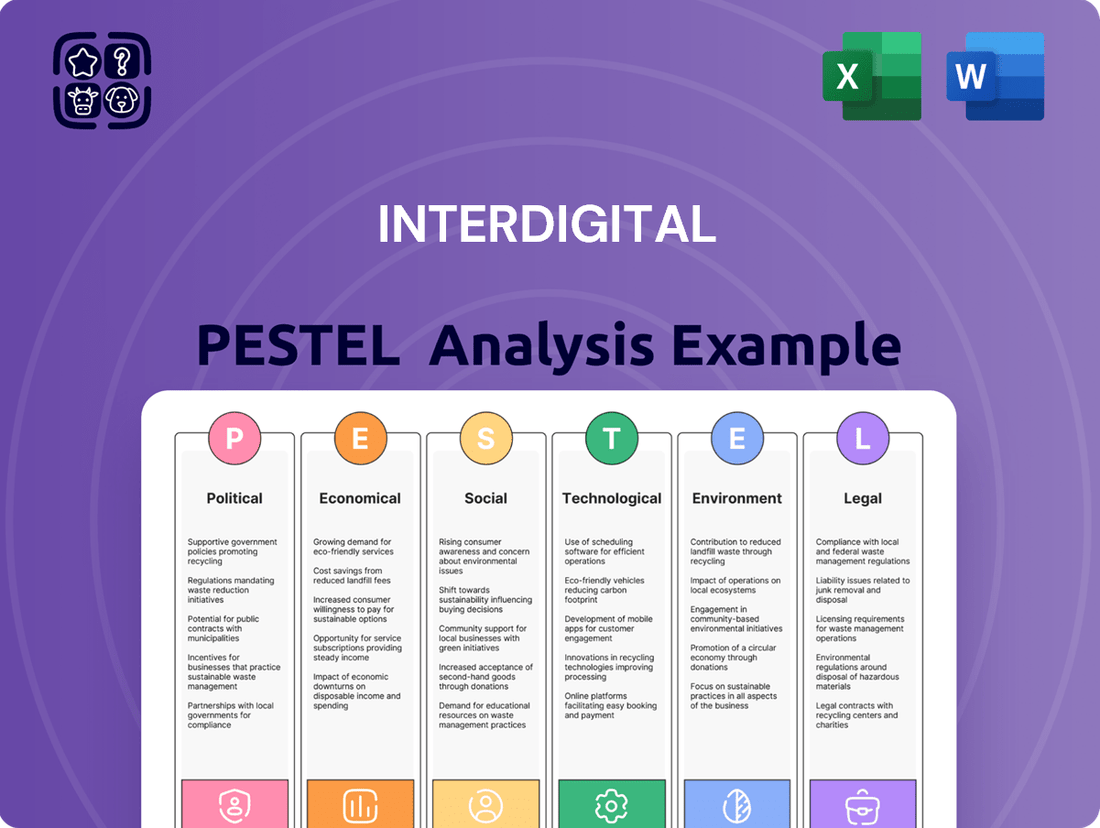

This InterDigital PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic direction.

It provides a comprehensive understanding of the external landscape, highlighting key trends and potential impacts for informed decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, distilling complex external factors into actionable insights.

Economic factors

Global economic growth significantly impacts InterDigital's revenue streams. When the world economy is robust, consumers tend to spend more on electronic devices like smartphones and tablets, which directly boosts InterDigital's royalty income from licensed technologies.

For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight increase from 3.1% in 2023, indicating a generally supportive environment for consumer electronics sales. However, economic downturns can curb this spending, leading to a decrease in licensing fees for InterDigital.

High inflation, such as the 3.3% year-over-year increase in the US Consumer Price Index as of July 2024, directly elevates InterDigital's operational expenditures, especially in R&D and the legal costs tied to patent protection.

Furthermore, the Federal Reserve's maintained interest rates, hovering around 5.25%-5.50% in mid-2024, increase InterDigital’s potential debt servicing expenses and can constrain licensees' capacity for investing in new technologies, thereby potentially slowing market adoption.

Consumer spending power is a significant economic factor for InterDigital. Changes in how much disposable income consumers have directly influence the demand for electronic devices that use InterDigital's patented technologies. For instance, if consumers feel financially secure, they are more likely to purchase new smartphones, tablets, and other connected devices, which benefits InterDigital's licensees and, consequently, InterDigital itself through royalties.

Economic downturns or periods of high inflation can erode consumer purchasing power, leading to reduced spending on discretionary items like new electronics. This directly impacts the sales volumes of InterDigital's licensees. For example, a slowdown in consumer electronics sales in late 2023 and early 2024, partly due to persistent inflation and economic uncertainty in many regions, could translate into a smaller royalty base for InterDigital.

The health of consumer spending is therefore a critical indicator for InterDigital's revenue streams. As of early 2024, while inflation has shown some signs of moderating in key markets like the US, consumer confidence remains a key variable. Continued strength in consumer demand for 5G-enabled devices and other connected technologies is essential for InterDigital's ongoing success.

Currency exchange rate fluctuations

Currency exchange rate fluctuations present a significant economic factor for InterDigital, a company with a global licensing model. As InterDigital receives royalty payments in numerous currencies, the conversion of these earnings back into its reporting currency, the US Dollar, is directly affected by exchange rate volatility. This creates a constant foreign exchange (FX) risk that can impact its reported financial performance.

A stronger US Dollar, for instance, can diminish the reported value of royalty income earned in foreign currencies. Conversely, a weaker dollar can boost the reported value of these same foreign-denominated revenues. For example, if InterDigital's revenue from Europe declines due to a strengthening dollar against the Euro, this directly reduces the USD equivalent of those payments. This dynamic necessitates careful financial management and hedging strategies to mitigate potential negative impacts on profitability.

- Impact on Revenue: Fluctuations in exchange rates directly affect the US Dollar value of InterDigital's royalty income earned in foreign currencies.

- FX Risk: A strengthening USD can decrease the reported value of foreign revenues, while a weakening USD can increase it, creating inherent FX risk.

- Hedging Strategies: Companies like InterDigital often employ financial instruments to hedge against adverse currency movements, aiming to stabilize reported earnings.

R&D investment cycles of licensees

The R&D investment cycles of InterDigital's licensees are a critical factor influencing demand for its patent portfolio. When companies like Samsung, Apple, and Xiaomi are actively investing in developing new 5G, Wi-Fi 7, and advanced video codecs, their need for foundational wireless and video technology licenses increases. This heightened investment directly translates into greater licensing opportunities for InterDigital, as these advancements often rely on patented innovations.

For instance, the ongoing rollout and evolution of 5G Advanced and the development of Wi-Fi 7 technologies are driving significant R&D spending among mobile device manufacturers and network equipment providers. InterDigital's licensees are expected to continue investing billions in these areas throughout 2024 and 2025. A robust R&D environment fuels the demand for InterDigital's licensing, directly impacting its revenue streams. Conversely, a significant downturn in industry-wide R&D spending could present a headwind for future licensing agreements.

Key R&D investment areas for InterDigital's licensees include:

- 5G Advanced and 6G research: Companies are investing in features like enhanced mobile broadband, ultra-reliable low-latency communications, and massive machine-type communications.

- Wi-Fi 7 deployment: The industry is actively developing and integrating Wi-Fi 7 capabilities for faster speeds and lower latency in consumer electronics and enterprise solutions.

- Video compression and streaming technologies: Ongoing efforts to improve video quality and efficiency for streaming services and broadcast applications.

- Artificial Intelligence integration: R&D into how AI can be applied to enhance wireless network performance and user experience.

InterDigital's revenue is closely tied to global economic health, with robust growth generally leading to increased consumer spending on electronic devices, thereby boosting royalty income. The IMF's projection of 3.2% global growth for 2024 offers a generally positive outlook for the consumer electronics market. Conversely, economic downturns can significantly reduce this spending, directly impacting InterDigital's licensing fees.

High inflation, exemplified by the US CPI increase of 3.3% year-over-year in July 2024, escalates InterDigital's operational costs, particularly in research and development and patent enforcement. Additionally, interest rates maintained by central banks, such as the Federal Reserve's 5.25%-5.50% range in mid-2024, can increase debt servicing expenses for InterDigital and limit its licensees' investment capacity, potentially slowing market adoption of new technologies.

Currency exchange rate fluctuations pose a notable economic challenge for InterDigital's global licensing model. As royalties are received in various currencies, their conversion to US Dollars is subject to volatility, creating foreign exchange risk that can impact reported financial performance. For instance, a strengthening US Dollar can reduce the reported value of revenues earned in other currencies, necessitating careful financial management and hedging strategies.

Preview the Actual Deliverable

InterDigital PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of InterDigital.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting InterDigital.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into InterDigital's strategic landscape.

Sociological factors

Global digital adoption continues to surge, with an estimated 5.3 billion internet users worldwide by early 2024, representing over 66% of the global population. This widespread use of smartphones, streaming services, and the Internet of Things (IoT) directly fuels the demand for the advanced wireless and video technologies that InterDigital licenses.

The increasing reliance on seamless connectivity for daily life and business operations means more devices and applications will incorporate InterDigital's foundational patents. For instance, the global mobile data traffic is projected to grow significantly, reaching over 200 exabytes per month by 2025, highlighting the expanding market for efficient wireless communication solutions.

Consumers increasingly expect lightning-fast speeds, crystal-clear high-resolution video, and deeply engaging digital experiences. This drives device manufacturers to incorporate cutting-edge technologies, many of which are protected by InterDigital's patents.

This persistent consumer appetite for innovation directly translates into a steady demand for InterDigital's research and development efforts and its valuable patent portfolio. Companies licensing InterDigital's technology are motivated to integrate these advancements to satisfy ever-changing consumer tastes.

For example, the global 5G services market was valued at approximately $47.1 billion in 2023 and is projected to grow significantly, fueled by these consumer demands for enhanced mobile broadband and immersive applications. Staying ahead of these evolving preferences is absolutely critical for InterDigital's continued relevance and market position.

Societal concerns regarding data privacy and security are increasingly shaping the digital communication landscape. While InterDigital's core business revolves around technology patents rather than direct consumer data handling, these growing public anxieties can indirectly influence the market for connected devices and services that utilize their intellectual property.

For instance, a significant data breach affecting a major platform in 2024 could heighten consumer demand for more secure communication protocols. This, in turn, might spur innovation and patent filings in areas like end-to-end encryption and secure data transmission, potentially benefiting companies like InterDigital that hold relevant patents.

Regulatory bodies are also responding to these concerns. In late 2024, the EU continued to refine its data protection regulations, impacting how personal data is handled across connected devices. Such regulatory shifts, driven by societal pressure, can indirectly affect the adoption rates and design specifications of technologies covered by InterDigital's patent portfolio.

Demographic shifts and emerging markets

Demographic shifts, particularly population growth and rising digital literacy in emerging markets, offer substantial avenues for InterDigital. As these regions increasingly adopt mobile and video technologies, the pool of potential licensees and the sheer volume of devices sold are projected to expand. This growth directly translates into heightened demand for InterDigital's patented innovations.

For instance, the global population is expected to reach 8.5 billion by 2030, with a significant portion of this growth occurring in Africa and Asia. Digital literacy rates in these regions are also climbing rapidly; for example, internet penetration in Sub-Saharan Africa grew by over 15% between 2020 and 2023, reaching approximately 40%. This expanding digital footprint creates a fertile ground for InterDigital's technology licensing business.

- Growing Mobile Penetration: Emerging markets are experiencing a surge in mobile device adoption, with smartphone shipments in Asia-Pacific alone projected to exceed 500 million units annually in the coming years.

- Increasing Video Consumption: The demand for video streaming services and content is exploding globally, particularly in developing economies, driving the need for efficient video compression technologies.

- Younger Demographics: Many emerging markets have a youthful population, which is typically more receptive to adopting new digital technologies and services.

- Economic Development: As economies in these regions grow, disposable incomes rise, enabling more consumers to purchase advanced mobile devices and access digital services.

Work-from-home and remote collaboration trends

The enduring shift to remote and hybrid work models, a trend significantly accelerated in recent years, continues to fuel demand for sophisticated wireless communication and video conferencing technologies. InterDigital's extensive patent portfolio, crucial for enabling these seamless digital interactions, directly benefits from this ongoing societal adaptation. As of late 2024, studies indicate that over 30% of the global workforce operates in a hybrid or fully remote capacity, underscoring the sustained need for reliable connectivity.

This persistent reliance on digital collaboration tools means that the underlying infrastructure, much of which is patented by InterDigital, remains essential. The need for high-speed, low-latency data transmission to support video calls, cloud-based applications, and real-time collaboration is paramount. For instance, the growth in video conferencing traffic alone has seen substantial year-over-year increases, with projections suggesting continued expansion through 2025.

- Sustained Remote Work: Over 30% of the global workforce is expected to remain in hybrid or remote roles through 2025.

- Digital Collaboration Demand: Increased usage of video conferencing and cloud-based tools drives demand for advanced connectivity solutions.

- InterDigital's Role: Patents covering essential wireless and video technologies position the company to benefit from these evolving work patterns.

Societal attitudes towards technology and connectivity continue to evolve, with a growing emphasis on user experience and privacy. As of early 2024, over 5.3 billion people are internet users globally, highlighting the pervasive nature of digital interaction. This widespread adoption directly influences the demand for the advanced wireless and video technologies that InterDigital licenses, as consumers expect seamless and high-quality digital experiences.

Concerns about data privacy are also shaping the digital landscape, with regulatory bodies like the EU actively refining data protection laws in late 2024. While InterDigital focuses on patent licensing, shifts towards more secure communication protocols, potentially driven by these societal anxieties, could indirectly benefit companies holding relevant patents.

Demographic trends, including population growth and increasing digital literacy in emerging markets, present significant opportunities. For example, internet penetration in Sub-Saharan Africa grew by over 15% between 2020 and 2023, reaching approximately 40%, indicating a widening user base for technologies like those InterDigital patents.

The persistent shift towards remote and hybrid work models, with over 30% of the global workforce expected to remain in such arrangements through 2025, continues to drive demand for robust wireless and video communication solutions. This sustained need for reliable digital collaboration tools ensures the ongoing relevance of InterDigital's foundational patent portfolio.

Technological factors

The relentless advancement of wireless communication, from 5G to the nascent stages of 6G, forms the bedrock of InterDigital's operations. As a significant player in shaping these standards, InterDigital's extensive patent library in these domains guarantees continued licensing revenue from device makers integrating cutting-edge cellular tech.

InterDigital's commitment to 5G Advanced, a key part of the 5G evolution, is evident in their ongoing contributions to standardization bodies. This focus is crucial as the global 5G market was projected to reach over $600 billion by 2024, showcasing the immense licensing potential for companies like InterDigital.

Looking ahead, InterDigital is actively involved in research and development for 6G, which promises even faster speeds and lower latency. This forward-thinking approach ensures their continued relevance and revenue generation as the industry transitions to the next generation of wireless technology.

InterDigital's deep expertise in video technology, particularly advanced video coding standards like HEVC and emerging codecs, is a significant technological factor. As video traffic continues to surge, accounting for a substantial portion of global internet usage, the demand for efficient and high-quality video delivery solutions is paramount. For instance, by 2024, it's projected that video will make up over 82% of all consumer internet traffic globally, highlighting the critical role of InterDigital's innovations in this space.

The rapid expansion of connected device categories, including the Internet of Things (IoT), augmented reality (AR), and virtual reality (VR) hardware, presents significant opportunities for InterDigital. As of early 2024, the global IoT market alone is projected to reach over $1.1 trillion by 2026, indicating a massive installed base for wireless communication technologies.

InterDigital's core competencies in wireless and video compression are becoming even more critical as these new device types integrate increasingly sophisticated connectivity and media processing. For instance, the AR/VR market is expected to grow substantially, with IDC forecasting the worldwide market for AR and VR headsets to reach over 50 million units shipped in 2024, a year-over-year increase of 46.1%.

This diversification into emerging hardware segments allows InterDigital to broaden its patent licensing reach beyond traditional mobile devices. The demand for efficient, high-performance wireless solutions in smart infrastructure and wearable technology further solidifies the relevance and value of InterDigital's intellectual property portfolio.

Convergence of technologies (AI, IoT, Edge Computing)

The merging of wireless communication with artificial intelligence (AI), the Internet of Things (IoT), and edge computing creates significant avenues for InterDigital to embed its patent portfolio into emerging systems. As these technologies increasingly interlink, InterDigital's role in supplying foundational patents for their smooth functioning gains critical importance.

This technological convergence directly fuels the demand for InterDigital's cross-disciplinary innovations. For instance, the global IoT market was valued at approximately $1.1 trillion in 2023 and is projected to reach $2.5 trillion by 2030, showcasing the immense growth potential for companies providing enabling technologies.

- AI Integration: AI's role in optimizing wireless networks, from spectrum management to predictive maintenance, enhances the value of InterDigital's communication patents.

- IoT Expansion: The proliferation of connected devices necessitates robust communication standards, a core area for InterDigital's patent licensing.

- Edge Computing Growth: Processing data closer to the source requires efficient and intelligent wireless communication, aligning with InterDigital's expertise.

Pace of innovation and R&D investment

InterDigital's prosperity hinges on its commitment to research and development, ensuring it stays ahead in a rapidly evolving technological landscape. The company's ability to consistently innovate and secure new, vital patents is crucial for its future licensing revenue streams.

The relentless speed of technological advancement demands sustained investment in R&D. For instance, InterDigital reported approximately $300 million in R&D expenses for the fiscal year 2023, a significant allocation aimed at developing patents for upcoming industry standards and products.

Failing to keep pace with innovation risks diminishing InterDigital's competitive advantage and its ability to generate future licensing income. The market for wireless technologies, particularly 5G and the emerging 6G, is highly competitive, with companies like Qualcomm and Ericsson also making substantial R&D investments.

Key aspects of InterDigital's technological positioning include:

- Focus on 5G Advanced and 6G development: InterDigital is actively contributing to the standardization of these next-generation technologies, which will drive future licensing opportunities.

- Strategic patent portfolio growth: The company aims to build a robust portfolio of essential patents that will be critical for device manufacturers and network operators.

- Collaboration and partnerships: Engaging with industry players and research institutions helps InterDigital stay at the forefront of technological breakthroughs.

InterDigital's technological strength lies in its deep involvement with evolving wireless standards like 5G Advanced and the emerging 6G. Their extensive patent portfolio in these areas is crucial for licensing revenue as new devices integrate these advanced communication technologies. The global 5G market's projected growth, exceeding $600 billion by 2024, underscores the significant revenue potential.

The company's expertise in video compression, including standards like HEVC, is also a key technological asset. With video traffic expected to constitute over 82% of global consumer internet usage by 2024, efficient video delivery solutions are in high demand, directly benefiting InterDigital's licensing efforts.

Furthermore, InterDigital is positioned to capitalize on the expansion of IoT and AR/VR markets. The IoT market alone is projected to surpass $1.1 trillion by 2026, while AR/VR headset shipments were anticipated to reach over 50 million units in 2024, highlighting the broad application of InterDigital's wireless and video technologies across diverse hardware segments.

| Technological Area | Key Developments/Impact | Market Relevance/Data (2024-2025) |

| 5G Advanced & 6G | Standardization contributions, patent development | Global 5G market projected over $600 billion (2024); 6G research ongoing |

| Video Compression | HEVC and emerging codecs | Video to be >82% of global consumer internet traffic (2024) |

| IoT & Connected Devices | Enabling wireless communication for diverse hardware | Global IoT market projected >$1.1 trillion (by 2026) |

| AR/VR | High-performance wireless solutions for immersive tech | AR/VR headset shipments expected >50 million units (2024) |

Legal factors

The outcomes of patent infringement lawsuits and licensing disputes are crucial for InterDigital's financial health. Favorable rulings in 2024, such as those affirming the validity of their core technologies, directly translate to stronger negotiating positions for licensing deals, potentially boosting revenue streams. Conversely, adverse judgments can weaken their patent portfolio's perceived value, impacting future licensing income and even leading to write-downs.

Changes in global patent laws, such as evolving patent eligibility criteria and judicial interpretations on infringement, directly affect InterDigital's core business of licensing its intellectual property. For instance, shifts in how courts in major markets like the US or Europe define patentable subject matter can influence the strength and scope of InterDigital's patent portfolio. In 2024, ongoing discussions around AI-generated inventions and their patentability continue to shape legal frameworks, potentially impacting the types of innovations InterDigital can protect.

InterDigital's approach to licensing its Standard Essential Patents (SEPs) under Fair, Reasonable, and Non-Discriminatory (FRAND) terms faces ongoing scrutiny from antitrust and competition authorities globally. For instance, in 2024, the European Commission continued its investigation into potential anticompetitive practices within the digital sector, which could impact patent licensing frameworks. Aggressive enforcement could force InterDigital to adjust its licensing rates or practices, potentially affecting its revenue streams, which are heavily reliant on these agreements.

Fair, Reasonable, and Non-Discriminatory (FRAND) licensing disputes

Disputes concerning what constitutes Fair, Reasonable, and Non-Discriminatory (FRAND) terms for licensing Standard Essential Patents (SEPs) represent a significant legal challenge. These disagreements directly impact InterDigital's revenue streams and the valuation of its intellectual property. For instance, ongoing litigation and regulatory scrutiny surrounding FRAND can create uncertainty in licensing negotiations, potentially affecting royalty rates and market access.

Court decisions and evolving regulatory frameworks globally are crucial in shaping FRAND interpretations. These rulings can establish binding precedents, influencing how InterDigital structures its licensing agreements and the ultimate profitability derived from its extensive patent portfolio. A lack of consistent FRAND application across different jurisdictions adds complexity to international licensing strategies.

- FRAND Litigation Impact: High-profile FRAND disputes, such as those involving major technology firms, can lead to substantial financial penalties or mandated licensing terms, directly affecting InterDigital's bottom line. For example, in 2023, several ongoing FRAND-related cases continued to shape licensing practices in the telecommunications sector.

- Regulatory Scrutiny: Antitrust regulators in key markets, including the European Union and the United States, actively monitor FRAND practices, which can lead to investigations and new guidance impacting patent licensing models.

- Global Consistency: The absence of universally agreed-upon FRAND principles creates legal and commercial hurdles for companies like InterDigital, necessitating tailored approaches for different markets.

Patent validity challenges and revocation actions

InterDigital's extensive patent portfolio faces ongoing scrutiny, with validity challenges frequently arising in litigation and administrative proceedings like inter partes reviews (IPRs). For instance, during 2024, the company actively defended numerous patents across various jurisdictions, highlighting the constant legal pressure on its intellectual property assets.

A successful challenge can result in the revocation of a patent, which directly impacts the value and scope of InterDigital's licensing agreements and overall market position. This underscores the critical importance of robust legal strategies to safeguard their intellectual property rights.

InterDigital's business model hinges on the strength and enforceability of its patents. Therefore, the company must continually invest in legal defense to maintain the validity of its portfolio, ensuring its ability to generate revenue through licensing and protect its competitive advantage in the telecommunications sector.

- Patent Challenges: InterDigital's patents are frequently challenged in courts and administrative bodies.

- Revocation Risk: Successful challenges can lead to patent revocation, reducing the portfolio's value.

- Legal Defense Investment: Maintaining patent validity requires significant ongoing legal expenditure.

- Business Continuity: The enforceability of their patents is crucial for InterDigital's ongoing operations and revenue streams.

InterDigital's reliance on patent licensing means that changes in patent law and enforcement directly impact its revenue. For example, in 2024, the ongoing debate around patent eligibility for AI-generated inventions could affect the scope of protection for future technologies. Furthermore, the company's active defense of its patent portfolio, as seen in numerous legal challenges throughout 2024, underscores the significant investment required to maintain its intellectual property's value and enforceability.

The company's licensing agreements are also subject to global regulatory scrutiny, particularly concerning Fair, Reasonable, and Non-Discriminatory (FRAND) terms. Investigations by bodies like the European Commission in 2024 into digital sector practices highlight the potential for new regulations that could influence InterDigital's licensing rates and strategies.

| Legal Factor | Description | 2024/2025 Relevance |

|---|---|---|

| Patent Validity Challenges | InterDigital's patents are frequently contested in legal proceedings, including inter partes reviews. | Ongoing defense in 2024 against numerous challenges impacts portfolio value and licensing revenue. |

| FRAND Compliance | Licensing of Standard Essential Patents (SEPs) under FRAND terms faces regulatory oversight. | Continued scrutiny by antitrust authorities in 2024 could lead to adjustments in licensing practices and rates. |

| Patent Law Evolution | Changes in patent eligibility and infringement interpretations affect IP protection. | Discussions around AI-generated inventions in 2024 could shape future patentability and InterDigital's portfolio strategy. |

Environmental factors

Growing global regulations on electronic waste (e-waste) and the push for circular economy principles, while not directly impacting InterDigital's patent licensing, can indirectly influence its licensees. Manufacturers may see increased costs associated with product design for recyclability, end-of-life management, and disposal, potentially affecting their operational budgets and, consequently, their ability to meet royalty obligations.

These evolving environmental standards are reshaping the electronics sector, encouraging more sustainable practices that could lead to shifts in production volumes and profitability for companies that license InterDigital's technology. For example, the European Union’s Ecodesign for Sustainable Products Regulation, which came into full effect in 2024, mandates stricter requirements for product durability, repairability, and recyclability, adding to manufacturing overheads.

The expanding energy demands of wireless networks, data centers, and the proliferation of connected devices, all underpinned by technologies for which InterDigital holds patents, present a significant environmental challenge. The global data center energy consumption alone was estimated to be around 1% of total global electricity consumption in 2023, a figure expected to rise.

While InterDigital itself is not a direct manufacturer of these energy-consuming products, its ongoing research into more energy-efficient communication protocols and technologies holds the potential to mitigate these environmental impacts. This focus on efficiency could make InterDigital's patent portfolio increasingly valuable to licensees prioritizing sustainability in their operations.

Efficiency is rapidly evolving from a desirable feature to a fundamental design imperative across the digital infrastructure landscape. For instance, advancements in 5G network energy efficiency aim to reduce power consumption per bit transmitted by up to 90% compared to previous generations, a trend InterDigital's innovations can support.

Licensees, especially major global electronics companies, are experiencing heightened scrutiny from consumers, investors, and governments regarding the sustainability of their entire supply chains. For InterDigital, while positioned upstream, any significant disruptions or added expenses for manufacturers due to these sustainability mandates could indirectly affect their manufacturing output and, by extension, InterDigital's licensing income.

Sustainable practices are increasingly viewed as a key competitive advantage. For instance, in 2024, a significant percentage of consumers reported that they would pay more for products from sustainable brands, indicating a strong market pull for environmentally conscious operations throughout the value chain.

Climate change impact on global operations

Climate change presents a significant indirect risk to InterDigital's business model by potentially disrupting the global manufacturing and distribution networks of its licensees. Extreme weather events, such as the increased frequency of hurricanes and typhoons observed in recent years, can cause substantial damage to manufacturing facilities and logistics infrastructure, impacting the production and availability of electronic devices that generate InterDigital's royalties. For instance, the Asia-Pacific region, a major hub for electronics manufacturing, is particularly vulnerable to climate-related disruptions.

Resource scarcity, another facet of climate change, could also indirectly affect InterDigital. Shortages of key raw materials used in electronics, driven by climate-induced agricultural impacts or water stress, might lead to increased production costs or reduced output for InterDigital's licensees. This ripple effect could translate into lower sales volumes and, consequently, reduced royalty revenue for InterDigital.

The need for resilience in global operations is paramount for InterDigital's licensees. Companies are increasingly investing in supply chain diversification and climate-resilient infrastructure to mitigate these risks. For example, industry reports from 2024 highlight a growing trend among tech manufacturers to establish redundant production sites in geographically diverse locations to buffer against localized climate impacts.

- Supply Chain Vulnerability: Global electronics manufacturing, a key market for InterDigital's licensees, faces increasing threats from climate-related extreme weather events.

- Resource Scarcity Impact: Potential shortages of critical raw materials due to climate change could raise production costs for licensees, affecting their sales and InterDigital's royalty income.

- Resilience Investments: Leading tech manufacturers are enhancing supply chain resilience through diversification and infrastructure upgrades, a trend expected to continue through 2025.

Corporate social responsibility (CSR) expectations

Societal and investor demands for corporate social responsibility (CSR) and environmental stewardship are significantly shaping operations within the technology sector. Companies are increasingly scrutinized for their commitment to sustainability, influencing partnerships and investment decisions.

While InterDigital's direct environmental footprint may be limited, its alignment with overarching industry sustainability objectives and the demonstration of ethical business conduct are crucial for bolstering its reputation. This commitment can also improve its appeal to potential partners and investors looking for responsible entities.

CSR performance is emerging as a key non-financial indicator, with a growing emphasis on environmental, social, and governance (ESG) factors. For instance, in 2024, a significant percentage of institutional investors reported that ESG considerations directly influenced their investment choices, highlighting the financial implications of robust CSR programs.

- Growing Investor Focus: By 2025, it's projected that over 70% of global assets under management will be influenced by ESG criteria, making CSR a vital component of InterDigital's investor relations strategy.

- Reputational Capital: Strong CSR practices can translate into enhanced brand image and trust, which are intangible assets that contribute to long-term business value.

- Partner Due Diligence: Potential business partners are increasingly incorporating CSR assessments into their vendor selection processes, meaning InterDigital's commitment to responsible practices can be a competitive advantage.

The increasing global focus on environmental sustainability directly impacts InterDigital's licensees by driving demand for eco-friendly product design and manufacturing. The European Union's 2024 Ecodesign for Sustainable Products Regulation, for example, mandates greater product durability and recyclability, potentially increasing production costs for device manufacturers.

The energy consumption of digital infrastructure, from data centers to wireless networks, presents a growing environmental challenge. InterDigital's innovations in energy-efficient communication protocols could offer a competitive advantage to licensees seeking to reduce their carbon footprint, a trend amplified by the fact that global data center energy consumption was around 1% of total global electricity in 2023.

Climate change poses indirect risks through supply chain disruptions and resource scarcity. Extreme weather events in manufacturing hubs like Asia-Pacific can halt production, while shortages of raw materials due to climate impacts may raise costs for licensees, potentially affecting InterDigital's royalty revenue. Consequently, tech manufacturers are investing in supply chain resilience, with 2024 reports showing a rise in diversified production sites.

Societal and investor pressure for corporate social responsibility (CSR) is significant. By 2025, over 70% of global assets under management are expected to be influenced by ESG criteria, making InterDigital's commitment to sustainability crucial for investor relations and partnerships, as strong CSR can enhance brand image and trust.

PESTLE Analysis Data Sources

Our PESTLE Analysis for InterDigital is built on a robust foundation of data from official government publications, leading economic forecasting agencies, and reputable technology industry reports. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.