InterDigital Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

InterDigital Bundle

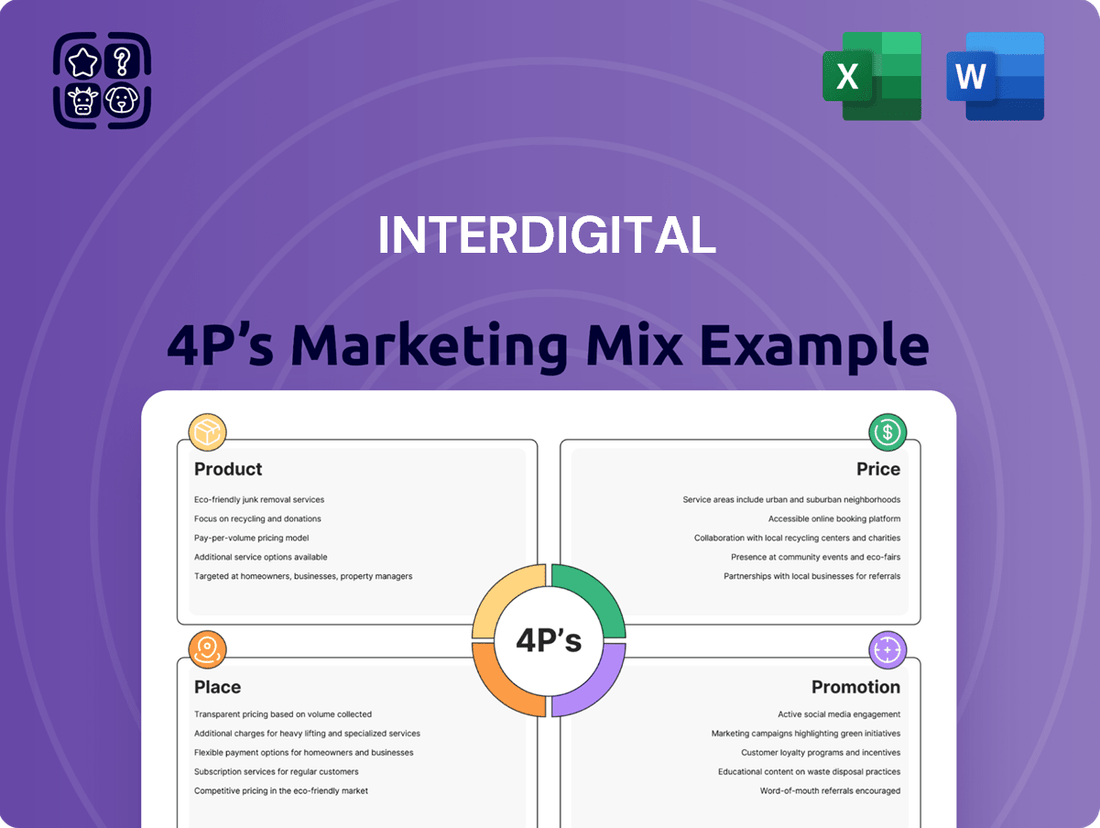

InterDigital's marketing brilliance lies in its strategic alignment of Product, Price, Place, and Promotion. Discover how their innovative licensing models, competitive pricing, global reach, and targeted communication create a powerful market presence.

Unlock the secrets behind InterDigital's success with a comprehensive 4Ps analysis. This ready-to-use report provides actionable insights into their product portfolio, pricing strategies, distribution channels, and promotional efforts, perfect for business professionals and students alike.

Go beyond the surface and gain a deep understanding of InterDigital's marketing engine. Purchase the full 4Ps analysis to see how their product innovation, pricing architecture, channel strategy, and communication mix drive their competitive advantage, and learn how to apply these principles to your own business.

Product

InterDigital's foundational wireless technologies represent its core product offering, encompassing a vast patent portfolio crucial for 4G, 5G, and the developing 6G standards. These patents are the bedrock of mobile communication, powering the devices and networks we rely on daily.

The company's commitment to research and development ensures this portfolio remains at the cutting edge. For instance, InterDigital continues to heavily invest in R&D, with a significant portion of its revenue dedicated to innovation, aiming to secure its position in future wireless generations.

InterDigital's advanced video technologies are a cornerstone of their product offering, focusing on cutting-edge compression and delivery. Their patent portfolio is crucial for modern video systems, powering everything from streaming to broadcast. This specialization ensures efficient and high-quality video experiences for consumers worldwide.

Key innovations include patents for HEVC (High Efficiency Video Coding), a standard that significantly reduces video file sizes without sacrificing quality, and DTV (Digital Television) patents vital for digital broadcasting. These technologies are fundamental for companies in the streaming service and consumer electronics sectors, enabling them to deliver content effectively.

The company's leadership in video tech directly supports a vast ecosystem of video-enabled devices and services. For instance, the adoption of HEVC has been widespread, with major streaming platforms and device manufacturers leveraging its efficiency. This positions InterDigital as a critical enabler of the global video landscape.

InterDigital is actively broadening its patent licensing from smartphones to encompass the burgeoning Internet of Things (IoT) and connected devices. This strategic move allows them to monetize their core technologies across a wider ecosystem, including consumer electronics and connected vehicles.

The company's commitment to the CE, IoT, and Automotive sectors is yielding tangible results. In the second quarter of 2025, InterDigital reported a substantial revenue surge within this segment, underscoring the growing demand for its intellectual property in these innovative markets.

Artificial Intelligence (AI) Integration in Technologies

InterDigital's product strategy heavily features Artificial Intelligence (AI) integration across its wireless and video technology portfolios. This focus is designed to boost network performance and user satisfaction. By 2025, AI is anticipated to be a cornerstone in evolving wireless standards, driving significant advancements.

The company's research and development investment reflects this commitment, with AI playing a crucial role in optimizing network operations and creating smarter connected experiences. This strategic direction is poised to unlock new capabilities and efficiencies within their technological offerings, anticipating a more intelligent future for communication.

- AI-driven network optimization: Enhancing efficiency and reliability.

- Video technology enhancement: Improving user experience through AI.

- Future wireless standards: AI's projected transformative impact by 2025.

IP-as-a-Service Business Model

InterDigital's core product offering is an IP-as-a-Service model, generating revenue through licensing its foundational technologies rather than selling physical products. This approach empowers other manufacturers by providing essential innovations for their own product development, highlighting the intrinsic value of InterDigital's intellectual property.

This licensing strategy has proven highly successful, with the company securing over $4 billion in total contract value from licenses signed since the beginning of 2021. This substantial figure underscores the strong market demand and the effectiveness of their IP-as-a-Service business model in the current technological landscape.

- Revenue Generation: Primarily through licensing intellectual property, not physical goods.

- Value Proposition: Providing foundational technologies for other manufacturers.

- Recent Performance: Over $4 billion in total contract value from licenses signed since 2021.

- Market Position: Demonstrates strong momentum and demand for its innovation.

InterDigital's product strategy centers on its extensive patent portfolio, licensing foundational wireless and video technologies that are essential for global communication and entertainment. This intellectual property is the core offering, enabling device manufacturers and network operators to build advanced products and services.

The company's focus on innovation ensures its patents remain relevant, covering current standards like 5G and future advancements such as 6G, alongside cutting-edge video compression technologies like HEVC. This forward-looking approach is supported by consistent R&D investment, with a significant portion of revenue reinvested to maintain technological leadership.

InterDigital's product reach is expanding beyond traditional mobile devices to include the Internet of Things (IoT), connected vehicles, and consumer electronics, broadening the application of its core IP. The integration of Artificial Intelligence (AI) into its offerings is a key differentiator, enhancing network performance and video experiences, with AI expected to be critical in 2025 wireless standards.

| Technology Area | Key Innovations | Market Impact |

|---|---|---|

| Wireless Communication | 4G, 5G, 6G Patents | Enables global mobile connectivity and future network evolution. |

| Video Technologies | HEVC, DTV Patents | Drives efficient video streaming and digital broadcasting. |

| Emerging Markets | IoT, Connected Vehicles | Expands IP licensing to new device ecosystems. |

| AI Integration | Network Optimization, Video Enhancement | Boosts performance and user experience in wireless and video. |

What is included in the product

This analysis offers a comprehensive examination of InterDigital's marketing strategies, detailing its Product, Price, Place, and Promotion tactics through real-world examples and competitive context.

It provides a structured, data-driven breakdown of InterDigital's marketing positioning, ideal for professionals seeking to understand or benchmark its approach.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of understanding InterDigital's market positioning.

Provides a clear, concise overview of InterDigital's 4Ps, easing the burden of strategic marketing analysis for any stakeholder.

Place

InterDigital's primary distribution channel is direct patent licensing, forging multi-year agreements with major wireless and consumer electronics manufacturers globally. These direct engagements, exemplified by their substantial contracts with industry leaders like Samsung and HP, are the bedrock of their recurring revenue streams, ensuring their intellectual property is integrated into a vast array of consumer products.

InterDigital's global market reach is a cornerstone of its licensing strategy, ensuring its innovations are adopted worldwide. Significant revenue streams originate from major markets like the United States, Europe, and Asia, demonstrating broad international acceptance of their technology portfolios. This expansive geographic footprint allows for diverse adoption by device makers across various regions.

InterDigital's strategic partnerships with standards bodies like 3GPP are crucial. By actively contributing to the development of global mobile communication standards, they ensure their patented technologies become foundational for future devices and services. This deep integration into industry-wide specifications is a key driver for their ongoing revenue streams.

Their influence in shaping the future of mobile technology, particularly with their leadership in 6G development, positions them to capitalize on emerging markets. For instance, the 3GPP Release 18, a significant step towards 5G-Advanced, further solidifies the importance of standards InterDigital helps define, impacting billions of connected devices.

Expansion into New Verticals

InterDigital is actively broadening its market reach beyond its traditional smartphone stronghold. The company is strategically venturing into new verticals, including personal computers, connected vehicles, and cloud-based video services. This diversification is designed to tap into new revenue streams and leverage their intellectual property across a wider array of burgeoning technologies.

This expansion is already showing tangible results. For instance, InterDigital has secured recent agreements with major players like HP, signaling a successful entry into the PC market. Furthermore, their ongoing investments and developments in video services underscore their commitment to establishing a significant presence in this growing sector.

- Diversification Strategy: Moving beyond smartphones into PCs, connected vehicles, and cloud video services.

- Revenue Stream Expansion: Aiming to create new income sources by applying existing IP to emerging technologies.

- Market Penetration: Recent agreements with companies like HP demonstrate progress in new verticals.

Legal and Arbitration Channels

When direct licensing talks falter, InterDigital actively pursues legal and arbitration routes to protect its intellectual property and finalize agreements. This strategic use of litigation and arbitration serves as a crucial 'place' for revenue generation and reinforcing the value of its patent portfolio.

A prime example of this strategy in action is InterDigital's successful arbitration with Samsung. This resolution not only secured a multi-year renewal of their licensing agreement but also underscored the effectiveness of these formal channels in validating the company's technological contributions and ensuring ongoing financial returns.

- Arbitration Success: InterDigital's arbitration with Samsung resulted in a renewed, multi-year licensing agreement, demonstrating the power of formal dispute resolution.

- IP Enforcement: Legal and arbitration channels are vital for InterDigital to enforce its patent rights and secure fair licensing terms when negotiations stall.

- Revenue Assurance: These channels act as a critical mechanism to ensure consistent revenue streams and protect the long-term value of its extensive patent portfolio.

InterDigital's 'place' encompasses its direct licensing model, global market presence, and strategic integration into industry standards. Their revenue is generated through multi-year agreements with major device manufacturers worldwide, with significant contributions from key markets like the US, Europe, and Asia. Furthermore, their active participation in shaping global mobile communication standards, such as those defined by 3GPP, ensures their patented technologies are embedded in future devices, driving ongoing revenue.

The company is also strategically expanding its reach into new verticals like personal computers, connected vehicles, and cloud video services, as evidenced by recent agreements with companies like HP. This diversification aims to unlock new revenue streams by leveraging their intellectual property across a broader technological landscape. InterDigital also utilizes legal and arbitration processes to enforce its patent rights and secure fair licensing terms when direct negotiations are challenging, as demonstrated by their successful arbitration with Samsung.

| Market Segment | Key Markets | Recent Developments/Examples |

|---|---|---|

| Wireless Devices (Smartphones) | Global (US, Europe, Asia) | Core business, multi-year licensing agreements with major manufacturers. |

| Personal Computers | Global | Expanding presence, secured agreements with HP. |

| Connected Vehicles | Global | Strategic venture, leveraging IP for automotive technology. |

| Cloud Video Services | Global | Growing focus, investments in video technology. |

| Standards Development | Global | Active participation in 3GPP (e.g., Release 18 for 5G-Advanced). |

Same Document Delivered

InterDigital 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of InterDigital's 4P's Marketing Mix is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you get precisely what you expect.

Promotion

InterDigital effectively communicates its IP-as-a-Service model, positioning itself as a crucial innovation engine for the digital communication sector. This strategy underscores their commitment to developing foundational technologies that empower other companies.

The company's success is clearly demonstrated by its robust financial performance, with total contract value from licenses surpassing $4 billion since 2021. This significant figure validates their business model and the value they deliver to partners.

InterDigital actively shapes the future of wireless by contributing to global standards bodies, a key element of its promotional strategy. This participation highlights their technical prowess and influence in developing essential technologies. For instance, their significant contributions to 5G Advanced standards, finalized in late 2023 and early 2024, underscore their commitment to industry advancement.

The company's leadership in 6G research and the integration of AI into wireless standards further solidify its forward-thinking image. This proactive stance in emerging technologies, like the advancements seen in AI-driven spectrum management discussed in industry forums throughout 2024, positions InterDigital as a key player in defining next-generation connectivity.

InterDigital actively communicates its financial health and strategic wins through robust investor relations. This includes detailed earnings calls, comprehensive annual reports, and transparent proxy statements, ensuring stakeholders are well-informed about the company's trajectory.

The company's financial performance is a key draw for investors. For instance, InterDigital reported a revenue of $500.5 million in 2023, a notable increase driven by successful licensing activities. This financial strength is further bolstered by strategic achievements like the favorable Samsung arbitration outcome and new licensing agreements, such as the one with HP, which underscore the value of its intellectual property portfolio.

Strategic Licensing Announcements

InterDigital strategically announces key licensing agreements and renewals with major global manufacturers. These include partnerships with giants like Samsung, HP, OPPO, Google, and Lenovo, underscoring the significant market acceptance and value of their extensive patent portfolio.

These announcements act as powerful endorsements, validating the widespread adoption of InterDigital's patented technologies across a broad spectrum of consumer electronics and mobile devices. For instance, in 2024, the company continued to report strong recurring revenue from its licensing programs, with a significant portion derived from these high-profile relationships.

- Samsung: Continued renewal of major licensing agreements, contributing substantially to recurring revenue.

- HP: Expansion of licensing coverage to new product categories, reflecting the broad applicability of InterDigital's IP.

- OPPO, Google, Lenovo: Ongoing and renewed commitments to licensing InterDigital’s foundational technologies for their device ecosystems.

Protection and Enforcement of IP

InterDigital actively promotes its intellectual property by demonstrating a strong commitment to enforcing its patent rights. Their litigation against companies like The Walt Disney Company in 2024 highlights this proactive approach, serving as a clear message to potential infringers and reinforcing the significant value of their technological innovations.

This assertive strategy underscores the necessity for businesses incorporating InterDigital's technology to secure proper licenses. By showcasing their willingness to defend their IP, InterDigital effectively communicates the importance of respecting their patent portfolio and incentivizes licensing agreements.

- Litigation as a Deterrent: InterDigital's legal actions, such as the ongoing dispute with Disney, act as a powerful deterrent against unauthorized use of their patented technologies.

- IP Value Reinforcement: These enforcement efforts directly communicate the substantial economic and strategic value embedded within InterDigital's extensive patent portfolio.

- Licensing Incentive: The company's proactive stance encourages other technology firms to engage in licensing discussions, ensuring compliance and mutual benefit.

InterDigital's promotional efforts center on showcasing its role as an innovation leader and the tangible value of its IP portfolio. They highlight significant contract wins, like exceeding $4 billion in total contract value since 2021, demonstrating market confidence and the economic strength of their licensing model.

The company actively participates in shaping future technologies, contributing to 5G Advanced standards finalized in early 2024 and leading in 6G and AI integration research. This thought leadership, communicated through industry engagement and forward-looking strategies, positions them as a key player in next-generation connectivity.

Strategic announcements of licensing agreements with major players like Samsung, HP, and Google, which continued in 2024, serve as powerful endorsements. These partnerships underscore the widespread adoption and value of InterDigital's foundational technologies across diverse device ecosystems.

InterDigital also reinforces its IP value through assertive enforcement, including litigation in 2024. This strategy acts as a deterrent against unauthorized use and incentivizes potential licensees, clearly communicating the importance of their patent portfolio.

Price

InterDigital's core pricing strategy revolves around royalty-bearing, non-exclusive license agreements. These contracts allow manufacturers to integrate InterDigital's patented technologies into their devices, with payments typically structured as ongoing royalties tied to product sales or other metrics.

A prime example of this model is the agreement with Samsung, which is projected to generate around $131 million in recurring annual revenue for InterDigital. This demonstrates the significant and predictable income stream generated by these licensing arrangements.

InterDigital's pricing strategy heavily relies on multi-year contract structures, which are crucial for securing stable and predictable revenue. These long-term agreements are a cornerstone of their business model, reflecting the enduring value of their wireless and video technology patents.

A prime example of this is the eight-year agreement with Samsung, valued at over $1 billion. This substantial contract underscores the significant long-term financial commitment customers make to access InterDigital's intellectual property, providing a solid revenue foundation for years to come.

InterDigital's pricing strategy for its patents is deeply rooted in value-based principles. The company sets licensing fees based on the perceived value and critical importance of its foundational technologies to the wireless and video sectors. This approach ensures that the price accurately reflects the contribution of their intellectual property to industry standards and product innovation.

The strength of InterDigital's patent portfolio, covering crucial areas like 4G, 5G, and the emerging 6G, along with advanced video compression, empowers them to negotiate substantial licensing fees. These fees are competitive and directly correlate with the essentiality of their patented innovations in enabling next-generation communication and media technologies.

The recent arbitration outcome with Samsung is a key indicator of how InterDigital's foundational research and extensive IP portfolio are valued. This resolution is understood to have properly quantified the worth of their pioneering work, setting a benchmark for future licensing agreements and reinforcing their value-based pricing model.

Arbitration and Litigation Outcomes

Arbitration and litigation outcomes significantly influence InterDigital's pricing strategy when direct negotiations falter. The successful arbitration with Samsung in 2023, for instance, secured substantial 'catch-up' revenue, demonstrating how legal resolutions can directly impact realized IP value and establish crucial precedents for future licensing agreements. This highlights the integral role of legal processes in defining the effective price of InterDigital's intellectual property portfolio.

These legal victories translate into tangible financial gains and shape market perceptions of InterDigital's licensing terms. For example, the Samsung arbitration was estimated to bring in hundreds of millions of dollars in back payments, bolstering InterDigital's revenue streams and reinforcing the value of its patent portfolio. Such outcomes are critical for setting the benchmark for future negotiations and ensuring fair compensation for its innovations.

- Samsung Arbitration Impact: Secured significant 'catch-up' revenue, estimated to be in the hundreds of millions of dollars, reinforcing InterDigital's IP valuation.

- Precedent Setting: Successful legal outcomes establish benchmarks for future licensing agreements, influencing pricing across the industry.

- Revenue Diversification: Litigation and arbitration provide a crucial revenue stream, especially when direct licensing negotiations are challenging.

- IP Monetization Strategy: Legal resolutions are a key component of InterDigital's overall strategy to effectively monetize its extensive patent portfolio.

Tiered or Segmented Pricing

InterDigital likely utilizes tiered or segmented pricing, especially as they expand into consumer electronics, IoT, and automotive sectors. This strategy allows them to customize licensing fees based on industry, product complexity, and usage volume, thereby capturing maximum value from each market segment.

The substantial revenue growth observed in their Consumer Electronics, IoT, and Automotive segments, which saw a significant increase in Q1 2024, points towards the effectiveness of these differentiated pricing approaches. For instance, licensing for a high-volume automotive application might differ considerably from that for a niche IoT device.

- Industry-Specific Tiers: Licensing fees adjusted for the unique revenue models and market dynamics of sectors like automotive versus consumer electronics.

- Usage-Based Segmentation: Pricing structured around the volume or intensity of technology deployment within a licensee's products.

- Product Complexity: Differentiated rates based on the sophistication and integration level of InterDigital's patented technologies in end products.

- Strategic Partnerships: Potential for customized pricing agreements with key strategic partners in emerging markets.

InterDigital's pricing strategy is fundamentally value-based, reflecting the essentiality of its patents for industry standards like 5G and video compression. This approach is reinforced by multi-year licensing agreements, such as the over $1 billion deal with Samsung, ensuring predictable revenue streams. Recent arbitration outcomes, like the Samsung case, have been pivotal, securing substantial back payments and setting precedents that bolster their value-based pricing model.

| Licensing Agreement Type | Key Feature | Example/Impact |

|---|---|---|

| Royalty-Bearing, Non-Exclusive Licenses | Integration of patented technologies into devices | Samsung agreement projected to generate ~$131 million annually |

| Multi-Year Contracts | Secures stable, predictable revenue | 8-year Samsung agreement valued at over $1 billion |

| Value-Based Pricing | Fees based on perceived value and critical importance of IP | Reflects contribution to industry standards and product innovation |

| Legal Resolutions (Arbitration/Litigation) | Establishes IP valuation benchmarks and secures revenue | Samsung arbitration provided hundreds of millions in back payments (2023) |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis leverages a comprehensive suite of data, including official company filings, investor relations materials, and direct brand communications. We also incorporate insights from industry-specific reports and competitive intelligence platforms to ensure a robust understanding of InterDigital's market positioning.