InterDigital Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

InterDigital Bundle

Unlock the strategic potential of InterDigital's product portfolio with a clear understanding of its position within the BCG Matrix. See which innovations are poised for growth and which require careful management.

This glimpse into InterDigital's BCG Matrix is just the start. Purchase the full report to gain a comprehensive analysis, including detailed quadrant placements and actionable strategies to optimize your investments and product development.

Don't miss out on the critical insights that will shape InterDigital's future success. Get the complete BCG Matrix to understand market dynamics and make informed decisions for competitive advantage.

Stars

InterDigital is heavily invested in 6G research and development, aiming to define the future of wireless communication. This forward-thinking approach places them in a strong position for the high-growth potential of 6G, which will likely blend AI, pervasive connectivity, and sophisticated sensing.

Their active participation in crucial industry forums such as 3GPP and attendance at 6G-focused symposiums underscore a substantial commitment to this emerging technology. Such engagement is vital for shaping standards and securing early market advantages.

InterDigital is making significant strides by integrating AI into its wireless and video technologies. This focus aims to boost network efficiency, reliability, and overall user experience. For instance, in 2024, the company continued its investment in its dedicated AI lab, exploring AI-driven innovations for dynamic spectrum management, a critical area for future wireless performance.

The company's research into AI for predictive network maintenance is particularly noteworthy. By leveraging AI, InterDigital seeks to anticipate and resolve network issues before they impact users, a key differentiator in the competitive wireless landscape. This strategic direction positions InterDigital to capitalize on the growing demand for smarter, more resilient wireless networks.

InterDigital is a key player in developing next-generation video codecs like VVC, essential for high-quality streaming and emerging XR content. This positions them to capitalize on the ever-increasing demand for efficient video delivery across the internet.

Immersive Experiences and XR Technologies

InterDigital is heavily investing in research for immersive experiences and extended reality (XR) technologies. These applications, like virtual and augmented reality, demand substantial improvements in wireless network capabilities to handle the massive data and low latency requirements. Recognizing this, InterDigital is strategically positioning itself to be a key player in this burgeoning sector.

Their work at the nexus of wireless communication, advanced video processing, and artificial intelligence is crucial for enabling seamless XR. This focus targets a high-growth market where foundational patent ownership is paramount. For instance, the global XR market was valued at approximately $30 billion in 2023 and is projected to reach over $300 billion by 2027, underscoring the immense opportunity.

- XR Market Growth: The XR market is experiencing rapid expansion, with significant investment flowing into hardware and software development.

- Infrastructure Demands: Immersive XR experiences necessitate advanced wireless solutions, including 5G and future 6G technologies, to support high bandwidth and ultra-low latency.

- InterDigital's Strategy: The company aims to secure a strong patent portfolio in key areas like efficient video compression, AI-driven network optimization, and XR-specific communication protocols.

- Investment Rationale: By focusing on these foundational technologies, InterDigital seeks to capitalize on the long-term growth trajectory of the immersive technology landscape.

High-Frequency Wireless Technologies (e.g., 144 GHz)

InterDigital is pushing the boundaries of wireless technology, actively developing and demonstrating high-frequency communication links, including those operating at 144 GHz. This focus is crucial for enabling the next generation of wireless, such as 6G, which will demand unprecedented speeds and ultra-low latency.

This advanced research places InterDigital squarely in a high-growth, technically demanding segment of the wireless market, signaling a strong commitment to innovation. For instance, the company's work in millimeter-wave (mmWave) and sub-terahertz frequencies is a key enabler for these future capabilities.

- 144 GHz Spectrum: This frequency band offers vast bandwidth potential, enabling multi-gigabit per second data rates.

- 6G Development: InterDigital's research in this area directly supports the foundational technologies required for 6G networks.

- Low Latency Applications: High-frequency communication is essential for real-time applications like advanced augmented reality and autonomous systems.

- Market Leadership: By investing in these cutting-edge technologies, InterDigital aims to secure a leading position in future wireless ecosystems.

InterDigital's investments in 6G, AI integration, and XR technologies position them as Stars in the BCG matrix. Their active participation in industry standards bodies and focus on foundational patent development for these high-growth areas are key indicators. The company's commitment to pushing the boundaries of high-frequency communication, such as 144 GHz, further solidifies their Star status by addressing the critical infrastructure needs of future wireless ecosystems.

| Category | Key Technologies | Market Potential | InterDigital's Role |

|---|---|---|---|

| 6G Wireless | AI integration, high-frequency communication (e.g., 144 GHz) | Enabling future connectivity, massive data transfer | Defining standards, developing foundational patents |

| Artificial Intelligence | AI-driven network optimization, predictive maintenance | Enhancing network efficiency and user experience | Investing in AI labs, applying AI to wireless and video |

| Extended Reality (XR) | Advanced video codecs (VVC), low-latency communication | Immersive experiences, virtual and augmented reality | Securing patents for XR-specific communication protocols |

What is included in the product

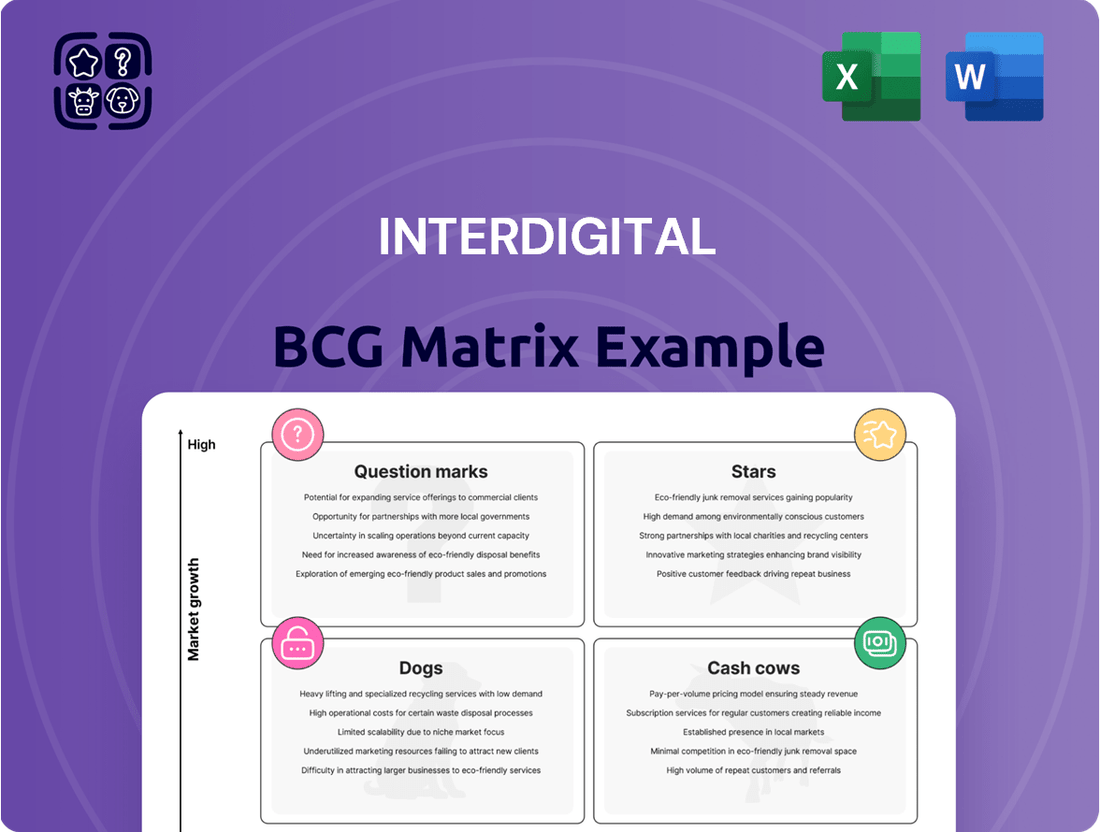

The InterDigital BCG Matrix analyzes its patent portfolio, categorizing assets as Stars, Cash Cows, Question Marks, or Dogs.

This framework guides strategic decisions on investment, divestment, and resource allocation for optimal portfolio growth.

InterDigital's BCG Matrix offers a clear, one-page overview, alleviating the pain of complex portfolio analysis.

Cash Cows

InterDigital's foundational 5G wireless patents are a prime example of a cash cow within the BCG matrix. Their extensive patent portfolio, crucial for 5G standards, has grown significantly, with their 5G patent count surpassing their 4G holdings.

These essential patents are the engine behind substantial recurring revenue streams, primarily generated through licensing agreements with leading global smartphone manufacturers. Recent licensing deals with major players like Samsung underscore the ongoing demand and value of InterDigital's intellectual property in the rapidly expanding 5G market.

InterDigital's HEVC video codec patent portfolio stands as a significant cash cow. As a key patent holder for HEVC (High Efficiency Video Coding), the company consistently generates robust cash flow through licensing agreements. This mature technology is fundamental to streaming services and consumer electronics, ensuring a reliable revenue stream from its intellectual property.

InterDigital's Wi-Fi standard essential patents, covering technologies like Wi-Fi 6 and the upcoming Wi-Fi 7, represent a strong Cash Cow. The company holds a substantial portfolio of these patents, which are crucial for enabling wireless connectivity in a vast array of devices.

These patents are licensed to a diverse customer base, including major PC manufacturers and consumer electronics companies. This broad adoption across a mature and widely used technology market ensures a steady and predictable revenue stream for InterDigital, a hallmark of a Cash Cow.

Long-Term Licensing Agreements with Major OEMs

Long-term licensing agreements with major Original Equipment Manufacturers (OEMs) represent a significant cash cow for InterDigital. The company has secured and renewed these crucial agreements with a substantial part of the global smartphone market, including seven of the top ten vendors, alongside major consumer electronics manufacturers.

These established relationships are a cornerstone of InterDigital's financial stability, generating predictable and high-margin recurring revenue streams. For instance, in 2023, InterDigital reported total revenue of $542 million, with its licensing segment being the primary driver of this consistent performance.

- Predictable Recurring Revenue: Long-term contracts ensure a steady income flow, reducing financial volatility.

- High Profit Margins: Licensing intellectual property typically carries very high margins, boosting profitability.

- Market Penetration: Agreements with seven of the top ten smartphone vendors indicate broad market reach.

- Diversified Customer Base: Partnerships with major consumer electronics firms further strengthen revenue stability.

IoT and Automotive Patent Licensing

InterDigital's patent portfolio is finding significant traction in the Internet of Things (IoT) and automotive industries, marking a strategic shift and a robust expansion of its revenue streams. This diversification is a key element in its Cash Cow strategy, as these sectors represent substantial and growing markets for connected technologies.

The licensing of patents for IoT devices, ranging from smart home gadgets to industrial sensors, is generating consistent and predictable income. Similarly, the automotive sector's rapid adoption of connected car technologies, including telematics and advanced driver-assistance systems, presents a lucrative and expanding licensing opportunity. For instance, by the end of 2023, InterDigital had announced new or expanded licensing agreements across these burgeoning fields, bolstering its position as a key enabler of wireless innovation.

- IoT Expansion: InterDigital's patents are crucial for enabling connectivity in a wide array of IoT devices, contributing to stable revenue.

- Automotive Integration: The company's licensing agreements in the automotive sector are capitalizing on the increasing demand for connected vehicle technologies.

- Diversified Revenue: This strategic focus on IoT and automotive segments broadens InterDigital's income base beyond traditional mobile markets.

InterDigital's established patent portfolios, particularly in 5G wireless and HEVC video codecs, function as significant cash cows. These mature technologies, licensed to a broad base of major manufacturers, generate consistent and high-margin recurring revenue, underpinning the company's financial stability. The company's strategic focus on expanding these licensing agreements into growing sectors like IoT and automotive further solidifies their cash cow status, as demonstrated by their robust 2023 performance.

| Patent Area | Key Technology | Revenue Driver | Market Status | 2023 Revenue Contribution (Est.) |

|---|---|---|---|---|

| 5G Wireless | 5G Standards | Licensing to smartphone makers | Mature, high demand | Significant portion of total |

| Video Codecs | HEVC | Licensing for streaming/electronics | Mature, essential | Consistent, reliable |

| Wi-Fi Standards | Wi-Fi 6/7 | Licensing to PC/electronics firms | Mature, widespread | Steady, predictable |

| Emerging Technologies | IoT, Automotive | Licensing for connected devices | Growing, expanding | Increasingly important |

Preview = Final Product

InterDigital BCG Matrix

The InterDigital BCG Matrix preview you're viewing is the complete, unwatermarked report you'll receive immediately after purchase. This professionally formatted document offers a clear strategic overview of InterDigital's product portfolio, ready for immediate use in your business planning. You'll gain access to the full analysis without any demo content or hidden limitations, ensuring you have the precise tool needed for informed decision-making.

Dogs

InterDigital's legacy 2G/3G wireless patent portfolios represent assets with diminishing relevance. As the global telecommunications industry rapidly advances towards 4G and 5G technologies, the market demand and licensing potential for patents tied to older network generations have significantly decreased. This shift means that the revenue generated from these older patents may not justify the ongoing costs associated with their maintenance and enforcement.

Non-core, undifferentiated patent assets in InterDigital's portfolio, those not aligning with its primary focus on wireless, video, and AI, or lacking widespread industry adoption, would be classified as dogs. These patents might represent an ongoing cost for maintenance without generating significant licensing revenue, potentially diverting resources from more strategic areas.

Protracted or unsuccessful patent litigation can significantly drain resources. For InterDigital, this means substantial legal fees and the risk of adverse judgments, potentially turning valuable patent families into liabilities.

While InterDigital prefers amicable negotiations, unfavorable arbitration or court rulings can directly impact revenue and increase costs. For instance, if a key patent family is deemed invalid or infringes on another's rights after extensive legal battles, it could be reclassified as a 'dog' within their portfolio.

Older Video Codec Patents with Limited Modern Use

Some older video codec patents, particularly those not considered foundational or broadly applicable to current and emerging video technologies, could be categorized as 'dogs' within the InterDigital BCG Matrix. As video compression technologies like AV1 and HEVC continue to advance, patents tied to less efficient or less adopted older codecs may experience a significant decline in licensing demand.

For instance, patents related to codecs like MPEG-2, while historically important, might now represent a smaller portion of InterDigital's revenue streams compared to newer, more widely adopted standards. The rapid evolution of video compression means that the market relevance of older technologies can diminish quickly, impacting the growth potential of related patent portfolios.

- Declining Licensing Revenue: Older codec patents may generate less income as newer, more efficient technologies gain traction.

- Limited Market Share: Patents for codecs with low adoption rates or those superseded by newer standards have reduced commercial value.

- Technological Obsolescence: The rapid pace of innovation in video compression can render older patented technologies less relevant.

- Focus on Newer Standards: Companies like InterDigital often shift their strategic focus and investment towards patents covering current and future video technologies.

Divested or Non-Strategic Patent Portfolios

Divested or non-strategic patent portfolios within InterDigital's portfolio would be classified as Dogs in a BCG Matrix analysis. These are patents that the company has chosen to sell or has not actively developed for new licensing, indicating they no longer align with its core business objectives or revenue generation strategies.

These assets are often disposed of to free up resources or are allowed to lapse if their contribution to the company's overall value proposition diminishes. For example, InterDigital might divest patents related to older technologies that have been superseded by newer innovations or those that have a limited market for licensing.

- InterDigital's 2024 strategy focuses on core patent areas like 5G and beyond, potentially leading to divestment of older, less relevant patents.

- The company's financial reports for 2023 and early 2024 indicate a continued emphasis on monetizing its advanced wireless technology portfolios.

- Any patent asset sales in 2024 would likely involve portfolios deemed non-core or those with declining licensing potential.

Dogs in InterDigital's portfolio are patents with low market share and declining revenue, often related to older technologies like 2G/3G or less adopted video codecs. These assets require ongoing maintenance costs without generating significant licensing income, diverting resources from more strategic areas like 5G and AI. InterDigital's 2024 strategy prioritizes advanced wireless technologies, suggesting potential divestment or reduced focus on these underperforming patent portfolios.

| Patent Category | Market Relevance | Revenue Potential | Strategic Fit |

|---|---|---|---|

| 2G/3G Wireless | Declining | Low | Non-Core |

| Older Video Codecs (e.g., MPEG-2) | Diminishing | Low to Moderate | Potentially Non-Core |

| Non-Core, Undifferentiated Patents | Varies (often low) | Low | Non-Core |

Question Marks

InterDigital's patent portfolio reveals a growing number of standalone AI applications, distinct from its established wireless and video integration efforts. These emerging AI patents, filed in areas like advanced predictive analytics and novel machine learning algorithms for non-communication applications, represent InterDigital's foray into potentially high-growth, but currently low-market-share, segments. The company's commitment to AI innovation is evident, with a substantial portion of its research and development budget allocated to these forward-looking technologies.

InterDigital's foray into specialized industrial IoT niches, such as predictive maintenance for heavy machinery or smart grid monitoring, falls into the question mark category of the BCG matrix. These segments offer substantial growth prospects, with the global industrial IoT market projected to reach over $1 trillion by 2030, according to various industry analyses. However, InterDigital's current market share in these highly specific areas is likely nascent, necessitating substantial investment in research and development to tailor solutions and build a strong licensing portfolio.

InterDigital is actively engaged in the research and early patenting of next-generation Wi-Fi standards, like Wi-Fi 8 (IEEE 802.11bn). This places them in a high-growth, unproven market segment, characteristic of a question mark in the BCG matrix.

Wi-Fi 8 promises significant advancements, including ultra-high reliability and extremely low latency, which are crucial for the burgeoning Internet of Things (IoT) ecosystem. However, the actual market adoption and InterDigital's future market share remain uncertain, reflecting the inherent risks of pioneering new technologies.

Content Delivery Network (CDN) Related Patents from Recent Acquisitions

InterDigital's acquisition of Edgio's patent portfolio marks a strategic entry into the Content Delivery Network (CDN) space, a market experiencing significant growth driven by escalating video consumption. For instance, global IP video traffic is projected to reach 280 exabytes per month by 2026, a substantial increase from previous years.

However, the integration of these CDN-related patents presents a challenge for InterDigital. The market share of the acquired portfolio and how effectively these patents can be incorporated into InterDigital's established licensing model, especially given the stipulation of a license-back to Edgio, introduce an element of uncertainty regarding their immediate impact and long-term value.

- Market Entry: Acquisition of Edgio's CDN patent portfolio.

- Growth Driver: Increasing global video traffic, projected to reach 280 EB/month by 2026.

- Integration Challenge: Uncertainty surrounding market share and effective licensing integration, including license-back to Edgio.

Patent Enforcement in New Jurisdictions or Against New Types of Services (e.g., Video Streaming Services)

InterDigital's strategy to enforce patents against major video streaming platforms like Disney+, Hulu, and ESPN+ highlights a significant, albeit uncertain, growth avenue. This move targets cloud-based video services, a relatively new area for patent licensing, presenting both opportunity and risk.

The success of these enforcement actions is a key question mark. Establishing licensing precedents for video streaming technologies could unlock substantial revenue, but the outcomes of these complex legal battles remain to be seen. For instance, InterDigital's licensing revenue from its patent portfolio has historically been robust, with the company reporting over $600 million in licensing revenue in 2023, demonstrating its capability in monetizing its intellectual property.

- New Market Frontier: Targeting video streaming services opens a high-growth, albeit nascent, licensing market for InterDigital.

- Uncertainty in Outcomes: The legal challenges and the establishment of licensing rates for cloud-based video services introduce significant uncertainty.

- Potential Revenue Upside: Successful enforcement could lead to substantial new revenue streams, diversifying InterDigital's income.

- Strategic Importance: This initiative reflects InterDigital's proactive approach to adapting its licensing strategy to evolving technological landscapes.

InterDigital's investments in emerging AI applications and specialized industrial IoT segments represent classic question marks. These areas offer high growth potential, but InterDigital's current market share is minimal, requiring significant R&D investment to establish a strong position.

The company's push into next-generation Wi-Fi standards like Wi-Fi 8 also fits the question mark profile. While the technology promises advancements, market adoption and InterDigital's future share are yet to be determined, making it a high-risk, high-reward venture.

Similarly, InterDigital's recent patent acquisitions in the Content Delivery Network (CDN) space are question marks. Despite strong market growth driven by video consumption, the integration challenges and licensing uncertainties with the acquired portfolios create a degree of unpredictability.

The strategic enforcement of patents against major video streaming platforms is another key question mark. While this targets a new, high-growth licensing market, the success of these legal actions and the establishment of licensing precedents remain uncertain, though InterDigital's 2023 licensing revenue of over $600 million indicates a strong foundation for such efforts.

BCG Matrix Data Sources

Our InterDigital BCG Matrix is built on robust data, integrating financial disclosures, patent filings, and market research to accurately assess product portfolio performance.