InterDigital Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

InterDigital Bundle

InterDigital operates in a dynamic technology landscape where the bargaining power of buyers, particularly large device manufacturers, significantly influences pricing and licensing terms. The threat of new entrants is moderate, as substantial R&D investment and patent portfolios are required to compete effectively in the wireless technology space.

The complete report reveals the real forces shaping InterDigital’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

InterDigital's reliance on highly specialized talent for its patent portfolio development significantly amplifies supplier bargaining power. These engineers and researchers possess unique, often scarce, expertise in fields like 5G, 6G, and advanced video compression, making their intellectual capital irreplaceable.

The scarcity of top-tier talent in these cutting-edge wireless and video technologies means these individuals, acting as suppliers of crucial knowledge, hold considerable sway. InterDigital's innovation pipeline is directly dependent on their skills, necessitating substantial investment in R&D to attract and retain this critical human capital.

Proprietary research methodologies could give suppliers significant leverage over InterDigital. If certain firms or academic groups have unique, highly effective patent development techniques, InterDigital might be compelled to pay premium prices or accept less favorable terms to access them. This reliance on specialized knowledge could translate into increased operational costs.

While InterDigital is known for developing its own intellectual property, reliance on foundational external research or key breakthroughs can shift power. If critical technologies are patented by other entities and become necessary for industry standards, InterDigital could find itself dependent on these external IP holders. This dependence grants significant bargaining power to those controlling essential foundational patents, allowing them to dictate terms for licensing or acquisition.

Cost of Intellectual Property Protection Services

The cost of intellectual property (IP) protection services significantly influences the bargaining power of suppliers for companies like InterDigital. Securing, maintaining, and enforcing a global patent portfolio is a complex and resource-intensive undertaking. This involves engaging specialized law firms and IP analytics providers who possess the expertise in patent law, international filings, and litigation. These specialized services are crucial for InterDigital to safeguard its innovations and generate revenue through licensing.

Law firms focusing on patent law and IP strategy are key suppliers to InterDigital. Their deep knowledge of patent prosecution, maintenance fees across various jurisdictions, and the intricacies of IP enforcement grants them considerable leverage. The ongoing need for these services, coupled with the high stakes of patent disputes, allows these firms to command premium pricing, directly impacting InterDigital's operational expenses and profitability.

- Specialized Legal Expertise: Law firms offering patent law, IP analytics, and international filing services are critical suppliers.

- High Service Costs: The process of securing, maintaining, and enforcing a global patent portfolio incurs substantial legal and administrative fees.

- Supplier Leverage: The specialized knowledge and the critical nature of IP protection empower these law firms, giving them significant bargaining power over InterDigital.

Availability of Research Infrastructure and Tools

Suppliers offering advanced research infrastructure like specialized labs or high-performance computing can exert moderate bargaining power. While many tools are widely available, highly specific or proprietary equipment crucial for wireless and video R&D may have limited suppliers. This scarcity can translate into increased acquisition costs for companies like InterDigital, potentially forcing reliance on a select few vendors for critical development capabilities.

For instance, the semiconductor industry, a key supplier of components for InterDigital's technology development, saw its global revenue reach approximately $583.7 billion in 2023, according to the Semiconductor Industry Association. However, the availability of highly specialized testing equipment or simulation software tailored for cutting-edge wireless standards, such as those for 6G development, might be concentrated among a smaller number of providers. This concentration can give these specialized tool suppliers a stronger hand in negotiations, influencing pricing and access for InterDigital.

- Limited Availability of Niche R&D Tools: Suppliers of highly specialized research equipment, particularly for advanced wireless technologies, may have limited competition.

- Potential for Increased Procurement Costs: Scarcity of specialized infrastructure can drive up the cost of essential development tools for companies like InterDigital.

- Vendor Dependence for Critical Capabilities: Companies may become reliant on specific vendors for unique or proprietary R&D tools, impacting their flexibility and negotiating leverage.

InterDigital's bargaining power with suppliers is influenced by the concentration of specialized legal and research talent. The scarcity of experts in advanced wireless and video technologies, such as those developing 6G standards, grants these individuals and firms significant leverage. This necessitates higher compensation and potentially less favorable terms for InterDigital, impacting R&D costs.

The reliance on specialized IP protection services, provided by a limited number of law firms, further strengthens supplier bargaining power. These firms command premium pricing due to their critical expertise in patent law and enforcement, directly affecting InterDigital's operational expenses. For instance, the global legal services market is substantial, and specialized IP law firms are essential for safeguarding InterDigital's innovations.

Suppliers of niche R&D infrastructure, like specialized testing equipment for advanced wireless development, also hold moderate bargaining power. Limited competition for these proprietary tools can lead to increased procurement costs for InterDigital, fostering dependence on a select few vendors for critical development capabilities.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on InterDigital |

| Specialized Legal Talent (Patent Law Firms) | Scarcity of expertise, critical nature of IP protection, high stakes of patent disputes | Premium pricing for services, increased operational costs |

| Advanced R&D Infrastructure Providers | Limited competition for proprietary tools, concentration of specialized equipment suppliers | Higher acquisition costs for R&D tools, potential vendor dependence |

| Highly Skilled Researchers/Engineers | Unique and scarce expertise in cutting-edge technologies (e.g., 6G) | Increased R&D investment for talent acquisition and retention |

What is included in the product

Uncovers the competitive intensity within the wireless technology licensing sector, highlighting InterDigital's strategic positioning and the external pressures it faces.

Instantly identify and mitigate competitive threats with a dynamic, interactive model that highlights the impact of each Porter's Five Force.

Customers Bargaining Power

InterDigital's bargaining power of customers is significantly influenced by the concentration of its major licensees. A few key players, including giants like Samsung, Apple, and Lenovo, represent a large chunk of InterDigital's overall revenue. This means these major manufacturers hold considerable sway during licensing discussions and when contracts are up for renewal.

The substantial revenue these major licensees contribute gives them leverage. They can impact licensing terms, potentially extending negotiations through arbitration or even litigation, which directly affects InterDigital's income and how predictable its financial performance is. For instance, in 2023, InterDigital's top five customers represented approximately 50% of its total revenue, highlighting this customer concentration.

Once a manufacturer integrates InterDigital's patented technologies into their products, switching to alternative technologies or developing their own equivalent intellectual property can be incredibly costly and disruptive. This high switching cost works in InterDigital's favor, as it locks in licensees and reduces their incentive to seek alternatives.

The embedded nature of standard-essential patents further enhances this stickiness, making it difficult for customers to easily abandon the licensed technology. For example, in 2024, the average cost for a company to migrate to a new cellular standard could run into millions of dollars, encompassing R&D, retooling, and market re-entry challenges.

Large manufacturers, like major smartphone makers, have substantial R&D budgets, often exceeding billions of dollars annually. For instance, in 2023, Apple and Samsung reportedly spent over $20 billion and $15 billion respectively on R&D. This financial muscle allows them to explore developing their own intellectual property, potentially diminishing their need for external patent licenses from companies like InterDigital.

While creating entirely new, foundational wireless standards is a monumental undertaking, the *threat* of in-house development serves as a powerful negotiation tactic for these large customers. This pressure compels InterDigital to constantly prove the unique value and breadth of its patent portfolio, ensuring its licensing terms remain competitive and attractive against the perceived alternative of self-sufficiency.

Influence of Patent Pools and Cross-Licensing

Customers, particularly large device manufacturers, can significantly influence InterDigital's pricing power through collective action. By participating in patent pools or engaging in cross-licensing, these customers can reduce their individual royalty burdens. For instance, the Avanci patent pool, which includes patents from companies like InterDigital, Nokia, and Ericsson, offers a consolidated licensing solution for connected vehicles. This pooling strategy allows automakers to access a broad portfolio of essential technologies at a potentially more favorable rate than negotiating with each patent holder individually.

This collective bargaining power can dilute InterDigital's leverage in bilateral negotiations. When customers can point to alternative, standardized licensing frameworks, it pressures InterDigital to offer more competitive royalty rates. The existence of such pools can foster a market expectation for standardized licensing terms, making it harder for individual patent holders to command premium pricing outside these arrangements. This dynamic was evident in the ongoing discussions around 5G licensing, where industry players sought to consolidate and streamline royalty payments.

- Patent Pools Offer Consolidated Access: Companies like InterDigital are part of licensing pools that aggregate patents from multiple entities, simplifying technology access for licensees.

- Cross-Licensing Reduces Individual Costs: Manufacturers can exchange patent rights, thereby lowering direct royalty payments to individual patent holders like InterDigital.

- Standardization Drives Down Rates: The collective bargaining power within pools can lead to more standardized and potentially lower royalty rates, impacting InterDigital's revenue streams.

- Market Leverage Shifts: The ability of customers to form or join these collective licensing agreements enhances their negotiating position against individual patent licensors.

Impact of Litigation and Arbitration Outcomes

The bargaining power of InterDigital's customers is significantly shaped by the unpredictable nature of litigation and arbitration outcomes. These legal processes directly impact the company's patent licensing revenue, which is inherently 'lumpy.' For instance, a favorable arbitration with a major licensee like Samsung in 2023 led to a substantial revenue uplift, demonstrating how positive resolutions can strengthen InterDigital's position. Conversely, adverse rulings could embolden customers to push for renegotiated, less favorable licensing terms.

Ongoing legal battles and their associated expenses create a climate of uncertainty for InterDigital. This uncertainty, coupled with the potential for customers to leverage negative outcomes as a basis to challenge existing royalty rates, effectively increases customer bargaining power. The financial strain and resource allocation required for these disputes can subtly shift leverage towards the licensees, who may see these challenges as opportunities to secure more advantageous agreements.

- Revenue Volatility: InterDigital's financial performance is subject to significant swings based on the success or failure of its legal engagements with licensees.

- Impact of Arbitration: Positive arbitration outcomes, like the one with Samsung in 2023 which reportedly settled outstanding royalties, can provide significant revenue boosts.

- Customer Leverage: Negative legal results or prolonged disputes empower customers by providing grounds to contest royalty payments and seek more favorable terms.

- Cost of Litigation: The substantial costs incurred in legal battles can indirectly enhance customer bargaining power by creating financial pressure on InterDigital.

InterDigital's customers, particularly large device manufacturers, possess considerable bargaining power due to the significant revenue they generate. For instance, in 2023, InterDigital's top five customers accounted for approximately 50% of its total revenue, underscoring their influence in licensing negotiations.

The threat of in-house intellectual property development by these well-funded companies also acts as a negotiating lever. With annual R&D budgets often in the billions, as seen with Apple and Samsung in 2023, they can explore creating their own solutions, potentially reducing reliance on external patent holders.

Furthermore, customers can consolidate their power through patent pools and cross-licensing agreements, which can lead to more standardized and potentially lower royalty rates. This collective bargaining can dilute InterDigital's leverage in individual discussions.

The outcomes of litigation and arbitration also play a crucial role, with favorable rulings strengthening InterDigital’s position and unfavorable ones potentially emboldening customers to seek renegotiated terms. The substantial costs associated with these legal battles can indirectly shift leverage towards licensees.

| Customer Factor | Impact on InterDigital | Supporting Data (Approximate) |

|---|---|---|

| Customer Concentration | High leverage for major licensees | Top 5 customers = ~50% of revenue (2023) |

| In-house R&D Capability | Potential to develop alternatives | Apple R&D > $20B, Samsung R&D > $15B (2023) |

| Collective Licensing (Pools) | Pressure for standardized/lower rates | Industry trend towards consolidated licensing |

| Litigation/Arbitration Outcomes | Can shift negotiation leverage | Samsung arbitration (2023) showed revenue impact |

What You See Is What You Get

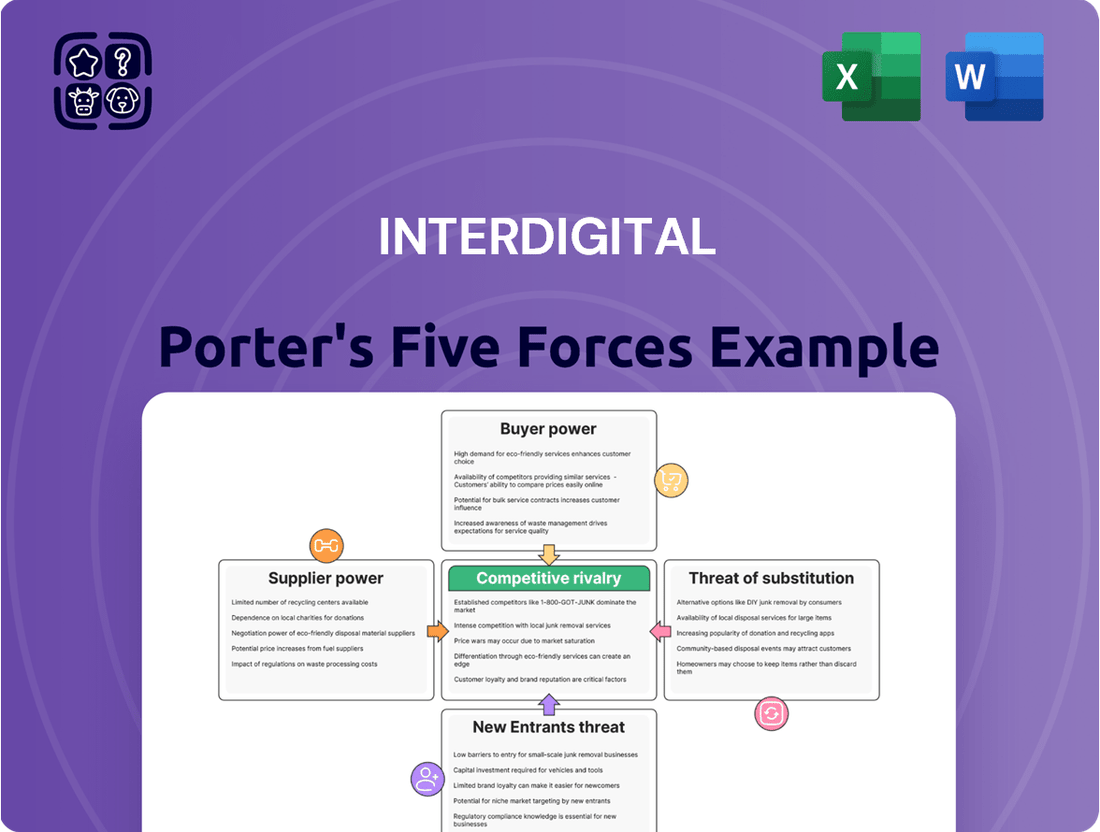

InterDigital Porter's Five Forces Analysis

This preview showcases the complete InterDigital Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape. The document you see here is the exact, professionally formatted report you will receive immediately after purchase. It details the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within InterDigital's industry. Rest assured, what you are previewing is precisely what you will be able to download and utilize after completing your transaction.

Rivalry Among Competitors

The patent licensing arena for wireless and video technologies is a crowded space, with formidable players like Ericsson, Nokia, and Qualcomm holding substantial patent portfolios. This intense competition directly impacts InterDigital, as these rivals also vie for licensing agreements and market dominance.

This rivalry frequently escalates through strategic legal battles, the formation of cross-licensing pacts, and ongoing, substantial investments in research and development. The goal is to continuously secure patents that are essential for future industry standards, thereby strengthening their competitive position.

The competitive rivalry in the wireless and video technology sector is intensified by significant research and development expenditures from key industry participants. Companies are pouring resources into developing cutting-edge technologies, such as the upcoming 6G standards, and actively securing new patents to bolster their licensing advantages. This continuous innovation cycle creates a highly dynamic landscape where a robust patent portfolio is crucial for market standing.

Patent litigation and arbitration are frequently employed strategies within the wireless technology sector, serving as crucial mechanisms for enforcing intellectual property rights and ensuring equitable compensation. The prevalence and results of these legal disputes are direct indicators of the competitive intensity among industry players.

For instance, InterDigital's successful arbitration against Samsung in 2023, which resulted in a significant licensing revenue increase, exemplifies how favorable legal outcomes can bolster a company's competitive standing. Conversely, adverse rulings can diminish a company's market power and inadvertently benefit rivals.

Emergence of Patent Pools

The emergence of patent pools, like Sisvel's Wi-Fi 6 pool, significantly alters the competitive landscape. These pools consolidate intellectual property, offering a streamlined licensing process that can reduce costs and increase efficiency for implementers. However, they also create a unified front for patent holders, increasing their collective bargaining power against potential licensees.

Companies now face a strategic choice: participate in a patent pool or pursue individual licensing agreements. This decision impacts how royalty rates are set and how technologies are adopted. For instance, the Wi-Fi 6 patent pool, which includes major players, aims to simplify licensing for the latest Wi-Fi standard, potentially influencing the royalty structures for the entire ecosystem.

- Patent Pool Formation: Groups of patent holders collaborate to license their essential patents collectively, simplifying the process for companies adopting a specific technology.

- Collective Bargaining Power: Patent pools enhance the negotiation leverage of licensors, potentially leading to standardized royalty rates across the industry.

- Strategic Licensing Choices: Companies must weigh the benefits of pool participation (reduced transaction costs, legal certainty) against the potential for lower rates or greater flexibility through bilateral agreements.

- Impact on Competition: Pools can accelerate technology adoption by reducing licensing friction but may also lead to higher overall royalty burdens if not managed competitively.

Differentiation of Patent Portfolios

The uniqueness, breadth, and essentiality of a company's patent portfolio are critical differentiators in the competitive landscape of wireless communications technology. InterDigital's strategic focus on foundational technologies for wireless communications, such as 5G standards, and video delivery mechanisms, provides a robust basis for its differentiation. This focus allows them to license essential patents that are critical for device manufacturers and service providers.

However, this strength also fuels intense competition. Rivals are continuously investing in research and development to create equally essential patents, fostering a dynamic race for technological superiority and ongoing market relevance. For instance, in 2023, companies like Qualcomm and Ericsson, major players in the 5G patent space, continued to secure new patents and engage in licensing discussions, highlighting the ongoing patent development activity.

The essentiality of InterDigital's patents, particularly in areas like 5G, means that companies seeking to implement these standards often need to license them. This creates a strong competitive advantage. However, the constant evolution of technology means that patents can become less essential over time if new, more efficient technologies emerge, requiring continuous innovation to maintain portfolio value.

- Uniqueness & Breadth: InterDigital's patents cover foundational aspects of wireless communication and video compression, offering a broad scope of protection.

- Essentiality for 5G: Many of InterDigital's patents are deemed essential for 5G implementation, granting them significant licensing leverage.

- Competitive Landscape: Key competitors like Qualcomm and Ericsson are also actively developing and asserting their own essential patent portfolios.

- Ongoing Innovation: The rapid pace of technological advancement necessitates continuous R&D to ensure patent portfolios remain relevant and essential.

Competitive rivalry is a defining characteristic of the wireless technology patent licensing market, with InterDigital facing strong opposition from established players like Ericsson, Nokia, and Qualcomm. These companies are locked in a continuous battle for market share through aggressive patent acquisition, strategic legal actions, and substantial R&D investments. The intensity of this rivalry is underscored by the significant patent litigation and arbitration cases that frequently occur, impacting licensing revenues and market positioning. For example, InterDigital's 2023 arbitration win against Samsung highlights how crucial favorable legal outcomes are in this competitive arena.

The landscape is further shaped by the formation of patent pools, such as Sisvel's Wi-Fi 6 pool, which consolidate intellectual property from multiple licensors. This consolidation enhances the collective bargaining power of patent holders, potentially standardizing royalty rates and influencing technology adoption across the industry. Companies must strategically decide whether to join these pools or pursue individual licensing agreements, a choice that directly affects their negotiation leverage and royalty structures.

InterDigital differentiates itself through the uniqueness, breadth, and essentiality of its patent portfolio, particularly in foundational 5G technologies and video compression. However, this strength also intensifies competition, as rivals like Qualcomm and Ericsson are equally committed to developing and asserting their own essential patent portfolios. The rapid evolution of wireless standards necessitates continuous innovation to maintain the relevance and value of these patents, making ongoing R&D a critical factor in staying competitive.

| Competitor | Approximate Patent Portfolio Size (Millions) | Key Technology Areas | 2023 Licensing Revenue (USD Billions) |

|---|---|---|---|

| Ericsson | ~60,000+ patents | 5G, IoT, Network Infrastructure | ~2.5-3.0 (estimated) |

| Nokia | ~20,000+ patents | 5G, Mobile Networks, Cloud | ~1.5-2.0 (estimated) |

| Qualcomm | ~150,000+ patents | 5G, Mobile Processors, Connectivity | ~9.0-10.0 (estimated) |

| InterDigital | ~3,000+ patents | 5G, Wi-Fi, Video Compression | ~1.0-1.2 (estimated) |

SSubstitutes Threaten

The growing adoption of open-source software and hardware presents a significant threat of substitutes for InterDigital's licensed technologies. Many applications and platforms can now be built using open-source alternatives, bypassing the need for traditional patent licenses, especially in areas not strictly tied to foundational wireless and video standards.

For instance, the global open-source software market was valued at approximately $36.5 billion in 2023 and is projected to reach $129.3 billion by 2030, demonstrating its increasing maturity and widespread acceptance. This growth suggests that more companies may opt for open-source solutions, potentially reducing the demand for proprietary licenses and exerting downward pressure on InterDigital's revenue streams.

Large technology giants and manufacturers possess substantial financial backing and robust research and development arms, enabling them to create their own wireless and video technologies. While matching the extensive range of InterDigital's patented portfolio is a considerable hurdle, these entities may choose to develop specific technological components or features internally.

This strategic move towards in-house innovation presents a viable alternative to external licensing agreements. When the financial calculus leans towards the cost-effectiveness of internal development over continuous royalty payments, it directly challenges InterDigital's licensing revenue streams.

While InterDigital is a leader in established standards like 5G, the potential for entirely new communication and video transmission methods poses a long-term threat. Should disruptive technologies emerge that bypass current patentable frameworks, they could act as effective substitutes. InterDigital's ongoing investment in 6G research and development is a proactive strategy to address this evolving landscape.

Cross-Licensing and Patent Swaps

Cross-licensing and patent swaps offer a significant substitute for traditional royalty payments. Instead of paying cash, companies can grant each other access to their patent portfolios, creating a reciprocal exchange of intellectual property rights. This can directly impact InterDigital’s licensing revenue model.

The prevalence of these agreements, particularly among large technology firms, can diminish the demand for standalone patent licensing. For instance, major players in the telecommunications sector often engage in such deals to share essential technologies, thereby reducing their reliance on external patent holders for licensing fees.

- Reciprocal IP Access: Companies exchange patent rights, bypassing direct cash payments.

- Reduced Licensing Demand: Large tech firms’ cross-licensing can lower overall demand for pure licensing.

- Strategic Advantage: These agreements can secure access to critical technologies without significant upfront costs.

Technological Obsolescence

Technological obsolescence is a significant threat for InterDigital. The rapid evolution of wireless and video standards means that even foundational patents can lose their relevance quickly. For instance, the transition from 4G to 5G, and now the ongoing development of 6G, necessitates continuous innovation to maintain patent value. InterDigital's ability to secure patents for emerging technologies is crucial to counter this threat.

Failure to adapt and innovate means InterDigital's existing patent portfolio could become less valuable as newer, more efficient technologies gain traction. This risk compels substantial and ongoing investment in research and development to stay ahead of technological shifts. In 2024, the industry saw significant R&D spending across major players in the telecommunications sector, highlighting the competitive pressure to innovate.

- Rapid technological advancement: New wireless and video standards emerge frequently, potentially devaluing existing patents.

- Need for continuous innovation: InterDigital must constantly invest in R&D to secure patents for future technologies.

- Risk of portfolio obsolescence: Outdated patents can lead to a decline in licensing revenue and market position.

- Competitive pressure: Competitors are also investing heavily in R&D to develop next-generation technologies.

The rise of open-source alternatives in software and hardware presents a direct substitute for InterDigital's licensed technologies, as many applications can now be developed without traditional patent licenses. The global open-source software market's projected growth to $129.3 billion by 2030 underscores this trend, potentially reducing demand for proprietary licenses.

Furthermore, large technology firms developing their own solutions internally can bypass the need for external licensing agreements, especially when internal development proves more cost-effective than ongoing royalty payments. This strategic insourcing directly challenges InterDigital's revenue model by offering a substitute for licensing fees.

The emergence of entirely new communication and video transmission methods, potentially bypassing current patent frameworks, represents a long-term disruptive threat. InterDigital's proactive investment in 6G research aims to counter this by developing patents for future technologies.

Cross-licensing and patent swaps also serve as significant substitutes, allowing companies to exchange IP rights instead of paying cash royalties. Major telecommunications players frequently engage in these reciprocal agreements, diminishing the demand for standalone patent licensing and impacting InterDigital's revenue streams.

| Substitute Type | Description | Impact on InterDigital |

|---|---|---|

| Open-Source Solutions | Development of applications using freely available software and hardware. | Reduces demand for licensed foundational technologies. |

| In-House Development | Large tech firms creating proprietary technologies internally. | Bypasses licensing fees, impacting InterDigital's revenue. |

| Disruptive Technologies | Emergence of new communication methods bypassing existing patent frameworks. | Potential obsolescence of InterDigital's current patent portfolio. |

| Cross-Licensing/Patent Swaps | Reciprocal exchange of IP rights between companies. | Decreases reliance on direct licensing payments. |

Entrants Threaten

Entering the foundational mobile and video technology research and patent licensing market demands substantial upfront investment in research and development. Developing a robust portfolio of standard-essential patents, akin to InterDigital's impressive collection exceeding 33,000, is a decades-long endeavor requiring continuous and significant financial commitment.

This high capital expenditure acts as a significant deterrent for potential new competitors, effectively creating a formidable barrier to entry and making it exceptionally challenging for emerging companies to establish a competitive foothold in this specialized sector.

To enter the patent licensing arena credibly, a new player must amass a substantial collection of high-quality, standard-essential patents. This endeavor is both costly and lengthy, requiring patents that are truly foundational and capable of surviving rigorous legal scrutiny.

InterDigital's existing patent portfolio, boasting over 39,000 granted and pending patents as of early 2024, represents a formidable barrier. The sheer scale and demonstrated legal strength of this portfolio make it exceptionally difficult for newcomers to establish a comparable competitive position.

The patent licensing business, like InterDigital's, is deeply intertwined with legal prowess and the capacity to defend intellectual property through intricate and often lengthy court proceedings. Newcomers must invest significantly in building formidable legal departments and be prepared for the substantial financial and temporal commitments of engaging in protracted legal disputes with established entities.

The sheer cost and time involved in patent litigation present a significant hurdle for potential new entrants. For instance, patent infringement lawsuits can easily run into millions of dollars in legal fees, and the resolution process can span several years, making it a daunting prospect for any new player looking to enter this competitive landscape.

Established Relationships with Major Manufacturers

InterDigital's established long-term licensing relationships with major global manufacturers represent a significant barrier to new entrants. These relationships, covering approximately 80% of the smartphone market as of 2024, are often cemented by multi-year agreements and prior arbitration outcomes, creating a formidable competitive moat.

Securing licenses from these deeply entrenched players would be an arduous task for any newcomer. The sheer scale and longevity of InterDigital's existing partnerships make it incredibly difficult for new entities to gain traction or displace them in the market.

- Established Market Share: InterDigital licenses its technology to roughly 80% of global smartphone manufacturers.

- Long-Term Agreements: Many of these licensing deals are multi-year contracts, providing stability and predictability.

- Arbitration Outcomes: Past successful arbitration proceedings have further solidified InterDigital's position and the terms of its licenses.

- High Switching Costs: For manufacturers, changing licensing partners can involve significant legal and operational hurdles.

Regulatory and Legal Barriers to Entry

The global intellectual property landscape is a labyrinth of intricate and ever-changing regulations and legal precedents. New companies looking to enter InterDigital's space must first grapple with these complex rules, which include navigating antitrust concerns surrounding standard-essential patents and adhering to fair, reasonable, and non-discriminatory (FRAND) licensing terms.

Successfully understanding and complying with these multifaceted regulations, alongside the significant challenge of building a robust and defensible patent portfolio, creates a substantial hurdle for any potential new competitor aiming to challenge InterDigital's established market position.

- Regulatory Complexity: Navigating global patent laws and compliance requirements is a significant barrier.

- Antitrust and FRAND: Understanding and adhering to rules on standard-essential patents and FRAND licensing is crucial.

- Patent Portfolio Development: Building a strong, defensible patent portfolio requires substantial investment and expertise.

- Legal Costs: The expense associated with legal compliance and patent litigation deters new entrants.

The threat of new entrants into InterDigital's patent licensing market is low due to the immense capital required for R&D and building a substantial patent portfolio, exceeding 39,000 patents by early 2024. Newcomers face significant legal hurdles and the need for extensive litigation capabilities to challenge established players.

InterDigital's dominant market share, licensing to about 80% of smartphone manufacturers as of 2024 through long-term agreements, creates high switching costs for customers. Navigating complex global IP regulations and antitrust laws further deters potential new entrants.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| R&D Investment | Developing foundational mobile and video technology requires substantial upfront capital. | High financial barrier, requiring decades of investment. |

| Patent Portfolio Size | InterDigital held over 39,000 granted and pending patents in early 2024. | New entrants need to amass a similarly large and legally sound portfolio. |

| Legal Expertise & Litigation Costs | Defending patents involves complex, costly, and time-consuming legal proceedings. | Deters companies lacking significant legal resources and financial reserves. |

| Established Customer Relationships | InterDigital licenses to ~80% of smartphone manufacturers with multi-year agreements. | Makes it difficult for new entrants to secure comparable licensing deals. |

| Regulatory Complexity | Navigating global IP laws, antitrust concerns, and FRAND terms is challenging. | Requires specialized knowledge and compliance infrastructure. |

Porter's Five Forces Analysis Data Sources

Our InterDigital Porter's Five Forces analysis is built upon a robust foundation of data, drawing from InterDigital's annual reports, SEC filings, and investor presentations. We also incorporate industry-specific market research reports and analyses from reputable financial institutions to provide a comprehensive view of the competitive landscape.