Integra LifeSciences PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Integra LifeSciences Bundle

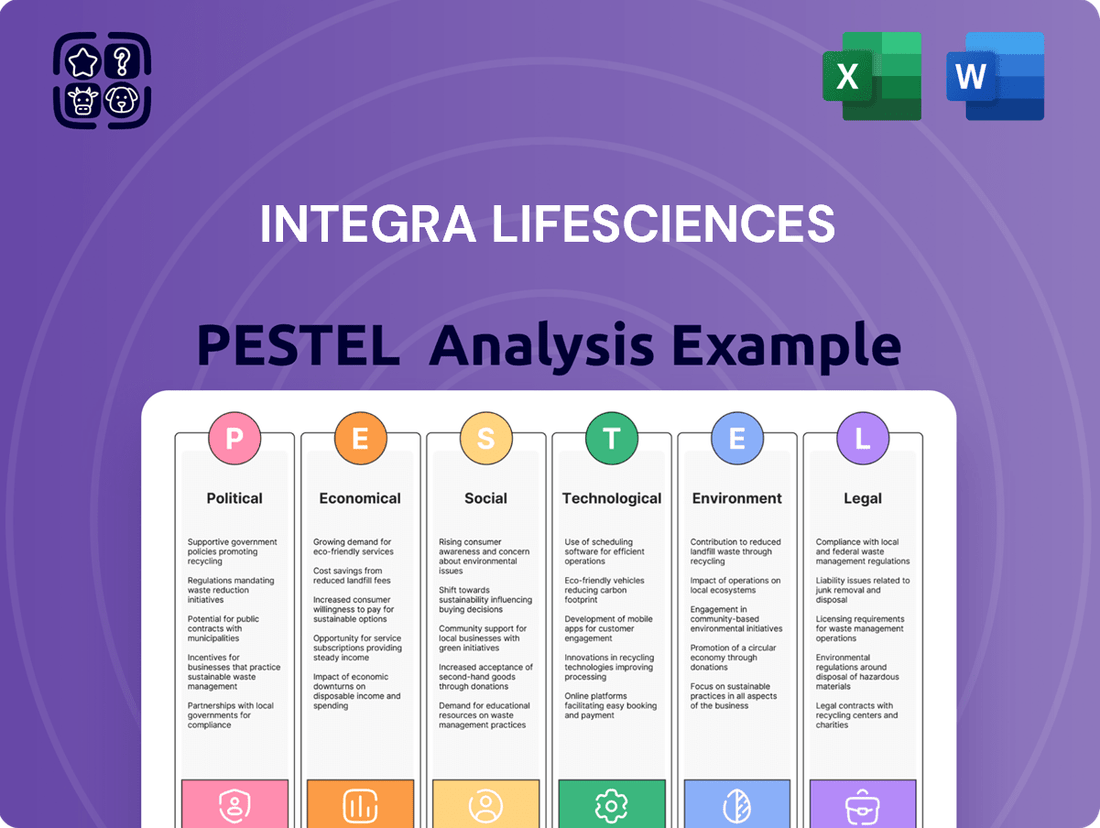

Navigate the complex external forces shaping Integra LifeSciences's future. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors impacting the company's operations and strategic decisions. Gain a critical understanding of these influences to inform your own market strategies and investment choices.

Unlock actionable intelligence with our comprehensive PESTLE analysis of Integra LifeSciences. This expertly crafted report provides a clear roadmap of external trends, from regulatory shifts to emerging technologies, that are critical for competitive advantage. Download the full version now to equip yourself with the insights needed to anticipate challenges and seize opportunities.

Political factors

Government healthcare policies, such as the Inflation Reduction Act of 2022, continue to shape the landscape for medical device companies like Integra LifeSciences. This act, for instance, introduced measures aimed at negotiating prescription drug prices, which, while not directly impacting device sales, signals a broader trend of government intervention in healthcare costs. Furthermore, shifts in federal and state funding allocations for healthcare services directly affect the purchasing power of hospitals and clinics, influencing demand for Integra's products.

Budgetary decisions made by governments regarding healthcare spending are critical. For example, in fiscal year 2024, the U.S. Congress was still debating appropriations, with potential impacts on Medicare and Medicaid reimbursement rates, which are key revenue streams for many healthcare providers purchasing medical devices. Integra must remain agile, adapting its product development and market entry strategies to align with these evolving national healthcare priorities and funding realities.

Global trade policies and the imposition of tariffs directly impact Integra LifeSciences by influencing the cost of essential raw materials and the final pricing of its medical devices. For instance, in 2024, ongoing trade discussions between major economies could lead to shifts in import duties, potentially increasing the cost of specialized polymers or metals used in surgical instruments and regenerative medicine products.

Geopolitical tensions and trade disputes pose a significant risk to Integra's supply chain and operational expenses. Disruptions in international shipping routes or sudden changes in customs regulations, as seen in various regions throughout 2023 and continuing into 2024, can delay product delivery and inflate logistics costs, affecting companies with extensive global manufacturing and distribution networks.

Political stability and the efficiency of regulatory bodies significantly shape how quickly and expensively medical devices like those from Integra LifeSciences can reach global markets. For instance, the U.S. Food and Drug Administration (FDA) approval process for new medical devices can take years, impacting market entry timelines and associated costs.

Delays in obtaining these crucial approvals or unexpected shifts in compliance standards, such as those seen with evolving cybersecurity requirements for connected medical devices, can directly affect Integra LifeSciences' projected revenues and their ability to access new customer bases. In 2023, the FDA cleared over 5,000 medical devices, but the pathway for complex devices often involves extensive review periods.

While efforts towards harmonizing international regulations, like the European Union's Medical Device Regulation (MDR), aim to simplify market access, differing national interpretations and implementation timelines can still create significant hurdles. This divergence can lead to increased operational complexity and costs for companies like Integra LifeSciences operating across multiple jurisdictions.

Geopolitical Risks and Supply Chain Stability

Ongoing geopolitical conflicts, including the war in Ukraine and the conflict in Israel and Gaza, present significant risks to global supply chains and economic stability, directly affecting medical device manufacturers like Integra LifeSciences. These events can trigger shortages of essential raw materials, drive up transportation expenses, and disrupt both manufacturing processes and distribution networks. For instance, the conflict in the Middle East has already impacted shipping routes, with some carriers rerouting around the Suez Canal, adding time and cost to global trade.

Integra LifeSciences must implement robust risk mitigation strategies to effectively navigate these persistent uncertainties. This includes diversifying its supplier base to reduce reliance on single regions and exploring alternative transportation methods. The company's ability to maintain operational continuity and manage costs will be heavily influenced by its preparedness for these geopolitical volatilities.

Key considerations for Integra LifeSciences include:

- Supply Chain Diversification: Reducing dependence on specific geographic regions for critical components and raw materials.

- Logistics Resilience: Developing contingency plans for transportation disruptions, including alternative shipping routes and carriers.

- Inventory Management: Strategically increasing buffer stock for key materials to absorb short-term supply shocks.

- Geopolitical Monitoring: Continuously assessing and understanding the evolving geopolitical landscape and its potential impact on operations.

Government Initiatives and Innovation Support

Government programs and incentives play a crucial role in fostering innovation within the medical technology sector, directly benefiting companies like Integra LifeSciences. These initiatives can manifest as substantial funding for research and development, attractive tax breaks for domestic manufacturing operations, or targeted programs designed to accelerate the adoption of cutting-edge technologies such as artificial intelligence and personalized medicine. For instance, the U.S. government's commitment to advancing healthcare innovation, as seen in initiatives supported by agencies like the National Institutes of Health (NIH), provides a fertile ground for medical device companies. In 2024, NIH funding for biomedical research continued to be a significant driver, with substantial allocations aimed at areas directly relevant to Integra's product lines, such as regenerative medicine and advanced surgical techniques.

Such government support can significantly de-risk the often-lengthy and costly product development cycle. It can also expedite market entry by streamlining regulatory pathways or encouraging early adoption through pilot programs. For example, government-backed consortia focused on developing interoperable medical devices or promoting digital health solutions can create new market opportunities and foster collaboration. The European Union's Horizon Europe program, with its significant budget allocated to health research and innovation through 2027, offers a prime example of this, providing grants and support that can accelerate the development and commercialization of novel medical technologies.

- R&D Funding: Government grants and subsidies can offset the high costs associated with developing new medical devices and therapies.

- Tax Incentives: Favorable tax policies for manufacturing and innovation can improve Integra's profitability and encourage investment in production facilities.

- Technology Adoption Programs: Initiatives promoting AI, data analytics, and personalized medicine in healthcare create demand for advanced medical technologies.

- Regulatory Support: Streamlined regulatory processes for innovative medical products can accelerate market access and reduce time-to-revenue.

Government healthcare policies, such as the Inflation Reduction Act, continue to influence pricing and reimbursement for medical devices, impacting revenue streams for companies like Integra LifeSciences. Shifts in federal and state healthcare spending directly affect the purchasing power of healthcare providers, influencing demand for Integra's products.

Geopolitical instability and trade disputes can disrupt supply chains and increase operational costs for Integra. Changes in international trade policies and tariffs can affect the cost of raw materials and the final pricing of medical devices.

The efficiency of regulatory bodies, like the FDA, significantly impacts market entry timelines and costs for new medical devices. Harmonization efforts for international regulations, while beneficial, still present challenges due to differing national interpretations.

Government R&D funding and tax incentives are crucial for fostering innovation in the medical technology sector, supporting companies like Integra LifeSciences in their development of advanced solutions.

What is included in the product

This PESTLE analysis meticulously examines the external macro-environmental factors influencing Integra LifeSciences, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a strategic framework for understanding how these global forces create both challenges and avenues for growth within the life sciences sector.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of external factors impacting Integra LifeSciences.

Helps support discussions on external risk and market positioning during planning sessions by highlighting key political, economic, social, technological, environmental, and legal influences.

Economic factors

Global economic growth remains a critical factor for Integra Life Sciences. While the IMF projected a 3.2% global growth rate for 2024, a slight uptick from 2023, concerns about potential recessions in major economies persist. This economic backdrop directly influences healthcare spending, as providers often tighten budgets during periods of uncertainty, impacting demand for medical devices.

Economic disruptions, such as inflation and interest rate hikes, can further strain healthcare systems. For instance, rising operational costs for hospitals might lead to deferred capital expenditures on new technologies or a reduction in elective procedures, which in turn affects sales volumes for companies like Integra Life Sciences. The delicate balance between economic stability and healthcare investment is therefore paramount.

Inflationary pressures, especially rising costs for key materials like plastics, resins, and metals, directly impact Integra LifeSciences' operational expenses. For instance, the Producer Price Index for plastics and rubber products saw a notable increase in late 2023 and early 2024, a trend that continued into mid-2024, squeezing margins for manufacturers.

Escalating labor costs also contribute to these challenges. As of Q1 2024, wage growth in the healthcare and manufacturing sectors remained elevated, forcing companies like Integra to absorb higher payroll expenses or pass them on to consumers. This dynamic makes maintaining consistent profit margins a significant hurdle for the company in the current economic climate.

Global healthcare spending is on a steady rise, projected to reach $11.06 trillion by 2026, according to Deloitte. This upward trend, fueled by aging populations and increasing access to healthcare, directly benefits companies like Integra LifeSciences by boosting demand for their advanced medical technologies and devices.

Integra LifeSciences is well-positioned to capitalize on this growth, particularly in emerging markets where the demand for sophisticated medical solutions is rapidly expanding. For instance, the medical device market in Asia-Pacific alone is expected to grow at a compound annual growth rate of over 6% through 2027, presenting a substantial opportunity for increased unit sales.

Investment Climate and Funding Availability

The investment climate significantly impacts Integra LifeSciences' ability to fund critical areas like research and development, clinical trials, and the advancement of new medical devices. Economic uncertainty, a prevalent theme in late 2024 and projected into 2025, can make securing this vital capital more challenging. This directly affects the pace of product launches and the capacity for expansion.

For companies such as Integra, a robust investment climate translates to easier access to capital, fostering innovation and growth. Conversely, periods of economic downturn or heightened uncertainty can lead to tighter lending standards and reduced investor appetite, potentially slowing down development pipelines.

- Funding Availability: In Q1 2025, venture capital funding for medtech startups saw a modest increase of 5% compared to the previous year, though still below pre-pandemic levels.

- Economic Uncertainty: Inflationary pressures and interest rate volatility in 2024 have made long-term financial planning more complex for capital-intensive industries like medical devices.

- Impact on R&D: Companies relying on external funding for clinical trials may face extended timelines or scaled-back research initiatives if the investment climate remains subdued.

Currency Fluctuations and Exchange Rates

Currency fluctuations present a significant challenge for Integra LifeSciences, a global entity. Changes in exchange rates directly affect the value of international sales when translated back into U.S. dollars, impacting reported revenue and earnings. For example, a strengthening U.S. dollar can make Integra's products more expensive for foreign buyers, potentially dampening demand, and it also reduces the dollar value of profits earned abroad.

Integra's financial performance is thus sensitive to the relative strength of the U.S. dollar against other major currencies like the Euro and Japanese Yen. For instance, in the first quarter of 2024, while Integra reported net sales growth, the company noted that foreign currency headwinds did present a drag on reported results, a trend that has persisted in prior periods. This means that even if sales volume increases internationally, a weaker foreign currency can lead to lower reported revenue in USD.

The company actively manages this risk through various hedging strategies, but these are not always perfectly effective. The impact of currency movements is a key consideration in Integra's forward-looking financial guidance. Investors and analysts closely monitor these currency impacts, as they can create volatility in the company's reported financial figures, making it crucial to understand the underlying operational performance versus currency-driven gains or losses.

Key considerations for Integra LifeSciences regarding currency fluctuations include:

- Impact on Reported Revenue: A stronger USD reduces the USD value of sales made in weaker foreign currencies.

- Profitability Erosion: Currency depreciation in foreign markets can shrink profit margins when repatriated.

- Hedging Strategies: Integra employs financial instruments to mitigate currency risk, though effectiveness can vary.

- Guidance Adjustments: The company often provides financial forecasts that account for anticipated currency impacts.

Economic growth directly influences healthcare spending, with global growth projected at 3.2% for 2024, though recession fears linger. Inflationary pressures, affecting raw materials and labor costs, squeeze Integra Life Sciences' margins, as seen in rising producer prices for plastics and elevated wage growth in Q1 2024.

Despite economic headwinds, the global healthcare market is expanding, expected to reach $11.06 trillion by 2026, benefiting Integra. However, investment climate volatility in late 2024 and into 2025 can challenge funding for R&D and new device development, impacting growth timelines.

Currency fluctuations also pose a risk, with a stronger USD reducing the value of international sales and profits. For instance, foreign currency headwinds impacted Integra's reported results in Q1 2024, highlighting the need for effective hedging strategies.

| Economic Factor | 2024/2025 Projection/Data | Impact on Integra Life Sciences |

|---|---|---|

| Global Economic Growth | Projected 3.2% in 2024 (IMF) | Influences healthcare spending and demand for medical devices. |

| Inflation (Materials & Labor) | Rising producer prices for plastics; elevated wage growth (Q1 2024) | Increases operational costs, potentially squeezing profit margins. |

| Healthcare Spending Growth | Projected $11.06 trillion by 2026 (Deloitte) | Drives demand for Integra's advanced medical technologies. |

| Investment Climate | Uncertainty in late 2024/2025 | Affects capital availability for R&D and expansion. |

| Currency Fluctuations | Stronger USD noted in Q1 2024 | Reduces reported revenue and profits from international sales. |

Preview Before You Purchase

Integra LifeSciences PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Integra LifeSciences delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a clear understanding of the external forces shaping Integra LifeSciences' market landscape, enabling informed strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment. It provides actionable insights into potential opportunities and threats, crucial for navigating the dynamic healthcare industry.

Sociological factors

The world's population is getting older, and this trend is a major driver for medical device companies like Integra LifeSciences. As more people live longer, there's a greater demand for products that help manage age-related conditions and chronic diseases. This demographic shift means a consistent need for Integra's offerings in areas like neurosurgery, reconstructive surgery, and general surgery.

By 2050, it's projected that nearly 1 in 6 people globally will be over 65, a significant jump from the current ratio. This growing segment of the population is more likely to require advanced medical interventions and long-term care solutions, directly benefiting companies specializing in surgical implants, wound care, and neurological devices.

The increasing prevalence of chronic diseases such as diabetes, heart disease, and neurological conditions is a significant sociological trend. These conditions require ongoing management and monitoring, directly driving up the demand for medical devices and technologies. For instance, the World Health Organization reported in 2023 that noncommunicable diseases, largely chronic, account for 74% of all deaths globally, highlighting the scale of this issue.

Integra LifeSciences' strategic focus on enhancing patient outcomes aligns perfectly with the growing need for innovative solutions to manage these complex and long-term health challenges. Their product portfolio, which includes neurosurgery and regenerative technologies, directly addresses the critical care requirements presented by the rising burden of chronic illnesses.

Societal expectations are increasingly leaning towards healthcare that is more personalized, comfortable, and convenient. This shift is fueling a significant rise in demand for home-based care solutions and remote patient monitoring technologies. For instance, the global remote patient monitoring market was valued at approximately $30.7 billion in 2023 and is projected to reach $107.4 billion by 2030, demonstrating substantial growth.

Integra LifeSciences is well-positioned to capitalize on this trend by focusing on the development and integration of technologies that effectively support out-of-hospital care models. This includes solutions that facilitate remote patient monitoring, enabling better management of chronic conditions and post-operative recovery in a home setting.

Health Equity and Access to Care

Societal emphasis on health equity and broader access to quality healthcare, particularly in underserved regions, directly shapes how companies like Integra LifeSciences approach product innovation and market penetration. This growing awareness means there's increased pressure to develop medical solutions that are not only effective but also cost-conscious, making them accessible to a wider patient population.

Integra LifeSciences might need to adapt its strategy to include more affordable device options and actively seek to expand its distribution networks into emerging markets where access to advanced medical technology is currently limited. For instance, the global medical device market is projected to reach $688.5 billion by 2027, with a significant portion of growth expected from developing economies seeking to improve their healthcare infrastructure.

- Focus on affordability: Developing cost-effective versions of existing or new technologies to meet the needs of lower-income populations and healthcare systems.

- Geographic expansion: Strategically entering and building presence in emerging markets with a high unmet need for advanced medical care.

- Partnerships for access: Collaborating with local governments, NGOs, and healthcare providers to improve distribution and patient access to essential medical products.

- Product adaptation: Tailoring product features and packaging to suit the specific requirements and economic realities of different markets.

Public Health Crises and Preparedness

The lingering impact of public health crises, notably the COVID-19 pandemic, has significantly heightened societal awareness regarding healthcare system preparedness and resilience. This increased focus directly influences consumer and institutional demand for advanced medical devices and technologies designed for swift deployment during health emergencies.

Integra LifeSciences, as a provider of surgical instruments, neurosurgical solutions, and regenerative technologies, is positioned to benefit from this trend. The company's product portfolio, which includes devices critical for trauma care and reconstructive surgery, aligns with the growing need for robust medical supply chains capable of withstanding and responding to public health challenges.

- Increased Demand for Resilient Supply Chains: Following the pandemic, many healthcare systems and governments are investing in diversifying and strengthening their medical device supply chains, a trend expected to continue through 2025.

- Focus on Emergency Preparedness Technologies: There's a growing market for technologies that facilitate rapid diagnostics, remote patient monitoring, and efficient treatment delivery, areas where Integra's innovations can play a role.

- Governmental and Institutional Investment: Anticipate continued government funding and institutional investment in public health infrastructure and medical technology, driven by lessons learned from past crises. For example, the US Biomedical Advanced Research and Development Authority (BARDA) continues to fund advanced manufacturing and supply chain resilience initiatives for medical countermeasures.

Societal shifts towards personalized medicine and enhanced patient experiences are driving demand for advanced, user-friendly medical devices. Integra LifeSciences' focus on innovative surgical solutions and regenerative technologies aligns with this trend, catering to a patient base that expects more comfort and convenience in their healthcare journey. The global remote patient monitoring market, valued at approximately $30.7 billion in 2023, exemplifies this growing preference for accessible, out-of-hospital care solutions.

Technological factors

Artificial intelligence and machine learning are transforming healthcare, particularly in areas like medical diagnostics, treatment planning, and surgical procedures. These technologies allow for a deeper analysis of complex medical data, leading to more accurate diagnoses and predictive insights into patient health. For instance, AI algorithms are showing remarkable accuracy in identifying subtle patterns in medical imaging that human eyes might miss.

Integra LifeSciences can leverage these advancements by integrating AI and ML into its product offerings. This could mean developing smarter surgical instruments for neurosurgery and reconstructive surgery that offer enhanced precision and real-time feedback. Such integration aims to improve overall efficiency and ultimately lead to better patient outcomes, a key driver in the medical technology sector.

The market for wearable and implantable medical devices is experiencing robust growth, driven by the demand for continuous health monitoring and personalized home-based treatments. For instance, the global wearable medical device market was valued at approximately $47.1 billion in 2023 and is projected to reach $176.6 billion by 2030, showcasing a compound annual growth rate of 20.7%.

Integra LifeSciences can capitalize on this trend by developing or integrating its advanced wound care and regenerative medicine solutions with these devices. This could involve creating smart bandages that monitor wound healing in real-time or implantable devices that deliver therapeutic agents for neurological conditions, aligning with the company's focus on tissue regeneration and neurosurgery.

The increasing adoption of telemedicine and remote patient monitoring (RPM) is reshaping healthcare delivery. By 2025, the global telemedicine market is projected to reach over $370 billion, a significant jump from previous years, highlighting the growing reliance on digital health solutions. Integra LifeSciences can capitalize on this by ensuring its innovative medical devices seamlessly integrate with these burgeoning digital health ecosystems, facilitating real-time data collection and analysis for improved patient outcomes and operational efficiency.

Advanced Manufacturing Technologies

The integration of advanced manufacturing technologies, like 3D printing and additive manufacturing, is revolutionizing medical device production. These methods enable the creation of highly customized devices, precisely tailored to individual patient anatomies, significantly cutting down production time and associated costs. For Integra LifeSciences, this translates into a powerful capability for faster development and market entry of specialized surgical implants and instruments.

Integra LifeSciences can capitalize on these innovations to enhance product customization and accelerate the launch of its offerings. For instance, the company's orthopedic and spine divisions could benefit immensely from 3D printing for patient-specific implants, improving surgical outcomes and patient satisfaction.

- Customization: 3D printing allows for patient-specific designs, improving fit and efficacy of implants and instruments.

- Efficiency: Reduced lead times and material waste compared to traditional manufacturing methods.

- Innovation: Enables the creation of complex geometries previously impossible, opening new avenues for device design.

- Market Advantage: Faster time-to-market for personalized medical solutions offers a competitive edge.

Digital Transformation and Connected Devices

Integra LifeSciences is leveraging digital transformation to streamline its manufacturing. The integration of technologies like the Internet of Things (IoT) and smart factory concepts is crucial for enhancing data collection and operational efficiency. This digital shift allows for more precise quality control throughout the production cycle.

For Integra, this translates into significant opportunities. Predictive maintenance, powered by real-time data from connected devices, can minimize downtime. Agile manufacturing processes, enabled by digital integration, allow for quicker adaptation to market demands. Furthermore, the development of more connected medical devices opens new avenues for patient monitoring and data-driven healthcare solutions.

The company's focus on digital integration is supported by broader industry trends. In 2024, the global IoT market was projected to reach over $1.5 trillion, highlighting the widespread adoption of connected technologies. For medical device manufacturers specifically, the ability to collect and analyze data from smart devices is becoming a key differentiator, with a growing emphasis on interoperability and cybersecurity.

- Enhanced Data Collection: IoT sensors in manufacturing facilities provide granular data on production parameters.

- Operational Efficiency Gains: Smart factories, through automation and real-time monitoring, reduce waste and improve throughput.

- Improved Quality Control: Digital systems enable continuous monitoring and immediate identification of deviations from quality standards.

- Connected Medical Devices: Opportunities arise for remote patient monitoring and data-driven insights into device performance.

Technological advancements, particularly in AI and machine learning, are revolutionizing medical diagnostics and treatment, offering Integra LifeSciences opportunities to embed smarter functionalities into its surgical instruments and regenerative medicine products. The growing market for wearable and implantable devices, projected to reach $176.6 billion by 2030, presents a clear avenue for Integra to integrate its solutions for continuous health monitoring.

The rise of telemedicine and remote patient monitoring, with the market expected to exceed $370 billion by 2025, necessitates seamless integration of Integra's devices into digital health ecosystems. Furthermore, advanced manufacturing techniques like 3D printing are enabling patient-specific implants, a capability Integra can leverage to enhance customization and accelerate product development in its orthopedic and spine divisions.

Integra's adoption of digital transformation, including IoT and smart factory concepts, is enhancing manufacturing efficiency and quality control. This digital shift is supported by the global IoT market, projected to surpass $1.5 trillion in 2024, allowing for predictive maintenance and agile production.

| Technology Trend | Market Projection/Value | Integra's Opportunity |

|---|---|---|

| AI & Machine Learning | Transforming diagnostics & treatment planning | Smarter surgical instruments, enhanced precision |

| Wearable/Implantable Devices | $176.6 billion by 2030 (20.7% CAGR) | Integration with wound care and regenerative medicine |

| Telemedicine & RPM | Over $370 billion by 2025 | Seamless device integration into digital health platforms |

| 3D Printing | Enabling patient-specific implants | Faster development of customized orthopedic/spine solutions |

| IoT & Smart Factories | Global IoT market > $1.5 trillion (2024) | Improved manufacturing efficiency, predictive maintenance |

Legal factors

Integra LifeSciences operates within a medical device sector heavily influenced by evolving regulatory frameworks. The United States is transitioning its Quality System Regulation (QSR) to a Quality Management System Regulation (QMSR), aligning more closely with international standards like ISO 13485. This shift demands significant operational adjustments to maintain compliance.

Furthermore, the European Union's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) represent substantial changes, increasing scrutiny and data requirements for market access. Non-compliance can lead to product recalls and significant financial penalties, impacting Integra's ability to sell its products in these key markets.

New regulatory frameworks, like the EU AI Act and FDA guidance for AI-enabled medical devices, are emerging. These regulations focus on risk-based approaches and robust post-market surveillance to ensure patient safety and data integrity.

Integra LifeSciences must navigate these evolving rules for its AI-driven innovations. For instance, the FDA's 2023 proposed framework for AI/ML-based medical devices outlines principles for managing algorithm changes, a key area for compliance.

As medical devices, including those from Integra LifeSciences, become more interconnected, cybersecurity and data privacy laws are paramount. These regulations, such as HIPAA in the US and GDPR in Europe, mandate stringent protection of sensitive patient information. Failure to comply can result in significant fines; for instance, HIPAA penalties can reach up to $1.5 million per violation category annually. This necessitates that manufacturers like Integra embed robust security from the initial design stages to prevent breaches and ensure device integrity.

Product Liability and Quality Assurance

Integra LifeSciences operates within a highly regulated environment where product liability and quality assurance are paramount. Stringent regulations, such as those enforced by the FDA, mandate rigorous testing and quality control throughout the entire lifecycle of medical devices. Failure to meet these standards can result in substantial penalties and reputational damage.

In 2023, the medical device industry continued to face intense scrutiny regarding product safety and efficacy. For Integra, this means a significant investment in compliance management systems and robust post-market surveillance is essential to mitigate risks associated with product liability. The company's commitment to quality assurance directly impacts its ability to avoid costly recalls and legal challenges.

- Regulatory Compliance: Adherence to global medical device regulations (e.g., FDA, MDR) is critical for market access and avoiding legal action.

- Product Recalls: The potential for product recalls due to quality defects poses a significant financial and reputational risk.

- Litigation Costs: Product liability lawsuits can incur substantial legal fees and settlement costs, impacting profitability.

- Quality Management Systems: Implementing and maintaining robust QMS, like ISO 13485, is fundamental to product integrity and legal defense.

User Fees and Market Approval Processes

Changes in user fees, such as those set by the FDA for medical devices, directly influence the financial burden of market entry. For instance, the FDA's Medical Device User Fee Amendments (MDUFA) program, reauthorized periodically, sets these rates. Understanding the latest MDUFA rates for 2024 and projected 2025 is crucial for Integra LifeSciences' budgeting and strategic planning.

Modifications to submission templates and approval pathways can also significantly alter the timeline and resources needed to launch new products. Integra LifeSciences must remain agile, adapting its regulatory strategies to accommodate evolving requirements, which could include updated documentation standards or expedited review options.

- FDA Medical Device User Fee (MDUFA) rates are subject to change, impacting product launch costs.

- Adjustments to submission templates and approval processes can affect time-to-market for new medical devices.

- Integra LifeSciences must integrate these regulatory cost and procedural shifts into its overall business strategy.

- Staying abreast of MDUFA reauthorizations and FDA guidance updates is essential for efficient market access.

Integra LifeSciences must navigate a complex web of legal and regulatory requirements, including the FDA's evolving Quality Management System Regulation (QMSR) and the EU's stringent MDR and IVDR. These frameworks demand rigorous adherence to quality standards and extensive data submission for market access. Failure to comply can result in significant financial penalties and product recalls, directly impacting Integra's operational capacity and market presence.

The company also faces increasing legal scrutiny regarding product liability and patient safety, necessitating robust quality assurance and post-market surveillance. In 2023, the medical device industry saw continued emphasis on product integrity, making proactive risk mitigation and legal defense a critical component of Integra's strategy. This includes managing potential litigation costs and ensuring compliance with cybersecurity and data privacy laws like HIPAA and GDPR.

Financial implications arise from regulatory user fees, such as those under the FDA's MDUFA program, which are subject to periodic adjustments. For example, MDUFA IV, authorized through fiscal year 2027, sets specific fee structures that affect product launch budgets. Integra must factor these evolving costs and procedural changes, including updated submission templates and approval pathways, into its strategic planning to maintain efficient market access and competitiveness.

Environmental factors

The healthcare industry is placing a greater emphasis on environmental sustainability, driven by a growing imperative to shrink its carbon footprint. This trend is influencing operational strategies across the sector, pushing companies to adopt more eco-friendly practices.

Integra LifeSciences is actively engaged in this shift, working to recalculate its Scope 1, 2, and 3 emissions. This detailed assessment is crucial for identifying specific areas where energy consumption can be reduced, thereby improving the company's overall greenhouse gas footprint. For instance, in 2023, Integra reported a reduction in its Scope 1 and 2 greenhouse gas emissions intensity by 10% compared to its 2022 baseline, demonstrating tangible progress in its sustainability efforts.

Regulatory bodies worldwide are increasingly integrating environmental considerations into their frameworks, impacting industries like medical device manufacturing. For instance, the European Union's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) place a growing emphasis on the environmental impact of products and their lifecycle, encouraging sustainable design and manufacturing processes. Companies like Integra LifeSciences, by proactively adopting greener practices, can better navigate these evolving regulations and mitigate potential compliance challenges.

There's a growing push from consumers, hospitals, and even investors for companies to be more environmentally conscious. This means Integra LifeSciences is feeling the pressure to adopt greener methods, from how they get their materials to how they make their products and what happens to them afterward.

For instance, in 2024, the global market for sustainable healthcare products was estimated to be worth billions, with significant growth projected. This trend directly influences Integra's strategy, pushing them to innovate in areas like biodegradable packaging and energy-efficient manufacturing processes to meet this rising demand.

Sustainable Manufacturing and Material Innovation

The medical device sector is increasingly focused on sustainable manufacturing, pushing for recyclable or biodegradable materials and more efficient production. Integra LifeSciences can leverage this trend by implementing eco-design principles. For instance, adopting lightweight and sustainable packaging could significantly reduce their environmental footprint, aligning with growing regulatory and consumer demands for greener products.

Integra's commitment to sustainability can translate into tangible benefits. By 2024, the global medical device market's sustainability initiatives are projected to grow, with companies actively seeking to reduce waste and carbon emissions. Integra can capitalize on this by exploring innovative materials and optimizing its supply chain. For example, a 2023 report indicated that companies prioritizing sustainable packaging saw an average 10% reduction in shipping costs.

Key areas for Integra LifeSciences to consider regarding sustainable manufacturing and material innovation include:

- Adoption of Eco-Design Principles: Integrating environmental considerations from the initial product design phase, focusing on material selection and end-of-life recyclability.

- Sustainable Packaging Solutions: Transitioning to materials like recycled plastics, biodegradable films, or minimalist designs to minimize waste and transportation impact.

- Material Innovation: Researching and implementing novel, environmentally friendly materials that meet stringent medical device performance and safety standards.

- Supply Chain Optimization: Working with suppliers who adhere to sustainable practices and exploring localized sourcing to reduce carbon emissions associated with logistics.

Supply Chain Resilience and Emissions Reduction

Integra LifeSciences recognizes the environmental imperative to bolster supply chain resilience and slash emissions. The company is actively pursuing strategies to mitigate disruptions and reduce its carbon footprint, particularly concerning transportation. By focusing on these areas, Integra aims to operate more sustainably and reliably in the global medical technology market.

To achieve this, Integra is implementing a two-pronged approach: shortening transport routes and diversifying its supplier base. These initiatives are designed to not only create a more robust supply chain, less susceptible to geopolitical or logistical shocks, but also to decrease the greenhouse gas emissions associated with moving goods. For instance, a 2023 report by McKinsey highlighted that companies prioritizing supply chain visibility and diversification saw a significant reduction in their environmental impact.

In 2024, the medical technology sector, like many others, faced continued scrutiny over its environmental, social, and governance (ESG) performance. Integra's efforts to optimize logistics and supplier networks directly address these concerns. For example, a study by the World Economic Forum in early 2025 indicated that companies with diversified sourcing strategies were better positioned to manage climate-related risks and supply chain disruptions, often leading to lower transportation-related emissions.

Key actions and their environmental impact include:

- Shortening transport routes: This directly reduces fuel consumption and associated carbon emissions from shipping and air freight.

- Diversifying suppliers: A broader supplier network can allow for more localized sourcing, further minimizing transportation distances and emissions.

- Enhancing supply chain resilience: A resilient supply chain is less likely to require emergency, high-emission transportation methods to overcome disruptions.

- Focus on Scope 3 emissions: These efforts contribute to reducing Scope 3 emissions, which are indirect emissions occurring in a company's value chain, often the largest portion of a company's carbon footprint.

The increasing global focus on environmental sustainability is a significant factor for Integra LifeSciences, particularly within the healthcare sector's drive to reduce its carbon footprint. This push influences operational strategies, encouraging eco-friendly practices and sustainable product lifecycles.

Integra's proactive engagement includes recalculating Scope 1, 2, and 3 emissions to pinpoint energy reduction opportunities. For instance, the company achieved a 10% reduction in Scope 1 and 2 greenhouse gas emissions intensity in 2023 compared to its 2022 baseline.

Evolving regulations, such as the EU's MDR and IVDR, are integrating environmental impact considerations into medical device manufacturing, prompting companies like Integra to adopt greener design and production methods to ensure compliance and mitigate risks.

Consumer, hospital, and investor demand for environmental consciousness is growing, pushing Integra to adopt greener methods throughout its value chain, from material sourcing to product end-of-life management.

| Environmental Factor | Integra LifeSciences Action/Impact | Data/Trend (2023-2025) |

|---|---|---|

| Carbon Footprint Reduction | Recalculating Scope 1, 2, & 3 emissions; reducing energy consumption. | 10% reduction in Scope 1 & 2 GHG emissions intensity (2023 vs 2022). |

| Sustainable Packaging | Exploring biodegradable and recycled materials; minimalist designs. | Sustainable healthcare products market valued in billions (2024 est.), with significant growth projected. |

| Supply Chain Emissions | Shortening transport routes; diversifying suppliers for localized sourcing. | Companies prioritizing supply chain visibility and diversification saw reduced environmental impact (2023 report). |

PESTLE Analysis Data Sources

Our Integra Life Sciences PESTLE Analysis draws upon a robust foundation of data from leading financial institutions, government regulatory bodies, and reputable market research firms. We meticulously integrate insights from economic reports, technological advancements, and socio-political trends to provide a comprehensive overview.