Integra LifeSciences Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Integra LifeSciences Bundle

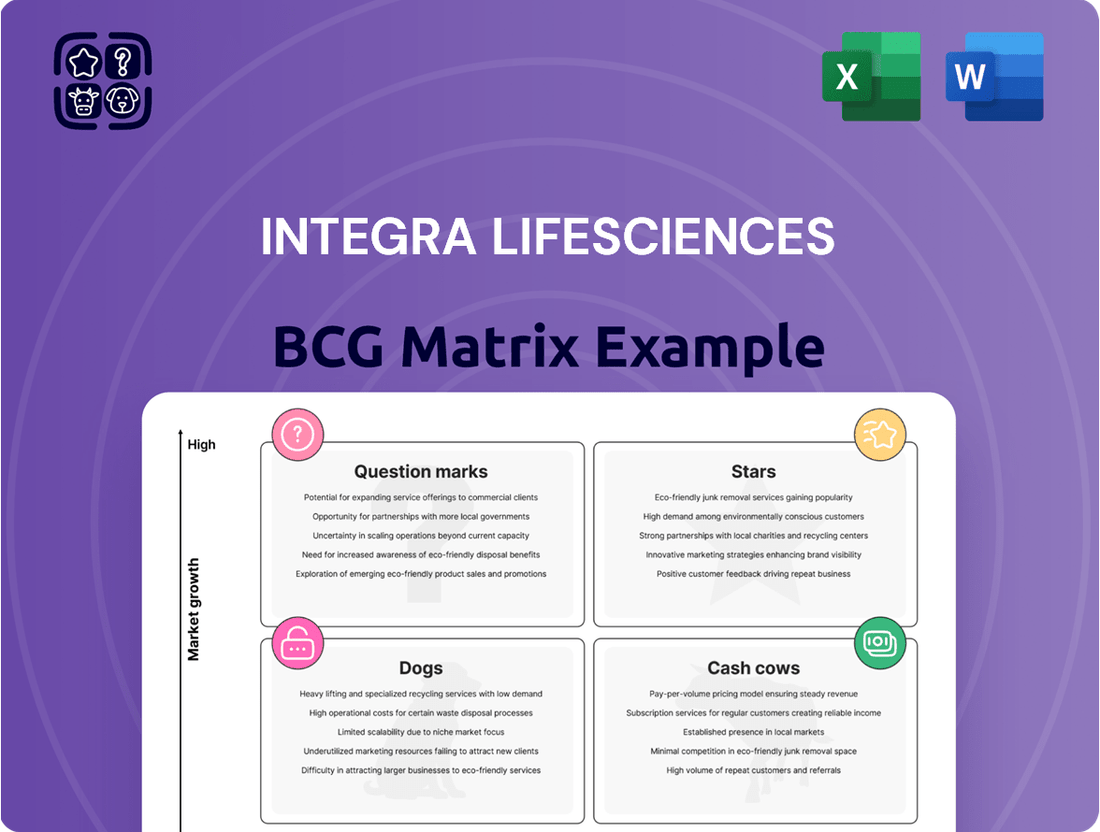

Integra LifeSciences' BCG Matrix offers a strategic lens to understand its product portfolio's market share and growth potential. This snapshot reveals which products are poised for future success and which may require careful consideration.

To truly harness the power of this analysis, dive into the full BCG Matrix report. It provides a comprehensive breakdown of Integra's offerings across Stars, Cash Cows, Dogs, and Question Marks, equipping you with actionable insights for optimized resource allocation and strategic planning.

Unlock a clearer vision of Integra LifeSciences' competitive landscape and make informed decisions. Purchase the full BCG Matrix today for a data-driven roadmap to maximize your investment and drive growth.

Stars

CereLink ICP monitors are a significant contributor to Integra's neuro monitoring offerings. In 2024, these monitors experienced robust single-digit growth, reflecting strong market acceptance and demand.

Operating within the neurosurgery consumables market, which is both substantial and expanding, CereLink ICP monitors are positioned as a leader in a high-growth sector. This strategic placement suggests a promising future for the product.

Integra LifeSciences' acquisition of Acclarent in April 2024 was a strategic move that significantly expanded its footprint in the Ear, Nose, and Throat (ENT) sector. This acquisition places Integra as a key player in an anatomical area closely related to its existing neurosurgery business.

Products such as AERA and TruDi navigated disposables are demonstrating robust growth within the Acclarent ENT business. This upward trend suggests that this segment could evolve into a high-growth, high-market share area for Integra LifeSciences.

DuraSorb is positioned as a Star within Integra Life Sciences' BCG Matrix. Its performance in 2024 demonstrated low-double digit growth in the wound reconstruction segment.

Further strengthening its Star status, DuraSorb experienced approximately 10% growth in the second quarter of 2025. This growth trajectory aligns with the broader advanced wound care market, which is both robust and expanding, indicating DuraSorb's strong market presence in a high-demand sector.

MicroMatrix & Cytal

MicroMatrix and Cytal, key components of Integra Life Sciences' wound reconstruction offerings, are demonstrating robust growth. In 2024, these products achieved low-double digit growth, and in Q2 2025, they continued this momentum with high single-digit growth.

This sustained performance underscores their significance within Integra's portfolio, particularly in the dynamic advanced wound care sector. Their contributions are vital to Integra's strategic positioning and market expansion.

- Product Performance: MicroMatrix and Cytal exhibited low-double digit growth in 2024 and high single-digit growth in Q2 2025.

- Market Contribution: These products are key drivers for Integra Life Sciences in the expanding advanced wound care market.

- Strategic Importance: Their consistent performance bolsters Integra's competitive standing and growth trajectory.

Integra Skin

Integra Skin, a key product within Integra LifeSciences' portfolio, is positioned as a strong contender in the BCG Matrix, likely in the 'Star' category. This classification is supported by its performance in a high-growth market segment.

Despite past production challenges, Integra Skin experienced a notable rebound. In the second quarter of 2025, the product achieved approximately 20% growth. This surge indicates a recovery and a positive trajectory for the product.

Production levels for Integra Skin are now on track to meet normal revenue expectations. This operational improvement is crucial for sustaining its market position and capitalizing on demand.

The wound reconstruction market, where Integra Skin operates, continues to exhibit robust growth. This favorable market environment provides fertile ground for Integra Skin’s expansion and market share gains.

- Market Growth: Integra Skin competes in the high-growth wound reconstruction market.

- Recent Performance: Q2 2025 saw approximately 20% growth for Integra Skin.

- Operational Recovery: Production is now pacing towards normal revenue levels.

- Market Position: The product is showing signs of regaining momentum and increasing market share.

Integra Skin and the products from the Acclarent ENT acquisition, like AERA and TruDi, are strong candidates for the Stars category in Integra Life Sciences' BCG Matrix. These products operate in high-growth markets and have demonstrated significant recent performance improvements.

Integra Skin, in particular, achieved approximately 20% growth in Q2 2025, recovering from past production issues and now tracking towards normal revenue expectations. Similarly, AERA and TruDi are showing robust growth within the expanding ENT segment, indicating their potential to become high-market share contributors.

| Product/Segment | 2024 Growth | Q2 2025 Growth | Market Position |

|---|---|---|---|

| Integra Skin | N/A (recovering) | ~20% | High-Growth Market |

| AERA & TruDi (Acclarent ENT) | Robust Growth | Robust Growth | High-Growth Market |

What is included in the product

The Integra LifeSciences BCG Matrix analyzes its product portfolio by market share and growth, guiding investment decisions.

A clear visual of Integra LifeSciences' BCG Matrix, showcasing each business unit's strategic position, alleviates the pain of resource allocation uncertainty.

Cash Cows

Integra Life Sciences' DuraGen and DuraSeal portfolios are prime examples of established cash cows. These products, primarily used for dural repair in neurosurgery, have a strong foothold in a mature yet stable market.

Despite facing some market headwinds, these offerings continue to demonstrate consistent growth. Their robust market position ensures a steady and reliable stream of cash flow for Integra, underscoring their value as mature assets.

Certas Plus Valves, a significant product within Integra Life Sciences' cerebrospinal fluid (CSF) management offerings, demonstrated robust performance in 2024, achieving low double-digit growth. This growth trajectory underscores its position as a mature yet strong performer within the neurocritical care market.

This reliable revenue generation makes Certas Plus a classic cash cow for Integra's Codman Specialty Surgical segment. Its consistent contribution is vital for funding other business units with higher growth potential.

Integra Life Sciences' core neurosurgical instruments, primarily sold to hospitals, are positioned as cash cows. Despite broader market fluctuations, hospital sales in this segment experienced growth in 2024, indicating strong demand for these essential tools.

These foundational instruments likely hold a significant market share within a mature market. This maturity, coupled with established hospital relationships, translates into stable and predictable revenue streams, a hallmark of a cash cow.

BactiSeal

BactiSeal is positioned as a Cash Cow within Integra LifeSciences' BCG Matrix. This classification stems from its robust performance in established markets. In 2024, BactiSeal demonstrated strong contributions, achieving low double-digit growth within the CSF management sector.

Furthermore, the product also delivered high single-digit growth in the neuro monitoring segment during the same year. This consistent expansion in key neurosurgical applications indicates a significant market share and a reliable source of cash generation for the company.

- BactiSeal's 2024 performance in CSF management: Low double-digit growth.

- BactiSeal's 2024 performance in neuro monitoring: High single-digit growth.

- Implication: High market share in established neurosurgical applications.

- Financial role: Reliable cash generator for Integra LifeSciences.

Mature Reconstructive Surgery Solutions

Integra LifeSciences' mature reconstructive surgery solutions, such as those for complex hernias and nerve/tendon repair, represent a significant cash cow within their portfolio. These offerings are well-established in the market, benefiting from years of clinical use and physician trust.

While precise growth figures for every mature product aren't publicly segmented, the consistent demand for reconstructive procedures, particularly in areas like hernia repair where prevalence remains high, suggests a sustained high market share. For instance, the global hernia repair market was valued at approximately $3.5 billion in 2023 and is projected to grow steadily, indicating a stable revenue stream for Integra's related solutions.

- Dominant Market Position: Integra's reconstructive surgery products hold a strong position in a mature market, benefiting from brand recognition and established clinical pathways.

- Steady Cash Flow Generation: The consistent demand for procedures like hernia repair and tendon reconstruction ensures a reliable and predictable cash flow from these mature offerings.

- Contribution to Portfolio Stability: These cash cows provide financial stability, allowing Integra to invest in research and development for emerging technologies or growth areas.

- High Market Share in Established Segments: The utility and widespread adoption of Integra's reconstructive solutions in common surgical interventions translate to a significant, stable market share.

Integra Life Sciences' DuraGen and DuraSeal portfolios are prime examples of established cash cows. These products, primarily used for dural repair in neurosurgery, have a strong foothold in a mature yet stable market.

Certas Plus Valves, a significant product within Integra Life Sciences' cerebrospinal fluid (CSF) management offerings, demonstrated robust performance in 2024, achieving low double-digit growth. This growth trajectory underscores its position as a mature yet strong performer within the neurocritical care market.

Integra Life Sciences' core neurosurgical instruments, primarily sold to hospitals, are positioned as cash cows. These foundational instruments likely hold a significant market share within a mature market, translating into stable and predictable revenue streams.

BactiSeal is positioned as a Cash Cow within Integra LifeSciences' BCG Matrix, demonstrating low double-digit growth in CSF management and high single-digit growth in neuro monitoring in 2024. This consistent expansion indicates a significant market share and a reliable source of cash generation.

Integra Life Sciences' mature reconstructive surgery solutions, such as those for complex hernias and nerve/tendon repair, represent a significant cash cow. The global hernia repair market was valued at approximately $3.5 billion in 2023, indicating a stable revenue stream for Integra's related solutions.

| Product Portfolio | BCG Category | 2024 Performance Insights | Market Role | Financial Contribution |

|---|---|---|---|---|

| DuraGen & DuraSeal | Cash Cow | Established in a mature, stable market. | Strong foothold in dural repair. | Steady, reliable cash flow. |

| Certas Plus Valves | Cash Cow | Low double-digit growth in CSF management. | Mature, strong performer in neurocritical care. | Vital funding for other units. |

| Neurosurgical Instruments | Cash Cow | Growth in hospital sales despite market fluctuations. | Essential tools with significant market share. | Stable and predictable revenue. |

| BactiSeal | Cash Cow | Low double-digit growth (CSF), high single-digit (neuro monitoring). | Significant market share in established neurosurgical applications. | Reliable cash generator. |

| Reconstructive Surgery Solutions | Cash Cow | Sustained high market share driven by consistent demand. | Well-established in hernia and nerve/tendon repair. | Contribution to portfolio stability. |

Delivered as Shown

Integra LifeSciences BCG Matrix

The Integra LifeSciences BCG Matrix preview you are viewing is the complete and final document you will receive upon purchase. This means you can be confident that the strategic insights and visual representation of Integra LifeSciences' product portfolio are exactly as they will be delivered, ready for immediate integration into your business planning. You'll gain access to a professionally formatted and analysis-ready report without any watermarks or demo content, ensuring a seamless transition from preview to practical application.

Dogs

The voluntary global recall of products manufactured at Integra's Boston facility, initiated in late 2024, has had a significant impact. This recall led to a substantial $511 million goodwill impairment charge recognized in the second quarter of 2025.

These affected products are currently a considerable financial burden, consuming valuable capital and necessitating expensive remediation and transition strategies. Consequently, they are clearly categorized as 'Dogs' within Integra LifeSciences' product portfolio, representing assets that are underperforming and draining resources.

Integra Life Sciences' private label business within its Tissue Technologies segment is currently positioned as a Dog in the BCG Matrix. In 2024, this segment saw a substantial organic sales decline of 16%, underscoring its underperformance.

The challenges persisted into the first half of 2025, with Q2 2025 reporting a 5.9% decline in private label sales. This downturn is attributed to persistent component supply delays and a softening in commercial demand, directly impacting revenue generation.

The consistent underperformance and significant resource allocation without generating adequate returns solidify its status as a Dog. This indicates a need for strategic review regarding its future within Integra's portfolio.

Integra LifeSciences' instrument business faced a mixed landscape in 2024. While hospital instrument sales showed growth, the overall organic instrument sales were flat or even saw a decline by Q2 2025. This dip is largely attributed to reduced sales in alternative sites and shifts in order timing.

This performance suggests that certain instrument lines within Integra are likely in the Dogs quadrant of the BCG Matrix. These are products with low market share in slow-growing or shrinking markets, indicating they are not performing well and may require strategic review.

Products Subject to Persistent Shipping Holds

Integra Life Sciences faces challenges with certain products currently under persistent shipping holds. These holds stem from ongoing operational issues and the company's ongoing Compliance Master Plan implementation. This situation means that even potentially strong products are struggling to reach customers, leading to lost sales and inventory that isn't generating cash.

These products, though they might have market potential, are effectively cash traps because they are tied up and unable to be sold. For example, in early 2024, the company reported that these types of disruptions impacted its ability to fulfill certain orders, directly affecting revenue streams. The company is actively working to resolve these issues to get these products back to market.

- Product Viability vs. Market Access: Products are viable but face intermittent shipping holds due to operational and compliance issues.

- Financial Impact: Lost revenue and tied-up inventory act as cash traps, hindering financial performance.

- Compliance Master Plan: Implementation of this plan is a contributing factor to the ongoing shipping disruptions.

- Market Recovery Focus: Integra is prioritizing the resolution of these holds to restore reliable market access and revenue generation.

Legacy Products with Low Market Adoption

Within Integra Life Sciences' diverse product offerings, certain legacy items may exhibit low market adoption. These could be older technologies or products that haven't received substantial innovation or marketing push, leading to a shrinking customer base and minimal growth potential. For instance, if a product launched in the early 2010s hasn't been significantly upgraded, its market share might be declining against newer, more advanced competitors. In 2023, Integra reported that its established product lines, while contributing to revenue, were not the primary drivers of growth, with newer innovations showing higher uptake.

These products, often kept in the portfolio for historical reasons or to serve a niche, may contribute little to the company's overall profitability. Their maintenance costs could even outweigh their revenue generation. For example, a product with less than 2% annual revenue growth in a rapidly expanding market segment would likely fall into this category. Integra's financial reports from 2024 indicated that while overall revenue grew, the contribution from certain older product categories remained stagnant.

- Dwindling Market Share: Products with limited updates often see their market share erode as competitors introduce more advanced solutions.

- Low Growth Trajectory: These items typically experience minimal to no revenue growth, failing to capitalize on market expansion.

- Minimal Profitability Contribution: Their low sales volume and potential for higher maintenance costs mean they contribute little to the bottom line.

- Strategic Review Candidates: Such products are often candidates for divestiture, discontinuation, or significant R&D investment to revitalize them.

Integra Life Sciences' private label business within Tissue Technologies is a clear 'Dog,' experiencing a 16% organic sales decline in 2024 and a further 5.9% drop in Q2 2025 due to supply delays and reduced demand. Similarly, certain instrument lines are 'Dogs,' with flat or declining organic sales in 2024-2025, impacted by shifts in alternative site sales and order timing. Legacy products with low market adoption and minimal growth potential also fall into this category, as indicated by stagnant revenue contributions from older product lines in 2024.

| Product Category | BCG Classification | Key Performance Indicators (2024-2025) | Strategic Implication |

|---|---|---|---|

| Private Label (Tissue Technologies) | Dog | -16% organic sales decline (2024) -5.9% Q2 2025 sales decline |

Requires strategic review; potential divestiture or turnaround effort. |

| Certain Instrument Lines | Dog | Flat or declining organic sales (2024-2025) | Underperforming; may need discontinuation or focused revitalization. |

| Legacy Products | Dog | Stagnant revenue contribution (2024) Low market adoption |

Low growth potential; consider divestiture or minimal investment. |

Question Marks

SurgiMend and PriMatrix are positioned as Question Marks within Integra LifeSciences' BCG Matrix. Their relaunch at the new Braintree facility, expected in early 2026, targets the high-growth wound reconstruction market. SurgiMend's pending PMA for breast reconstruction further highlights this potential.

Currently, these products hold a low market share due to past production challenges, necessitating substantial investment to regain and expand their market presence. This investment is crucial to capitalize on the significant growth prospects within the wound reconstruction sector.

Integra Life Sciences is strategically launching innovative products like MicroMatrix and Certas Plus in European markets, alongside DuraGen Secure and Certas Plus in China. These moves represent significant new market entries in regions poised for growth, demanding considerable investment in marketing and sales efforts. The objective is to capture substantial market share, positioning these offerings as potential future Stars in Integra's portfolio.

Integra LifeSciences' next-generation synthetic dural substitute, launched in 2023, is positioned as a Star in the BCG matrix. This product targets the expanding dural patch market with its focus on enhanced biointegration.

While its market share is currently modest, the dural substitute operates within a high-growth industry segment. This necessitates significant investment in marketing and sales efforts to secure wider adoption and drive future market leadership.

Emerging Technologies in Regenerative Care

Integra Life Sciences is actively exploring emerging technologies within regenerative care, aiming to pioneer new treatment pathways. This includes identifying novel applications for their existing product portfolio and scouting for potential future acquisitions in this dynamic field.

These nascent technologies represent high-growth potential markets, but currently exhibit low market penetration. Consequently, they require substantial investment in research and development, alongside dedicated market development efforts to achieve wider adoption.

- Stem Cell Therapies: These are early-stage but hold promise for tissue repair and regeneration, requiring significant R&D.

- Biologics and Growth Factors: While showing potential, their market penetration is still developing, necessitating focused market education.

- Advanced Biomaterials: Innovations in scaffolds and matrices are crucial for regenerative applications, demanding ongoing material science research.

- 3D Bioprinting: This technology offers revolutionary possibilities for creating complex tissues, but faces hurdles in scalability and regulatory approval, demanding considerable investment.

TruDi Navigation System

Acclarent's TruDi Navigation System, now under Integra LifeSciences, represents a key technological advancement within the ENT sector. This system, which includes navigated surgical instrumentation, is positioned to enhance precision in ENT procedures.

While the ENT market shows strong growth potential, advanced navigation systems like TruDi might still be in the nascent phases of broad market penetration. Integra's strategy will likely involve targeted investments to accelerate adoption and secure a larger market share for TruDi.

- Market Position: TruDi is a product of Acclarent, acquired by Integra, operating within the growing ENT market.

- Adoption Stage: Advanced systems like TruDi may be in early adoption stages, necessitating strategic push.

- Growth Strategy: Integra's focus will be on investing in TruDi to capture greater market share and unlock its full potential.

- Competitive Landscape: The success of TruDi will depend on its ability to differentiate and gain traction against existing and emerging navigation technologies in ENT surgery.

SurgiMend and PriMatrix are currently considered Question Marks for Integra Life Sciences. These products are slated for a relaunch in early 2026, targeting the expanding wound reconstruction market, with SurgiMend also seeking PMA approval for breast reconstruction. Despite the promising market outlook, their current market share is low due to past production issues, requiring significant investment to improve their standing.

These products require substantial investment to overcome past production challenges and capitalize on the high-growth wound reconstruction market. The goal is to increase their market share and transform them into Stars.

The company's investment in these products aims to capture a larger portion of the growing wound reconstruction market, potentially turning them into future market leaders.

Integra Life Sciences' strategic focus on SurgiMend and PriMatrix highlights their potential to become significant contributors to the company's portfolio, provided the necessary investments are made to address current market share limitations.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial reports, industry growth rates, and competitor analyses, to accurately position each business unit.