Integra LifeSciences Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Integra LifeSciences Bundle

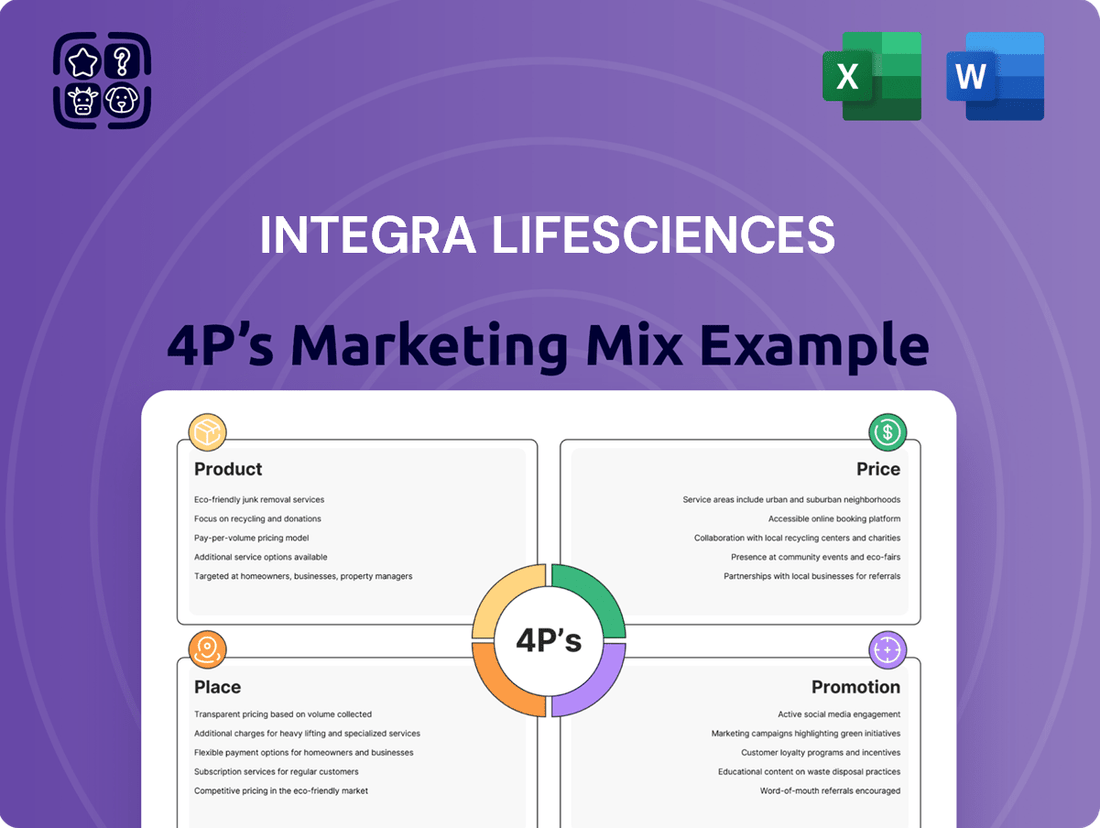

Dive into Integra LifeSciences' strategic brilliance with our comprehensive 4Ps Marketing Mix Analysis. Discover how their innovative product development, precise pricing, strategic distribution, and impactful promotional campaigns create a powerful market presence.

Unlock the secrets behind Integra LifeSciences' success by exploring their detailed product portfolio, competitive pricing strategies, extensive distribution networks, and targeted promotional efforts. This analysis is your key to understanding their market dominance.

Ready to gain a competitive edge? Our full 4Ps Marketing Mix Analysis of Integra LifeSciences provides actionable insights and a ready-to-use framework. Elevate your own marketing strategies by learning from the best.

Product

Integra LifeSciences boasts a diverse medical technology portfolio, encompassing a wide array of surgical implants and instruments. This extensive offering caters to critical medical fields such as neurosurgery, reconstructive surgery, and general surgery, all aimed at improving patient recovery and results.

The company's product lines extend to advanced wound care, orthobiologics, and innovative tissue regeneration solutions. For instance, in 2023, Integra reported revenue of $1.57 billion, with a significant portion driven by its diverse product offerings in these key areas, demonstrating strong market penetration and demand for its technological advancements.

Integra LifeSciences' Neurosurgical Solutions leadership is built on a robust portfolio of advanced medical devices. Their offerings include critical technologies like cranial stabilization and fixation systems, dural repair devices, and sophisticated electrosurgery and tissue ablation tools. This comprehensive approach addresses key needs within the neurosurgical field.

Key product lines such as the CUSA ultrasonic surgical devices, the Aurora and Mayfield systems for cranial fixation, and innovative solutions like DuraSeal, Bactiseal, and CereLink intracranial pressure monitors solidify Integra's prominent standing. These technologies are vital for precise and effective neurosurgical interventions.

The company's commitment to innovation in neurosurgery is evident in its continued development of specialized products. For instance, in 2024, Integra LifeSciences reported significant revenue growth in its Codman Neurosurgery segment, driven by strong demand for these advanced solutions, underscoring their market leadership and the critical role these products play in patient care.

Integra LifeSciences' regenerative technologies, like the Integra® Dermal Regeneration Template, are pivotal in soft tissue reconstruction, targeting complex wounds and burns. These advanced solutions, including PriMatrix® and SurgiMend®, are designed to accelerate healing and improve patient outcomes in a critical medical market. The company's commitment to innovation in this space is evident, as the global wound care market was valued at approximately $25 billion in 2023 and is projected to grow significantly, driven by an aging population and increasing prevalence of chronic diseases like diabetes.

Surgical Instrumentation and ENT

Integra LifeSciences offers a comprehensive suite of surgical instruments and lighting solutions, extending beyond its well-known implant portfolio. These tools are critical for a wide range of medical procedures, ensuring precision and efficiency in the operating room.

The strategic acquisition of Acclarent, Inc. in April 2024 significantly bolstered Integra's presence in the Ear, Nose, and Throat (ENT) market. This move solidified Integra's position as a key player in ENT technologies.

Key ENT products now part of Integra's offerings include the AERA and TruDi navigated disposables. These advanced technologies are designed to enhance surgical outcomes in ENT procedures.

- Product: Surgical instruments, lighting solutions, and advanced ENT technologies.

- Key ENT Offerings: AERA and TruDi navigated disposables.

- Market Impact: Strengthened position in the ENT sector following Acclarent acquisition.

Continuous Innovation and Development

Integra LifeSciences is deeply committed to continuous innovation, consistently investing in the development of its product portfolio. This focus is particularly evident in their core clinical areas, such as cerebrospinal fluid management, neuro-critical care monitoring, and advanced minimally invasive surgical technologies. For instance, in 2024, the company highlighted its progress in developing next-generation neurosurgical instruments designed to improve patient outcomes and surgeon efficiency.

Their innovation strategy extends beyond new product launches to include exploring new applications for existing technologies. This approach allows them to maximize the value of their current offerings and address evolving clinical needs. Integra also actively pursues advancements in early-stage technology platforms, aiming to build a robust pipeline for future growth. In their 2024 investor presentations, they detailed plans for several new product introductions expected in the 2025 fiscal year, targeting key growth segments within neurosurgery and regenerative technologies.

- Focus on Core Clinical Applications: Continued development in CSF management, neuro-critical care, and minimally invasive surgery.

- New Indications for Existing Technologies: Expanding the utility and market reach of current product lines.

- Advancement of Early-Stage Platforms: Investing in future technologies to drive long-term growth.

- 2024/2025 Pipeline: Plans for new product introductions and technological enhancements in the near term.

Integra LifeSciences offers a broad spectrum of medical technologies, with a particular emphasis on neurosurgery and regenerative technologies. Their product suite includes advanced cranial fixation systems, dural repair devices, and ultrasonic surgical instruments. These offerings are designed to enhance surgical precision and patient outcomes in complex procedures.

The company's regenerative medicine portfolio features dermal regeneration templates and tissue matrices, crucial for treating severe wounds and burns. In 2023, Integra reported $1.57 billion in revenue, with a significant portion attributed to these innovative product lines, reflecting strong market adoption and demand.

Further strengthening its market position, Integra acquired Acclarent, Inc. in April 2024, integrating advanced ENT technologies like the AERA and TruDi navigated disposables. This strategic move expanded their presence in the ENT sector, complementing their existing neurosurgical and regenerative solutions.

| Product Category | Key Products/Technologies | 2023 Revenue Contribution (Estimated) | 2024 Strategic Moves |

|---|---|---|---|

| Neurosurgical Solutions | CUSA, Aurora, Mayfield, DuraSeal, Bactiseal | Significant portion of total revenue | Continued innovation and new product development |

| Regenerative Technologies | Integra® Dermal Regeneration Template, PriMatrix®, SurgiMend® | Significant portion of total revenue | Focus on complex wound and burn treatment |

| ENT Technologies | AERA, TruDi navigated disposables | N/A (Pre-Acquisition) | Acquisition of Acclarent, Inc. in April 2024 |

What is included in the product

This analysis offers a comprehensive examination of Integra LifeSciences' marketing strategies across Product, Price, Place, and Promotion, providing actionable insights for strategic decision-making.

Provides a clear, actionable framework for understanding how Integra LifeSciences leverages its marketing mix to alleviate pain points for healthcare professionals and patients.

Helps identify opportunities to optimize product, price, place, and promotion strategies for enhanced pain relief solutions.

Place

Integra Life Sciences leverages a direct sales force across critical markets like the United States, Canada, Germany, the UK, Benelux, and France. This strategy, exemplified by divisions such as Integra NeuroSciences and Integra Reconstructive Surgery, enables direct engagement with healthcare providers. For instance, in 2023, the company reported net sales of $1.57 billion, with a significant portion driven by these direct market efforts.

Integra LifeSciences utilizes a robust global distribution network, complementing its direct sales force. This strategy is crucial for market penetration, ensuring their specialized medical products reach a wide array of healthcare settings.

By partnering with independent distributors, Integra LifeSciences effectively expands its reach into over 120 countries. This expansive network is vital for making their innovative neurosurgery, regenerative medicine, and surgical instruments accessible to a diverse international customer base.

Integra Life Sciences actively cultivates strategic alliances with industry titans like Johnson & Johnson, Medtronic, and Zimmer Holdings. These collaborations are crucial for broadening market penetration and accelerating product launches, reinforcing Integra's competitive standing in the med-tech sector.

In 2023, Integra reported total revenue of $1.6 billion, underscoring the significant market presence achieved partly through these strategic partnerships. Such alliances allow Integra to leverage the established distribution networks and brand recognition of its partners, thereby enhancing its go-to-market strategy and overall market share.

Presence in Hospitals and Outpatient Centers

Integra LifeSciences strategically places its innovative medical devices and surgical technologies within hospitals and outpatient centers, the primary venues for complex medical procedures. This ensures their products are readily accessible to surgeons and healthcare professionals performing critical interventions. The company’s distribution network is designed to serve these acute care environments and specialized surgical facilities.

This focused approach means Integra's solutions are available at the point of care for advanced patient treatment. For instance, their neurosurgery products are vital in hospital neuro units, while their reconstructive surgery offerings are utilized in both inpatient and outpatient surgical suites. This direct engagement with healthcare providers in these settings is key to their market penetration.

- Hospital and Outpatient Center Focus: Integra's primary sales channels are acute care settings.

- Specialized Facility Presence: Their products are found in physician and dental practices for specific procedures.

- Point of Care Accessibility: Solutions are available where complex surgical procedures are performed.

- Market Penetration Strategy: Direct engagement with healthcare providers in these settings is crucial.

Supply Chain and Manufacturing Optimization

Integra LifeSciences is making significant strides in optimizing its supply chain and manufacturing operations. These investments are crucial for maintaining product availability and meeting growing market demand. The company is actively transitioning manufacturing for select products to new, state-of-the-art facilities, a move designed to boost efficiency and alleviate existing production bottlenecks.

These strategic enhancements are directly impacting Integra's ability to serve its customers reliably. By focusing on manufacturing capacity and supply chain resilience, the company aims to prevent stockouts and ensure a consistent flow of its medical devices and technologies to healthcare providers worldwide. This proactive approach is vital in the dynamic medical technology landscape.

- Facility Transitions: Integra is relocating manufacturing for certain product lines to new facilities to improve capacity and efficiency.

- Efficiency Gains: Investments in modern manufacturing processes are expected to yield greater operational efficiency.

- Reduced Constraints: The company is actively working to minimize production limitations, ensuring a steadier supply.

- Product Availability: These supply chain and manufacturing optimizations directly support consistent product availability for customers.

Integra Life Sciences places its products directly within hospitals and specialized surgical centers, ensuring immediate access for healthcare professionals performing critical procedures. This strategic placement, evident in their neurosurgery and reconstructive surgery divisions, targets the point of care where advanced patient treatments occur.

Their distribution network is meticulously designed to serve these acute care environments, making solutions available where they are most needed. This focus on the physical location of product deployment is key to their market penetration strategy, ensuring surgeons and clinicians have their technologies at hand.

By being present in these specific healthcare settings, Integra facilitates the seamless integration of its devices into surgical workflows. This ensures that their offerings, from neurosurgical instruments to regenerative medicine products, are readily available for complex interventions.

The company’s commitment to placing products at the point of care is a cornerstone of its market strategy, directly supporting patient outcomes and clinician needs.

| Key Placement Channels | Examples of Use | Strategic Importance |

|---|---|---|

| Hospitals (Neurosurgery Units) | Neurosurgical instruments, implants | Direct access for critical procedures |

| Outpatient Surgical Centers | Reconstructive surgery devices | Facilitating advanced patient treatment |

| Specialized Medical Practices | Dental and physician offices | Targeted use for specific interventions |

Full Version Awaits

Integra LifeSciences 4P's Marketing Mix Analysis

The preview you see here is the exact same Integra LifeSciences 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This comprehensive breakdown of Product, Price, Place, and Promotion is fully complete and ready for your immediate use.

Promotion

Integra LifeSciences actively invests in medical education and training programs, offering a robust suite of resources for healthcare professionals (HCPs). These programs encompass hands-on practical labs, in-depth didactic courses, and accessible live and recorded webinars designed to foster continuous learning and skill enhancement.

The company further supports professional development through credentialed education, including Continuing Medical Education (CME) for physicians and Continuing Education Units (CEU) for nurses. These offerings are crucial for promoting best practices and ensuring HCPs stay current with the latest advancements in medical science and patient care.

In 2024, Integra LifeSciences continued to expand its digital learning platforms, reporting a 15% increase in HCP engagement with their online educational modules compared to the previous year. This digital focus aims to broaden reach and accessibility, supporting a growing number of professionals seeking to advance their expertise.

Integra LifeSciences consistently invests in participating in key healthcare conferences and congresses. These events serve as vital platforms for demonstrating their latest product innovations and engaging directly with healthcare professionals and potential partners. For instance, in 2024, Integra showcased its regenerative medicine portfolio at the American Academy of Orthopaedic Surgeons (AAOS) Annual Meeting, a significant industry gathering.

These conferences are instrumental in fostering industry visibility and building thought leadership. Integra leverages these opportunities to connect with the investment community, often presenting their financial performance and strategic outlook. Such engagement helps in building investor confidence and understanding market dynamics, crucial for a publicly traded entity like Integra.

Beyond product showcases, participation in these events facilitates crucial networking and knowledge exchange. Integra uses these gatherings to gather market intelligence, understand emerging trends, and identify potential collaborations. This proactive approach ensures they remain at the forefront of medical technology advancements, contributing to their long-term growth strategy.

Integra Life Sciences leverages digital channels to connect with stakeholders, notably through its investor relations website, which serves as a hub for financial news and corporate announcements. This digital presence ensures timely dissemination of critical information to investors and the financial community.

The company's commitment to education is exemplified by the Integra Institute, a global medical education platform providing accessible, on-demand learning resources. This initiative underscores Integra's dedication to fostering continuous professional development within the medical field.

These digital resources enhance information accessibility and promote ongoing engagement, supporting Integra's broader marketing objectives. For instance, in early 2024, the company highlighted its digital engagement strategies, emphasizing the value of platforms like the Integra Institute in reaching healthcare professionals worldwide.

Clinical Evidence and Publications

Integra LifeSciences' commitment to robust clinical evidence and publications underpins its marketing strategy. This focus on data-driven validation is crucial for gaining the trust and acceptance of healthcare professionals. By showcasing the efficacy and benefits of their offerings, Integra aims to influence prescribing habits and establish their products as standard-of-care within specific medical fields.

The company actively supports and disseminates research that highlights the advantages of their technologies. This includes studies on their regenerative technologies and surgical instruments. For example, publications in peer-reviewed journals often detail positive patient outcomes and improved procedural efficiencies associated with Integra's products, reinforcing their value proposition.

- Clinical Trials: Integra invests in clinical trials to gather objective data on product performance and patient safety, often sharing these findings at medical conferences.

- Peer-Reviewed Publications: A significant number of their products are featured in respected medical journals, providing in-depth analysis and evidence for their clinical utility.

- Key Opinion Leader (KOL) Engagement: Collaborations with leading medical experts often result in joint publications and presentations, further validating product benefits.

- Real-World Evidence: Beyond controlled trials, Integra also emphasizes collecting and analyzing real-world data to demonstrate long-term effectiveness and patient satisfaction.

Public Relations and Investor Communications

Integra LifeSciences actively engages in public relations and investor communications, utilizing channels like press releases and earnings calls to share financial performance and strategic updates. This commitment to transparency aims to inform and attract a broad audience of financially-literate stakeholders, from individual investors to institutional analysts.

In 2024, Integra LifeSciences continued its practice of regular investor outreach, including quarterly earnings calls and participation in key industry conferences. For instance, their Q1 2024 earnings call on May 2, 2024, provided insights into their financial results and strategic priorities, highlighting progress in key growth areas.

- Financial Transparency: Regular reporting of financial results ensures stakeholders have up-to-date information on revenue, profitability, and operational performance.

- Strategic Communication: Investor presentations and press releases detail ongoing initiatives, such as new product launches or market expansions, providing context for future growth.

- Stakeholder Engagement: Direct communication through earnings calls and investor days fosters dialogue and builds confidence among investors, analysts, and the broader financial community.

- Market Perception: Consistent and clear communication helps shape market perception of Integra LifeSciences' value and long-term prospects.

Integra LifeSciences' promotional efforts focus heavily on educating healthcare professionals through various channels, including digital platforms and in-person events. Their investment in medical education, such as the Integra Institute, aims to foster continuous learning and skill enhancement, directly influencing product adoption and best practice implementation.

The company actively participates in key industry conferences like the American Academy of Orthopaedic Surgeons (AAOS) Annual Meeting, showcasing innovations and engaging with professionals to build thought leadership and market visibility. This strategy extends to digital outreach, enhancing accessibility and reach for their educational resources.

Integra also prioritizes robust clinical evidence and peer-reviewed publications to validate product efficacy and influence prescribing habits. Collaborations with Key Opinion Leaders (KOLs) and the dissemination of real-world evidence further solidify their value proposition, driving acceptance and establishing their technologies as standard-of-care.

Investor relations and public relations are crucial promotional components, with regular earnings calls and press releases ensuring financial transparency and strategic communication. This approach, exemplified by their Q1 2024 earnings call on May 2, 2024, aims to build confidence and shape positive market perception among a wide range of stakeholders.

| Promotional Activity | Key Focus Area | 2024 Data/Activity Highlight |

|---|---|---|

| Medical Education & Training | HCP Skill Enhancement | 15% increase in HCP engagement with online modules |

| Industry Conferences | Product Innovation Showcase | Participation in AAOS Annual Meeting showcasing regenerative medicine |

| Clinical Evidence & Publications | Product Validation | Emphasis on peer-reviewed journals and KOL collaborations |

| Investor & Public Relations | Financial Transparency | Q1 2024 earnings call on May 2, 2024 |

Price

Integra LifeSciences likely employs a value-based pricing strategy for its specialized medical devices and implants. This approach is driven by the significant clinical benefits and improved patient outcomes these products deliver, justifying a premium over standard alternatives.

The pricing reflects the total value proposition, including potential cost savings for healthcare systems by reducing complications and hospital stays. For instance, their neurosurgery portfolio, known for precision, commands prices aligned with its ability to minimize patient trauma and recovery time.

In 2024, the company's focus on innovative solutions, such as their regenerative medicine products, continues to support this strategy. By demonstrating superior efficacy and long-term patient benefits, Integra can set prices that capture a substantial portion of the value created for both patients and providers.

Integra Life Sciences navigates a fiercely competitive medical technology landscape where pricing is a delicate balance. The company must meticulously analyze competitor pricing for similar devices and implants, such as those offered by Stryker or Zimmer Biomet in orthopedics, while ensuring its own profitability. This means understanding the value proposition of its innovations, like its neurosurgery or regenerative medicine products, against established players.

In 2024, the medical device market continues to see intense competition, with companies frequently adjusting their pricing strategies to capture market share. For Integra, this means that while groundbreaking technology can command a premium, the need to remain competitive, especially in areas like wound care or surgical instruments, requires careful price setting. For instance, in the surgical instrumentation segment, pricing often reflects not just the product but also bundled services and support, a factor Integra must weigh.

Reimbursement is a huge piece of the puzzle for medical device companies like Integra LifeSciences. Getting paid often hinges on navigating complex policies from Medicare, Medicaid, and private insurance. In 2023, Medicare paid out over $900 billion in benefits, highlighting the significant impact these programs have on healthcare provider revenue.

Integra understands this and offers robust reimbursement support. They provide healthcare professionals with crucial coding information, summaries for both hospital stays and outpatient procedures, and help with verifying benefits and getting prior authorization. This assistance is vital for encouraging the use of their products and ensuring they receive proper payment.

Discounts and Financing Options

While Integra Life Sciences doesn't publicly detail specific discount structures or financing options, it’s a standard practice in the medical device industry. Companies often provide flexible payment terms or volume-based discounts, particularly for substantial capital equipment purchases or large-scale product orders from healthcare institutions. This approach is crucial for making advanced medical technologies financially attainable for hospitals and clinics.

These financial arrangements are designed to ease the upfront cost burden, thereby increasing product adoption. For instance, a hospital might negotiate a multi-year payment plan for a new surgical system or receive tiered pricing based on the volume of disposables purchased. Such strategies are vital for competitive positioning, especially when considering the capital-intensive nature of healthcare procurement.

The 2024 medical device market, valued at approximately $510 billion globally, sees intense competition where pricing flexibility is a key differentiator. Integra's ability to offer tailored financing, even if not explicitly advertised, would align with industry norms to secure contracts and build long-term relationships with healthcare providers. This often translates into more predictable revenue streams for the company.

- Volume Discounts: Offering reduced per-unit costs for larger orders of implants or instruments.

- Leasing Options: Providing equipment on a lease-to-own basis for high-cost capital items.

- Payment Plans: Structuring payments over extended periods to manage cash flow for providers.

- Bundled Pricing: Combining capital equipment with service contracts or recurring supply needs at a reduced overall price.

Impact of Economic Conditions and Tariffs

External economic conditions and tariffs directly affect Integra LifeSciences' pricing power and profitability. For instance, the company's 2025 financial outlook anticipates a decrease in gross margins, partly due to the ongoing impact of tariffs. This highlights how macroeconomic shifts can pressure pricing strategies and ultimately impact the company's bottom line.

The sensitivity of Integra's gross margins to tariff impacts underscores the importance of monitoring global trade policies. For 2025, the company projected gross margins to be in the range of 55.5% to 56.5%, with a portion of the anticipated decline explicitly linked to these trade-related costs. This suggests that tariffs could represent a significant headwind, forcing adjustments in pricing or cost management to maintain profitability.

- Tariff Impact on Margins: Integra LifeSciences anticipates a portion of its projected gross margin decline in 2025 to be attributable to tariff impacts.

- Gross Margin Outlook (2025): The company's guidance for 2025 suggests gross margins are expected to be between 55.5% and 56.5%.

- Economic Sensitivity: Pricing strategies and gross margins are demonstrably sensitive to broader economic conditions and trade policies.

Integra Life Sciences likely uses a value-based pricing model, reflecting the clinical advantages of its specialized medical products. This strategy is supported by the company's focus on innovation, such as advancements in regenerative medicine, which justify premium pricing due to improved patient outcomes and potential cost savings for healthcare systems.

The company must balance this premium pricing with competitive pressures in the medical device market, as seen in 2024. For instance, while their neurosurgery portfolio commands prices based on precision, other areas like surgical instruments require pricing that considers bundled services and support to remain competitive against players like Stryker.

External factors significantly influence Integra's pricing. For 2025, the company projects gross margins between 55.5% and 56.5%, with a portion of the anticipated decline linked to the impact of tariffs, demonstrating the sensitivity of pricing and profitability to global trade policies.

| Pricing Strategy Component | Key Considerations | 2024/2025 Data/Context |

| Value-Based Pricing | Clinical benefits, patient outcomes, healthcare system savings | Focus on neurosurgery and regenerative medicine innovations |

| Competitive Landscape | Competitor pricing, market share objectives | Intense competition in surgical instruments and wound care |

| External Economic Factors | Tariffs, trade policies, economic conditions | Projected gross margin impact from tariffs in 2025 (55.5%-56.5% outlook) |

4P's Marketing Mix Analysis Data Sources

Our Integra Life Sciences 4P's Marketing Mix Analysis is built upon a foundation of comprehensive data, including official company filings, investor relations materials, and detailed product information. We also incorporate insights from industry reports, market research databases, and competitive intelligence to ensure a holistic view.