Integra LifeSciences Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Integra LifeSciences Bundle

Integra LifeSciences operates in a dynamic medical technology landscape, facing moderate threats from new entrants and intense rivalry among established players. Understanding the bargaining power of buyers and suppliers is crucial for navigating this competitive environment.

The complete report reveals the real forces shaping Integra LifeSciences’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Integra LifeSciences, operating in the medical technology sector, depends on specialized raw materials and components. A limited number of suppliers for these crucial inputs can significantly amplify their bargaining power. This concentration can translate into increased costs and potential vulnerabilities within Integra's supply chain.

The medical device industry has faced persistent supply chain challenges, including shortages of essential raw materials, as noted in industry analyses throughout 2024. Such conditions inherently bolster the negotiating leverage of suppliers, allowing them to dictate terms and prices more effectively.

Integra Life Sciences' reliance on specialized inputs for neurosurgery and reconstructive surgery significantly impacts supplier bargaining power. These fields demand precision components and unique materials that aren't readily available from multiple sources.

If Integra sources proprietary technologies or components requiring highly specific manufacturing processes, their ability to switch suppliers becomes restricted. This dependence grants suppliers more leverage in price negotiations and terms.

For instance, the use of specialized materials like titanium for surgical implants is a prime example. Sourcing these from a limited number of qualified suppliers inherently increases their bargaining power over Integra.

Switching suppliers in the medical device industry, especially for critical components like those Integra LifeSciences relies on, presents substantial hurdles. These include lengthy and expensive qualification processes, securing necessary regulatory approvals, and the inherent risk of production disruptions during the transition. These high switching costs significantly bolster the bargaining power of Integra's current suppliers.

For Integra, the financial and operational impact of changing suppliers can be considerable. Imagine the expense and time needed to re-validate every component, ensure compliance with FDA or similar regulatory bodies, and then integrate a new supplier's workflow without impacting patient care or product availability. These factors make it difficult for Integra to easily shift away from established relationships, giving existing suppliers more leverage.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers poses a significant factor in assessing their bargaining power over Integra Life Sciences. If suppliers possess the capability and a strong incentive to move into manufacturing medical devices themselves, they can directly compete with Integra. This potential scenario significantly enhances their leverage, as Integra would need to manage these relationships carefully, perhaps by offering more favorable pricing or terms to dissuade them from becoming direct rivals.

While this threat is generally less pronounced for suppliers of highly specialized raw materials, it's a crucial consideration for Integra. For instance, if a supplier of a critical component used in Integra's neurosurgery products were to develop its own implantable devices, it could disrupt Integra's market position. The financial health and strategic goals of key suppliers are therefore vital data points for Integra's competitive analysis. In 2024, the medical device industry saw continued consolidation, which can sometimes empower larger suppliers to consider such strategic moves.

- Supplier Capability: Assess if suppliers have the technical expertise, capital, and market access to enter medical device manufacturing.

- Supplier Incentive: Evaluate if profit margins or market share gains from direct competition would outweigh the benefits of remaining a supplier.

- Industry Trends: Monitor broader industry movements, such as M&A activity among suppliers or the emergence of new manufacturing technologies, that could facilitate forward integration.

Importance of Integra to Suppliers

The bargaining power of suppliers to Integra Life Sciences is influenced by how crucial Integra is to their business. If Integra represents a substantial portion of a supplier's revenue, that supplier's leverage is likely reduced, as they depend heavily on Integra's continued patronage. Conversely, if Integra is a minor client for a large, diversified supplier, the supplier holds more sway.

Integra's operational challenges, such as production constraints and intermittent ship holds reported in their recent financial updates, could also affect their standing with suppliers. These issues might make Integra a less attractive or more demanding customer for certain suppliers, potentially shifting the balance of power in favor of the supplier.

- Supplier Dependence: If a supplier relies heavily on Integra for a significant percentage of their sales, their bargaining power diminishes. For instance, if a specialized medical component manufacturer derives over 20% of its annual revenue from Integra, it may be less likely to dictate terms.

- Integra's Customer Size: Conversely, if Integra is a small customer for a large, diversified supplier of raw materials or finished goods, the supplier's bargaining power increases. A supplier that serves hundreds of clients might be less concerned with losing Integra's business.

- Operational Performance Impact: Integra's reported production issues, like those noted in Q1 2024, can weaken its negotiating position. Suppliers might become hesitant to prioritize Integra's orders or may impose stricter payment terms if they perceive increased risk or operational strain from Integra's side.

- Market Conditions for Suppliers: The overall market conditions for suppliers also play a role. If there are numerous suppliers available for critical components, Integra's power is greater. However, if a key component comes from a single or limited number of suppliers, those suppliers gain considerable bargaining power.

The bargaining power of suppliers for Integra Life Sciences is considerable due to the specialized nature of its required components and the limited number of qualified manufacturers. High switching costs, including rigorous qualification processes and regulatory hurdles, further solidify supplier leverage. For example, the critical nature of materials for neurosurgery and reconstructive surgery means few suppliers can meet Integra's stringent demands, enabling suppliers to command higher prices and favorable terms.

| Factor | Impact on Supplier Bargaining Power | Example for Integra |

|---|---|---|

| Supplier Concentration | High | Limited suppliers for specialized neurosurgical materials |

| Switching Costs | High | Lengthy qualification & regulatory approval for medical components |

| Forward Integration Threat | Moderate | Larger suppliers consolidating in 2024 may consider vertical integration |

| Integra's Importance to Supplier | Variable | Depends on Integra's revenue share with each supplier |

What is included in the product

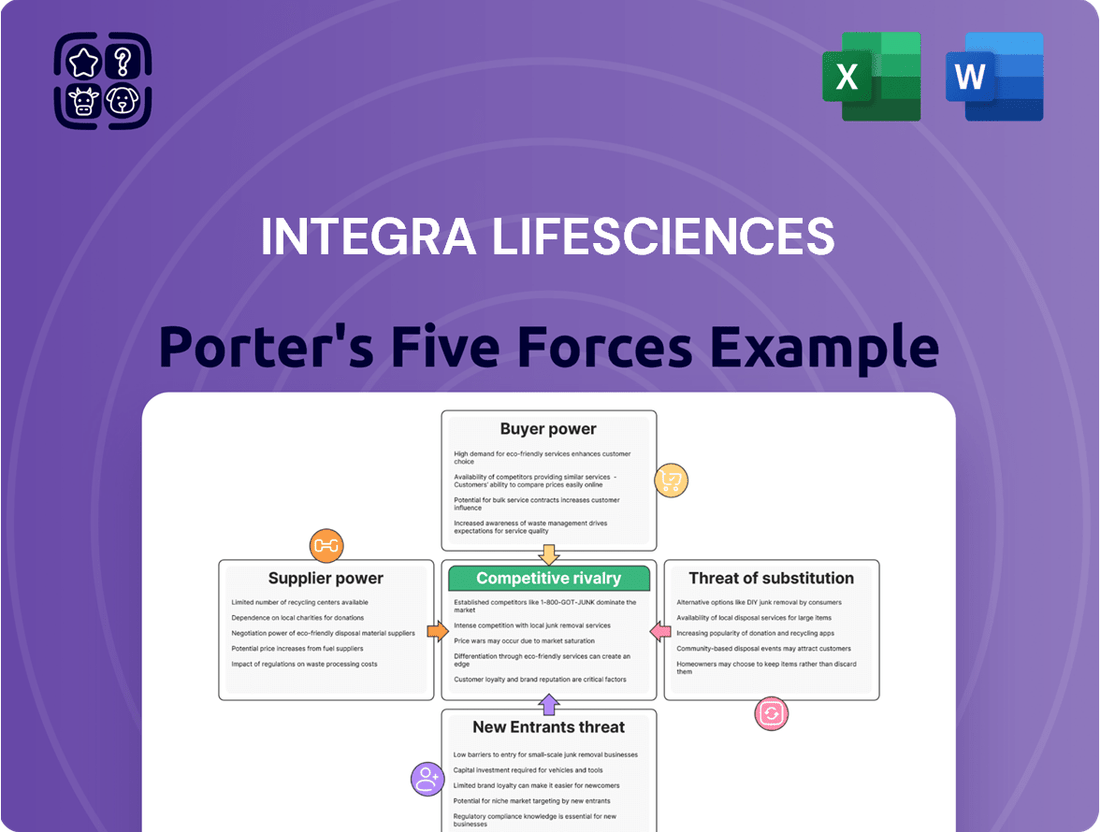

This analysis unpacks the competitive forces shaping Integra LifeSciences' market, detailing supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the medical technology sector.

Quickly identify and address competitive threats with a visual breakdown of supplier power, buyer bargaining, and new entrant risks.

Streamline strategic planning by pinpointing areas where Integra LifeSciences faces intense rivalry or substitute product pressure.

Customers Bargaining Power

Integra Life Sciences' customers, primarily hospitals and surgical centers, wield considerable bargaining power, especially when they band together. These healthcare providers frequently leverage Group Purchasing Organizations (GPOs) to amplify their collective buying strength.

GPOs act as powerful intermediaries, negotiating bulk discounts and favorable terms for their member institutions. This consolidation significantly increases customer leverage, creating downward pressure on the prices Integra can charge for its medical devices. By 2024, a staggering 97% of hospitals are members of GPOs, with large organizations like Vizient and Premier Inc. representing a vast number of staffed hospital beds, underscoring the immense collective purchasing power they represent.

Switching costs for customers in the medical device sector, while present, are often manageable for healthcare providers. These costs can include training personnel on new Integra Life Sciences products or integrating new equipment into existing hospital workflows. However, the dynamic medical device market, with numerous competitors, and the influence of Group Purchasing Organizations (GPOs) can significantly lessen the burden of these switching costs.

For instance, if a competitor offers a device with similar or superior performance at a lower price point, healthcare providers might find it economically advantageous to switch, despite the initial setup effort. This willingness to switch is amplified when alternative solutions provide clear cost savings or improved patient outcomes, directly impacting the bargaining power of customers against companies like Integra Life Sciences.

Hospitals and healthcare systems are increasingly feeling the pinch of rising costs, reimbursement difficulties, and the move towards value-based care models. This makes them highly sensitive to price changes. For instance, in 2024, many healthcare providers faced tighter budgets, making cost-saving a top priority.

Inflationary pressures and tariffs on medical products in 2024 further exacerbated this price sensitivity. These external factors directly impact the cost of goods for healthcare providers, forcing them to scrutinize every purchase, including surgical implants and instruments.

Integra Life Sciences finds its pricing power for surgical implants and instruments limited by this strong customer demand for cost-effective solutions. Customers are actively seeking suppliers who can offer competitive pricing without compromising on quality, a trend that intensified throughout 2024.

Availability of Substitute Products

The availability of substitute medical devices from competitors, or even alternative treatment pathways, significantly amplifies customer bargaining power. Integra Life Sciences operates in fiercely competitive markets such as neurosurgery and reconstructive surgery, where numerous companies offer products that are similar or functionally equivalent. This abundance of choice means customers, including hospitals and surgeons, can readily switch to alternatives if Integra's pricing or terms become unfavorable.

For example, in the neurosurgery segment, competitors may offer comparable dural repair products or cranial fixation systems. Similarly, in reconstructive surgery, the market for wound care or soft tissue repair devices features many players. This competitive landscape, characterized by a high degree of substitutability, forces Integra to remain competitive on price and product innovation to retain its customer base.

In 2024, the medical device industry continued to see robust competition. Companies like Stryker and Medtronic, major players in neurosurgery, offer a wide array of competing products. This intense rivalry directly impacts Integra's ability to dictate terms, as customers can leverage these alternatives to negotiate better pricing or seek out superior value propositions.

- High Substitutability: Competitors offer functionally similar neurosurgery and reconstructive surgery devices.

- Customer Choice: Hospitals and surgeons have multiple alternatives available, increasing their leverage.

- Competitive Pressure: Integra faces pressure to maintain competitive pricing and product features due to readily available substitutes.

- Market Dynamics: The presence of strong competitors like Stryker and Medtronic in key segments reinforces customer bargaining power.

Customer Information and Transparency

Customer information and transparency significantly bolster their bargaining power against medical technology firms like Integra Life Sciences. In 2024, the increasing availability of detailed product performance data and transparent pricing structures, often aggregated by Group Purchasing Organizations (GPOs), equips customers with a clearer understanding of value. This heightened awareness allows them to more readily compare alternatives and leverage this knowledge during negotiations, pushing for more favorable terms.

- Increased Data Accessibility: GPOs and industry-wide data platforms in 2024 provide customers with unprecedented access to pricing and performance benchmarks.

- Informed Comparison: This transparency enables customers, such as hospitals and healthcare systems, to conduct more thorough comparisons of competing medical devices and services.

- Negotiation Leverage: Armed with this information, customers can more effectively negotiate prices and contract terms, directly impacting Integra's pricing power.

- Market Pressure: A well-informed customer base exerts upward pressure on pricing and demands greater product efficacy, forcing companies to compete on more than just brand name.

Integra Life Sciences' customers, primarily hospitals and surgical centers, possess significant bargaining power, largely due to their consolidated purchasing through Group Purchasing Organizations (GPOs). By 2024, approximately 97% of hospitals are GPO members, with major GPOs representing a substantial portion of staffed hospital beds, amplifying collective negotiation strength and driving down prices. This trend is further intensified by the ease with which customers can switch to competitors offering comparable or superior products at lower costs, especially given the manageable switching costs in the medical device sector.

| Factor | Impact on Integra | 2024 Data/Trend |

|---|---|---|

| Customer Consolidation (GPOs) | Increased leverage, downward price pressure | 97% of hospitals are GPO members |

| Switching Costs | Lowered by competitive landscape and GPO influence | Manageable for healthcare providers |

| Price Sensitivity | High due to budget constraints and value-based care | Tight budgets for many providers in 2024 |

| Availability of Substitutes | High, limiting Integra's pricing power | Intense competition in neurosurgery and reconstructive surgery |

Preview the Actual Deliverable

Integra LifeSciences Porter's Five Forces Analysis

This preview showcases the complete, professionally written Integra LifeSciences Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape. The document you see here is precisely the same detailed analysis you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning.

Rivalry Among Competitors

Integra Life Sciences operates within a crowded medical technology sector, particularly in neurosurgery and reconstructive surgery, facing intense competition from numerous global giants and niche specialists. Key rivals like Medtronic, Stryker Corporation, Johnson & Johnson, Zimmer Biomet, and B. Braun Melsungen AG, all possess significant market share and extensive product portfolios, directly challenging Integra's market position.

The medical device industry, while generally robust, exhibits varied growth rates across its segments. This dynamic directly influences competitive rivalry, as high-growth areas naturally draw more players and capital, thereby intensifying competition and spurring innovation.

For instance, the neurosurgical devices market is a prime example of a segment experiencing significant projected growth. This expansion is anticipated to attract new entrants and encourage existing companies to invest heavily in research and development, potentially leading to a more crowded and competitive landscape.

Integra Life Sciences strives to stand out by innovating in areas like tissue regeneration, neurosurgical access, and surgical instruments. However, the medical device market often sees intense competition where differentiation hinges on price, features, and proven clinical results, making it a tough battleground.

The medical technology landscape is evolving rapidly, with companies like Integra Life Sciences facing a dynamic competitive environment. For instance, in 2023, the global medical devices market was valued at approximately $500 billion, highlighting the significant scale and competitive nature of the industry.

To gain an edge, many players are now embedding artificial intelligence and robotic capabilities into their products. This technological integration is becoming a key strategy for differentiating offerings and capturing market share in an increasingly sophisticated and demanding healthcare sector.

Exit Barriers

Integra Life Sciences faces intense competition partly due to high exit barriers. Specialized assets, like advanced manufacturing equipment for medical implants, and stringent regulatory approvals for medical devices mean that exiting the market is costly and time-consuming. These factors can trap even unprofitable competitors, forcing them to continue operating and thus intensifying the rivalry for market share.

The medical device sector, where Integra operates, demands significant upfront investment in research and development and sophisticated manufacturing facilities. For instance, developing and obtaining FDA approval for a new surgical device can take years and millions of dollars. This substantial capital commitment creates a high hurdle for companies looking to leave the industry, as their specialized assets may have limited resale value outside of the medical technology sphere.

These exit barriers directly impact competitive rivalry by:

- Keeping less efficient firms in the market: Competitors unable to achieve profitability may continue to operate due to the high costs of exiting, leading to prolonged price competition and reduced margins for all players.

- Discouraging new entrants: While not directly an exit barrier, the knowledge that exiting is difficult can make potential new entrants more cautious, though the existing players' continued presence due to exit barriers can still be a deterrent.

- Influencing strategic decisions: Companies must carefully consider the long-term implications of market entry and exit, as the sunk costs associated with specialized assets and regulatory compliance can significantly influence strategic planning and investment.

Strategic Stakes

The medical technology sector holds significant strategic value for large, diversified healthcare corporations. These giants often channel substantial resources into research and development, aiming to capture and maintain market share. This dynamic naturally fuels aggressive competition, as companies strive for leadership within crucial market segments, directly influencing Integra Life Sciences' strategic standing.

This intense rivalry means companies are constantly innovating and expanding their product portfolios. For instance, in 2024, major players in the neurosurgery and spine markets, areas where Integra operates, continued to announce new product launches and strategic acquisitions, signaling a commitment to growth and market dominance. This competitive pressure necessitates that Integra consistently demonstrates superior product performance and value to retain its competitive edge.

- High R&D Investment: Major medical technology firms are expected to continue increasing R&D spending, with industry-wide projections suggesting a steady upward trend through 2025, impacting the pace of innovation.

- Market Share Battles: Companies are actively pursuing growth in key therapeutic areas, leading to intensified competition for market share in segments like regenerative medicine and advanced wound care.

- Acquisition Activity: Expect continued consolidation as larger companies acquire innovative technologies and promising startups to bolster their offerings and competitive position.

Competitive rivalry is a significant force for Integra Life Sciences, operating in a dynamic medical technology sector. The market is populated by large, established players such as Medtronic, Stryker, and Johnson & Johnson, who possess substantial resources and broad product portfolios, directly challenging Integra's market position. This intense competition is further fueled by high R&D investment and a constant drive for innovation, with companies actively pursuing growth in key therapeutic areas.

The medical device industry, valued at approximately $500 billion in 2023, sees companies like Integra focusing on differentiation through superior product performance and value. Strategic acquisitions are also common, as larger firms aim to integrate innovative technologies, intensifying the battle for market share. For instance, in 2024, key players in neurosurgery and spine markets continued to unveil new products, underscoring the aggressive nature of this competitive landscape.

High exit barriers, stemming from specialized assets and stringent regulatory approvals, tend to keep less efficient firms in the market. This prolongs price competition and can reduce overall industry margins, making it crucial for Integra to maintain a strong competitive edge through continuous innovation and demonstrable product value.

| Competitor | Approximate 2023 Revenue (USD Billions) | Key Product Areas |

|---|---|---|

| Medtronic | 39.0 | Cardiovascular, Medical Surgical, Restorative Therapies, Diabetes |

| Stryker Corporation | 20.5 | Orthopedics, MedSurg, Neurotechnology and Spine |

| Johnson & Johnson (Medical Devices Segment) | 27.4 | Orthopedics, Surgery, Vision, Interventional Solutions |

| Zimmer Biomet | 6.7 | Musculoskeletal Healthcare |

| B. Braun Melsungen AG | 8.7 (Global Sales) | Hospital Care, Aesculap Division (Surgery) |

SSubstitutes Threaten

The threat of substitutes for Integra LifeSciences' surgical implants and instruments is a significant consideration. These substitutes aren't necessarily direct competitors but rather alternative ways to achieve similar patient outcomes. For instance, advanced drug therapies or different, less invasive procedures could reduce the demand for traditional surgical interventions that rely on Integra's products.

Consider the orthopedic market, where Integra offers implants. A growing trend towards regenerative medicine, utilizing stem cells or biologic agents, could offer an alternative to traditional joint replacement surgery, thereby impacting implant sales. While specific market share data for these emerging alternatives against Integra's specific product lines is still developing, the overall growth in regenerative medicine suggests a tangible threat. For example, the global regenerative medicine market was valued at approximately $13.7 billion in 2023 and is projected to grow significantly, indicating a substantial shift in treatment paradigms.

The threat of substitutes for Integra Life Sciences' products is a significant consideration. If alternative treatments or technologies emerge that provide similar or better patient outcomes at a lower price point, this can erode Integra's market share. For example, by late 2024, the increasing sophistication of robotic surgery systems and AI-driven diagnostic tools could present a competitive challenge to traditional surgical instruments and implants, even within the same surgical procedures.

The willingness of healthcare providers and patients to switch to alternative treatments for Integra Life Sciences' products is a key factor in assessing the threat of substitutes. This propensity is heavily influenced by the availability of robust clinical evidence supporting these alternatives, the ease with which physicians can be trained on new procedures or devices, and patient preferences, particularly for less invasive or more convenient options. For instance, if a new, less invasive surgical technique gains widespread acceptance and demonstrable superior outcomes, it could significantly draw patients and surgeons away from Integra's traditional offerings.

Reimbursement policies also play a crucial role; if payers are more willing to cover less invasive or novel treatments, this can accelerate their adoption and thus increase the threat of substitution. A strong market trend favoring non-surgical or minimally invasive interventions would naturally heighten this threat for companies like Integra whose portfolio might include more traditional surgical solutions.

Regulatory Landscape for Substitutes

The regulatory environment significantly shapes the threat of substitutes for Integra Life Sciences. For instance, the U.S. Food and Drug Administration (FDA) approval process for new medical devices and drugs can be lengthy, potentially slowing the entry of innovative alternatives. In 2024, the FDA continued to emphasize efficiency in its review processes, aiming to bring novel therapies and devices to market faster, which could intensify competition for established products.

A more streamlined approval pathway for emerging substitute technologies, such as advanced biologics or novel surgical techniques, could dramatically accelerate their adoption. This acceleration directly increases the threat to Integra's current product portfolio by offering patients and healthcare providers quicker access to potentially superior or more cost-effective alternatives. For example, if a new regenerative medicine technique bypasses traditional lengthy clinical trials, it could rapidly gain market share.

The speed at which regulatory bodies like the FDA or the European Medicines Agency (EMA) approve competing products is a critical factor. In 2024, regulatory agencies globally were grappling with how to balance patient safety with the need for timely access to innovation. This ongoing dynamic directly impacts the timeline for substitute market penetration.

The threat of substitutes is therefore intrinsically linked to regulatory efficiency.

- Regulatory Hurdles: Complex and lengthy approval processes can act as a barrier to entry for substitutes.

- Streamlined Pathways: Faster approval for alternative treatments can significantly increase competitive pressure.

- Global Variations: Differences in regulatory timelines across regions can create uneven competitive landscapes.

- Innovation Focus: Regulatory bodies' emphasis on facilitating innovation can accelerate the introduction of substitutes.

Innovation in Adjacent Industries

Innovation in adjacent industries like biotechnology and pharmaceuticals poses a significant threat to Integra LifeSciences. For instance, advancements in regenerative medicine or novel drug delivery systems could create substitutes for some of Integra's surgical and medical device offerings. In 2024, the global biotechnology market size was valued at approximately $1.7 trillion, showcasing the rapid pace of innovation in this sector that could directly impact Integra's product lines.

Digital health solutions, such as AI-powered diagnostic tools or remote patient monitoring, also represent a growing threat. These technologies can reduce the need for certain invasive procedures or traditional monitoring methods that Integra's products support. The digital health market is projected to reach over $600 billion by 2026, indicating a substantial shift towards tech-enabled healthcare solutions that could offer alternatives to existing treatments.

Integra must actively monitor these cross-industry technological advancements. This vigilance is crucial for identifying potential disruptive innovations that could render its current product portfolio less competitive or obsolete. Staying ahead of these emerging substitutes requires continuous investment in research and development and strategic partnerships.

- Biotechnology advancements: Potential for new therapies to replace surgical interventions.

- Pharmaceutical innovations: Development of new drugs that reduce the need for medical devices.

- Digital health integration: AI and remote monitoring as alternatives to traditional medical procedures.

- Market dynamics: The growing digital health market size (projected over $600 billion by 2026) highlights the competitive pressure.

The threat of substitutes for Integra LifeSciences is amplified by advancements in regenerative medicine and alternative treatment modalities. For instance, the growing adoption of stem cell therapies and biologic agents in orthopedics presents a direct challenge to traditional implants. While specific data on substitute penetration against Integra's exact product lines is still emerging, the overall regenerative medicine market was valued around $13.7 billion in 2023, underscoring the significant potential for these alternatives to reshape treatment landscapes.

Furthermore, innovations in digital health, such as AI-driven diagnostics and remote patient monitoring, can reduce the reliance on certain invasive procedures and traditional medical devices. The digital health market, projected to exceed $600 billion by 2026, highlights a clear trend towards tech-enabled healthcare solutions that may offer competitive alternatives to Integra's offerings.

The pace of regulatory approval for these emerging substitutes is a critical factor. In 2024, regulatory bodies like the FDA continued to focus on streamlining pathways for novel therapies and devices. A faster approval process for alternatives, such as advanced biologics, could accelerate their market entry and intensify competitive pressure on Integra's established product portfolio.

| Substitute Area | Potential Impact on Integra | Market Trend/Data (2023-2024) |

|---|---|---|

| Regenerative Medicine | Reduced demand for implants and traditional surgical interventions. | Global regenerative medicine market valued at ~$13.7 billion in 2023. |

| Advanced Drug Therapies | Decreased need for certain surgical procedures and devices. | Continuous innovation in pharmaceutical R&D. |

| Digital Health Solutions (AI, Remote Monitoring) | Lower utilization of traditional monitoring and diagnostic tools. | Digital health market projected to exceed $600 billion by 2026. |

| Minimally Invasive Techniques | Shift away from more traditional surgical approaches. | Increasing physician and patient preference for less invasive options. |

Entrants Threaten

The medical device sector, where Integra Life Sciences operates, is heavily regulated. This means new companies must navigate extensive clinical trials, rigorous quality control measures, and intricate approval pathways overseen by agencies like the U.S. Food and Drug Administration (FDA) and the European Union's Medical Device Regulation (EU MDR).

These regulatory requirements represent a substantial barrier. For instance, bringing a new medical device to market can cost millions of dollars and take several years to achieve the necessary certifications, effectively deterring many potential new competitors.

Developing, manufacturing, and marketing surgical implants and medical instruments requires significant upfront capital. Integra LifeSciences, for instance, invests heavily in research and development, sophisticated manufacturing capabilities, and a robust sales and marketing network. These substantial capital demands act as a considerable barrier, making it difficult for new companies to enter the market and compete effectively.

Integra LifeSciences, like many established players in the medical technology sector, benefits from a robust portfolio of intellectual property and patents. For instance, as of early 2024, the company held hundreds of patents covering its diverse product lines, from regenerative technologies to surgical instruments. This strong patent protection significantly raises the barrier for new entrants, requiring them to invest heavily in research and development to create non-infringing alternatives or face substantial licensing costs.

Access to Distribution Channels

New entrants in the medical device sector face significant hurdles in securing access to established distribution channels. These channels, which include vital relationships with hospitals, surgeons, and Group Purchasing Organizations (GPOs), are often tightly controlled by incumbent firms like Integra LifeSciences.

Building trust and a track record with these key stakeholders takes considerable time and investment, making it difficult for newcomers to penetrate existing networks. For instance, in 2024, the consolidation within GPOs means that fewer, larger entities hold significant purchasing power, further concentrating access and making it harder for unproven companies to gain a foothold.

- Limited access to hospital purchasing departments: New entrants must navigate complex procurement processes and demonstrate product value to gain shelf space.

- Surgeon loyalty to established brands: Surgeons often prefer devices they are familiar with, creating a high barrier for new technologies to be adopted.

- GPO contract exclusivity: Many GPOs have exclusive contracts with established medical device companies, effectively blocking new competitors.

- High cost of building distribution networks: Establishing direct sales forces or partnering with distributors requires substantial upfront capital and ongoing operational expenses.

Brand Loyalty and Reputation

In the highly regulated medical device sector, brand loyalty and reputation are significant barriers to entry. Surgeons and healthcare professionals often stick with brands they trust due to the critical nature of patient safety and product efficacy. For instance, Integra Life Sciences has cultivated a strong reputation over decades, making it difficult for newcomers to replicate that level of trust.

Building a solid reputation in the medical field requires extensive clinical validation, regulatory approvals, and a proven history of reliable performance. New entrants must invest heavily in research and development, clinical trials, and marketing to even begin to challenge established players like Integra. This long and costly process deters many potential competitors.

The threat of new entrants is thus moderated by the substantial time and capital required to establish a credible brand. For example, the average time to bring a new medical device to market can be several years, coupled with millions in development costs. This makes it challenging for smaller or less capitalized firms to compete effectively against established entities with deep-rooted customer relationships.

Consider these factors impacting new entrants due to brand loyalty:

- Established Trust: Healthcare providers prioritize reliability, making it hard for new brands to gain traction against trusted names like Integra Life Sciences.

- High Switching Costs: For surgeons and hospitals, changing to a new device often involves retraining, new protocols, and potential risks, increasing loyalty to existing suppliers.

- Regulatory Hurdles: The stringent approval processes for medical devices favor companies with established regulatory expertise and a track record of compliance, disadvantaging new entrants.

- Reputational Risk: A single product failure can severely damage a new entrant's reputation, a risk that many healthcare providers are unwilling to take when patient well-being is at stake.

The threat of new entrants for Integra Life Sciences is significantly limited by high capital requirements, stringent regulatory hurdles, and established intellectual property. For instance, the U.S. FDA approval process alone can cost millions and take years, a substantial deterrent. Furthermore, Integra's extensive patent portfolio, encompassing hundreds of innovations as of early 2024, necessitates costly R&D or licensing for newcomers.

Access to distribution channels and building surgeon loyalty also pose considerable challenges. Established relationships with hospitals and Group Purchasing Organizations (GPOs), which are increasingly consolidating, favor incumbent players. For example, GPO contract exclusivity in 2024 makes it harder for unproven companies to gain market access, as these entities hold significant purchasing power.

| Barrier to Entry | Impact on New Entrants | Integra Life Sciences' Advantage |

| Capital Requirements | High upfront investment for R&D, manufacturing, and sales networks. | Established infrastructure and financial resources. |

| Regulatory Approvals | Lengthy and costly processes (e.g., FDA, EU MDR). | Proven expertise in navigating complex regulatory landscapes. |

| Intellectual Property | Need to develop non-infringing technologies or pay licensing fees. | Extensive patent portfolio (hundreds as of early 2024) protecting key innovations. |

| Distribution Channels | Difficulty accessing hospitals, surgeons, and GPOs. | Existing strong relationships and GPO contracts. |

| Brand Reputation & Loyalty | Building trust and overcoming surgeon preference for established brands. | Decades of cultivated trust and a track record of reliability. |

Porter's Five Forces Analysis Data Sources

Our Integra LifeSciences Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, SEC filings, and investor presentations. This allows for a deep dive into financial health, strategic initiatives, and competitive positioning.