Integral Diagnostics SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Integral Diagnostics Bundle

Integral Diagnostics is a leader in the medical imaging sector, boasting strong brand recognition and a robust network of facilities. Their commitment to cutting-edge technology and skilled professionals forms a significant competitive advantage.

However, the evolving regulatory landscape and increasing competition pose notable challenges that require careful navigation. Understanding these dynamics is crucial for strategic planning and investment decisions.

Want the full story behind Integral Diagnostics' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Integral Diagnostics boasts an extensive network, operating a significant number of clinics and hospitals across Australia and New Zealand. This broad footprint firmly establishes it as a market leader in diagnostic imaging services.

The company's recent merger with Capitol Health Limited has been a game-changer, significantly increasing its operational scale. This strategic move has positioned Integral Diagnostics as the second largest diagnostic imaging provider in Australia, boasting 155 clinics.

This expansion not only enhances its geographic reach but also deepens its market penetration. The combined entity benefits from a more robust presence, enabling greater access to patients and referring clinicians.

Integral Diagnostics boasts a comprehensive service offering that covers a wide spectrum of diagnostic imaging modalities. This includes advanced services like MRI and CT scans, alongside essential imaging like X-ray, ultrasound, and nuclear medicine. This broad capability allows them to serve a diverse patient base and meet the varied demands of medical referrers.

By providing such a complete range of high-quality diagnostic imaging, Integral Diagnostics is well-positioned to capture a significant portion of the market. Their ability to adapt to changing medical needs and technological advancements within these services is a key strength. For example, in FY2023, the company reported significant growth in its imaging segment, driven by increased patient volumes and the expansion of its service network.

Integral Diagnostics is strategically enhancing its operational capabilities through the accelerated adoption of teleradiology, digital solutions, and Artificial Intelligence (AI). This focus aims to significantly improve both patient and referrer experiences, while simultaneously boosting the efficiency of its medical professionals.

A key element of this strategy is the partnership with Aidoc, a leader in clinical AI solutions. This collaboration integrates AI to identify and prioritize critical findings within medical images, directly contributing to higher quality and more timely patient care. For instance, during the 2023 financial year, Integral Diagnostics reported a 16% increase in its digital service offerings, highlighting the growing impact of these technological advancements.

This proactive integration of AI in medical imaging positions Integral Diagnostics as a forward-thinking market leader. By leveraging AI to streamline diagnostic processes and improve accuracy, the company is setting a benchmark for innovation in the healthcare sector, with AI-assisted reads accounting for an estimated 5% of their total imaging volume by the end of 2024.

Strong Industry Fundamentals and Regulatory Tailwinds

Integral Diagnostics is strategically positioned to capitalize on robust industry fundamentals. An aging global population, coupled with a rising incidence of chronic diseases, directly fuels demand for diagnostic imaging services. Furthermore, the growing emphasis on preventative healthcare means more individuals are undergoing regular screenings, a trend expected to continue its upward trajectory through 2025.

Regulatory tailwinds are also providing a significant boost. In Australia, the deregulation of MRI licenses, effective July 2025, is anticipated to expand access and utilization of these advanced diagnostic tools. Additionally, the upcoming National Lung Cancer Screening Program, also launching in Australia in July 2025, is projected to drive substantial growth in the sector, directly benefiting providers like Integral Diagnostics.

- Aging Population: Global life expectancy continues to rise, increasing the need for diagnostic services.

- Disease Prevalence: Higher rates of conditions like cancer and cardiovascular disease necessitate more imaging.

- Preventative Care: Increased focus on early detection drives demand for routine screenings.

- MRI Deregulation (Australia, July 2025): Expected to increase MRI service accessibility and volume.

- National Lung Cancer Screening Program (Australia, July 2025): Aims to detect lung cancer earlier, boosting demand for relevant imaging.

Robust Financial Position and Growth Strategy

Integral Diagnostics maintains a robust financial standing, characterized by strong free cash flow generation and well-managed debt, even amidst occasional fluctuations in short-term profitability. This financial resilience underpins its ambitious growth strategy.

The company is actively pursuing a multi-pronged approach to expansion, emphasizing organic earnings growth and operational enhancements. Integral Diagnostics also strategically employs accretive mergers and acquisitions to bolster its market position and drive future performance.

- Strong Free Cash Flow: Integral Diagnostics has consistently demonstrated healthy free cash flow, providing financial flexibility for investment and debt management.

- Strategic Acquisitions: The recent completion of the merger with Capitol Health is a prime example of its M&A strategy, aimed at unlocking substantial cost synergies and accelerating growth.

- Debt Management: The company maintains manageable debt levels, ensuring its financial stability and capacity to pursue further strategic initiatives.

Integral Diagnostics' extensive operational network across Australia and New Zealand, significantly expanded by the Capitol Health merger to 155 clinics, solidifies its market leadership. This broad geographic reach, coupled with a comprehensive suite of imaging services including advanced MRI and CT scans, positions the company to capture substantial market share. Their proactive adoption of teleradiology, digital solutions, and AI, exemplified by a 16% increase in digital services in FY2023, further enhances patient care and operational efficiency.

| Metric | FY2023 (Approx.) | Significance |

|---|---|---|

| Clinic Network Size | 155 clinics | Second largest in Australia post-merger |

| Digital Service Growth | 16% increase | Demonstrates strong adoption of technology |

| AI-Assisted Reads Projection | 5% of imaging volume by end of 2024 | Highlights commitment to innovation |

What is included in the product

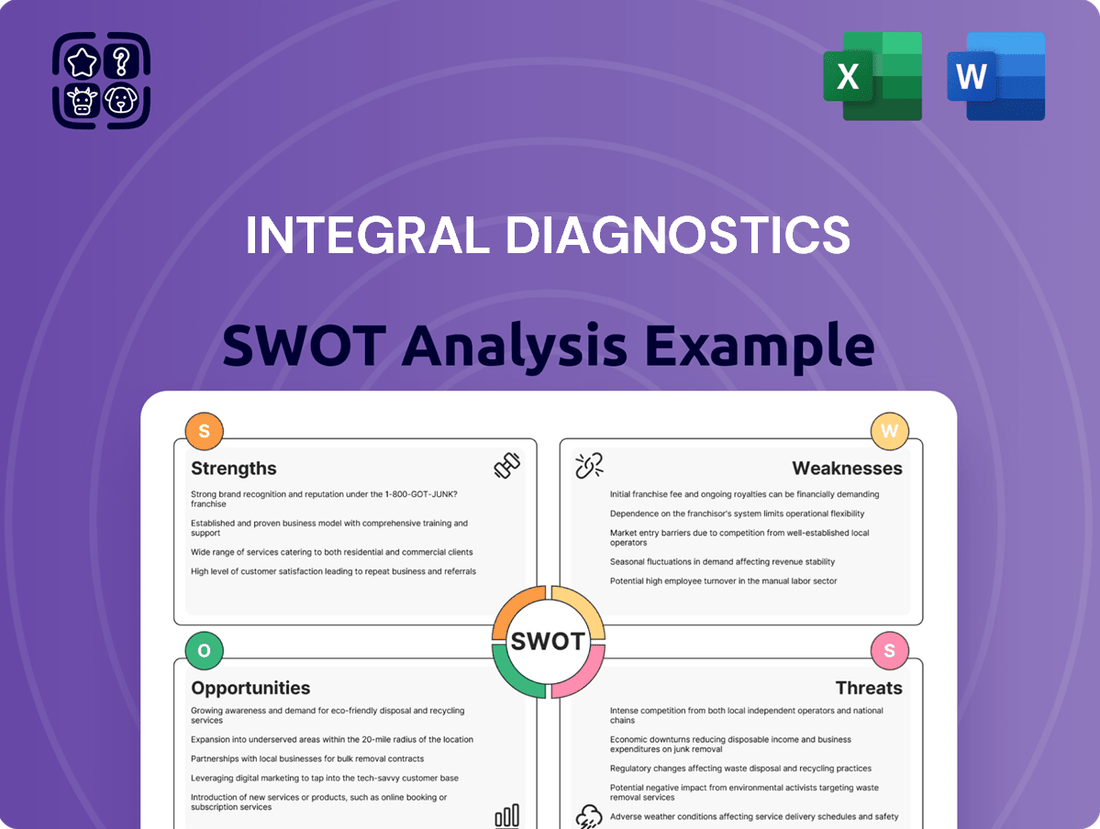

Delivers a strategic overview of Integral Diagnostics’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats to inform future strategy.

Simplifies complex diagnostic data into actionable strategic insights for pain point resolution.

Weaknesses

Integral Diagnostics' financial performance is closely tied to government healthcare policies, especially Medicare in Australia. For instance, a slowdown in Medicare indexation, as observed in recent years, directly constrains revenue growth for diagnostic services.

A reduction in funding for specific modalities, such as CT scans, could significantly impact Integral Diagnostics' earnings, as these services represent a substantial portion of their service mix. The company's reliance on these reimbursement frameworks introduces a notable regulatory risk, making it vulnerable to policy shifts that could alter profitability.

Integral Diagnostics faces significant financial hurdles due to its extensive network of diagnostic imaging clinics. The acquisition and continuous upgrading of sophisticated medical equipment, such as MRI and CT scanners, demand considerable capital investment. For instance, a new high-field MRI scanner can cost upwards of $1 million, and CT scanners can range from $500,000 to over $2 million, depending on specifications.

This substantial and ongoing need for capital expenditure can place considerable strain on Integral Diagnostics' financial resources. Even with robust cash generation capabilities, these significant investments can impact the company's free cash flow, potentially limiting its ability to pursue other growth opportunities or return capital to shareholders.

Integral Diagnostics' reliance on a highly specialized workforce, particularly radiologists and imaging specialists, presents a significant vulnerability. The quality and speed of diagnostic interpretations are directly tied to the expertise of these professionals, making their availability and retention critical for operational success.

The company grapples with rising clinical staff costs, an inflationary pressure particularly felt in regional and remote locations where attracting and keeping specialized medical talent is more challenging. This can lead to higher operational expenses and potential disruptions in service delivery.

Furthermore, Integral Diagnostics faces the ongoing risk of shortages in specialized medical staff. Such deficits can constrain the company's capacity to meet demand, potentially impacting patient wait times and revenue generation, especially in competitive healthcare markets.

Integration Risks from Mergers and Acquisitions

While Integral Diagnostics' acquisition of Capitol Health in late 2023 presented significant growth avenues, the integration process introduces inherent risks. Successfully realizing the projected annual synergies of at least $10.0 million from this merger is paramount for the company's financial outlook.

Any setbacks in integrating Capitol Health's operations, such as unexpected cost escalations or prolonged delays in achieving projected efficiencies, could directly hinder the anticipated financial benefits. Furthermore, challenges in merging distinct corporate cultures can impede operational harmony and ultimately dilute the expected positive impact on Integral Diagnostics' overall performance.

- Integration Hurdles: Delays or cost overruns in merging Capitol Health operations.

- Synergy Realization Risk: Failure to achieve the targeted $10.0 million annual synergies.

- Cultural Mismatch: Potential friction from integrating different organizational cultures.

- Financial Impact: Negative consequences on expected financial performance if integration falters.

Profit Volatility and Margin Pressures

Integral Diagnostics has faced significant profit volatility, highlighted by a statutory loss of $16.1 million in the first half of FY25. This downturn was attributed to a combination of unusual expenses and unexpectedly high clinical staff cost inflation, which impacted the company's bottom line.

Despite management's efforts to implement cost control measures and enhance operational efficiency, persistent cost pressures, particularly concerning labor, continue to exert downward pressure on operating margins. This ongoing challenge poses a risk to sustained profitability and financial stability.

The company's margins are susceptible to these increasing operational costs, which can erode profitability even with revenue growth.

- First half FY25 statutory loss: $16.1 million.

- Key drivers: Unusual expenses and clinical staff cost inflation.

- Ongoing risk: Persistent labor cost pressures impacting operating margins.

Integral Diagnostics' financial health is exposed to significant capital expenditure requirements for maintaining and upgrading its advanced medical imaging equipment. For example, acquiring new MRI machines can cost over $1 million, while CT scanners can range from $500,000 to more than $2 million, impacting free cash flow and limiting other growth avenues.

The company's profitability is vulnerable to increasing clinical staff costs, especially in attracting and retaining specialized talent in regional areas, which can lead to higher operational expenses and potential service disruptions. Shortages of these essential professionals can also constrain capacity and affect revenue generation.

The integration of Capitol Health, acquired in late 2023, presents a risk of failing to achieve its projected $10.0 million in annual synergies. Any integration setbacks, cost escalations, or cultural clashes could negatively impact the anticipated financial benefits.

Integral Diagnostics experienced a statutory loss of $16.1 million in the first half of FY25 due to unusual expenses and high clinical staff cost inflation, highlighting ongoing margin pressures from labor costs that could affect sustained profitability.

Preview the Actual Deliverable

Integral Diagnostics SWOT Analysis

You're previewing the actual analysis document. Buy now to access the full, detailed report on Integral Diagnostics. This comprehensive SWOT analysis will provide you with a deep understanding of the company's strategic position.

The content below is pulled directly from the final SWOT analysis of Integral Diagnostics. Unlock the full report when you purchase to gain valuable insights into their Strengths, Weaknesses, Opportunities, and Threats.

This preview reflects the real document you'll receive—professional, structured, and ready to use for your strategic planning. The full Integral Diagnostics SWOT analysis is packed with actionable information.

Opportunities

The deregulation of MRI licenses in Australia, effective July 2025, is a prime opportunity for Integral Diagnostics to broaden its fully licensed MRI services across its entire network. This includes upgrading equipment in facilities that currently operate with partially licensed machines, unlocking new revenue streams and patient access.

Following its merger with Capitol Health, Integral Diagnostics has achieved a greater scale, enhancing its ability to access high-value diagnostic modalities. This expanded capacity positions the company to capitalize on increased patient volumes, particularly in regions like New South Wales where its presence is currently limited, allowing for strategic growth.

Integral Diagnostics is well-positioned to seize opportunities by further investing in and accelerating its teleradiology, digital health, and AI initiatives. These technological advancements are key to boosting operational efficiency, sharpening diagnostic accuracy, and ultimately improving patient care.

The company's expanded collaboration with Aidoc, which includes testing new AI algorithms specifically for lung cancer screening, is a prime example of this strategy in action. This move allows Integral Diagnostics to tap into the rapidly expanding use of AI in medical diagnoses, promising quicker reporting times and more streamlined workflows.

By embracing AI, Integral Diagnostics can expect to see tangible benefits. For instance, AI-powered tools have demonstrated the ability to reduce radiologist reading times by up to 30% in certain studies, and improve the detection rates of subtle abnormalities, thereby enhancing diagnostic precision.

The Australian government's National Lung Cancer Screening Program, launching in July 2025, presents a substantial opportunity for Integral Diagnostics. This program is expected to significantly boost demand for low-dose CT scans used in lung cancer screening.

Integral Diagnostics can anticipate a surge in patient referrals for these screening CTs, directly translating into increased service utilization. Beyond initial screening, the program will also drive demand for crucial follow-up imaging services, including interventional procedures and PET-CT scans for diagnosed cases.

This government-funded initiative represents a new, reliable revenue stream for diagnostic imaging providers. It’s estimated that such programs can increase the volume of screening CTs by 10-15% annually in the initial years, with follow-on imaging services adding further revenue layers.

Strategic Acquisitions and Partnerships

Integral Diagnostics' robust financial position, evidenced by its capacity for strategic acquisitions, opens doors for continued inorganic growth. The company has a clear focus on mergers and acquisitions that are accretive, meaning they are expected to increase earnings per share. This strategic approach allows Integral Diagnostics to expand its reach and service portfolio efficiently.

The successful integration of Capitol Health serves as a prime example of this capability. This acquisition not only broadened Integral Diagnostics' geographical footprint but also enhanced its service offerings. Such strategic moves are crucial for solidifying its market standing and unlocking economies of scale, leading to improved operational efficiencies and profitability.

- Strong Balance Sheet: Integral Diagnostics maintains a healthy balance sheet, providing the financial flexibility to pursue and execute significant acquisition opportunities.

- Proven M&A Integration: The successful integration of Capitol Health in 2023, a transaction valued at approximately AUD 1.05 billion, demonstrates the company's proven ability to absorb and leverage acquired assets effectively.

- Market Consolidation: The diagnostic imaging sector often sees consolidation, and Integral Diagnostics is well-positioned to capitalize on this trend by acquiring smaller players or complementary businesses to gain market share and expand service lines.

- Synergies and Scale: Acquisitions offer the potential to realize significant cost and revenue synergies, leading to enhanced profitability and a stronger competitive advantage through greater operational scale.

Demographic Tailwinds and Preventative Health

The aging population in Australia and New Zealand presents a significant opportunity for Integral Diagnostics. By 2025, the proportion of Australians aged 65 and over is projected to reach approximately 18.5%, a figure that will continue to climb. This demographic shift directly translates to increased demand for diagnostic imaging services as older individuals often require more frequent medical check-ups and treatments.

Furthermore, growing awareness of preventative health is a key driver. Australians are increasingly proactive about their health, seeking early detection of diseases through regular screenings. This trend is supported by data indicating a rise in the uptake of various health screening programs across the region, bolstering the structural demand for imaging services.

Integral Diagnostics is well-positioned to leverage these demographic tailwinds. The company can capitalize by:

- Expanding Service Capacity: Increasing the number of facilities and available appointment slots to accommodate the growing patient base.

- Investing in Advanced Modalities: Acquiring and implementing the latest imaging technologies to offer more precise and comprehensive diagnostic capabilities.

- Enhancing Patient-Centric Care: Focusing on patient experience, from booking to results, to foster loyalty and attract new patients seeking quality healthcare.

The deregulation of MRI licenses in Australia from July 2025 offers Integral Diagnostics a chance to expand its fully licensed MRI services network-wide, potentially increasing revenue. The company's scale following the Capitol Health merger enhances its ability to adopt high-value diagnostic tools and capture market share, particularly in underserved areas like New South Wales.

Threats

The diagnostic imaging sector in Australia and New Zealand is a crowded space, with both government-funded and private entities actively competing for patients and market share. This inherent competitiveness is expected to intensify.

Anticipation of robust future growth, particularly driven by factors like MRI deregulation and the implementation of national screening programs, is likely to attract more players. This influx of competition could translate into significant pricing pressures for existing providers like Integral Diagnostics, potentially squeezing profit margins.

For instance, the Australian diagnostic imaging market was valued at approximately AUD 4.5 billion in 2023 and is projected to grow, making it an attractive area for new entrants and existing competitors to expand their offerings.

Integral Diagnostics must navigate this increasingly competitive landscape by focusing on service differentiation and operational efficiency to maintain its profitability and market position.

Integral Diagnostics faces a significant threat from potential adverse changes in government healthcare funding. Despite recent positive indexation adjustments to the Medicare Benefits Schedule (MBS) in Australia, the risk of future cuts or unfavorable shifts in these schedules persists. For instance, the Australian government's budget for healthcare spending is a dynamic area, and any tightening of fiscal policy could lead to reduced reimbursements for diagnostic services.

A reduction in reimbursement rates for key services, or changes to incentives like bulk-billing, could directly impact Integral Diagnostics' revenue streams. The company's business model is heavily reliant on the public health system, meaning that shifts in government policy regarding payments for pathology and radiology services can have a material effect on its financial performance and profitability.

Integral Diagnostics faces a significant threat from the ongoing shortage of specialized medical professionals, particularly radiologists and sonographers. This scarcity directly impacts operational capacity and growth potential.

High labor costs are exacerbated by the intense competition for these in-demand skills. For instance, reports from late 2024 indicated that the average salary for a radiologist in Australia had seen a notable increase, putting further pressure on operating margins.

Retaining qualified staff, especially in regional and remote areas, presents a persistent challenge for Integral Diagnostics. This difficulty in retention can lead to higher recruitment costs and a potential decline in service consistency if critical roles remain unfilled for extended periods.

The combined effects of shortages and retention issues can result in increased operational expenses and a reduced ability to meet patient demand, potentially impacting service quality and overall revenue generation.

Cybersecurity Risks and Data Breaches

Integral Diagnostics, as a healthcare provider, is acutely exposed to cybersecurity risks and the potential for data breaches. Handling sensitive patient information means that a successful cyberattack could have devastating consequences. This is a pervasive threat across the healthcare sector, with the Australian Cyber Security Centre noting a significant increase in ransomware attacks targeting healthcare organisations in recent years.

The fallout from a data breach can be substantial. Beyond the immediate operational disruption, Integral Diagnostics could face severe financial penalties, significant reputational damage, and a critical erosion of patient trust. For example, the Notifiable Data Breaches (NDB) scheme in Australia mandates reporting of eligible data breaches, with penalties for non-compliance potentially reaching millions of dollars. Such an event could jeopardise the company's long-term viability and brand image.

- Increased Threat Landscape: Healthcare data is highly valuable on the black market, making providers like Integral Diagnostics prime targets for cybercriminals.

- Regulatory Penalties: Breaches of patient privacy laws, such as Australia's Privacy Act 1988, can result in substantial fines.

- Reputational Damage: Loss of patient confidence following a data breach can lead to a significant decline in customer loyalty and market share.

- Operational Disruption: Ransomware attacks or system compromises can halt diagnostic services, directly impacting revenue and patient care.

Economic Downturn and Patient Out-of-Pocket Costs

An economic downturn and rising cost of living present a significant threat to Integral Diagnostics. As household budgets tighten, patients may defer or reduce elective medical procedures and diagnostic tests, particularly those requiring out-of-pocket payments. This could directly impact patient volumes and, consequently, revenue, especially for services less covered by public healthcare schemes. For instance, a 1% increase in inflation in Australia during 2024 could further squeeze discretionary spending on healthcare services.

Furthermore, a sustained economic slowdown might trigger a shift in patient preference towards public hospitals, potentially reducing demand for private sector radiology and pathology services. Integral Diagnostics, while benefiting from Medicare revenue, could see its revenue mix affected if private health insurance uptake declines or if patients opt for more affordable public alternatives. This potential erosion of the private patient base could weigh on overall profitability and growth prospects.

- Economic pressures may reduce patient willingness to pay for non-essential diagnostic services.

- A decline in private health insurance uptake could impact Integral Diagnostics' revenue streams.

- Increased reliance on public healthcare by patients could divert volumes away from private providers.

- Rising inflation in key markets like Australia could exacerbate reduced discretionary healthcare spending.

Integral Diagnostics faces escalating competition in the Australian diagnostic imaging market, valued at approximately AUD 4.5 billion in 2023. This intensified competition, driven by deregulation and national screening programs, poses a threat of pricing pressures and reduced profit margins.

Adverse changes in government healthcare funding, particularly concerning the Medicare Benefits Schedule (MBS), represent a significant risk. Any future cuts or unfavorable policy shifts could directly impact Integral Diagnostics' revenue, as its business model relies heavily on public reimbursements.

Shortages of specialized medical professionals, such as radiologists and sonographers, coupled with high labor costs and retention challenges, particularly in regional areas, threaten operational capacity and growth. Reports from late 2024 indicated rising radiologist salaries in Australia, exacerbating these pressures.

Cybersecurity risks and the potential for data breaches are substantial threats, given the sensitive patient information handled. The Australian Cyber Security Centre noted an increase in ransomware attacks on healthcare organizations, and breaches can lead to severe financial penalties under schemes like the Notifiable Data Breaches (NDB) scheme, alongside reputational damage and loss of patient trust.

SWOT Analysis Data Sources

This Integral Diagnostics SWOT analysis is built upon a robust foundation of verified financial reports, comprehensive market intelligence, and authoritative industry publications. These sources provide the essential data for a thorough assessment of the company's internal capabilities and external environment.