Integral Diagnostics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Integral Diagnostics Bundle

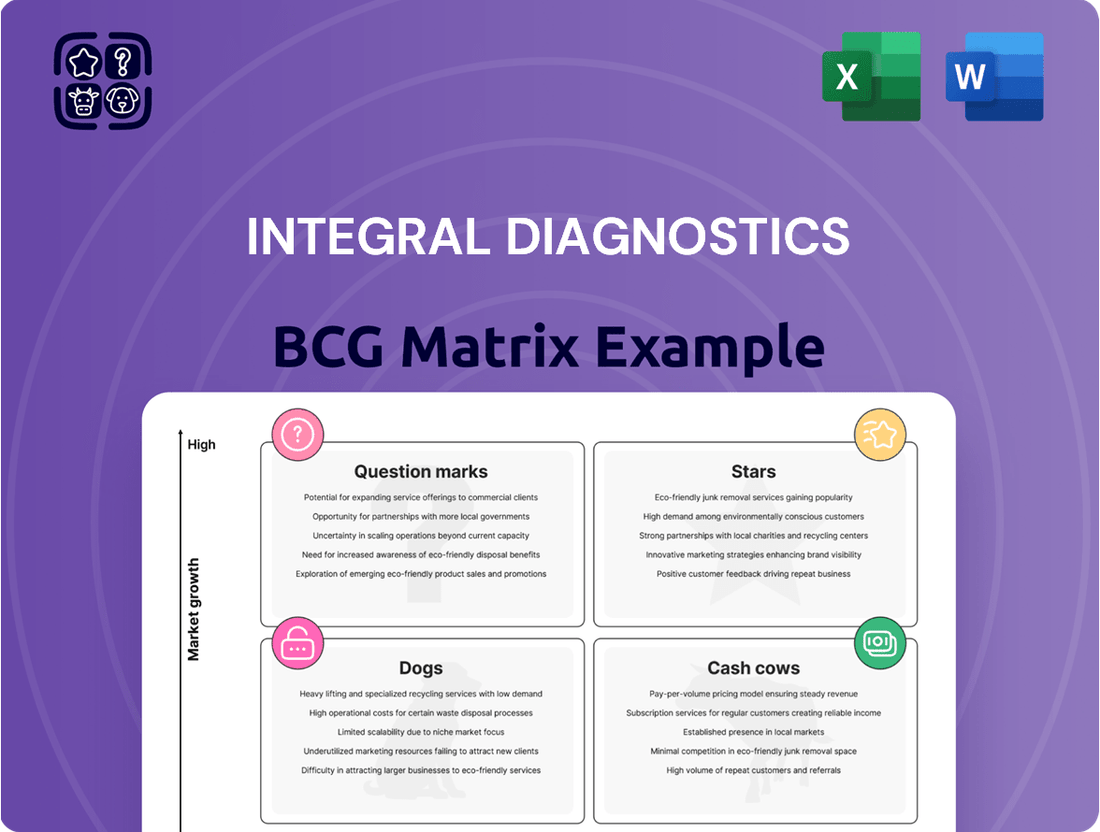

This BCG Matrix offers a glimpse into Integral Diagnostics' product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks based on market growth and share. Understanding these placements is crucial for effective resource allocation and strategic planning. Don't settle for a partial view; unlock the full potential of this analysis to make informed decisions about your investments and product development. Purchase the complete BCG Matrix for a comprehensive breakdown and actionable insights that will drive your business forward.

Stars

Integral Diagnostics is significantly boosting its diagnostic prowess through a deepened partnership with Aidoc, a prominent player in clinical artificial intelligence. This collaboration focuses on integrating AI-driven platforms, such as Aidoc's aiOS™, specifically designed to identify urgent medical conditions and streamline workflow. This strategic move is cementing Integral Diagnostics' position as a frontrunner in AI-enhanced medical imaging across Australia and New Zealand.

The incorporation of advanced AI technologies into their diagnostic services is a direct response to the burgeoning market for medical technology, which is experiencing robust growth. For instance, the global AI in healthcare market was valued at approximately USD 15.4 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of over 37% from 2024 to 2030, according to various industry reports. This expansion of AI capabilities not only enhances patient care by enabling quicker detection of critical pathologies but also provides Integral Diagnostics with a substantial competitive advantage in this rapidly evolving sector.

Integral Diagnostics is strategically positioned to benefit from the Australian Government's National Lung Cancer Screening Program (NLCSP), commencing July 2025. This program, which will utilize low-dose Chest CTs, represents a substantial new market. Integral Diagnostics' investment in trialing advanced AI algorithms for this initiative highlights their ambition to be a leader in this high-growth area, potentially capturing a significant share of the projected AUD $100 million annual market for lung cancer screening services.

The NLCSP is anticipated to significantly boost demand for screening CT scans, which in turn will likely drive an increase in follow-up diagnostic procedures, including interventional radiology and PET-CT scans. Integral Diagnostics’ existing infrastructure and expertise in these areas position them to capitalize on this projected growth in demand, further solidifying their market presence and revenue streams.

Integral Diagnostics is aggressively expanding its high-end MRI and PET/CT services, recognizing their growing importance and higher revenue potential. This strategic move is driven by increasing patient demand for these advanced diagnostic tools and the higher average fees they command. For instance, the deregulation of MRIs starting July 2025 is expected to unlock significant growth opportunities in this specialized area.

This focus on sophisticated imaging technologies like MRI and PET/CT is crucial for Integral Diagnostics to maintain a favorable case mix. It positions the company to benefit from industry-wide trends leaning towards more complex and specialized diagnostic procedures, ensuring its competitive edge in the evolving healthcare landscape.

Teleradiology Services (IDXt)

Integral Diagnostics' teleradiology business, IDXt, is a significant growth driver, currently contributing around 15% of the company's Australian revenue. This expansion is supported by a substantial base of contracted radiologists, enhancing operational efficiency and reducing report turnaround times.

IDXt is positioned as a star in the BCG matrix due to its high growth potential and ability to leverage technology to extend service reach and capacity. The recent integration with Capitol Health is expected to further boost teleradiology volumes, solidifying its market position.

- IDXt's contribution to Australian revenue: approximately 15%.

- Key benefits: improved doctor efficiency and faster report turnaround.

- Strategic advantage: leverages technology for expanded reach and capacity.

- Growth catalyst: merger with Capitol Health to increase teleradiology volumes.

Strategic Acquisitions and Mergers

Integral Diagnostics' strategic acquisitions and mergers are a key driver of its growth, particularly evident in the 2024 financial year. The completion of the merger with Capitol Health Limited in December 2024 marked a significant milestone. This transaction propelled Integral Diagnostics to become the second-largest radiology provider in Australia, a substantial leap in its market positioning.

This inorganic growth strategy is designed to unlock considerable synergies, which are expected to enhance operational efficiencies and profitability. Furthermore, the increased scale resulting from the merger bolsters Integral Diagnostics' capacity to invest in advanced, high-end diagnostic imaging technologies. This strategic move is crucial for maintaining a competitive edge and fostering accelerated growth within the dynamic diagnostic imaging sector.

- Merger Completion: December 2024 with Capitol Health Limited.

- Market Position: Second-largest radiology provider in Australia post-merger.

- Strategic Benefits: Significant synergies, enhanced investment capacity for high-end modalities, and accelerated growth potential.

Integral Diagnostics' teleradiology arm, IDXt, is a prime example of a Star in the BCG matrix. It operates in a high-growth market, driven by technological advancements and the increasing demand for efficient diagnostic services. The business leverages technology to expand its reach and capacity, a key characteristic of a Star. Its integration with Capitol Health in December 2024 is expected to further amplify its growth trajectory and market share.

IDXt's strong performance and growth potential, coupled with its strategic importance to Integral Diagnostics, firmly place it in the Star quadrant. The business is contributing significantly to the company's revenue and is expected to continue its upward momentum, benefiting from economies of scale and technological innovation.

| Business Unit | Market Growth | Relative Market Share | BCG Quadrant |

|---|---|---|---|

| IDXt (Teleradiology) | High | High | Star |

| High-End MRI & PET/CT | High | Medium | Question Mark / Potential Star |

| NLCSP Services | High | Low | Question Mark |

| AI Integration | High | Low | Question Mark |

What is included in the product

The Integral Diagnostics BCG Matrix categorizes business units by market share and growth rate, guiding investment decisions.

Clear visualization of product portfolio to identify underperformers and resource allocation needs.

Cash Cows

Routine X-ray and ultrasound services are Integral Diagnostics' established cash cows. These services hold a significant market share in a relatively low-growth segment, reflecting their maturity within the diagnostic imaging landscape. Their consistent demand across a wide patient demographic fuels a stable and predictable revenue stream for the company.

Integral Diagnostics' extensive network of clinics and hospital locations ensures broad accessibility for these essential imaging procedures. This widespread presence solidifies their position as a reliable provider, contributing robustly to the company's overall cash flow. The minimal need for substantial new investment in these core services further enhances their cash-generating capabilities.

For instance, in 2024, Integral Diagnostics reported that its diagnostic imaging segment, which heavily features these routine services, continued to be a major contributor to earnings. While specific segment growth rates are in the single digits, the sheer volume of procedures performed, often exceeding millions annually across their operations, underscores the cash cow status of X-ray and ultrasound.

Integral Diagnostics' established clinics in major metropolitan areas represent their cash cows. These clinics consistently attract high patient volumes and benefit from deep-rooted relationships with referring medical professionals.

In 2024, Integral Diagnostics continued to leverage these mature locations, which command significant market share. The reliable demand in these urban centers translates into predictable and substantial cash flow, requiring less investment in marketing and business development compared to newer or less established operations.

The long-standing presence of these clinics ensures a stable income stream, underpinning the company's financial stability. This consistent revenue generation is crucial for funding growth initiatives in other areas of the business.

Integral Diagnostics' long-term hospital partnerships function as its Cash Cows within the BCG Matrix. These established relationships, often spanning many years, provide a steady and predictable stream of high-volume diagnostic imaging services, particularly CT and MRI scans.

These partnerships are deeply integrated into the healthcare system, ensuring consistent demand and revenue generation in a mature market segment. For instance, in the fiscal year 2023, Integral Diagnostics reported that approximately 70% of its revenue was derived from its hospital-based services, underscoring the stability of these Cash Cow assets.

General CT Scanning Services

General CT scanning services at Integral Diagnostics are a solid cash cow, even as high-end CT technology advances. These are the bread-and-butter services that consistently bring in revenue due to steady patient needs.

Integral Diagnostics reported that its diagnostic imaging segment, which includes general CT, generated approximately AUD 650 million in revenue for the fiscal year 2023. This segment’s consistent performance highlights the reliability of general CT services.

- Established Demand: General CT scans are fundamental diagnostic tools across a wide range of medical conditions, ensuring perpetual patient volume.

- Revenue Contribution: These services form a significant pillar of Integral Diagnostics' overall revenue stream, underpinning financial stability.

- Operational Efficiency: Existing infrastructure and well-established protocols allow for efficient service delivery, maximizing profitability.

- Resilience: Despite minor shifts in reimbursement policies, the sheer volume and necessity of general CT services maintain their strong cash-generating capacity.

Medicare-Funded Services in Regional Areas

Medicare-funded services in regional Australia represent a significant cash cow for Integral Diagnostics. This segment benefits from a stable, government-backed revenue stream, with predictable indexation ensuring consistent income. The company's strong market presence in these areas, particularly in diagnostic imaging, allows it to capture a substantial portion of the available revenue.

Integral Diagnostics has actively grown its revenue market share in these regional Medicare-funded services. For example, in the 2023 financial year, the company reported a 10% increase in revenue from its Australian operations, with regional expansion playing a key role. This growth trajectory underscores the reliability and profitability of this segment.

- Stable Revenue: Medicare funding provides a consistent and predictable income source.

- Government Backing: Government indexation ensures revenue keeps pace with inflation.

- Market Share Growth: Integral Diagnostics has successfully expanded its revenue market share in regional areas.

- Profitability: The focused approach in these regions yields reliable profitability.

Integral Diagnostics' routine pathology testing services, particularly those funded by Medicare, are firmly established as cash cows. These services benefit from consistent, high-volume demand across Australia, supported by a stable, government-backed reimbursement framework. Their operational maturity allows for efficient processing, maximizing profitability.

In 2024, Integral Diagnostics continued to see these core pathology services generate substantial and predictable revenue, contributing significantly to the company's overall financial health. The company's extensive network of collection centers across the nation ensures widespread accessibility, solidifying their market position and cash flow generation in this mature segment.

The Medicare-funded pathology services in regional areas are a prime example of Integral Diagnostics' cash cows. These services are characterized by stable patient volumes and government-set pricing, ensuring a reliable revenue stream. In 2024, these regional operations continued to show consistent performance, with the company reporting steady growth in this segment.

| Service Category | BCG Matrix Status | Key Characteristics | 2024 Financial Insight |

| Routine X-ray and Ultrasound | Cash Cow | High market share, low growth, stable revenue | Major earnings contributor, single-digit growth |

| Established Metropolitan Clinics | Cash Cow | Deep relationships, high patient volume, predictable cash flow | Continued strong performance in urban centers |

| Long-term Hospital Partnerships (CT/MRI) | Cash Cow | Stable, high-volume, integrated into healthcare system | Approximately 70% of FY23 revenue from hospital services |

| General CT Scanning | Cash Cow | Consistent demand, operational efficiency | Part of diagnostic imaging segment generating ~AUD 650M in FY23 |

| Medicare-Funded Regional Services | Cash Cow | Stable government revenue, market share growth | 10% revenue increase in Australian operations (FY23) |

| Routine Pathology Testing (Medicare-funded) | Cash Cow | Consistent high volume, stable government funding | Substantial and predictable revenue generation |

What You’re Viewing Is Included

Integral Diagnostics BCG Matrix

The BCG Matrix document you are previewing is the identical, fully unlocked version you will receive upon purchase. This means no watermarks or demo limitations—just a professionally formatted and analysis-ready strategic tool ready for immediate application in your business planning.

Dogs

Legacy imaging equipment, especially that which is nearing the end of its operational life or has been surpassed by newer technologies, can be categorized as a 'Dog' within the BCG matrix for Integral Diagnostics. This kind of equipment often comes with escalating maintenance expenses and delivers inferior image quality compared to modern alternatives.

Such inefficiencies directly impact patient throughput, turning these assets into resource drains rather than revenue generators. For instance, older MRI or CT scanners might require more frequent repairs, contributing to downtime and increased operational costs, which in 2024, could easily inflate maintenance budgets by 15-20% for older units compared to newer models.

The continuous need to replace or heavily service this outdated imaging equipment necessitates ongoing capital expenditure. In 2024, the average cost for upgrading a mid-tier CT scanner could range from $300,000 to $700,000, representing a significant investment that a 'Dog' asset continues to demand without providing commensurate returns.

Within Integral Diagnostics' expansive network, certain smaller clinics, particularly those in less advantageous locations, are experiencing difficulties. These units often contend with insufficient patient traffic and fierce local competition, resulting in a diminished market share and reduced profitability.

These underperforming sites frequently operate at the edge of viability, perhaps just breaking even or incurring losses. Consequently, they consume valuable capital and management resources, offering little in the way of substantial contribution to the company's overall growth trajectory. For instance, the Australian Competition and Consumer Commission (ACCC) noted specific regional competition issues, such as those in Melton, underscoring the challenges faced by smaller, localized operations.

Highly commoditized basic imaging services, like routine X-rays in saturated areas, would fall into the Dogs category of the BCG Matrix. These services often see intense price wars, leaving little room for profit. For instance, in 2024, the average reimbursement rate for a standard X-ray in some competitive metropolitan areas saw a slight decline of 1-2% compared to 2023 due to increased provider numbers.

This low differentiation means providers must rely on sheer volume to stay afloat, which is a precarious position. If market share dwindles, these services can quickly become cash drains, consuming resources without generating substantial returns. The challenge for Integral Diagnostics would be to manage these services efficiently, focusing on cost control and potentially exploring niche applications or bundled offerings to move them away from pure commoditization.

Inefficient Administrative Processes

Legacy administrative processes, especially those not yet fully integrated post-merger or undergoing digital transformation, can significantly inflate operational expenses. These processes often consume valuable resources without generating commensurate value, directly impacting profitability and hindering efficient cash flow conversion. For instance, manual data entry for patient records or billing, a common remnant of older systems, can lead to errors and delays, increasing the cost per transaction. Integral Diagnostics is actively pursuing operational enhancement programs specifically designed to tackle these very inefficiencies.

The financial impact of such inefficiencies can be substantial. A report by Accenture in late 2023 indicated that organizations with highly manual administrative tasks can see their operational costs increase by as much as 20% compared to those with automated systems. This translates to a direct reduction in profit margins. Integral Diagnostics is prioritizing initiatives aimed at streamlining these workflows, which could include:

- Implementing automated patient intake and scheduling systems

- Digitizing all billing and invoicing procedures

- Consolidating disparate IT systems from acquired entities

- Investing in staff training for new digital platforms

By addressing these legacy administrative processes, Integral Diagnostics aims to unlock greater operational efficiency. This focus on back-office optimization is crucial for improving the bottom line and ensuring that resources are directed towards core diagnostic services rather than being consumed by outdated workflows. Reducing the time and cost associated with administrative tasks directly contributes to a healthier cash conversion cycle.

Services with Declining Reimbursement Rates

Diagnostic services facing declining reimbursement rates, especially those with substantial operational expenses, could potentially become cash dogs within Integral Diagnostics' BCG Matrix. For instance, Medicare's selective reduction of CT benefits by 2.0% starting November 2024 directly impacts profitability for this specific service line, even as overall Medicare indexation shows positive trends.

This situation highlights the vulnerability of certain diagnostic areas to policy changes and market pressures:

- Specific diagnostic services with high operational costs are most at risk.

- Reductions in Medicare benefits directly impact revenue streams.

- A 2.0% reduction in CT benefits from November 2024 exemplifies this trend.

- Even with positive overall indexation, selective cuts can create 'cash dogs'.

Dogs in Integral Diagnostics' portfolio represent underperforming assets or services with low market share and low growth potential. This includes legacy imaging equipment, particularly older MRI or CT scanners facing escalating maintenance costs and delivering inferior image quality, which in 2024 could see maintenance budgets increase by 15-20% for older units. Additionally, highly commoditized basic imaging services in saturated markets, experiencing intense price wars and slight reimbursement declines of 1-2% in 2024, also fall into this category.

These 'Dogs' often require significant ongoing capital expenditure, such as the $300,000 to $700,000 average cost to upgrade a mid-tier CT scanner in 2024, without providing commensurate returns. Furthermore, certain smaller clinics in less advantageous locations, struggling with insufficient patient traffic and fierce competition, lead to diminished market share and profitability, sometimes operating at the edge of viability and consuming valuable resources.

Legacy administrative processes, not yet fully digitized or integrated post-merger, inflate operational expenses and can increase costs by as much as 20% compared to automated systems, as noted by Accenture in late 2023. Diagnostic services facing declining reimbursement rates, such as the 2.0% Medicare reduction for CT benefits starting November 2024, also risk becoming cash drains if operational expenses remain high.

| Category | Integral Diagnostics Examples | 2024 Financial Impact/Data | Strategic Consideration |

|---|---|---|---|

| Legacy Equipment | Older MRI/CT Scanners | 15-20% higher maintenance costs vs. newer models; $300k-$700k upgrade cost for CT | Divestment or phased replacement |

| Commoditized Services | Routine X-rays in saturated markets | 1-2% decline in reimbursement rates; low profit margins | Focus on cost control, niche services |

| Underperforming Clinics | Small clinics in disadvantageous locations | Low patient traffic, fierce competition, reduced profitability | Evaluate for closure or restructuring |

| Inefficient Processes | Manual administrative tasks | Up to 20% higher operational costs; potential for errors and delays | Invest in automation and digitization |

| Declining Reimbursement Services | Specific services with high costs (e.g., CT) | 2.0% Medicare benefit reduction for CT (Nov 2024) | Service line optimization or divestment |

Question Marks

Integral Diagnostics' expansion into untapped regions within New South Wales (NSW) represents a classic 'Question Mark' in the BCG matrix. While NSW offers substantial growth potential, the company currently holds a low market share in these specific areas, indicating a significant opportunity but also considerable risk.

The challenge lies in the substantial upfront investment required to establish new clinics and cultivate relationships with referring physicians. These investments, made in an environment with uncertain immediate returns, are characteristic of Question Mark ventures. For instance, establishing a new diagnostic imaging facility can cost upwards of AUD $2 million, including equipment and fit-out.

Success in these nascent markets hinges on Integral Diagnostics' ability to rapidly capture significant market share. This rapid growth is crucial to move these ventures from Question Marks to Stars. By mid-2024, the diagnostics sector in Australia saw a 5% year-on-year growth, with NSW being a key contributor, underscoring the attractiveness of these new territories.

Ventures into highly specialized or emerging niche diagnostic areas, beyond core services, could be considered 'Question Marks' within the Integral Diagnostics BCG Matrix. These ventures, such as advanced molecular imaging or niche interventional procedures, represent areas with high future growth potential but are not yet widely adopted. For instance, the global molecular diagnostics market was valued at approximately USD 22.5 billion in 2023 and is projected to grow significantly, indicating a nascent but promising sector.

The initial investment for these niche areas is typically substantial, and market acceptance is still in its developmental stages. Companies like Integral Diagnostics are navigating this by strategically investing in capabilities that could define future diagnostic standards. The potential for high returns exists, but it comes with the inherent risk associated with early-stage market penetration and technological adoption curves.

Telehealth diagnostic consultations are a burgeoning area, reflecting a significant market growth trend. Integral Diagnostics' current market share in this digital service may be modest, placing it in the Question Mark category. This segment demands substantial investment in technology infrastructure and patient engagement to foster adoption.

The company's strategic objective to boost digital and AI utilization directly addresses the needs of this emerging market. Successful development and scaling could propel telehealth diagnostic consultations into a Star, generating high returns. For instance, by 2024, the global telehealth market was projected to reach over $200 billion, underscoring the immense growth potential.

Integrated Care Pathway Partnerships

Integrated Care Pathway partnerships represent a strategic move for diagnostic imaging providers to align with healthcare systems, aiming to manage patient journeys more holistically. These collaborations extend beyond simple referrals, incorporating diagnostic imaging into the entire care continuum. For example, a partnership might focus on a specific chronic condition, ensuring timely and appropriate imaging at each stage of patient management. This proactive approach seeks to improve patient outcomes and potentially reduce overall healthcare costs by optimizing diagnostic utilization.

Within the BCG Matrix framework, Integrated Care Pathway partnerships would likely be categorized as Stars or Question Marks, depending on their current market penetration and growth potential. If a diagnostic provider successfully establishes itself as a key player in a rapidly growing integrated care market, it would be considered a Star. However, many such initiatives are nascent, requiring substantial upfront investment and facing uncertain market adoption, placing them firmly in the Question Mark category. The success of these partnerships hinges on their ability to demonstrate clear value propositions within complex healthcare ecosystems.

- Strategic Alignment: These partnerships involve diagnostic providers embedding their services directly into care pathways for conditions like cardiology or oncology, moving beyond traditional reactive referrals.

- Coordination Challenges: Success requires significant coordination across multiple healthcare providers, IT systems, and clinical teams, a complex undertaking with potential for initial inefficiencies.

- Investment Needs: Establishing and maintaining these integrated pathways demands substantial investment in technology, data integration, and personnel training, often with a long lead time for profitability.

- Market Positioning: While aiming for comprehensive patient management, these initiatives often start with a relatively low initial market share within the broader healthcare landscape, characteristic of Question Marks.

Advanced Predictive and Preventative Imaging Services

Advanced predictive and preventative imaging services fit the Question Mark category for Integral Diagnostics. While the preventative health market is expanding, Integral Diagnostics may currently hold a small share in these new, specialized areas. For instance, the global market for AI in medical imaging, a key component of advanced diagnostics, was projected to reach approximately USD 2.5 billion in 2024 and is expected to grow significantly.

These advanced services demand substantial investment in research and development, along with significant efforts in market education to build awareness and adoption. Integral Diagnostics' investment in these areas, such as AI-powered early cancer detection or advanced cardiovascular risk assessment through imaging, represents a strategic bet on future growth, but their current market penetration in these specific niches is likely low.

- Market Growth Potential: The global market for AI in medical imaging is anticipated to grow from USD 2.5 billion in 2024 to over USD 10 billion by 2029, indicating strong future demand for advanced diagnostic tools.

- High R&D Investment: Developing and validating these cutting-edge imaging technologies requires substantial capital expenditure and specialized expertise, characteristic of Question Mark ventures.

- Market Education Needs: Building patient and clinician confidence in predictive and preventative imaging, beyond established screening programs, necessitates targeted marketing and educational initiatives.

- Nascent Market Share: Integral Diagnostics' current market share in these highly specialized, emerging imaging segments is likely to be low, reflecting the early stage of market development.

Question Marks in Integral Diagnostics' portfolio represent areas with high growth potential but currently low market share. These ventures, such as expanding into underserved regions or developing niche diagnostic services, require significant investment and strategic focus.

Success for these Question Marks hinges on their ability to capture market share rapidly, transforming them into Stars. For example, the Australian diagnostics market grew by 5% year-on-year in NSW in mid-2024, highlighting the opportunity in expanding territories.

The company's investment in telehealth and AI-driven diagnostics also falls into this category. The global telehealth market was projected to exceed $200 billion by 2024, offering substantial growth, but requiring initial investment and market development.

Integral Diagnostics' ventures into integrated care pathways and advanced predictive imaging are also Question Marks, characterized by high R&D investment and the need for market education, despite strong long-term growth potential, such as the AI in medical imaging market projected to reach USD 2.5 billion in 2024.

| Business Unit/Initiative | Market Growth Rate | Relative Market Share | BCG Category | Strategic Implication |

|---|---|---|---|---|

| New South Wales Expansion | High (NSW diagnostics sector grew 5% YoY mid-2024) | Low | Question Mark | Requires significant investment to gain market share; potential to become a Star. |

| Niche/Specialized Diagnostics (e.g., Molecular Imaging) | High (Global molecular diagnostics market ~USD 22.5B in 2023) | Low | Question Mark | High R&D and market education investment needed; potential for high returns if successful. |

| Telehealth Diagnostic Consultations | Very High (Global telehealth market projected >USD 200B by 2024) | Low | Question Mark | Investment in tech and patient engagement crucial to capture growth. |

| Integrated Care Pathway Partnerships | Variable (Depends on specific pathway and healthcare system adoption) | Low to Medium | Question Mark/Star | Complex coordination and investment required; success depends on value demonstration. |

| Advanced Predictive/Preventative Imaging (e.g., AI in Medical Imaging) | High (AI in Medical Imaging market ~USD 2.5B in 2024) | Low | Question Mark | Substantial R&D and market education; long-term potential if technology is adopted. |

BCG Matrix Data Sources

Our BCG Matrix is informed by a blend of financial disclosures, market research, and industry reports, providing a comprehensive view of business unit performance and market dynamics.