Integral Diagnostics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Integral Diagnostics Bundle

Integral Diagnostics operates in a dynamic market shaped by several key forces. Understanding the bargaining power of both buyers and suppliers is crucial for their strategic positioning. The threat of new entrants and the availability of substitutes also significantly influence their competitive landscape.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Integral Diagnostics’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Specialized medical equipment manufacturers, particularly those producing high-end diagnostic imaging devices such as MRI, CT, and PET scanners, exert considerable bargaining power. This strength stems from the highly specialized nature of their products, the substantial investment required for their development and production, and the relatively small pool of global companies capable of manufacturing such advanced technology.

Integral Diagnostics’ dependence on these suppliers for the cutting-edge technology that underpins its diagnostic services positions these manufacturers as powerful entities in the supply chain. The significant capital outlay associated with acquiring new MRI machines, which can easily range from $1 million to $3 million, directly impacts Integral Diagnostics’ financial planning and operational capacity.

Radiologists and highly skilled technicians are crucial for Integral Diagnostics' service delivery. Their specialized knowledge is the bedrock of accurate diagnoses, making their availability a key operational factor.

A scarcity of these professionals, especially when demand is high, significantly amplifies their bargaining power. This can translate into increased salary expectations and more demanding recruitment processes for Integral Diagnostics, impacting operational costs and the ability to staff facilities adequately.

Integral Diagnostics relies heavily on a substantial workforce of radiologists and technicians. Their collective expertise directly influences the quality of diagnostic services provided, a core component of the company's value proposition.

Providers of specialized medical imaging software, PACS, and AI-driven diagnostic tools hold considerable bargaining power over Integral Diagnostics. This power is amplified when these solutions are proprietary or deeply embedded within the diagnostic workflow, making integration a significant factor.

Switching to alternative software providers involves substantial costs, including data migration, system reconfigurations, and extensive staff retraining, which further strengthens the suppliers' position. The global healthcare software market was valued at around $60 billion in 2024, and this sector experiences notable vendor concentration.

Contrast Agent and Consumables Suppliers

The bargaining power of contrast agent and consumables suppliers for Integral Diagnostics is a key factor. While individual items like contrast agents might appear small, their reliable supply and consistent quality are crucial for performing a wide range of diagnostic imaging procedures. Integral Diagnostics, like many in the sector, relies on a steady stream of these materials to maintain operational efficiency and service delivery.

The influence these suppliers wield is largely determined by the availability of alternative sources and how critical their specific products are to Integral Diagnostics' core operations. If there are few suppliers for a particular essential consumable, or if the product is highly specialized and difficult to substitute, their bargaining power increases. This can translate into higher costs for Integral Diagnostics.

For instance, a higher modality mix within Integral Diagnostics’ service offerings, meaning a greater variety of imaging technologies used, can sometimes lead to slightly elevated consumable costs. This is because different modalities may require specialized contrast agents or other consumables that have fewer competitive suppliers, thus giving those suppliers more leverage.

- Supplier Concentration: The market for specialized contrast agents can be concentrated, with a few key global manufacturers dominating supply.

- Product Differentiation: Certain contrast agents offer unique properties or improved safety profiles, which can reduce the substitutability and increase supplier power.

- Switching Costs: While not always high, switching suppliers for critical consumables can involve requalification processes and potential disruptions to service.

- Volume Discounts: Integral Diagnostics' ability to negotiate favorable pricing is often tied to the volume of consumables purchased.

Real Estate and Facility Owners

The bargaining power of real estate and facility owners is a significant factor for Integral Diagnostics. As a provider of diagnostic services, Integral Diagnostics relies on a network of clinics and hospitals, making the location and terms of these facilities crucial. Owners of these properties, especially in prime or high-demand urban areas, can wield considerable influence. For instance, in 2023, prime commercial real estate rents in major Australian cities like Sydney and Melbourne continued to experience upward pressure, reflecting strong demand and limited supply, which can translate to higher lease costs for Integral Diagnostics.

The specialized nature of diagnostic imaging facilities often necessitates substantial fit-out investments. This creates high switching costs for Integral Diagnostics, as relocating or modifying a clinic to meet new regulatory or operational standards can be both time-consuming and expensive. Consequently, landlords in these scenarios have greater leverage during lease negotiations. The strategic placement of clinics is paramount for patient accessibility and convenience for referring medical practitioners, further solidifying the landlord's position, particularly when a clinic's success is intrinsically linked to its specific location.

- High Demand Locations: Property owners in sought-after areas can command higher lease rates due to intense competition for space.

- Specialized Fit-Outs: The significant investment in adapting facilities for medical imaging increases the cost and difficulty of relocation, strengthening landlord leverage.

- Strategic Importance of Location: Integral Diagnostics’ dependence on accessible locations for patient and referrer convenience empowers landlords in negotiations.

Suppliers of specialized medical equipment and essential consumables hold significant bargaining power over Integral Diagnostics. This leverage arises from the high cost and technical complexity of diagnostic imaging machinery and the often concentrated nature of the contrast agent market. In 2024, the global medical imaging equipment market was valued at approximately $120 billion, with a notable portion attributed to advanced systems where supplier concentration is higher.

| Supplier Type | Key Factors Driving Power | Impact on Integral Diagnostics |

|---|---|---|

| Imaging Equipment Manufacturers | High R&D costs, proprietary technology, few global producers | Significant capital expenditure, dependence on upgrades |

| Contrast Agents & Consumables | Product criticality, limited alternative suppliers, specialized formulations | Potential for price increases, supply chain vulnerability |

What is included in the product

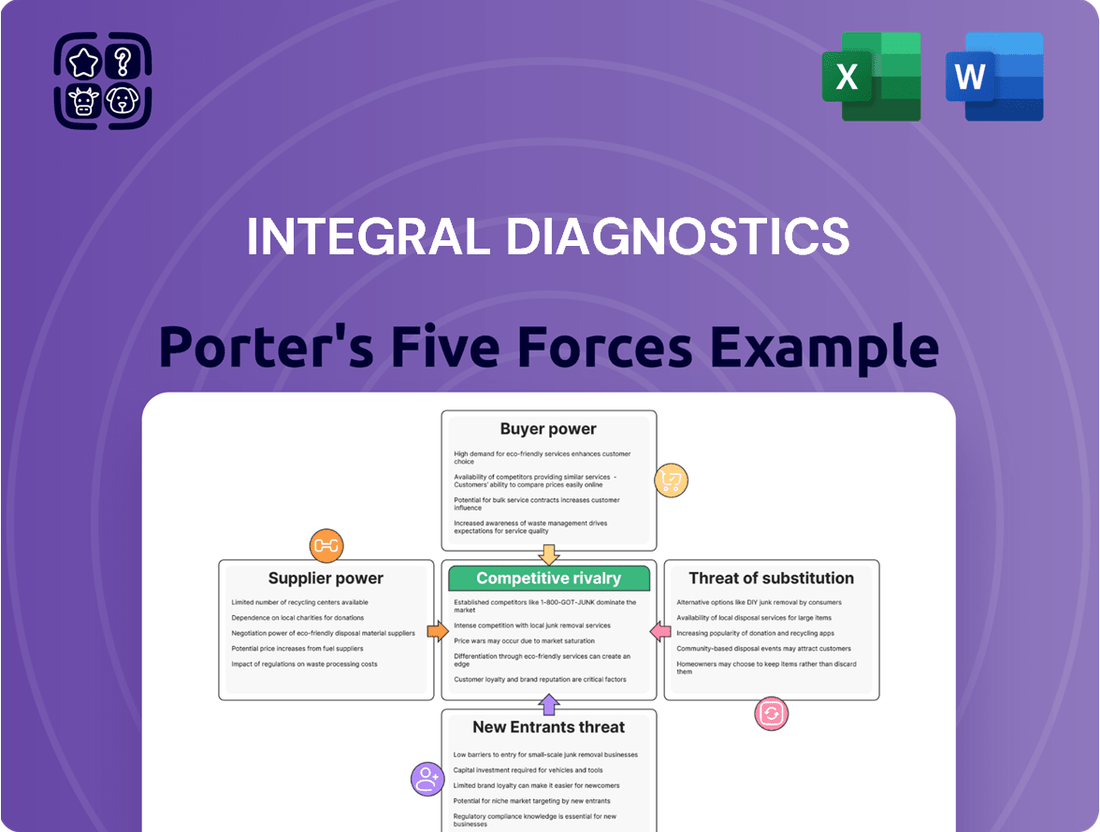

This Porter's Five Forces analysis dissects the competitive landscape for Integral Diagnostics, evaluating the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the presence of substitute services.

Easily identify and mitigate competitive threats by visualizing the impact of each force with an intuitive Porter's Five Forces dashboard.

Customers Bargaining Power

Referring medical professionals, including general practitioners and specialists, hold considerable sway by directing patients to diagnostic imaging providers like Integral Diagnostics. Their choices are driven by service quality, prompt report delivery, referral convenience, and existing rapport. In Australia, a substantial 70% of patients are referred by physicians, underscoring this group's significant influence on patient volume.

Individual patients, as end-users of Integral Diagnostics' services, wield some bargaining power. This power is most evident in metropolitan areas where a greater number of diagnostic providers compete for their business. Patients can influence their choice of provider based on factors like out-of-pocket expenses, the convenience of location and appointment scheduling, the perceived quality of service, and importantly, the waiting times for appointments and results.

While the referring doctor often plays a significant role in directing patients to specific diagnostic centers, patients are increasingly becoming more informed and vocal about their preferences. Government policies, such as those aimed at increasing competition among healthcare providers, are also designed to enhance patient affordability and, by extension, their bargaining power. For instance, in 2024, the Australian government continued its focus on improving healthcare access and affordability, which indirectly strengthens the patient's position in choosing services.

In Australia, the bargaining power of customers for private health insurers and government bodies like Medicare is substantial, directly influencing Integral Diagnostics' financial performance. Medicare, through the Department of Health and Aged Care, subsidizes a significant portion of diagnostic imaging services, effectively acting as a major price influencer. For instance, changes to the Medicare Benefits Schedule (MBS) item numbers and their associated rebates directly impact the revenue Integral Diagnostics can generate from these services.

Private health insurers also wield considerable bargaining power. They negotiate service agreements and fee schedules with providers like Integral Diagnostics to manage costs for their members. This means Integral Diagnostics must consider the pricing pressures from these insurers when setting its service fees, as insurers can steer patients towards preferred providers or limit coverage for certain procedures if negotiations falter.

The capital sensitivity rules introduced by the government further illustrate this customer power by impacting how providers can claim benefits for new equipment. In 2024, the ongoing dialogue around MBS indexation rates and the potential for future reforms in diagnostic imaging funding underscores the continuous pressure Integral Diagnostics faces from these powerful customer segments. The company’s revenue is intricately tied to the decisions made by these government bodies and private insurers regarding reimbursement levels and service availability.

Hospitals and Healthcare Networks

Hospitals and healthcare networks represent significant customer power for Integral Diagnostics, particularly for services rendered within hospital settings or via formal agreements. These large entities leverage their purchasing volume to negotiate favorable terms, pushing for competitive pricing, superior service quality, and smooth operational integration. Integral Diagnostics' presence across 20 hospital sites underscores the substantial B2B component of its revenue, highlighting the importance of these relationships.

The bargaining power of these healthcare customers is amplified by several factors:

- Volume Purchasing: Hospitals and networks buy in large quantities, giving them leverage to demand lower per-unit costs.

- Service Level Agreements (SLAs): Customers often impose strict SLAs, requiring high uptime and specific performance metrics, which can increase costs for providers if not met.

- System Integration: The need for seamless integration with hospital IT and patient management systems adds complexity and cost, which customers expect to be handled efficiently.

- Price Sensitivity: Healthcare reimbursement models can make hospitals highly sensitive to the cost of diagnostic services, driving a constant demand for price reductions.

Corporate and Bulk Contract Clients

Corporate and bulk contract clients, such as large employers and occupational health providers, wield significant bargaining power over Integral Diagnostics. These clients often require customized service packages and competitive pricing for their extensive screening programs and employee health initiatives. Their substantial order volumes grant them considerable leverage in negotiations, enabling them to secure more favorable terms.

The demand for integrated health data and streamlined service delivery is a key driver for these corporate clients. For instance, in 2023, the occupational health sector saw continued growth, with many large corporations actively seeking comprehensive diagnostic solutions. This trend allows them to negotiate from a position of strength, pushing for cost efficiencies and specialized service agreements.

- Volume Discounts: Large contracts often necessitate volume-based pricing reductions.

- Service Customization: Corporate clients can demand tailored service offerings to meet specific occupational health needs.

- Negotiating Leverage: The potential loss of significant recurring revenue gives these clients considerable power.

- Integrated Data Demands: Requirements for consolidated health data can influence contract terms and provider selection.

The bargaining power of Integral Diagnostics' customers is considerable, stemming from various segments including referring medical professionals, individual patients, private health insurers, government bodies like Medicare, hospitals, and corporate clients. Referring doctors significantly influence patient volume, with around 70% of patients in Australia being physician-referred, making their satisfaction with service quality and report turnaround critical. While patients have growing power, especially in competitive urban markets, government subsidies and insurer negotiations directly impact revenue streams, as seen with Medicare rebates and private health insurance fee schedules which were under continued review in 2024.

What You See Is What You Get

Integral Diagnostics Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces Analysis for Integral Diagnostics details the competitive landscape, including the threat of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and intensity of rivalry. This in-depth analysis is crucial for understanding Integral Diagnostics' strategic positioning and potential challenges within the diagnostic imaging market.

Rivalry Among Competitors

The diagnostic imaging sector in Australia and New Zealand features substantial competition from major national chains. Integral Diagnostics itself is a significant player, and its recent merger with Capitol Health in early 2024 solidified its position, creating a clear number three entity in the market.

This consolidation, bringing together Integral Diagnostics and Capitol Health, significantly reshapes the competitive dynamics. The combined entity now directly challenges larger established players like I-MED Radiology Network, indicating an increasingly concentrated and robust competitive environment.

Competitive rivalry in the Australian diagnostic imaging sector is intensifying, driven by industry growth and shifting market shares. The Australian market alone was valued at USD 977.20 million in 2024, with projections indicating a compound annual growth rate of 5.80% through 2033. This expansion, alongside a similar robust performance in New Zealand, creates a fertile ground for competition as existing players and new entrants battle for dominance.

Integral Diagnostics has demonstrated its ability to capture a larger piece of this growing pie, having achieved a 0.6% increase in its Australian revenue market share in the two years leading up to June 2024. This kind of gain, especially within a consolidating market, naturally heightens the competitive dynamic. As companies like Integral Diagnostics strengthen their positions, others must adapt and innovate to maintain or grow their own market presence, leading to a more aggressive and dynamic competitive landscape.

The diagnostic imaging sector is inherently capital-intensive, demanding substantial upfront investment in sophisticated machinery like MRI and CT scanners. For instance, a new MRI machine can cost upwards of $1 million. This high barrier to entry and significant ongoing expenditure means clinics must operate at high capacity to spread these costs and achieve profitability, thereby fueling intense competition among providers.

Furthermore, the capital sensitivity rules for Medicare, which often tie reimbursement rates to the age and technological advancement of equipment, necessitate frequent upgrades. This adds another layer of financial pressure, encouraging clinics to continuously invest in newer technology to remain competitive and compliant, further intensifying the rivalry as firms vie to offer the latest diagnostic capabilities.

Service Differentiation and Specialization

Competitive rivalry in diagnostic imaging is intense, driven by differentiation in specialized services. While basic X-rays and CT scans are largely commoditized, providers like Integral Diagnostics vie for market share by excelling in niche areas. This includes offering sub-specialty reporting by highly trained radiologists, ensuring rapid turnaround times for critical results, and enhancing the overall patient experience.

Integral Diagnostics specifically leverages its unique medical leadership model and deep sub-specialty expertise as key differentiators. This focus on specialized knowledge allows them to attract referring physicians who require expert interpretation for complex cases. For instance, their investment in advanced AI integration, as seen in their pilot programs in 2024, aims to further streamline workflows and improve diagnostic accuracy, setting them apart from competitors who may lag in adopting such technologies.

- Sub-specialty Focus: Integral Diagnostics emphasizes expertise in areas like neurology, musculoskeletal, and interventional radiology to attract complex cases.

- Technology Adoption: The company actively integrates new technologies, including AI-powered diagnostic tools, to enhance service delivery and efficiency, a trend gaining momentum in 2024.

- Patient Experience: Efforts to improve patient comfort, appointment scheduling, and communication contribute to service differentiation.

- Turnaround Times: Faster reporting of results, particularly for urgent cases, remains a critical competitive factor in the industry.

Regulatory Environment and Medicare Impact

The regulatory landscape, especially concerning Medicare funding and policy shifts, profoundly impacts competitive rivalry within the diagnostic imaging sector. For instance, reforms aimed at broadening access to MRI services and adjusting fees for CT scans can reshape market dynamics, potentially intensifying competition by making previously less accessible services eligible for Medicare reimbursement. This can draw in new players or encourage existing ones to expand their offerings.

In 2023, Medicare expenditure on diagnostic imaging services in Australia continued to be a significant factor influencing provider strategies and competition. Changes in bulk-billing incentives and Medicare Benefits Schedule (MBS) item number reviews directly affect revenue streams and operational viability for companies like Integral Diagnostics. These policy adjustments can create both opportunities and challenges, altering the competitive balance as providers adapt to new funding models.

The ongoing acceptance of non-arm's length referral practices in New Zealand presents a distinct competitive challenge for Integral Diagnostics. This practice, where referring doctors may have a financial interest in the diagnostic facility, can create an uneven playing field. Companies adhering to stricter ethical and governance standards, such as Integral Diagnostics, may face a competitive disadvantage if they cannot leverage similar referral arrangements.

- Medicare Impact: Changes in Medicare funding for diagnostic imaging can alter the cost-effectiveness of services, influencing patient choice and provider competition.

- Service Expansion: Reforms expanding access to services like MRI can encourage market entry and intensify rivalry among existing players.

- Referral Practices: The acceptance of non-arm's length referrals in certain markets, like New Zealand, creates a structural competitive disadvantage for companies operating under different referral models.

Competitive rivalry in diagnostic imaging is intense, with Integral Diagnostics' early 2024 merger with Capitol Health solidifying its position as the third-largest player in Australia. This move directly challenges market leaders like I-MED Radiology Network, creating a more concentrated and aggressive market. The Australian diagnostic imaging market, valued at approximately USD 977.20 million in 2024 and projected to grow at 5.80% annually, fuels this rivalry as firms battle for market share.

| Metric | Integral Diagnostics (Post-Merger) | Key Competitor (e.g., I-MED) | Market Growth (2024) |

|---|---|---|---|

| Market Position | Number 3 (Australia) | Number 1 (Australia) | 5.80% CAGR |

| Revenue Market Share Gain (Australia) | 0.6% (2 years to June 2024) | N/A | N/A |

| Capital Investment per Machine (MRI) | > $1 Million | > $1 Million | N/A |

SSubstitutes Threaten

For certain conditions, a comprehensive clinical examination or a sequence of lab tests can effectively substitute for diagnostic imaging, particularly in the initial stages of diagnosis or when monitoring less complicated health concerns. While these methods might lack the detailed structural visualization offered by imaging, they provide a faster and often more cost-effective alternative. For instance, in 2024, routine blood panels and physical assessments remain primary tools for diagnosing many common ailments, potentially delaying or eliminating the need for imaging in a significant number of cases. This fundamental diagnostic approach can therefore lessen the immediate demand for advanced imaging services.

While Integral Diagnostics emphasizes cutting-edge imaging, less advanced modalities like basic X-rays can serve as substitutes for specific diagnostic needs where detailed views are not paramount. For instance, a simple X-ray might suffice for detecting a fracture, bypassing the need for a more expensive CT scan.

Point-of-care ultrasound (POCUS) also presents a growing substitute threat. POCUS offers immediate, real-time imaging, making it ideal for rapid assessments in emergency settings or primary care. Its increasing accessibility and ease of use allow for quicker diagnoses in certain scenarios, potentially reducing reliance on traditional radiology departments for initial evaluations.

In 2023, the global medical imaging market, encompassing both advanced and basic technologies, was valued at an estimated $35.8 billion. This broad market indicates the significant presence and continued utility of various imaging modalities, including those that might be considered less advanced but still effective substitutes in specific clinical contexts.

The rise of non-imaging diagnostic technologies presents a significant threat of substitutes for Integral Diagnostics. Future advancements in areas like highly sensitive blood tests, comprehensive genetic testing, and wearable sensors offering real-time physiological data could diminish the necessity for traditional imaging modalities in diagnosing certain conditions. For example, liquid biopsies are showing promise in detecting cancer at earlier stages, potentially bypassing the need for some imaging scans. This shift towards less invasive and more convenient diagnostic pathways could divert patient volumes and revenue from imaging services.

Artificial Intelligence (AI) for Diagnosis

While artificial intelligence is largely seen as a tool to augment diagnostic imaging, improving precision and speed, its long-term potential poses a threat of substitution. Highly sophisticated AI could eventually handle initial diagnostic interpretations or categorize patient cases with minimal human involvement, thereby lessening the demand for extensive radiologist time on standard examinations.

This shift raises significant questions about the future roles of radiographers and their job security, as AI takes on more interpretative functions. By 2024, the integration of AI in radiology is accelerating, with many institutions exploring its use for tasks like anomaly detection and workflow optimization. For example, some AI platforms are already demonstrating the ability to identify potential abnormalities in mammograms or CT scans with high accuracy, sometimes exceeding that of human readers in specific, well-defined tasks.

The threat of substitutes here lies in AI potentially reducing the necessity for certain human-performed diagnostic steps in the future. This could impact the overall cost structure of diagnostic services and necessitate a re-evaluation of staffing models within healthcare providers. The market for AI in medical imaging was projected to grow significantly, with some reports suggesting a compound annual growth rate of over 30% in the years leading up to 2025.

- AI's growing capability in image analysis

- Potential reduction in human oversight for routine diagnoses

- Concerns over job displacement for medical imaging professionals

- The escalating investment and development in AI for healthcare diagnostics

Prevention and Lifestyle Interventions

While preventive healthcare and lifestyle changes don't replace diagnostic imaging when a problem is identified, they can lower the overall need for scans. For instance, widespread adoption of healthier diets and increased physical activity could reduce the incidence of conditions like cardiovascular disease, which often requires imaging for diagnosis and management. This shift could gradually impact demand for certain types of diagnostic procedures.

Consider the impact of public health initiatives. In 2024, for example, many countries continued to invest in programs promoting early cancer screening and management of chronic diseases, aiming to catch issues earlier or prevent them altogether. If these efforts prove highly successful, the long-term demand for diagnostic services related to these specific conditions might plateau or even decline.

The threat of substitutes, in this context, is more about reducing the underlying need for diagnostic services rather than finding alternative technologies for diagnosis itself. A healthier population, achieved through effective interventions, could mean fewer patients requiring diagnostic imaging in the future.

- Reduced Incidence: Lifestyle interventions aim to prevent diseases, thereby lowering the overall demand for diagnostic services.

- Healthier Population: A focus on public health can lead to a population that requires fewer medical interventions, including diagnostic imaging.

- Long-Term Impact: Successful preventive strategies could gradually decrease the reliance on diagnostic imaging for certain conditions over time.

The threat of substitutes for Integral Diagnostics primarily stems from less technologically advanced but often more cost-effective alternatives and evolving non-imaging diagnostic methods. While advanced imaging offers detailed visualization, simpler tests like blood panels and basic X-rays can suffice for initial diagnoses or less complex conditions, as seen in their continued prevalence in 2024. Point-of-care ultrasound (POCUS) also emerges as a growing substitute, offering rapid, on-site diagnostics that can reduce reliance on traditional radiology departments for preliminary assessments.

Furthermore, advancements in areas like liquid biopsies and genetic testing present a significant long-term threat by potentially bypassing the need for imaging altogether in certain cancer detections. Even artificial intelligence, while often augmenting imaging, could eventually reduce demand for human interpretation of standard scans, impacting the role of radiologists and radiographers. For instance, AI's rapid development in medical imaging, with market growth projected to exceed 30% annually leading up to 2025, highlights this potential shift.

| Substitute Type | Examples | Impact on Integral Diagnostics | 2024 Relevance |

| Less Advanced Modalities | Basic X-rays, routine lab tests | Can fulfill diagnostic needs where high detail isn't critical, potentially reducing demand for advanced imaging. | Still widely used for initial screening and common ailments. |

| Non-Imaging Diagnostics | Liquid biopsies, genetic testing, advanced blood tests | Directly replaces the need for imaging in specific diagnostic pathways, diverting patient volume and revenue. | Growing promise in early disease detection, particularly in oncology. |

| Preventive Healthcare | Lifestyle changes, public health initiatives | Reduces the underlying incidence of conditions requiring diagnostic imaging, thereby lowering overall demand. | Continued focus on chronic disease management and early screening aims to decrease future need for some imaging. |

Entrants Threaten

The threat of new entrants into the diagnostic imaging sector is significantly curtailed by the immense capital required to establish operations. Setting up a fully equipped clinic, especially one featuring advanced technologies like MRI and CT scanners, demands an extremely high initial investment. For instance, a single new MRI machine can easily cost between $1 million and $3 million, presenting a formidable financial hurdle. This substantial capital requirement acts as a powerful deterrent, effectively discouraging many potential competitors from entering the market and challenging established players like Integral Diagnostics.

The diagnostic imaging sector in Australia and New Zealand faces significant barriers to entry due to stringent regulatory and accreditation requirements. For instance, operating MRI services necessitates specific licensing arrangements, adding a layer of complexity for potential new entrants.

These regulations are not merely bureaucratic; they are designed to uphold quality and safety standards essential for Medicare eligibility. Companies must navigate rigorous processes to achieve and maintain accreditation, which can be both time-consuming and costly.

In 2024, the ongoing emphasis on patient safety and data integrity means that regulatory bodies continue to scrutinize new entrants thoroughly. This environment effectively deters smaller or less-resourced players from entering the market, thereby protecting established businesses like Integral Diagnostics.

The need for a highly skilled workforce presents a considerable barrier to new entrants in the diagnostic imaging sector. Attracting and retaining qualified professionals like radiologists, nuclear medicine specialists, and experienced technicians is a persistent challenge. For instance, the Australian Institute of Health and Welfare noted in 2023 that a significant portion of the medical workforce is approaching retirement age, potentially exacerbating future shortages of specialists. Integral Diagnostics leverages its established network and reputation to attract top talent, highlighting its team of leading radiologists as a key differentiator that new competitors would struggle to replicate quickly.

Established Referral Networks and Brand Reputation

Integral Diagnostics, like other established players in diagnostic imaging, benefits significantly from deep-rooted referral networks. These are the long-standing relationships built over years with doctors, specialists, and allied health professionals who direct patients for imaging services. For instance, in the Australian market, the stability of these relationships is a key barrier; a new entrant would need to invest heavily in building similar trust and demonstrating superior service to even begin chipping away at incumbent referral volumes. This is not a quick process, as physician trust is earned over time through consistent quality and reliability.

The brand reputation of incumbents also plays a crucial role. Integral Diagnostics has cultivated a perception of quality and dependability among both referring physicians and patients. This reputation is a valuable intangible asset, making it difficult for newcomers to attract patients who often rely on their doctor's recommendation. In 2024, the diagnostic imaging sector continues to see patients place significant weight on physician referrals when choosing a provider, highlighting the enduring power of these established networks.

This established trust and the inherent time lag in developing comparable networks represent a substantial hurdle for new entrants. They must not only offer competitive pricing and services but also overcome the inertia of existing referral patterns. Consider this: the effort required to build a robust referral base for a new diagnostic imaging provider could easily span several years and require substantial marketing and relationship management expenditure.

The threat of new entrants is therefore moderated by these entrenched referral networks and strong brand reputations. This dynamic:

- Inhibits rapid market share acquisition by new companies.

- Requires significant investment in relationship building and marketing for new entrants.

- Leverages the trust built over years with medical professionals.

- Means patient choice is heavily influenced by physician recommendations, favoring established providers.

Economies of Scale and Cost Advantages of Incumbents

Established players in the diagnostic imaging sector, like Integral Diagnostics, often command significant economies of scale. This allows them to negotiate better rates for high-value equipment, medical supplies, and even administrative services. For instance, in 2023, major imaging providers in Australia reported substantial purchasing power, impacting the cost of MRI and CT scanner consumables.

New entrants face a steep challenge in replicating these cost advantages. Without the same volume of operations, their per-unit costs for essential supplies and equipment maintenance will likely be higher.

Furthermore, the influence of Medicare benefits on pricing structures in Australia means that new entrants must compete on a cost basis that is heavily influenced by existing market dynamics.

- Economies of Scale: Large incumbents benefit from lower per-unit costs in purchasing and operations.

- Negotiating Power: Established firms secure more favorable terms with suppliers and insurers.

- Competitive Pricing: Incumbents can leverage cost advantages to offer more competitive pricing.

- Barriers to Entry: Newcomers struggle to match the cost efficiencies of established players.

The threat of new entrants into diagnostic imaging is significantly mitigated by high capital requirements, stringent regulations, the need for specialized staff, and established referral networks. Integral Diagnostics benefits from these factors, which create substantial barriers to entry, protecting its market position.

High upfront costs for equipment, such as MRI machines costing upwards of $1 million to $3 million, deter many potential competitors. Coupled with rigorous licensing and accreditation processes essential for Medicare eligibility, these hurdles demand significant time and financial resources. For example, in 2024, regulatory bodies continue to emphasize patient safety, making thorough scrutiny of new entrants a standard practice, thereby limiting the influx of smaller players.

The sector also faces a shortage of qualified professionals, with a significant portion of the medical workforce nearing retirement age, as noted by the Australian Institute of Health and Welfare in 2023. Integral Diagnostics' ability to attract and retain top radiologists provides a competitive edge that new entrants would struggle to replicate quickly.

Furthermore, established referral networks, built over years of trust with medical professionals, are a critical barrier. Patients often rely on physician recommendations, making it difficult for new providers to gain traction without substantial investment in relationship building and demonstrating consistent quality. The brand reputation of incumbents like Integral Diagnostics further solidifies this advantage, as patients tend to favor providers with a proven track record.

Porter's Five Forces Analysis Data Sources

Our Integral Diagnostics Porter's Five Forces analysis is built upon a foundation of publicly available company disclosures, including annual reports and investor presentations. We also leverage industry-specific market research reports and data from reputable financial news outlets to capture competitive dynamics.