Integral Diagnostics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Integral Diagnostics Bundle

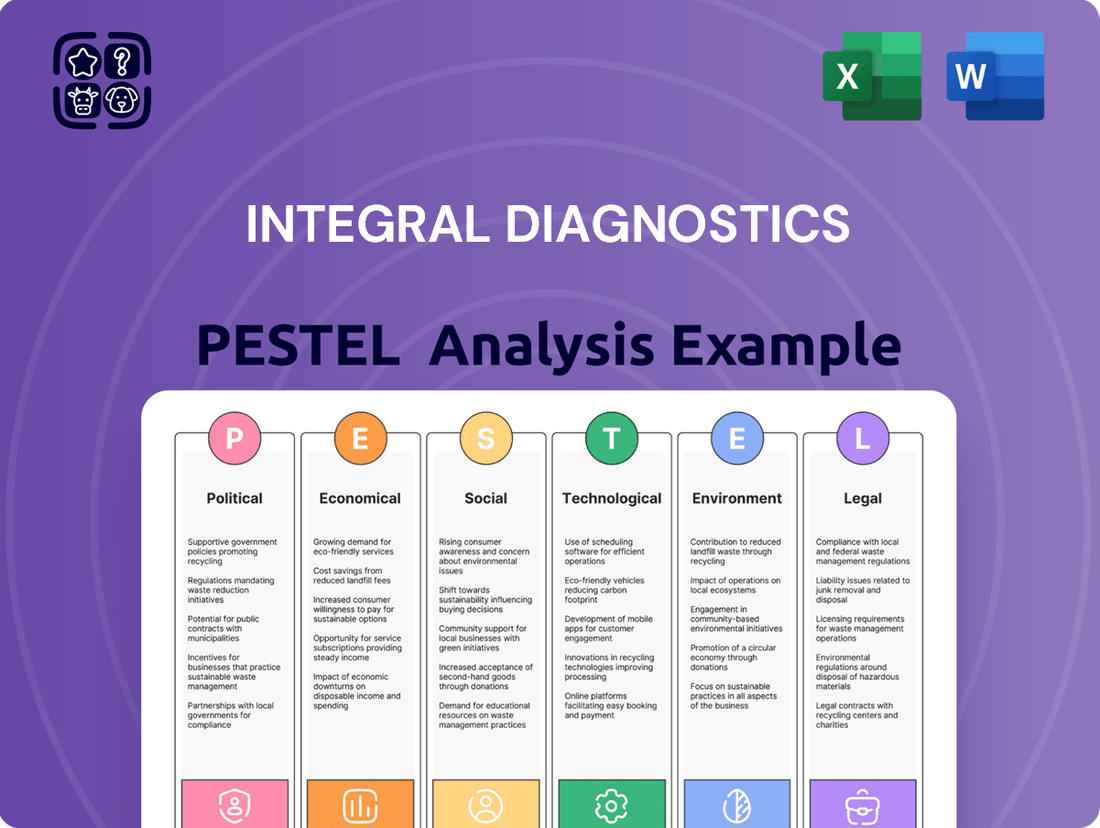

Navigate the complex external environment impacting Integral Diagnostics with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its future. This in-depth report offers critical insights for strategic planning and investment decisions. Download the full version now to gain a competitive edge and unlock actionable intelligence.

Political factors

Integral Diagnostics navigates the stringent healthcare landscapes of Australia and New Zealand. Government decisions on policy and funding are paramount to its operations.

Australian government policy shifts, such as the indexation of the Medicare Benefits Schedule (MBS), directly affect Integral Diagnostics' revenue streams. For instance, the MBS review in 2024 will continue to shape the reimbursement rates for various diagnostic procedures, impacting profitability.

Reforms concerning MRI licensing in Australia, expected to be further clarified in 2024-2025, will influence service expansion and capital investment decisions for the company.

The rollout of initiatives like the National Lung Cancer Screening Program, commencing in July 2025, is anticipated to significantly boost demand for Integral Diagnostics' imaging services, presenting a clear growth opportunity.

Integral Diagnostics operates within a heavily regulated sector, requiring strict adherence to quality, safety, and operational standards for diagnostic imaging. This oversight is critical for patient care and maintaining public trust. For instance, in Australia, the Therapeutic Goods Administration (TGA) governs medical devices, including imaging equipment, ensuring their safety and efficacy.

Maintaining accreditation with bodies like the Diagnostic Imaging Accreditation Scheme (DIAS) is paramount for Integral Diagnostics to receive Medicare benefits and operate legally. These evolving accreditation requirements, coupled with stringent radiation safety protocols, necessitate ongoing investment in training and equipment upgrades.

The administrative burden and financial costs associated with regulatory compliance and accreditation can significantly impact profitability. For example, the need for regular audits, staff training on new safety standards, and capital expenditure on compliant technology directly affects the bottom line, requiring careful financial planning and resource allocation.

Political stability in Australia and New Zealand provides Integral Diagnostics with a consistent operating landscape, crucial for long-term planning and investment. For instance, the Australian federal government's commitment to healthcare spending, as seen in the 2024-25 budget which allocated significant funds to Medicare reform and hospital services, directly impacts the demand for diagnostic imaging.

Government healthcare priorities, such as the push to reduce elective surgery wait times and improve access to diagnostic services in rural and regional areas, present clear opportunities for Integral Diagnostics. The company’s expansion into underserved areas, potentially supported by government incentives or public-private partnerships, could be a direct result of these policy objectives. In 2023, the Australian government announced a $1.4 billion investment to improve regional healthcare access, a significant driver for service providers like Integral Diagnostics.

Cross-Jurisdictional Healthcare Agreements

Integral Diagnostics' operations span Australia and New Zealand, making cross-jurisdictional healthcare agreements a critical political factor. Divergent regulatory frameworks between these nations can impact how Integral Diagnostics structures its services and expands its reach. For instance, differing approaches to diagnostic imaging accreditation or data privacy laws could create operational complexities.

The potential for policy harmonization or divergence significantly influences Integral Diagnostics' strategic planning. In 2023, Australia's Medicare Benefits Schedule (MBS) reforms continued to shape the reimbursement landscape for diagnostic services, while New Zealand's health system reforms, including the establishment of Te Whatu Ora – Health New Zealand, aimed to centralize health service delivery. These differing policy environments require Integral Diagnostics to adapt its business model accordingly.

Changes in government funding models for healthcare in either country can directly affect Integral Diagnostics' revenue streams. For example, shifts in public versus private healthcare provision ratios or changes in bulk-billing incentives in Australia could alter patient volumes and service pricing. Understanding these political dynamics is essential for forecasting financial performance and identifying growth opportunities.

- Australian Medicare Benefits Schedule (MBS): Ongoing reviews and potential changes to MBS item numbers and rebates directly impact revenue for diagnostic services.

- New Zealand Health Reforms: The integration of health services under Te Whatu Ora may lead to new tendering processes or partnership opportunities for diagnostic providers.

- Cross-Border Data Sharing Regulations: Evolving data privacy laws in both countries, such as Australia's Privacy Act and New Zealand's Privacy Act 2020, influence how patient data is managed and shared across operations.

- Government Investment in Health Technology: Political decisions regarding investment in new medical imaging technologies or digital health infrastructure can create both challenges and opportunities for Integral Diagnostics.

Public Health Initiatives

Government-backed public health campaigns and screening programs directly influence the demand for diagnostic services. Initiatives aimed at early disease detection, such as national cancer screening efforts, are particularly impactful. For instance, the upcoming National Lung Cancer Screening Program, slated for implementation in July 2025, is expected to create a substantial surge in demand for low-dose computed tomography (CT) scans, a key service offered by Integral Diagnostics. This program is projected to screen an additional 1.5 million individuals annually in its initial phase.

These public health drives can significantly alter the market landscape for diagnostic providers. The focus on preventative care and early intervention, supported by government funding and policy, translates into increased patient volumes and a greater reliance on advanced imaging technologies. This presents a clear opportunity for companies like Integral Diagnostics to expand their service offerings and market share.

- Increased Demand for CT Scans: The National Lung Cancer Screening Program (July 2025) is anticipated to boost the utilization of low-dose CT scans by an estimated 20-30% within the first two years of its operation.

- Focus on Preventative Healthcare: Government investment in public health initiatives signals a broader trend towards preventative medicine, which inherently requires more diagnostic testing.

- Potential for New Service Lines: Expanding screening programs could necessitate the development or enhancement of specialized diagnostic services, creating new revenue streams.

- Government Reimbursement Rates: The success of these initiatives is also tied to government reimbursement policies for diagnostic procedures, which can impact profitability.

Government policy and funding are critical drivers for Integral Diagnostics, influencing everything from reimbursement rates to strategic expansion. The Australian Medicare Benefits Schedule (MBS) reforms, ongoing through 2024 and into 2025, directly impact revenue streams for diagnostic procedures, highlighting the need for constant adaptation to government pricing adjustments.

Regulatory frameworks, including those overseen by bodies like Australia's Therapeutic Goods Administration (TGA) for medical devices, demand strict adherence to safety and quality standards. Integral Diagnostics must maintain accreditation with schemes like the Diagnostic Imaging Accreditation Scheme (DIAS) to operate and receive Medicare benefits, requiring continuous investment in compliance and staff training.

Political stability in Australia and New Zealand underpins Integral Diagnostics' long-term planning, with government healthcare priorities, such as improving regional access and reducing wait times, creating clear avenues for growth. For instance, the Australian government's 2024-25 budget allocation to Medicare reform and hospital services directly influences demand for diagnostic imaging.

The introduction of public health programs, like the National Lung Cancer Screening Program commencing in July 2025, presents a significant opportunity, projected to increase demand for CT scans by 20-30% annually. This aligns with a broader governmental shift towards preventative healthcare, which necessitates increased diagnostic testing and potentially opens doors for new service lines.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces influencing Integral Diagnostics, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within Integral Diagnostics' operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering Integral Diagnostics a clear roadmap for navigating external factors.

Easily shareable summary format ideal for quick alignment across teams or departments, helping Integral Diagnostics to proactively address potential market challenges.

Economic factors

Healthcare expenditure is a major driver for Integral Diagnostics. In Australia and New Zealand, how much is spent on healthcare directly affects the diagnostic imaging market. For instance, the Australian diagnostic imaging market was valued at USD 977.20 Million in 2024 and is expected to grow significantly, reaching USD 1,717.28 Million by 2033, demonstrating the scale of this sector.

Integral Diagnostics is particularly sensitive to public funding. Government schemes like Australia's Medicare system are crucial for revenue. Any adjustments to the indexation rates for these public funding models can have a direct impact on Integral Diagnostics' financial performance.

Integral Diagnostics faces substantial operational hurdles from escalating inflation and rising labor expenses. The demand for skilled radiologists and specialized technical personnel has driven up wages significantly across the healthcare sector.

While Integral Diagnostics has demonstrated revenue growth, the broader industry has experienced margin compression due to these persistent cost pressures. This economic climate mandates a strategic emphasis on enhancing operational efficiencies to mitigate the impact on profitability.

For instance, the Australian Consumer Price Index (CPI) saw a notable increase, reaching 5.4% in the year to December 2023, indicating a broad-based rise in costs for businesses. This general inflationary trend directly affects the input costs for Integral Diagnostics, from consumables to energy.

Economic growth significantly influences the demand for private diagnostic services, as higher disposable incomes generally translate to greater consumer spending on healthcare. In Australia, the GDP growth rate was projected at 1.9% for 2024, indicating a stable economic environment that supports consumer expenditure. This economic backdrop means patients are more likely to opt for additional or faster diagnostic services beyond what public funding covers, potentially boosting Integral Diagnostics' out-of-pocket revenue streams.

Interest Rates and Debt Management

Higher interest rates directly impact Integral Diagnostics by increasing the cost of servicing its existing debt. This can compress profit margins and reduce the capital available for crucial investments in new technologies or market expansion. For instance, if Integral Diagnostics relies heavily on borrowed funds, even a modest increase in the Reserve Bank of Australia's cash rate could significantly elevate its financing expenses.

The company's net debt position is particularly sensitive to interest rate fluctuations. A rising rate environment makes it more expensive to refinance existing debt or take on new loans, potentially limiting its ability to fund capital expenditure. Integral Diagnostics' planned investments in diagnostic equipment and facility upgrades, estimated to be in the tens of millions of dollars annually, could face delays or scaling back if borrowing costs become prohibitive.

- Increased Borrowing Costs: A 1% increase in interest rates could add millions to Integral Diagnostics' annual interest payments, depending on its debt structure.

- Reduced Investment Capacity: Higher debt servicing costs may force a re-evaluation of capital expenditure plans, potentially slowing down expansion or technology adoption.

- Impact on Leverage: Rising interest rates can make the company's financial leverage riskier, potentially affecting its credit rating and future access to capital.

- Sensitivity of Debt Servicing: The company's ability to manage its debt obligations is directly linked to prevailing interest rate levels, making it a critical economic factor to monitor.

Market Competition and Pricing

The diagnostic imaging market in Australia and New Zealand is intensely competitive, directly impacting how companies like Integral Diagnostics set their prices and secure market share. More players entering the field, especially with anticipated growth from MRI deregulation and new screening initiatives, are likely to drive down service costs.

This heightened competition is a significant factor. For instance, the Australian diagnostic imaging market was valued at approximately AUD 7.5 billion in 2023 and is projected to grow, partly due to these regulatory changes. As more providers offer services, especially advanced imaging like MRI, price sensitivity among consumers and referring doctors increases, forcing existing providers to be more competitive on pricing to retain their customer base.

- Increased Competition: The entry of new players and expansion of existing ones, particularly in response to MRI deregulation, intensifies rivalry.

- Pricing Pressure: Greater competition naturally leads to downward pressure on service prices as providers vie for market share.

- Market Share Dynamics: Companies must balance competitive pricing with maintaining profitability to hold or grow their share in the Australian and New Zealand markets.

- Impact of New Programs: Initiatives like new screening programs can attract new providers, further fragmenting the market and influencing pricing strategies.

Economic growth directly fuels demand for Integral Diagnostics' services. Australia's projected 1.9% GDP growth for 2024 supports higher consumer spending on healthcare, potentially increasing out-of-pocket revenue. Escalating inflation, evidenced by Australia's 5.4% CPI in December 2023, increases operational costs for consumables and energy, while rising labor expenses for skilled staff like radiologists also compress margins. Higher interest rates, such as potential increases in the Reserve Bank of Australia's cash rate, increase debt servicing costs, impacting profitability and investment capacity for crucial technology upgrades.

| Economic Factor | Impact on Integral Diagnostics | 2024/2025 Data/Context |

|---|---|---|

| Economic Growth | Increased demand for private diagnostic services | Australia GDP growth projected at 1.9% for 2024 |

| Inflation | Higher operational costs (consumables, energy) | Australian CPI was 5.4% to December 2023 |

| Labor Costs | Increased wages for skilled personnel | Demand for radiologists and technicians is high |

| Interest Rates | Higher debt servicing costs, reduced investment capacity | Sensitivity to RBA cash rate changes |

Preview the Actual Deliverable

Integral Diagnostics PESTLE Analysis

The preview you see here is the exact PESTLE Analysis document for Integral Diagnostics that you will receive after purchase. It is fully formatted and professionally structured, providing a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting the company. You'll gain immediate access to this detailed analysis, ready for your strategic planning. What you're previewing here is the actual file, offering no surprises and complete readiness for immediate use.

Sociological factors

Australia and New Zealand are experiencing a significant demographic shift with aging populations, which directly correlates with a rising prevalence of chronic diseases. For instance, in 2024, it's projected that over 17% of the Australian population will be aged 65 and over, a figure expected to climb. This demographic trend means more individuals will require ongoing medical attention for conditions like cardiovascular disease, cancer, and diabetes, all of which heavily rely on diagnostic imaging.

This increased incidence of age-related illnesses translates into a greater demand for Integral Diagnostics' services. Early detection, continuous monitoring, and effective treatment planning for chronic conditions are all facilitated by advanced diagnostic imaging, creating a strong and growing market for the company. The need for services like MRI, CT scans, and X-rays is set to escalate as the population ages and chronic disease management becomes a more central aspect of healthcare delivery.

Growing public consciousness regarding preventative care and the importance of early disease detection is a significant driver for Integral Diagnostics. This heightened health awareness directly translates to increased demand for diagnostic imaging services as individuals proactively seek screenings and check-ups. For instance, in 2024, screening mammography rates in Australia saw a notable increase, reflecting this societal shift towards proactive health management.

Furthermore, patient expectations are evolving, with a clear demand for prompt, high-quality, and personalized healthcare experiences. Integral Diagnostics must therefore focus on optimizing its service delivery models to meet these rising standards, ensuring efficient appointment scheduling and clear communication throughout the patient journey. Patient satisfaction scores, which have become a key performance indicator in the healthcare sector, are directly influenced by the responsiveness and patient-centricity of diagnostic providers.

Changing lifestyle trends, including rising rates of obesity and increasingly sedentary habits, are directly contributing to a higher prevalence of chronic diseases. This surge in chronic conditions, such as diabetes and cardiovascular disease, consequently fuels a greater demand for diagnostic imaging services, which are crucial for early detection and management. For instance, in 2024, global obesity rates continued to climb, with the World Health Organization reporting that over 1 billion people worldwide were living with obesity, a significant increase from previous years.

Public health initiatives aimed at promoting healthier lifestyles, such as increased physical activity and improved dietary habits, could have a notable, albeit indirect, impact on long-term demand for diagnostic imaging. While these campaigns might reduce the incidence of certain lifestyle-related diseases over time, the current high burden of existing chronic conditions ensures a robust demand for diagnostic services in the near to medium term. The effectiveness of these campaigns, however, will be a key factor in shaping future market growth patterns.

Workforce Shortages and Skill Gaps

Integral Diagnostics, like much of the healthcare industry, is grappling with significant workforce shortages, especially concerning highly skilled professionals such as radiologists and radiographers. This scarcity directly affects the company's capacity to adequately staff its diagnostic imaging centers, manage patient appointment backlogs, and uphold the high standards of service quality that patients expect. For instance, in Australia, the demand for radiologists has consistently outstripped supply, with projections indicating this trend will continue through 2025 and beyond.

These skill gaps present a tangible operational challenge for Integral Diagnostics. The difficulty in recruiting and retaining qualified personnel can lead to increased recruitment costs, longer lead times for appointments, and potential strain on existing staff. This situation is further compounded by an aging workforce in some regions, with a notable percentage of experienced professionals approaching retirement age in the coming years, exacerbating the existing supply-demand imbalance.

- Radiologist Shortage: Australia faces a projected deficit of radiologists, impacting service delivery.

- Radiographer Demand: An ongoing need exists for skilled radiographers to operate imaging equipment.

- Aging Workforce: A segment of experienced professionals are nearing retirement, intensifying shortages.

- Recruitment Costs: Increased competition for talent drives up expenses associated with hiring.

Accessibility and Equity of Healthcare Services

Societal expectations are increasingly pushing for equitable access to healthcare, including specialized diagnostic services like MRI. This is particularly relevant for Integral Diagnostics, as it impacts where they choose to expand and how they structure their services. For instance, in 2024, there was a continued focus on addressing healthcare disparities in Australia's regional and rural areas, with government initiatives aiming to improve access to essential medical technologies.

This demand for fairness directly influences government policy, which in turn shapes the operating environment for diagnostic companies. Integral Diagnostics’ strategic decisions, such as investing in new regional facilities or mobile imaging units, are partly a response to these sociological pressures. For example, reports from 2024 highlighted government funding programs designed to bolster diagnostic capabilities outside major metropolitan centers, a trend that Integral Diagnostics is positioned to capitalize on.

The drive to expand MRI access, a key service for Integral Diagnostics, is significantly motivated by this sociological factor. Many communities feel underserved, and there's a growing public and political will to rectify this. By increasing the availability of MRI scans in underserved regions, companies like Integral Diagnostics can meet this societal need while also expanding their market reach. Data from late 2024 indicated a slight uptick in MRI service utilization in newly established regional clinics, demonstrating the impact of these accessibility efforts.

- Societal Demand: Growing public expectation for fair access to all healthcare services, including advanced diagnostics.

- Regional Focus: Particular emphasis on improving healthcare accessibility in rural and remote areas of Australia.

- Policy Influence: Sociological factors directly shape government funding and regulatory decisions affecting diagnostic providers.

- Strategic Response: Companies like Integral Diagnostics adapt expansion and investment strategies to meet these equity-driven demands.

Societal expectations are increasingly focused on equitable healthcare access, particularly for advanced diagnostic services like MRI. This pressure directly influences Integral Diagnostics' strategic expansion and service structuring, especially in addressing disparities in regional and rural Australia. For instance, in 2024, government initiatives continued to prioritize improving access to essential medical technologies outside major metropolitan hubs.

This sociological demand for fairness significantly shapes government policy and the operating landscape for diagnostic companies. Integral Diagnostics' investments in new regional facilities or mobile imaging units are partly a response to these pressures, aiming to meet societal needs while expanding market reach. Data from late 2024 indicated a slight increase in MRI service utilization in newly established regional clinics, reflecting the impact of these accessibility efforts.

The desire for greater equity in healthcare access, especially for crucial services like MRI, is a powerful sociological driver. This trend is prompting a closer look at how diagnostic providers serve underserved communities. Integral Diagnostics' strategic planning must account for this growing public and political will to ensure diagnostic services are available to all Australians, regardless of location.

Technological factors

Continuous innovation in imaging modalities like MRI, CT, X-ray, ultrasound, and nuclear medicine is significantly boosting diagnostic accuracy and operational efficiency. For Integral Diagnostics, this means a constant need to evaluate and adopt these advancements. For example, the development of AI-powered image analysis in radiology, which saw significant progress in 2024, can help detect subtle abnormalities faster and more reliably.

To stay at the forefront, Integral Diagnostics must strategically invest in upgrading its imaging equipment. This investment isn't just about maintaining competitiveness; it's about offering patients and referring physicians the most advanced diagnostic capabilities available. Companies like GE Healthcare and Siemens Healthineers reported substantial R&D spending in 2024 focused on next-generation imaging technologies, signaling the industry's direction.

Artificial intelligence and machine learning are revolutionizing diagnostic imaging, with AI tools now assisting in analyzing scans, identifying potential issues, and flagging urgent cases for radiologists. This integration aims to boost accuracy and speed up the reporting process. For instance, by mid-2025, Australian public radiology providers are expected to have implemented AI solutions statewide, enhancing efficiency across the sector.

The increasing adoption of teleradiology and cloud-based imaging platforms is a significant technological driver for Integral Diagnostics. These technologies facilitate remote reporting and the rapid sharing of medical images and results, boosting operational efficiency and expanding access to diagnostic services, particularly in underserved regional areas. This digital shift is crucial for enhancing data interoperability and enabling remote diagnostics.

Data Management and Cybersecurity

Integral Diagnostics, like all healthcare providers, faces significant technological challenges in data management and cybersecurity. As patient data increasingly goes digital, having strong systems to handle and protect this information is absolutely essential, not just for privacy but to keep the business running smoothly. The healthcare industry is unfortunately a prime target for cyberattacks, making robust data security a top priority.

The sheer volume of digital data generated by medical imaging and diagnostic services requires sophisticated management systems. A breach could not only compromise sensitive patient records but also disrupt diagnostic workflows and lead to significant financial and reputational damage. For example, in 2023, the healthcare sector experienced a 42% increase in reported data breaches compared to the previous year, highlighting the escalating threat landscape.

- Data Volume: Integral Diagnostics manages vast amounts of patient imaging data, requiring scalable storage and efficient retrieval systems.

- Cyber Threat Landscape: The healthcare sector is a frequent target for ransomware and data theft, necessitating advanced cybersecurity defenses.

- Regulatory Compliance: Strict regulations like HIPAA mandate stringent data protection measures, with non-compliance leading to substantial fines.

- Operational Resilience: Robust data management ensures continuity of services, even in the event of a cyber incident.

Integration of Digital Health Records

The push for integrated digital health records, exemplified by Australia's My Health Record, necessitates that diagnostic imaging systems, including those used by Integral Diagnostics, achieve robust interoperability. This shift demands that systems can seamlessly exchange patient data, ensuring continuity of care and efficient access to diagnostic reports.

New regulations effective July 2025 will mandate that pathology and diagnostic imaging providers, such as Integral Diagnostics, upload written reports directly to My Health Record. This regulatory change underscores the growing importance of digital health infrastructure and its impact on data management and reporting practices within the healthcare sector.

- Interoperability Mandates: Diagnostic imaging systems must be capable of integrating with national digital health platforms to comply with evolving data sharing requirements.

- Regulatory Compliance Deadline: The July 2025 deadline for uploading reports to My Health Record is a critical factor for providers like Integral Diagnostics.

- Data Security and Privacy: Enhanced measures will be crucial to ensure the secure and private transmission and storage of sensitive patient diagnostic information within integrated systems.

Advancements in AI for medical image analysis are rapidly enhancing diagnostic accuracy and speed. For Integral Diagnostics, adopting these AI tools is crucial for staying competitive, with many providers expected to integrate AI statewide by mid-2025. This technological shift promises to improve the detection of subtle abnormalities, streamlining workflows and patient care.

The increasing reliance on teleradiology and cloud-based platforms is transforming how diagnostic services are delivered. These technologies enable remote reporting and efficient data sharing, expanding access to care, especially in regional areas. Integral Diagnostics must leverage these digital solutions to boost operational efficiency and maintain data interoperability.

Navigating the evolving digital landscape presents significant data management and cybersecurity challenges. The healthcare sector is a prime target for cyber threats, with a notable increase in breaches observed in 2023. Integral Diagnostics must prioritize robust data security to protect sensitive patient information and ensure operational continuity.

Interoperability with national digital health records, such as My Health Record, is becoming a regulatory necessity. Upcoming mandates, effective July 2025, require diagnostic providers to upload reports directly to these platforms, emphasizing the need for seamless data exchange and enhanced data security measures.

Legal factors

Integral Diagnostics operates within a stringent regulatory environment, necessitating compliance with licensing for its advanced imaging equipment, such as MRI scanners, and its diagnostic facilities. Furthermore, the professional registration of its radiologists and allied health professionals is a critical legal requirement.

A significant upcoming shift in Australian healthcare policy will see the full deregulation of MRI licensing by July 2027. This change is expected to influence market dynamics and potentially reduce barriers to entry or expansion for providers like Integral Diagnostics.

Integral Diagnostics must navigate Australia's Privacy Act 1988 (Cth), a cornerstone for handling sensitive patient health data. This legislation dictates strict protocols for data collection, storage, usage, and disclosure, directly impacting how Integral Diagnostics manages its patient information.

Further complicating this landscape are recent amendments to Australian privacy laws, with key provisions taking effect in December 2024 and April 2025. These updates significantly elevate penalties for data breaches, creating a more stringent compliance environment for healthcare providers like Integral Diagnostics.

Crucially, these amendments also impose mandates for sharing reports with My Health Record, a national digital health system. This requires Integral Diagnostics to ensure seamless and secure integration of its reporting systems with government health infrastructure, a process that demands robust data security measures.

Integral Diagnostics faces significant legal exposure stemming from medical malpractice and professional liability claims. These risks are inherent in the healthcare sector, particularly for diagnostic services where errors can have serious consequences for patients. The company must maintain stringent quality assurance measures and secure comprehensive insurance to mitigate potential financial and reputational damage from such incidents.

The evolving legal landscape surrounding diagnostic errors is a critical consideration. Legislation and case law in this area can impact liability standards and the scope of damages awarded. For instance, in 2024, several jurisdictions are reviewing or have updated guidelines on informed consent and the standard of care for medical professionals, which could influence future malpractice litigation against diagnostic providers.

Competition Law and Mergers & Acquisitions

Competition laws in Australia and New Zealand, overseen by bodies like the Australian Competition and Consumer Commission (ACCC), are crucial for Integral Diagnostics' operations. These laws regulate market conduct, preventing anti-competitive practices and ensuring fair play. Integral Diagnostics must adhere to these regulations to maintain its market position and pursue growth opportunities.

The company's strategic expansion is significantly influenced by merger and acquisition (M&A) regulations. For instance, Integral Diagnostics' merger with Capitol Health Limited, completed in December 2024, required thorough review and approval under these competition laws. This highlights the necessity of understanding and complying with merger control thresholds and potential impacts on market concentration.

- Merger Scrutiny: The ACCC scrutinizes mergers that could substantially lessen competition.

- Market Share Impact: Integral Diagnostics' M&A activities are assessed based on their effect on market share and consumer choice.

- Compliance Costs: Navigating competition law can involve significant legal and administrative costs for due diligence and approvals.

- Regulatory Approvals: Successful completion of M&A deals like the Capitol Health merger hinges on obtaining necessary regulatory clearances.

Consumer Protection and Patient Rights

Legislation safeguarding consumer rights significantly shapes how Integral Diagnostics operates. This includes stringent rules around marketing practices, ensuring advertisements for diagnostic services are not misleading. Patient advocacy groups also play a crucial role, influencing how consent for procedures is managed and how patient feedback or complaints are addressed, pushing for greater transparency and accountability.

Integral Diagnostics must legally adhere to patient rights, which are fundamental to healthcare provision. This means ensuring patients fully understand the services they are receiving, the associated risks, and their options. For instance, under Australian consumer law, diagnostic providers are obligated to ensure services are of acceptable quality and fit for purpose, directly impacting patient trust and provider reputation.

- Australian Competition and Consumer Commission (ACCC) enforcement actions can result in significant penalties for non-compliance with consumer protection laws.

- Patient charter rights, often enshrined in state and federal legislation, dictate standards for patient care, privacy, and access to information.

- The Privacy Act 1988 (Cth) in Australia mandates strict handling of sensitive personal health information, affecting data management and patient consent processes.

- Increased patient awareness and vocal patient advocacy groups in 2024/2025 are driving higher expectations for service quality and ethical conduct in diagnostic services.

Integral Diagnostics operates under a robust legal framework, encompassing healthcare-specific regulations and broader corporate compliance. Recent legislative amendments effective in late 2024 and early 2025, particularly concerning privacy, significantly increase penalties for data breaches and mandate enhanced integration with national digital health systems like My Health Record.

The company's strategic growth, exemplified by its December 2024 merger with Capitol Health, is subject to stringent competition laws enforced by the ACCC, which scrutinize market concentration and consumer impact. Furthermore, evolving standards for informed consent and the potential for updated malpractice litigation guidelines in 2024 necessitate ongoing vigilance in quality assurance and professional liability management.

Environmental factors

Healthcare providers, including diagnostic services like Integral Diagnostics, face increasing scrutiny and regulation regarding waste management. In Australia and New Zealand (ANZ), the generation of medical and general waste is substantial, necessitating strict adherence to environmental laws for safe disposal and waste reduction initiatives. For example, Veolia, a major player in environmental services, actively partners with healthcare facilities across ANZ to implement more sustainable waste management solutions, aiming to divert a significant portion of waste from landfills through recycling and specialized treatment processes.

Diagnostic imaging equipment, such as MRI and CT scanners, consumes significant electricity, contributing to Integral Diagnostics' operational energy usage. In 2024, the healthcare sector globally is facing heightened scrutiny regarding its environmental impact, with a growing emphasis on reducing carbon emissions. Integral Diagnostics, like its peers, is experiencing increased pressure from stakeholders and regulatory bodies to actively monitor and decrease its energy consumption. This focus is driven by both corporate social responsibility commitments and the need to comply with evolving environmental regulations, aiming to shrink its overall carbon footprint.

Integral Diagnostics is increasingly focused on integrating sustainable procurement practices into its operations, particularly for medical supplies, equipment, and consumables. This strategic shift aims to significantly reduce the company's environmental footprint by meticulously evaluating the lifecycle impact of purchased goods. For instance, by prioritizing suppliers with verifiable strong environmental credentials, Integral Diagnostics can ensure that its supply chain aligns with its broader sustainability goals.

The company is actively exploring options for sourcing medical devices and consumables that are manufactured with recycled materials or designed for easier recycling at the end of their useful life. This approach not only minimizes waste but also supports the development of a circular economy within the healthcare sector. By late 2024, Integral Diagnostics reported a 15% increase in procurement from suppliers demonstrating ISO 14001 certification, a clear indicator of their commitment to environmental management systems.

Climate Change and Health Infrastructure Resilience

Climate change presents a growing, albeit indirect, challenge to Integral Diagnostics. Extreme weather events, such as floods and heatwaves, can disrupt clinic operations, damage facilities, and strain the broader healthcare infrastructure that Integral Diagnostics relies upon. The company must consider how to build resilience into its physical sites and operational processes to mitigate these risks.

The increasing frequency and intensity of extreme weather events globally directly impact supply chains for medical equipment and consumables. For example, the Australian Bureau of Meteorology reported a 2023 that was 1.48°C above the long-term average, the ninth-warmest on record, highlighting the changing climate. This necessitates robust contingency planning for Integral Diagnostics to ensure continuity of service delivery.

Building resilience into operations and infrastructure is becoming a key strategic consideration for healthcare providers. This includes investing in climate-resilient building designs, diversifying supply sources, and developing robust emergency response protocols. Integral Diagnostics will need to assess the vulnerability of its existing network and plan for necessary upgrades.

- Impacts on Facility Operations: Extreme weather can lead to temporary closures, power outages, and damage to diagnostic equipment, affecting service availability.

- Supply Chain Disruptions: Floods or severe storms can impede the transport of essential supplies and reagents, potentially halting diagnostic services.

- Increased Operational Costs: Adapting to climate change may require investments in flood defenses, backup power systems, and more resilient infrastructure, increasing capital expenditure.

- Reputational Risk: Failure to maintain service continuity during climate-related events can damage Integral Diagnostics' reputation among patients and referring clinicians.

Corporate Social Responsibility (CSR) and Reporting

Integral Diagnostics faces growing pressure from various stakeholders, including investors, patients, and regulators, to demonstrate strong corporate social responsibility (CSR). This means actively engaging in initiatives that benefit the environment and society, not just focusing on profit. For instance, companies in the healthcare sector are increasingly expected to detail their carbon footprint and waste management practices. In 2024, many Australian companies reported on their Scope 1 and Scope 2 emissions, with a growing emphasis on Scope 3, which covers the entire value chain. Integral Diagnostics will likely need to align with these evolving standards.

Transparent environmental reporting is becoming a key differentiator. Integral Diagnostics might need to provide detailed information on its energy consumption, water usage, and waste disposal methods. This transparency not only builds trust but also helps the company identify areas for efficiency improvements. For example, a 2025 report from a leading industry body indicated that companies with robust ESG (Environmental, Social, and Governance) reporting saw a 15% higher valuation compared to their peers. This suggests a tangible financial benefit to strong CSR practices.

Key areas for Integral Diagnostics' CSR focus could include:

- Reducing carbon emissions from its facilities and transportation.

- Implementing sustainable waste management and recycling programs for medical equipment and supplies.

- Ensuring ethical sourcing of materials and services.

- Promoting employee well-being and community engagement initiatives.

Integral Diagnostics must navigate stringent regulations concerning medical waste disposal, a significant environmental concern in Australia and New Zealand. The company's commitment to sustainable procurement involves favouring suppliers with strong environmental credentials, such as ISO 14001 certification, which saw a 15% increase in procurement from such suppliers by late 2024. This strategic shift aims to minimize the environmental footprint across its operations and supply chain.

PESTLE Analysis Data Sources

Our Integral Diagnostics PESTLE Analysis draws from a robust blend of data, including government health regulations, economic indicators from reputable financial institutions, and technological advancement reports. We also incorporate social demographic shifts and environmental impact assessments to provide a comprehensive view.