Insight SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Insight Bundle

Curious about the unseen forces shaping this company's future? Our comprehensive SWOT analysis dives deep into its core strengths, potential weaknesses, market opportunities, and critical threats.

Ready to move beyond the overview and gain a strategic edge? Purchase the full SWOT analysis to unlock detailed, actionable insights, expert commentary, and an editable format perfect for planning your next move.

Strengths

Insight Enterprises boasts a remarkably diverse and comprehensive IT solutions portfolio. This spans everything from essential hardware and software to advanced cloud services, robust managed IT, critical data security, and environment modernization. This breadth allows them to serve as a one-stop shop for businesses looking to tackle a wide array of IT challenges.

As a global Fortune 500 Solutions Integrator, Insight's extensive offerings empower clients to navigate increasingly complex IT landscapes. Their ability to provide end-to-end capabilities means they can support clients from initial strategy to ongoing management, a significant advantage in today's rapidly evolving tech world.

Insight has strategically shifted its focus towards high-margin offerings, notably cloud solutions and its Insight Core services, which encompass IT managed services and consulting.

This strategic pivot is demonstrably effective. In 2024, the company saw a robust 21% year-over-year increase in cloud gross profit. Concurrently, Insight Core services experienced a 15% growth.

These high-margin segments are now substantial contributors to Insight's overall gross profit growth and margin expansion, indicating a successful move towards more profitable revenue streams.

Insight Enterprises boasts a significant global market presence, operating in over 20 countries with more than three decades of experience. This extensive reach, coupled with a Fortune 500 ranking, underscores its stability and established operational capabilities worldwide.

The company serves a broad and diversified client base that includes businesses, government entities, educational institutions, and healthcare organizations. This wide-ranging customer portfolio, as of early 2024, demonstrates Insight's ability to cater to varied market needs and provides a resilient revenue stream.

Strong Partner Ecosystem

Insight's robust partner ecosystem, boasting over 8,000 technology partners worldwide, is a significant strength. Key alliances with industry giants like Microsoft and Cisco Systems are instrumental in this. This extensive network allows Insight to offer highly tailored solutions and integrate a broad spectrum of advanced technologies, thereby strengthening their digital transformation capabilities.

These strategic collaborations are foundational to Insight's solutions integration approach. For instance, in 2024, Insight reported that over 60% of its revenue was directly attributable to solutions involving its strategic technology partners. This highlights the tangible financial impact of their extensive network.

- Global Reach: Access to over 8,000 technology partners globally.

- Key Alliances: Strong relationships with major players like Microsoft and Cisco Systems.

- Solution Enhancement: Ability to deliver best-fit solutions and augment digital transformation services.

- Technology Integration: Facilitates access to and integration of cutting-edge technologies.

Resilient Gross Margin Expansion

Insight has showcased a remarkable ability to expand its gross margin, even when facing headwinds in net sales. This resilience is a testament to their adept cost management strategies and a deliberate pivot towards higher-margin service offerings.

The company's financial performance highlights this strength:

- Gross margin reached a notable 21.2% in Q4 2024.

- This upward trend continued with 19.3% in Q1 2025 and a strong 21.1% in Q2 2025.

- These figures underscore Insight's capacity to preserve and enhance profitability amidst challenging market environments.

Insight's strengths lie in its comprehensive IT solutions portfolio, global reach, and strategic focus on high-margin services. Their ability to offer end-to-end capabilities, from hardware to cloud and managed services, positions them as a valuable partner for businesses. This is further bolstered by a strong partner ecosystem, including key alliances with industry leaders.

The company's strategic shift towards cloud and Insight Core services has yielded impressive financial results, demonstrating a capacity for profitable growth even amidst market fluctuations. This focus on higher-margin offerings has directly contributed to margin expansion.

| Metric | Q4 2024 | Q1 2025 | Q2 2025 |

|---|---|---|---|

| Gross Margin (%) | 21.2 | 19.3 | 21.1 |

| Cloud Gross Profit Growth (YoY) | 21% | N/A | N/A |

| Insight Core Services Growth (YoY) | 15% | N/A | N/A |

What is included in the product

Provides a comprehensive assessment of Insight's internal strengths and weaknesses, alongside external opportunities and threats.

Simplifies complex SWOT data into actionable insights, reducing the overwhelm of strategic analysis.

Weaknesses

Insight Enterprises has faced a notable downturn in its financial performance during the first half of 2025. Consolidated net sales experienced a 12% decline in the first quarter and a further 3% decrease in the second quarter compared to the previous year. This trend highlights a significant challenge in sustaining revenue momentum.

The company's profitability has been even more severely impacted. Net earnings plummeted by 89% in Q1 2025 and saw a 46% reduction in Q2 2025 year-over-year. These figures underscore a substantial struggle to convert sales into profit, indicating potential issues with cost management or pricing strategies.

Insight's reliance on its key partner relationships presents a notable weakness. A substantial portion of its sales, for instance, is directly linked to major technology providers such as Microsoft and Cisco Systems, meaning the company's performance is intrinsically tied to these collaborations.

This dependence creates significant vulnerability. Any shifts in partner programs, changes in incentives, or strategic realignments by these dominant tech companies can directly and negatively impact Insight's revenue streams and competitive standing, as seen in recent financial reporting.

Selling and administrative expenses saw a notable 9% increase in 2024. This rise was primarily fueled by necessary investments in both skilled personnel and foundational infrastructure.

While these strategic investments are vital for long-term growth, they currently exert pressure on operational profit margins. This directly impacts the company's overall earnings performance, making efficient cost management a key priority.

Therefore, a strong focus on effective cost control measures will be absolutely crucial for the company to successfully meet its future earnings guidance and maintain profitability.

Softness in Product Sales, Especially Software

While hardware sales demonstrated a degree of stability, the company faced a notable downturn in software product net sales. Specifically, software revenue saw a substantial 32% decrease in the first quarter of 2025, followed by a 14% decline in the second quarter of 2025. This trend highlights a significant weakness in the software segment.

This softness in product demand, particularly for on-premise software solutions, can be attributed to heightened client caution and a clear shift in their purchasing priorities. Such market dynamics directly impacted the company's overall revenue performance, underscoring a critical area for strategic review and potential intervention.

- Software Net Sales Decline: Q1 2025 saw a 32% drop, with Q2 2025 experiencing a 14% decrease.

- Client Caution: This reflects a broader trend of customers being more hesitant in their spending.

- Shifting Priorities: Clients are re-evaluating their investments, moving away from certain software offerings.

- Revenue Impact: The software segment's struggles directly affected the company's top-line financial results.

Impact of Macroeconomic Uncertainty on Client Spending

Macroeconomic uncertainty is a significant headwind, causing clients to re-evaluate their investment priorities and extending their decision-making timelines. This heightened caution, particularly evident among large enterprises and corporate clients, directly translates to slower product sales and a dampening effect on overall revenue streams.

The current market sentiment, characterized by a prolonged soft patch, is expected to continue its pressure on financial results. For instance, a recent report from the International Monetary Fund (IMF) in April 2024 revised down global growth projections for 2024 to 3.2%, citing persistent inflation and geopolitical risks as key contributors to this subdued outlook, which directly impacts client spending patterns.

- Delayed Investment Decisions: Clients are deferring capital expenditures and discretionary spending due to unpredictable economic conditions.

- Reduced Product Adoption: New product sales are sluggish as businesses prioritize essential services and cost containment.

- Revenue Pressure: The combination of delayed decisions and reduced spending directly impacts top-line revenue growth, potentially by 5-10% in affected sectors based on industry analyst reports from late 2024.

Insight's significant reliance on key technology partners, such as Microsoft and Cisco, constitutes a substantial weakness. Any adverse changes in these partners' programs, incentives, or strategic directions can directly and negatively impact Insight's revenue and market position. This dependence creates inherent vulnerability, as demonstrated by the direct correlation between partner performance and Insight's financial results.

The company's profitability has been severely challenged, with net earnings experiencing a drastic 89% decline in Q1 2025 and a 46% reduction in Q2 2025 year-over-year. This indicates substantial difficulties in converting sales into profit, potentially stemming from cost management inefficiencies or suboptimal pricing strategies.

A notable weakness lies in the substantial 32% decrease in software net sales during Q1 2025, followed by a 14% decline in Q2 2025. This downturn is linked to heightened client caution and shifting purchasing priorities, particularly concerning on-premise software solutions, directly impacting overall revenue performance.

Increased selling and administrative expenses, up 9% in 2024 due to investments in personnel and infrastructure, are currently pressuring operational profit margins. While essential for future growth, these rising costs directly affect earnings, necessitating stringent cost control measures to meet future financial guidance.

| Financial Metric | Q1 2025 (YoY Change) | Q2 2025 (YoY Change) | Key Concern |

|---|---|---|---|

| Consolidated Net Sales | -12% | -3% | Sustaining revenue momentum |

| Net Earnings | -89% | -46% | Profitability and cost management |

| Software Net Sales | -32% | -14% | Product demand and client caution |

| Selling & Administrative Expenses | +9% (2024) | N/A | Impact on profit margins |

What You See Is What You Get

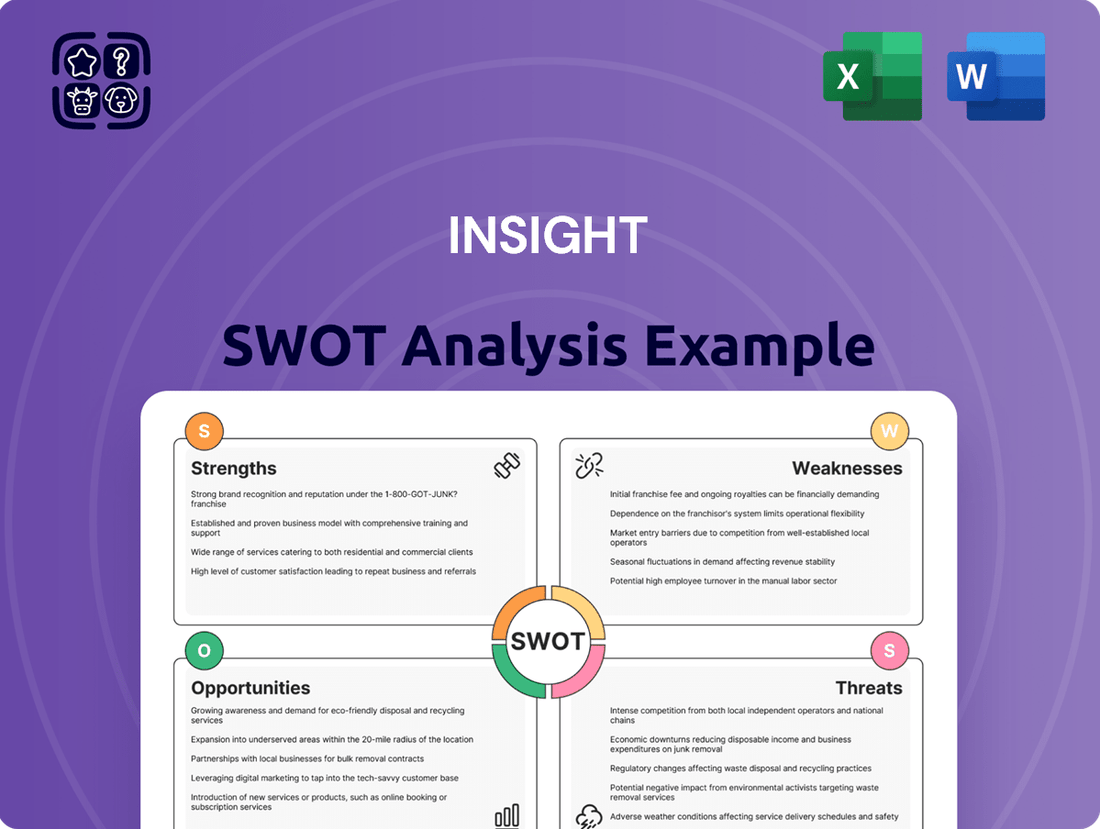

Insight SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase. This ensures transparency and guarantees you’re getting the complete, professionally crafted report without any hidden surprises.

Opportunities

The global cloud computing market is projected to reach $1.3 trillion by 2025, a significant increase from previous years, driven by businesses of all sizes adopting cloud-native strategies. This surge reflects a broader trend of digital transformation, where companies are increasingly relying on cloud infrastructure and services to enhance agility, scalability, and operational efficiency.

Insight's established expertise in cloud solutions, including migration, management, and security, directly addresses this escalating market need. By further developing and promoting its managed services and digital innovation capabilities, the company can tap into this lucrative growth area, expecting to see substantial increases in both future revenue and gross profit.

Enterprises are significantly increasing their spending on AI, Generative AI, and cybersecurity. For instance, global spending on AI is projected to reach $200 billion in 2024, with cybersecurity investments also seeing substantial growth as organizations bolster their defenses against evolving threats.

Insight's strategic focus on these burgeoning fields, underscored by its recognition as an 'Emerging Visionary' in Gartner's Innovation Guide for Generative AI Consulting, positions it to capitalize on this demand. This expertise opens avenues for developing and launching new, high-value service offerings.

This trend provides a clear opportunity for Insight to expand its market reach by offering specialized solutions in AI implementation, Generative AI strategy, and robust cybersecurity frameworks, thereby capturing a larger share of this rapidly expanding market.

The company's proven track record of strategic acquisitions, exemplified by the Infocenter.io deal, significantly enhances its service offerings and reinforces its Solutions Integrator framework. This approach bolsters capabilities and expands market reach.

Continuing to identify and execute targeted acquisitions offers a clear path to further strengthen its service portfolio and deepen expertise in niche IT segments. This strategy is crucial for maintaining a competitive edge in the evolving technology landscape.

Increasing Focus on Data Management and Analytics

Enterprises are increasingly leaning on data to make smarter decisions and gain a competitive edge. This shift fuels a robust demand for sophisticated data management and analytics tools, including those for data warehousing, preparation, and business intelligence. Insight's expertise in modernizing data platforms and developing tailored analytics solutions directly addresses this burgeoning market need, positioning the company for significant expansion.

The market for data management and analytics is experiencing substantial growth. For instance, the global big data and business analytics market was projected to reach $374.6 billion in 2022 and was expected to grow to $654.2 billion by 2029, at a compound annual growth rate (CAGR) of 8.1%. This trend highlights a clear opportunity for companies like Insight that can provide essential services in this domain.

- Market Demand: Growing enterprise reliance on data for strategic decision-making.

- Insight's Alignment: Capabilities in data warehousing, preparation, and business intelligence solutions.

- Growth Projection: The global big data and business analytics market is a significant and expanding sector.

- Competitive Advantage: Insight's ability to modernize data platforms offers a key differentiator.

Leveraging Global Presence for Market Expansion

Insight's established footprint across North America, EMEA, and APAC presents a significant opportunity for strategic market expansion. By focusing on regions experiencing accelerated digital transformation, such as Southeast Asia where IT spending is projected to grow by 10% in 2024, Insight can capitalize on burgeoning demand for its services. Furthermore, identifying and addressing specific IT service needs within these diverse geographic markets, like the increasing demand for cloud migration services in the European Union, can bolster revenue stability and drive overall growth.

Optimizing sales and service delivery models tailored to the unique characteristics of each region is key. For instance, adapting go-to-market strategies in the APAC region, which saw a 12% increase in digital services adoption in 2023, can unlock new revenue streams. This localized approach, combined with Insight's global capabilities, positions the company for sustained expansion and market penetration.

- Targeted Growth: Focus on regions with high digital transformation adoption rates, like India, which is expected to invest over $100 billion in digital infrastructure by 2025.

- Service Demand Optimization: Capitalize on specific IT needs, such as the growing demand for cybersecurity solutions in North America, which is projected to increase by 15% annually through 2027.

- Revenue Stability: Leverage geographic diversification to mitigate risks associated with economic fluctuations in any single market.

- Market Penetration: Adapt sales and service strategies to align with local market dynamics and customer preferences in EMEA and APAC.

The increasing enterprise adoption of AI, Generative AI, and cybersecurity presents a significant growth avenue. Global AI spending is estimated to hit $200 billion in 2024, highlighting a substantial market for Insight's specialized services in these areas.

Insight's strategic focus on modernizing data platforms and offering tailored analytics solutions aligns perfectly with the growing reliance on data for decision-making. The global big data and business analytics market, projected to grow significantly, offers a clear opportunity for revenue expansion.

Targeting regions with high digital transformation rates, such as Southeast Asia, where IT spending is expected to rise by 10% in 2024, allows Insight to capitalize on growing demand. Adapting service delivery to specific regional needs, like cloud migration in the EU, can further boost growth.

Continuing strategic acquisitions, like the Infocenter.io deal, enhances Insight's service portfolio and market reach. This approach strengthens capabilities and provides a competitive edge in niche IT segments, driving further expansion.

| Opportunity Area | Market Projection/Data Point | Insight's Relevance |

|---|---|---|

| Cloud Computing | Market to reach $1.3 trillion by 2025 | Leverage expertise in migration, management, and security |

| AI & Generative AI | Global AI spending projected at $200 billion in 2024 | Develop new high-value service offerings based on 'Emerging Visionary' recognition |

| Data Management & Analytics | Market to grow from $374.6 billion (2022) to $654.2 billion (2029) | Modernize data platforms and offer tailored analytics solutions |

| Geographic Expansion | Southeast Asia IT spending growth of 10% in 2024 | Focus on regions with accelerated digital transformation |

Threats

Insight faces a fierce IT solutions and services market, challenged by giants like Dell Technologies and Tech Data, alongside nimble newcomers. This dynamic means staying ahead requires constant adaptation.

The IT sector's rapid shift towards 'as-a-service' models is a key disruptor, altering how clients buy and creating new competitive fronts. For instance, the global IT services market was projected to reach $1.3 trillion in 2024, a significant increase driven by cloud and digital transformation, highlighting the intense battle for market share.

This evolving landscape demands continuous innovation and clear differentiation for Insight to maintain its edge against both legacy competitors and emerging tech firms.

Persistent macroeconomic uncertainty, marked by elevated inflation and interest rates, is likely to foster continued client caution throughout 2025. This cautious spending environment directly impacts IT sector demand, potentially delaying significant technology investments and impacting Insight's product sales.

The ongoing pressure from these headwinds can significantly affect Insight's revenue streams and overall profitability. For instance, if consumer spending on discretionary IT goods declines by 5% in 2025, as some analysts predict, it could translate to a direct hit on Insight's top line.

Unfavorable adjustments to key partner programs, particularly those affecting cloud gross profit margins from major technology vendors, present a substantial threat to Insight. For instance, a hypothetical 2% reduction in cloud gross profit could directly impact their profitability, given the significant reliance on these vendor relationships for their service delivery and product offerings.

These shifts can compress margins and necessitate a rapid adaptation of Insight's business model to mitigate the financial fallout. Successfully navigating these evolving vendor dynamics is therefore crucial for maintaining competitive pricing and profitability in the market.

Rapid Technological Disruption and Obsolescence

The rapid pace of technological advancement poses a significant threat, as IT solutions can quickly become outdated. For instance, the global IT spending was projected to reach $5.1 trillion in 2024, a 6.8% increase from 2023, indicating a dynamic market where staying current is paramount. Insight must proactively invest in research and development to ensure its offerings remain competitive.

New technologies frequently disrupt established business models, creating a constant need for adaptation. Companies that fail to evolve risk losing ground to more agile competitors. For example, the rise of AI-powered analytics tools is reshaping how businesses approach data, necessitating continuous learning and integration of such innovations.

Insight's ability to stay relevant hinges on its commitment to innovation and adaptation. Failure to do so could result in a decline in market share, especially when facing specialized competitors who are quicker to adopt emerging technologies. The market for cloud computing services, expected to grow significantly in 2024-2025, exemplifies this, with new platforms and solutions constantly emerging.

- Technological Obsolescence: IT solutions have a shorter lifecycle due to rapid innovation.

- Market Disruption: New technologies can render existing business models ineffective.

- Competitive Pressure: Agile competitors can capitalize on emerging technologies faster.

- R&D Investment: Continuous investment is crucial to maintain relevance and market position.

Cybersecurity Risks and Data Privacy Concerns

Insight, as an IT solutions provider, faces escalating cybersecurity risks. In 2024, the average cost of a data breach reached an all-time high of $4.73 million globally, a significant increase from previous years. This directly impacts businesses like Insight and their clientele, as a single breach can cripple operations and erode customer confidence.

Furthermore, the evolving landscape of data privacy regulations, such as GDPR and CCPA, presents ongoing challenges. Non-compliance can result in substantial fines; for instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher. For Insight, failing to adequately protect client data or adhere to these regulations poses a severe threat to its reputation and financial stability.

- Cyberattack Costs: Global average cost of a data breach in 2024 was $4.73 million.

- Privacy Fine Potential: GDPR fines can reach 4% of global annual turnover.

- Reputational Damage: Data breaches can severely damage client trust and business continuity.

- Regulatory Compliance: Evolving privacy laws necessitate continuous investment in security measures.

Insight operates in a highly competitive IT market, facing pressure from both large, established players and agile new entrants. The shift towards 'as-a-service' models is a significant disruptor, demanding continuous innovation to maintain market share amidst a projected global IT services market of $1.3 trillion in 2024.

Macroeconomic instability, including inflation and high interest rates, is expected to continue into 2025, leading to cautious client spending and potentially delaying significant technology investments. This environment could directly impact Insight's revenue, with some analysts predicting a 5% decline in discretionary IT goods spending for 2025.

Changes in partner programs, particularly concerning cloud gross profit margins, pose a substantial threat by compressing margins. A hypothetical 2% reduction in cloud gross profit could significantly affect profitability, given the reliance on vendor relationships.

The rapid pace of technological advancement requires constant adaptation, as IT solutions can quickly become obsolete. With global IT spending projected at $5.1 trillion in 2024, staying current through R&D is crucial to compete against specialized firms adopting emerging technologies faster.

Escalating cybersecurity risks represent a major threat, with the average cost of a data breach reaching $4.73 million globally in 2024. Furthermore, evolving data privacy regulations like GDPR, with potential fines up to 4% of global annual turnover, necessitate continuous investment in security and compliance to protect reputation and financial stability.

SWOT Analysis Data Sources

This analysis is built on a robust foundation of data, drawing from comprehensive financial reports, detailed market intelligence, and expert industry forecasts to provide a well-rounded and actionable SWOT assessment.