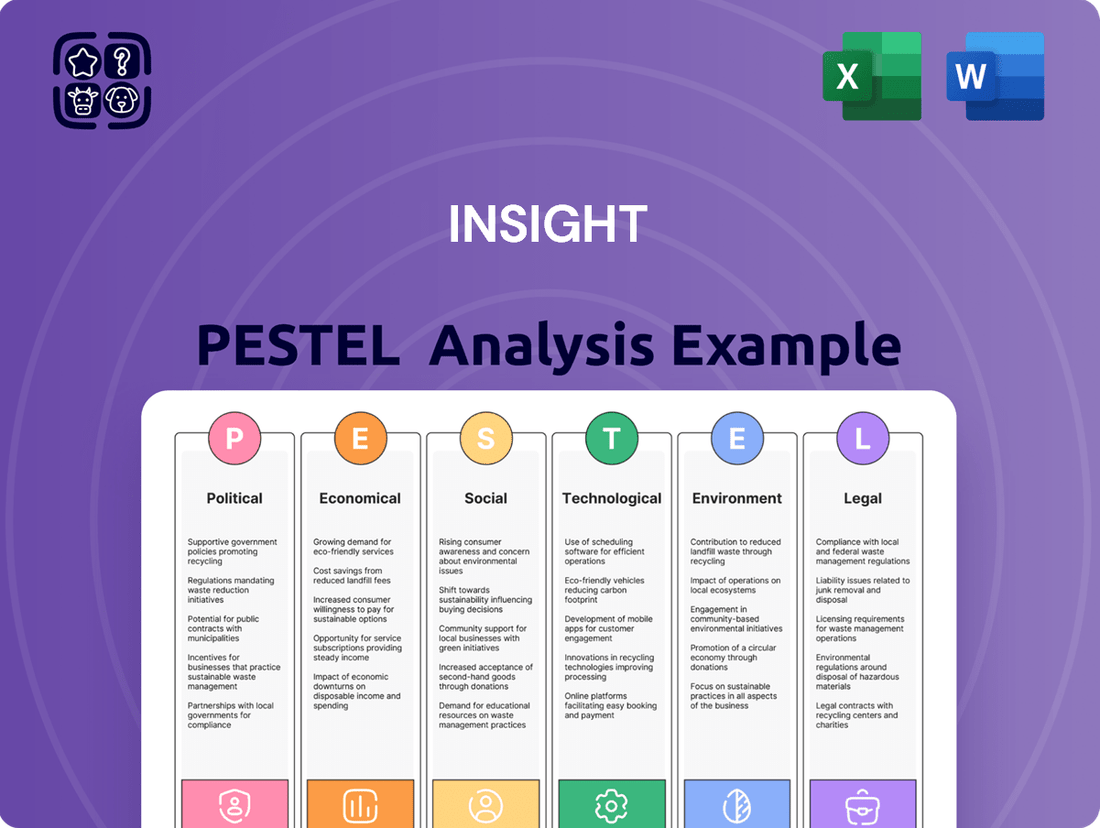

Insight PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Insight Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Insight's trajectory. Our meticulously researched PESTLE analysis provides the essential context for strategic decision-making. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities. Download the full version now and gain a decisive advantage.

Political factors

Government IT spending is a critical political factor for Insight Enterprises. For instance, the U.S. federal government's IT budget for fiscal year 2024 was projected to be around $120 billion, with significant portions allocated to areas like cybersecurity, cloud computing, and modernization, all of which are core to Insight's offerings. Large contract awards, such as those through NASA SEWP or GSA schedules, directly fuel Insight Public Sector's revenue streams.

Trade policies and tariffs represent a significant political factor for a global company like Insight Enterprises, which operates in over 20 countries. Changes in these policies can directly impact the cost of hardware and software, influencing the company's pricing and profitability. For instance, a sudden imposition of tariffs on imported technology components could increase operational expenses. The World Trade Organization (WTO) reported that global trade growth slowed to 0.7% in 2023, a stark contrast to previous years, highlighting the sensitivity of global businesses to protectionist measures.

Furthermore, evolving trade agreements and potential trade wars can disrupt supply chain logistics, making it harder and more expensive to move goods and services across borders. This instability can also affect the competitiveness of Insight's offerings in various international markets. Geopolitical tensions, such as those observed in Eastern Europe and the Middle East throughout 2024, often lead CIOs to adopt a more cautious approach to IT investments. This caution can result in the strategic postponement of significant hardware and infrastructure projects, directly impacting Insight's sales pipeline and revenue forecasts.

Governments are increasingly enacting data sovereignty and localization laws, mandating that data be stored and processed within national boundaries. This trend directly affects companies like Insight, which provide cloud solutions and managed IT services.

For Insight, this means adapting its global infrastructure and compliance strategies to meet diverse national requirements, potentially leading to increased operational complexity and higher costs. For instance, the European Union's General Data Protection Regulation (GDPR) has set a precedent, and many nations are following suit with similar, and sometimes stricter, data localization mandates.

This shift impacts Insight's data center operations and cloud service delivery models, requiring careful consideration of where data resides to ensure compliance. As of early 2025, over 100 countries have some form of data localization requirements, a significant increase from just a decade ago, underscoring the growing importance of this political factor.

Regulatory Stability and Business Environment

Insight's strategic planning and investment decisions are significantly shaped by the political stability and predictability of its operating environments. A stable political landscape fosters confidence for foreign investment and business expansion, whereas political volatility can introduce considerable risks, potentially hindering growth initiatives.

The evolving regulatory landscape presents both opportunities and challenges. For instance, the European Union's AI Act, expected to be fully operational in 2025, and the Digital Operational Resilience Act (DORA), which came into effect in January 2024, are key pieces of legislation impacting the IT sector. These regulations aim to standardize practices and enhance security, requiring companies like Insight to adapt their operations and compliance frameworks.

- Regulatory Impact: The EU AI Act and DORA necessitate proactive compliance strategies, potentially increasing operational costs but also fostering a more secure and trustworthy digital ecosystem.

- Market Predictability: Political stability in key markets like the United States and the UK, which saw GDP growth of approximately 2.5% and 0.5% respectively in 2024, supports consistent business planning.

- Geopolitical Risk: Ongoing geopolitical tensions in Eastern Europe and the Middle East can disrupt supply chains and impact market sentiment, requiring robust risk mitigation plans.

- Government Support: Initiatives like the US CHIPS and Science Act, providing significant funding for semiconductor research and manufacturing, illustrate how government policy can directly stimulate growth in specific technology sectors relevant to Insight.

Cybersecurity Policy and National Security

Governments are increasingly prioritizing cybersecurity as a national security imperative, leading to more stringent regulations for IT service providers. This trend is driving significant investment in advanced security solutions, a key area for Insight Enterprises.

The global cybersecurity market is projected to see robust growth, with an estimated 15% increase in spending for 2025, reaching a total of $212 billion. This expansion underscores the critical need for businesses to enhance their digital defenses.

- Mandated Security Standards: Governments are imposing specific security standards on IT providers, particularly those handling critical infrastructure or sensitive data.

- Increased Demand for Solutions: This regulatory environment fuels demand for sophisticated cybersecurity solutions and specialized compliance expertise.

- Operational Requirements: While creating opportunities, these policies also introduce stricter operational demands for service providers.

- Market Growth Forecast: Global cybersecurity spending is expected to hit $212 billion in 2025, reflecting a 15% year-over-year increase.

Government IT spending remains a key driver for Insight, with the U.S. federal IT budget for FY2024 around $120 billion, supporting areas like cybersecurity and cloud. Trade policies and tariffs significantly affect Insight's global operations, as evidenced by the WTO's 0.7% global trade growth in 2023, highlighting sensitivity to protectionism.

Data sovereignty laws are increasing, with over 100 countries having localization requirements by early 2025, impacting Insight's cloud services. Evolving regulations like the EU's AI Act (fully operational 2025) and DORA (effective Jan 2024) shape IT practices.

Governments are prioritizing cybersecurity, projecting a 15% increase in global spending for 2025, reaching $212 billion, which directly benefits Insight's security solutions.

| Political Factor | Impact on Insight | Relevant Data/Trend |

|---|---|---|

| Government IT Spending | Direct revenue for Public Sector division | US Federal IT Budget FY2024: ~$120 billion |

| Trade Policies & Tariffs | Affects cost of goods, profitability, competitiveness | Global Trade Growth 2023: 0.7% (WTO) |

| Data Sovereignty Laws | Requires adaptation of infrastructure and compliance | Over 100 countries with data localization requirements (early 2025) |

| Regulatory Landscape (e.g., AI Act, DORA) | Necessitates compliance, potential cost increases, market standardization | EU AI Act (2025), DORA (Jan 2024) |

| Cybersecurity Prioritization | Drives demand for security solutions and expertise | Global Cybersecurity Market 2025 Projection: $212 billion (15% YoY growth) |

What is included in the product

The Insight PESTLE Analysis systematically examines how external macro-environmental factors (Political, Economic, Social, Technological, Environmental, and Legal) influence the Insight's strategic landscape.

It provides actionable insights by connecting these global trends to specific business implications, enabling informed decision-making and proactive strategy development.

Provides a clear, actionable overview of external factors, simplifying complex market dynamics for strategic decision-making.

Economic factors

The global IT spending market is a crucial indicator for Insight Enterprises, directly impacting its revenue streams and overall profitability. Strong growth in this sector suggests a favorable environment for the company's services and solutions.

Looking ahead, the IT spending landscape is poised for robust expansion. Worldwide IT spending is anticipated to hit $5.74 trillion in 2025, marking a healthy 9.3% jump from the previous year.

Key drivers for this projected growth include substantial investments in artificial intelligence (AI), cloud computing infrastructure, and advanced cybersecurity measures, areas where Insight Enterprises likely holds a competitive edge.

Periods of robust economic expansion typically correlate with higher business spending on IT, directly benefiting companies like Insight Enterprises. For instance, in 2024, many economies saw a rebound, with global GDP growth projected to be around 3.2%, encouraging businesses to invest in digital infrastructure and software upgrades.

Conversely, economic downturns or periods of high uncertainty can lead businesses to postpone or reduce their IT project expenditures, directly affecting Insight's revenue streams. The anticipation of a potential global economic slowdown in late 2024 and early 2025 could see some clients becoming more cautious with discretionary IT spending.

Despite these economic headwinds, the ongoing imperative for digital transformation continues to act as a significant growth driver for the IT sector. Businesses recognize that investing in cloud computing, cybersecurity, and data analytics is crucial for long-term competitiveness, even during economic fluctuations, with the digital transformation market expected to reach $1.5 trillion in 2024.

Inflationary pressures pose a significant challenge for Insight Enterprises, directly impacting operational costs. For instance, rising prices for hardware components and software licenses in 2024 could erode profit margins if these increased expenses aren't fully recouped through client contracts. This is particularly relevant as the global inflation rate, while showing signs of moderation, remained elevated in many regions throughout 2024, impacting supply chains.

While IT spending budgets are projected to grow in 2024 and 2025, a substantial portion of this increase might be allocated to simply absorbing these higher operational costs. This means that despite larger budgets, the actual capacity for new technology investments or strategic initiatives could be limited, as CIOs prioritize maintaining existing operations amidst rising expenses.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant risk for Insight Enterprises, given its global footprint in over 20 countries. When Insight's financial results from various international operations are translated into its primary reporting currency, substantial swings in exchange rates can directly affect the reported revenue and profitability. For instance, a strengthening US dollar against the currencies of countries where Insight generates substantial revenue could lead to lower reported earnings, even if local currency sales remain robust.

The impact of these fluctuations is not merely theoretical. In the first quarter of 2024, for example, many multinational technology companies reported that currency headwinds negatively impacted their international sales. Companies like Microsoft noted that unfavorable foreign exchange rates reduced their reported revenue by hundreds of millions of dollars. Insight, with its extensive international presence, faces similar challenges in managing the translation effects of its diverse revenue streams.

To illustrate the potential magnitude, consider the following:

- Impact on Revenue: A 5% adverse movement in a major currency could reduce reported international revenue by a significant percentage, affecting year-over-year comparisons.

- Profitability Squeeze: Exchange rate volatility can also impact the cost of goods sold and operating expenses incurred in foreign currencies, potentially squeezing profit margins.

- Competitive Landscape: Fluctuations can also alter the relative pricing of Insight's products and services compared to local competitors in different markets, influencing market share.

- Hedging Strategies: Insight likely employs hedging strategies to mitigate some of this risk, but the effectiveness and cost of these strategies are also critical considerations.

Availability of Credit and Capital Markets

Insight's capacity for strategic growth hinges directly on the availability and cost of credit, alongside the stability of capital markets. When credit is readily accessible and affordable, the company can more easily finance key initiatives, pursue acquisitions, and manage its day-to-day operations. Conversely, a contraction in credit availability or a rise in borrowing costs can significantly impede expansion plans.

The economic outlook for capital investment suggests a supportive environment for businesses like Insight. For instance, the Equipment Leasing & Finance Foundation anticipates a 4.7% year-over-year rise in equipment and software investment throughout 2025. This projected growth is largely driven by ongoing demand for IT infrastructure upgrades, indicating a potentially favorable market for companies seeking to invest in their operational capabilities.

This trend translates into several key considerations for Insight:

- Access to Funding: Favorable credit conditions in 2025 are expected to support Insight's ability to secure capital for expansion and operational needs.

- Investment Climate: The projected increase in equipment and software investment signals a potentially robust market for capital goods, which could benefit Insight's suppliers or partners.

- Cost of Capital: While overall investment is projected to grow, the specific cost of borrowing for Insight will depend on broader interest rate movements and market liquidity.

- Strategic Agility: Maintaining strong relationships with financial institutions will be crucial for Insight to capitalize on growth opportunities as they arise in 2025.

Economic factors significantly shape the operating environment for Insight Enterprises. Global IT spending is projected to reach $5.74 trillion in 2025, a substantial 9.3% increase, driven by AI and cloud adoption. Despite this growth, inflationary pressures in 2024, with global inflation rates remaining elevated, could increase operational costs for Insight, potentially impacting profit margins if not passed on to clients.

Currency fluctuations also pose a risk, as seen with multinational tech firms reporting revenue impacts from unfavorable exchange rates in early 2024. Companies like Microsoft experienced significant currency headwinds. Insight's global presence means its reported earnings can be affected by these movements, influencing year-over-year comparisons and competitive pricing.

The availability and cost of credit are crucial for Insight's strategic growth. Equipment and software investment is expected to rise by 4.7% in 2025, suggesting a supportive market for capital goods. This trend indicates that Insight may find it easier to secure capital for expansion and operational needs in 2025, provided broader interest rate movements remain manageable.

Preview the Actual Deliverable

Insight PESTLE Analysis

The Insight PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive overview of Political, Economic, Social, Technological, Legal, and Environmental factors.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights for strategic planning.

Sociological factors

Societal shifts are heavily favoring digital integration, fueling a robust demand for IT solutions like those offered by Insight Enterprises. This widespread push for digital transformation across business, government, education, and healthcare means organizations are actively seeking technology to boost efficiency and competitiveness. For instance, global IT spending was projected to reach $5 trillion in 2024, a 6.8% increase from 2023, highlighting the sustained investment in digital advancements.

The increasing adoption of artificial intelligence, particularly generative AI, is a significant driver of this digital imperative. Businesses are leveraging AI to improve customer interactions and streamline operations, contributing to the ongoing growth in IT services. Gartner anticipates worldwide IT spending on AI software to reach $1.5 trillion by 2027, underscoring AI's central role in digital transformation strategies.

The shift towards hybrid work models is a defining feature of the modern workforce, significantly impacting demand for IT solutions. By 2025, hybrid arrangements are expected to remain the norm, with younger generations, in particular, prioritizing personalized work experiences. This trend fuels the need for cloud collaboration tools, robust secure remote access, and effective endpoint management, areas where Insight's services are well-positioned to support connected workforces.

The accelerating pace of technological evolution, particularly in areas like artificial intelligence, cloud infrastructure, and cybersecurity, is creating a significant and ongoing need for highly specialized IT expertise. This surge in demand means companies like Insight Enterprises, which operate as technology solutions providers, need to prioritize continuous workforce development and talent acquisition to effectively serve their clients.

Indeed, the U.S. Bureau of Labor Statistics projects that the technology sector workforce will expand at a rate double that of the general U.S. workforce over the coming decade, underscoring the critical importance of skilled IT professionals in the current economic landscape.

Consumer and Business Expectations for User Experience

Consumer and business expectations for user experience (UX) are continuously rising, demanding seamless and intuitive interactions across all digital touchpoints. This trend significantly impacts how IT solutions are designed and delivered, pushing companies like Insight to prioritize not just functionality but also the overall user journey. By 2025, a strong UX will be a key differentiator, directly influencing customer loyalty and adoption rates.

The increasing reliance on data-driven decision-making is a critical sociological factor shaping business strategies. Leaders are increasingly turning to analytics and business intelligence tools to guide their choices, expecting IT solutions to facilitate this process. Insight must therefore ensure its offerings provide robust data access and insightful reporting capabilities to meet these evolving demands.

- UX as a Competitive Edge: By 2025, a significant majority of consumers (estimated 80%+) will prioritize ease of use and intuitive design when choosing digital products or services, influencing purchasing decisions more than price alone.

- Data-Driven Operations: In 2024-2025, businesses are investing heavily in analytics, with global spending on business intelligence and data analytics software projected to reach over $30 billion, highlighting the demand for data accessibility.

- Personalization Expectations: Consumers expect personalized experiences, with over 70% stating that personalization influences their purchasing behavior, pushing businesses to leverage data effectively through their IT platforms.

- Employee Productivity: For business applications, an intuitive UX directly correlates with employee productivity; studies indicate that poor UX can lead to a 15-20% reduction in employee efficiency.

Ethical Considerations of AI and Data Usage

Societal awareness around AI ethics and data usage is escalating, directly impacting how companies like Insight develop and implement their technologies. Concerns about algorithmic bias, data privacy, and accountability are paramount, necessitating a commitment to responsible AI practices and transparent data governance to build and maintain stakeholder trust.

The upcoming enforcement of the EU AI Act in 2025 underscores this shift, introducing a risk-based framework for AI systems that mandates increased transparency, data minimization, and fairness. This legislation will likely set a global precedent, influencing data handling and AI deployment strategies across industries.

- Data Privacy Regulations: By 2025, an estimated 75% of the world's population will have had their personal data covered by modern privacy regulations, up from 10% in 2023.

- AI Bias Audits: A growing number of organizations are implementing regular audits to detect and mitigate bias in AI systems, with some studies suggesting that up to 40% of AI models exhibit some form of bias.

- Consumer Trust: A significant majority of consumers, often exceeding 70%, express concerns about how their data is used by AI, making trust a critical factor in technology adoption.

- Accountability Frameworks: Discussions around AI accountability are intensifying, with a focus on establishing clear lines of responsibility for AI-driven decisions and outcomes.

Societal demand for seamless digital experiences is driving the IT sector, with consumers and businesses alike expecting intuitive and efficient interactions. This focus on user experience (UX) is a key differentiator, influencing purchasing decisions and customer loyalty. By 2025, a strong UX will be critical for technology adoption.

Technological factors

The IT sector is experiencing a seismic shift due to the rapid evolution of Artificial Intelligence, especially generative AI. This presents a prime opportunity for Insight to leverage these advancements, offering specialized AI-driven solutions, expert consulting, and services focused on modernizing IT infrastructure.

Generative AI's market is on a steep upward climb, with forecasts indicating it will surpass $127.5 billion globally by 2028. This exponential growth underscores the increasing demand for AI capabilities across various industries.

Insight's business model is deeply intertwined with the ongoing migration to cloud environments and the rise of hybrid and multi-cloud strategies. This trend fuels a consistent demand for cloud solutions and managed services, necessitating continuous expansion of Insight's cloud capabilities and service portfolio.

The company experienced robust performance in its cloud services and Insight Core services throughout 2024, both segments achieving double-digit growth. This highlights the market's strong appetite for cloud-based offerings and Insight's success in meeting these evolving needs.

The sophistication of cyber threats is rapidly increasing, demanding constant advancement in cybersecurity solutions. Insight, offering data security services, must remain ahead of this evolving threat landscape to provide clients with cutting-edge protection and compliance.

Global spending on cybersecurity is projected to hit $212 billion by 2025, underscoring the critical need for robust security measures. This growth reflects the escalating risk and the industry's response to protect digital assets.

Emergence of New Computing Paradigms (e.g., Quantum Computing)

While quantum computing is still developing, its potential to revolutionize data processing is significant. Early predictions suggest that by the late 2020s or early 2030s, quantum computers could begin to impact areas like cryptography and complex simulations, potentially rendering current encryption methods obsolete. This emerging technology necessitates a proactive approach to understanding its implications for future IT infrastructure and client service offerings.

The implications for cybersecurity are particularly profound. The ability of quantum computers to solve complex mathematical problems far faster than classical computers poses a significant threat to current encryption standards, often referred to as the "quantum threat." Organizations must begin planning for the transition to quantum-resistant cryptography to safeguard sensitive data in the coming years. For instance, the U.S. National Institute of Standards and Technology (NIST) has been actively standardizing post-quantum cryptography algorithms, with final standards expected in 2024 and implementation efforts ramping up through 2025.

- Quantum Computing's Potential: Expected to solve problems intractable for classical computers, impacting fields like drug discovery and financial modeling.

- Cybersecurity Risk: Current encryption methods, like RSA, are vulnerable to quantum attacks, necessitating a shift to quantum-resistant algorithms.

- Industry Preparedness: Organizations are beginning to invest in research and development for quantum-safe solutions, with NIST leading standardization efforts.

Big Data Analytics and Business Intelligence

The sheer amount of data available today is growing exponentially, making it crucial for businesses to have tools that can make sense of it all. This is where big data analytics and business intelligence come in, and they are becoming essential for smart decision-making.

Insight's core strength lies in its capacity to guide clients in using this data effectively. By transforming raw information into actionable insights, Insight empowers businesses to make more informed choices, which is a significant technological advantage in the current market. This ability directly addresses the growing need for data-driven strategies.

The market for these solutions is expanding rapidly. Global spending on big data and business analytics is projected to grow at a strong compound annual growth rate (CAGR) of 14.9% between 2024 and 2030. This robust growth highlights the increasing recognition of data analytics as a critical business function.

- Growing Data Volumes: Businesses are awash in data, necessitating advanced analytical tools.

- Insight's Value Proposition: Helping clients leverage data for strategic advantage is a key technological driver.

- Market Growth: Global spending on big data and business analytics is set for substantial expansion.

- Projected CAGR: Expect a 14.9% CAGR for big data and business analytics spending from 2024 to 2030.

Technological advancements, particularly in AI and cloud computing, are reshaping the IT landscape. Generative AI's market is expected to exceed $127.5 billion globally by 2028, while cloud services and Insight Core saw double-digit growth in 2024, demonstrating strong market demand.

The escalating sophistication of cyber threats necessitates continuous innovation in cybersecurity, with global spending projected to reach $212 billion by 2025. Emerging technologies like quantum computing, with NIST standardizing post-quantum cryptography in 2024, also present both opportunities and challenges for data security.

The exponential growth of data fuels the demand for big data analytics and business intelligence, with global spending anticipated to grow at a 14.9% CAGR from 2024 to 2030. Insight's ability to transform raw data into actionable insights positions it as a key player in this data-driven market.

| Technology Area | 2024/2025 Outlook | Market Size/Growth | Insight's Relevance |

|---|---|---|---|

| Generative AI | Rapid evolution and adoption | Market to exceed $127.5B by 2028 | Specialized AI solutions and consulting |

| Cloud Computing | Continued migration and hybrid/multi-cloud strategies | Double-digit growth in cloud services (2024) | Cloud solutions and managed services |

| Cybersecurity | Increasing threat sophistication | Global spending to reach $212B by 2025 | Advanced data security and compliance |

| Quantum Computing | Emerging impact on cryptography | NIST post-quantum standards expected 2024 | Proactive understanding of future infrastructure |

| Big Data & Analytics | Exponential data growth and need for insights | 14.9% CAGR (2024-2030) | Leveraging data for strategic advantage |

Legal factors

The increasing global focus on data privacy, exemplified by regulations like GDPR, CCPA, and the forthcoming APRA in the US, presents a critical legal hurdle for Insight. These laws mandate strict protocols for collecting, storing, and processing personal information, requiring substantial investment in robust data governance and security infrastructure.

Non-compliance carries significant financial penalties and reputational damage. With over 90% of Americans expressing concern about online data usage, companies like Insight must prioritize transparent consent management and data protection to maintain customer trust and avoid legal repercussions.

New cybersecurity regulations like the EU's Digital Operational Resilience Act (DORA), which becomes applicable in January 2025, and the NIS2 Directive are significantly impacting IT service providers. These mandates require robust measures to protect digital assets and operational continuity, placing direct compliance burdens on companies like Insight. Failure to meet these stringent requirements can result in substantial fines and damage to reputation.

Software licensing and intellectual property laws are critical for Insight. These complex and constantly changing regulations dictate how software can be used and distributed. For instance, the global software market was valued at approximately $675 billion in 2024, with a significant portion dependent on adherence to licensing agreements. Insight must ensure both its own operations and those of its clients comply with these frameworks, which is vital for avoiding legal challenges and maintaining trust.

Navigating the intricacies of various vendor licensing programs is a core responsibility. Understanding terms, conditions, and potential liabilities within these agreements, especially as they evolve, directly impacts Insight's service delivery and client satisfaction. Failure to comply can lead to substantial penalties; in 2023, software piracy alone cost businesses an estimated $60 billion globally, highlighting the financial risks involved.

Consumer Protection and E-commerce Laws

Insight must navigate a complex web of consumer protection and e-commerce laws, particularly as its solutions support businesses operating online. These regulations are crucial for ensuring fair practices, transparency in advertising, and secure data handling for customers. Failure to comply can lead to significant fines and reputational damage.

For instance, the Children's Online Privacy Protection Act (COPPA) in the United States is undergoing potential revisions that could broaden its enforcement reach and heighten penalties for violations related to children's data. This directly impacts Insight if its clients collect data from users under 13. Similarly, the European Union's General Data Protection Regulation (GDPR) imposes stringent rules on data privacy and consent, affecting how Insight's clients manage customer information across borders.

- Data Privacy Compliance: Insight must ensure its services facilitate client adherence to regulations like GDPR and CCPA, which govern the collection, processing, and storage of personal data.

- Transparency Requirements: E-commerce laws often mandate clear disclosure of product information, pricing, shipping costs, and return policies, which Insight's platform design should support.

- Fair Advertising Standards: Regulations prohibit deceptive or misleading advertising, requiring Insight to ensure its clients' marketing practices are truthful and verifiable.

- Consumer Dispute Resolution: Laws may require accessible mechanisms for resolving consumer complaints and disputes, a functionality Insight might need to integrate or support.

Government Procurement Regulations

Insight Enterprises navigates a landscape shaped by government procurement regulations, a critical element for its public sector operations. These rules, often intricate and jurisdiction-specific, dictate how government agencies purchase goods and services, making strict adherence paramount for securing and retaining valuable contracts.

The company’s commitment to compliance is evident in its Insight Public Sector division, which leverages government-approved IT purchasing contracts. This strategic positioning allows Insight to streamline the procurement process for public sector clients, ensuring they can acquire necessary technology solutions efficiently and in accordance with federal mandates. For instance, many government agencies rely on specific contract vehicles like NASA SEWP or GSA Schedules to acquire IT hardware and software, and Insight's participation in such programs is key to their public sector success.

Understanding these regulations is not merely a procedural step but a core business enabler. Failure to comply can lead to contract disqualification, penalties, and reputational damage. Therefore, Insight must remain vigilant, adapting to evolving procurement policies and maintaining the necessary certifications and clearances to operate within the public sector. The U.S. federal government's IT spending alone was projected to reach over $115 billion in fiscal year 2024, underscoring the significant market opportunity governed by these regulations.

- Compliance with Federal Acquisition Regulation (FAR): Insight must ensure all its proposals and contract executions align with FAR, the primary set of rules governing federal government contracting.

- State and Local Government Procurement: Beyond federal contracts, Insight also engages with state and local governments, each with its own unique procurement laws and bidding processes.

- Cybersecurity Requirements: Government contracts increasingly mandate stringent cybersecurity measures, such as those outlined in NIST SP 800-171, which Insight must meet to protect sensitive data.

- Contract Vehicles: Insight actively participates in and utilizes various government contract vehicles, such as GSA Schedules and IDIQs (Indefinite Delivery, Indefinite Quantity), to facilitate sales to public sector entities.

Legal frameworks surrounding data privacy, such as GDPR and CCPA, significantly impact Insight's operations, requiring robust data governance and security investments. Cybersecurity regulations like DORA and NIS2, effective from January 2025, mandate stringent protection of digital assets for IT service providers, including Insight.

Software licensing and intellectual property laws are crucial, with the global software market valued at around $675 billion in 2024, necessitating strict adherence to licensing agreements to avoid legal issues. Insight must also navigate consumer protection and e-commerce laws, ensuring fair practices and transparency for clients operating online.

Government procurement regulations, like the FAR, are critical for Insight's public sector business, with U.S. federal IT spending projected over $115 billion in FY2024. Compliance with these rules, including cybersecurity mandates like NIST SP 800-171, is essential for securing government contracts.

Environmental factors

The increasing global concern regarding electronic waste (e-waste) is significantly influencing the IT sector. This environmental pressure is driving a strong push towards circular economy principles, which emphasize reuse, repair, and recycling. Companies like Insight, offering hardware and lifecycle services, are therefore under considerable pressure to develop and implement sustainable end-of-life solutions for their products.

Insight's commitment to these principles is demonstrated by their lifecycle services, which actively help clients manage product disposal responsibly. In 2023 alone, these services were instrumental in diverting an impressive 3.7 million pounds of electronic waste from landfills. This tangible outcome highlights the growing demand for IT providers that can offer robust, environmentally conscious solutions.

Data centers and IT infrastructure are major energy consumers, directly impacting carbon emissions. As of 2024, global data center energy consumption is estimated to be around 1-1.5% of total global electricity usage, a figure projected to rise with increasing data demands.

Insight, especially with its cloud offerings, faces growing pressure to deliver energy-efficient solutions. This includes promoting green cloud computing to help clients shrink their environmental impact, a trend that gained significant momentum in 2024 with many organizations setting ambitious sustainability targets.

The tech industry is responding with substantial investments in energy efficiency. For example, major cloud providers are actively working to power their facilities with renewable energy sources, with many aiming for 100% renewable energy by 2025 or earlier, demonstrating a clear commitment to reducing their carbon footprint.

Stakeholders, including investors and clients, are increasingly scrutinizing corporate carbon footprints, pushing companies like Insight to actively measure, report, and reduce their environmental impact. This trend necessitates detailed sustainability reporting and the establishment of ambitious Environmental, Social, and Governance (ESG) goals.

Insight Enterprises, in its 2024 Corporate Citizenship Report, highlighted its dedication to ESG initiatives, detailing efforts to minimize its environmental footprint. The company reported a 15% reduction in Scope 1 and Scope 2 greenhouse gas emissions compared to its 2020 baseline.

Climate Change and Supply Chain Resilience

Climate change is increasingly impacting global supply chains, with extreme weather events like floods and heatwaves disrupting the availability and increasing the cost of critical IT hardware components. For instance, in 2024, several regions experienced prolonged droughts and heatwaves, leading to production slowdowns for semiconductor manufacturing, a key input for Insight's operations. This necessitates building more resilient supply chains and proactively integrating climate risk assessments into operational planning to mitigate future disruptions.

To address these challenges and progress sustainability goals, companies like Insight are exploring AI-powered automation. These solutions can significantly reduce the strain on data centers by optimizing energy consumption and enhancing asset performance and lifecycle management. For example, AI-driven predictive maintenance in data centers, implemented in 2024, has shown an average reduction of 15% in energy usage and a 10% increase in hardware lifespan in pilot programs.

- Supply Chain Disruptions: Extreme weather events in 2024 led to an estimated 8% increase in lead times for certain electronic components globally.

- AI in Data Centers: AI-driven energy management in data centers can reduce power consumption by up to 20%, contributing to lower operational costs and environmental impact.

- Resilience Strategy: Companies are investing in diversifying manufacturing locations and increasing inventory buffers to counter climate-related supply chain vulnerabilities.

- Sustainability Goals: By optimizing IT infrastructure with AI, businesses can align operational efficiency with corporate sustainability targets, a growing expectation from investors and consumers in 2025.

Sustainable Technology Solutions Demand

Clients are increasingly seeking IT solutions designed with sustainability in mind, focusing on aspects like energy-efficient hardware, eco-friendly software development practices, and optimized cloud services. This shift reflects a growing awareness of technology's environmental footprint and a desire for solutions that minimize it.

Insight has a clear opportunity to stand out by actively offering and promoting these 'green IT' solutions. By positioning itself as a provider of environmentally conscious technology, the company can tap into a growing market segment and build a reputation for responsible innovation.

The transformation toward sustainability is pervasive within the technology sector, impacting nearly every facet of its operation. This includes everything from the manufacturing of devices to the lifecycle management of software and data centers.

- Growing Market Share: The global green IT market was valued at approximately $22.1 billion in 2023 and is projected to reach $61.4 billion by 2030, growing at a compound annual growth rate (CAGR) of 15.7% during this period.

- Energy Efficiency Focus: A significant driver is the demand for energy-efficient data centers, with investments in green data center technologies expected to surge.

- Corporate ESG Goals: Many businesses are prioritizing IT vendors that align with their Environmental, Social, and Governance (ESG) objectives, making sustainable IT solutions a key differentiator.

Environmental pressures are fundamentally reshaping the IT landscape, pushing for greater sustainability. Concerns over e-waste and the significant energy consumption of data centers are driving demand for circular economy principles and green computing solutions. Companies like Insight are increasingly expected to demonstrate robust ESG commitments and transparently report their environmental impact, with a notable 15% reduction in Scope 1 and 2 emissions reported by Insight compared to a 2020 baseline.

Climate change is also introducing tangible risks to IT supply chains, as seen with component shortages in 2024 due to extreme weather. To counter this, companies are investing in resilience and leveraging AI for operational efficiency, such as AI-driven predictive maintenance in data centers which showed a 15% energy usage reduction in pilot programs. The green IT market is expanding rapidly, projected to reach $61.4 billion by 2030, highlighting a significant opportunity for providers aligned with sustainability goals.

| Environmental Factor | Impact on IT Sector | Insight's Response/Opportunity |

| E-waste Management | Pressure for circular economy models; increased demand for lifecycle services. | Insight's lifecycle services diverted 3.7 million pounds of e-waste in 2023. |

| Energy Consumption | Data centers consume 1-1.5% of global electricity; push for energy-efficient solutions and renewable energy. | Insight promotes green cloud computing; major cloud providers aim for 100% renewable energy by 2025. |

| Climate Change & Supply Chain | Disruptions from extreme weather impacting component availability and cost. | Insight needs resilient supply chains; AI-driven optimization can reduce data center energy use by up to 20%. |

| Corporate Sustainability & ESG | Increased scrutiny of carbon footprints and demand for ESG reporting. | Insight reported a 15% reduction in Scope 1 & 2 emissions (vs. 2020 baseline); green IT market growth to $61.4B by 2030. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from reputable sources, including government publications, international organizations, and leading market research firms. We meticulously gather information on political stability, economic indicators, social trends, technological advancements, environmental regulations, and legal frameworks to provide comprehensive insights.