Insight Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Insight Bundle

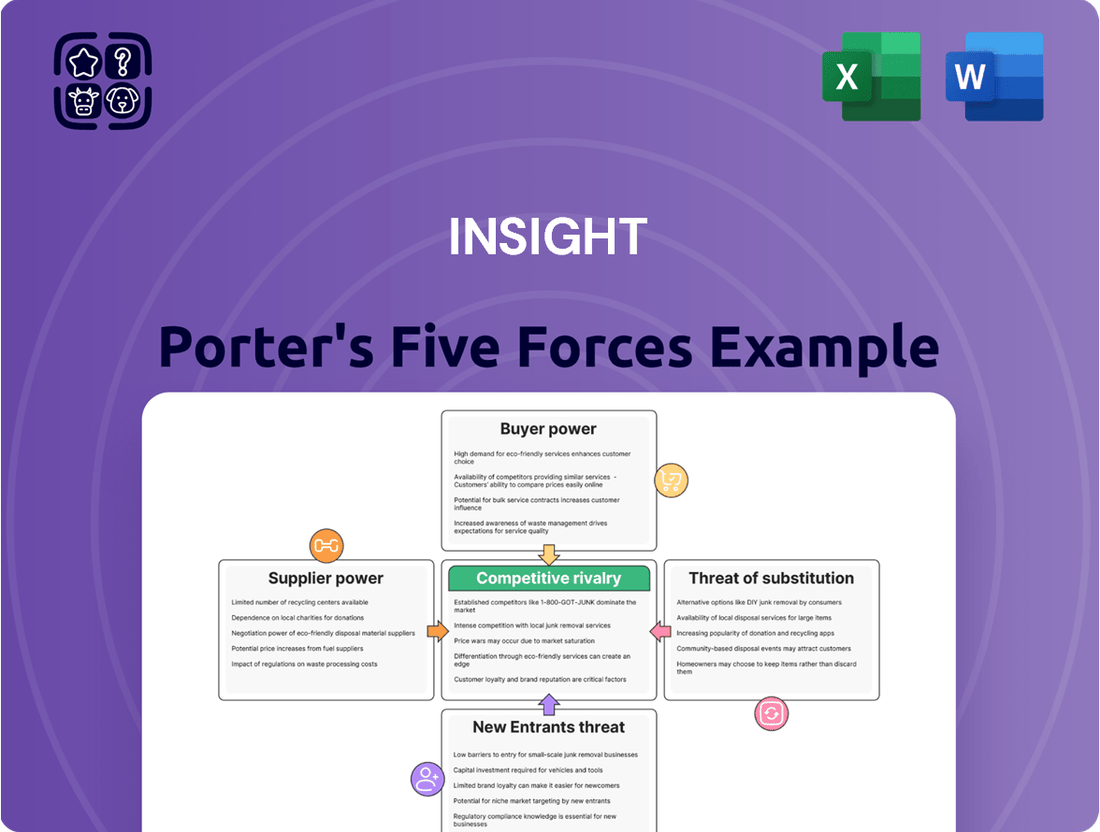

Understanding the competitive landscape is crucial for any business, and Porter's Five Forces analysis provides a powerful framework to dissect it. This method reveals the underlying forces that shape profitability and strategy within an industry, offering a clear view of market dynamics.

The complete Porter's Five Forces Analysis for Insight delves into the intricate interplay of buyer power, supplier power, the threat of new entrants, the threat of substitutes, and the intensity of rivalry. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration is a key factor influencing bargaining power. In the IT solutions and services sector, a few major players dominate the landscape for essential hardware, software, and cloud infrastructure. Companies like Microsoft, Amazon Web Services (AWS), and Google Cloud hold significant sway.

This concentration means that integrators, such as Insight Enterprises, often have limited alternatives when sourcing critical technologies or accessing leading cloud platforms. For instance, in 2023, AWS, Azure, and Google Cloud collectively held over 65% of the global cloud infrastructure market share, underscoring their substantial leverage over businesses relying on these services.

For Insight Enterprises, the bargaining power of suppliers is significantly influenced by switching costs. High costs associated with migrating between major technology platforms or software vendors, such as retraining personnel, reconfiguring existing solutions, and the potential for service interruptions, can make it difficult for Insight to change suppliers. This reliance on specific vendor ecosystems effectively enhances the suppliers' leverage.

Suppliers whose products are highly specialized or represent cutting-edge advancements, like novel semiconductor designs or proprietary software algorithms, command significant bargaining power. For instance, a supplier of advanced quantum computing components could hold substantial sway over any company seeking to integrate such technology. This uniqueness limits alternatives for the buyer, directly impacting their ability to innovate and compete.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into a buyer's industry can significantly shift bargaining power. For instance, large cloud providers like Amazon Web Services (AWS) and Microsoft Azure, while primarily infrastructure providers, possess the capability to expand their professional services divisions. This expansion could see them directly competing with IT solutions integrators, thereby increasing their leverage over these integrators.

This potential for forward integration by major cloud vendors is a notable consideration. By offering their own implementation and management services, they could capture a larger portion of the value chain. For example, in 2024, the global cloud computing market was valued at over $600 billion, indicating the immense scale and resources these providers command, making such an expansion a tangible threat.

- Cloud Provider Service Expansion: Major cloud players like AWS and Azure could bolster their professional services to directly challenge IT solutions integrators.

- Increased Supplier Leverage: This forward integration would grant suppliers greater control and influence over their customer base.

- Market Dynamics: The substantial growth of the cloud market, exceeding $600 billion in 2024, provides ample incentive and resources for such strategic moves by leading providers.

Importance of Insight to Suppliers

Insight Enterprises, a major global solutions integrator, acts as a crucial gateway to market for numerous technology suppliers. Its extensive customer network and influence in driving the adoption of new technologies can significantly shift the balance of power, making Insight a valuable ally for these suppliers. This intermediary role often mitigates the suppliers' inherent bargaining power by providing them with a broader and more accessible customer base.

For example, in 2023, Insight Enterprises reported net sales of $10.1 billion, underscoring its substantial market reach. This scale allows Insight to negotiate favorable terms with suppliers, as demonstrated by its ability to secure competitive pricing and preferred access to new product launches. Suppliers recognize that partnering with Insight provides them with a more efficient and impactful route to market than direct sales efforts alone.

- Insight's Market Reach: With over $10 billion in annual sales, Insight offers suppliers a significant channel to a vast customer base.

- Technology Adoption Driver: Insight's expertise in integrating and promoting new technologies helps suppliers gain traction and market share.

- Negotiating Leverage: The sheer volume of business Insight conducts provides it with considerable leverage when negotiating with suppliers, potentially reducing supplier pricing power.

- Strategic Partnership Value: Suppliers view Insight not just as a reseller, but as a strategic partner essential for scaling their business and reaching enterprise-level clients.

The bargaining power of suppliers is a critical element in understanding the competitive landscape for companies like Insight Enterprises. When suppliers have significant leverage, they can command higher prices, dictate terms, and potentially limit the availability of key products or services, impacting a buyer's profitability and operational flexibility.

Key factors determining supplier power include concentration, switching costs, the uniqueness of their offerings, and the threat of forward integration. For Insight, navigating these dynamics is essential for maintaining its competitive edge and ensuring favorable terms with its technology partners.

In 2024, the IT solutions market continued to see consolidation among major hardware and software vendors, reinforcing their supplier power. For instance, the continued dominance of a few key cloud providers, like Microsoft Azure and Amazon Web Services, highlights the concentrated nature of critical infrastructure supply.

Switching costs remain a significant barrier for many businesses looking to change technology ecosystems. The effort and expense involved in migrating data, retraining staff, and reconfiguring systems can lock buyers into existing supplier relationships, thereby increasing supplier leverage.

| Supplier Power Factor | Impact on Insight Enterprises | Example/Data (2023-2024) |

|---|---|---|

| Supplier Concentration | Limited alternatives for critical components and services | AWS, Azure, Google Cloud held >65% of cloud market share in 2023 |

| Switching Costs | High costs to migrate between vendor platforms | Complex migration processes increase reliance on existing vendors |

| Product Uniqueness | Proprietary or cutting-edge technologies command premium | Specialized hardware or advanced software algorithms |

| Threat of Forward Integration | Suppliers may enter buyer's industry | Cloud providers expanding professional services capabilities |

What is included in the product

Unpacks the competitive landscape by examining buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry, offering strategic insights for Insight.

Identify and mitigate competitive threats with a comprehensive understanding of industry power dynamics.

Customers Bargaining Power

Customer concentration and size are key factors in understanding bargaining power. For a company like Insight, serving diverse sectors such as business, government, education, and healthcare, the sheer volume of business from large enterprise or government clients can be significant. Even if no single client represents a majority of revenue, these major players can wield considerable influence.

These large clients often have the leverage to negotiate for customized solutions or more favorable pricing due to the substantial revenue they generate. For instance, a major government contract could represent a substantial portion of a company's annual revenue, giving that government entity considerable sway in contract negotiations. This is a common dynamic in the technology and services sectors where large, long-term contracts are prevalent.

Customers possess significant leverage due to the wide array of IT solutions and services available. They can easily turn to other large IT integrators, niche consulting firms, or even opt for building their own internal IT departments.

The ability for customers to switch providers, particularly for standard IT services, directly amplifies their bargaining power. For instance, in 2024, the IT services market saw continued growth in specialized cloud migration and cybersecurity solutions, offering customers more targeted and potentially cost-effective alternatives to broad-spectrum integrators.

In the competitive IT services landscape, customers often exhibit significant price sensitivity, especially when it comes to acquiring standard hardware and software. This means that the cost of these components can heavily influence purchasing decisions, pushing companies to seek out the most economical options available.

Economic uncertainties, like those experienced in 2024 with persistent inflation and concerns about global growth, tend to amplify this customer price sensitivity. During such periods, clients become even more diligent in scrutinizing their IT expenditures, actively searching for more cost-effective solutions and potentially delaying non-essential upgrades.

For instance, a 2024 report indicated that over 60% of businesses surveyed were prioritizing cost reduction in their IT budgets, with a significant portion actively renegotiating contracts with existing vendors or exploring alternative, lower-cost providers for commodity IT services.

Customer Information and Transparency

Customers in the IT sector benefit significantly from increased information availability, allowing them to readily compare prices, service features, and competitor strengths. This market transparency directly translates into greater customer leverage.

The widespread accessibility of data, coupled with the prevalence of competitive bidding, means customers are better equipped to negotiate favorable terms. For instance, in 2024, studies indicated that over 70% of IT procurement decisions involved multi-vendor comparisons, highlighting the power of informed choice.

- Informed Decision-Making: Customers can easily research product specifications, pricing, and reviews, reducing information asymmetry.

- Price Sensitivity: Greater transparency makes customers more sensitive to price differences, pushing vendors to offer competitive rates.

- Vendor Comparison: The ease of comparing offerings across multiple IT service providers empowers customers to select the best value.

- Negotiating Power: Armed with market intelligence, customers can effectively challenge pricing and service level agreements.

Switching Costs for Customers

While customers often have numerous IT service provider options, the actual act of switching can be surprisingly costly and complex. For instance, migrating large datasets, reconfiguring integrated systems, and retraining staff can represent substantial financial and time investments. This complexity effectively raises the switching costs for customers, particularly in established, deeply integrated relationships.

These elevated switching costs directly impact customer bargaining power. Companies deeply embedded with a particular IT service provider may find it prohibitive to switch even if better pricing is available elsewhere. For example, a business relying on a provider's proprietary software or specialized managed services faces significant hurdles in finding and integrating a new solution.

- High Data Migration Costs: Businesses can spend millions on data migration projects; for example, a large enterprise might face costs upwards of $1 million to $5 million to migrate complex data structures.

- Integration Complexity: Switching IT service providers for integrated solutions can require extensive system re-engineering, potentially costing hundreds of thousands of dollars.

- Operational Disruption: Downtime during a transition can lead to lost revenue; a single hour of downtime for a large e-commerce platform could result in millions in lost sales.

- Learning Curve and Training: New systems require staff training, which can add significant operational costs and temporary productivity dips.

Customers' bargaining power is significantly influenced by the availability of alternatives and their price sensitivity. In 2024, the IT services market continued to offer a wide range of options, from large integrators to niche specialists, empowering clients to seek competitive pricing and tailored solutions. This ease of comparison, fueled by readily available market data, directly translates into increased customer leverage.

When customers can easily switch providers or have many choices, their ability to negotiate favorable terms increases. This is especially true for standard IT services where switching costs might be lower. For instance, in 2024, businesses actively sought cost-effective cloud solutions, often renegotiating contracts or exploring new vendors to reduce IT expenditures.

The bargaining power of customers is amplified by their access to information, allowing for thorough price and feature comparisons. In 2024, over 70% of IT procurement decisions involved multi-vendor comparisons, underscoring the impact of informed choices on vendor negotiations.

| Factor | Impact on Bargaining Power | 2024 Trend/Data |

|---|---|---|

| Availability of Alternatives | High | Continued growth in specialized IT solutions offered more choices. |

| Customer Price Sensitivity | High | Economic uncertainties led over 60% of businesses to prioritize IT cost reduction. |

| Information Availability | High | Over 70% of IT procurement involved multi-vendor comparisons. |

| Switching Costs | Moderate to High | While alternatives exist, data migration and integration complexity remain significant barriers. |

Preview Before You Purchase

Insight Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces Analysis, offering a comprehensive examination of competitive forces within an industry. The document you see here is the exact, professionally formatted file you will receive immediately upon purchase, ensuring no surprises or missing content.

Rivalry Among Competitors

The IT solutions and services market is a crowded arena, featuring a wide array of competitors. Major global players like CDW, SHI International, and IBM operate alongside many smaller, niche providers, creating a diverse competitive environment.

This broad spectrum of companies, from massive multinational corporations to specialized local firms, means intense rivalry for every segment of the market. For example, in 2024, the global IT services market was valued at over $1.3 trillion, underscoring the sheer volume of business and the number of entities vying for it.

The IT services and cloud computing sectors are booming, with projections indicating continued strong growth driven by AI and digital transformation initiatives. For instance, the global IT services market was valued at approximately $1.2 trillion in 2023 and is expected to reach over $1.5 trillion by 2025, demonstrating a robust compound annual growth rate.

However, this high growth rate fuels intense competition. Companies like Accenture, IBM, and TCS are vying for market share, leading to price pressures and a constant need for differentiation through specialized services or technological advancements.

This dynamic environment demands continuous innovation. Companies must invest heavily in R&D and talent to stay ahead, as failing to adapt to evolving client needs and technological shifts can quickly erode competitive advantage.

Competitive rivalry in the IT solutions sector is intense, with companies like Insight differentiating through specialized expertise in areas such as artificial intelligence, cybersecurity, and specific cloud platforms. This focus allows them to offer unique solutions that address niche market needs.

Quality of service delivery is another critical differentiator. Insight's commitment to providing reliable support and efficient problem-solving builds trust and fosters long-term client relationships, which is crucial in a market where switching costs can be significant.

For the fiscal year 2024, Insight Enterprises reported net sales of $5.1 billion, demonstrating their substantial presence and ability to compete effectively. Their continued investment in advanced technologies and customer-centric approaches is key to maintaining this competitive edge.

High Fixed Costs and Exit Barriers

The IT services sector often demands substantial upfront investment in skilled personnel, ongoing training, and robust technological infrastructure. For instance, a typical mid-sized IT services firm might spend upwards of 15-20% of its revenue on talent development and technology upgrades annually.

These high fixed costs, coupled with significant exit barriers like long-term client contracts and investments in proprietary or highly specialized technology, can intensify competitive rivalry. Companies are often compelled to aggressively pursue new business and retain existing clients to ensure their assets remain utilized and their market position is maintained, even in challenging economic conditions.

- Talent Acquisition & Training: IT services firms often allocate 15-20% of annual revenue to skilled labor development.

- Infrastructure Investment: Significant capital is tied up in technology platforms and R&D.

- Long-Term Contracts: Client agreements can span several years, creating sticky relationships but also commitment.

- Specialized Assets: Investments in unique software or hardware can limit flexibility and increase exit costs.

Strategic Stakes

The IT sector's role as a catalyst for digital transformation across all industries significantly elevates the strategic stakes for companies like Insight Enterprises. This intensified competition fuels substantial investments in cutting-edge technologies, strategic acquisitions, and aggressive market expansion to maintain relevance and ensure sustained growth. For instance, Insight's acquisition of Infocenter.io in 2023 demonstrates this commitment to bolstering its capabilities and market position.

The high strategic stakes manifest in several key areas:

- Intensified R&D and Innovation: Companies are compelled to invest heavily in research and development to stay ahead of technological advancements, which can include AI, cloud computing, and cybersecurity solutions.

- Mergers and Acquisitions (M&A): The pursuit of market share and new capabilities drives a robust M&A landscape. Insight Enterprises itself has been active, with its acquisition of Infocenter.io in March 2023 for an undisclosed sum, aimed at enhancing its cloud and data analytics offerings.

- Talent Wars: Securing and retaining skilled IT professionals is paramount, leading to increased competition for talent and higher compensation packages.

- Customer Acquisition and Retention: With numerous providers offering similar services, the focus on delivering superior customer experience and value is critical for retaining clients and attracting new ones.

Competitive rivalry in the IT solutions and services market is fierce due to a large number of players, from global giants to niche specialists. This intense competition is driven by high growth rates in areas like cloud computing and AI, pushing companies to constantly innovate and differentiate. For example, the global IT services market was valued at over $1.3 trillion in 2024, illustrating the vast opportunities and the number of entities vying for them.

| Competitor | 2024 Net Sales (Approx.) | Key Focus Areas |

|---|---|---|

| Insight Enterprises | $5.1 billion | AI, Cybersecurity, Cloud Platforms |

| CDW | $23.3 billion | Hybrid Cloud, Digital Transformation |

| SHI International | $14.5 billion | Software Licensing, Cloud Solutions |

| IBM | $62.0 billion | Hybrid Cloud, AI, Consulting |

SSubstitutes Threaten

Direct customer insourcing represents a significant threat to IT service providers like Insight. Large enterprises, particularly those with substantial IT budgets and in-house expertise, may opt to bring their technology management functions under their own roof. This internal development bypasses the need for external vendors altogether.

For instance, major corporations in 2024 continue to invest heavily in their digital transformation journeys, often building out internal capabilities for cloud management, cybersecurity, and custom software development. This trend is driven by a desire for greater control, cost optimization, and tailored solutions that external providers might not perfectly match.

The rise of cloud-native solutions and Software-as-a-Service (SaaS) presents a significant threat of substitutes for traditional IT integration services. Businesses are increasingly opting for readily available SaaS applications, such as Salesforce for CRM or Workday for HR, which often require minimal integration with existing systems. This trend allows companies to bypass lengthy and costly traditional IT integration projects, directly accessing specialized functionalities. For instance, the global SaaS market was projected to reach over $200 billion in 2024, demonstrating its widespread adoption and the reduced reliance on bespoke integration.

The increasing availability of standardized, cloud-based IT solutions and automation tools poses a significant threat of substitutes. For routine IT tasks like data storage, basic software deployment, and helpdesk support, businesses can increasingly opt for these off-the-shelf, low-cost alternatives. This trend is exemplified by the growth in Software-as-a-Service (SaaS) and Infrastructure-as-a-Service (IaaS) providers, which offer scalable and often more affordable options compared to traditional, integrated IT service providers.

For instance, the global cloud computing market, encompassing IaaS, PaaS, and SaaS, was projected to reach over $1.3 trillion by the end of 2024, indicating a massive shift towards readily available, commoditized IT functionalities. This directly challenges comprehensive solution integrators whose value proposition often lies in bespoke integration and ongoing management of complex IT environments. As more basic functions become easily accessible and affordable through these substitutes, the perceived necessity and pricing power of traditional IT service models diminish.

Technological Advancements and AI Automation

Rapid advancements in AI and automation are emerging as significant substitutes for certain IT services. These technologies can automate tasks previously handled by human IT professionals, potentially reducing demand for traditional integration and managed services. For instance, by 2024, many businesses are expected to increase their investment in AI-driven IT operations, with some reports indicating a 20-30% rise in automation adoption for routine IT support functions.

This trend directly impacts companies like Insight by offering alternative solutions that may be more cost-effective or efficient for specific IT needs. As AI capabilities mature, they can perform functions such as predictive maintenance, automated cybersecurity threat detection, and even basic system configuration, directly substituting for human expertise in these areas.

- AI-powered IT support platforms can handle a significant portion of help desk inquiries, reducing the need for human intervention.

- Automated code generation and testing tools can accelerate software development cycles, potentially substituting for some manual coding and QA services.

- Robotic Process Automation (RPA) is increasingly used to automate repetitive IT administrative tasks, such as user provisioning and software deployment.

- The global AI in IT operations market size was estimated to be around $3.5 billion in 2023 and is projected to grow substantially in the coming years, indicating a clear shift towards automated IT solutions.

Alternative Consulting Models

Clients are increasingly exploring alternative consulting models that can directly substitute for traditional, comprehensive service providers like Insight. This trend is fueled by a desire for cost-efficiency and specialized expertise.

For instance, businesses facing specific IT infrastructure issues might bypass large integrators and instead engage boutique firms or freelance consultants who offer deep knowledge in areas like cloud migration or cybersecurity. This unbundling of services allows clients to cherry-pick solutions, potentially reducing overall expenditure compared to a full-service contract.

In 2024, the gig economy and specialized consulting platforms continued to grow, offering readily accessible expertise. Data from Statista indicates that the global freelance platform market is projected to reach $9.2 billion by 2026, highlighting the increasing adoption of alternative talent sourcing for specialized tasks.

- Niche Consulting Firms: Offer deep expertise in specific technology areas, providing a direct substitute for specialized project components.

- Independent Contractors/Freelancers: Provide flexible, on-demand expertise, often at a lower cost than larger firms for targeted needs.

- Online Consulting Platforms: Connect businesses with pre-vetted experts, streamlining the process of finding specialized skills.

- Internal Skill Development: Companies may invest in training their own staff to handle certain IT functions, reducing reliance on external consultants altogether.

The threat of substitutes for IT service providers like Insight is amplified by readily available, commoditized technology solutions. Businesses can increasingly leverage off-the-shelf software, cloud services, and automation tools to fulfill IT needs that were once exclusively met by integrated service providers. This shift diminishes the perceived value of traditional, comprehensive IT solutions.

The widespread adoption of Software-as-a-Service (SaaS) and Infrastructure-as-a-Service (IaaS) offers a direct substitute for custom IT integration and management. For instance, the global cloud computing market, encompassing IaaS, PaaS, and SaaS, was projected to exceed $1.3 trillion by the end of 2024, showcasing a significant move towards accessible and often more affordable IT functionalities.

Furthermore, advancements in AI and automation are creating powerful substitutes for specific IT services. AI-powered platforms can now handle many help desk inquiries and automate routine IT tasks, impacting the demand for traditional human-led support. The global AI in IT operations market, estimated at around $3.5 billion in 2023, is expected to see substantial growth, reflecting this trend towards automated solutions.

Clients are also exploring alternative consulting models, opting for niche firms or freelance consultants for specialized expertise. This unbundling of services allows businesses to acquire targeted skills more cost-effectively, bypassing larger, full-service providers. The growth of the freelance platform market, projected to reach $9.2 billion by 2026, underscores this shift towards alternative talent sourcing for specialized IT needs.

| Substitute Type | Description | Impact on IT Service Providers | 2024 Trend Example |

|---|---|---|---|

| SaaS/IaaS Solutions | Off-the-shelf cloud-based software and infrastructure | Reduces need for custom integration and managed services | Global cloud market projected >$1.3 trillion |

| AI & Automation Tools | Automated IT support, operations, and task execution | Substitutes for human IT support and administrative roles | AI in IT operations market growing significantly |

| Niche Consulting & Freelancers | Specialized expertise from smaller firms or individuals | Offers targeted solutions, potentially bypassing large providers | Freelance platform market projected $9.2 billion by 2026 |

| Direct Customer Insourcing | Enterprises building in-house IT capabilities | Decreases reliance on external IT service vendors | Continued heavy enterprise investment in digital transformation |

Entrants Threaten

Entering the IT solutions and services market, particularly at a global scale like Insight, demands substantial financial backing. This includes significant upfront investments in attracting top-tier talent, acquiring cutting-edge technology, building robust infrastructure, and establishing operations across various regions. For instance, a company aiming to compete globally in IT services might need hundreds of millions of dollars in initial capital to cover R&D, sales, and marketing efforts.

Insight Enterprises benefits significantly from deeply entrenched client relationships and a robust brand reputation cultivated over many years. This history fosters a high degree of trust and reliability in the eyes of its existing customer base.

New entrants into this market face a substantial barrier in attempting to replicate this level of established trust and loyalty. Displacing incumbent providers with proven track records requires considerable effort and investment in building credibility from scratch.

For instance, in 2024, IT solution providers often cite customer retention rates exceeding 90%, underscoring the difficulty for new players to gain market share against established, trusted vendors like Insight.

New IT solution providers face a significant hurdle in gaining access to essential distribution channels and forming crucial partnerships. Established players often have exclusive agreements with major technology vendors like Microsoft, AWS, and Cisco, making it challenging for newcomers to secure the same leverage. For instance, in 2024, the cloud infrastructure market, dominated by AWS, Azure, and Google Cloud, saw continued consolidation, with these giants strengthening their partner ecosystems, further entrenching incumbents.

Proprietary Technology and Expertise

The threat of new entrants in the IT services sector, particularly for companies like Insight specializing in complex digital transformation, is significantly mitigated by proprietary technology and deep expertise. While many IT services focus on system integration, firms like Insight cultivate unique methodologies, proprietary software tools, and a wealth of accumulated knowledge from executing intricate digital initiatives. This specialized intellectual property and the practical know-how gained from years of experience present a substantial hurdle for newcomers attempting to replicate their capabilities.

For instance, in 2024, the demand for specialized cloud migration and AI integration services continued to surge. Companies that have invested heavily in developing unique frameworks for these complex projects, such as Insight, establish a strong competitive advantage. New entrants would face considerable challenges in matching the efficiency and effectiveness derived from such established, proprietary assets.

- Proprietary Methodologies: Insight's unique approaches to digital transformation streamline complex projects, making it difficult for new firms to compete on efficiency.

- Accumulated Expertise: Years of experience in handling intricate digital transformation projects have built a knowledge base that is hard for new entrants to quickly acquire.

- Intellectual Property: The development of specialized tools and software by established players like Insight creates a barrier to entry due to the cost and time required for replication.

Regulatory and Compliance Hurdles

Operating in sectors like government or healthcare, or even internationally, means grappling with a web of complex regulations and compliance standards. Think about data privacy laws, industry-specific certifications, and varying international trade rules. For any newcomer, meeting these stringent requirements demands significant upfront investment in legal counsel, compliance officers, and specialized systems.

For instance, in the European Union, the General Data Protection Regulation (GDPR) imposes strict rules on data handling, with fines for non-compliance reaching up to 4% of global annual revenue. Similarly, in the United States, the Health Insurance Portability and Accountability Act (HIPAA) sets rigorous standards for protecting patient health information. These regulatory landscapes act as substantial barriers, deterring potential new entrants who may lack the resources or expertise to navigate them effectively.

- Regulatory complexity: Navigating diverse legal frameworks across industries and geographies.

- Compliance costs: Significant investment required for legal, personnel, and system adherence.

- Industry-specific certifications: Mandatory approvals needed for operation in certain sectors.

- Data privacy mandates: Strict rules like GDPR and HIPAA increase operational overhead.

The threat of new entrants for IT solutions providers like Insight is generally considered moderate to low. Significant capital requirements for talent, technology, and global infrastructure are substantial hurdles. Furthermore, established players benefit from strong brand loyalty and deep client relationships, making it difficult for newcomers to gain traction. Proprietary technologies and accumulated expertise also create a considerable competitive moat.

New entrants face challenges in accessing distribution channels and securing partnerships, as incumbents often have exclusive agreements with major technology vendors. The complex regulatory environment across different industries and geographies, coupled with high compliance costs, further deters new competition. For example, in 2024, the IT services market continued to see consolidation, with major players like Accenture and IBM strengthening their market positions, making it harder for smaller, new firms to enter and compete effectively.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High upfront investment in talent, technology, and infrastructure. | Significant financial hurdle, limiting the number of potential entrants. |

| Brand Loyalty & Client Relationships | Established trust and long-term partnerships with existing customers. | Difficult for new firms to displace incumbents and build credibility. |

| Proprietary Technology & Expertise | Unique methodologies, software tools, and accumulated knowledge. | Requires substantial R&D and time for new entrants to replicate capabilities. |

| Distribution Channels & Partnerships | Exclusive agreements with major technology vendors. | Limits access for newcomers to essential resources and markets. |

| Regulatory Compliance | Navigating complex laws, certifications, and data privacy standards. | Increases operational costs and complexity for new entrants. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including proprietary market research, financial statements from publicly traded companies, and industry-specific trade publications to provide a comprehensive view of competitive pressures.