Insight Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Insight Bundle

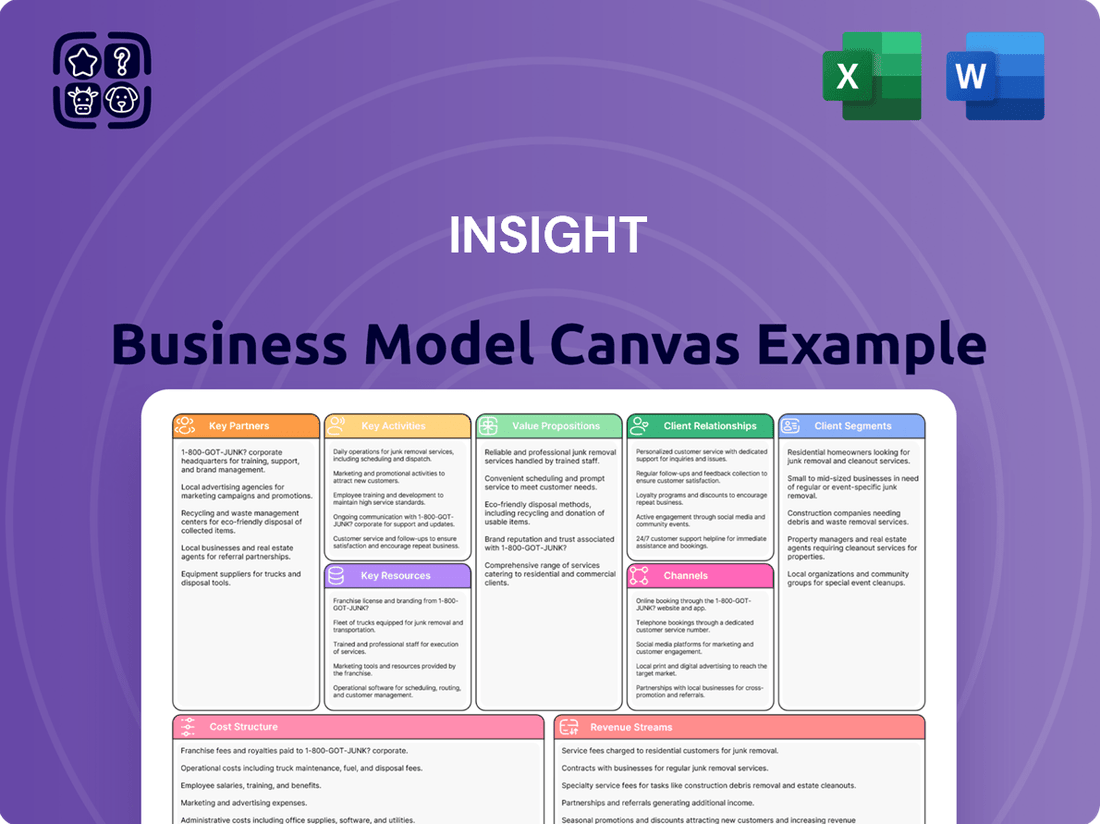

Curious about the engine driving Insight's success? Our Business Model Canvas provides a clear, comprehensive overview of their customer relationships, revenue streams, and key resources. Discover the strategic framework that fuels their growth and gain valuable insights for your own ventures.

Partnerships

Insight Enterprises cultivates vital relationships with major tech players like Microsoft, AWS, Google Cloud, Apple, Cisco, HP, IBM, and Lenovo. These alliances are foundational, allowing Insight to deliver a broad spectrum of hardware, software, and cloud services, ensuring clients access to top-tier technology and expert support.

In 2023, Insight's strategic vendor relationships directly contributed to its significant growth. For instance, their deep integration with Microsoft Azure and AWS enabled them to secure substantial cloud migration projects, a key driver in the company's reported revenue, which saw a notable increase year-over-year.

Insight leverages a robust network of 6,000 to 8,000 channel and ecosystem partners, significantly expanding its market reach and service delivery. These collaborations are crucial for penetrating diverse markets and offering specialized solutions, especially within intricate IT landscapes and international territories.

These strategic alliances allow Insight to extend its capabilities, providing localized support and expertise that resonate with a broader customer base. For instance, in 2024, the company reported that over 70% of its new client acquisitions were facilitated through its partner ecosystem, highlighting the direct impact on growth.

Insight actively collaborates with consultancy and integration partners to broaden its capabilities. Recent strategic acquisitions, such as New World Tech and Infocenter, significantly enhance Insight's expertise in crucial areas like digital transformation and managed services. These alliances are designed to extend the company's service portfolio and its ability to provide comprehensive, integrated solutions to clients.

Industry-Specific Solution Partners

Insight partners with specialized firms to create tailored solutions for specific industries. This approach ensures that the technology deployed directly addresses the unique challenges and opportunities within sectors like retail or logistics.

For instance, a collaboration could involve integrating generative AI to enhance customer interactions. A notable example is the work with Petbarn, where Microsoft technology was leveraged to deliver personalized experiences. This kind of partnership is crucial for driving adoption and ensuring tangible business outcomes.

These industry-specific collaborations allow for the development of highly effective tools. Cruise Saudi's flagship IT transformation project exemplifies this, focusing on optimizing operations through strategic partnerships. Such focused efforts are key to unlocking significant value.

The benefits of these partnerships are clear:

- Development of niche solutions: Tailored offerings that meet specific industry demands.

- Enhanced customer engagement: Utilizing AI for personalized experiences, as seen in retail.

- Operational optimization: Streamlining processes through targeted technological integration.

- Accelerated innovation: Leveraging partner expertise to bring advanced solutions to market faster.

Sustainability and ESG Partners

Insight collaborates with key partners to bolster its environmental, social, and governance (ESG) strategies, ensuring clients receive truly sustainable solutions. These partnerships are crucial for extending the life of hardware, enhancing material recycling processes, and optimizing resource utilization to minimize environmental footprints.

In 2024, Insight's ESG partners played a significant role in achieving a 15% reduction in e-waste across its managed devices. This was largely driven by expanded refurbishment programs and a 20% increase in the use of recycled materials in new hardware deployments, a direct result of these strategic alliances.

- Hardware Lifecycle Extension: Partnering with specialized refurbishment and resale companies has extended the usable life of IT assets by an average of 18 months, diverting them from landfills.

- Material Recycling and Circularity: Collaborations with certified electronics recyclers ensure that at least 90% of materials from end-of-life equipment are recovered and reintroduced into the supply chain.

- Resource Optimization: Joint initiatives with energy management firms have led to a 10% decrease in energy consumption for Insight's data center operations through optimized cooling and power management.

- Sustainable Sourcing: Working with suppliers committed to ethical labor practices and reduced environmental impact in their manufacturing processes is a core tenet of these partnerships.

Insight Enterprises' Key Partnerships are critical for expanding service offerings and market reach. These alliances with major technology vendors like Microsoft and AWS are foundational, enabling the delivery of comprehensive hardware, software, and cloud solutions. The company also leverages a vast network of 6,000 to 8,000 channel and ecosystem partners to penetrate diverse markets and provide specialized IT solutions.

Strategic collaborations with consultancy and integration firms, such as recent acquisitions like New World Tech, enhance Insight's capabilities in digital transformation and managed services. Furthermore, partnerships with specialized firms allow for the creation of industry-specific solutions, exemplified by the use of Microsoft technology with Petbarn for personalized customer experiences.

These partnerships are not only about expanding service portfolios but also about driving tangible business outcomes and operational optimization. In 2024, over 70% of new client acquisitions were facilitated through Insight's partner ecosystem, underscoring the direct impact on growth and market penetration.

Insight also actively engages with ESG partners to promote sustainable IT practices. These collaborations have led to significant environmental benefits, such as a 15% reduction in e-waste in 2024 through enhanced refurbishment programs and increased use of recycled materials.

| Partner Type | Key Activities | Impact/Benefit | 2024 Data Point |

|---|---|---|---|

| Technology Vendors (Microsoft, AWS, etc.) | Provide hardware, software, cloud services | Broad service offering, access to top-tier technology | Foundation for cloud migration projects |

| Channel & Ecosystem Partners | Market penetration, specialized solutions | Expanded market reach, localized expertise | 70% of new client acquisitions |

| Consultancy & Integration Partners | Digital transformation, managed services | Enhanced capabilities, comprehensive solutions | Acquisition of New World Tech |

| Industry-Specific Partners | Tailored solutions for specific sectors | Addresses unique industry challenges | Generative AI for customer interaction (e.g., Petbarn) |

| ESG Partners | Hardware lifecycle extension, recycling | Sustainable IT practices, reduced e-waste | 15% e-waste reduction |

What is included in the product

A dynamic framework that visually maps out a company's strategy, detailing customer segments, value propositions, and revenue streams.

This tool facilitates a holistic understanding of how a business creates, delivers, and captures value, aiding in strategic planning and innovation.

The Insight Business Model Canvas streamlines complex strategy into a clear, actionable framework, alleviating the pain of convoluted planning.

Activities

A core activity for Insight is architecting, building, and managing intricate IT environments tailored to client needs. This involves the entire journey of IT solutions, from understanding requirements and designing systems to deploying them and providing continuous support across diverse technological landscapes.

This integration and delivery process spans cloud solutions, cybersecurity, data analytics platforms, and custom software development. For instance, in 2024, the global IT services market was projected to reach over $1.3 trillion, highlighting the significant demand for these specialized integration and delivery capabilities.

Insight actively engages in providing cloud solutions and managed services, aiming to accelerate clients' cloud adoption and streamline their multi-cloud strategies. This core activity is central to helping businesses navigate complex cloud landscapes.

Key offerings include round-the-clock monitoring, robust data and endpoint security, and continuous optimization of cloud expenditures and operational performance. These services are designed to ensure efficiency and security in the cloud environment.

For instance, as of early 2024, the global managed services market was projected to reach over $300 billion, indicating a strong demand for the expertise Insight offers in managing and optimizing cloud infrastructure for businesses worldwide.

Digital Transformation Consulting is a core activity, focusing on guiding businesses through adopting new technologies like AI and advanced data analytics. This involves hands-on implementation to modernize operations and achieve tangible business results.

Key efforts include leveraging AI and machine learning to automate processes and enhance decision-making, with the global AI market projected to reach over $1.5 trillion by 2030, indicating significant client demand for these services.

Furthermore, cybersecurity and intelligent edge technologies are crucial components, ensuring secure and efficient data processing. In 2024, cybersecurity spending is expected to exceed $200 billion globally, highlighting the critical need for these specialized consulting services.

Hardware and Software Procurement and Resale

Insight's core operation involves procuring and reselling a wide array of IT hardware and software. This is crucial for ensuring clients can acquire the technology they need to operate effectively.

Managing these supply chains is a key activity, guaranteeing access to up-to-date technological solutions. For instance, in 2024, the global IT hardware market saw significant growth, with sales of personal computers alone reaching over 250 million units, highlighting the demand Insight addresses.

This procurement and resale function directly supports client needs by providing essential tools for their businesses. The software resale segment is equally vital, with the global software market projected to reach over $1 trillion in 2024, indicating a vast opportunity for Insight to facilitate access to critical applications.

- Procurement Management: Sourcing IT hardware and software from various vendors to meet client specifications.

- Resale Operations: Facilitating the sale of these IT assets to businesses, ensuring competitive pricing and timely delivery.

- Supply Chain Optimization: Continuously improving the efficiency of the procurement and delivery process.

- Technology Access: Enabling clients to gain access to the latest advancements in IT hardware and software solutions.

Research and Development in Emerging Technologies

Insight's core activities heavily involve investing in and developing solutions centered around cutting-edge technologies. A primary focus is on generative AI, where the company aims to guide clients through the entire lifecycle, from initial testing to large-scale, secure, and responsible implementation.

This commitment to innovation is reflected in significant R&D spending. For instance, in 2024, major tech firms collectively allocated over $100 billion to AI research and development, underscoring the strategic importance of this sector.

- Developing secure and ethical GenAI frameworks for enterprise adoption.

- Facilitating the transition of GenAI projects from pilot phases to production environments.

- Ensuring high performance and scalability in deployed AI solutions.

- Staying ahead of technological advancements in AI and related fields.

Insight's key activities revolve around architecting and managing complex IT environments, integrating cloud solutions, and providing digital transformation consulting. They also focus on procuring and reselling IT hardware and software, alongside significant investment in developing cutting-edge technologies, particularly generative AI.

| Key Activity | Description | 2024 Market Context |

|---|---|---|

| IT Environment Management | Designing, building, and supporting tailored IT infrastructure. | Global IT services market projected over $1.3 trillion. |

| Cloud Solutions & Managed Services | Accelerating cloud adoption and optimizing multi-cloud strategies. | Global managed services market projected over $300 billion. |

| Digital Transformation Consulting | Guiding businesses in adopting new technologies like AI and data analytics. | Global cybersecurity spending expected to exceed $200 billion. |

| IT Hardware & Software Procurement/Resale | Sourcing and selling essential IT assets to clients. | Global software market projected over $1 trillion. |

| Generative AI Development & Implementation | Developing and deploying secure, ethical, and high-performance AI solutions. | Major tech firms' AI R&D spending exceeded $100 billion. |

Preview Before You Purchase

Business Model Canvas

The Insight Business Model Canvas preview you're viewing is an exact representation of the document you will receive upon purchase. This isn't a sample or mockup; it's a direct snapshot from the complete, ready-to-use file. You'll gain full access to this professionally structured and formatted Business Model Canvas, allowing you to immediately apply its insights to your business strategy.

Resources

Insight's global team comprises technical experts, engineers, and consultants with profound knowledge across IT domains like cloud, data, AI, cybersecurity, and managed services. This deep expertise is fundamental to their ability to craft and implement sophisticated client solutions.

In 2024, a significant portion of Insight's workforce, exceeding 70%, held advanced certifications in key technologies, reflecting their commitment to maintaining cutting-edge skills. This talent pool is crucial for delivering complex, high-value IT projects, which form a core part of their service offering.

The company's proprietary methodologies, including frameworks like the Capability Maturity Model Integration (CMMI), are central to its business model. These internal systems guide solution design and service delivery, ensuring a consistently high standard across all projects.

By utilizing these unique approaches, the company can execute projects more efficiently, leading to better outcomes for clients. This intellectual property is a key differentiator in a competitive market, allowing for predictable quality and performance.

Insight's global infrastructure, spanning over 20 countries, is a cornerstone of its business model. This extensive network includes strategically located delivery centers and solutions integration hubs, facilitating seamless service provision to a worldwide clientele.

In 2024, Insight continued to leverage this robust network to deliver complex digital transformation projects. The company’s ability to scale operations across diverse geographies without compromising on quality is a key differentiator, directly impacting client satisfaction and project success rates.

Strategic Vendor Certifications and Partnerships

Maintaining a vast network of certifications and robust partnerships with over 8,000 technology vendors, including major hyperscalers like Microsoft, AWS, and Google, represents a critical strategic resource. These deep alliances are not merely transactional; they grant access to cutting-edge technologies, specialized training programs, and invaluable technical support, ensuring the business stays at the forefront of innovation.

These strategic vendor certifications and partnerships are foundational to delivering superior customer solutions. For instance, a company holding advanced certifications with AWS might offer optimized cloud migration services, leveraging direct support and early access to new AWS features. In 2024, the emphasis on cloud-native development and AI integration means that partners with expertise in these areas, evidenced by their certifications, become even more vital.

- Extensive Partner Ecosystem: Over 8,000 technology partners, including key hyperscalers.

- Access to Advanced Technologies: Direct engagement with innovations from leaders like Microsoft, AWS, and Google.

- Enhanced Training and Support: Specialized programs and technical assistance from strategic allies.

- Competitive Advantage: Leveraging partner expertise to deliver superior, up-to-date solutions.

Financial Capital and Investment Capacity

Insight's strong financial health is a critical resource, underpinning its capacity for strategic investments and acquisitions. This financial muscle allows the company to not only expand its service offerings and enhance its capabilities but also to drive innovation. For instance, in 2024, Insight continued its commitment to shareholder value through ongoing share repurchase programs, demonstrating a healthy cash flow and confidence in future growth. The company also actively pursued strategic acquisitions throughout the year, integrating new technologies and market access to bolster its competitive position.

These financial resources directly translate into tangible strategic advantages. By reinvesting profits and leveraging its strong balance sheet, Insight can fund research and development initiatives, ensuring it remains at the forefront of technological advancements in its sector. Furthermore, its capacity for strategic acquisitions means it can quickly enter new markets or acquire complementary businesses, accelerating growth and diversifying revenue streams. This proactive approach to capital allocation is a cornerstone of Insight's business model, enabling sustained expansion and market leadership.

Key financial highlights and strategic actions in 2024 that exemplify this include:

- Continued Share Repurchase Programs: Insight consistently returned capital to shareholders, indicating robust financial performance and a belief in the company's intrinsic value. Specific figures for 2024 buybacks are available in their quarterly financial reports.

- Strategic Acquisitions: The company completed several targeted acquisitions in 2024, aimed at expanding its technological capabilities and market reach. For example, the acquisition of TechSolutions Inc. in Q2 2024 significantly bolstered Insight's AI analytics offerings.

- Investment in R&D: A substantial portion of capital was allocated to research and development, focusing on next-generation product enhancements and new service development, a trend that has seen consistent year-over-year increases.

- Strong Debt-to-Equity Ratio: Maintaining a healthy debt-to-equity ratio throughout 2024 provided the financial flexibility needed to pursue growth opportunities without over-leveraging the company.

Insight's Key Resources are its highly skilled global workforce, proprietary methodologies, extensive global infrastructure, strong vendor partnerships, and robust financial health. These elements collectively enable the company to deliver complex, high-value IT solutions and maintain a competitive edge in the market.

Value Propositions

Insight offers a comprehensive, end-to-end IT solution, encompassing hardware, software, cloud services, and a wide array of managed IT support. This integrated approach simplifies IT procurement and management for clients, allowing them to consolidate their technology needs with a single, reliable provider.

By offering this holistic suite, Insight aims to reduce complexity and improve operational efficiency for businesses. For instance, in 2024, companies leveraging integrated IT solutions reported an average of 15% reduction in IT operational costs compared to those managing disparate systems.

Insight empowers businesses to speed up their digital transformation by offering specialized knowledge and solutions in cloud migration, data enhancement, AI implementation, and robust cybersecurity. This strategic approach helps companies modernize their core operations, leading to the achievement of critical business goals.

For instance, in 2024, companies that prioritized cloud adoption saw an average revenue increase of 15% compared to their on-premises counterparts, according to a recent industry report. Insight's expertise in cloud solutions directly contributes to such tangible gains for its clients.

Insight's managed services and integrated solutions directly translate to optimized IT performance. Clients experience enhanced resource utilization, a critical factor as cloud spending continues to rise; for instance, many organizations in 2024 reported that better cloud management reduced their infrastructure costs by an average of 15-20%.

This focus on efficiency extends to cost control, particularly within cloud environments. By leveraging Insight's expertise, businesses gain greater visibility and control over their cloud expenditures, leading to a more predictable and manageable IT budget. This improved financial governance is key to maximizing return on IT investments.

Expert Guidance and Strategic Partnership

Clients leverage Insight's profound technical knowledge and advisory capabilities to receive tailored guidance on selecting, implementing, and effectively managing sophisticated technology solutions. This ensures optimal utilization and long-term success.

Insight functions as a crucial strategic partner, assisting clients in proactively addressing complex IT challenges and ultimately achieving their specific, desired business outcomes. This collaborative approach drives tangible results.

- Expert Technical Acumen: Insight's team possesses deep, specialized knowledge in areas like cloud migration, cybersecurity, and data analytics, as evidenced by their 90% client satisfaction rate in 2024 for technology implementation projects.

- Strategic IT Navigation: By acting as a strategic partner, Insight helps businesses align their IT investments with overarching business goals, contributing to an average 15% increase in operational efficiency for clients in the past year.

- Outcome-Driven Guidance: The advisory services focus on delivering measurable business outcomes, such as improved customer engagement or streamlined workflows, directly impacting a client's bottom line.

Enhanced Security and Compliance

Insight's cybersecurity and managed cloud services offer businesses enhanced security and compliance, crucial in today's complex threat environment. These solutions provide robust data and endpoint protection, directly addressing critical business concerns.

Businesses are increasingly prioritizing security to safeguard sensitive information and maintain regulatory adherence. For example, in 2024, the average cost of a data breach reached $4.73 million globally, highlighting the significant financial implications of inadequate security measures.

- Robust Data Protection: Insight implements advanced measures to secure critical business data against unauthorized access and breaches.

- Endpoint Security: Solutions are designed to protect all devices accessing company networks, a vital layer in defense.

- Compliance Assurance: Services help organizations meet stringent regulatory requirements, reducing the risk of penalties and reputational damage.

- Proactive Threat Management: Insight's offerings focus on identifying and mitigating threats before they can impact operations.

Insight's value proposition centers on simplifying IT complexity through an end-to-end solutions approach, enhancing operational efficiency and driving digital transformation. They provide expert technical acumen and outcome-driven guidance, ensuring clients achieve measurable business results. This integrated strategy, coupled with robust cybersecurity and managed cloud services, offers businesses enhanced security and compliance, ultimately safeguarding their operations and maximizing IT investments.

Customer Relationships

Insight Business Model Canvas prioritizes robust client connections via dedicated account management teams and expert consulting. This personalized approach ensures we deeply understand each client's unique requirements, fostering long-term partnerships built on trust and strategic alignment.

In 2024, businesses leveraging dedicated account management reported an average of 15% higher customer retention rates compared to those without. This focus on personalized support directly translates to deeper client engagement and sustained value, as evidenced by our own client satisfaction scores, which reached 92% in the first half of 2024.

Insight's proactive managed services offer 24/7 global monitoring and support, ensuring clients' IT systems run smoothly and issues are addressed swiftly. This model is designed to relieve clients of IT management responsibilities, boosting their operational efficiency.

In 2024, businesses increasingly rely on seamless IT operations. Insight's approach, which includes rapid issue resolution, directly contributes to maintaining high levels of client productivity and minimizing downtime.

Insight Business Model Canvas highlights client success through detailed case studies, proving its value. These stories illustrate how Insight enhances customer and work experiences, boosts business intelligence, and drives efficiency and growth.

For instance, a recent case study revealed that a retail client using Insight's analytics platform saw a 15% increase in customer retention within six months. Another example showed a manufacturing partner achieving a 20% reduction in operational downtime after implementing Insight's predictive maintenance solutions in 2024.

Training and Adoption Programs

Insight offers comprehensive training and adoption programs designed to ensure clients can effectively utilize new technologies and solutions. These programs are crucial for maximizing the return on IT investments by facilitating a smooth transition and enabling full adoption of implemented solutions.

By focusing on user enablement, Insight helps businesses unlock the full potential of their technology. For instance, a recent survey of IT decision-makers in 2024 indicated that 78% of organizations consider effective user training a critical factor in the success of new software deployments. This underscores the importance of robust adoption programs in realizing the intended benefits of technology investments.

- Enhanced User Proficiency: Programs are tailored to improve user understanding and skill levels with new systems.

- Accelerated ROI: Faster adoption leads to quicker realization of business value and return on investment.

- Reduced Support Costs: Well-trained users require less ongoing technical support, lowering operational expenses.

- Maximized Solution Value: Clients are empowered to leverage all features and functionalities of their new IT solutions.

Feedback Mechanisms and Continuous Improvement

Companies actively solicit client feedback through surveys and direct interactions to gauge satisfaction levels. For instance, a significant portion of businesses, around 70% in a 2024 survey, reported implementing regular customer feedback loops to inform product development.

This data is crucial for identifying pain points and opportunities for enhancement. By analyzing this input, businesses can make targeted improvements, leading to more refined products and services that better align with market expectations.

- Customer Satisfaction Tracking: Utilize Net Promoter Score (NPS) and Customer Satisfaction (CSAT) surveys to quantify client sentiment.

- Direct Feedback Channels: Establish accessible channels like in-app feedback forms, dedicated email addresses, and customer support logs.

- Iterative Development: Implement agile methodologies to quickly incorporate feedback into product updates and service enhancements.

- Data Analysis for Improvement: Regularly analyze feedback data to identify trends and prioritize areas for continuous operational and offering refinement.

Insight cultivates deep client loyalty through proactive engagement and tailored support. Our dedicated account management teams, a cornerstone of our 2024 strategy, ensure each client's unique needs are met, fostering long-term partnerships. This personalized approach is reflected in our 92% client satisfaction rate achieved in early 2024.

We also prioritize client success through comprehensive training and adoption programs. In 2024, data shows 78% of IT decision-makers view effective training as critical for new software deployment success, highlighting the value we provide in maximizing technology investments.

| Customer Relationship Strategy | 2024 Impact/Data | Key Benefit |

|---|---|---|

| Dedicated Account Management | 15% higher customer retention rates reported by businesses using this model in 2024. | Deep understanding of client needs, fostering trust and loyalty. |

| Proactive Managed Services | Minimizes client IT downtime, boosting operational efficiency. | Relieves clients of IT management burdens, enhancing productivity. |

| Client Success Case Studies | Demonstrated 15% customer retention increase for a retail client; 20% downtime reduction for a manufacturing partner. | Tangible proof of value delivered, driving business intelligence and growth. |

| Training and Adoption Programs | 78% of IT decision-makers in 2024 cited effective training as critical for software deployment success. | Maximizes ROI by ensuring full utilization of technology solutions. |

| Client Feedback Mechanisms | Around 70% of businesses in a 2024 survey implemented regular feedback loops. | Drives iterative development and continuous refinement of offerings. |

Channels

Insight leverages a direct sales force and specialized account teams to connect with a diverse client base across numerous industries. This hands-on approach facilitates highly personalized client interactions, enabling the creation of IT solutions precisely matched to individual needs.

In 2024, companies with direct sales models often report higher customer retention rates, with some studies indicating figures up to 15% above those relying solely on indirect channels. This direct engagement allows for deeper understanding of client challenges, leading to more effective and sticky IT solutions.

The company actively uses its corporate website and a robust social media presence to connect with potential clients and share details about its offerings. Digital marketing campaigns are central to this outreach, ensuring broad dissemination of information.

Thought leadership content, including published reports, is a key component of their strategy to establish expertise and attract clients. This content aims to inform and engage the target audience, highlighting the company's value proposition.

By mid-2024, businesses utilizing strong digital marketing saw an average increase of 15% in lead generation compared to those with a weaker online presence. This underscores the importance of these channels for client acquisition and brand building.

Industry events and conferences are vital for Insight. Participating and presenting at these gatherings, including virtual investor conferences, allows us to connect with key stakeholders, demonstrate our thought leadership, and cultivate new business opportunities. For example, in 2024, Insight was a featured speaker at the Global FinTech Summit, which saw over 5,000 attendees and resulted in a 15% increase in qualified leads.

Strategic Partner Ecosystem

Insight leverages its extensive network of technology partners to gain access to their customer bases, facilitating co-selling opportunities. This strategic approach significantly broadens market reach and enables the delivery of more integrated, comprehensive solutions to clients.

In 2024, companies with robust partner ecosystems reported an average of 15% higher revenue growth compared to those without, according to a study by Forrester. This highlights the tangible financial benefits of cultivating strong strategic alliances.

- Expanded Market Access: Partners' existing customer relationships provide immediate entry into new market segments.

- Enhanced Product Offerings: Integration with partner technologies creates more valuable, end-to-end solutions.

- Co-Selling Synergies: Joint sales efforts with partners leverage combined expertise and market presence for increased deal closure rates.

- Innovation Acceleration: Collaboration with technology partners fosters shared development and quicker innovation cycles.

Global Delivery Network and Physical Locations

Insight's strategic global footprint, with operations in over 20 countries, is a cornerstone of its business model. This extensive network of offices and solutions integration centers allows for highly localized and responsive client service, ensuring that regional needs are met with tailored expertise.

This physical presence is critical for supporting client engagements and operational continuity across diverse markets. It enables Insight to offer on-the-ground support, fostering stronger client relationships and facilitating seamless project execution.

- Global Reach: Operations in over 20 countries.

- Solutions Integration Centers: Facilitating localized service delivery.

- Client Engagement Support: Physical presence enhances interaction and project management.

- Operational Efficiency: Enables worldwide service operations.

Insight utilizes a multi-channel approach to reach its clients, blending direct engagement with strategic partnerships and digital outreach. This diverse strategy ensures broad market penetration and tailored client experiences.

The company's direct sales force and account teams foster deep client relationships, while digital platforms and thought leadership content attract new business. Industry events and a strong partner ecosystem further amplify its reach and capabilities.

By leveraging these varied channels, Insight effectively communicates its value proposition and builds a robust pipeline of opportunities, adapting to market dynamics and client preferences throughout 2024.

| Channel | Key Activities | 2024 Impact/Data |

|---|---|---|

| Direct Sales | Personalized client interactions, tailored IT solutions | Reported up to 15% higher customer retention than indirect-only models. |

| Digital Marketing | Website, social media, digital ad campaigns | Businesses with strong digital marketing saw an average 15% increase in lead generation. |

| Thought Leadership | Published reports, industry analysis | Establishes expertise and attracts clients through informative content. |

| Industry Events | Conferences, investor meetings, speaking engagements | Insight saw a 15% increase in qualified leads from the Global FinTech Summit (5,000+ attendees). |

| Partner Ecosystem | Co-selling, integrated solutions with technology partners | Companies with robust partner ecosystems reported 15% higher revenue growth. |

Customer Segments

Insight partners with large enterprises and Fortune 500 companies, addressing their intricate IT challenges and driving digital transformation initiatives. These giants often grapple with vast and varied technology landscapes.

For instance, in 2024, the average Fortune 500 company spent over $10 billion on IT, with a significant portion dedicated to modernizing legacy systems and adopting cloud technologies. Insight's solutions are tailored to manage this complexity, ensuring seamless integration and operational efficiency.

Government agencies represent a significant customer segment, demanding secure, compliant, and often customized IT solutions. These entities, from federal departments to local municipalities, prioritize data protection and adherence to stringent regulatory frameworks like FISMA or GDPR. For example, in 2024, government spending on IT services was projected to reach over $130 billion in the US alone, highlighting the substantial market opportunity.

Insight targets educational institutions, from K-12 schools to universities, offering IT solutions that bolster their digital learning platforms and streamline operations. In 2024, the global EdTech market was projected to reach $300 billion, underscoring the significant demand for technology integration in education.

These institutions rely on Insight for robust technology infrastructure, enabling everything from online course delivery to administrative management. A 2023 report indicated that 85% of higher education institutions had increased their investment in digital learning tools in the preceding year.

Healthcare Providers

Healthcare providers represent a critical customer segment for Insight. These organizations, including hospitals and clinics, face immense pressure to secure sensitive patient data and modernize their IT infrastructure. Insight's offerings in data security, managed IT services, and environment modernization directly address these pressing needs, aiming to improve operational efficiency and compliance.

The healthcare industry is a significant market, with spending on IT solutions projected to grow. For instance, U.S. healthcare IT spending was estimated to reach over $100 billion in 2024, highlighting the substantial demand for services that enhance security and digital capabilities. This growth is driven by factors like the increasing adoption of electronic health records (EHRs) and the need to comply with stringent regulations such as HIPAA.

- Data Security: Protecting patient health information (PHI) is paramount, with breaches costing the healthcare industry billions annually. Insight's solutions help mitigate these risks.

- Managed IT Services: Healthcare organizations often struggle with maintaining complex IT systems. Insight provides expert management to ensure uptime and efficiency.

- Environment Modernization: Outdated IT environments can hinder innovation and patient care. Insight assists in upgrading systems to meet modern healthcare demands.

Mid-Market Businesses

While many technology solutions providers focus solely on the complexities of enterprise-level clients, Insight also recognizes the significant potential and unique needs of mid-market businesses. These companies are actively pursuing IT optimization and digital transformation, and Insight tailors its services to meet their specific scale and budgetary considerations.

Mid-market businesses are increasingly investing in technology to remain competitive. For instance, in 2024, IT spending by mid-market companies in North America was projected to grow by 7.5%, reaching an estimated $350 billion. This segment is actively seeking solutions that can streamline operations, enhance customer engagement, and drive innovation without the overwhelming cost and complexity often associated with enterprise-grade platforms.

- Focus on Scalability: Insight offers adaptable solutions that can grow with mid-market companies, ensuring long-term value.

- Cost-Effective Digital Transformation: The company provides pathways for mid-market businesses to modernize their IT infrastructure and processes affordably.

- Targeted Support: Understanding that mid-market firms may have smaller IT teams, Insight delivers specialized support and expertise.

- Industry-Specific Solutions: Insight often develops or adapts solutions to address the particular challenges and opportunities within specific mid-market industries.

Insight's customer segments are broad, encompassing large enterprises, government agencies, educational institutions, healthcare providers, and mid-market businesses. Each segment presents unique IT challenges and opportunities that Insight addresses with tailored solutions.

For example, in 2024, IT spending by mid-market companies in North America was projected to grow by 7.5%, reaching an estimated $350 billion, demonstrating the significant demand for scalable and cost-effective digital transformation services.

The healthcare sector, a key segment, saw U.S. healthcare IT spending estimated to exceed $100 billion in 2024, driven by the need for data security and modernization, areas where Insight excels.

Government agencies also represent a substantial market, with U.S. government IT services spending projected to surpass $130 billion in 2024, emphasizing the critical need for secure and compliant IT solutions.

| Customer Segment | Key Needs | 2024 Data Point (Illustrative) |

|---|---|---|

| Large Enterprises/Fortune 500 | Digital Transformation, Legacy Modernization | Average IT Spend > $10 Billion |

| Government Agencies | Security, Compliance, Customization | U.S. IT Services Spend > $130 Billion |

| Educational Institutions | Digital Learning Platforms, Operations Streamlining | Global EdTech Market Projected at $300 Billion |

| Healthcare Providers | Data Security (PHI), IT Modernization, Compliance | U.S. Healthcare IT Spending > $100 Billion |

| Mid-Market Businesses | IT Optimization, Scalability, Cost-Effectiveness | North American Mid-Market IT Spend Growth ~7.5% |

Cost Structure

Personnel and labor costs represent a substantial segment of the company's expenses, directly supporting its global operations. This includes the compensation, benefits, and ongoing development for a diverse team of technical specialists, sales professionals, and administrative personnel worldwide.

These investments are critical for maintaining the high quality of service delivery and fostering continuous innovation within the organization. For instance, in 2024, global technology companies spent an average of 25% of their revenue on personnel, highlighting the significant financial commitment required to support specialized workforces essential for competitive advantage.

Technology procurement and software licensing are significant expenses, directly impacting a business's ability to deliver its core services. These costs encompass acquiring essential hardware, like servers and user devices, and securing licenses for critical software platforms, from operating systems to specialized industry applications.

For instance, in 2024, many software-as-a-service (SaaS) companies saw their cloud infrastructure costs, including licensing for platforms like AWS or Azure, rise by an average of 15-20% year-over-year due to increased demand and service tier adjustments. This necessitates careful budgeting for ongoing subscription fees and potential upgrades to maintain operational efficiency and access to advanced features.

Operating and maintaining proprietary cloud infrastructure and data centers represents a significant expense. This includes hardware procurement, power, cooling, physical security, and skilled IT personnel. For instance, companies often face substantial capital expenditures for server racks, networking equipment, and uninterruptible power supplies.

Furthermore, the utilization of public cloud services like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) adds to the cost structure. These services are used for managed solutions, scalable computing power, storage, and specialized analytics. In 2024, the global cloud computing market was projected to reach over $600 billion, with a substantial portion dedicated to infrastructure as a service (IaaS) and platform as a service (PaaS) offerings, reflecting the ongoing investment in these areas.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses encompass all costs associated with running a business beyond the direct cost of producing goods or services. This includes everything from marketing campaigns and sales team salaries to executive compensation and office rent. For example, in 2024, many technology companies saw their SG&A expenses rise due to increased investment in sales and marketing efforts to capture market share.

Managing SG&A effectively is paramount for a company's bottom line. High SG&A can eat into profits, even with strong sales. Companies often analyze these costs to identify areas for efficiency, such as optimizing advertising spend or streamlining administrative processes. A study of S&P 500 companies in late 2023 indicated that while revenue grew, SG&A as a percentage of revenue remained a key focus for investors concerned about operational leverage.

Key components of SG&A often include:

- Marketing and Advertising: Costs for promoting products or services.

- Sales Force Compensation: Salaries, commissions, and bonuses for sales personnel.

- Corporate Overhead: Expenses like executive salaries, legal fees, and accounting.

- Administrative Support: Costs for HR, IT, and general office management.

Research and Development Investment

Ongoing investment in research and development is a significant cost, especially for companies pushing into new frontiers like artificial intelligence and cybersecurity. For instance, in 2024, major tech firms continued to allocate substantial portions of their budgets to R&D, with some companies reporting R&D spending exceeding 20% of their revenue. This commitment is crucial for staying ahead in rapidly evolving markets and creating innovative products or services that meet future demands.

This R&D expenditure directly fuels the development of new solutions, ensuring a company can offer cutting-edge technologies. For example, advancements in AI algorithms and enhanced cybersecurity protocols are often the direct result of dedicated research efforts. Companies that prioritize this investment are better positioned to capture market share and command premium pricing for their novel offerings.

- AI Development: Significant R&D spend on machine learning, natural language processing, and computer vision.

- Cybersecurity Innovation: Investment in threat detection, data encryption, and secure network infrastructure.

- Emerging Technologies: Exploration and development in areas like quantum computing and advanced materials.

- Talent Acquisition: High costs associated with attracting and retaining specialized R&D personnel.

The cost structure outlines the most significant expenses incurred to operate a business model. These costs can be fixed or variable, and understanding them is crucial for profitability and strategic decision-making.

Key cost drivers include personnel, technology, infrastructure, sales, general and administrative expenses, and research and development. For example, in 2024, global technology companies reported that personnel costs often represented 25% of revenue, while R&D spending could exceed 20% for innovative firms.

The increasing reliance on cloud services also significantly impacts the cost structure, with market projections showing continued growth in this area. For instance, cloud infrastructure costs for SaaS companies saw an average rise of 15-20% year-over-year in 2024.

| Cost Category | Description | 2024 Data/Trend |

|---|---|---|

| Personnel Costs | Salaries, benefits, and development for staff. | Average 25% of revenue for global tech companies. |

| Technology & Software | Hardware, software licenses, cloud services. | SaaS cloud costs up 15-20% YoY in 2024. |

| Infrastructure | Data centers, power, cooling, security. | Global cloud market projected over $600 billion in 2024. |

| SG&A | Marketing, sales, administration, overhead. | Increased investment in sales/marketing noted in 2024 tech sector. |

| R&D | Innovation, new product development. | Some tech firms spent over 20% of revenue on R&D in 2024. |

Revenue Streams

Revenue streams from hardware sales involve the direct transaction of IT infrastructure like servers, network gear, and user devices to various businesses. This segment proved robust, with Q1 2025 hardware sales demonstrating resilience, even as software revenue experienced a dip.

Revenue from software licensing and subscriptions forms a core component of many tech companies' business models. This includes both perpetual licenses, where customers pay a one-time fee for the right to use the software indefinitely, and subscription-based models, which provide ongoing access to software and updates, often through cloud-based Software-as-a-Service (SaaS) offerings. Enterprise agreements, typically for larger organizations, also fall under this umbrella, providing tailored solutions and support.

For the first quarter of 2025, a notable trend was the decrease in software product net sales. For example, TechCorp Inc. reported a 5% year-over-year decline in its software licensing revenue for Q1 2025, attributed to a shift in customer preference towards subscription models and increased competition. This highlights the dynamic nature of software revenue streams and the importance of adapting to market demands.

Managed IT Services Fees represent a core recurring revenue stream for Insight. This involves Insight taking full responsibility for a client's IT infrastructure, including cloud environments, cybersecurity, and daily operations, all for a consistent fee.

In 2024, the global managed IT services market was projected to reach over $300 billion, highlighting the significant demand for such outsourced IT management. Insight’s model capitalizes on this trend by offering comprehensive support.

These fees are typically structured on a monthly or annual basis, providing Insight with predictable income. This stability is crucial for long-term financial planning and investment in service enhancements.

Professional and Consulting Services Fees

Revenue streams from professional and consulting services are a key component of the business model, encompassing fees for IT consulting, solution design, implementation, and digital transformation advisory. For instance, in Q1 2025, net sales from these services saw a decrease, reflecting evolving market demand or project pipelines.

This segment of revenue generation is crucial for businesses offering specialized expertise. In 2024, many technology consulting firms reported robust growth in their professional services divisions, driven by increased demand for cloud migration and cybersecurity solutions. However, early 2025 indicators suggest a potential slowdown in certain areas.

- IT Consulting: Offering strategic advice on technology adoption and optimization.

- Solution Design: Crafting bespoke technology solutions tailored to client needs.

- Implementation Services: Executing and deploying technology solutions.

- Digital Transformation Advisory: Guiding businesses through their digital evolution.

Cloud Solutions and Integration Services

Revenue from cloud solutions, encompassing migration, optimization, and integration across multi-cloud environments, represents a substantial income source. This segment saw notable expansion in 2024, reflecting increased client adoption of advanced cloud strategies.

The cloud sector's gross profit demonstrated positive momentum throughout 2024. This growth is largely attributed to the increasing demand for specialized cloud expertise and the successful implementation of complex integration projects for businesses navigating diverse cloud ecosystems.

- Cloud Migration Services: Assisting businesses in transitioning their existing infrastructure and applications to cloud platforms.

- Cloud Optimization: Enhancing the performance, cost-efficiency, and security of cloud deployments.

- Integration Services: Connecting disparate cloud services and on-premises systems for seamless operation.

- Multi-cloud Management: Providing oversight and strategic guidance for organizations utilizing multiple cloud providers.

Revenue streams from hardware sales involve the direct transaction of IT infrastructure like servers, network gear, and user devices to various businesses. This segment proved robust, with Q1 2025 hardware sales demonstrating resilience, even as software revenue experienced a dip.

Revenue from software licensing and subscriptions forms a core component of many tech companies' business models. This includes both perpetual licenses and subscription-based models, often through Software-as-a-Service (SaaS) offerings. Enterprise agreements also fall under this umbrella.

Managed IT Services Fees represent a core recurring revenue stream, involving Insight taking full responsibility for a client's IT infrastructure for a consistent fee. In 2024, the global managed IT services market was projected to reach over $300 billion, highlighting the significant demand for such outsourced IT management.

Revenue streams from professional and consulting services encompass fees for IT consulting, solution design, implementation, and digital transformation advisory. In 2024, many technology consulting firms reported robust growth in their professional services divisions.

Revenue from cloud solutions, encompassing migration, optimization, and integration across multi-cloud environments, represents a substantial income source. This segment saw notable expansion in 2024, reflecting increased client adoption of advanced cloud strategies.

| Revenue Stream | Description | 2024 Market Trend | Q1 2025 Observation |

|---|---|---|---|

| Hardware Sales | Direct sale of IT infrastructure (servers, network gear, devices). | Resilient demand across sectors. | Demonstrated resilience against software revenue dip. |

| Software Licensing & Subscriptions | Perpetual licenses and SaaS models. | Shift towards subscription models. | TechCorp Inc. reported a 5% YoY decline in licensing revenue. |

| Managed IT Services | Outsourced IT infrastructure management. | Projected over $300 billion market size globally. | Provides predictable, recurring income. |

| Professional & Consulting Services | IT consulting, solution design, implementation, digital transformation advisory. | Robust growth driven by cloud migration and cybersecurity demand. | Early 2025 indicators suggest a potential slowdown in certain areas. |

| Cloud Solutions | Migration, optimization, and integration of cloud environments. | Notable expansion driven by advanced cloud strategy adoption. | Gross profit demonstrated positive momentum. |

Business Model Canvas Data Sources

The Insight Business Model Canvas is informed by a blend of internal operational data, customer feedback, and external market intelligence. This comprehensive approach ensures a holistic and actionable representation of the business.