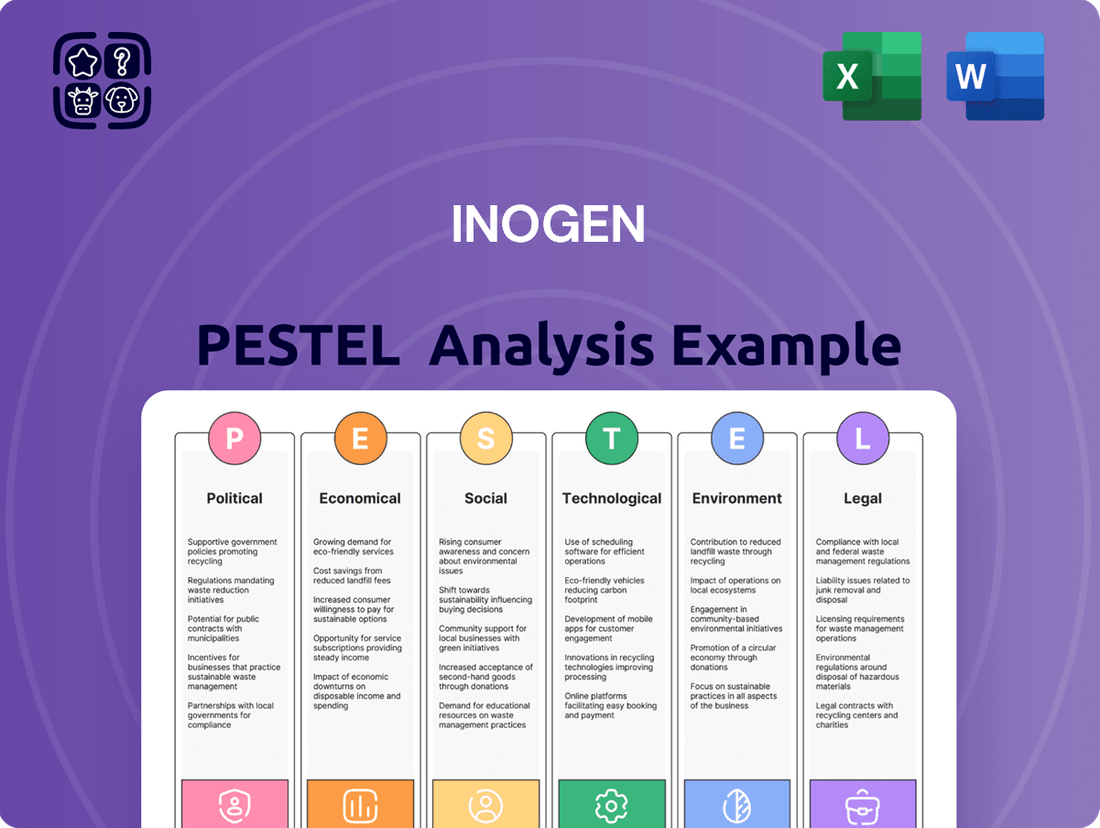

Inogen PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inogen Bundle

Uncover the critical external forces shaping Inogen's trajectory with our comprehensive PESTLE analysis. From evolving healthcare policies to technological advancements and demographic shifts, understand the landscape that will define the company's future. This detailed report equips you with the strategic foresight needed to navigate opportunities and mitigate risks. Download the full version now to gain actionable intelligence that drives informed decision-making and secures your competitive advantage.

Political factors

Government healthcare policies, especially those concerning chronic respiratory conditions like COPD, are a critical driver for Inogen. Changes in Medicare reimbursement rates for portable oxygen concentrators, a key product for Inogen, directly affect the affordability and adoption of their devices. For instance, in 2024, Medicare continues to be a primary payer for DME, and any shifts in coverage or co-pays can significantly alter Inogen's revenue streams.

Furthermore, legislative pushes towards home-based care over institutional settings often benefit companies like Inogen that provide solutions for at-home patient management. Policies that encourage or mandate remote patient monitoring and telehealth could also create tailwinds for Inogen's connected devices, expanding their market reach and service offerings in 2024 and beyond.

Government and private payers' rules for portable oxygen concentrator coverage and reimbursement are crucial for Inogen. Favorable reimbursement codes and adequate payment rates, such as Medicare's Durable Medical Equipment (DME) fee schedule, directly impact patient affordability and Inogen's market access. For instance, changes in reimbursement rates for HCPCS codes like E1390 can significantly influence sales volumes.

Global trade policies and tariffs significantly influence Inogen's operations. For instance, the U.S. International Trade Commission reported that tariffs on imported medical devices, though not directly targeting Inogen's core products in early 2024, can indirectly impact component costs if suppliers face increased import duties on their own raw materials. Changes in import/export regulations in key markets like the European Union or Australia can affect Inogen's ability to competitively price its portable oxygen concentrators.

Trade disputes, such as those observed between major economic blocs in 2023 and continuing into 2024, create uncertainty. These disputes can lead to sudden imposition or alteration of tariffs, directly impacting the cost of components sourced internationally or the final price of Inogen devices sold in affected countries. Successfully navigating these shifting trade landscapes is crucial for maintaining efficient global supply chains and market competitiveness.

Medical Device Regulation and Approval Processes

The political will and efficiency of regulatory bodies, like the US Food and Drug Administration (FDA), directly influence Inogen's product development and market entry. A swift yet thorough approval process is crucial for Inogen to bring innovative respiratory solutions to market efficiently. For example, the FDA's 2024 initiatives aimed at modernizing medical device approvals could significantly impact Inogen's pipeline.

Changes in political sentiment, whether towards stricter or more lenient oversight, can drastically alter the landscape for medical device manufacturers like Inogen. The balance between ensuring patient safety and fostering innovation is a constant political consideration. In 2025, continued debate around healthcare access and affordability may shape regulatory priorities for devices like Inogen's portable oxygen concentrators.

- FDA Approval Times: Inogen's success hinges on the FDA's ability to efficiently review and approve new devices, potentially shortening the time to market.

- Regulatory Landscape Shifts: Political decisions to tighten or loosen regulations, particularly concerning home medical equipment, could impact Inogen's operational costs and market access.

- Healthcare Policy Influence: Broader healthcare policies enacted by governments can indirectly affect demand for Inogen's products and the reimbursement environment.

Healthcare Reform Initiatives

Broader healthcare reform efforts, particularly those focused on controlling costs and improving patient access, present a dynamic landscape for companies like Inogen. For instance, ongoing discussions and potential legislative changes in the United States regarding Medicare reimbursement rates for durable medical equipment (DME) can directly impact Inogen's revenue streams. The Biden-Harris administration's focus on lowering healthcare costs, as seen in efforts to negotiate prescription drug prices, signals a broader trend that could extend to other healthcare services and equipment.

Policies encouraging value-based care models, where providers are reimbursed based on patient outcomes rather than the volume of services, could create opportunities for Inogen. Such shifts might favor the adoption of portable oxygen concentrators (POCs) that enable greater patient mobility and potentially reduce hospital readmissions. In 2024, the Centers for Medicare & Medicaid Services (CMS) continues to refine its payment policies, with a sustained emphasis on efficiency and patient-centered care, aligning with the benefits offered by advanced POC technology.

Understanding the trajectory of these reforms is crucial for Inogen's strategic planning. For example, initiatives promoting telehealth and remote patient monitoring could be leveraged to enhance the service and support for their POC devices. The increasing adoption of integrated health networks, aiming to provide more coordinated care, may also create avenues for Inogen to partner with larger healthcare systems that prioritize efficient and home-based respiratory solutions.

Key considerations for Inogen in light of healthcare reform include:

- Potential impact of Medicare reimbursement rate adjustments on revenue.

- Opportunities arising from value-based care models that reward patient outcomes and efficiency.

- Alignment of Inogen's technology with telehealth and remote patient monitoring trends.

- Strategic partnerships with integrated health networks prioritizing home-based respiratory care.

Government healthcare policies, particularly those affecting Medicare reimbursement for durable medical equipment (DME), directly impact Inogen’s revenue. Changes in coverage or payment rates for portable oxygen concentrators (POCs) in 2024 and projected for 2025 are critical for market access and affordability.

Legislative support for home-based care and telehealth initiatives can create tailwinds for Inogen's connected devices, expanding their reach. For instance, the FDA's ongoing efforts to modernize medical device approvals in 2024 could accelerate Inogen's product pipeline and market entry.

Global trade policies and tariffs introduce uncertainty, potentially affecting component costs and pricing for Inogen's products in international markets throughout 2024 and into 2025. Navigating these shifts is vital for maintaining competitive supply chains.

| Factor | Impact on Inogen | Data/Trend (2024-2025) |

| Medicare Reimbursement | Directly affects revenue and patient affordability of POCs. | Continued focus on DME fee schedules; potential for adjustments based on value-based care initiatives. |

| Healthcare Reform | Drives demand for home-based care solutions and telehealth integration. | CMS policies emphasizing efficiency and patient-centered care align with Inogen's offerings. |

| Regulatory Approvals | Influences speed of new product launches. | FDA modernization efforts may shorten review times for innovative respiratory devices. |

| Trade Policies | Impacts supply chain costs and international pricing. | Ongoing global trade uncertainties and potential tariff adjustments affect global operations. |

What is included in the product

This Inogen PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key threats and opportunities derived from current market and regulatory dynamics.

A readily digestible PESTLE analysis for Inogen, offering clear insights into external factors that can be leveraged to mitigate operational risks and identify new market opportunities.

Economic factors

Global healthcare spending is projected to reach $10.05 trillion by 2024, according to Deloitte, directly impacting the market for respiratory care devices like those offered by Inogen. As national healthcare budgets face increasing strain, there's a noticeable shift towards more cost-effective treatment modalities. This trend favors home oxygen therapy, offering a viable alternative to more expensive inpatient respiratory care.

The increasing prevalence of chronic respiratory diseases, such as COPD, fuels the demand for long-term management solutions. Inogen's business model is well-positioned to capitalize on this, as greater investment in chronic disease management translates into expanded opportunities for their portable oxygen concentrators.

Disposable income significantly influences the purchasing power for Inogen's products, even with insurance coverage. Patient co-pays and out-of-pocket expenses remain a crucial factor for consumers, particularly seniors who often rely on fixed incomes.

The general economic climate and the disposable income of Inogen's primary demographic, typically older adults, directly impact their capacity and inclination to afford premium portable oxygen solutions. Economic slowdowns can lead to reduced discretionary spending on non-essential, albeit beneficial, health equipment.

For instance, in the United States, the median income for individuals aged 65 and over was approximately $32,194 in 2022, according to the U.S. Census Bureau. This figure highlights the potential sensitivity of this demographic to out-of-pocket healthcare costs, including co-pays for devices like Inogen's.

Inflationary pressures significantly impact Inogen's operational expenses, directly affecting the cost of essential manufacturing inputs like semiconductors, plastics, and specialized components. For instance, the Consumer Price Index (CPI) in the US, a key inflation indicator, saw an increase, potentially raising Inogen’s raw material procurement costs.

Escalating supply chain expenses, driven by factors such as increased shipping rates and global logistics disruptions, can put considerable pressure on Inogen's profit margins. If these rising costs cannot be effectively absorbed or passed on to customers through price adjustments, it could lead to a reduction in profitability.

The stability of the global economy and fluctuations in commodity prices are critical. For example, a surge in energy prices, a key commodity, directly inflates transportation and manufacturing costs throughout Inogen's supply chain, impacting their overall cost structure and competitiveness.

Interest Rates and Access to Capital

Interest rate fluctuations directly impact Inogen's financial flexibility. For instance, if the Federal Reserve continues its hawkish stance into 2024 and 2025, Inogen might face increased borrowing costs for essential activities like expanding manufacturing capacity or funding new product development. This could potentially slow down their pace of innovation and market expansion.

Access to capital at favorable rates is a cornerstone for Inogen's sustained growth. In the current economic climate, with inflation concerns lingering, companies like Inogen need to secure affordable financing to invest in research and development, crucial for maintaining their competitive edge in the respiratory care market. The ability to access capital will be a key determinant of their future success.

- Interest Rate Impact: Changes in benchmark interest rates, such as the Federal Funds Rate, can directly influence Inogen's cost of debt. For example, if rates rise, Inogen's interest expense on existing variable-rate debt and new borrowings will likely increase.

- Capital Access for Growth: Inogen's strategic plans, including potential acquisitions or significant R&D investments, are often contingent on the availability of capital. In periods of higher interest rates, the cost of equity financing may also rise, making overall capital acquisition more challenging.

- Economic Conditions: As of mid-2024, many central banks are navigating a complex economic landscape with persistent inflation and geopolitical uncertainties. This environment often leads to higher borrowing costs, impacting Inogen's ability to finance its operations and growth initiatives cost-effectively.

- Financing Strategy: Inogen's management will need to carefully evaluate its financing strategies, potentially exploring a mix of debt and equity, while considering the prevailing interest rate environment to ensure optimal capital structure and minimize financial risk.

Competitive Pricing Environment

The portable oxygen concentrator market is highly competitive, with numerous players vying for market share. This intense rivalry often translates into significant pricing pressures, forcing companies like Inogen to carefully consider their pricing strategies. Maintaining a balance between its premium product positioning and the need to remain competitive is crucial for Inogen to retain its customer base and attract new ones.

Factors influencing competitor costs, such as advancements in manufacturing technology or changes in raw material prices, directly impact their ability to offer competitive pricing. For instance, if a competitor gains access to more affordable components or streamlines production, they might be able to lower their prices, putting pressure on Inogen's margins. In 2023, the global portable oxygen concentrator market was valued at approximately $3.5 billion, with projections suggesting continued growth, further intensifying the competitive landscape.

- Intense Competition: The portable oxygen concentrator market features a significant number of manufacturers, leading to price sensitivity among consumers.

- Pricing Dilemma: Inogen faces the challenge of justifying its premium pricing while remaining competitive against lower-cost alternatives.

- Cost Influences: Fluctuations in manufacturing costs and supply chain dynamics among competitors can directly affect market pricing structures.

- Market Value: The global portable oxygen concentrator market's estimated $3.5 billion valuation in 2023 highlights its size and attractiveness to competitors.

Global healthcare spending is projected to reach $10.05 trillion by 2024, directly impacting the market for respiratory care devices like Inogen's. Economic downturns and reduced disposable income, especially for seniors with fixed incomes, can limit out-of-pocket spending on health equipment. Inflationary pressures on raw materials and supply chain costs also impact Inogen's operational expenses and profit margins.

Preview the Actual Deliverable

Inogen PESTLE Analysis

The preview you see here is the exact Inogen PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Inogen, providing valuable insights for strategic planning.

You'll gain a thorough understanding of the external forces shaping Inogen's market and operations.

The content and structure shown in the preview is the same document you’ll download after payment, offering immediate access to actionable intelligence.

Sociological factors

The world's population is getting older, and this is a major factor for companies like Inogen. By 2050, it's estimated that nearly 17% of the global population will be over 65, a significant jump from around 10% in 2022. This aging trend directly benefits Inogen because older individuals are more prone to respiratory issues such as Chronic Obstructive Pulmonary Disease (COPD).

As more people age, the need for oxygen therapy and portable oxygen concentrators (POCs) is expected to rise consistently. For instance, the global COPD market alone was valued at approximately $32 billion in 2023 and is projected to grow. This demographic shift creates a steadily expanding customer base for Inogen's products.

The escalating rates of chronic respiratory diseases worldwide are a significant sociological driver for Inogen. Factors like increased air pollution, a persistent smoking culture, and evolving lifestyle choices are contributing to a larger patient pool experiencing conditions such as COPD and asthma. This trend directly fuels the demand for portable oxygen solutions.

Globally, the prevalence of respiratory diseases continues to be a major public health concern. For instance, the World Health Organization reported in 2022 that lower respiratory infections were a leading cause of death in children under five. While this statistic highlights a broader issue, the underlying environmental and behavioral factors also drive adult respiratory conditions, underpinning the market for Inogen's products.

Furthermore, public health campaigns aimed at raising awareness and managing chronic respiratory conditions indirectly benefit Inogen. As governments and health organizations invest in disease management programs and patient education, the visibility and acceptance of home oxygen therapy, including portable concentrators, increase. This creates a more receptive market environment for Inogen's offerings, particularly as the company aims to expand its reach in key markets.

Modern patients, particularly those needing oxygen therapy, are placing a higher value on their independence and the ability to live an active life. This shift in perspective is a significant sociological factor influencing healthcare choices.

Inogen's portable oxygen concentrators directly address this societal trend. By providing lightweight and mobile solutions, they offer a stark contrast to the cumbersome nature of traditional oxygen tanks, enabling users to maintain their desired lifestyles. For instance, Inogen's user base often reports increased participation in activities like travel and social gatherings, directly attributable to the freedom their devices afford.

This enhanced mobility not only improves patient adherence to prescribed oxygen therapy but also significantly boosts overall satisfaction and quality of life. In 2024, Inogen reported that a substantial majority of their users felt their quality of life improved with the use of their portable oxygen concentrators, with many citing increased freedom and reduced dependence on stationary oxygen sources.

Awareness and Acceptance of Home Healthcare

Societal trends are increasingly favoring home-based healthcare solutions, a significant factor for companies like Inogen. This preference stems from patients desiring greater comfort and autonomy, coupled with the cost-effectiveness of managing care outside of traditional hospital settings. Technological advancements are also playing a crucial role, making it more feasible and safe for individuals to receive sophisticated medical treatment in their own homes.

As awareness and acceptance of home healthcare grow, so does the demand for portable oxygen concentrators (POCs) and similar devices. This shift directly benefits Inogen, as patients and their caregivers become more comfortable managing complex medical needs at home. This not only improves patient quality of life but also alleviates pressure on hospital resources. For instance, the home healthcare market in the US was valued at approximately $340 billion in 2023 and is projected to grow steadily, indicating a strong and expanding customer base for Inogen's products.

- Growing patient preference for home care: Surveys consistently show a majority of patients prefer receiving care in familiar surroundings.

- Cost-effectiveness of home healthcare: Home care can be up to 30% less expensive than facility-based care for certain conditions.

- Technological advancements enabling home care: Innovations in remote monitoring and medical devices have made complex home treatments viable.

- Reduced hospital burden: Successful home care management can lead to fewer hospital readmissions, saving healthcare systems billions annually.

Health Literacy and Patient Education

The ability of individuals to understand and act on health information, known as health literacy, directly impacts how readily they adopt and correctly use medical devices like Inogen's portable oxygen concentrators. In the US, for example, an estimated 77 million adults have below basic health literacy, meaning they may struggle to grasp complex instructions for device operation or understand the full benefits of their therapy. This highlights the critical need for clear, accessible patient education materials and support. In 2024, reports indicated a growing emphasis on patient-centric care models, which often include enhanced educational components to improve adherence and outcomes.

Effective patient education, delivered through various channels including digital platforms and in-person consultations, is key to driving demand for devices that improve quality of life for those with chronic respiratory conditions. As of mid-2025, many healthcare providers are expanding their telehealth services, incorporating device training and follow-up into these virtual interactions, aiming to reach a wider patient base. Increased access to reliable online health resources also empowers patients to research their conditions and treatment options, potentially leading them to seek out advanced solutions like Inogen's products.

Societal views on chronic illness also shape the market for respiratory support devices. A more open dialogue and reduced stigma surrounding conditions like COPD can encourage individuals to seek help and embrace technologies that enable them to live more active lives. By 2024, public awareness campaigns focused on lung health and the impact of air quality continued to grow, fostering a more supportive environment for patients managing respiratory diseases.

- Health Literacy Impact: Approximately 77 million US adults possess below-basic health literacy, potentially hindering understanding and use of complex medical devices.

- Patient Education Emphasis: 2024 saw a continued push towards patient-centric care, with expanded educational initiatives for medical device users.

- Telehealth Integration: By mid-2025, many healthcare systems were integrating device training into telehealth services to broaden patient access and support.

- Societal Perceptions: Growing public awareness and reduced stigma surrounding chronic respiratory illnesses in 2024 encouraged more individuals to seek advanced treatment options.

The increasing value placed on personal independence and an active lifestyle directly benefits Inogen. Their portable oxygen concentrators enable users to travel and socialize more freely, a key factor in patient satisfaction. In 2024, a significant majority of Inogen users reported improved quality of life due to increased freedom and reduced reliance on stationary oxygen.

Technological factors

Improvements in battery efficiency, lifespan, and weight are absolutely critical for companies like Inogen, which specialize in portable oxygen concentrators. These advancements directly impact how long a patient can use their device away from a power source, offering more freedom and convenience. For instance, by 2025, battery technology is projected to see further gains, potentially extending the operational time of portable concentrators by an additional 15-20% compared to current models.

Longer battery life is a significant selling point, making Inogen's products more appealing to individuals who require continuous oxygen therapy but wish to maintain an active lifestyle. Consider that by mid-2024, many leading portable oxygen concentrators offer battery lives ranging from 4 to 8 hours, and ongoing research aims to push this towards 10-12 hours on a single charge.

Continuous innovation in battery technology provides a crucial competitive edge in the medical device market. Companies that can offer lighter, more powerful, and longer-lasting batteries will naturally attract more customers. The global battery market itself is expanding rapidly, with significant investment in research and development, suggesting a promising future for these essential components in devices like Inogen's.

Ongoing technological advancements are continuously driving the miniaturization and weight reduction of portable oxygen concentrators. This evolution is critical for Inogen, as it directly supports their core value proposition of offering enhanced mobility and discreet therapy options to patients. Innovations in materials science and advanced design engineering are central to achieving these improvements without sacrificing the quality or volume of oxygen delivered.

For instance, Inogen's latest models, such as the Inogen One G5, weigh around 4.7 pounds, a significant reduction compared to earlier generations of oxygen therapy equipment. This focus on reducing the physical burden for users directly translates to a better quality of life and greater independence for individuals requiring supplemental oxygen, a key differentiator in the competitive home healthcare market.

The integration of smart features and enhanced connectivity is a significant technological driver for companies like Inogen. These advancements, including remote monitoring capabilities and smartphone app integration, directly address patient adherence and allow for proactive maintenance, potentially reducing downtime. For instance, the growing adoption of telehealth, which saw a substantial surge, underscores the demand for connected health solutions. This trend is expected to continue, with projections indicating further growth in the digital health market through 2025, driven by the desire for more convenient and efficient patient care.

Manufacturing Automation and Efficiency

Technological advancements in manufacturing processes, particularly automation and robotics, are significantly boosting production efficiency for companies like Inogen. This trend allows for reduced operational costs and a noticeable improvement in product quality, which are critical for staying competitive. For instance, by integrating advanced robotics into assembly lines, Inogen can achieve faster production cycles and more consistent output, directly impacting its ability to meet growing market demand.

Streamlined production lines, enabled by these technologies, empower Inogen to scale its operations more effectively. This agility is vital for responding quickly to fluctuations in market demand, ensuring that the company can capitalize on growth opportunities. Inogen’s commitment to investing in advanced manufacturing techniques is therefore not just about efficiency, but also about strategic responsiveness in a dynamic market.

Key technological factors impacting Inogen's manufacturing include:

- Increased Automation: The adoption of AI-powered robotics and automated assembly systems is projected to further reduce labor costs and enhance precision in manufacturing. For example, the global industrial robotics market was valued at over $50 billion in 2023 and is expected to see continued growth, benefiting Inogen's production capabilities.

- Data Analytics in Manufacturing: Advanced analytics and IoT integration allow for real-time monitoring of production processes, enabling predictive maintenance and process optimization. This can lead to a reduction in downtime and waste, potentially improving Inogen's overall equipment effectiveness (OEE) by 5-10%.

- Advanced Materials and Processes: Innovations in materials science and manufacturing techniques, such as additive manufacturing (3D printing), can lead to lighter, more durable components and faster prototyping. This could streamline Inogen's product development cycles and improve the performance of its portable oxygen concentrators.

Development of Alternative Oxygen Delivery Methods

While Inogen is a leader in portable oxygen concentrators (POCs), keeping an eye on groundbreaking advancements in oxygen delivery is crucial. Emerging technologies, such as new oxygen-generating materials or innovative drug delivery methods that integrate with oxygen therapy, could significantly alter the competitive landscape. For instance, research into solid-state oxygen generators, moving away from current molecular sieve technology, could offer greater portability and efficiency.

The potential for disruptive technologies means Inogen must remain agile. Monitoring the progress of these alternative methods is vital for maintaining market leadership and adapting its long-term strategic planning. A breakthrough in this area could redefine patient care and create new market opportunities or challenges.

- Monitoring Advanced Materials: Tracking the development of novel materials capable of efficiently generating or storing oxygen, potentially reducing reliance on current PSA technology.

- Novel Drug Delivery Integration: Observing innovations that combine oxygen delivery with targeted drug administration for respiratory conditions.

- Disruptive Potential: Recognizing that significant shifts in oxygen delivery technology could impact the demand for traditional POCs.

Technological advancements in battery technology are crucial for Inogen, directly impacting the portability and usability of its devices. By 2025, battery efficiency is expected to improve, potentially extending portable concentrator operation by 15-20%, offering users greater freedom. Current models, like the Inogen One G5, already benefit from lighter designs, weighing around 4.7 pounds, enhancing patient mobility.

Legal factors

Inogen must strictly adhere to regulations from bodies like the U.S. Food and Drug Administration (FDA) and international equivalents. This involves extensive testing, clinical trials, and obtaining approvals for new portable oxygen concentrators, alongside continuous compliance for their existing product line. For instance, the FDA's 2024 focus continues to be on improving premarket review efficiency and postmarket surveillance.

Failure to meet these stringent requirements can result in severe consequences, including substantial fines and costly product recalls. In 2023, medical device manufacturers faced an increasing number of FDA enforcement actions, highlighting the critical importance of robust compliance programs. Inogen's commitment to quality assurance directly impacts its market access and reputation.

Inogen's operations are significantly shaped by patient data privacy laws, notably HIPAA in the United States and GDPR in Europe. These regulations mandate strict protection of sensitive patient health information collected and transmitted by Inogen's portable oxygen concentrators. Failure to comply can result in substantial fines, with GDPR penalties reaching up to 4% of annual global turnover or €20 million, whichever is higher, as seen in various enforcement actions in 2023 and early 2024.

Maintaining patient trust hinges on robust data security and transparent privacy practices. Inogen must invest in advanced cybersecurity measures to safeguard patient data from breaches, a growing concern given the increasing sophistication of cyber threats. The company's adherence to these legal frameworks directly impacts its reputation and ability to operate in key markets, with ongoing regulatory scrutiny expected throughout 2024 and 2025.

Inogen operates under stringent product liability and safety standards, crucial for consumer protection and minimizing legal exposure. Failure to adhere to these regulations can lead to significant financial penalties and reputational damage. For instance, the U.S. Food and Drug Administration (FDA) actively monitors medical device manufacturers like Inogen, requiring adherence to quality system regulations (QSR) which encompass design controls, manufacturing processes, and post-market surveillance.

Maintaining rigorous quality control throughout the product lifecycle, from initial design to manufacturing and distribution, is paramount. This includes robust testing and validation to ensure devices meet all specified performance and safety benchmarks. Inogen's commitment to these standards helps prevent adverse events and potential lawsuits stemming from product defects or malfunctions.

The company must also engage in proactive post-market surveillance to identify and address any emerging safety concerns. This involves monitoring customer feedback, incident reports, and regulatory updates. A proactive approach to safety, exemplified by timely corrective actions, is essential to navigate the complex legal landscape governing medical devices.

Intellectual Property Rights and Patent Protection

Protecting Inogen's innovative portable oxygen concentrator technology, unique designs, and efficient manufacturing methods through patents and other intellectual property (IP) rights is fundamental to safeguarding its market position. This legal framework shields Inogen from competitors who might otherwise copy its advancements. For example, in 2023, Inogen actively managed its IP portfolio, a key element in its strategy to maintain technological leadership in the respiratory care sector.

Legal disputes concerning patent infringement represent a significant risk, potentially leading to substantial financial expenditures and diverting critical resources away from research and development. Such challenges can impact Inogen's ability to invest in new product lines and market expansion. The company's ongoing commitment to innovation necessitates a proactive approach to securing new patents, thereby reinforcing its competitive edge.

- Patent Portfolio Management: Inogen continuously invests in securing and defending its intellectual property, which includes a robust portfolio of patents covering its core oxygen delivery technology and device designs.

- Risk of Infringement Litigation: The company faces potential legal challenges related to patent infringement, which could result in significant legal costs and damage awards if unfavorable judgments are rendered.

- Innovation and New Patents: A key strategy involves ongoing innovation to develop next-generation products and securing new patents to protect these advancements, thereby maintaining a technological lead.

- Global IP Protection: Inogen seeks to protect its intellectual property rights across key global markets where it operates and sells its products, ensuring a consistent level of protection worldwide.

Healthcare Fraud and Abuse Laws

Inogen must meticulously adhere to healthcare fraud and abuse legislation, such as the Anti-Kickback Statute and Stark Law. These laws govern how Inogen interacts with healthcare providers, distributors, and manages reimbursement practices. Failure to comply can lead to significant financial penalties and reputational damage, as seen in past settlements within the healthcare industry, where companies have paid millions to resolve allegations of improper inducements or referrals.

Maintaining robust internal compliance programs is therefore critical for Inogen to mitigate these risks. These programs should specifically address potential violations related to physician self-referral, kickbacks for business referrals, and accurate billing for services. The U.S. Department of Justice and the Office of Inspector General actively pursue enforcement actions against companies demonstrating a lack of due diligence in these areas.

- Anti-Kickback Statute (AKS) Violations: Inogen must ensure no remuneration is offered or paid, directly or indirectly, overtly or covertly, in cash or in kind, to induce or reward referrals of federal healthcare program business.

- Stark Law Compliance: Prohibitions on physician self-referral for designated health services are paramount, requiring careful structuring of relationships with physicians.

- Civil Monetary Penalties (CMPs): Violations can result in substantial CMPs, with penalties often exceeding $100,000 per incident, plus treble damages.

- Reputational and Operational Impact: Beyond financial penalties, legal entanglements can severely damage Inogen's brand and disrupt its core business operations.

Inogen's legal landscape is dominated by stringent FDA regulations for medical devices, requiring rigorous testing and approvals for its portable oxygen concentrators. In 2024, the FDA continued its focus on streamlining premarket reviews and enhancing postmarket surveillance, impacting Inogen's product lifecycle management. Non-compliance can lead to significant fines and recalls, as seen with increased FDA enforcement actions against medical device manufacturers in 2023.

Patient data privacy is a critical legal consideration, governed by HIPAA in the US and GDPR in Europe. Inogen must ensure robust protection of sensitive health information, with GDPR penalties reaching up to 4% of global annual turnover or €20 million for breaches. Maintaining patient trust through strong data security and transparent practices is essential, especially given the escalating sophistication of cyber threats in 2024-2025.

Intellectual property (IP) protection is vital for Inogen's competitive edge, safeguarding its patented technologies and designs. In 2023, Inogen actively managed its IP portfolio to maintain technological leadership. However, the company faces the risk of patent infringement litigation, which can incur substantial legal costs and divert resources from R&D, underscoring the need for continuous innovation and patent acquisition.

Healthcare fraud and abuse laws, including the Anti-Kickback Statute and Stark Law, govern Inogen's interactions with healthcare providers and reimbursement practices. Violations can result in severe financial penalties and reputational damage, necessitating strong internal compliance programs to prevent improper inducements or referrals. The US Department of Justice and OIG actively pursue enforcement in this area.

Environmental factors

As environmental accountability becomes a major focus, Inogen faces growing pressure to implement sustainable manufacturing. This means actively reducing waste, cutting down on energy use in its production plants, and making sure resources are used as efficiently as possible. For example, by 2024, many companies in the medical device sector are aiming to cut manufacturing waste by 15% compared to 2022 levels.

Adopting greener production techniques isn't just about compliance; it can significantly boost Inogen's reputation. Consumers and business partners increasingly favor companies that demonstrate a commitment to environmental stewardship. A report from 2023 indicated that 68% of consumers consider a company's environmental impact when making purchasing decisions.

Managing the disposal and recycling of portable oxygen concentrators like those produced by Inogen presents a significant environmental hurdle, particularly with the increasing volume of electronic medical devices. Inogen must actively consider the entire product lifecycle, focusing on responsible end-of-life management and developing robust recycling programs for critical components.

Growing regulatory pressures worldwide are pushing for extended producer responsibility (EPR), meaning manufacturers are held accountable for their products even after sale. For instance, the European Union's WEEE Directive (Waste Electrical and Electronic Equipment) already mandates specific collection and recycling targets for electronic waste, a trend likely to expand globally.

Inogen's portable oxygen concentrators are designed with energy efficiency in mind, which directly impacts their environmental footprint. By consuming less power, both during use and while charging, these devices help conserve energy, aligning with global sustainability efforts. This focus on reduced energy consumption not only benefits users with extended battery life but also lessens the overall demand on power grids.

Supply Chain Environmental Footprint

Inogen is increasingly focused on minimizing the environmental impact of its entire supply chain, a critical aspect of its operations. This includes scrutinizing raw material sourcing, manufacturing processes, and the transportation of its respiratory devices. For instance, Inogen reported in its 2023 ESG report that it continued to work on improving energy efficiency within its manufacturing facilities, although specific percentage reductions for the 2024-2025 period are still being finalized. The company aims to partner with suppliers who demonstrate strong environmental stewardship, understanding that a truly sustainable footprint requires collaboration across the entire value chain.

Optimizing logistics to reduce emissions is another key initiative. This involves exploring more efficient shipping routes and potentially utilizing lower-emission transportation methods. While Inogen does not publicly disclose specific emission data for its supply chain logistics for 2024 or projected 2025, the industry trend, as highlighted by numerous reports in late 2023 and early 2024, is a significant push towards decarbonizing freight transport. Stakeholders are demanding greater transparency, pushing companies like Inogen to provide clearer insights into their environmental performance.

- Supplier Audits: Implementing more rigorous environmental audits for key suppliers to ensure alignment with Inogen's sustainability goals.

- Logistics Optimization: Investing in technology and partnerships to enhance route planning and reduce fuel consumption in product distribution.

- Packaging Reduction: Exploring innovative and sustainable packaging solutions to minimize waste and environmental impact during shipping.

- Emissions Monitoring: Developing more robust systems for tracking and reporting greenhouse gas emissions across the entire supply chain by 2025.

Regulatory Pressure for Eco-Friendly Products

Governments worldwide are tightening environmental regulations, compelling manufacturers to prioritize eco-friendly product development. This includes stricter mandates on material sourcing, energy efficiency benchmarks, and end-of-life product recycling. For instance, the European Union's Ecodesign Directive continues to evolve, impacting product lifecycles and material composition across various sectors.

Inogen must proactively adapt to these shifting environmental requirements to maintain regulatory compliance and secure ongoing market access. Failure to do so could result in penalties or restricted sales. The company's commitment to sustainable practices, such as exploring biodegradable materials or enhancing product energy efficiency, will be crucial in navigating this landscape.

- Increased regulatory scrutiny on product lifecycle impacts.

- Mandates for reduced carbon emissions and waste generation.

- Potential for new taxes or fees on non-compliant products.

- Growing consumer preference for sustainably produced goods.

Inogen faces increasing pressure to adopt sustainable manufacturing practices, focusing on waste reduction and energy efficiency, with industry targets aiming for a 15% decrease in manufacturing waste by 2024 compared to 2022. This commitment to environmental stewardship is also a key factor for consumers, as a 2023 report noted 68% of consumers consider a company's environmental impact in their purchasing decisions.

The responsible disposal and recycling of portable oxygen concentrators are significant environmental challenges, especially with the growing volume of medical devices. Inogen is addressing this by focusing on the entire product lifecycle and developing robust recycling programs for critical components, aligning with global trends towards extended producer responsibility.

Inogen's energy-efficient device design directly contributes to a reduced environmental footprint by conserving power during use and charging, supporting global sustainability goals. The company is also enhancing its supply chain's environmental performance, with ongoing efforts in energy efficiency and collaborations with environmentally conscious suppliers, as detailed in its 2023 ESG report.

Global environmental regulations are becoming more stringent, pushing manufacturers like Inogen towards eco-friendly product development, stricter material sourcing, and enhanced recycling mandates. Proactive adaptation to these evolving requirements is crucial for Inogen's regulatory compliance and continued market access.

| Environmental Factor | Impact on Inogen | Industry Trend/Data |

| Sustainable Manufacturing | Pressure to reduce waste and energy consumption in production. | Aim to cut manufacturing waste by 15% by 2024 (vs. 2022). |

| Consumer Preference | Need to demonstrate environmental commitment to attract customers. | 68% of consumers consider environmental impact in purchasing (2023). |

| Product Lifecycle Management | Challenge of responsible disposal and recycling of devices. | Focus on end-of-life management and component recycling. |

| Regulatory Compliance | Adapting to stricter global environmental regulations. | EU's WEEE Directive mandates e-waste collection and recycling targets. |

PESTLE Analysis Data Sources

Our Inogen PESTLE Analysis is built on a comprehensive review of publicly available data, including regulatory filings, market research reports, and industry publications. We also incorporate insights from economic indicators and technological advancement forecasts to ensure a thorough understanding of the external environment.