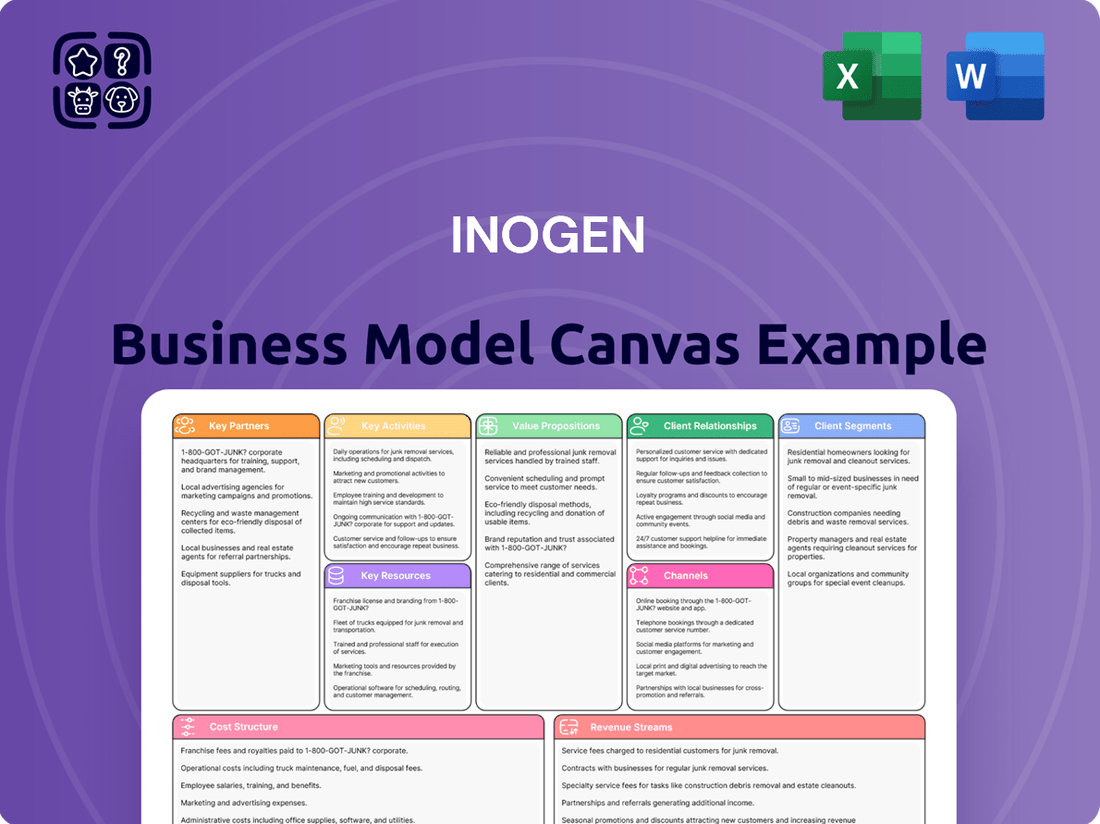

Inogen Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inogen Bundle

Discover the strategic core of Inogen's success with this comprehensive Business Model Canvas. It meticulously outlines their approach to serving respiratory patients, leveraging direct-to-consumer sales and a robust distribution network. This canvas highlights their innovative portable oxygen concentrators as a key value proposition, addressing a significant market need.

Unlock the full strategic blueprint behind Inogen's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Inogen strategically partners with key medical equipment distributors such as Apria Healthcare and Lincare Holdings. These collaborations are fundamental to extending the market reach of Inogen's portable oxygen concentrators, ensuring efficient product delivery to a wide base of end-users.

This robust distribution network is vital for Inogen's market penetration strategy. In 2023, Inogen reported net revenue of $379.9 million, underscoring the significant sales volumes these partnerships help generate.

Inogen collaborates with leading healthcare providers and hospital systems, such as Mayo Clinic and Cleveland Clinic. These partnerships are crucial for embedding Inogen's portable oxygen concentrators directly into patient care pathways and discharge planning. This integration ensures patients receive advanced oxygen therapy solutions through established and trusted medical networks, aiding in their recovery and ongoing management.

Inogen actively cultivates relationships with specialized oxygen therapy clinics and rehabilitation centers across the United States. These strategic alliances are crucial for gaining direct access to patient communities that require supplemental oxygen, enabling the delivery of customized therapy solutions.

These partnerships are instrumental in driving both product sales and rental revenue streams for Inogen. For instance, in 2024, Inogen reported that a significant portion of its revenue was generated through its direct-to-consumer and business-to-business channels, which heavily rely on these established clinical networks to reach patients.

By collaborating with these centers, Inogen can effectively cater to a wide array of patient needs and diverse treatment plans. This approach ensures that patients receive the most appropriate oxygen delivery system, enhancing their quality of life and adherence to prescribed therapies.

Insurance Companies and Medicare/Medicaid Programs

Inogen’s key partnerships with insurance providers, including government programs like Medicare and Medicaid, are fundamental to its business model. These relationships are crucial for securing reimbursement and ensuring patients can access Inogen’s portable oxygen concentrators. By obtaining approved supplier status with major private insurers such as UnitedHealthcare and Cigna, Inogen enhances the affordability and accessibility of oxygen therapy for a broader patient population. Navigating the intricate healthcare reimbursement system relies heavily on these established agreements, making them a cornerstone for Inogen’s revenue and market penetration.

These strategic alliances directly impact Inogen’s ability to operate and grow. For instance, Inogen’s participation in Medicare’s Durable Medical Equipment, Prosthetics, Orthotics, and Supplies (DMEPOS) program is a significant revenue driver. In 2023, Medicare continued to be a primary payer for home oxygen therapy, with reimbursement rates impacting Inogen’s net revenue. Similarly, partnerships with large private payers are essential. For example, a robust contract with a payer like Humana or Aetna can unlock access to millions of covered lives, directly translating into sales opportunities for Inogen devices.

- Medicare Reimbursement: Inogen relies on Medicare's established reimbursement framework for a substantial portion of its revenue, ensuring consistent payment for covered oxygen therapy services.

- Medicaid Partnerships: Collaborations with state Medicaid programs broaden Inogen's reach to underserved populations, facilitating access to oxygen equipment for eligible beneficiaries.

- Private Payer Agreements: Securing contracts with leading private insurers, such as Anthem and Humana, expands Inogen’s market access and provides patients with more insurance coverage options.

- Approved Supplier Status: Achieving and maintaining approved supplier status with key payers is critical for Inogen to receive payments and operate within regulatory compliance.

Strategic Manufacturing and International Collaborations

Inogen strategically partners with key manufacturers to bolster its product development and supply chain efficiency. These collaborations, like those with established players such as Philips Respironics and ResMed in oxygen concentrator technology, are crucial for staying ahead in a competitive landscape. For instance, Inogen's integration of advanced sensor technology from partners has been instrumental in refining the performance of its portable oxygen concentrators.

A notable international collaboration with Yuwell Medical provides Inogen with critical access to the expanding Chinese respiratory market. This alliance is multifaceted, enabling Inogen to broaden its product offerings with stationary oxygen concentrators and fostering joint research and development initiatives. Such global partnerships are vital for optimizing supply chains and adapting products to diverse market needs, especially as the global demand for respiratory solutions continues to rise. In 2023, the global home healthcare market, which includes oxygen therapy, was valued at over $350 billion, highlighting the scale of these strategic market entries.

These partnerships are foundational to Inogen's business model, allowing it to leverage external expertise and manufacturing capabilities. Key aspects include:

- Enhanced Product Innovation: Access to specialized manufacturing and R&D capabilities from partners accelerates the development of next-generation respiratory devices.

- Market Expansion: Collaborations like the one with Yuwell Medical unlock access to significant international markets, such as the rapidly growing Chinese market.

- Supply Chain Optimization: Strategic alliances help streamline production, reduce costs, and ensure a reliable supply of critical components and finished goods.

- Portfolio Diversification: Partnerships facilitate the integration of new product types, such as stationary oxygen concentrators, broadening Inogen's market appeal.

Inogen's key partnerships extend to original equipment manufacturers (OEMs) and component suppliers, crucial for product innovation and supply chain resilience. Collaborations with companies providing advanced sensor technology and battery components ensure the continuous improvement and reliability of their portable oxygen concentrators. These relationships are vital for maintaining a competitive edge in the rapidly evolving respiratory care market.

Strategic alliances with specialized clinics and rehabilitation centers provide direct patient access and tailored therapy solutions. These collaborations are essential for reaching patient communities and ensuring effective delivery of Inogen's products and services. By working with these centers, Inogen can better address diverse patient needs and treatment plans, enhancing overall patient care and adherence.

Inogen's partnerships with major distributors like Apria Healthcare and Lincare are fundamental to its market reach and sales volume. These relationships facilitate efficient product delivery to a broad customer base. In 2024, Inogen continued to leverage these channels, reporting strong performance in its business-to-business segments, which rely heavily on these established distribution networks.

Crucially, Inogen collaborates with insurance providers, including Medicare, Medicaid, and large private payers like UnitedHealthcare. These partnerships are vital for reimbursement and patient access to oxygen therapy. In 2023, Inogen's net revenue was $379.9 million, with a significant portion dependent on these payer agreements, underscoring their importance for revenue generation and market penetration.

| Partnership Type | Key Partners/Examples | Strategic Importance | 2023/2024 Relevance |

| Distributors | Apria Healthcare, Lincare Holdings | Market reach, efficient delivery | Drove significant B2B sales in 2024 |

| Healthcare Providers | Mayo Clinic, Cleveland Clinic | Patient care pathways, discharge planning | Integrated devices into established medical networks |

| Insurance Providers | Medicare, Medicaid, UnitedHealthcare, Cigna | Reimbursement, patient access, affordability | Essential for $379.9M revenue in 2023 |

| OEMs & Suppliers | Philips Respironics, ResMed (technology) | Product innovation, supply chain | Enabled integration of advanced sensor tech |

| International Markets | Yuwell Medical (China) | Market expansion, product diversification | Access to Chinese market, stationary concentrators |

What is included in the product

This Inogen Business Model Canvas provides a detailed roadmap of their strategy, focusing on direct-to-consumer sales of portable oxygen concentrators and their recurring revenue streams from supplies and services.

It highlights Inogen's key resources, activities, and partnerships, while outlining their cost structure and revenue streams to support growth in the home healthcare market.

Inogen's Business Model Canvas effectively relieves the pain of fragmented patient care by clearly outlining its integrated approach to portable oxygen solutions, from device manufacturing to direct-to-patient services.

Activities

Inogen's commitment to research and development is a cornerstone of its business model. The company consistently allocates resources to innovate its portable oxygen concentrator (POC) technology, aiming for lighter, more mobile, and higher-performing devices. This focus ensures Inogen stays ahead in the competitive respiratory care market.

Key product development efforts in 2024 and leading up to mid-2025 include the introduction of the Inogen Rove 4, a highly anticipated model designed for enhanced user experience and portability. Beyond POCs, Inogen is also advancing its portfolio with devices like the Simeox airway clearance system and the Voxi 5 stationary oxygen concentrator, broadening its reach within respiratory therapy solutions.

This relentless pursuit of innovation is critical for Inogen's sustained growth and market leadership. By investing in R&D, the company not only addresses evolving patient needs but also anticipates future healthcare trends, ensuring its product pipeline remains robust and technologically advanced.

Inogen's core activity involves the manufacturing of its portable oxygen concentrators. To achieve this, the company leverages contract manufacturing, notably with Foxconn in the Czech Republic. This partnership is crucial for both new device production and efficient repair services, particularly for their European customer base.

This manufacturing strategy ensures a steady supply of Inogen's innovative oxygen therapy devices to meet the growing global demand. By outsourcing production, Inogen can focus on its core competencies in research, development, and sales, while benefiting from the specialized manufacturing expertise of partners like Foxconn.

The optimization of these manufacturing processes is a key driver for cost efficiency. For instance, by streamlining production and repair workflows, Inogen can reduce per-unit costs, which can translate into more competitive pricing for consumers and improved profit margins for the company. In 2023, Inogen reported total revenue of $351.9 million, reflecting the ongoing demand for their products.

Inogen's key activities heavily revolve around robust sales and marketing efforts. They operate across direct-to-consumer channels, domestic business-to-business, and international business-to-business segments. This multifaceted approach requires managing a dedicated salesforce and nurturing customer relationships to highlight the advantages of portable oxygen concentrators (POCs) compared to outdated oxygen tanks.

Strategic marketing campaigns are central to their strategy, designed to boost product adoption and successfully enter new markets. For instance, in 2023, Inogen reported net revenue of $392.1 million, with a significant portion driven by these sales and marketing initiatives, demonstrating their commitment to expanding market reach and customer base.

Distribution and Logistics

Inogen's core activities heavily rely on managing a sophisticated global distribution network to ensure their portable oxygen concentrators reach patients and partners efficiently across more than 65 countries. This involves intricate coordination with a diverse range of distributors and home medical equipment (HME) providers.

This global reach is vital for Inogen's operational success. For instance, in 2023, the company reported net revenue of $320.1 million, underscoring the scale of their international operations and the importance of seamless product delivery.

Key activities in this area include:

- Managing global distribution channels: Ensuring products are available in over 65 countries, requiring robust supply chain management.

- Coordinating with partners: Working closely with distributors and HME providers for timely product delivery and essential after-sales service.

- Optimizing logistics: Implementing efficient shipping and warehousing strategies to maintain product integrity and customer satisfaction.

- Facilitating market access: Streamlining the process for new and existing customers to obtain Inogen devices, thereby expanding market penetration.

Regulatory Compliance and Reimbursement Pursuit

Navigating the intricate web of healthcare regulations and securing reimbursement are paramount for Inogen's operations. This involves diligently obtaining and maintaining approvals from bodies like the Food and Drug Administration (FDA) for its innovative portable oxygen concentrators. For instance, the successful FDA 510(k) clearance for new devices, as seen with products like Simeox, is a crucial step in bringing them to market.

Furthermore, Inogen actively engages with payers, including private insurance companies and government programs like Medicare, to establish and maintain reimbursement coverage. This process ensures that patients have access to Inogen's life-enhancing devices without prohibitive out-of-pocket costs. In 2024, understanding and adapting to evolving reimbursement policies remains a core strategic focus.

- FDA 510(k) Clearance: Securing regulatory approval for new devices is a foundational activity.

- Reimbursement Strategy: Engaging with Medicare and private payers to ensure product accessibility.

- Compliance Management: Adhering to all relevant healthcare laws and regulations in device manufacturing and sales.

- Market Access: Facilitating patient access to oxygen therapy solutions through successful reimbursement negotiations.

Inogen's key activities center on the sophisticated manufacturing and distribution of its portable oxygen concentrators (POCs). They utilize contract manufacturing, notably with Foxconn in the Czech Republic, to ensure production and repair efficiency, especially for their European market. This strategy, supported by $351.9 million in 2023 revenue, allows Inogen to focus on innovation while maintaining a steady supply chain.

The company's sales and marketing are multifaceted, encompassing direct-to-consumer, domestic B2B, and international B2B channels. By employing dedicated sales teams and targeted campaigns, Inogen effectively communicates the benefits of POCs over traditional oxygen tanks, contributing to their $392.1 million in net revenue in 2023.

Managing a global distribution network spanning over 65 countries is another vital activity. This involves close coordination with distributors and home medical equipment providers to ensure timely delivery and service, underpinning their international operations reflected in $320.1 million in 2023 net revenue.

Navigating healthcare regulations and reimbursement is critical. Inogen actively pursues FDA approvals, such as 510(k) clearances for new devices, and engages with payers like Medicare to secure and maintain coverage, ensuring patient access to their life-enhancing respiratory solutions.

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas preview you are viewing is not a demonstration but an authentic excerpt from the final document you will receive. Upon completing your purchase, you will gain access to this very same, fully populated Business Model Canvas, meticulously structured and ready for immediate use. This ensures absolute clarity and confidence, as the content and layout you see now will be exactly what you download. No alterations or substitutions will occur; you get the complete, original file.

Resources

Inogen's key resources are deeply rooted in its proprietary portable oxygen concentrator technology, notably showcased in its Inogen One and Inogen Rove product lines. These systems represent the culmination of significant research and development, allowing for the creation of devices that are both lightweight and exceptionally efficient for patients requiring supplemental oxygen.

The company's intellectual property portfolio, comprising numerous patents and carefully guarded trade secrets, forms a critical barrier to entry for competitors in the respiratory care sector. This protected innovation allows Inogen to maintain a distinct competitive edge, ensuring its technology remains at the forefront of the industry.

For instance, Inogen's commitment to innovation is reflected in its consistent patent filings. While specific numbers fluctuate, Inogen has historically held a robust patent portfolio covering various aspects of oxygen concentration technology, safeguarding its market position.

Inogen’s manufacturing and production facilities are a cornerstone of its business model, enabling the creation of its portable oxygen concentrators. Access to robust manufacturing capabilities, including a significant partnership with contract manufacturer Foxconn, is a critical resource for producing high volumes of these devices. This collaboration ensures Inogen can meet the substantial market demand effectively.

These facilities are vital for maintaining the high quality of Inogen’s products and ensuring scalability as the company grows. Foxconn's involvement, a renowned leader in electronics manufacturing, provides Inogen with advanced production techniques and efficient supply chain management. This strategic resource directly supports Inogen's ability to deliver reliable oxygen therapy solutions to patients worldwide.

Inogen's skilled human capital is a cornerstone of its business model, encompassing R&D engineers crucial for product innovation, clinical specialists who ensure product efficacy and user support, and regulatory experts navigating complex compliance landscapes. This diverse expertise directly fuels the company's ability to develop cutting-edge respiratory solutions and maintain high product quality.

The sales and marketing teams, while recently restructured for greater efficiency, remain indispensable. In 2023, Inogen reported approximately 960 employees, with a significant portion dedicated to these customer-facing roles. Their direct engagement with both individual patients and business-to-business partners is essential for driving revenue and expanding market reach.

Financial Capital

Financial capital is a cornerstone of Inogen's business model, providing the necessary fuel for its operations and growth initiatives. This includes maintaining healthy levels of cash and cash equivalents to cover day-to-day expenses, invest in future innovations, and execute marketing strategies. A robust financial position allows Inogen to remain agile in a dynamic market.

As of December 31, 2024, Inogen reported having $113.8 million in cash and cash equivalents. This significant liquidity is vital for supporting ongoing operations, funding critical research and development efforts, and executing impactful marketing campaigns. Such financial strength directly contributes to the company's ability to sustain its growth trajectory and work towards achieving sustained profitability.

- Operational Funding: Cash reserves are essential for managing Inogen's manufacturing, sales, and administrative costs.

- Research and Development: Significant financial capital is allocated to R&D for developing next-generation portable oxygen concentrators and improving existing product lines.

- Marketing and Sales Initiatives: Funds are dedicated to reaching new customers and expanding market share through various promotional activities.

- Strategic Investments: Financial capital enables Inogen to explore potential acquisitions, partnerships, or new market entries to drive long-term value.

Established Brand and Customer Base

Inogen's established brand reputation as a leader in portable oxygen therapy is a cornerstone of its business model. This strong brand signifies quality, reliability, and a commitment to enhancing patient mobility, which is critical in the healthcare sector. The company's loyal customer base further amplifies this resource, as satisfied users often become advocates, driving organic growth and market penetration. This deep-seated trust is invaluable for customer acquisition and retention, directly impacting market share and revenue stability.

The brand equity built by Inogen translates into tangible market advantages. For instance, in 2023, Inogen reported net revenue of $347.7 million, a testament to the demand for its products, which is significantly influenced by its brand strength. This established presence allows Inogen to command premium pricing and navigate competitive landscapes more effectively. The company’s focus on innovation and patient outcomes has cemented its position, making its brand a powerful asset.

- Brand Recognition: Inogen is widely recognized for its innovation in portable oxygen concentrators, a key differentiator in the respiratory care market.

- Customer Loyalty: A significant portion of Inogen's revenue is derived from repeat customers and referrals, underscoring the trust and satisfaction built over time.

- Market Leadership: The company's brand perception as a leader fosters confidence among healthcare providers and patients, facilitating market access and growth.

- Competitive Advantage: This established brand and loyal customer base provide a substantial barrier to entry for new competitors in the portable oxygen therapy market.

Inogen's key resources are its proprietary portable oxygen concentrator technology, protected by a robust intellectual property portfolio including numerous patents. This innovation, exemplified by the Inogen One and Rove product lines, ensures a distinct competitive edge. The company also leverages contract manufacturing, notably with Foxconn, for efficient, high-volume production, ensuring product quality and scalability.

Skilled human capital is vital, encompassing R&D engineers, clinical specialists, and regulatory experts who drive innovation and ensure product efficacy. The sales and marketing teams, despite recent restructuring, remain crucial for customer engagement and revenue generation. Financially, Inogen maintained $113.8 million in cash and cash equivalents as of December 31, 2024, funding operations, R&D, and marketing.

The company's established brand reputation for quality and reliability in portable oxygen therapy is a significant asset, supported by a loyal customer base. This brand equity, contributing to 2023 net revenues of $347.7 million, allows for premium pricing and strengthens its market leadership position.

| Key Resource | Description | Impact | Supporting Data (as of Dec 31, 2024 unless otherwise noted) |

| Proprietary Technology | Lightweight, efficient portable oxygen concentrators (Inogen One, Rove) | Competitive edge, market differentiation | Extensive patent portfolio |

| Manufacturing Capabilities | In-house facilities and contract manufacturing (Foxconn) | High-volume production, quality control | Partnership with Foxconn |

| Human Capital | R&D, clinical, regulatory, sales, marketing expertise | Innovation, customer support, revenue generation | Approx. 960 employees (2023) |

| Financial Capital | Cash reserves for operations, R&D, marketing | Operational stability, growth funding | $113.8 million in cash and cash equivalents |

| Brand Reputation | Leader in portable oxygen therapy, customer loyalty | Premium pricing, market access, repeat business | Net revenue of $347.7 million (2023) |

Value Propositions

Inogen's core value is empowering individuals with respiratory conditions by offering portable oxygen concentrators. These devices are a game-changer, providing a level of mobility and independence that traditional oxygen tanks simply cannot match.

Imagine living with the freedom to travel, socialize, and engage in everyday activities without the constant worry of bulky, heavy oxygen cylinders. Inogen's lightweight, compact concentrators make this a reality, significantly improving users' quality of life.

For instance, Inogen's sales of its portable oxygen concentrators have shown consistent growth, with the company reporting over $400 million in revenue in 2023, reflecting the strong market demand for enhanced patient independence.

Inogen’s core value proposition revolves around lightweight and portable oxygen solutions, exemplified by devices like the Inogen Rove 4 and G5. These concentrators are designed to be exceptionally light, often fitting into standard tote bags or backpacks, a significant advantage for users needing oxygen therapy on the go. This focus on portability directly addresses user needs for increased mobility and reduced burden, a critical factor for those relying on oxygen. For instance, the Inogen Rove 4 weighs just 4.8 pounds, enabling users to maintain an active lifestyle without the constraints of heavier equipment.

Inogen's portable oxygen concentrators (POCs) offer a significant upgrade from traditional oxygen tanks, which are often bulky, heavy, and can pose fire risks. Our POCs draw in ambient air, filter out nitrogen, and deliver concentrated oxygen directly to the user. This means no more running out of oxygen unexpectedly or the hassle of arranging frequent tank deliveries.

The convenience factor is immense; users are freed from the logistical burdens associated with oxygen tanks, such as managing refills and worrying about flammability. This innovation truly transforms respiratory care, providing a safer, more mobile, and user-friendly experience for individuals requiring supplemental oxygen.

For instance, Inogen reported that their direct-to-consumer channel generated over $300 million in revenue in 2023, highlighting the strong market demand for their advanced oxygen solutions. This growth reflects the tangible benefits patients experience – continuous oxygen delivery without the constant anxieties and limitations of older technologies.

Reliable and Clinically Validated Therapy

Inogen provides respiratory devices that are rigorously tested and clinically proven to be reliable for continuous, 24/7 use. This unwavering commitment to quality ensures patients receive consistent and effective oxygen therapy, fostering deep trust with both users and medical professionals. The validation extends beyond mere functionality, confirming the devices' efficacy in real-world clinical settings.

This focus on clinically validated therapy directly translates to improved patient outcomes. Inogen’s devices are designed to empower individuals with chronic respiratory conditions to live more active and fulfilling lives. For instance, Inogen's portable oxygen concentrators have demonstrated efficacy in various clinical studies, supporting their role in enhancing patient mobility and quality of life. The company's investment in research and development ensures their products meet the highest standards of performance and safety.

- Clinically Validated for 24/7 Use: Inogen devices undergo extensive testing to confirm their reliability for round-the-clock operation, a crucial factor for patients requiring continuous oxygen therapy.

- Enhanced Patient Trust: The proven reliability and clinical validation build significant trust among patients and healthcare providers, positioning Inogen as a dependable solution for respiratory care.

- Improved Patient Outcomes: By ensuring consistent and effective oxygen delivery, Inogen's therapies contribute to better overall health and well-being for individuals managing respiratory conditions.

- Investment in R&D: Inogen actively invests in research and development, evidenced by their ongoing clinical trials and product advancements, to further solidify the efficacy and reliability of their offerings.

Comprehensive Respiratory Care Portfolio

Inogen is evolving beyond portable oxygen concentrators (POCs) to offer a comprehensive suite of respiratory care solutions. This strategic expansion is highlighted by recent achievements, such as the FDA clearance of the Simeox airway clearance device, a significant step in broadening their treatment options. The introduction of the Voxi 5 stationary oxygen concentrator further solidifies this commitment by providing a more robust solution for patients requiring continuous oxygen therapy at home.

This diversification strategy aims to cater to a wider spectrum of respiratory conditions, moving Inogen towards becoming a complete respiratory care provider. The collaboration with Yuwell Medical is instrumental in this, expanding Inogen's reach and product availability to serve more patients effectively. By offering a more complete range of solutions, Inogen addresses the varied needs of individuals managing chronic respiratory diseases.

The expanded portfolio includes:

- Simeox Airway Clearance Device: FDA cleared, offering a non-invasive method for mucus clearance.

- Voxi 5 Stationary Oxygen Concentrator: A new addition providing reliable, high-flow oxygen.

- POCs: Continued innovation and support for their core portable oxygen solutions.

- Yuwell Medical Collaboration: Enhancing product access and market penetration.

Inogen provides advanced portable oxygen concentrators, offering unparalleled freedom and independence to individuals with respiratory conditions. Their lightweight, user-friendly devices significantly improve quality of life by enabling mobility and reducing the burden of traditional oxygen tanks.

The company's commitment to clinical validation ensures reliable, 24/7 oxygen delivery, fostering trust and leading to better patient outcomes. Inogen is also expanding its offerings to become a comprehensive respiratory care provider, as evidenced by the FDA clearance of the Simeox airway clearance device and the introduction of the Voxi 5 stationary oxygen concentrator.

Inogen's strategic expansion is supported by collaborations like the one with Yuwell Medical, enhancing product access. This diversification caters to a broader range of respiratory needs, solidifying Inogen's position as a key player in respiratory health.

| Product/Service | Key Value Proposition | 2023 Revenue Contribution (Approx.) |

|---|---|---|

| Portable Oxygen Concentrators (POCs) | Mobility, independence, lightweight design | >$300 million (Direct-to-consumer channel) |

| Simeox Airway Clearance Device | Non-invasive mucus clearance, FDA cleared | New offering, contributing to portfolio expansion |

| Voxi 5 Stationary Oxygen Concentrator | Reliable, high-flow home oxygen therapy | New offering, expanding home care solutions |

Customer Relationships

Inogen's direct-to-consumer sales model is built on dedicated sales representatives who offer personalized consultations, ensuring patients receive tailored support. This direct engagement fosters strong customer relationships by allowing Inogen to deeply understand individual needs and preferences.

While Inogen has undergone some restructuring to boost efficiency, this direct sales and support channel remains a cornerstone of their customer relationship strategy. For instance, as of the first quarter of 2024, Inogen reported a net revenue of $70.3 million, underscoring the continued importance of their direct sales efforts.

Inogen prioritizes nurturing robust B2B partnerships with home medical equipment providers, resellers, and global distributors. This strategic focus ensures their innovative oxygen solutions are effectively integrated into partner offerings.

Dedicated account management and comprehensive support are cornerstones of these relationships, facilitating smooth operations and product adoption for business clients.

The company's sustained growth in B2B channels, evidenced by a significant increase in partner networks, underscores the success of its relationship management approach. For instance, Inogen reported a 12% year-over-year increase in its B2B revenue for the first quarter of 2024, demonstrating the strength of these ongoing collaborations.

Inogen actively champions its products by generating robust clinical evidence and fostering strong relationships with Key Opinion Leaders (KOLs) and its Scientific Advisory Board. This strategy is crucial for driving product adoption within the healthcare community.

The company invests significantly in clinical research, including studies designed to showcase the benefits of their portable oxygen concentrators. For instance, in 2023, Inogen reported substantial investments in clinical programs aimed at further validating their technology and its impact on patient outcomes.

By collaborating closely with respected medical professionals who are influential in advocating for appropriate oxygen therapy, Inogen builds credibility. These KOLs play a vital role in educating other healthcare providers and shaping prescribing habits, thereby cultivating essential clinical trust.

This dedicated engagement with KOLs and the scientific community not only reinforces the clinical efficacy of Inogen's solutions but also directly influences market perception and adoption rates, a key driver for their business growth.

Digital Engagement and App Support

Inogen significantly strengthens customer relationships by leveraging digital engagement, particularly through its Inogen Connect app. This platform is designed to enhance user experience and device accessibility, offering seamless connectivity and robust support.

The Inogen Connect app acts as a crucial touchpoint, providing patients with direct access to their device data and enabling remote monitoring. This digital integration streamlines service requests and troubleshooting, leading to greater patient convenience and satisfaction.

- Digital Connectivity: The Inogen Connect app allows users to monitor their device’s battery life, operating status, and therapy usage remotely.

- Enhanced Support: It facilitates direct communication with Inogen support teams, streamlining issue resolution and service requests.

- Data Insights: Patients gain valuable insights into their therapy adherence and device performance, empowering them to manage their health more effectively.

- User Experience: This technological integration improves overall ease-of-use and accessibility for Inogen’s portable oxygen concentrator users.

Patient-First Programs

Inogen's patient-first programs are central to its customer relationships, focusing on enhancing the lives of those with respiratory conditions. This commitment involves actively seeking and incorporating patient feedback into product development, ensuring devices are intuitive and easy to use. The company's mission directly translates into fostering greater freedom and an improved quality of life for individuals relying on oxygen therapy.

This patient-centric approach is evident in Inogen's product design and support services. For example, in 2023, Inogen reported a significant portion of its revenue derived from direct-to-consumer sales, highlighting the importance of a strong patient relationship. The company also emphasizes accessibility to therapy, aiming to remove barriers for patients needing consistent oxygen support.

- Patient Feedback Integration: Inogen actively uses patient input to refine its portable oxygen concentrator technology, aiming for maximum usability and effectiveness.

- User-Friendly Design: The company prioritizes developing devices that are lightweight and easy for patients to manage independently, enhancing daily mobility.

- Therapy Accessibility: Inogen works to ensure that patients can readily access and maintain their prescribed oxygen therapy, supporting their continued well-being.

- Quality of Life Focus: Ultimately, the programs are designed to restore and improve the overall quality of life and independence for individuals with chronic respiratory diseases.

Inogen cultivates strong customer relationships through a multi-faceted approach, prioritizing both direct patient engagement and strategic B2B partnerships. Their direct-to-consumer model relies on personalized consultations from sales representatives, ensuring patients receive tailored support and that their individual needs are understood.

Furthermore, Inogen leverages digital platforms like the Inogen Connect app to enhance user experience and provide ongoing support, offering patients remote monitoring and direct communication channels for issue resolution.

The company also fosters robust relationships with home medical equipment providers and distributors, ensuring their innovative oxygen solutions reach a wider patient base through dedicated account management and comprehensive support.

Inogen's commitment to patient well-being is further demonstrated through its patient-first programs, which actively incorporate user feedback into product development and focus on improving the quality of life and independence for individuals with respiratory conditions.

| Customer Relationship Strategy | Key Elements | Supporting Data/Focus Area |

|---|---|---|

| Direct-to-Consumer (DTC) | Personalized consultations, tailored support | Focus on understanding individual patient needs |

| B2B Partnerships | Dedicated account management, comprehensive support | Strengthening collaborations with HME providers and distributors |

| Digital Engagement | Inogen Connect app, remote monitoring, user support | Enhancing user experience and accessibility |

| Clinical & KOL Relationships | Clinical evidence generation, KOL engagement | Building credibility and influencing healthcare providers |

| Patient-First Programs | Patient feedback integration, user-friendly design | Improving quality of life and independence for patients |

Channels

Inogen's direct-to-consumer (DTC) sales channel allows individuals to buy portable oxygen concentrators straight from the company. This approach builds strong customer connections.

While this channel has experienced some challenges, including a reduction in its salesforce to boost efficiency, it continues to be a vital part of Inogen's strategy. The company is focused on stabilizing this segment and driving future growth.

For instance, Inogen's revenue from direct sales, encompassing both domestic and international DTC, was approximately $91.6 million in the first quarter of 2024. This highlights the ongoing significance of this channel.

Domestic B2B sales represent a crucial revenue stream for Inogen, predominantly serving home medical equipment (HME) providers, resellers, and major clients such as gas companies. This channel demonstrated robust growth throughout 2024, reflecting increased demand for portable oxygen concentrators (POCs).

Inogen's strategic focus remains on bolstering this B2B network. The company aims to deepen its penetration of POC-based oxygen therapy solutions across the United States by cultivating stronger relationships with existing partners and onboarding new ones.

Inogen's international B2B sales are a cornerstone of its global strategy, reaching over 65 countries. This expansive network relies on a dual approach: partnerships with local distributors and direct sales to major healthcare providers. This multichannel strategy is vital for penetrating diverse markets and capturing significant market share.

The international B2B channel is a key driver of Inogen's growth, consistently demonstrating robust expansion year after year. In 2023, Inogen reported international revenue of $105.8 million, a notable increase from the previous year, highlighting the channel's importance for expanding its global footprint.

A significant development for Inogen's international B2B efforts is the strategic collaboration with Yuwell Medical. This partnership is specifically designed to accelerate Inogen's entry into the vast Chinese respiratory market, a move that promises to significantly diversify its international revenue streams and tap into a high-potential demographic.

Rental Programs

Inogen's rental programs offer a key avenue for customers to access their portable oxygen concentrators, catering to those who may not wish to purchase outright or have short-term needs. This flexibility broadens market reach. For instance, in 2023, rental revenue continued to be a significant contributor to Inogen's top line, demonstrating its ongoing importance despite evolving reimbursement landscapes.

These rental services are crucial for making Inogen's technology accessible to a wider patient base, including those with temporary oxygen requirements or who are navigating changes in healthcare coverage. The company's strategy includes optimizing these rental offerings to maintain customer engagement and revenue streams.

- Rental Program Importance: Provides flexible access to Inogen's oxygen concentrators for patients preferring rental over purchase, particularly for short-term use.

- Market Accessibility: Expands the customer base by making products available to individuals with varying financial situations and needs.

- Revenue Contribution: Rental services represent a substantial portion of Inogen's overall revenue, highlighting their financial significance.

- Industry Dynamics: While facing pressures from shifts in insurance plans, rentals remain a vital channel for the company.

Online Presence and Digital Platforms

Inogen leverages its official website and the Inogen Connect app as primary digital channels. These platforms are crucial for sharing company information, engaging with investors, and making products accessible to users.

The Inogen Connect app, for instance, allows users to monitor and control their Inogen Portable Oxygen Concentrators, enhancing the customer experience and product utility. As of the first quarter of 2024, Inogen reported that its direct-to-consumer sales, heavily influenced by digital engagement, represented a significant portion of its revenue, underscoring the importance of these channels.

- Website Functionality: The Inogen website serves as a hub for product information, customer support resources, and investor relations, including the disclosure of material non-public information.

- Inogen Connect App: This mobile application enhances user engagement by enabling remote monitoring and control of Inogen devices, providing a direct line of communication and support.

- Digital Sales Strategy: Online platforms are integral to Inogen's direct-to-consumer sales strategy, facilitating customer acquisition and ongoing product support.

- Investor Communication: Digital channels are key for disseminating financial reports, press releases, and other critical information to the investment community.

Inogen utilizes a multifaceted channel strategy encompassing direct-to-consumer (DTC), business-to-business (B2B), rentals, and digital platforms. The DTC channel, though streamlined, generated approximately $91.6 million in Q1 2024. Domestic B2B sales, primarily to HME providers, showed strong growth in 2024, with international B2B revenue reaching $105.8 million in 2023, bolstered by a key partnership with Yuwell Medical for the Chinese market. Rental programs provide crucial market accessibility and revenue, while digital channels like the Inogen website and Connect app enhance customer engagement and sales.

| Channel | 2023 Revenue (Approx.) | 2024 Q1 Revenue (Approx.) | Key Initiatives |

| Direct-to-Consumer (DTC) | N/A | $91.6 million | Salesforce efficiency, stabilizing segment |

| Domestic B2B | N/A | N/A (Strong growth reported) | Deepening HME penetration, onboarding new partners |

| International B2B | $105.8 million | N/A | Expansion into China via Yuwell Medical |

| Rental Programs | Significant contributor | N/A | Optimizing offerings for accessibility and engagement |

| Digital (Website/App) | Integral to DTC | Integral to DTC | Enhancing user experience, facilitating sales and support |

Customer Segments

Patients requiring long-term oxygen therapy are primarily individuals battling chronic respiratory illnesses like COPD, emphysema, and pulmonary fibrosis. These patients depend on consistent oxygen delivery to manage their condition and improve their daily functioning.

For these individuals, the ability to maintain an active lifestyle is crucial for their well-being. They actively seek portable and user-friendly devices that provide oxygen discreetly, allowing them greater freedom and independence. This segment values solutions that minimize disruption to their routines and enhance their overall quality of life.

Inogen's product offerings are specifically engineered to address these critical medical and lifestyle requirements. Their focus on lightweight, battery-powered concentrators directly caters to the mobility needs of this patient group.

Home Medical Equipment (HME) providers represent a key business-to-business customer segment for Inogen. These companies specialize in distributing a range of medical devices for patient use in their homes.

Inogen collaborates with these HME providers to ensure its portable oxygen concentrators reach a broad patient base. This partnership is fundamental to Inogen's strategy for expanding its reach within the domestic market and driving sales volume.

In 2024, the HME market continued to show resilience, with a growing demand for in-home care solutions. This trend directly benefits Inogen's business model, as HME providers are essential channels for their innovative oxygen therapy products.

Hospitals and large healthcare networks are key customers for Inogen, integrating its portable oxygen concentrators (POCs) into their patient care. These institutions use Inogen's devices for both in-hospital treatment and to support patients after they leave. This ensures a continuous and consistent approach to respiratory care.

Prestigious institutions like Mayo Clinic and Cleveland Clinic have partnered with Inogen, highlighting the trust placed in their technology. These collaborations are vital for demonstrating the effectiveness of POCs in comprehensive medical management, from initial diagnosis through to ongoing homecare. Such partnerships often lead to broader adoption within the healthcare system.

For the fiscal year 2023, Inogen reported total revenue of $331.7 million, with a significant portion attributed to its direct-to-consumer business, but the increasing integration into institutional settings signifies a growing channel. The company's focus on improving patient mobility and independence resonates strongly with healthcare providers aiming for better patient outcomes and reduced readmission rates.

These healthcare networks often procure Inogen devices through direct sales or durable medical equipment (DME) providers that serve hospital systems. The value proposition for hospitals includes potentially lower overall costs of care for respiratory patients, improved patient satisfaction, and enhanced operational efficiency by facilitating earlier discharge with reliable home oxygen therapy.

Oxygen Therapy Clinics and Rehabilitation Centers

Oxygen therapy clinics and rehabilitation centers are vital customer segments for Inogen, directly reaching individuals requiring respiratory assistance. These facilities act as crucial intermediaries, enabling Inogen to connect with patients and offer hands-on product demonstrations and personalized fittings. In 2024, the demand for home oxygen therapy solutions continued to grow, with these specialized centers playing a significant role in patient care pathways.

These centers frequently integrate Inogen's portable oxygen concentrators into their prescribed treatment plans, recognizing their benefits for patient mobility and quality of life. Partnerships with these institutions provide Inogen with a direct channel to a significant patient population. For instance, a substantial portion of Inogen's direct-to-consumer sales are influenced by recommendations from healthcare providers and facilities.

- Direct Patient Access: Clinics and rehab centers offer a direct pathway to patients needing respiratory support.

- Product Endorsement: These facilities often recommend and supply Inogen devices as part of comprehensive therapy.

- Demonstration and Fitting: Partnerships facilitate essential product trials and personalized fittings for patients.

- Market Penetration: These centers are key to Inogen's strategy for reaching and serving its target patient demographic.

International Distributors and Large Accounts

Inogen strategically engages international distributors and large accounts, like gas companies, to broaden its global reach beyond the United States. These partnerships are vital for navigating varied regulatory environments and accessing extensive international patient bases. This approach helps Inogen overcome market-specific challenges and leverage local expertise. For instance, the company's 2024 expansion into new international markets, such as through collaborations like the one with Yuwell Medical, underscores this segment's importance.

These customer segments are instrumental in Inogen’s international growth strategy. They provide the necessary infrastructure and market access to effectively serve a global customer base. By working with established partners, Inogen can accelerate its penetration into new territories.

- International Distributors: Act as key intermediaries, managing sales, marketing, and customer support within their respective countries.

- Large Accounts: Includes entities such as hospitals, home healthcare agencies, and potentially government bodies that procure medical equipment in significant volumes.

- Gas Companies: In certain international markets, traditional medical oxygen suppliers, often large gas companies, represent a significant channel for portable oxygen concentrators.

- Regulatory Navigation: Distributors and large accounts possess critical knowledge and experience in complying with diverse international healthcare regulations and reimbursement policies, facilitating market entry and ongoing operations for Inogen.

Inogen's customer base is diverse, encompassing patients, healthcare providers, and international partners. Patients are primarily individuals with chronic respiratory conditions seeking mobility and independence, while Home Medical Equipment (HME) providers and hospitals are key B2B channels for distributing Inogen's portable oxygen concentrators (POCs).

Oxygen therapy clinics and rehabilitation centers serve as direct access points to patients, facilitating product adoption and demonstrating the value of POCs in improving quality of life. International distributors and large accounts are crucial for global market penetration, navigating regulatory landscapes and expanding Inogen's reach.

In 2023, Inogen reported $331.7 million in revenue, with a significant portion coming from direct-to-consumer sales, highlighting the importance of individual patient adoption, often influenced by healthcare providers.

| Customer Segment | Key Characteristics | 2023 Revenue Influence (Approximate) | Strategic Importance |

|---|---|---|---|

| Patients (Direct-to-Consumer) | Chronic respiratory conditions, seeking mobility and independence. | Significant portion of total revenue. | Primary end-users, driving demand and product necessity. |

| HME Providers | Distributors of medical devices for home use. | Key sales channel, driving volume. | Extensive patient reach within domestic markets. |

| Hospitals & Healthcare Networks | Integrate POCs for in-hospital and post-discharge care. | Growing integration, impacting patient pathways. | Enhance patient outcomes, reduce readmissions, improve efficiency. |

| Oxygen Therapy Clinics & Rehab Centers | Direct patient interaction, product demonstrations. | Influence direct-to-consumer sales. | Crucial for patient education and product trial. |

| International Distributors & Large Accounts | Global market access, regulatory navigation. | Facilitating international growth. | Expanding market footprint and revenue streams. |

Cost Structure

A substantial part of Inogen's spending goes into research and development, fueling the creation and enhancement of its portable oxygen concentrators and other respiratory equipment. This dedication to innovation is key to staying ahead in the market.

In 2024, Inogen invested $11.7 million in research and development, highlighting its focus on building a robust pipeline of new products and technologies. These financial commitments are vital for its long-term growth and competitive positioning.

These R&D expenditures are not just about keeping pace; they are about driving future success. By investing in new device development and improving existing ones, Inogen aims to broaden its product portfolio and meet evolving patient needs.

Manufacturing and production costs are central to Inogen's business model, encompassing everything from the acquisition of raw materials and essential components to the ongoing pursuit of operational efficiencies in building their portable oxygen concentrators. These are the direct expenses incurred to create the product.

Inogen has actively worked to lower material cost premiums, a strategic move that, coupled with enhancements in manufacturing efficiency, led to a notable improvement in their gross margin during 2024. This focus directly translates to a healthier bottom line.

For instance, in the first quarter of 2024, Inogen reported a gross margin of 44.2%, a substantial jump from 39.3% in the same period of 2023, largely driven by these cost management initiatives in production.

Effectively managing these manufacturing and production expenses is absolutely critical for Inogen, as it has a direct and significant impact on the company's overall profitability and its ability to compete in the market.

Inogen dedicates significant resources to its sales and marketing functions. This includes the costs associated with a direct sales force, crucial for reaching customers, and broader promotional activities across multiple advertising and digital platforms. These investments are fundamental to Inogen's strategy for increasing revenue and capturing a larger portion of the market.

In 2024, Inogen reported sales and marketing expenses amounting to $71.8 million. This figure reflects the ongoing commitment to customer acquisition and brand building, even as the company has adjusted its direct-to-consumer salesforce structure to enhance operational efficiency.

General and Administrative Expenses

General and administrative (G&A) expenses represent the operational overheads essential for running Inogen, encompassing costs like administrative salaries, office rent, utilities, and crucial corporate functions such as legal and accounting services. Effective management of these G&A costs is a key component of Inogen's strategy to improve its financial performance and move towards sustained profitability.

Inogen has demonstrated progress in controlling its operational spending. For instance, in the first quarter of 2025, the company reported a year-over-year reduction in total operating expenses, indicating a focused effort on efficiency. This includes a diligent approach to managing the G&A segment.

- Administrative Salaries: Costs associated with management and support staff.

- Office Expenses: Includes rent, utilities, and supplies for corporate offices.

- Legal and Professional Fees: Expenses for legal counsel, auditing, and other professional services.

- Other Corporate Functions: Costs related to IT, human resources, and general overhead.

Regulatory and Compliance Costs

Inogen faces substantial regulatory and compliance costs inherent to the medical technology industry. These expenses are crucial for obtaining and sustaining vital certifications, such as FDA clearances, and for adhering to evolving global healthcare regulations. For instance, in 2023, Inogen reported $14.8 million in research and development expenses, a significant portion of which is allocated to navigating complex regulatory pathways and ensuring product compliance across different markets. This investment is non-negotiable for market access.

These costs directly impact Inogen's ability to bring and keep its innovative respiratory devices on the market. By meeting stringent safety and efficacy standards, Inogen ensures its products are approved for sale in key regions like the United States and Europe. The company's commitment to these standards is reflected in its ongoing efforts to maintain its quality management system and prepare for future regulatory updates.

- FDA Clearances: Essential for marketing devices in the US.

- Global Healthcare Regulations: Compliance with varying international standards.

- Quality Management Systems: Costs associated with maintaining ISO certifications.

- Post-Market Surveillance: Ongoing expenses for monitoring product performance and safety.

Inogen's cost structure is heavily influenced by its commitment to innovation, evident in significant research and development investments. Manufacturing expenses are also a core component, with efforts to control material costs and boost production efficiency playing a crucial role in margin improvement. Sales and marketing costs are substantial, reflecting the company's strategy for market penetration and customer acquisition.

General and administrative expenses cover the essential overheads for corporate operations, while regulatory and compliance costs are unavoidable due to the nature of the medical technology industry. These elements collectively shape Inogen's operational expenses and impact its overall profitability.

| Cost Category | 2024 Expense (Millions USD) | Key Activities |

|---|---|---|

| Research & Development | $11.7 | New product innovation, technology enhancement |

| Manufacturing & Production | (Variable, impacts Gross Margin) | Raw materials, component sourcing, operational efficiency |

| Sales & Marketing | $71.8 | Direct sales force, advertising, digital promotion |

| General & Administrative | (Included in Operating Expenses) | Salaries, office rent, legal, accounting |

| Regulatory & Compliance | (Significant portion of R&D, also operational) | FDA clearances, international standards, quality systems |

Revenue Streams

Inogen's main way of making money is by selling its special portable oxygen machines, like the Inogen Rove and Inogen One. These are sold directly to people who need them and also to businesses. In 2024, the company saw its total revenue climb to $335.7 million, with a big push coming from these business-to-business sales.

Inogen offers rental services for its oxygen concentrators, providing a flexible and accessible option for patients needing respiratory support. This revenue stream allows individuals to utilize the technology without the upfront cost of purchasing a device, ensuring broader access to care.

Despite market pressures, the rental segment continues to be a steady source of income for Inogen. This demonstrates the ongoing demand for flexible oxygen therapy solutions.

In a recent reporting period, Inogen saw a significant 23.8% increase in rental revenue quarter-over-quarter. This growth highlights the increasing adoption and preference for rental models among patients.

Inogen generates revenue not only from its primary oxygen concentrator units but also through the consistent sale of accessories and replacement parts. These include essential items like batteries, specialized carrying bags, and cannulas, all crucial for the ongoing operation and user experience of their devices.

This accessory and parts segment is vital for Inogen’s recurring revenue model, ensuring continued engagement with existing customers. For instance, Inogen reported in its 2023 annual report that the company’s total revenue from its direct-to-consumer business, which heavily features accessory sales, remained a significant contributor to its overall financial performance.

Service Contracts and Freight

Inogen's revenue streams include income from service contracts, which are crucial for maintaining the functionality and longevity of their portable oxygen concentrators. These contracts offer customers peace of mind through ongoing maintenance and technical support, ensuring their devices operate at peak performance. This recurring revenue model provides a stable financial base for the company.

Beyond service contracts, Inogen also generates revenue from freight charges. These charges cover the costs associated with shipping their products to customers and distributors. While a smaller component, these fees contribute to the overall financial inflow and reflect the logistical aspects of their business operations.

- Service Contracts: Inogen offers service contracts that provide customers with ongoing maintenance, repair, and support for their oxygen concentrator devices, ensuring continued operational efficiency and user satisfaction.

- Freight Revenue: The company also earns revenue from freight charges, which are applied to the shipment of new devices, replacement parts, and other accessories to customers and distribution partners.

- Customer Experience: Both service contracts and freight charges are integral to the overall customer experience, contributing to Inogen's financial performance by ensuring product reliability and efficient delivery.

International Sales Growth

International sales represent a significant and growing revenue stream for Inogen. In 2024, the company observed substantial growth in this area, largely driven by business-to-business channels.

This international expansion is further bolstered by strategic market entries. For instance, Inogen's entry into the Chinese respiratory market, facilitated by collaborations like the one with Yuwell Medical, is poised to accelerate international revenue growth.

The financial impact of this international focus is clear: In 2024, approximately 34.9% of Inogen's total revenue was generated from sales outside the United States, highlighting the increasing importance of global markets to the company's financial performance.

- International Sales Growth: A key revenue driver, particularly through B2B channels.

- 2024 Performance: Significant increases observed in international business-to-business sales.

- Market Expansion: Entering new regions like China via strategic partnerships, such as with Yuwell Medical.

- Revenue Contribution: International sales accounted for 34.9% of total revenue in 2024.

Inogen’s revenue is primarily generated through the direct sale of its portable oxygen concentrator systems, which saw a substantial contribution to its $335.7 million in total revenue for 2024. The company also benefits from a robust rental program, offering flexible access to its technology, evident in a 23.8% quarter-over-quarter increase in rental revenue. Additionally, Inogen secures recurring income from the sale of essential accessories and replacement parts, alongside service contracts that ensure device longevity and customer satisfaction.

| Revenue Stream | Description | 2024 Relevance |

|---|---|---|

| Product Sales (Direct & B2B) | Sale of portable oxygen concentrator systems. | Core revenue driver, contributing significantly to $335.7M total revenue in 2024. |

| Rental Services | Providing oxygen concentrators on a rental basis. | Demonstrated strong growth with a 23.8% quarter-over-quarter increase in rental revenue. |

| Accessories & Parts | Sales of batteries, cannulas, and other device components. | Vital for recurring revenue and customer engagement. |

| Service Contracts | Ongoing maintenance and technical support agreements. | Ensures device functionality and provides a stable financial base. |

| Freight Revenue | Charges for shipping products and parts. | Contributes to overall financial inflow, covering logistical costs. |

| International Sales | Revenue from markets outside the United States. | Significant growth, accounting for 34.9% of total revenue in 2024, driven by B2B. |

Business Model Canvas Data Sources

The Inogen Business Model Canvas is constructed using a blend of internal financial reports, customer feedback, and competitive market analysis. This multi-faceted approach ensures each component of the canvas is grounded in practical Inogen operations and market realities.