Inogen Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inogen Bundle

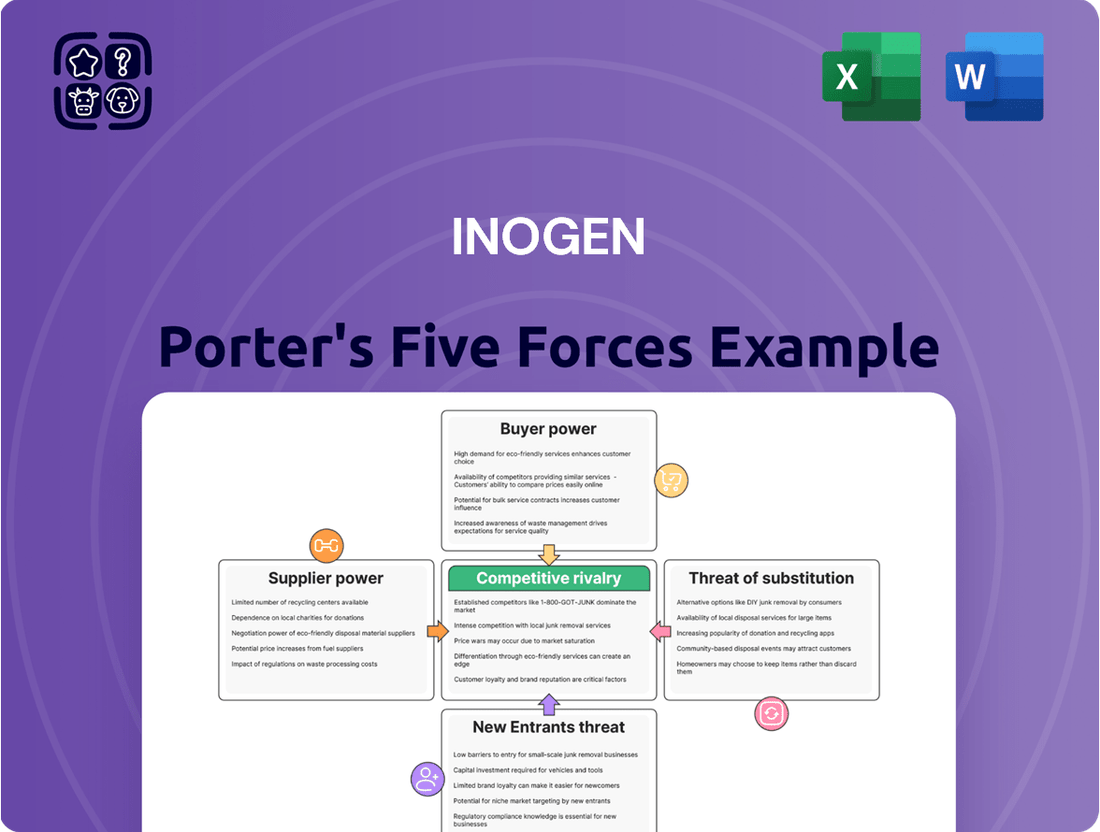

The Inogen Porter's Five Forces Analysis reveals a dynamic competitive landscape for portable oxygen concentrators. Understanding the intensity of buyer power and the threat of substitutes is crucial for navigating this market. Factors like supplier bargaining power and the threat of new entrants also significantly shape Inogen's strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Inogen’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Inogen's reliance on a small group of specialized manufacturers for critical components, such as medical-grade electronics and precision oxygen filters, grants these suppliers substantial bargaining power. With only about 3 to 4 key suppliers dominating this niche market, Inogen faces limited alternatives, making it vulnerable to price increases or supply disruptions. This concentration of suppliers means they can dictate terms, impacting Inogen's production costs and efficiency. For example, in 2024, the cost of specialized medical-grade components saw an average increase of 7% across the industry due to these supply chain dynamics, directly affecting companies like Inogen that depend on them.

Inogen's reliance on specialized components like rare earth metals, high-purity aluminum alloys, and specific medical-grade polymers significantly amplifies supplier bargaining power. These materials often have few, if any, viable global alternatives, giving suppliers considerable leverage. For instance, the market for certain rare earth elements, crucial for electronic components within Inogen's devices, has seen price volatility. In 2024, global demand for these materials in advanced manufacturing, including medical technology, continued to outstrip readily available supply, pushing up costs for downstream producers like Inogen.

Recent global supply chain disruptions, notably the persistent shortage of semiconductor chips and crucial electronic components like microprocessors and precision sensors, have significantly affected Inogen's manufacturing capabilities. These ongoing constraints directly limit Inogen's ability to secure necessary parts, thereby increasing supplier leverage and contributing to price volatility.

The scarcity of these specialized components means suppliers can dictate terms more forcefully, potentially increasing costs for Inogen. For example, lead times for certain semiconductor components, critical for Inogen's portable oxygen concentrators, stretched significantly throughout 2023 and into early 2024, driving up procurement expenses.

Moderate Supplier Switching Costs

Moderate supplier switching costs in the medical device industry, particularly for components like those used in Inogen's portable oxygen concentrators, significantly bolster supplier leverage. Navigating the intricate web of regulatory approvals, such as the FDA certification process which can typically take 12 to 18 months, makes it costly and time-consuming for Inogen to change suppliers. This inherent difficulty in finding and qualifying new sources for critical, often specialized, medical-grade parts means suppliers hold a stronger hand in price negotiations and contract terms.

These moderate switching costs translate into tangible advantages for suppliers:

- Extended Qualification Times: The 12-18 month FDA certification timeline for new medical components creates a significant barrier to entry for potential new suppliers and a disincentive for Inogen to switch from established ones.

- Component Specialization: Suppliers often provide highly specialized components that require unique manufacturing processes, further increasing the effort and cost associated with finding alternatives.

- Impact on Production Continuity: A disruption in the supply of critical components due to a supplier switch could halt Inogen's production, highlighting the risks associated with changing vendors.

- Supplier Pricing Power: The combination of regulatory hurdles and specialized production allows suppliers to command higher prices, as Inogen faces substantial costs and risks in seeking alternative sources.

Impact of Supplier Issues on Production

Supply chain disruptions have previously forced Inogen to pause manufacturing, demonstrating how critical supplier reliability is to their production capabilities. These interruptions directly impact Inogen's ability to meet customer demand, potentially leading to lost sales and market share erosion. For instance, in late 2023, Inogen experienced production delays attributed to component shortages, impacting their ability to fulfill orders for their portable oxygen concentrators. This underscores the significant bargaining power suppliers can wield when they control essential components or materials.

The bargaining power of suppliers is a key factor in Inogen's operational stability. When suppliers have significant leverage, they can dictate terms, increase prices, or limit availability, all of which can squeeze Inogen's profit margins and hinder its growth.

- Component Scarcity: Reliance on a few suppliers for specialized electronic components or battery technology grants those suppliers considerable pricing power.

- Unforeseen Disruptions: Events like geopolitical instability or natural disasters can severely impact the supply of critical raw materials, giving affected suppliers increased leverage.

- Quality Control Demands: Suppliers with robust quality control can command higher prices, especially for medical-grade components where consistency is paramount.

- Limited Alternatives: If Inogen has few alternative suppliers for essential parts, existing suppliers can more easily impose unfavorable terms.

Inogen's suppliers possess significant bargaining power due to the specialized nature of components and limited alternatives. This leverage allows them to influence pricing and terms, impacting Inogen's cost structure and production continuity. For example, the average price of medical-grade electronic components saw a 7% increase in 2024, a direct consequence of supply concentration.

The scarcity of critical materials like rare earth elements, essential for Inogen's devices, further amplifies supplier influence. In 2024, high demand in advanced manufacturing, including medical technology, exacerbated shortages, driving up costs for Inogen.

Supplier switching costs, particularly regulatory hurdles like FDA certification (12-18 months), create substantial barriers for Inogen to change vendors, reinforcing supplier leverage and pricing power.

| Factor | Impact on Inogen | 2024 Data/Example |

| Component Specialization | Few alternatives, high supplier leverage | Medical-grade electronics, precision filters |

| Supplier Concentration | Limited sourcing options increase supplier power | 3-4 key specialized manufacturers |

| Switching Costs (Regulatory) | FDA certification delays (12-18 months) increase cost/time to change suppliers | High barrier to switching, reinforcing existing supplier terms |

| Material Scarcity | Demand outstrips supply for critical materials | Rare earth elements, semiconductors; component prices up 7% |

What is included in the product

This Inogen Porter's Five Forces analysis delves into the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the portable oxygen concentrator market.

Instantly visualize competitive threats and opportunities with a dynamic, interactive Porter's Five Forces model, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

Inogen's diverse customer channels, including direct-to-consumer (DTC), business-to-business (B2B) via distributors and home medical equipment (HME) providers, and rental programs, influence customer bargaining power. While the DTC channel faced headwinds in 2024, with reports indicating a slowdown, the robust growth observed in the B2B segment in the same year suggests that distributors and HME providers, as key intermediaries, may wield significant leverage due to their volume purchasing power and market access.

Patients increasingly favor homecare, particularly for long-term oxygen therapy. This trend is fueled by portable oxygen concentrators offering greater mobility and an improved quality of life, directly influencing patient purchasing decisions.

In 2024, the global home healthcare market continued its upward trajectory, with projections indicating a compound annual growth rate of over 7% through 2028. This surge is largely driven by the demand for convenient, patient-centric solutions like portable oxygen concentrators, giving customers significant leverage in choosing providers and products.

Reimbursement policies from Medicare and other payers wield considerable influence over Inogen's customers' purchasing decisions. For instance, Medicare's average reimbursement rates for durable medical equipment (DME), which includes oxygen concentrators, directly impact the financial viability of renting Inogen's devices. Changes to these rates, such as potential reductions or shifts in coverage, can significantly alter the attractiveness of Inogen's rental model compared to outright purchase or alternative solutions, thereby increasing customer bargaining power.

Availability of Competing Products

The availability of numerous competing products significantly impacts the bargaining power of customers in the portable oxygen concentrator market. Inogen faces competition from established players like Philips Respironics, CAIRE, and Invacare, as well as newer entrants such as O2 Concepts and Belluscura. This broad competitive landscape empowers customers by providing them with abundant choices, allowing them to compare features, pricing, and service offerings across different brands. For instance, Belluscura's Xcare XC-500, launched in recent years, offers a competitive alternative with its lightweight design and extended battery life, directly challenging Inogen's market position.

This competitive intensity means customers can often find alternative solutions if they are dissatisfied with Inogen's pricing or product specifications. The ability to switch easily to a competitor's product means customers can demand better terms or more favorable pricing. In 2024, the market continues to see innovation, with companies focusing on improving battery technology and device portability, further enhancing customer options and their leverage. For example, CAIRE’s FreeStyle Comfort has been a strong performer, offering reliable performance and a user-friendly design that appeals to a wide customer base.

The presence of these alternatives directly influences Inogen's pricing strategies and its ability to maintain market share without offering competitive value. Customers, armed with information from various sources, can negotiate more effectively or simply opt for a product that better meets their specific needs and budget. This dynamic underscores the importance for Inogen to continually innovate and differentiate its offerings to retain customer loyalty.

- Competitive Landscape: Key competitors include Philips Respironics, CAIRE, Invacare, O2 Concepts, and Belluscura.

- Customer Choice: A wide array of products provides customers with options for features, pricing, and service.

- Market Dynamics: Innovation in battery technology and portability in 2024 enhances customer alternatives.

- Negotiating Power: The ease of switching to competitor products strengthens customers' ability to negotiate terms.

Technological Advancements and Features

Technological advancements in portable oxygen concentrators (POCs) are significantly impacting customer bargaining power. Innovations like extended battery life, lighter designs, and integrated smart features, such as remote monitoring capabilities, offer consumers more choices and the ability to demand superior products. For example, by mid-2024, the market saw a surge in POCs offering 8-12 hours of battery life on a single charge, a substantial improvement over earlier models, allowing patients greater freedom and reducing reliance on charging infrastructure.

Customers can now meticulously select devices that align with their specific lifestyle needs, from enhanced portability for active individuals to quieter operation for use in shared living spaces. This granular choice empowers them to negotiate better terms or switch to competitors offering more suitable technology. The increasing availability of POCs with advanced features, like Bluetooth connectivity for data tracking, means customers are less tied to any single brand and can leverage competitive offerings to their advantage.

- Enhanced Portability: Devices continue to reduce in weight, with many models in 2024 weighing under 5 pounds, increasing user mobility.

- Extended Battery Life: The average battery duration for continuous use has reached 8-12 hours, a key factor for patient autonomy.

- Smart Technology Integration: Features like app connectivity for monitoring usage and device status are becoming standard, giving users more control.

- Quieter Operation: Noise levels have decreased, with many units operating below 45 decibels, improving patient comfort and that of those around them.

The bargaining power of customers is a significant factor for Inogen. With a growing home healthcare market and technological advancements in portable oxygen concentrators (POCs), patients have more choices than ever. This increased selection empowers them to seek better value, whether through pricing, features, or overall product performance. The availability of numerous competing products, coupled with evolving reimbursement policies, means customers can exert considerable influence over Inogen's business practices.

In 2024, the global home healthcare market continued its strong growth, projected to expand at a compound annual growth rate exceeding 7% through 2028. This trend, driven by patient preference for home-based care and the enhanced mobility offered by devices like POCs, directly translates to greater customer leverage. Patients can more readily compare and select providers and products that best suit their individual needs and financial considerations.

The competitive landscape for POCs is robust, featuring established players and new entrants alike. Companies like Philips Respironics, CAIRE, and Invacare, alongside innovators such as O2 Concepts and Belluscura, offer a diverse range of products. Belluscura's Xcare XC-500, for instance, provides a compelling alternative with its lightweight design and extended battery life, directly challenging Inogen's market position. Similarly, CAIRE’s FreeStyle Comfort remains a strong competitor, appealing to customers with its reliable performance and user-friendly interface.

| Competitor | Key Product Feature Example | 2024 Market Trend Relevance |

| Philips Respironics | Lightweight, durable designs | Focus on patient comfort and ease of use |

| CAIRE | FreeStyle Comfort - reliable performance | Continued strong demand for user-friendly devices |

| Invacare | Diverse range of respiratory products | Broad product portfolio offers patient choice |

| O2 Concepts | Portable and user-friendly models | Growing emphasis on portability for active lifestyles |

| Belluscura | Xcare XC-500 - lightweight, extended battery | Innovation in battery life and device weight |

Full Version Awaits

Inogen Porter's Five Forces Analysis

This preview shows the exact Porter's Five Forces Analysis of Inogen you'll receive immediately after purchase—no surprises, no placeholders. It thoroughly examines the competitive landscape, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the portable oxygen concentrator market. You'll gain a comprehensive understanding of the strategic factors influencing Inogen's profitability and market position. This professionally written analysis is ready for your immediate use.

Rivalry Among Competitors

The global portable oxygen concentrators market is a hotbed of activity, projected to grow at a healthy 8.68% compound annual growth rate between 2025 and 2034. By 2034, this market is expected to reach a substantial $4.53 billion. This significant expansion naturally draws in more players, intensifying the competitive landscape.

Inogen faces a highly competitive landscape with numerous established players vying for market share in the portable oxygen concentrator (POC) industry. Competitors like Belluscura, Invacare, Drive DeVilbiss Healthcare, Precision Medical, CAIRE, and Philips Respironics offer a range of similar products, intensifying the rivalry.

This crowded market means companies must constantly innovate and differentiate to attract and retain customers. For instance, the increasing demand for lightweight and user-friendly POCs drives significant research and development efforts across the sector.

The presence of multiple key players directly impacts pricing strategies and marketing efforts. Companies must invest heavily in brand building and customer service to stand out, potentially leading to price wars or increased promotional spending.

In 2024, the home medical equipment market, which includes POCs, continued to see robust growth, estimated to reach over $200 billion globally, indicating both opportunity and the fierce competition Inogen navigates. This growth fuels further investment and product development from all participants.

Competitive rivalry in the portable oxygen concentrator market is intense, driven by a strong emphasis on product innovation. Companies are locked in a race to develop next-generation devices that are smaller, offer longer battery life, and incorporate advanced smart features for user convenience and remote monitoring.

Inogen has been actively participating in this innovation race. In 2024, the company launched its Rove 4 portable oxygen concentrator, a significant development in its product line. Furthermore, Inogen received FDA clearance for Simeox, a novel device targeting specific respiratory conditions, underscoring its commitment to expanding its technological offerings and addressing unmet patient needs within the competitive landscape.

Strategic Partnerships and Market Expansion

Competitive rivalry is intensifying as companies actively seek strategic partnerships and geographic expansion to capture greater market share. This drive is evident in Inogen's proactive approach, exemplified by its 2025 collaboration with Yuwell Medical.

This strategic alliance is designed to facilitate Inogen's entry into the significant Chinese market and simultaneously broaden its product offerings. Such moves are critical for staying competitive in the medical device sector, where global reach and diverse product lines are key differentiators.

The global market for portable oxygen concentrators, a key segment for Inogen, was valued at approximately $3.2 billion in 2024 and is projected to grow. This expansion into China, a market with a rapidly aging population and increasing healthcare demand, positions Inogen to capitalize on this growth.

- Strategic Alliance: Inogen partnered with Yuwell Medical in 2025.

- Market Entry: The partnership aims to establish Inogen's presence in China.

- Product Portfolio Expansion: The collaboration will also help Inogen diversify its product offerings.

- Market Dynamics: This reflects a broader industry trend of seeking growth through partnerships and international expansion.

Impact of Competitor Withdrawals

The withdrawal of key competitors, like Philips Respironics in 2024, significantly alters the competitive landscape. This action creates immediate market capacity, allowing surviving firms to potentially expand their production and market share. Such shifts can lead to a more concentrated market, potentially benefiting companies that can scale effectively to meet increased demand.

For instance, Philips Respironics' voluntary recall of certain CPAP machines in 2021, which continued to impact supply chains into 2024, created a void that other manufacturers sought to fill. This situation illustrates how competitor actions, even if not outright market withdrawal, can reshape competitive intensity and create opportunities for others in the respiratory care sector.

- Market Capacity Increase: Competitor withdrawals directly free up market share and production capacity.

- Accelerated Production for Survivors: Remaining players can ramp up output to capture increased demand.

- Shifting Competitive Dynamics: Market concentration changes, potentially leading to new leaders.

- Opportunity for Market Penetration: Companies with robust supply chains can gain ground.

Competitive rivalry in the portable oxygen concentrator (POC) market is fierce, with numerous players introducing innovative products. Inogen faces established competitors like Belluscura and Invacare, all vying for a share of a market projected to reach $4.53 billion by 2034. This intense competition necessitates continuous product development, as seen with Inogen's 2024 Rove 4 launch and FDA clearance for Simeox. The home medical equipment market, including POCs, was valued at over $200 billion globally in 2024, highlighting the significant opportunity and the competitive pressures to capture this demand.

| Competitor | Key Product Focus | 2024 Market Presence Indicator |

| Inogen | Lightweight, user-friendly POCs | Rove 4 launch, Simeox FDA clearance |

| Belluscura | Compact and portable oxygen solutions | Active product development and market presence |

| Invacare | Broad range of respiratory products | Established player with diverse offerings |

| Drive DeVilbiss Healthcare | Home respiratory care equipment | Significant market share in respiratory devices |

| Philips Respironics | Respiratory care devices (impacted by recalls) | Recall events in 2021 continued to affect supply into 2024 |

SSubstitutes Threaten

Traditional oxygen tanks represent a significant threat of substitution for portable oxygen concentrators (POCs) like those offered by Inogen. These tanks, while a long-standing solution for oxygen therapy, present considerable drawbacks in terms of weight and portability. For instance, a typical high-pressure oxygen cylinder can weigh upwards of 10-15 pounds, significantly limiting a user's mobility and independence compared to POCs.

POCs, in contrast, have revolutionized oxygen delivery by offering solutions that weigh as little as 3-5 pounds, drastically improving user quality of life. This difference in weight and design directly addresses the limitations of traditional tanks, making POCs a more attractive option for individuals seeking greater freedom. The market for home oxygen therapy is substantial, with millions of individuals relying on such devices, and the shift towards more portable solutions is evident.

Stationary oxygen concentrators represent a significant threat of substitutes for Inogen's portable offerings. These larger, less mobile units are a common choice for individuals requiring oxygen therapy primarily within their homes, offering a lower cost of entry compared to advanced portable systems.

While Inogen has strategically entered the stationary concentrator market through collaborations, the inherent lack of portability in these traditional devices directly contrasts with Inogen's core value proposition. This fundamental difference in user experience creates a clear segmentation.

The global stationary oxygen concentrator market was valued at approximately $2.5 billion in 2023, demonstrating its substantial presence and appeal to a segment of the oxygen therapy market that prioritizes cost and home-based use over mobility.

This persistent demand for stationary units underscores the ongoing threat of substitution, as these products cater to a distinct set of patient needs and preferences, potentially limiting the market share for portable devices like Inogen's.

Various other respiratory therapies can serve as substitutes for Inogen's portable oxygen concentrators, depending on a patient's specific medical needs and preferences. These include high-flow nasal cannula (HFNC) therapy, which delivers warmed, humidified oxygen at higher flow rates, and non-invasive ventilation (NIV) like BiPAP machines, often used for conditions like COPD exacerbations or sleep apnea. For instance, the market for CPAP devices, primarily used for sleep apnea, is substantial, with global sales projected to reach billions of dollars annually.

Furthermore, traditional oxygen delivery methods such as stationary oxygen concentrators and even compressed oxygen tanks remain viable alternatives, particularly in settings where portability is less critical or where initial equipment costs are a primary concern. Nebulizers, used for delivering inhaled medications, also address certain respiratory issues, though they are typically not a direct substitute for continuous oxygen therapy. The presence of these established and diverse treatment options poses a degree of threat to Inogen's market share.

Emerging Medical Research

New medical research could significantly impact the threat of substitutes for portable oxygen concentrators (POCs). For instance, studies emerging in 2024 and ongoing into 2025 are scrutinizing the long-term benefits of liberal oxygen therapy for specific patient demographics with chronic conditions like COPD. This research might lead to revised treatment protocols, potentially decreasing the perceived need for continuous, high-flow oxygen delivery for certain individuals.

Such shifts in medical guidelines could directly affect the demand for POCs. If new evidence suggests alternative or less intensive management strategies are equally or more effective for particular patient groups, the market for POCs could see a reduction in its perceived necessity. This is particularly relevant as the global respiratory disease market, which includes oxygen therapy, is projected for substantial growth, but the *nature* of that growth could be influenced by these emerging research findings.

- Shifting Treatment Paradigms: Emerging research in 2024-2025 may challenge the universal application of high-flow oxygen therapy for certain chronic respiratory conditions, potentially altering standard treatment guidelines.

- Reduced Perceived Necessity: If new studies demonstrate comparable or superior outcomes with less oxygen delivery, the perceived indispensability of continuous-flow POCs for some patient segments could diminish.

- Impact on Market Demand: A recalibration of oxygen therapy recommendations could lead to a softening of demand for POCs as alternative, potentially less costly or complex, management options gain traction.

- Competitive Landscape: Advances in non-oxygen-dependent therapies or improved home-based respiratory support could emerge as stronger substitutes, directly competing with the core value proposition of POCs.

Technological Advancements in POCs

Continuous technological advancements in portable oxygen concentrators (POCs) directly address and reduce the threat of substitutes. For instance, improvements in battery life, such as the Inogen Rove 4 offering up to 13 hours of operation on a single battery, make POCs far more convenient than older, less efficient models or alternative oxygen delivery systems.

These innovations also focus on making POCs lighter and more user-friendly. This increased portability and ease of use directly compete with less integrated or more cumbersome oxygen solutions, thereby diminishing their appeal. As POCs become more advanced, they effectively neutralize many potential substitute offerings.

The market is seeing a clear trend:

- Enhanced battery longevity: Devices are lasting longer, reducing the need for frequent recharging or backup systems.

- Reduced weight and size: POCs are becoming more discreet and easier to carry, improving patient mobility.

- Improved oxygen delivery efficiency: Newer models offer more precise and responsive oxygen delivery, mimicking or exceeding the performance of some traditional systems.

Traditional oxygen tanks and stationary concentrators remain significant substitutes for Inogen's portable oxygen concentrators (POCs). While tanks are cumbersome, stationary units, valued at around $2.5 billion globally in 2023, cater to cost-conscious, homebound patients. This highlights that while Inogen excels in portability, a substantial market segment prefers less mobile, often cheaper, alternatives.

Entrants Threaten

Entering the medical technology sector, especially for companies like Inogen aiming to manufacture sophisticated portable oxygen concentrators, necessitates a formidable initial outlay. This includes significant investment in cutting-edge research and development to ensure product efficacy and safety, alongside the establishment of state-of-the-art manufacturing facilities adhering to stringent regulatory standards.

The sheer scale of capital required for product development, regulatory approvals, and building a robust supply chain acts as a substantial deterrent to potential new competitors. For instance, the average R&D spending for medical device companies in 2024 is projected to be around 10-15% of revenue, with initial setup costs easily running into tens of millions of dollars.

Furthermore, the need for substantial inventory to meet demand, coupled with the costs associated with marketing and distribution networks, further elevates the barrier to entry. This financial hurdle means that only well-funded entities can realistically consider challenging established players in this market.

Extensive regulatory hurdles significantly deter new entrants in the medical device sector. For instance, obtaining FDA 510(k) clearance in the United States or CE marking in Europe involves complex, time-consuming, and expensive processes. These approvals can often take 12 to 18 months to secure, representing a substantial barrier to entry for smaller or less-resourced companies looking to compete with established players like Inogen.

New companies looking to break into markets often face a significant hurdle: the need for established distribution channels. For instance, in the competitive healthcare sector, a company like Inogen, which sells portable oxygen concentrators, relies heavily on a well-developed network. This includes direct-to-consumer sales, crucial partnerships with home medical equipment (HME) providers, and efficient rental programs.

Building these vital relationships and infrastructure from scratch is a formidable task. New entrants must invest substantial resources to create and maintain these channels, which can be a major barrier to entry. In 2024, the HME industry continued to see consolidation, making it even harder for new players to secure preferred provider status with key distributors, a critical factor for market access and revenue generation.

Technological Expertise and Patents

The threat of new entrants to the portable oxygen concentrator market is significantly mitigated by the substantial technological expertise and patent protection held by incumbent firms like Inogen. Developing cutting-edge portable oxygen concentrators requires deep knowledge in areas such as miniaturization, battery technology, and respiratory mechanics. Inogen, for instance, has consistently invested in research and development, leading to a portfolio of patents that protect its core technologies and product designs. This technological moat makes it difficult and costly for new companies to enter without infringing on existing intellectual property or facing a significant disadvantage in product performance and efficiency.

New entrants would need to overcome substantial barriers related to:

- Intellectual Property: Navigating and potentially circumventing Inogen's patent portfolio, which covers key aspects of their concentrator technology.

- Research and Development Costs: The significant capital required to develop innovative technology that can match or exceed the performance and features of established products.

- Product Differentiation: Creating a unique value proposition that stands out in a market where Inogen has a strong brand reputation and a track record of product advancements.

Brand Loyalty and Reimbursement Landscape

Established players in the respiratory device market, like Inogen, often cultivate strong brand loyalty among both patients and healthcare providers. This loyalty, built on trust and proven performance, makes it challenging for new entrants to gain traction. For instance, a significant portion of home oxygen therapy users may be hesitant to switch from familiar and reliable brands that have met their needs for extended periods.

Navigating the reimbursement landscape presents another substantial barrier for new entrants. The process of securing coverage from insurance providers, including Medicare and private payers, is complex and often fragmented across different regions and plans. New companies must invest considerable resources to understand these intricate systems, negotiate favorable reimbursement rates, and demonstrate clinical and economic value to gain market access. In 2024, the average reimbursement rate for durable medical equipment (DME) services like oxygen therapy remained a critical factor influencing market penetration.

- Brand Loyalty: Established brands enjoy trust, making patient and prescriber switching costly for new entrants.

- Reimbursement Complexity: New entrants face hurdles in securing coverage and favorable rates within fragmented healthcare payment systems.

- Cost of Market Entry: Significant investment is required to understand and navigate payer requirements, impacting new entrants' ability to compete on price and access.

- Clinical Evidence: Demonstrating superior clinical outcomes and cost-effectiveness is crucial for new devices to gain acceptance and reimbursement.

The threat of new entrants into the portable oxygen concentrator market is considerably low due to immense capital requirements and established brand loyalty. Significant upfront investment is needed for research, development, and regulatory compliance, with 2024 data showing medical device R&D averaging 10-15% of revenue. Furthermore, incumbent firms like Inogen benefit from strong patient and prescriber trust, making it difficult for newcomers to gain market share.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Inogen is built upon a foundation of publicly available data. This includes Inogen's annual reports and SEC filings, which provide detailed financial performance and strategic outlooks. We also leverage industry-specific market research reports and competitor analyses to understand the broader competitive landscape.