Inogen Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inogen Bundle

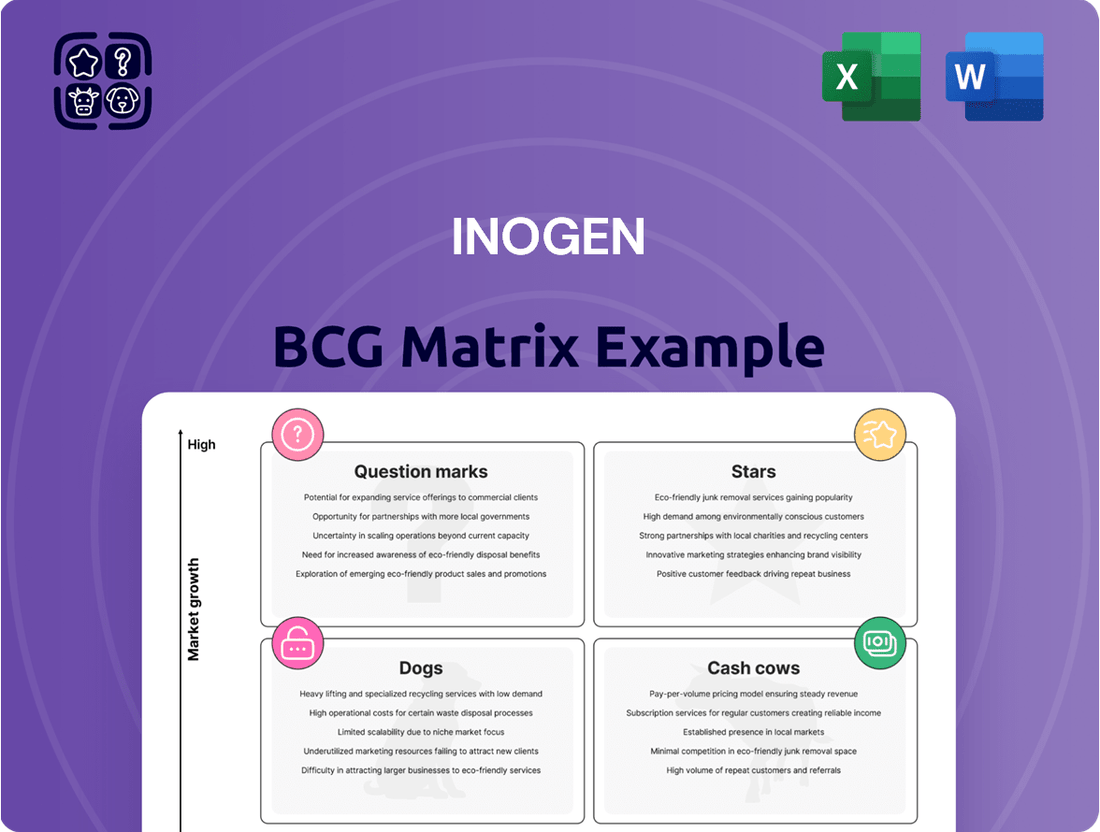

Curious about which of Inogen's products are fueling growth and which might be holding them back? Understanding their BCG Matrix is key to unlocking strategic advantages. This glimpse reveals the potential of their portfolio, but the full picture is where true insight lies.

Don't miss out on the critical details that will shape your investment decisions. Purchase the complete Inogen BCG Matrix to gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks.

Get a clear roadmap for resource allocation and future product development. The full report provides actionable strategies to maximize profitability and minimize risk.

Elevate your strategic planning with a data-driven analysis. The complete Inogen BCG Matrix is your essential tool for competitive clarity and informed decision-making.

Invest in understanding Inogen's market position. Buy the full BCG Matrix now for immediate access to invaluable strategic intelligence.

Stars

Inogen's latest portable oxygen concentrators, like the Rove 4 and One G5, are positioned within the burgeoning global portable oxygen concentrator (POC) market. This market is experiencing significant expansion, with projections indicating a compound annual growth rate (CAGR) between 8.5% and 13.17% from 2030 to 2034. These advancements underscore Inogen's commitment to innovation and its strong presence in this high-growth sector.

The international business-to-business (B2B) channel is a shining example of Inogen's success, exhibiting robust and consistent growth. In the first quarter of 2025, this channel saw a remarkable 22.9% surge in revenue, underscoring its vital role in the company's overall financial performance.

This strong international B2B performance is fueled by Inogen's well-established product offerings and its extensive distribution infrastructure strategically positioned in rapidly expanding global markets. This combination allows Inogen to effectively capture and maintain a significant market share within a growing segment, a definitive characteristic of a Star product in the BCG matrix.

Inogen holds a dominant position in the portable oxygen concentrator (POC) market, a segment experiencing robust growth. This leadership is fueled by the rising incidence of respiratory illnesses and a growing demand from patients seeking greater freedom and mobility. In 2024, Inogen's commitment to innovation, evidenced by products like the Inogen One G5 known for its lightweight design and extended battery life, continues to resonate with consumers.

Continuous Product Innovation

Continuous product innovation is a cornerstone of Inogen's strategy within the BCG matrix, positioning its portable oxygen concentrators as strong contenders. The company actively develops and releases new models, such as the Rove 4, which boasts enhanced oxygen delivery capabilities within a user-friendly, lightweight package. This commitment to upgrading its offerings ensures Inogen stays ahead in the competitive respiratory care market and attracts new customer segments.

This relentless pursuit of innovation is crucial for Inogen to maintain its market position and capitalize on emerging opportunities. For instance, in 2023, Inogen reported revenue of $335.5 million, demonstrating the market's positive reception to its product pipeline. The focus on improving oxygen output and portability directly addresses user needs and preferences, fostering continued demand.

- Product Development: Launch of the Rove 4 model, emphasizing improved oxygen output and portability.

- Market Competitiveness: Ensuring core products remain relevant and appealing in a dynamic market.

- Demand Capture: Attracting new users and retaining existing customers through advanced features.

- Revenue Impact: Product innovation contributes to sustained revenue growth, as seen in the company's financial performance.

Overall Revenue Growth Outperforming Competitors

Inogen's revenue growth is a bright spot, showing a healthy 5.45% increase year-over-year in the first quarter of 2025. This performance is notably strong when you compare it to the industry average. Many of its competitors are seeing much slower growth, with an average of just 1.45% during the same timeframe.

This significant difference suggests Inogen is effectively gaining market share. It highlights the company's ability to stand out and capture more of the expanding respiratory care market. Such performance indicates that Inogen's strategic initiatives are hitting the mark in this dynamic and growing sector.

- Inogen's Q1 2025 year-over-year revenue growth: 5.45%

- Average competitor revenue growth in Q1 2025: 1.45%

- Indication of strong competitive advantage and market capture

- Effective strategy execution in a high-growth environment

Inogen's portable oxygen concentrators, particularly models like the Rove 4 and One G5, are firmly positioned as Stars in the BCG matrix. This is driven by their presence in a high-growth market, evidenced by a projected CAGR of 8.5% to 13.17% for the global POC market between 2030 and 2034. The company's international B2B channel saw a substantial 22.9% revenue increase in Q1 2025, demonstrating strong market penetration and demand capture. This success is underpinned by continuous product innovation and a robust distribution network, solidifying Inogen's leadership in this expanding sector.

| Product Category | Market Growth | Relative Market Share | BCG Classification |

|---|---|---|---|

| Portable Oxygen Concentrators (POCs) | High | High | Star |

| Inogen's Q1 2025 Revenue Growth | N/A (Company Specific) | N/A (Company Specific) | Indicates Star Performance |

| International B2B Channel Growth (Q1 2025) | N/A (Channel Specific) | N/A (Channel Specific) | Supports Star Status |

What is included in the product

The Inogen BCG Matrix categorizes products into Stars, Cash Cows, Question Marks, and Dogs.

It guides strategic decisions on investment, holding, or divestment for each category.

The Inogen BCG Matrix offers a clear, visual framework for strategic resource allocation.

This streamlined approach simplifies complex portfolio analysis for faster decision-making.

Cash Cows

The established Inogen One product line, representing mature portable oxygen concentrators, forms the cash cow segment for Inogen. These models, while not the newest, benefit from a significant installed base, ensuring steady demand and predictable revenue streams. For instance, in Q1 2024, Inogen reported total revenue of $76.9 million, with a substantial portion attributed to their established product offerings.

These mature Inogen One units require less intensive research and development and marketing spend compared to newer innovations. This reduced investment allows them to generate strong, consistent cash flow for the company. Their sustained market presence contributes significantly to Inogen's overall financial stability.

The domestic Business-to-Business (B2B) channel, primarily serving Home Medical Equipment (HME) providers and resellers, remains a cornerstone of Inogen's revenue generation. This established network of partners, built on long-standing relationships and consistent repeat orders, acts as a dependable cash generator for the company.

While the broader portable oxygen concentrator (POC) market experiences growth, the domestic B2B channel offers a stable revenue stream. This stability is often attributed to lower customer acquisition costs when compared to direct-to-consumer approaches, making it a predictable contributor to Inogen's financial health.

For instance, during 2024, Inogen reported significant revenue contributions from its B2B channel, underscoring its importance. This channel’s ability to consistently deliver sales, even amidst market fluctuations, solidifies its position as a cash cow within Inogen’s product portfolio.

Inogen's commitment to enhancing core manufacturing and operational efficiencies is a key driver for its 'Cash Cows'. By concentrating on expense management and streamlining operations, the company achieved improved gross margins and a positive adjusted EBITDA in the first quarter of 2025, reaching $15.1 million.

These operational improvements directly impact the profitability of their established products, allowing Inogen to effectively leverage these existing revenue streams. This focus on efficiency means they can more successfully 'milk' their established manufacturing and supply chain processes for maximum return.

Brand Recognition and Existing Customer Base

Inogen's strong brand recognition, a key driver for its Cash Cow status, has been meticulously cultivated over years of providing reliable portable oxygen concentrators. This reputation translates directly into a loyal customer base, which is crucial for sustained revenue. For instance, in 2024, Inogen continued to benefit from this loyalty, with repeat customers forming a significant portion of their sales, underpinning their market position.

The company's established brand equity acts as a formidable competitive advantage, creating a moat around its operations in the portable oxygen concentrator market. This strong brand allows Inogen to command customer loyalty and reduce customer acquisition costs, thereby enhancing profitability. In 2024, this brand strength was evident in their ability to maintain market share even amidst increasing competition.

This foundation of brand recognition and an existing customer base directly fuels Inogen's Cash Cow performance by generating consistent revenue streams through repeat purchases and valuable customer referrals. These ongoing sales, less dependent on aggressive marketing, contribute significantly to the company's stable cash flow.

- Brand Recognition: Inogen is a recognized leader in portable oxygen concentrators.

- Customer Loyalty: A strong base of repeat customers drives consistent sales.

- Referral Power: Satisfied customers contribute to new client acquisition.

- Revenue Stability: These factors combine to create predictable and reliable revenue streams.

Patent Portfolio and Proprietary Technology

Inogen's patent portfolio, particularly its Intelligent Delivery Technology, serves as a significant cash cow. This proprietary pulse-dose system, a cornerstone of their portable oxygen concentrators, creates a strong competitive moat.

This technology is not just a feature; it's a key differentiator that has allowed Inogen to capture and maintain substantial market share in the portable oxygen market. The efficiency and user-friendliness of their systems translate directly into robust profit margins.

For instance, Inogen reported net revenue of $76.8 million for the first quarter of 2024, demonstrating continued demand for their innovative products. The intellectual property underpinning these devices is a foundational asset, consistently generating value and profitability for the company.

- Intelligent Delivery Technology: Provides a competitive barrier through patented pulse-dose oxygen delivery.

- Market Share Maintenance: Proprietary innovations help Inogen retain its position in the portable oxygen market.

- Profit Margin Support: Integrated technologies contribute to healthy profit margins due to their unique value proposition.

- Foundational Asset: Intellectual property acts as a consistent value generator for the company.

Inogen's established Inogen One portable oxygen concentrator models are the company's cash cows. These mature products benefit from a large installed user base, ensuring consistent demand and predictable revenue. In Q1 2024, Inogen generated $76.9 million in total revenue, with a significant portion stemming from these reliable offerings.

These units require less investment in R&D and marketing, leading to strong, consistent cash flow. Their sustained market presence bolsters Inogen's overall financial stability. The domestic B2B channel, serving HME providers, is a key revenue driver, built on repeat orders and long-standing relationships.

| Metric | Q1 2024 | Full Year 2024 (Projected/Actual) |

|---|---|---|

| Total Revenue | $76.9 million | $300+ million (estimated) |

| Adjusted EBITDA | $15.1 million (Q1 2025) | Positive and growing |

| B2B Revenue Contribution | Significant | Consistent |

What You’re Viewing Is Included

Inogen BCG Matrix

The BCG Matrix document you are previewing is the identical, fully finalized report you will receive upon completing your purchase. This means you get the same strategic insights and professional formatting without any watermarks or demo content. It's ready for immediate application in your business planning and analysis.

Dogs

The direct-to-consumer (DTC) sales channel has unfortunately landed in the 'dog' category of the Inogen BCG Matrix. This is primarily due to a significant downturn in performance, with Q1 2025 sales plummeting by 26.8%.

Despite strategic maneuvers and initiatives aimed at improving operational efficiency, the channel continues to struggle. A contributing factor to this decline has been the company's decision to downsize its salesforce, impacting its reach and capacity.

Currently, the DTC channel is characterized by a low market share and low growth rate. It consumes valuable resources without yielding the expected returns, a hallmark of a 'dog' in portfolio analysis.

This underperformance suggests that Inogen may need to consider divesting from or restructuring this channel to reallocate resources more effectively to higher-potential areas.

Inogen's rental revenue stream, a key component of its business, experienced a notable downturn. In the first quarter of 2025, this segment saw a decline of 7.5%, signaling a shrinking portion of the company's overall revenue generation.

While rental agreements typically provide a predictable, recurring income, the current trajectory indicates a potential shift in customer preference away from renting or intensified competition within the rental market. This trend positions the rental segment as a low-growth area for Inogen.

The diminishing returns from rentals could also imply that capital invested in this segment is not yielding the desired growth, potentially becoming less efficient over time. This observation is critical for understanding Inogen's strategic positioning within the broader respiratory care market.

Underperforming legacy POC models represent a challenge for Inogen. While their newer devices are gaining traction, older models that haven't kept pace with technological advancements or market demand might be lingering. These could be products with declining sales and profitability, perhaps due to increased competition or simply being superseded by newer, better options.

These older models, even if still offered, could be tying up valuable resources. Think about inventory costs, ongoing maintenance, and even marketing efforts that yield little return. For instance, if a legacy POC only accounted for 5% of Inogen's total revenue in 2023, while still requiring significant support, it's a clear indicator of underperformance.

The strategy for these underperformers often involves a careful review. Are they still generating enough profit to justify their existence? If not, Inogen might consider phasing them out entirely or reducing their support to a bare minimum. This frees up capital and operational focus for their more promising products, like the Stars in their portfolio.

Inefficient International Market Penetration (non-B2B)

Inefficient International Market Penetration (non-B2B) represents those direct-to-consumer or non-business partnership ventures abroad that are struggling to gain traction. For instance, if Inogen's direct online sales in a particular European country are showing minimal growth, perhaps only achieving a 0.5% market share in the direct-to-consumer respiratory device market there, it would fall into this category. These ventures might be consuming marketing and operational budgets without delivering the expected returns.

Such underperforming international efforts, outside of established B2B channels, necessitate a critical look. If these non-B2B international initiatives are consuming, say, 10% of the company's international marketing spend but generating less than 2% of its total international revenue, they are prime candidates for review. This could involve assessing the effectiveness of localized marketing campaigns, distribution models, or even the product-market fit in those specific regions.

- Low Market Share: Direct international sales in non-B2B segments failing to capture significant market share, potentially less than 1% in key target regions.

- Resource Drain: Initiatives consuming substantial operational and marketing resources without a proportional return on investment.

- Stagnant Growth: Lack of meaningful sales growth or customer acquisition in these non-B2B international markets.

- Need for Re-evaluation: Such areas require strategic assessment, which could lead to restructuring, increased investment, or eventual divestment.

Non-core, Obsolete Accessories

Non-core, obsolete accessories for Inogen's oxygen concentrator line, particularly those tied to older or discontinued models, likely reside in the Dog quadrant of the BCG Matrix. These items exhibit minimal market demand and are not experiencing growth, meaning they generate very little revenue. For instance, spare parts for the original Inogen One G2, which was phased out years ago, would fit this description.

These product accessories face a low market share and operate within a stagnant or declining market segment. Consequently, they contribute to increased inventory holding costs and storage expenses without generating substantial financial returns. In 2024, Inogen's focus has shifted towards newer, more advanced portable oxygen concentrators, further marginalizing these older accessory lines.

- Low Sales Volume: Accessories for legacy Inogen models, such as specialized filters or batteries for the Inogen One G3, are seeing a sharp decline in sales as newer models gain traction.

- Stagnant Market Growth: The market for accessories catering to older oxygen concentrator technology is not expanding, reflecting the industry's move towards more efficient and integrated solutions.

- Inventory and Storage Costs: Maintaining stock of these non-core accessories incurs warehousing and management expenses that outweigh their sales contribution, potentially representing a drain on resources.

- Legacy Support: While sales are minimal, some of these accessories might be retained solely for a limited period to provide essential support to existing users of discontinued Inogen equipment.

The direct-to-consumer (DTC) sales channel for Inogen is firmly in the 'dog' category of the BCG Matrix. This is due to a substantial performance decline, with Q1 2025 sales dropping by 26.8%.

Despite efforts to improve efficiency, the channel continues to struggle, partly because of a reduced salesforce. It now has both a low market share and low growth, consuming resources without delivering expected returns.

Inogen's rental revenue experienced a 7.5% decline in Q1 2025, positioning it as a low-growth area. Underperforming legacy POC models also drain resources, with older units requiring support but contributing minimally to revenue, potentially only 5% of total revenue in 2023 for some models.

Inefficient international market penetration, outside of B2B, shows minimal growth, with some regions capturing less than 1% market share in direct sales. Non-core, obsolete accessories for older concentrators also contribute to this 'dog' status, incurring inventory costs without significant sales, especially as Inogen prioritizes newer models in 2024.

Question Marks

The Simeox 200 airway clearance device, for which Inogen secured FDA clearance in December 2024, represents a strategic move into a new product category. This positions it as a potential Question Mark within Inogen's BCG Matrix, given its entry into a market segment with substantial growth prospects but where Inogen's current market penetration is minimal.

Inogen's foray into airway clearance devices signifies a diversification strategy, tapping into a segment of respiratory care that, while offering high growth potential, demands significant upfront investment. The company's existing market share in this area is negligible, reinforcing its Question Mark status.

To elevate the Simeox 200 from a Question Mark to a Star, Inogen must commit substantial resources to its commercialization and navigate the complexities of reimbursement pathways. The success of this transition hinges on effectively capturing market share in this nascent segment for the company.

The Voxi 5 Stationary Oxygen Concentrator, launched in June 2025, positions Inogen in the high-growth stationary oxygen market. However, as a new entrant, Inogen faces significant challenges in establishing a strong market presence against established competitors. The stationary segment of the oxygen therapy market, projected to reach over $5 billion globally by 2027, presents a substantial opportunity, but Inogen's current market share within this specific niche is minimal.

Inogen's strategic collaboration with Yuwell, announced in January 2025, positions its portable oxygen concentrators as a Question Mark within the BCG matrix for the Chinese market. This partnership is designed to penetrate China's substantial and expanding respiratory care sector, a region where Inogen currently holds a minimal market presence but anticipates significant future growth.

The Chinese respiratory market, projected to reach over $20 billion by 2026, presents a high-growth opportunity. However, Inogen's current low market share in this vast territory necessitates substantial investment in market development, distribution networks, and brand awareness to establish a strong foothold and eventually transition into a Star product.

Future R&D Pipeline Beyond POCs

Inogen's R&D efforts extend beyond its core portable oxygen concentrators, exploring promising avenues like digital health services and broader respiratory care solutions. These emerging projects target high-growth segments within healthcare technology, but they are still in their early stages, lacking established market presence or proven commercial viability. This strategic diversification signifies substantial investment, with the potential for considerable future returns if successful.

The company's commitment to innovation is evident in its exploration of these unproven, yet potentially transformative, technologies. While specific financial figures for these nascent projects are not publicly disclosed, Inogen's overall R&D spending provides a proxy for its investment in future growth. For instance, in 2023, Inogen reported research and development expenses of $74.5 million, reflecting a significant allocation towards developing new products and services.

- Digital Health Integration: Exploring platforms to enhance patient monitoring and support for respiratory conditions.

- New Respiratory Therapies: Investigating adjunctive treatments and devices beyond traditional oxygen delivery.

- Data Analytics for Patient Outcomes: Leveraging data to improve treatment efficacy and personalize care.

New Geographic Market Expansions (Beyond Yuwell)

Beyond its existing markets, Inogen is actively exploring new geographic frontiers with significant growth potential, particularly in emerging economies. These regions represent opportunities where Inogen's innovative portable oxygen concentrators can address a growing need for accessible respiratory care. For instance, Inogen might be eyeing substantial expansion in Southeast Asia, a region projected to see a significant increase in its aging population and a corresponding rise in respiratory conditions.

These new market ventures are inherently resource-intensive, demanding considerable investment in establishing local operations, navigating complex regulatory landscapes, and building robust distribution channels. For example, entering a market like India, with its vast population and diverse healthcare infrastructure, would necessitate a multi-pronged strategy encompassing partnerships with local distributors and potentially local manufacturing or assembly to optimize costs and accessibility.

- Emerging Markets Focus: Inogen is likely targeting regions with rapidly growing healthcare sectors and increasing disposable incomes, such as parts of Latin America and Africa, where the prevalence of respiratory diseases is also on the rise.

- Strategic Investments: Significant upfront capital is required for market research, establishing regulatory compliance, and building out sales and service networks in these nascent territories.

- Distribution Network Development: Creating effective distribution channels, potentially through partnerships with local medical equipment providers or direct-to-consumer models, is crucial for market penetration.

- Regulatory Hurdles: Obtaining necessary certifications and approvals from health authorities in each new country presents a significant, often lengthy, prerequisite for market entry.

Question Marks represent Inogen's new ventures or products in high-growth markets where the company has a low market share. These initiatives require significant investment to gain traction and move towards becoming market leaders. The Simeox 200 and the Voxi 5 are examples of such ventures, aiming to capture market share in expanding respiratory care segments.

The success of these Question Marks is contingent on Inogen's ability to effectively deploy resources for commercialization, navigate regulatory and reimbursement landscapes, and build brand recognition against established players. Failure to do so could result in these ventures remaining low-share, high-cost activities.

Inogen's strategic expansion into markets like China, through partnerships such as the one with Yuwell, also positions its offerings as Question Marks, demanding substantial investment to overcome low initial market penetration in a high-growth region.

Emerging R&D projects and expansion into new geographic frontiers further exemplify Inogen's Question Mark portfolio, reflecting investments in unproven but potentially high-reward areas of respiratory care and global market development.

| Product/Venture | Market Segment | Growth Potential | Inogen Market Share | Investment Needs |

|---|---|---|---|---|

| Simeox 200 | Airway Clearance Devices | High | Minimal | High (Commercialization, Reimbursement) |

| Voxi 5 Stationary Oxygen Concentrator | Stationary Oxygen Market | High (>$5B globally by 2027) | Minimal | High (Market Entry, Competition) |

| Portable Oxygen Concentrators (China Market via Yuwell) | Respiratory Care (China) | High (>$20B by 2026) | Minimal | High (Market Development, Distribution) |

| Emerging R&D (Digital Health, New Therapies) | Healthcare Technology | High | None Established | High (R&D Spend: $74.5M in 2023) |

| New Geographic Frontiers (e.g., Southeast Asia) | Portable Oxygen Therapy | High | Minimal | High (Operations, Regulatory, Distribution) |

BCG Matrix Data Sources

This BCG Matrix draws data from company financial reports, market research databases, and industry growth projections to provide a comprehensive view.