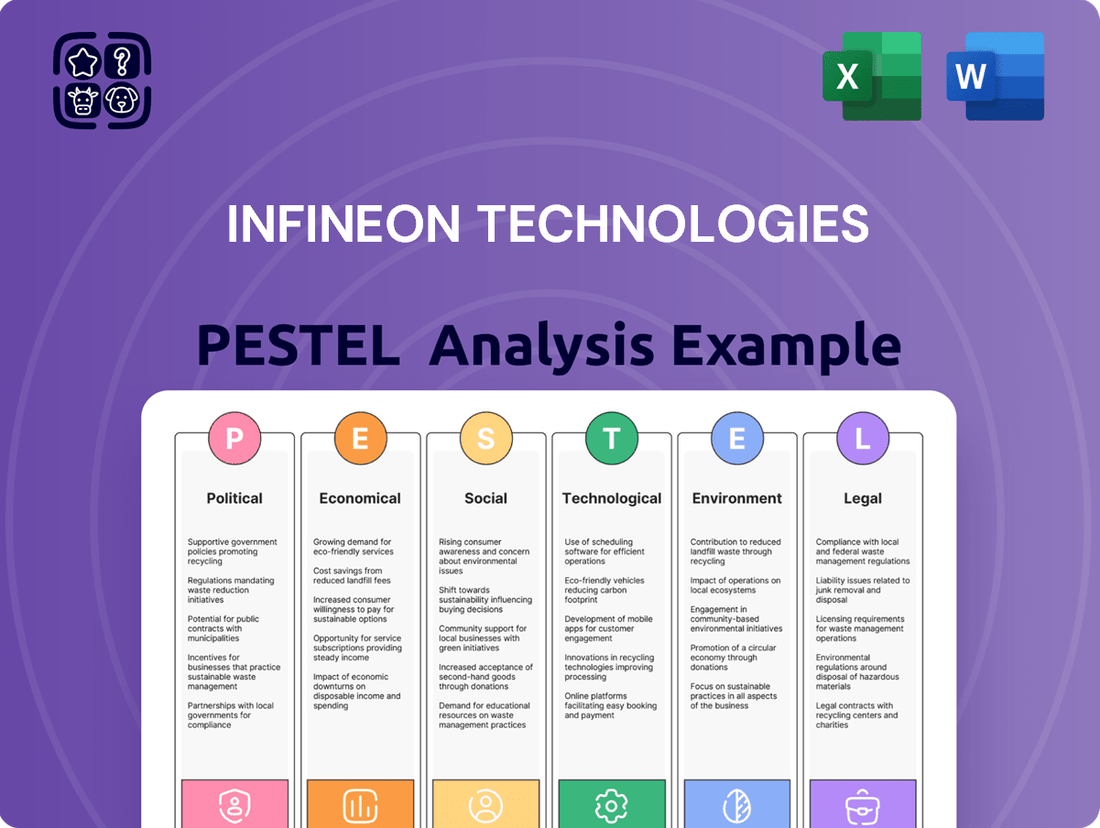

Infineon Technologies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Infineon Technologies Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping Infineon Technologies. Our expertly crafted PESTLE analysis provides the essential intelligence you need to understand the external landscape and anticipate future challenges and opportunities. Download the full version now and gain a strategic advantage.

Political factors

Geopolitical tensions, particularly between the United States and China, significantly impact the semiconductor industry, affecting companies like Infineon. These tensions can trigger trade restrictions and tariffs, leading to higher production costs and supply chain disruptions. For example, US import tariffs are projected to create challenges for global vehicle production, a key market for Infineon's automotive segment.

Governments globally are actively supporting semiconductor manufacturing through substantial subsidy programs. The EU Chips Act and the US CHIPS Act are prime examples, designed to bolster domestic production and secure supply chains. Infineon is strategically positioned to capitalize on these, having secured approval for funding under the EU Chips Act for its Smart Power Fab in Dresden, Germany.

This significant investment, part of a broader €3 billion initiative for the Dresden facility, underscores Europe's commitment to becoming a leading semiconductor hub and ensuring a more stable supply of critical components. Such government backing is crucial for Infineon's expansion plans and its ability to compete in the global market, particularly in advanced power semiconductors.

Governments worldwide are prioritizing supply chain resilience, particularly in critical sectors like semiconductors. This political focus aims to reduce dependency on single geographic locations or suppliers, a trend Infineon Technologies actively addresses.

Infineon is investing in expanding its manufacturing footprint across different regions to bolster supply chain security. For instance, its recent investments in Dresden, Germany, and its ongoing expansion in Melaka, Malaysia, are strategic moves to diversify production and mitigate geopolitical risks.

The company's approach aligns with regulatory initiatives such as the European Chips Act, which aims to strengthen the EU's semiconductor ecosystem. Infineon's commitment to crisis preparedness, including prioritizing orders during periods of scarcity, demonstrates its adaptation to these evolving political landscapes and its role in ensuring supply continuity.

Nationalization of Semiconductor Technology

Governments worldwide are increasingly recognizing semiconductors as critical national assets, prompting policies aimed at nationalizing technology and production. This trend directly impacts where companies like Infineon Technologies allocate their research, development, and manufacturing investments, as nations seek to secure their technological sovereignty and geopolitical standing.

This push for domestic semiconductor capabilities is evident in significant government funding initiatives. For instance, the US CHIPS and Science Act, enacted in 2022, allocated $52.7 billion for semiconductor manufacturing and research. Similarly, the European Union's European Chips Act, proposed in 2022 and gaining traction through 2023 and into 2024, aims to mobilize over €43 billion in public and private investment to bolster the EU's semiconductor ecosystem. These policies create both opportunities and challenges for global players like Infineon, potentially influencing supply chain strategies and market access.

- Strategic Asset Designation: Semiconductors are now viewed as vital for national security and economic competitiveness, leading to increased government intervention.

- Geopolitical Competition: Nations are vying for leadership in semiconductor technology, driving policies that favor domestic production and innovation.

- Investment Incentives: Government funding and tax breaks are being offered to encourage the establishment and expansion of semiconductor manufacturing facilities within national borders.

- Supply Chain Resilience: The desire to reduce reliance on foreign suppliers is a key driver behind nationalization efforts, aiming to build more robust and secure supply chains.

Impact of Armed Conflicts

Ongoing armed conflicts, particularly the war in Ukraine and the situation in the Middle East, inject significant volatility into global markets. This instability directly impacts semiconductor supply chains, which are already complex and sensitive. Infineon, like other players, faces potential disruptions in the availability of essential raw materials and components, alongside broader economic uncertainty. For instance, the conflict in Ukraine has previously impacted the supply of neon gas, crucial for chip manufacturing.

The geopolitical landscape presents ongoing challenges for global economic stability, which in turn affects demand for electronic components. Infineon must maintain a high degree of operational agility to navigate these unpredictable geopolitical events and their downstream effects on its business. The company's ability to diversify its sourcing and manufacturing locations becomes increasingly critical in mitigating these risks.

- Geopolitical Instability: Conflicts in Ukraine and the Middle East create supply chain vulnerabilities and economic uncertainty.

- Raw Material Sourcing: Disruptions can affect the availability of critical materials like neon gas, essential for semiconductor production.

- Economic Volatility: Global economic slowdowns or recessions, often exacerbated by conflicts, can reduce demand for electronics.

- Supply Chain Resilience: Infineon's strategy must prioritize diversification and flexibility to counter potential disruptions.

Governmental support for semiconductor manufacturing, exemplified by the US CHIPS Act and the EU Chips Act, is a significant political factor. Infineon is actively leveraging these initiatives, securing substantial funding for its Dresden facility, which is part of a broader €3 billion investment. This strategic alignment with government policies aims to bolster domestic production and enhance supply chain resilience, crucial for Infineon's growth and competitive positioning in the global market.

What is included in the product

This PESTLE analysis examines the external macro-environmental forces impacting Infineon Technologies, covering political, economic, social, technological, environmental, and legal factors.

It provides a comprehensive understanding of how these global trends create both challenges and strategic advantages for Infineon in the semiconductor industry.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a quick understanding of Infineon's external environment to address strategic uncertainties.

Easily shareable summary format ideal for quick alignment across teams or departments, simplifying complex external factors to foster cohesive strategic decision-making for Infineon.

Economic factors

Infineon Technologies is navigating a global economic environment characterized by muted growth. Many of its core markets are experiencing a slowdown, with the notable exception of sectors driven by artificial intelligence. This broad economic deceleration directly impacts the overall demand for semiconductors, a key component in a vast array of electronic devices and systems.

The semiconductor industry's typical cyclical recovery appears to be postponed. This delay suggests that the subdued business trajectory anticipated for Infineon in fiscal year 2025 is likely to persist. For instance, the International Monetary Fund (IMF) projected a global growth rate of 3.2% for 2024, a slight decrease from 3.5% in 2023, indicating a generally cautious economic outlook that affects consumer and industrial spending on electronics.

Infineon, like many in the semiconductor sector, is navigating a cyclical downturn marked by significant inventory corrections. This is particularly evident in the automotive and industrial segments, where demand visibility beyond the immediate future is being obscured.

The company has noted a sluggish recovery in industrial markets, with inventory digestion still a primary concern. For instance, in its fiscal Q1 2024 (ending December 31, 2023), Infineon reported a 27% year-over-year revenue decline in its Industrial Power Control segment, reflecting these ongoing adjustments.

This environment necessitates a cautious approach, with Infineon strategically preparing for a potentially challenging business landscape throughout 2024 and into 2025 as these inventory imbalances are worked through.

Infineon is encountering ongoing pricing pressures, especially for its standard power components within industrial sectors, notably in China. This trend directly impacts the company's profit margins and its ability to grow its market presence.

To navigate this, Infineon must prioritize operational efficiencies and stringent cost management. For instance, in the fiscal year 2023, while Infineon reported revenue growth, the automotive segment, a key area for power components, saw its revenue increase by 15% year-over-year to €10.4 billion, indicating continued demand but also the potential for margin compression if pricing remains under pressure.

Sustaining profitability in such a price-sensitive market environment is paramount. Infineon's strategy likely involves shifting focus towards higher-value, differentiated products where pricing power is stronger, rather than solely competing on cost for standard components.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations, particularly the EUR/USD, can significantly impact Infineon Technologies' reported revenue and profitability. For instance, a stronger US dollar relative to the Euro can reduce the value of USD-denominated earnings when translated back into Euros, potentially affecting the company's financial performance. Managing these foreign exchange exposures is a constant focus for the company's treasury operations.

Infineon's revised revenue outlook for fiscal year 2025 acknowledges the potential for adverse currency movements. This means that even if sales volumes remain consistent, changes in exchange rates could lead to a lower reported revenue figure. The company actively monitors these impacts to provide a more accurate financial forecast to investors.

- Impact on Revenue: Adverse EUR/USD movements can decrease the Euro value of US dollar earnings.

- Fiscal 2025 Outlook: Currency fluctuations are a noted factor in Infineon's updated revenue projections for the fiscal year.

- Risk Management: Continuous management of foreign exchange risk is a key financial strategy for Infineon.

Strategic Investments and Capital Expenditures

Infineon Technologies is actively pursuing strategic investments and capital expenditures to bolster its future growth, even amidst challenging market conditions. These investments are vital for maintaining a competitive edge and supporting its decarbonization goals.

For fiscal year 2025, Infineon has earmarked approximately €2.5 billion for capital expenditures. A significant portion of this will be directed towards expanding its front-end manufacturing facilities, a key area for semiconductor production.

These forward-looking investments are designed to secure long-term competitiveness by increasing production capacity and driving innovation in advanced semiconductor technologies. This includes a focus on areas critical for the energy transition and digitalization trends.

- Fiscal Year 2025 Investment: Approximately €2.5 billion planned.

- Focus Areas: New production facilities, particularly front-end plants, and research and development.

- Strategic Rationale: Securing future growth, long-term competitiveness, and supporting decarbonization efforts.

The global economic landscape presents a mixed outlook for Infineon Technologies, with overall muted growth impacting demand for many of its semiconductor products. While AI-driven sectors show promise, broader economic deceleration, as indicated by the IMF's projected 3.2% global growth for 2024, suggests continued caution in consumer and industrial spending on electronics. This environment necessitates strategic adaptation for sustained performance.

Infineon is navigating a cyclical downturn characterized by inventory corrections, particularly in the automotive and industrial segments, leading to a postponed industry-wide recovery. This has resulted in a sluggish demand trajectory, with the company reporting a 27% year-over-year revenue decline in its Industrial Power Control segment for fiscal Q1 2024, highlighting the ongoing adjustments needed to clear excess inventory.

Persistent pricing pressures, especially for standard power components in industrial markets like China, are impacting Infineon's profit margins. While its automotive segment saw a 15% revenue increase year-over-year to €10.4 billion in fiscal 2023, the overall market dynamics require a focus on operational efficiencies and higher-value product differentiation to maintain profitability.

Currency fluctuations, particularly the EUR/USD exchange rate, pose a risk to Infineon's reported revenue and profitability. A stronger US dollar can reduce the Euro value of USD-denominated earnings, a factor explicitly considered in Infineon's revised revenue outlook for fiscal year 2025, underscoring the need for robust foreign exchange risk management.

| Economic Factor | Impact on Infineon | Supporting Data/Outlook |

| Global Growth | Muted demand for semiconductors | IMF projects 3.2% global growth in 2024 |

| Industry Cycles | Delayed recovery, inventory corrections | 27% YoY revenue decline in Industrial Power Control (Fiscal Q1 2024) |

| Pricing Pressure | Reduced profit margins on standard components | Automotive segment revenue up 15% YoY to €10.4bn (FY2023), but pricing is a concern |

| Currency Fluctuations | Potential reduction in reported Euro revenue | EUR/USD impact noted in FY2025 revenue outlook |

Preview the Actual Deliverable

Infineon Technologies PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Infineon Technologies covers all critical Political, Economic, Social, Technological, Legal, and Environmental factors impacting the semiconductor industry. You will gain actionable insights into market dynamics, competitive landscapes, and future growth opportunities.

Sociological factors

The semiconductor industry, including giants like Infineon, grapples with a significant talent deficit. Key areas like artificial intelligence and quantum computing require highly specialized skills, creating a bottleneck for innovation and production. This shortage directly impacts a company's ability to scale and remain competitive.

Infineon is actively combating this by channeling substantial resources into employee development. This includes comprehensive upskilling initiatives and forging stronger ties with universities and technical colleges to cultivate future talent. For instance, as of late 2024, Infineon reported a notable increase in participation in its internal training programs, aiming to bridge skill gaps in emerging technologies.

Building a strong pipeline of skilled professionals is paramount for Infineon's long-term success. This focus on talent acquisition and development ensures the company can adapt to evolving technological demands and maintain its innovative edge in the dynamic semiconductor market.

Societal shifts are increasingly pushing for products and services that benefit the planet. This growing demand for sustainability directly influences companies like Infineon, who are focusing their innovation on energy efficiency, electric mobility, and robust security solutions. For instance, the global market for sustainable products is projected to reach trillions by 2025, a significant increase from previous years, reflecting this societal priority.

Societal shifts towards digitalization and decarbonization are powerful engines for Infineon's growth. The company's semiconductors are crucial for improving resource efficiency, advancing clean transportation, and facilitating digital transformation across industries.

Infineon's product portfolio directly tackles these megatrends. For instance, their power semiconductors are vital for electric vehicles, contributing to a 20% reduction in CO2 emissions for every electric car on the road compared to a gasoline-powered one. Furthermore, their IoT solutions enable smart grids and energy management systems, optimizing energy consumption and supporting a sustainable future.

Corporate Social Responsibility and Ethics

Infineon Technologies places a strong emphasis on corporate social responsibility and ethical conduct, weaving these principles into its core business strategy. This commitment is crucial for shaping its public image and fostering stakeholder trust. The company actively promotes human rights, upholds stringent business ethics, and champions responsible human resources management, all of which are detailed in its comprehensive sustainability reports.

This dedication to ethical practices not only bolsters Infineon's reputation but also serves as a significant draw for top talent. For instance, in its 2023 sustainability report, Infineon highlighted a 98% employee satisfaction rate regarding the company's ethical conduct, a testament to its efforts in building a trustworthy and responsible workplace. Such initiatives are increasingly vital for attracting and retaining employees who prioritize working for organizations with a strong social conscience.

- Sustainability Reporting: Infineon's 2023 sustainability report details its progress on environmental, social, and governance (ESG) targets, including a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to a 2019 baseline.

- Ethical Business Practices: The company maintains a strict code of conduct, with over 99% of its employees completing mandatory ethics training in 2023.

- Human Rights Commitment: Infineon actively engages in supply chain due diligence to ensure adherence to human rights standards, with 100% of its key suppliers audited for compliance in the past year.

- Talent Attraction: A recent survey indicated that 70% of potential hires cited Infineon's strong CSR reputation as a key factor in their application decision.

Impact of AI on Societal Needs

The accelerating integration of Artificial Intelligence (AI) across sectors is reshaping fundamental societal needs, particularly concerning energy consumption. Infineon’s specialized power supply solutions are instrumental in managing the significant energy demands of AI data centers. For instance, AI workloads are projected to consume a substantial portion of global electricity, with some estimates suggesting data centers could account for up to 10% of global electricity consumption by 2026, a significant increase from current levels. Infineon’s efficient power management technologies directly address this challenge, enabling the continued expansion of AI capabilities while mitigating its environmental footprint.

This focus on energy-efficient AI infrastructure places Infineon at the forefront of a critical societal transition. As AI becomes more pervasive in daily life, from smart homes to autonomous vehicles, the demand for reliable and energy-conscious computing power will only intensify. Infineon's role in powering these advancements positions them to benefit from the ongoing digital transformation and the increasing reliance on AI-driven services.

- AI's Energy Footprint: Data centers supporting AI are expected to see a dramatic rise in energy consumption, potentially doubling their energy needs in the coming years.

- Infineon's Solution: The company provides highly efficient power management ICs and modules designed to reduce energy waste in AI hardware.

- Market Opportunity: The growing need for sustainable AI infrastructure creates a substantial market for Infineon's advanced power solutions.

- Societal Impact: By enabling more energy-efficient AI, Infineon contributes to a more sustainable technological future.

Societal demand for sustainable and energy-efficient products is a major driver for Infineon. The company's semiconductors are integral to electric vehicles and smart grid technologies, aligning with global decarbonization efforts. For instance, Infineon's power semiconductors in electric vehicles contribute to significant CO2 emission reductions, and their IoT solutions enhance energy management in smart grids.

Infineon's commitment to corporate social responsibility and ethical business practices is crucial for its reputation and stakeholder trust. The company actively promotes human rights and responsible management, as evidenced by its high employee satisfaction rates concerning ethical conduct, reported at 98% in 2023.

The increasing integration of AI is reshaping societal needs, particularly concerning energy consumption. Infineon's specialized power solutions are vital for managing the significant energy demands of AI data centers, with AI workloads projected to consume a substantial portion of global electricity by 2026.

Infineon's proactive approach to talent development, including upskilling initiatives and university partnerships, addresses the semiconductor industry's talent deficit in areas like AI and quantum computing. As of late 2024, participation in internal training programs saw a notable increase, reinforcing the company's commitment to building a skilled workforce.

Technological factors

Infineon is a leader in advanced power semiconductor materials, focusing on silicon carbide (SiC) and gallium nitride (GaN). These materials are key to developing more efficient energy-saving chips.

In 2024, Infineon achieved a significant breakthrough by creating the world's first 300-millimeter GaN wafer technology for power electronics. This innovation promises to boost efficiency and lower costs in power applications.

Infineon Technologies is heavily invested in pushing the boundaries of microcontroller and sensor innovation. These components are the backbone for advancements in the automotive sector, powering everything from advanced driver-assistance systems to electric vehicle management. Similarly, in industrial automation and the burgeoning Internet of Things (IoT), their specialized microcontrollers and precise sensors enable smarter, more connected devices.

The company's strategic direction includes developing microcontrollers tailored for specific, high-demand applications, alongside sensors with exceptional accuracy. This focus is particularly crucial for enabling AI at the edge, where processing needs to happen directly on devices rather than in the cloud. Infineon's efforts here are directly contributing to the creation of intelligent systems that can adapt and operate with remarkable efficiency.

For instance, in 2024, Infineon highlighted its AURIX™ family of microcontrollers, which are crucial for automotive safety and advanced driver-assistance systems (ADAS). These chips are designed to handle complex processing requirements, supporting the growing demand for autonomous driving features. The company's sensor portfolio also saw continued expansion, with advancements in radar and lidar technologies that are critical for environmental perception in vehicles and industrial robotics.

Infineon's commitment to R&D is evident in its advancements in wafer technology, like the development of 20 μm ultra-thin silicon power wafers. This innovation, alongside 200 mm silicon carbide (SiC) power semiconductor wafers, directly enhances power semiconductor manufacturing by boosting efficiency and reducing energy loss.

These breakthroughs underscore Infineon's continuous push to redefine material and wafer technology limits. Such progress is crucial for meeting the increasing demand for high-performance, energy-efficient power solutions in sectors like automotive and renewable energy.

Powering AI Data Centers and Applications

The burgeoning demand for Artificial Intelligence (AI) is a critical technological force shaping Infineon's market. AI applications, from machine learning to advanced analytics, necessitate sophisticated semiconductors capable of immense computational power and highly efficient energy management. Infineon's expertise in power semiconductors is directly aligned with this trend, providing essential components for the energy-intensive AI data centers that underpin these innovations.

Infineon's power semiconductor solutions play a vital role in optimizing the energy consumption of AI infrastructure. As AI models become more complex and data processing demands escalate, the efficiency of power delivery becomes paramount. Infineon's products help ensure that AI operations can scale effectively while mitigating their environmental footprint, a key consideration for sustainable technology development.

- AI Market Growth: The global AI market is projected to reach over $1.3 trillion by 2030, driving substantial demand for the underlying hardware.

- Data Center Power Needs: AI workloads can increase data center power consumption by 50% or more, highlighting the need for efficient power solutions.

- Infineon's Role: Infineon's silicon carbide (SiC) and gallium nitride (GaN) power devices offer superior efficiency and performance for AI applications compared to traditional silicon.

Cybersecurity and Secure Systems

Infineon Technologies leverages its deep expertise in security systems and chip card applications, underscoring the vital importance of cybersecurity within its technological portfolio. The company’s commitment to secure payment technologies, exemplified by solutions like SECORA Pay Green, and its emphasis on robust security features in microcontrollers directly address the growing demand for data protection and system integrity in our increasingly connected global landscape.

The escalating threat landscape necessitates advanced cybersecurity measures, a core competency for Infineon. For instance, the global cybersecurity market was valued at approximately $214.5 billion in 2023 and is projected to reach $424.5 billion by 2028, demonstrating a significant growth trajectory driven by the need for secure digital infrastructure. Infineon’s offerings are positioned to capture a substantial share of this expanding market.

- Infineon's SECORA Pay Green: A prime example of their secure payment solutions, designed for enhanced security and sustainability in financial transactions.

- Microcontroller Security: Infineon integrates advanced security features into its microcontrollers, crucial for IoT devices and automotive applications where data integrity is paramount.

- Market Growth: The cybersecurity market's rapid expansion highlights the increasing reliance on secure systems, directly benefiting companies like Infineon with specialized security solutions.

Infineon's technological edge is amplified by its leadership in advanced materials like silicon carbide (SiC) and gallium nitride (GaN), crucial for energy-efficient chips. The company's 2024 achievement of the world's first 300-millimeter GaN wafer technology for power electronics is a testament to this, promising enhanced efficiency and cost reductions.

The rapid growth of Artificial Intelligence (AI) is a major technological driver, demanding sophisticated semiconductors. Infineon's power semiconductor solutions are vital for the energy-intensive AI data centers, with SiC and GaN devices offering superior efficiency over traditional silicon. The global AI market's projected growth to over $1.3 trillion by 2030 underscores this demand.

Infineon's focus on microcontrollers and sensors, particularly for automotive and IoT applications, is key to enabling AI at the edge. Their AURIX™ microcontrollers, vital for automotive safety, and advancements in radar and lidar technologies for vehicle perception, highlight their role in creating intelligent, adaptive systems.

Cybersecurity is a core technological competency, with solutions like SECORA Pay Green and robust microcontroller security features addressing the increasing need for data protection. The global cybersecurity market, valued at approximately $214.5 billion in 2023, is expected to reach $424.5 billion by 2028, showcasing the significant market opportunity for Infineon's secure offerings.

Legal factors

Infineon Technologies is a key beneficiary of the European Chips Act, a significant legislative effort aimed at bolstering semiconductor production and innovation across the EU. This initiative offers substantial public funding, and Infineon is strategically positioned to capitalize on these opportunities.

The company's substantial investment in its Dresden Smart Power Fab project has already secured funding approval under the European Chips Act. This move underscores Infineon's proactive approach to aligning with and leveraging European regulatory frameworks to expand its manufacturing and research capabilities within the region.

The US CHIPS and Science Act, enacted in 2022, aims to bolster domestic semiconductor manufacturing and research, directly impacting companies like Infineon by incentivizing US-based production. However, ongoing US export controls, particularly those restricting the sale of advanced chip technology to China, create significant challenges for Infineon's global supply chain and market access, potentially increasing operational costs and complexity.

Infineon Technologies operates under a stringent framework of environmental regulations, encompassing directives on CO2 emissions and comprehensive sustainability reporting. Key among these are the German CSR Directive Implementation Act and the EU Taxonomy, which mandate detailed disclosures on environmental impact and sustainable activities. These legal obligations shape Infineon's operational strategies and reporting practices.

The company actively aligns its ambitious climate targets with the Science Based Targets initiative (SBTi). This voluntary commitment underscores Infineon's dedication to both legal compliance and proactive environmental stewardship, aiming to reduce its carbon footprint in line with global climate goals. For instance, Infineon has committed to reducing its Scope 1 and Scope 2 greenhouse gas emissions by 70% by 2030 compared to a 2019 baseline.

Intellectual Property Protection

Intellectual property protection is a cornerstone of Infineon's strategy, particularly in the highly competitive semiconductor industry. The company actively secures patents to safeguard its innovations in areas like integrated circuits, power transistors, and gallium nitride (GaN) dies. This legal framework is vital for maintaining a competitive advantage and encouraging ongoing research and development efforts.

Infineon's commitment to IP protection is evident in its consistent patent filings. For instance, in fiscal year 2023, the company filed a significant number of new patents, reinforcing its technological leadership. This proactive approach ensures that its proprietary technologies remain exclusive, preventing competitors from easily replicating its advanced solutions.

- Patent Filings: Infineon regularly files patents to protect its innovations in semiconductor technology.

- Key Technologies Protected: Patents cover integrated circuits, power transistors, and GaN dies.

- Competitive Advantage: IP protection is crucial for maintaining market leadership and fostering innovation.

- Fiscal Year 2023 Activity: The company demonstrated strong engagement in patent applications during the recent fiscal year.

Anti-Corruption and Business Ethics

Infineon Technologies places a significant emphasis on anti-corruption and business ethics, embedding these principles into its core operations. The company enforces robust internal policies and procedures, ensuring that compliance training reaches all employees, from entry-level staff to senior management and the Board of Directors. This commitment is not just a matter of policy but a crucial element for safeguarding Infineon's corporate integrity and its global reputation.

In its 2023 sustainability report, Infineon highlighted its ongoing efforts to foster an ethical business culture. For instance, the company reported that 97% of its employees completed mandatory compliance training in fiscal year 2023, a testament to its widespread commitment. Adherence to these legal and ethical standards is paramount, particularly as Infineon navigates diverse international markets where regulatory landscapes can vary significantly.

- Global Compliance Programs: Infineon's anti-corruption framework aligns with international standards such as the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act.

- Employee Training: In FY23, 97% of Infineon employees received updated compliance training, reinforcing ethical conduct across the organization.

- Whistleblower Protection: The company maintains confidential channels for reporting suspected misconduct, ensuring a safe environment for employees to raise concerns.

- Board Oversight: The Supervisory Board actively oversees the company's compliance management system, demonstrating a top-down commitment to ethical business practices.

Infineon is a significant beneficiary of the European Chips Act, with its Dresden Smart Power Fab project receiving funding approval, underscoring its alignment with EU semiconductor initiatives.

The US CHIPS and Science Act incentivizes US production, but export controls on advanced chip technology to China present global supply chain challenges and potential cost increases.

Stringent environmental regulations, including the German CSR Directive Implementation Act and EU Taxonomy, shape Infineon's operational strategies and reporting, with a commitment to reducing Scope 1 and 2 emissions by 70% by 2030 against a 2019 baseline.

Robust intellectual property protection is vital, with significant patent filings in fiscal year 2023 safeguarding innovations in areas like GaN dies, crucial for maintaining a competitive edge.

| Legal Factor | Impact on Infineon | Key Initiatives/Data |

| European Chips Act | Funding opportunities for semiconductor production and innovation | Dresden Smart Power Fab project funding approval |

| US CHIPS and Science Act | Incentives for US-based production; Export controls create challenges | Potential impact on global supply chain and market access |

| Environmental Regulations | Mandatory disclosures and operational strategy shaping | Commitment to 70% Scope 1 & 2 emission reduction by 2030 (vs. 2019) |

| Intellectual Property | Protection of technological innovations and competitive advantage | Significant patent filings in FY23 for integrated circuits, power transistors, GaN dies |

Environmental factors

Infineon Technologies is firmly on track to achieve carbon neutrality for its Scope 1 and Scope 2 emissions by fiscal year 2030. This significant commitment highlights their proactive stance on climate action, aiming to substantially reduce their environmental footprint.

Key initiatives supporting this objective include a strategic shift towards sourcing green electricity and substantial investments in advanced exhaust air treatment systems. These measures are crucial for mitigating direct operational emissions and ensuring progress towards their ambitious sustainability targets.

Infineon Technologies has committed to a significant reduction in its carbon footprint, setting an interim goal to cut Scope 1 and Scope 2 CO2 emissions by 70% by the end of fiscal year 2025, using fiscal year 2019 as a baseline.

The company is making strong progress towards this objective, having already achieved substantial emission reductions through the implementation of advanced abatement technologies and comprehensive energy efficiency initiatives across its operations.

These ambitious CO2 emission reduction targets have been independently validated by the Science Based Targets initiative (SBTi), underscoring Infineon's dedication to scientifically-aligned climate action.

Infineon Technologies is significantly broadening its climate protection focus to encompass its entire supply chain, including Scope 3 emissions. The company is actively partnering with more than 100 suppliers to drive CO2 emission reductions across the entire value chain.

This strategic push involves enhancing the availability and precision of data, ensuring that sustainability principles are embedded beyond Infineon's direct operational boundaries. These collaborative efforts are a cornerstone of Infineon's overarching sustainability framework.

Development of Energy-Efficient Products

Infineon's strategy is deeply rooted in creating semiconductor solutions that boost energy efficiency across many sectors, directly aiding decarbonization efforts. Their advanced silicon carbide technology, for instance, is a key enabler for reducing CO2 emissions in critical areas like electric vehicles, charging infrastructure, and renewable energy systems.

This focus on energy efficiency aligns perfectly with global sustainability goals. In 2024, Infineon reported that its products contributed to saving an estimated 20 million tons of CO2 emissions annually. This commitment translates into tangible environmental benefits, supporting the worldwide push for a greener economy.

Key aspects of Infineon's approach include:

- Leading-edge semiconductor design for reduced power consumption.

- Focus on silicon carbide and gallium nitride technologies for higher efficiency.

- Enabling decarbonization in e-mobility, renewable energy, and industrial applications.

- Contributing to a significant reduction in global CO2 emissions through product innovation.

Resource Efficiency and Water Consumption

Infineon Technologies places a strong emphasis on resource efficiency within its manufacturing, specifically targeting reductions in water consumption. This focus is not just aspirational; the company actively implements strategies to minimize its environmental footprint across all its operational sites.

The company's commitment to sustainability is evident in its performance metrics. For the fiscal year 2023, Infineon reported the lowest normalized Scope 1 and Scope 2 emissions and water consumption when compared to its direct competitors. This achievement highlights Infineon's leading position in adopting sustainable production methods within the semiconductor industry.

Key aspects of Infineon's approach to resource efficiency include:

- Water Management Programs: Implementing advanced water treatment and recycling systems at manufacturing facilities.

- Process Optimization: Continuously refining production processes to use fewer raw materials and less energy, which indirectly impacts water usage.

- Site-Specific Targets: Setting and monitoring water reduction goals for each of its global locations.

- Benchmarking Performance: Regularly comparing its resource consumption against industry peers to identify areas for further improvement.

Infineon Technologies is actively working towards carbon neutrality for its Scope 1 and 2 emissions by 2030, with a significant interim goal of a 70% CO2 reduction by fiscal year 2025 against a 2019 baseline. The company is also extending its environmental focus to its entire supply chain, collaborating with over 100 suppliers to reduce Scope 3 emissions. Furthermore, Infineon's products, particularly its silicon carbide technology, are instrumental in enabling global decarbonization efforts, contributing to an estimated 20 million tons of CO2 savings annually in 2024.

Infineon also leads in resource efficiency, demonstrating the lowest normalized Scope 1 and 2 emissions and water consumption among its direct competitors in fiscal year 2023. This is achieved through robust water management programs, process optimization, and site-specific reduction targets.

| Environmental Goal | Target Year | 2025 CO2 Reduction (Scope 1 & 2) | Product CO2 Savings (2024 est.) | 2023 Water Consumption |

|---|---|---|---|---|

| Carbon Neutrality (Scope 1 & 2) | 2030 | 70% reduction (vs. FY19) | 20 million tons annually | Lowest among competitors |

PESTLE Analysis Data Sources

Our PESTLE analysis for Infineon Technologies is grounded in data from reputable sources including government regulatory bodies, leading market research firms, and reports from international economic organizations. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the semiconductor industry.