Infineon Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Infineon Technologies Bundle

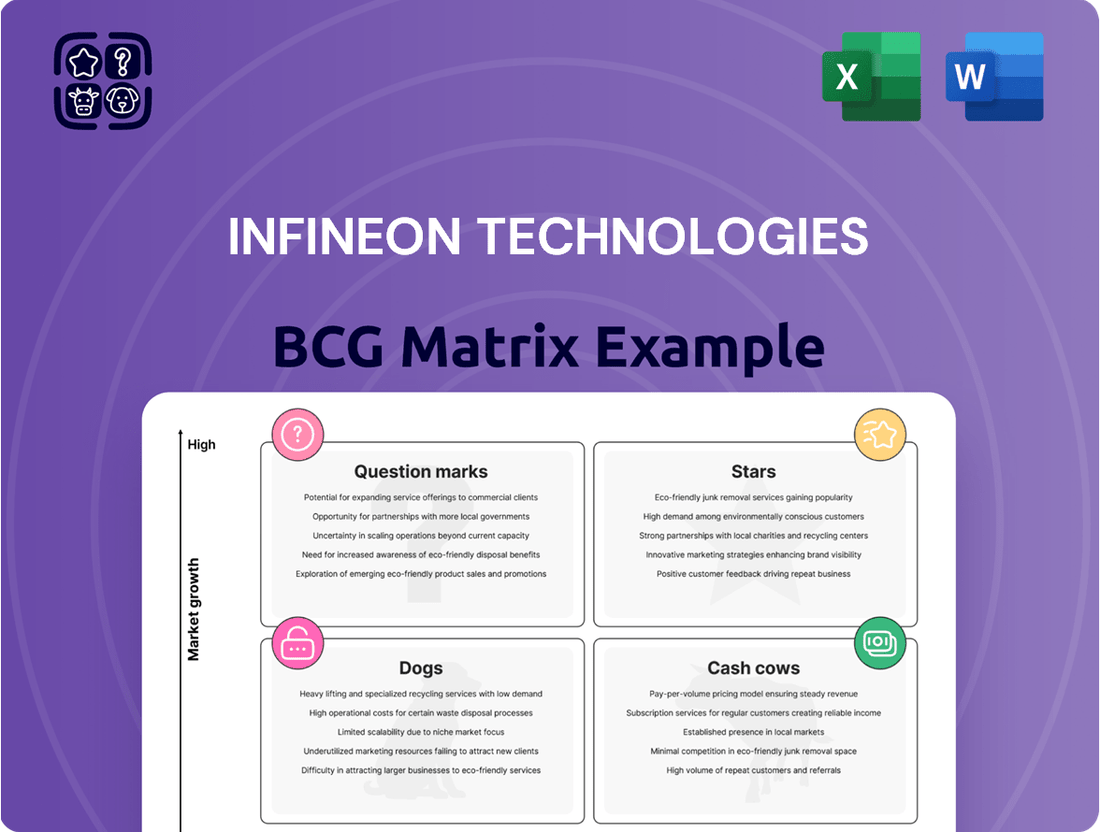

Curious about Infineon Technologies' market position? This glimpse into their BCG Matrix highlights key product categories, but the real strategic advantage lies in understanding the full picture. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Infineon Technologies is a powerhouse in automotive semiconductors, securing a significant 13.5% global market share in 2024. This strong performance is largely propelled by its commanding 32.0% market share within the automotive microcontroller segment, widening its lead over rivals.

The company's dominance in microcontrollers, especially those critical for advanced driver assistance systems (ADAS), is a key differentiator. This leadership persists even amidst an 8.2% contraction observed in the broader microcontroller market during the same period.

Infineon Technologies is a major player in power semiconductors, especially for electric vehicles (EVs). Their focus on Silicon Carbide (SiC) and Gallium Nitride (GaN) technologies, with investments in 200mm/300mm wafer production, positions them well for the growing EV market. These advanced materials are key components in EV drivetrains, like traction inverters and battery management systems, significantly boosting the semiconductor value in each vehicle.

In 2024, Infineon's strategic push into wide bandgap semiconductor technology paid off, resulting in a 15% surge in their automotive Power MOSFET market revenue. This growth highlights the increasing demand for efficient power solutions in EVs and Infineon's success in meeting that demand with cutting-edge materials.

AI data center power solutions represent a significant growth opportunity for Infineon, even amidst a generally subdued market. The burgeoning demand for AI infrastructure is directly fueling the need for Infineon's advanced power supply components.

This strategic emphasis on AI is crucial for Infineon, providing a vital engine to counteract slower growth in other sectors and bolster its presence in premium market segments. For instance, the global AI market was valued at approximately $200 billion in 2023 and is projected to grow substantially, with data centers being a primary beneficiary of this expansion.

New Automotive Connectivity and Security Solutions

Infineon Technologies is making significant strides in automotive connectivity and security, a key area for future growth. Their investment in a new NT$1.2 billion R&D center in Taiwan underscores a commitment to developing advanced Wi-Fi and Bluetooth chips tailored for the evolving electric vehicle market.

These next-generation chips are designed to meet the demanding computing needs of software-defined vehicles. This includes robust solutions for advanced networking and critical data security, areas that are becoming increasingly vital as vehicles become more connected and complex.

Infineon's focus on these emerging automotive solutions positions them to capture substantial market share in a sector experiencing rapid technological advancement.

- Investment in R&D: NT$1.2 billion R&D center in Taiwan.

- Product Focus: Next-generation Wi-Fi and Bluetooth chips for electric vehicles.

- Market Need: Addressing complex computing requirements of software-defined vehicles.

- Key Features: Advanced networking and data security solutions.

Micro Collision Sensor Chips

Infineon's micro collision sensor chips are experiencing significant momentum. In October 2024, the company reported robust sales growth in this segment, underscoring its strong market position.

This division operates in a high-growth market, driven by the automotive sector's increasing demand for advanced driver-assistance systems (ADAS) and autonomous driving capabilities. Infineon is a key innovator in this space.

- Market Growth Driver: Automotive ADAS and autonomous driving technologies.

- Infineon's Position: Leading player in micro collision sensor chips.

- Sales Performance: Strong sales growth reported in October 2024.

- Innovation Pace: Rapid innovation characterizes this rapidly expanding market.

Infineon's automotive microcontroller segment, a key driver of its 13.5% global market share in 2024, is a prime example of a Star in the BCG Matrix. Despite an 8.2% market contraction, Infineon maintained a commanding 32.0% share in automotive microcontrollers, particularly for ADAS, showcasing strong growth potential and market leadership.

The company's dominance in wide bandgap semiconductors, like SiC and GaN for EVs, also positions it as a Star. Their 15% revenue surge in automotive Power MOSFETs in 2024 highlights this segment's high growth and Infineon's strong competitive standing.

Infineon's investments in AI data center power solutions are another Star. This rapidly expanding market, valued at approximately $200 billion in 2023, offers substantial growth opportunities, complementing their strength in premium market segments.

The company's focus on next-generation Wi-Fi and Bluetooth chips for software-defined vehicles, backed by a NT$1.2 billion R&D center, also signifies a Star. This segment addresses the evolving needs of connected and complex vehicles, indicating high growth and market potential.

| Segment | 2024 Market Share (Infineon) | Market Growth | Infineon's Position |

|---|---|---|---|

| Automotive Microcontrollers | 32.0% | Contracting (8.2%) | Leader (Star) |

| Wide Bandgap Semiconductors (Automotive) | N/A (High Growth) | High | Leader (Star) |

| AI Data Center Power Solutions | N/A (Emerging) | Very High | Strong Player (Star) |

| Automotive Connectivity (Wi-Fi/Bluetooth) | N/A (Emerging) | High | Innovator (Star) |

What is included in the product

Infineon's BCG Matrix analysis highlights which business units to invest in, hold, or divest based on market share and growth.

A clear BCG Matrix provides a visual roadmap, relieving the pain of strategic uncertainty by highlighting areas needing investment or divestment.

Cash Cows

Infineon's automotive semiconductor business stands as a prime example of a cash cow. The company has held the top global spot for five years running, capturing a significant 13.5% of the market in 2024. This enduring leadership, even amidst a slight downturn in the broader automotive semiconductor market that year, highlights the segment's maturity and its role as a consistent, robust cash generator for Infineon.

Infineon's established microcontroller portfolio, including families like AURIX and TRAVEO, is a significant cash cow. In 2024, Infineon solidified its position as the top global microcontroller supplier with a 21.3% market share. These mature product lines have consistently outperformed the broader market for the past ten years, ensuring a steady and substantial revenue stream.

Infineon's Green Industrial Power (GIP) segment is a robust cash cow, demonstrating strong performance in Q4 FY24. This segment saw revenue growth fueled by robust demand across renewable energy, energy infrastructure, automation, and industrial drives. Its position in a mature yet critical market, coupled with the persistent global drive for decarbonization and energy efficiency, ensures a steady and reliable cash flow for the company.

Power & Sensor Systems (PSS) Segment

The Power & Sensor Systems (PSS) segment of Infineon Technologies demonstrated robust performance in Q4 FY24, driven significantly by the burgeoning demand from AI-related data centers and servers. This growth, coupled with strong sales of silicon microphones for smartphones, highlights the segment's dynamic capabilities.

Within the PSS segment, established power management and sensor solutions cater to mature applications. These offerings maintain a high market share, consistently generating substantial and stable cash flow for Infineon.

- AI-driven growth: Infineon's PSS segment experienced a revenue increase in Q4 FY24, notably boosted by AI-related data center and server demand.

- Smartphone contribution: Silicon microphones for smartphones also played a key role in the segment's revenue growth.

- Mature market strength: Established power management and sensor solutions hold a high market share in mature applications.

- Cash flow generation: These mature product lines are a consistent source of steady cash flow for Infineon Technologies.

Broad Portfolio of Standard Power Semiconductors

Infineon Technologies' extensive portfolio of standard power semiconductors, encompassing over 300 product families, represents a significant Cash Cow. These products, including established power MOSFETs and IGBTs, serve a wide array of industrial and consumer markets, providing reliable power management solutions.

These foundational products, while perhaps not experiencing explosive growth, are critical for maintaining existing infrastructure and meeting consistent demand. In 2024, the power semiconductor market continued its steady expansion, driven by electrification trends across automotive and industrial sectors. Infineon's strong position in these mature product categories likely translates to substantial and dependable cash flow generation.

- Market Dominance: Infineon holds leading positions in key power semiconductor segments.

- Consistent Revenue Streams: Established products provide predictable and stable cash flow.

- Broad Application Reach: Powers diverse sectors from automotive to consumer electronics.

- Profitability Driver: Contributes significantly to Infineon's overall financial health.

Infineon's presence in the automotive semiconductor market, particularly in areas like Advanced Driver-Assistance Systems (ADAS) and electrification, functions as a strong cash cow. The company maintained its leading global market share of 13.5% in 2024, demonstrating sustained demand and profitability in this mature, yet essential, sector.

The company's microcontroller portfolio, including the AURIX and TRAVEO families, continues to be a significant cash cow. With a commanding 21.3% global market share in 2024, these products consistently deliver robust and stable revenue, underscoring their maturity and market acceptance.

Infineon's Green Industrial Power (GIP) segment, especially its offerings for renewable energy and industrial automation, represents a solid cash cow. The segment's continued revenue growth in Q4 FY24, driven by sustained demand for energy efficiency solutions, highlights its role as a reliable cash generator in a vital, mature market.

| Segment | 2024 Market Share | Key Products | Cash Cow Characteristic |

| Automotive Semiconductors | 13.5% | ADAS, Electrification components | Sustained leadership, mature market |

| Microcontrollers | 21.3% | AURIX, TRAVEO | Consistent outperformance, stable revenue |

| Green Industrial Power (GIP) | N/A (segment focus) | Renewable energy, industrial automation | Robust demand, reliable cash flow |

What You’re Viewing Is Included

Infineon Technologies BCG Matrix

The Infineon Technologies BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This comprehensive analysis, crafted with expert insights, will be delivered without any watermarks or demo content, ensuring you get a polished, ready-to-use strategic tool. You can confidently use this preview as an accurate representation of the complete document, which is designed for immediate application in your business planning and decision-making processes.

Dogs

Infineon's product lines tied to general consumer electronics and automotive sectors are likely facing muted demand, as indicated by the CEO's outlook for 2025. These segments, excluding the AI-driven acceleration, are experiencing a 'muted business trajectory'.

For instance, products catering to the broader automotive market, beyond those specifically enhanced by AI, are seeing slower uptake. This aligns with the observation that "currently, there is hardly any growth momentum in our end markets except from AI."

Similarly, consumer-focused semiconductor solutions are also impacted by this general economic slowdown. Without the specific boost from AI applications, these product categories are likely in the question mark or dog quadrant of the BCG matrix.

Infineon Technologies' 'Dogs' in the BCG Matrix likely represent product segments currently undergoing a prolonged inventory correction. The company has explicitly stated that this correction is ongoing, making it difficult to gauge future demand trends with certainty. Products caught in this digestion phase, especially those with weaker underlying demand or less strategic focus, could be draining resources without generating substantial returns, aligning with the characteristics of a 'Dog'.

Infineon Technologies has strategically shifted its focus away from broad digital logic and high-performance computing, with microcontrollers being the primary exception. This divestment reflects a move towards more specialized and growth-oriented segments.

Any remaining legacy products in these former core areas, not aligned with their current strategic emphasis on power systems and the Internet of Things (IoT), are likely situated in mature, low-growth markets. Consequently, these offerings would typically hold a modest market share, positioning them as potential cash cows or question marks within the BCG matrix framework.

Commoditized Consumer Electronics Components

Infineon Technologies' presence in commoditized consumer electronics components likely falls into the Dogs category of the BCG Matrix. While the company serves consumer markets, recent economic challenges, including persistent inflation and a noticeable slowdown in consumer spending throughout 2024, have dampened growth prospects in these areas. This environment intensifies price competition for many standard components, making differentiation difficult.

These commoditized parts, often characterized by their high volume and low margins, represent a significant portion of Infineon's exposure to the consumer electronics sector. The intense price pressures mean that even with substantial sales volume, profitability can be squeezed, aligning with the low-growth, low-market-share profile of a Dog. For instance, basic power management ICs or standard microcontrollers used in a wide array of consumer devices often face intense competition from multiple suppliers, limiting Infineon's pricing power.

- Low Market Growth: The consumer electronics sector, particularly for non-essential goods, experienced subdued demand in 2024 due to economic uncertainties.

- Intense Price Competition: Components like standard MOSFETs or basic logic gates are highly commoditized, leading to significant price erosion.

- Low Differentiation: Many of these components offer minimal unique features, making it hard for Infineon to command premium pricing.

- Limited Profitability: Despite potential sales volume, the low margins associated with commoditized parts restrict their contribution to overall profit.

Underperforming Product Lines in Saturated Markets

Within Infineon's broad range of offerings, specific product lines catering to fully saturated markets, lacking substantial technological advantages or a distinct competitive edge, would likely be classified as Dogs. These products typically generate modest returns and necessitate minimal capital infusion, as ambitious revitalization strategies are improbable to yield substantial success.

For instance, legacy discrete semiconductor components in highly commoditized automotive or industrial sectors might represent such a category. In 2024, while Infineon's overall revenue growth is robust, these specific segments might show flat or declining sales volumes, reflecting the intense price competition and limited innovation potential. The company's strategy would likely involve managing these product lines for cash flow, rather than pursuing aggressive growth, potentially through gradual phase-outs or focusing on niche applications where minimal investment can maintain profitability.

- Low Growth: Product lines operating in mature, saturated markets often exhibit minimal to no unit volume growth.

- Low Profitability: Intense price competition in these segments typically leads to thin profit margins.

- Minimal Investment: Resources are not allocated for significant R&D or market expansion due to low expected returns.

- Cash Generation Focus: The objective is to extract any available cash flow with minimal ongoing expenditure.

Infineon's "Dogs" likely encompass legacy product lines in mature, saturated markets with low differentiation, such as certain commoditized consumer electronics components and discrete semiconductors in less innovative automotive or industrial sectors. These segments, characterized by intense price competition and minimal growth, are managed for cash flow rather than aggressive expansion, reflecting a strategic shift towards higher-growth areas.

For example, basic power management ICs or standard microcontrollers in consumer devices, facing significant price erosion in 2024, exemplify this category. Similarly, legacy discrete components in automotive sectors might exhibit flat or declining sales volumes due to intense competition and limited innovation potential, aligning with the Dogs' profile of low growth and profitability.

These product lines require minimal capital investment, with the primary objective being to extract any available cash flow. The company's strategic divestments and focus on power systems and IoT further underscore the move away from these less promising segments.

Infineon's strategic repositioning means that product lines lacking substantial technological advantages or a distinct competitive edge in saturated markets are likely classified as Dogs. These segments generate modest returns, and revitalization strategies are unlikely to yield significant success, leading to their management for cash generation.

Question Marks

Infineon's new RISC-V based AURIX microcontrollers position them as a potential challenger in the rapidly expanding software-defined vehicle market. While Infineon is an early entrant, this move signifies a strategic push into a high-growth segment where established players like NXP and Renesas currently hold significant sway. The company's investment in RISC-V architecture signals a commitment to open-standard innovation, aiming to capture future automotive computing needs.

Infineon is heavily investing in advanced E/E architectures, particularly for software-defined vehicles, moving towards centralized zonal designs. This strategic pivot addresses the increasing demand for sophisticated connectivity, robust cybersecurity, intelligent power management, and high-performance real-time processing.

The market for these solutions is expanding rapidly, with the global automotive E/E architecture market projected to reach $37.5 billion by 2028, growing at a CAGR of 8.9%. Infineon’s focus on this area positions it to capture significant market share by providing essential semiconductor components and expertise.

While Infineon Technologies has a commanding presence in automotive with Silicon Carbide (SiC) and Gallium Nitride (GaN), their strategic vision extends significantly beyond this core market. These wide bandgap semiconductors are crucial for next-generation power electronics, enabling higher efficiency and smaller form factors across a variety of demanding applications.

Infineon is actively pursuing emerging applications for SiC and GaN in industrial sectors, such as advanced motor drives and renewable energy systems. For instance, the demand for efficient power conversion in industrial automation is growing, with the global industrial power supply market projected to reach over $100 billion by 2028. Consumer electronics, particularly fast charging for devices like laptops and smartphones, also presents a substantial growth avenue, with GaN chargers becoming increasingly prevalent due to their compact size and rapid charging capabilities.

Next-Generation Gate Driver ICs for Electric Vehicles

Infineon Technologies is strategically positioning its next-generation gate driver ICs for electric vehicles, particularly its January 2025 launch of isolated gate driver ICs designed for the HybridPACK Drive G2 Fusion module. This move targets the rapidly expanding electric vehicle market, a sector experiencing significant technological advancement and increasing demand for advanced power electronics. The company's focus on high-reliability motor control ICs for by-wire systems underscores its commitment to innovation in a high-growth product segment.

These new gate drivers are crucial for enabling efficient and reliable motor control in electric vehicles, addressing a key bottleneck in EV powertrain development. The market adoption for these specialized components is still in its formative stages, presenting Infineon with a substantial opportunity to capture market share. The company's investment in this area reflects a forward-looking strategy to capitalize on the electrification trend.

- Product Innovation: Introduction of isolated gate driver ICs in January 2025, tailored for EV applications and compatible with the HybridPACK Drive G2 Fusion module.

- Market Focus: Addressing the growing need for high-reliability motor control ICs in modern by-wire systems within the electric vehicle sector.

- Growth Potential: Positioned in a high-growth product area where market adoption and share are actively developing, offering significant future revenue streams.

- Strategic Alignment: Aligns with Infineon's broader strategy to be a leading supplier of semiconductor solutions for the automotive industry, particularly in electrification.

Targeted Innovations in Industrial IoT

Infineon Technologies, a powerhouse in the Internet of Things (IoT), is strategically focusing its innovation efforts on high-growth segments within Industrial IoT (IIoT). These targeted innovations are designed to address the evolving needs of industries seeking greater efficiency, automation, and connectivity. For instance, advancements in edge computing and AI-enabled sensors are creating significant opportunities.

The company is actively investing in solutions for predictive maintenance and smart grid technologies, areas experiencing rapid adoption. This strategic push is aimed at capturing new market share in a sector that is still ripe for disruption and growth. Infineon's commitment to IIoT innovation is underscored by its robust product portfolio, which includes microcontrollers, sensors, and power management ICs tailored for demanding industrial environments.

- Edge AI and Advanced Sensors: Infineon is developing next-generation sensors and processing units for edge AI applications, enabling real-time data analysis and decision-making directly at the source. This is crucial for applications like autonomous machinery and intelligent surveillance systems.

- Smart Grid and Energy Management: The company is enhancing its offerings for smart grids, focusing on components that improve grid stability, energy efficiency, and the integration of renewable energy sources. This includes advanced power semiconductors and communication modules.

- Industrial Connectivity Solutions: Infineon is innovating in secure and reliable industrial communication protocols, supporting the increasing demand for seamless data exchange between machines and systems on the factory floor and beyond.

- Cybersecurity for IIoT: Recognizing the critical importance of security, Infineon is integrating robust cybersecurity features into its IIoT components, protecting sensitive industrial data and infrastructure from cyber threats.

Infineon's RISC-V based AURIX microcontrollers are positioned as potential stars in the burgeoning software-defined vehicle market. This strategic move into a high-growth segment, where competitors like NXP and Renesas currently dominate, signifies Infineon's commitment to open-standard innovation for future automotive computing needs.

Infineon's focus on advanced E/E architectures for software-defined vehicles, moving towards centralized zonal designs, addresses the increasing demand for connectivity, cybersecurity, intelligent power management, and high-performance processing. The automotive E/E architecture market is projected to reach $37.5 billion by 2028, growing at an 8.9% CAGR, a significant opportunity for Infineon.

Infineon's next-generation gate driver ICs, like the January 2025 launch for HybridPACK Drive G2 Fusion, target the rapidly expanding electric vehicle market. These components are vital for efficient motor control, a key aspect of EV powertrain development, and represent a high-growth product area with substantial market capture potential.

Infineon's investment in Industrial IoT (IIoT), particularly in edge AI, advanced sensors, smart grid technologies, and industrial connectivity, positions them for growth in sectors demanding greater efficiency and automation. The company's robust product portfolio supports these IIoT innovations.

BCG Matrix Data Sources

Our Infineon Technologies BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.