Infineon Technologies Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Infineon Technologies Bundle

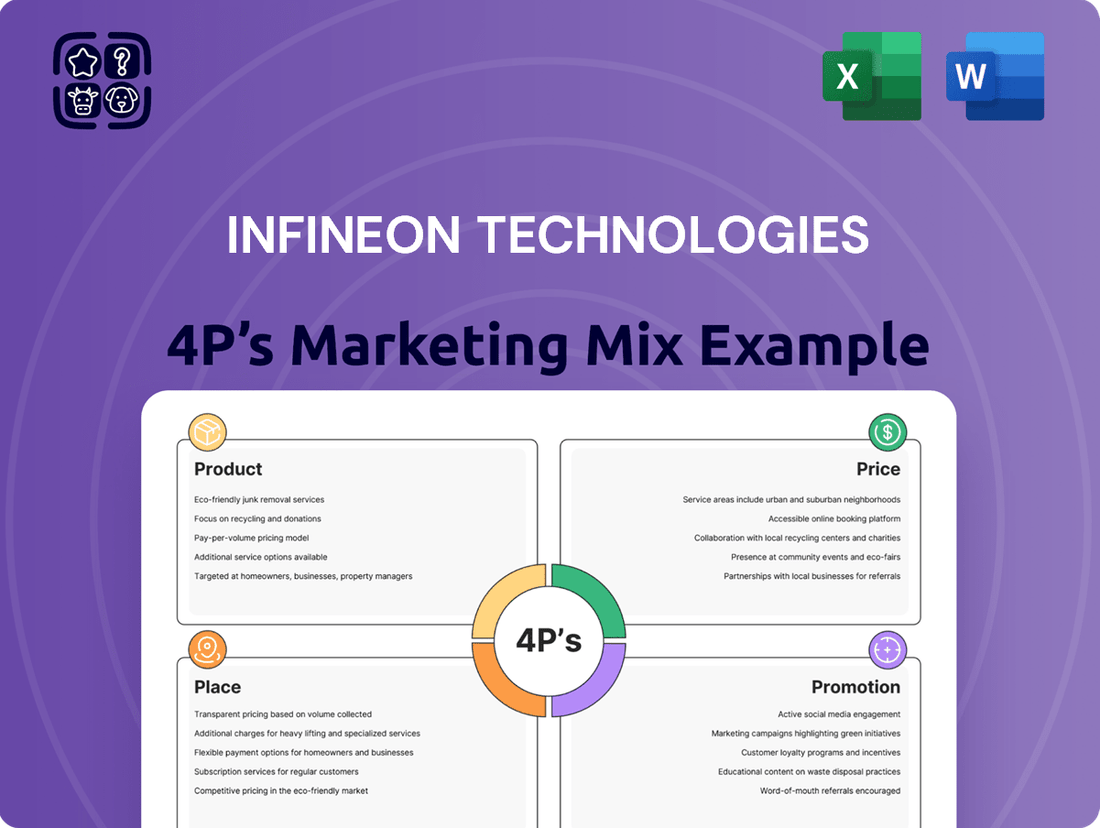

Discover how Infineon Technologies masterfully orchestrates its Product, Price, Place, and Promotion strategies to dominate the semiconductor market. This analysis reveals the intricate interplay of their offerings, pricing architecture, distribution channels, and communication mix.

Unlock a comprehensive, ready-to-use 4Ps Marketing Mix Analysis for Infineon Technologies, perfect for students, professionals, and consultants seeking strategic insights. Save valuable research time and gain actionable intelligence.

Dive deeper than ever before into Infineon's marketing success. Get the full, editable report that breaks down each P with real-world examples and structured thinking, empowering your own strategic planning.

Product

Infineon Technologies is a powerhouse in automotive semiconductors, a critical component for modern vehicles. In 2024, they commanded a significant 13.5% of the global automotive semiconductor market, underscoring their leadership. Their dominance is particularly evident in microcontrollers, where they held a commanding 32.0% market share, highlighting their deep integration into vehicle systems.

These semiconductors are the backbone of automotive innovation, enabling the digital transformation and decarbonization efforts. They are essential for sophisticated systems like advanced driver assistance (ADAS), efficient powertrain and battery management, enhanced comfort electronics, and secure infotainment systems. Infineon's chips are the silent enablers of safer, greener, and more connected driving experiences.

Looking ahead, Infineon is strategically positioned to support the evolution towards software-defined vehicles. This shift necessitates advanced capabilities in areas such as robust connectivity, stringent cybersecurity measures, intelligent power distribution, and high-speed real-time processing. Infineon's product portfolio is designed to meet these demanding requirements for next-generation automotive electrical and electronic architectures.

Infineon Technologies is the undisputed global leader in power semiconductors, a position they've held for 21 years straight, demonstrating consistent market dominance. This leadership is further solidified by their pioneering work in wide bandgap (WBG) materials like Silicon Carbide (SiC) and Gallium Nitride (GaN).

These advanced WBG materials are revolutionizing chip performance, offering significant improvements in efficiency, size reduction, weight savings, and ultimately, lower total cost of ownership for electronic systems. For instance, SiC MOSFETs can operate at higher temperatures and voltages than traditional silicon, leading to substantial energy savings.

The impact of these WBG power semiconductor solutions is profound, directly addressing critical energy efficiency needs across key growth sectors. This includes the booming electric vehicle (EV) market, where SiC components contribute to longer driving ranges and faster charging, and the rapidly expanding data center industry, which demands more efficient power management to reduce operational costs and environmental footprint.

Infineon's microcontroller portfolio, featuring the AURIX, PSoC, AIROC Wi-Fi-connected, and MOTIX series, forms a cornerstone of their product strategy. These MCUs are essential for the intricate control and monitoring required across automotive, industrial, and consumer electronics sectors. For instance, the AURIX family is widely adopted in automotive safety systems, with Infineon projecting significant growth in this segment.

The company is actively championing RISC-V as an open standard, particularly for automotive applications, aiming to foster innovation and interoperability. Furthermore, Infineon is developing solutions that meet stringent new regulations, such as the EU Cyber Resilience Act (CRA). This proactive approach ensures their MCUs provide enhanced security for the ever-increasing number of connected devices entering the market.

Sensors and Security Systems

Infineon Technologies provides a comprehensive suite of sensors and security systems, crucial for the burgeoning Internet of Things (IoT) market. Their product portfolio includes advanced chip card applications and embedded security solutions, such as the OPTIGA™ family, designed to safeguard sensitive data and ensure secure communication. This focus directly addresses the escalating demand for reliable protection in connected environments, from critical government identification systems to secure payment transactions and user authentication.

The company's commitment to innovation is evident in its substantial Research and Development (R&D) investments, aimed at staying ahead in the rapidly evolving semiconductor landscape. For instance, Infineon's dedicated efforts in security solutions are vital as the global cybersecurity market is projected to reach over $300 billion by 2025, underscoring the critical nature of their offerings. Their sensor technology also plays a pivotal role, with the automotive sensor market alone expected to grow significantly, driven by advancements in autonomous driving and driver assistance systems.

- Product: Infineon offers a broad range of sensors and embedded security solutions, including OPTIGA™ for chip card and IoT security.

- Market Need: Addresses the critical and growing demand for robust security in connected devices, payment systems, and identity management.

- R&D Investment: Continuous investment in advanced semiconductor technologies ensures a competitive edge in high-growth security and sensor markets.

- Financial Impact: Security solutions are a key growth driver, contributing to Infineon's overall revenue as the global cybersecurity market expands.

System Solutions for IoT and Industrial Applications

Infineon Technologies offers robust system solutions for IoT and industrial applications, moving beyond single components to provide integrated semiconductor packages. These solutions are designed to tackle intricate challenges in sectors like industrial automation, renewable energy, and smart infrastructure development. For instance, in 2024, the industrial semiconductor market was valued at approximately $75 billion, with IoT applications representing a significant growth driver.

The company leverages its broad product portfolio to deliver complementary semiconductors across various divisions. This allows Infineon to create tailored solutions that meet specific customer requirements in evolving markets. Their strategy focuses on enabling customers to build more efficient and connected systems, capitalizing on trends like Industry 4.0 and the expansion of smart grids.

- Integrated Solutions: Infineon provides end-to-end system solutions, not just individual parts, for IoT and industrial use cases.

- Market Focus: Key application areas include industrial automation, renewable energy systems, and smart infrastructure projects.

- Synergistic Portfolio: The company utilizes its diverse semiconductor offerings to create complementary product packages for specialized customer needs.

- Market Growth: The industrial semiconductor market, a key area for these solutions, is projected for continued expansion, driven by IoT adoption.

Infineon's product strategy centers on high-performance semiconductors, particularly in automotive and industrial sectors. Their offerings include microcontrollers like AURIX and power semiconductors utilizing advanced WBG materials (SiC, GaN). These products are crucial for enabling electrification, digitalization, and enhanced safety in vehicles, as well as driving efficiency in data centers and renewable energy systems.

| Product Category | Key Technologies | Primary Markets | 2024 Market Share (Automotive Semiconductors) | Key Growth Driver |

| Automotive Semiconductors | Microcontrollers (AURIX), Power Semiconductors | ADAS, Powertrain, Infotainment | 13.5% | Software-defined vehicles, Electrification |

| Power Semiconductors | Wide Bandgap (SiC, GaN) | Electric Vehicles, Data Centers, Renewables | Global Leader (21 years) | Energy efficiency, Higher performance |

| Microcontrollers | AURIX, PSoC, AIROC, MOTIX | Automotive, Industrial, Consumer | N/A (Specific segment data varies) | Connectivity, Security, RISC-V adoption |

| Sensors & Security | OPTIGA™ family, Embedded Security | IoT, Chip Cards, Payment Systems | N/A (Specific segment data varies) | IoT security, Data protection |

What is included in the product

This analysis provides a comprehensive breakdown of Infineon Technologies' marketing mix, detailing their product portfolio, pricing strategies, distribution channels, and promotional activities.

It offers a deep dive into how Infineon Technologies leverages its 4Ps to maintain its competitive edge in the semiconductor industry.

Simplifies complex marketing strategies by presenting Infineon's 4Ps as actionable solutions to market challenges.

Provides a clear, concise overview of how Infineon's product, price, place, and promotion strategies alleviate customer and market pain points.

Place

Infineon Technologies maintains a robust global sales network with a significant direct presence in crucial markets. This strategic approach involves finely tuned regional footprints, ensuring that pertinent products and specialized application expertise are delivered directly to customers.

In 2024, Infineon strategically reorganized its sales force into customer-focused segments: automotive, industrial and infrastructure, and consumer, computing, and communication. This global deployment aims to enhance customer engagement and market responsiveness.

Infineon Technologies strategically utilizes a robust network of distributors and Electronics Manufacturing Services (EMS) providers to significantly broaden its market presence. This approach ensures their advanced semiconductor solutions reach a diverse global customer base. As of fiscal year 2024, Infineon's distribution partners played a crucial role in driving approximately 70% of the company's revenue, highlighting the effectiveness of this channel strategy.

The company's dedicated sales organization actively manages these vital distribution partnerships. This hands-on management ensures seamless product delivery, consistent availability, and strong customer support across all touchpoints. This focus on channel management is key to Infineon's ability to meet the dynamic demands of various industries, from automotive to industrial applications.

This multi-channel distribution strategy not only maximizes customer convenience by offering multiple purchasing options but also optimizes Infineon's sales potential. By leveraging these established networks, Infineon can efficiently scale its operations and maintain a competitive edge in the fast-paced semiconductor market, a strategy that contributed to their reported revenue growth of over 8% in the first half of fiscal year 2025.

Infineon's manufacturing and fabrication facilities are a cornerstone of its strategy, ensuring a reliable supply of critical semiconductor components. The company's commitment to expanding its production footprint is evident in its substantial investments, such as the development of the world's largest 200mm Silicon Carbide (SiC) Power Fab in Kulim, Malaysia. This facility is poised to significantly boost the output of advanced SiC chips, a key growth area for the automotive and industrial sectors.

Further strengthening its European production capabilities, Infineon is also constructing a fourth manufacturing module in Dresden, Germany. This expansion is designed to increase capacity for power semiconductors, particularly those based on advanced technologies like Gallium Nitride (GaN) and SiC. By strategically placing and upgrading these facilities, Infineon aims to meet the escalating global demand for its high-performance products, underscoring its dedication to scalability and supply chain resilience.

Partnerships and Collaborations

Infineon Technologies actively cultivates strategic alliances with global industry leaders and partners in key markets. This approach is designed to broaden its market reach and enrich its product portfolios. For instance, their 'In China, for China' localization strategy embeds technology development and market penetration deeply within the Chinese market, demonstrating a commitment to tailored regional engagement.

These collaborations are instrumental in enabling Infineon to capitalize on emerging opportunities and solidify its competitive standing. By joining forces with established players and innovators, Infineon can accelerate product development cycles and gain access to new customer segments. This synergy is crucial for navigating the dynamic semiconductor landscape and ensuring sustained growth.

- Strategic Alliances: Infineon partners with companies like TSMC for advanced manufacturing and collaborates with automotive OEMs for joint development of next-generation solutions.

- Market Expansion: These partnerships are vital for penetrating new geographical regions and specific industry verticals, such as expanding their presence in the electric vehicle (EV) charging infrastructure market through collaborations with charging station manufacturers.

- Product Enhancement: Collaborations often lead to the co-development of integrated solutions, combining Infineon's semiconductor expertise with partners' system-level knowledge, thereby offering more comprehensive value to customers.

- Localization Efforts: The 'In China, for China' initiative, for example, involves partnerships with local Chinese companies and research institutions to better understand and serve the unique demands of that market, contributing to a significant portion of their revenue growth in the region.

Online Presence and Digital Platforms

Infineon Technologies actively cultivates a robust online presence, leveraging its official website, informative blog, and a suite of digital platforms. These channels are vital for disseminating comprehensive product details, technical documentation, and valuable industry perspectives to a global audience.

This digital ecosystem enhances customer accessibility, enabling seamless information retrieval and fostering engagement with Infineon's diverse product portfolio and solutions. For instance, Infineon's website experienced a significant increase in traffic in late 2023 and early 2024, driven by demand for its automotive and industrial semiconductor solutions.

- Website Traffic: Infineon's website saw a 15% year-over-year increase in unique visitors by Q1 2024.

- Content Engagement: Blog posts related to AI and IoT applications in the automotive sector achieved an average engagement rate of 8% in 2024.

- Digital Reach: The company actively utilizes LinkedIn and YouTube, with its YouTube channel surpassing 500,000 subscribers by mid-2024, showcasing technical deep dives and product demonstrations.

Infineon's global distribution network is a critical component of its place strategy, ensuring widespread product availability. By leveraging a robust network of distributors, Infineon reaches a diverse customer base across various industries and geographies. In fiscal year 2024, approximately 70% of Infineon's revenue was driven through these distribution partners, underscoring their importance in market access and sales achievement.

The company's manufacturing footprint, including major facilities in Kulim, Malaysia, and Dresden, Germany, is strategically positioned to serve key markets and meet growing demand for advanced semiconductors. These production sites are crucial for maintaining supply chain resilience and enabling the company to scale its operations effectively.

| Channel | Fiscal Year 2024 Revenue Contribution | Key Role |

|---|---|---|

| Direct Sales | ~30% | Serves key accounts and strategic partners, offering specialized application expertise. |

| Distributors | ~70% | Broadens market presence, ensures product accessibility, and drives significant revenue. |

| EMS Providers | Integral to supply chain | Facilitates manufacturing and delivery of semiconductor solutions to end customers. |

Preview the Actual Deliverable

Infineon Technologies 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Infineon Technologies' 4P's Marketing Mix is fully complete and ready for immediate use.

You're viewing the exact version of the analysis you'll receive—fully complete, ready to use. This detailed breakdown covers Product, Price, Place, and Promotion strategies for Infineon Technologies.

This isn’t a teaser or a sample—it’s the actual content you’ll receive when you complete your order. Gain immediate access to the complete Infineon Technologies 4P's Marketing Mix analysis.

Promotion

Infineon Technologies leverages industry events and trade shows like APEC and embedded world as crucial promotional tools. These platforms allow them to directly showcase cutting-edge semiconductor solutions and engage with customers face-to-face.

At these events, Infineon demonstrates its leadership in power electronics and microcontrollers, presenting new technologies and solutions across diverse application areas. For instance, at the 2024 APEC event, Infineon highlighted its latest gallium nitride (GaN) and silicon carbide (SiC) power devices, critical for energy efficiency in data centers and electric vehicles.

Infineon Technologies leverages a comprehensive digital marketing approach, focusing on SEO, content marketing, social media, and PPC to reach its target audience. This strategy aims to build brand awareness and drive engagement within the semiconductor industry.

The company actively produces high-quality content, such as white papers and technical articles on microcontrollers and power management ICs, distributed through its website and social platforms. This content establishes Infineon as a knowledgeable leader, attracting both existing and prospective clients seeking advanced semiconductor solutions.

Infineon Technologies actively cultivates its corporate brand and public image, a commitment recognized in 2024 with the 'Corporate Brand of the Year' award. This accolade highlights their success in shaping perceptions and building a strong reputation in the industry.

Their public relations strategy centers on transparently communicating their dedication to decarbonization and digitalization. By aligning these key initiatives with their brand identity, Infineon reinforces its core values and strategic direction to stakeholders.

This consistent 360-degree brand development spans all online and offline touchpoints, ensuring a cohesive and impactful message. This approach reinforces Infineon's position as a forward-thinking leader in the semiconductor industry.

Customer-Centric Communication

Infineon Technologies prioritizes customer-centric communication by streamlining interfaces to offer easier access to its extensive product portfolio. This approach facilitates matching specific customer needs with complementary products across different divisions.

The company's sales and marketing reorganization, effective March 1, 2024, underscores this customer-centric focus. The goal is to reduce touchpoints and expedite time-to-market for R&D initiatives powered by Infineon's semiconductor solutions.

- Streamlined Access: Customers can more easily navigate Infineon's broad product range.

- Tailored Solutions: The strategy aims to connect customers with complementary products, addressing specific requirements.

- Efficiency Gains: The 2024 reorganization targets fewer customer interfaces and faster product development cycles.

Strategic Partnerships and Co-Marketing

Infineon Technologies actively pursues strategic partnerships and co-marketing efforts to broaden its promotional impact and underscore its technological expertise. These collaborations are crucial for reaching wider audiences and reinforcing its standing as an industry innovator.

By teaming up with other prominent players in the technology sector, Infineon can jointly showcase its solutions, benefiting from the established credibility and extensive networks of its partners. This approach helps to validate Infineon's offerings and expand market penetration.

These strategic alliances are integral to Infineon's overall marketing strategy, enabling the company to capitalize on emerging market trends and solidify its competitive advantage. For instance, in 2024, Infineon continued to forge alliances within the automotive and industrial sectors, key areas for growth, aiming to co-develop and promote integrated solutions.

- Co-Marketing Initiatives: Infineon partners with complementary technology providers to jointly market solutions, leveraging shared customer bases and industry events to enhance visibility.

- Strategic Alliances: Collaborations with leading companies in sectors like automotive and renewable energy allow Infineon to validate its technologies and gain access to new markets.

- Technological Validation: Partnerships serve to confirm the performance and reliability of Infineon's semiconductor solutions in real-world applications, building trust with potential customers.

- Market Expansion: By working with established players, Infineon can accelerate its entry into new geographical regions or application segments, strengthening its global market position.

Infineon Technologies' promotional strategy is multi-faceted, encompassing industry events, digital marketing, brand building, and strategic partnerships. Their participation in major trade shows like APEC 2024, where they showcased advanced GaN and SiC power devices, directly engages customers and highlights technological leadership.

The company's robust digital presence, fueled by SEO, content marketing, and social media, aims to establish brand awareness and thought leadership through valuable resources like white papers on microcontrollers and power management ICs.

Infineon's commitment to brand excellence was recognized with the 2024 'Corporate Brand of the Year' award, reinforcing their dedication to transparently communicating their focus on decarbonization and digitalization across all platforms.

Furthermore, strategic partnerships and co-marketing efforts, particularly in the automotive and industrial sectors throughout 2024, expand their reach and validate their semiconductor solutions, driving market penetration.

| Promotional Activity | Key Focus Area | 2024 Highlight/Data |

|---|---|---|

| Industry Events | Showcasing new technologies, customer engagement | APEC 2024: Highlighted GaN and SiC power devices for EVs and data centers. |

| Digital Marketing | Brand awareness, lead generation, thought leadership | Content marketing with white papers on microcontrollers and power management ICs. |

| Brand Building | Corporate reputation, stakeholder communication | Awarded 'Corporate Brand of the Year' 2024; emphasis on decarbonization and digitalization. |

| Strategic Partnerships | Market expansion, technological validation | Collaborations in automotive and industrial sectors to co-develop and promote integrated solutions. |

Price

Infineon Technologies employs value-based pricing, aligning product costs with the perceived benefits customers receive, especially for its advanced semiconductor solutions. This strategy is evident in their offerings for critical sectors like automotive, industrial automation, and AI, where enhanced performance and efficiency are paramount. For instance, their automotive radar sensors, crucial for advanced driver-assistance systems (ADAS), command premium pricing due to their contribution to vehicle safety and autonomous driving capabilities.

Infineon Technologies navigates a competitive semiconductor landscape by focusing on value while maintaining strategic pricing. As a leading player, the company ensures its advanced solutions are both attractive and accessible to its diverse customer base, striking a balance between premium offerings and market competitiveness.

For instance, in the automotive sector, a key market for Infineon, the company's pricing reflects the significant R&D investment and the critical role its chips play in enabling advanced driver-assistance systems and electric vehicle powertrains. This approach is crucial as the automotive semiconductor market is projected to grow, with estimates suggesting it could reach over $150 billion by 2028, according to industry analyses from 2024.

Infineon Technologies, operating within a business-to-business framework, likely implements sophisticated pricing strategies for its key accounts. These often involve customized pricing structures, including volume discounts and tiered pricing, to accommodate the significant purchase volumes of major industrial and automotive clients.

These tailored pricing policies are typically established through long-term agreements, reflecting strategic alliances and the deep integration of Infineon's semiconductor solutions into their customers' critical product lines. For instance, in 2024, the automotive sector continued to be a major revenue driver, with Infineon's power semiconductors and sensors playing a crucial role in electric vehicle powertrains and advanced driver-assistance systems (ADAS).

Impact of Economic Conditions and Market Cycles

Infineon's pricing strategies are significantly shaped by broader economic conditions and the inherent cyclical nature of the semiconductor market. These external forces create a dynamic environment where pricing must remain adaptable.

For 2024 and into 2025, Infineon has projected a period of subdued business performance, with expectations of potential revenue contractions. This outlook stems from anticipated weak demand across several key end markets, with the exception of the burgeoning Artificial Intelligence (AI) sector. This scenario necessitates a flexible pricing approach to navigate the prevailing market dynamics.

- Economic Headwinds: Macroeconomic uncertainties in 2024 and 2025 are expected to dampen demand in consumer electronics and automotive sectors, influencing Infineon's pricing power.

- Semiconductor Cycle Impact: The industry's cyclical nature, characterized by periods of oversupply and undersupply, directly impacts component pricing, requiring strategic adjustments from Infineon.

- AI Demand Resilience: The sustained strong demand in AI applications provides a counterpoint, allowing for potentially more stable or premium pricing in those specific product segments.

- Flexible Pricing: Infineon's strategy involves adjusting pricing models to reflect varying demand levels and competitive pressures across different end markets during this period.

Investment in R&D and Manufacturing Efficiency

Infineon Technologies demonstrates a strong commitment to innovation and cost optimization through significant investments in research and development and manufacturing efficiency. These strategic investments, including the development of new fabrication plants and cutting-edge wafer technologies like 300mm Gallium Nitride (GaN) wafers, are designed to reduce production costs over time. This focus on efficiency enables Infineon to maintain competitive pricing for its products while ensuring profitability and fueling further investment in future technological advancements.

For the fiscal year 2023, Infineon reported capital expenditures of €2.4 billion, with a significant portion allocated to expanding its manufacturing capacity, particularly for power semiconductors. The company's strategic push into 300mm GaN wafer technology, expected to be operational in the coming years, aims to achieve economies of scale and further enhance cost competitiveness in a rapidly growing market. This allows Infineon to balance aggressive market penetration with sustained profitability.

- Investment in R&D: Infineon consistently invests heavily in R&D to stay at the forefront of semiconductor technology, particularly in areas like power semiconductors and automotive solutions.

- Manufacturing Efficiency: The company's focus on advanced manufacturing processes, such as 300mm GaN wafer production, targets long-term cost reductions and improved yields.

- Competitive Pricing: By driving down production costs, Infineon can offer competitive pricing, a crucial factor in the high-volume semiconductor market.

- Profitability and Future Investment: These efficiencies allow Infineon to maintain healthy profit margins, which are then reinvested into further innovation and capacity expansion.

Infineon Technologies employs a value-based pricing strategy, ensuring its advanced semiconductor solutions align with the benefits customers gain, especially in high-demand sectors like automotive and AI. This approach is critical as the automotive semiconductor market is projected to exceed $150 billion by 2028, with Infineon's chips being essential for ADAS and EV powertrains.

For 2024 and into 2025, Infineon anticipates a challenging demand environment across many sectors, with the exception of AI. This necessitates flexible pricing adjustments to navigate market fluctuations and competitive pressures effectively.

Infineon's significant investments in R&D and manufacturing efficiency, including the development of 300mm GaN wafer technology, aim to reduce production costs and maintain competitive pricing. The company's fiscal year 2023 capital expenditures reached €2.4 billion, underscoring this commitment to cost optimization and market competitiveness.

| Pricing Strategy Element | Description | 2024/2025 Relevance |

|---|---|---|

| Value-Based Pricing | Pricing based on perceived customer value and benefits. | Crucial for premium automotive and AI semiconductor segments. |

| Customized Key Account Pricing | Tailored pricing for large industrial and automotive clients, including volume discounts. | Reflects long-term agreements and deep product integration. |

| Economic Sensitivity | Pricing adapts to macroeconomic conditions and semiconductor industry cycles. | Flexibility required due to anticipated subdued demand in consumer electronics and automotive. |

| Cost Optimization Impact | R&D and manufacturing efficiency investments enable competitive pricing. | 300mm GaN wafer technology aims for economies of scale and cost reduction. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Infineon Technologies is built upon a foundation of verified, up-to-date information encompassing their product portfolio, pricing strategies, distribution channels, and promotional activities. We meticulously reference credible public filings, investor presentations, Infineon's official brand website, comprehensive industry reports, and detailed competitive benchmarks to ensure accuracy and relevance.